Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

China Healthcare Roadmap

Caricato da

jinmaoDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

China Healthcare Roadmap

Caricato da

jinmaoCopyright:

Formati disponibili

China Mainland - Medical Devices

Updated/posted: January 2011 Validated by: (in process)

DECISION MAKERS AND DECISION-MAKING PROCESSES

DIAGRAM

BACKGROUND DECISION-MAKERS AND INFLUENCERS REGULATORY PATHWAY/MARKET APPROVAL PROCESS REIMBURSEMENT AND COVERAGE/PAYMENT FLOW MAP AND

PROCUREMENT PROCESS

DATA REQUIREMENTS (HTA, PAYMENT DECISIONS) ACRONYMS SUGGESTED READING USEFUL LINKS

REFERENCE

AUTHORS & CONTRIBUTORS

China Mainland - Medical Devices

BACKGROUND

China health care delivery system is challenged by providing services for the most populous country with 1.3 billion people and a majority of rural residents. Health care delivery follows a parallel three-tiered structure established in the 1950s for rural and urban areas. In urban area, there are public hospitals which are operated independently in different level (provincial, city or district) and 1st -tired hospitals are mostly transformed to community health center in recent years. Few private hospitals exist in China. In rural area, county hospital, township hospital and clinics compose the three-tiered structure. There are also health surveillance institutions of various levels, such as CDCs. The total China health expenditure is 1128.95 billion RMB (US $ 164.77) in 2007 and this number is increasing in the last few years. The percentage of health expenditure paid by government, employer contributions (society) and out of pocket is 20%, 35%, 45% respectively. (ministry of health, 2009 yellow book) available at: http://www.moh.gov.cn/publicfiles/business/htmlfiles/zwgkzt/ptjnj/200908/42635.htm To address the escalating health expenditure, system inefficiency, and low insurance coverage, China implemented several health insurance reforms in the last few years. Besides commercial medical insurance, current health care system consists of three main social insurance programs: Urban Employee Basic Medical Insurance (UEBMI) for the urban employed (1997), Urban Resident Basic Medical Insurance (URBMI) for urban residents without formal Employment, New Cooperative Medical Scheme (NCMS) for the rural population (2003). Figure 1: Health Insurance programs

China Mainland - Medical Devices

Source: Ministry of Health, 2009 Yellow Book. http://www.moh.gov.cn/publicfiles/business/htmlfiles/zwgkzt/ptjnj/200908/42635.htm Financing health insurance is different for each program. Take Shanghai URBMI for example, three different accounts are used for collecting fund and pay for specific health service. Fig 2 URBMI Funding Source (Shanghai)

Source: Shanghai Medical Insurance Bureau http://ybj.sh.gov.cn/index.jsp Lin Yang (2004), Study on expenditure containment of Shanghai Urban Medical Insurance System, Shanghai Jiao Tong University. (In Chinese) DESCRIPTION OF MEDICAL DEVICE INDUSTRY The value of Chinas medical device market is expected to be US$28 billion by 2014 -- more than double the data from 2006. The increasing demand for home-use devices or high-quality implants and China new policy on expanding health coverage in rural areas bring this growth in the market of medical device. The domestic market for medical devices is still highly fragmented. Most of medical device manufacturers have limited market share and operate on a small scale with only a handful of profitable products. There are only four Chinese medical device companies traded on global exchanges. Domestic device makers are working to develop high-quality devices at a cost basis 30% lower than that of foreign competitors. Foreign companies have a comparative advantage in terms of technology and presently control 90% of the high-end device market, especially large medical device manufacturers from Japan, Germany, and the USA. Although the government is emphasizing low cost devices for rural projects, major hospitals in China still demand the best foreign equipment. Moreover,

China Mainland - Medical Devices

Chinese consumers are also wary of domestic brand and have increasing demand for foreign medical device when considering quality. Source: http://www.knowledgeatwharton.com.cn/index.cfm?fa=viewArticle&articleID=2082&languageid=1 TO TOP

DECISION-MAKERS AND INFLUENCERS

COMPETENT AUTHORITY SFDA (State Food and Drug Administration) is current national authority for medical device in China. According to the current regulation issued in 2000 by State Council, medical device are categorized into three classes, and for products in each class, they must comply with different standards and requirements for registration certificates and licenses under different authorities. Classification Class I Definition Safety and effectiveness can be ensured through routine administration; Further control is required to ensure their safety and effectiveness Registration Authority Municipal Department

Class II

Provincial and municipal Department SFDA

Class III

Medical device that are implanted into the human body, or used for life support or sustenance, or pose potential risk to the human body and thus must be strictly controlled in respect to safety and effectiveness.

Source: Regulations for the Supervision and Administration of Medical Devices, Decree 276 of the State Council, issued on January 4, 2000, effective since April 1, 2000 www.sfda.gov.cn TECHNOLOGY ASSESSMENT ORGANIZATIONS AQSIQ (General Administration of Quality Supervision, Inspection and Quarantine of Peoples Republic of China) AQSIQ is a ministerial administrative organ directly under the State Council which is in charge of Quality Supervision, Inspection and Quarantine. There are 35 CIOs (Entry-Exit Inspection and Quarantine Bureaus) and 31 provincial bureau of quality and technology supervision under AQSIQ. One important mission of AQSIQ is to carry out inspection and supervision on import and export commodity and its packaging and transportation means. Imported medical device assessment is mainly conducted by CIOs which administers the China Compulsory Certificate (CCC) program, a quality certification that is mandatory for a range of specified products, including diagnostic X-ray equipment, hemodialysis equipment, implantable cardiac pacemakers, and other medical devices. These tests are extremely similar to the tests the SFDA required in registration process. In the fall of 2008, the SFDA and AQSIQ jointly agreed on CCC marking and SFDA medical device registration will now share a single testing process, with no duplication of tests or fees. This strategy greatly released manufacturers burden and make utility of inspection resources more efficient. http://www.aqsiq.gov.cn/zwgk/zjjs/ SFDA- Department of Medical Device Supervision As part of SFDA, department of Medical Device Supervision plays a significant role in HTA during registration and

China Mainland - Medical Devices

post-market phases. The main responsibility of Department of Medical Device Supervision is to register medical device, draw up good practices for clinical trials, production and distribution of medical devices, supervise these practice and organize the adverse events monitoring, and medical device reevaluation. http://eng.sfda.gov.cn/eng/ SFDA- Ten Medical Device Quality Surveillance and Test Institutes There are ten core medical device quality surveillance and test institutes located in different cities. They are directly administrated by SFDA and provide HTA service of medical device in different dimension. (1) Medical Device Quality Surveillance and Test Institute: biological materials, artificial organs and tissue engineering. (2) Tianjin Medical Device Quality Surveillance and Test Institute: orthopedic materials and equipment, medical equipment of physical therapy; (3) Shenyang Medical Device Quality Surveillance and Test Institute: X-ray diagnostic equipment (including CT) and accessories, medical refrigerated products; (4) Hangzhou Medical Device Quality Surveillance and Test Institute: optical equipment, medical laser equipment, medical equipment of deep hypothermia therapy; (5) Beijing Medical Device Quality Surveillance and Test Institute: IVD, radiotherapy equipment; (6) Jinan Medical Device Quality Surveillance and Test Institute: medical polymer materials, sanitary materials; (7)Guangzhou Medical Device Quality Surveillance and Test Institute: Dental equipment, disinfection equipment etc; (8) Dental Materials Quality Surveillance and Test Institute in Peking University: Dental materials; (9) Shanghai Medical Device Quality Surveillance and Test Institute: anesthesia and respiratory equipment, surgical instruments etc. (10) Wuhan Medical Device Quality Surveillance and Test Institute: ultrasonic diagnostic equipment. TO TOP

REGULATORY PATHWAY/MARKET APPROVAL PROCESS

Registration procedures differ for domestic and imported medical device and registration certificate or license of medical device is only effective for four years; when it expires manufacturers must register it again. Some experts argued the same procedure and requirement for re-registration is inefficient and costly. In 2008, the number of medical devices successfully registered in Class I, II, III was 2117, 2172, 1485 respectively, the successful reregistered number of class I and II is 1583 and 2234 respectively. In addition, the number of imported medical devices approved is 3683, this number kept increasing in past three years. (SFDA Annual Report) REGISTRATION PROCEDURE FOR DOMESTIC MEDICAL DEVICE:

A: Class III (license for manufacturing trial) B: Class I (license for manufacturing or re-registration)

China Mainland - Medical Devices

C: Class II (license for manufacturing trial) and Class II, III (license for manufacturing or re-registration) REGISTRATION PROCEDURE FOR IMPORTED MEDICAL DEVICE:

Resource: Xianqiang Mi (2008), Management of Medical Device Supervision in China (in Chinese) ADDITIONAL REGULATION FOR IVD REAGENTS In late 2008, the SFDA issued new rules and procedures for determination of effective coverage of IVD Quality System Audit ((SFDAM [2007]229). IVDs are divided into 23 categories and IVDs in different categories must process quality system audits that are designed and implemented separately. In addition, IVDs with different risk classifications have different audits applied to them. Source: www.sfda.gov.cn TO TOP

REIMBURSEMENT AND COVERAGE/PAYMENT FLOW MAP AND PROCUREMENT PROCESS

TENDERING PROCESS--- LARGE SCALE EQUIPMENT CENTRALIZED TENDERING Since 1999, China has adopted a tendering method as a significant part of medical device procurement process because this method could bring more transparency and safeguards to ensure access for patients and quality of the medical technology. Since 2005, in order to reduce the corruption, the Ministry of Health (MOH) and the State council set up a procurement restriction on large scale equipments which are priced over 5 million RMB ($730,000). Under the restriction, individual hospitals and other private medical organizations are strictly forbidden to purchase any large scale equipment if it is a used and imported product. Government also interferes in the procurement process by collective purchasing and tendering of large scale medical equipment, and then reallocating the medical device to the hospitals or organizations. In 2005, MOH implemented a pilot program in eight areas (Beijing, Shanghai, Zhejiang, Tianjin, Hubei, Guangdong, Chongqing, and Liaoning) which targeted orthopedic and cardiac implants for the major hospitals. This program was designed to favor companies which are operating without distributors (a process which was facilitated by Chinas accession to the WTO), because Chinese officials believe that distributors contribute to high prices and corruption. In 2007, a system of comprehensive centralized tendering was adopted in all provinces. Source:

Regulations for the Supervision and Administration of Large Scale Equipment, issued by Ministry of Health

of the Peoples Republic of China, effective since 1st March, 2005

Medical device reimbursement in China, International Trade Administration Report,

/pwsyw/200907/41673.htm

2007http://www.trade.gov/td/health/Medical%20Reimbursement%20in%20China%202007.pdf

Ministry of Health of the Peoples Republic of China Http://www.moh.gov.vn/publicfiles/bussiness/htmlfiles

GENERAL PRICING AND REIMBURSEMENT APPROVAL PROCESS Pricing and reimbursement of medical device is regulated by the National Development and Reform Commission (NDRC) and the Ministry of Health (MOH). Reimbursement mechanisms and pricing is complicated since it is designed to meet different requirements at provincial/ municipal level. In general, reimbursement schemes treat

China Mainland - Medical Devices

the medical device differently by classifying them into two types: implantable or disposables. Only medical devices which are approved and put in the pricing formulary regulated by government could get reimbursed under the medical insurance coverage. Because of variety, we take Shanghai for example to explain pricing and reimbursement process. Shanghai pricing process In 2003, Shanghai government promotes its new pricing system and set the price ceiling for registered medical devices. To be included in an application for a local retail price, distributors need to provide import prices and other supporting data directly to the Shanghai Medical Device Association which is responsible for coding medical device. After that, the application is transferred to the Shanghai Pricing Bureau, which is in charge for setting the highest allowable price for medical device, making final decision and making the highest allowable price to public. It is worth mentioning that, once the highest allowable price is set, the medical device would be put into the Pricing management formula and qualified to get reimbursement, otherwise the medical device is excluded from the insurance coverage.

Source: Shanghai Health Bureau http://www.hs.sh.cn/website/b/32071.shtml Shanghai Reimbursement Approval Process

1. Shanghai Urban Basic Medical Insurance (UBMI)

Medical device reimbursement must follow the basic requirement for UBMI. There are different eligibility and basic package for UBEMI and UBRMI. Following illustrates how UBRMI reimbursement service of medical technology. Outpatient Deductible Reimbursement Ceiling Regular Chronic Emergency room Free checkout

1000, 700, and 500 RMB for tertiary, secondary , and primary medical institutes, respective ly

(1) Residents over 70:70% (2) Residents aged 6070: 60% (3) Residents aged 1860:50%

(1) Adults: 80 000 RMB; (2) Student and resident under 18 and not attending

(1) Residents over 70:60% (2) Residents aged 6070: 60% (3) Residents aged 1860:50 %(

Outpatient services reimbursement for10 chronic or fatal diseases

Residents aged 6070: 50%

NA

China Mainland - Medical Devices

(1000 RMB deductible, if in 1-tired hospital 60%) (4)Student s and residents under 18 and not attending school: 50%

school: 100 000

if in 1tired hospital 60%) (4)Stude nts and residents under 18 and not attending school: 50%

Source: Shanghai Medical Insurance Bureau http://ybj.sh.gov.cn/xxcx/zgdy.jsp?lm=3

2. Medical device reimbursement under UBMI

Classification Bone Fixation Inside of Spine Coinsurance * Ceiling 20,000 RMB 10,000 RMB 25,000 RMB NA

Outside of Spine Implantable medical devices for Congenital heart disease treatment Implantable medical devices for Peripheral vascular, Neurovascular disease treatment Domestic product Imported product * means coinsurance rate is according to UBMI requirements

20%

30%

NA

Source: Shanghai Health Bureau http://www.hs.sh.cn/website/b/32071.shtml Shanghai municipal labor and social security bureau http://www.12333sh.gov.cn/07zcfg/gfxwj/200912/t20091209_1104092.shtml

DATA REQUIREMENTS (HTA, PAYMENT DECISIONS)

DATA REQUIREMENT FOR REGISTRATION

China Mainland - Medical Devices

According to general registration process, each phase have specific data requirement: 1. Application preparation:

To Compile a Product Standard; Laboratory Test data (based on your chosen standard) for the Product at a SFDA recognized Testing Lab

(applicable for class II and III products);

Data of Clinical Trial in 2 Hospitals in China (applicable only for implantable products manufactured by a

foreign company which has never registered a medical device in China), or to collect Clinical Data for Product (applicable for all other class II and III products).

2. Application (application dossier (12 items))

Application Form for the registration; Qualification certificate(s) (Business License, etc.) of the applicant (manufacturer); Copy of Business License of the Application Agent and the authorization letter written by the applicant to the

agent;

Marketing authorization certificate issued by a foreign competent authority to allow the product to be

marketed in that country (or Region) as a medical device.

Adapted product standard; Instruction Manual of the device; Product Testing Report issued by a SFDA recognized testing lab (applicable for class II and III products); Clinical Test Report or clinical data; Product quality guarantee letter of the applicant; Authorization letter written by the applicant to a Representing Agent in China, letter of promise written by

the Representing Agent, and Business License or Organization Registration Certificate of the Agent; promise written by the agent, and qualification Certificate of the Agent;

Authorization letter written by the applicant to a responsible Post-marketing Service Agent in China, letter of Self-Declaration for the authenticity.

3. Audit and Assessment:

Clarify technical issues or finds the application dossier is insufficient in technical data

4. Disclose final decision DATA REQUIREMENT FOR REIMBURSEMENT DECISION (SHANGHAI MODULE WITH CHINESE DETAILS)

1. Application form 2. Evidence supporting clinical application 3. Evidence supporting specific clinical application in detail 4. Medical device certificates or license for allocation 5. Medical device certificates or license for registration by SFDA or Medical device certificates or license for 6. Other data municipal health insurance bureau required

1. 2. 3. registration by Municipal Department

China Mainland - Medical Devices

4. 5. 6.

Potrebbero piacerti anche

- Washpipe Assembly Washpipe Assembly: Service ManualDocumento60 pagineWashpipe Assembly Washpipe Assembly: Service ManualIvan Kawempy100% (4)

- Acquisition (Pagtamo) Meaning-Making (Pag-Unawa) Transfer (Paglilipat)Documento2 pagineAcquisition (Pagtamo) Meaning-Making (Pag-Unawa) Transfer (Paglilipat)MAY BEVERLY MORALES100% (8)

- Case Study #3 ThermodynamicsDocumento6 pagineCase Study #3 ThermodynamicsColeene Forteza100% (1)

- GCash OrientationDocumento27 pagineGCash OrientationArmiel SarmientoNessuna valutazione finora

- Objective of StudyDocumento6 pagineObjective of StudySandeep kumarNessuna valutazione finora

- Book Review ON: Authored byDocumento14 pagineBook Review ON: Authored bytuhion12Nessuna valutazione finora

- Upendra SynopsisDocumento9 pagineUpendra Synopsissarvesh.bhartiNessuna valutazione finora

- Security Analysis and Portfolio Management: Stock MarketDocumento13 pagineSecurity Analysis and Portfolio Management: Stock MarketGurvinder AroraNessuna valutazione finora

- RM On FlipkartDocumento17 pagineRM On FlipkartAbhishek Singh RaghuvanshiNessuna valutazione finora

- "Customer Satisfaction of Reliance Prepaid and Postpaid Services" in The Patna CityDocumento11 pagine"Customer Satisfaction of Reliance Prepaid and Postpaid Services" in The Patna Citynagendra_patel_2Nessuna valutazione finora

- Makalah Akk Kel 5 FKM UNAIRDocumento80 pagineMakalah Akk Kel 5 FKM UNAIRPranata DananNessuna valutazione finora

- Synopsis: Event Management Use As Tool of Brand AwarenessDocumento6 pagineSynopsis: Event Management Use As Tool of Brand Awarenessanon_719177Nessuna valutazione finora

- With Reference To: Project Report ONDocumento73 pagineWith Reference To: Project Report ONAnkam Pavan KumarNessuna valutazione finora

- Summer Training Project SynopsisDocumento4 pagineSummer Training Project SynopsisDavindEr SiNgh AnttalNessuna valutazione finora

- A Project Report On " ": A Study On Customer Satisfaction On National Insurance Co - LTDDocumento6 pagineA Project Report On " ": A Study On Customer Satisfaction On National Insurance Co - LTDSagar KumarNessuna valutazione finora

- A Business Plan ON Opening New Restaurant: Submitted BYDocumento20 pagineA Business Plan ON Opening New Restaurant: Submitted BYPrateekSrivastavaNessuna valutazione finora

- John HRMDocumento43 pagineJohn HRMShakti ShivanandNessuna valutazione finora

- A Report Organisation Study, System Study and Design Carried Out at Win Suzuki Pvt. LTD., NagercoilDocumento38 pagineA Report Organisation Study, System Study and Design Carried Out at Win Suzuki Pvt. LTD., NagercoilsumiNessuna valutazione finora

- Physics PracticalDocumento4 paginePhysics PracticalKhan JanNessuna valutazione finora

- (Session 2013-14) Supervised By: Submitted byDocumento7 pagine(Session 2013-14) Supervised By: Submitted byMadan SharmaNessuna valutazione finora

- Govt Schools IntroductionDocumento12 pagineGovt Schools IntroductionchaituNessuna valutazione finora

- Nairobi Elrc Causelist For 21.11.2022Documento16 pagineNairobi Elrc Causelist For 21.11.2022Stephen MabachiNessuna valutazione finora

- Training and Development: A Project Report ON With Reference ToDocumento6 pagineTraining and Development: A Project Report ON With Reference ToAnonymous W1qmBN8LNessuna valutazione finora

- MFC4013 Pengurusan Risiko Course OutlineDocumento7 pagineMFC4013 Pengurusan Risiko Course OutlineSyaker ZackNessuna valutazione finora

- Parthiban L2 System AdminDocumento4 pagineParthiban L2 System AdminAnonymous KnUvRMH6NNessuna valutazione finora

- F5 Physics L33Documento22 pagineF5 Physics L33WuileapNessuna valutazione finora

- Moataz Mohamed Mohamed Ez Al Den: Year Educational DegreeDocumento5 pagineMoataz Mohamed Mohamed Ez Al Den: Year Educational DegreeMOATAZNessuna valutazione finora

- Study Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Documento21 pagineStudy Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!TIGER TYSONNessuna valutazione finora

- Bussiness Law, B.MGTDocumento29 pagineBussiness Law, B.MGTanatoliNessuna valutazione finora

- Defination PhysicsDocumento14 pagineDefination PhysicsLuhannie Deer TMNessuna valutazione finora

- Bussiness Chapter 1Documento9 pagineBussiness Chapter 1Bethelhem YetwaleNessuna valutazione finora

- BSC (Physics) SyllabusDocumento16 pagineBSC (Physics) SyllabusAlok ThakkarNessuna valutazione finora

- PrefaceDocumento7 paginePrefaceankushkmrNessuna valutazione finora

- Physics 2022Documento4 paginePhysics 2022Ansiya SNessuna valutazione finora

- Suryashikhar Resume IndusDocumento7 pagineSuryashikhar Resume IndusShikhar GangradeNessuna valutazione finora

- Sikkim Manipal University: Consumer Satisfaction & Buying Behaviour of FMCG With Special Refference To FrootiDocumento4 pagineSikkim Manipal University: Consumer Satisfaction & Buying Behaviour of FMCG With Special Refference To FrootiSaurabh KumarNessuna valutazione finora

- Uas P A 2016 To Prop1Documento10 pagineUas P A 2016 To Prop1maisarahpohanNessuna valutazione finora

- Physics Laboratory Competence and Academic Achievement in PhysicsDocumento7 paginePhysics Laboratory Competence and Academic Achievement in PhysicsAnonymous CwJeBCAXpNessuna valutazione finora

- Industry VisiteDocumento10 pagineIndustry VisiteHarsh KardamNessuna valutazione finora

- Section XII - Physics: Question #399 RationalesDocumento5 pagineSection XII - Physics: Question #399 RationalesRodrigo MelaniNessuna valutazione finora

- CV English Haedar Akib August 2015Documento23 pagineCV English Haedar Akib August 2015RudiSalamNessuna valutazione finora

- Visvesvaraya Technological University: Workshop On Preparation of Iv Semester Model Question PapersDocumento49 pagineVisvesvaraya Technological University: Workshop On Preparation of Iv Semester Model Question PapersShankar HabibNessuna valutazione finora

- Bachelor of Arts in Business Administration UoWDocumento8 pagineBachelor of Arts in Business Administration UoWSyed Salim Bin EidzahNessuna valutazione finora

- Physics: Physics Engineering Syllabus For UPSC Main ExaminationDocumento4 paginePhysics: Physics Engineering Syllabus For UPSC Main ExaminationSam SamsNessuna valutazione finora

- Asim RehmanDocumento4 pagineAsim RehmanAsim RehmanNessuna valutazione finora

- 1yrMSc PhysicsDocumento4 pagine1yrMSc PhysicsVenkatesh BNessuna valutazione finora

- BUDIWIJAYADocumento4 pagineBUDIWIJAYASuffy AwwaliyahNessuna valutazione finora

- Bike Profile LatestDocumento40 pagineBike Profile LatestaezacsNessuna valutazione finora

- Front PaperDocumento6 pagineFront PaperBalakrishna JagarlamudiNessuna valutazione finora

- Administration Is One Way To Arrange To Be An Structural Position Public Administration Is One of Department in My UniversityDocumento18 pagineAdministration Is One Way To Arrange To Be An Structural Position Public Administration Is One of Department in My UniversityTasdik Abd KarimNessuna valutazione finora

- 2018 PhysicsDocumento38 pagine2018 PhysicsAadi SinghNessuna valutazione finora

- Project DocumentDocumento19 pagineProject DocumentZahraa AlQallaf100% (1)

- Physics Lecture NotesDocumento25 paginePhysics Lecture NotesTakudzwa MiltonNessuna valutazione finora

- Site Details 52609.1Documento5 pagineSite Details 52609.1sagrikakhandkaNessuna valutazione finora

- IGCSE Physics NotesDocumento15 pagineIGCSE Physics NotesOmkar Bhupesh RaneNessuna valutazione finora

- Daftar Harga BukuDocumento4 pagineDaftar Harga BukuViviany Angela Kandari100% (1)

- KNBI Inggris (1) Meeting DocumentationDocumento41 pagineKNBI Inggris (1) Meeting DocumentationsinagadianNessuna valutazione finora

- This Document Describes How To Install Discoverer 10Documento19 pagineThis Document Describes How To Install Discoverer 10surarapu100% (1)

- Physics q4Documento24 paginePhysics q4api-358413758Nessuna valutazione finora

- Law of Bussiness AssignmentDocumento34 pagineLaw of Bussiness AssignmentAbdul Basit QaziNessuna valutazione finora

- Adaptive Followup Mastering PhysicsDocumento8 pagineAdaptive Followup Mastering PhysicsElloani Ross Arcenal PitogoNessuna valutazione finora

- Physics InspiredDocumento14 paginePhysics InspiredMossNessuna valutazione finora

- BUSSINESS SCHOOL Trabajo Final Ingles 3Documento8 pagineBUSSINESS SCHOOL Trabajo Final Ingles 3Alex AlmonteNessuna valutazione finora

- Conducive Enviroment For Fostering India Specific Innovation: New Medical Device Rules 2017Documento7 pagineConducive Enviroment For Fostering India Specific Innovation: New Medical Device Rules 2017Ijdra Journal Jitendra BadjatyaNessuna valutazione finora

- Case Study Analysis of Apex Corporation PDFDocumento2 pagineCase Study Analysis of Apex Corporation PDFAJNessuna valutazione finora

- Revised Runway Length Discussion (20171206) - 201712211212022318Documento3 pagineRevised Runway Length Discussion (20171206) - 201712211212022318Ilham RaffiNessuna valutazione finora

- Ram Concrete AnalysisDocumento94 pagineRam Concrete AnalysisTom CurryNessuna valutazione finora

- Blue Solar Charge Controller MPPT: NOT AcceptedDocumento12 pagineBlue Solar Charge Controller MPPT: NOT Accepted1382aceNessuna valutazione finora

- PR-1078 - Hydrogen Sulphide Management ProcedureDocumento22 paginePR-1078 - Hydrogen Sulphide Management Procedureromedic360% (1)

- CatalogDocumento5 pagineCataloglangtu2011Nessuna valutazione finora

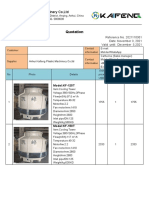

- KAIFENG Quotation For 150T Cooling TowerDocumento13 pagineKAIFENG Quotation For 150T Cooling TowerEslam A. FahmyNessuna valutazione finora

- WRO 2018 WeDo RegularDocumento14 pagineWRO 2018 WeDo RegularAlaas AlvcaszaNessuna valutazione finora

- CS2305 PP Lecture Notes PDFDocumento367 pagineCS2305 PP Lecture Notes PDFVijai KirubaNessuna valutazione finora

- ECS Florida SOQ - 2018 - FT MyersDocumento11 pagineECS Florida SOQ - 2018 - FT MyersPaul BenvieNessuna valutazione finora

- Fiocchi USA Catalogue 2010Documento60 pagineFiocchi USA Catalogue 2010Mario LopezNessuna valutazione finora

- Canalta Parts CatalogueDocumento25 pagineCanalta Parts Cataloguellando1Nessuna valutazione finora

- Sapthagiri College of Engineering: Tracing Manufacturing Processes Using Blockchain Based Token CompositionsDocumento19 pagineSapthagiri College of Engineering: Tracing Manufacturing Processes Using Blockchain Based Token CompositionsYashi FakeNessuna valutazione finora

- Haas Axis Lubrication Oil - Conversion - AD0629Documento12 pagineHaas Axis Lubrication Oil - Conversion - AD0629Jhonny PérezNessuna valutazione finora

- Alpha Testing Form LATESTDocumento2 pagineAlpha Testing Form LATESTazizaharsad0% (1)

- Synchronous LearningDocumento3 pagineSynchronous Learningaspittell3080Nessuna valutazione finora

- LG W4320S Service ManualDocumento24 pagineLG W4320S Service ManualeleandrorobertoNessuna valutazione finora

- BX Tuner ManualDocumento4 pagineBX Tuner ManualdanielthemanNessuna valutazione finora

- Module 8: Numerical Relaying I: Fundamentals: Fourier AlgorithmsDocumento15 pagineModule 8: Numerical Relaying I: Fundamentals: Fourier Algorithmsjijo123408Nessuna valutazione finora

- Final Project Miguel Santana GallegoDocumento44 pagineFinal Project Miguel Santana GallegoDaniel PereiraNessuna valutazione finora

- Richard Feynman BiographyDocumento5 pagineRichard Feynman Biographyapi-284725456100% (1)

- Mercedes Benz RangeDocumento37 pagineMercedes Benz RangeUZNAPMNessuna valutazione finora

- Principles of Accounting, Volume 2: Managerial AccountingDocumento59 paginePrinciples of Accounting, Volume 2: Managerial AccountingVo VeraNessuna valutazione finora

- Adirondack Life Media KitDocumento8 pagineAdirondack Life Media KitJohnny LibitzNessuna valutazione finora

- About Some Important Items of Composite Insulators Design: February 1999Documento6 pagineAbout Some Important Items of Composite Insulators Design: February 1999ipraoNessuna valutazione finora

- The Dilemma of The Last FilipinoDocumento12 pagineThe Dilemma of The Last FilipinoEunice Delos SantosNessuna valutazione finora