Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Eefc Queries - Fedai

Caricato da

callvkDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Eefc Queries - Fedai

Caricato da

callvkCopyright:

Formati disponibili

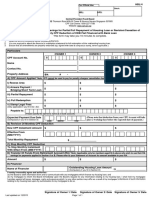

Queries on EEFC circular RBIs response

ANNEX

Serial No 1

Query A customer has balance of USD 4 million in his account. He has sold 3 months forward or bought 3 month put option for USD 3 million on 2nd May 2012, against the balance in his EEFC account. The customer can not convert 50% of USD 4 million balances in his EEFC account now, as amount of USD 3 million is earmarked for forward / option contract. Therefore, there is need for clarification.

Available balances may be arrived at by netting off earmarked amounts on account of outstanding forward / option contracts against the EEFC balances. Forward/option contracts based on past performance or export orders may be also excluded from available balance, if the customer instructs to earmark EEFC balance.

On 14 June 2012, a customer has an export transaction of USD 2 million and he expects realisation in October. On 1st Aug, he sells 3 month forward or bought 3 month put option for USD 2 million, against this order. Now, if he receives the proceeds in Sep 12, he needs to park entire USD 2 million in EEFC account and use it for settlement on the due date. If he is required to convert half the amount to INR i.e. USD 1 million, he will not be left with adequate balance to utilise his contract maturing in October

The customer is allowed to retain in the EEFC account amount equal to the forward cover / option contract booked and balance may be dealt with in terms of our circular.

A customer has payment obligation of USD 1 million for his imports The EEFC balances at the time of booking the purchase (of after 2 months. He has zero balance in EEFC account and he books customer) contract is to be taken into account and not on the call option or buys USD 1 million 2 month forward for this transaction. settlement date. On the due date, he has balance of USD 2 million in his EEFC account. As per the above circular, he is required to utilise the balance in his EEFC account before purchasing foreign exchange. If he does that, he will not be utilising related forward / option contract. A customer has balance of USD 1 million in his EEFC USD Yes. Customers will have to utilize the balance in the EEFC account. He receives import bill of Yen 40 million. Is he required to account irrespective of the currency in which it is held. utilise the balance in EEFC USD account to settle the import bill in JPY?

Whether 50% of the balance in EEFC account held as of the circular date today (i.e. reference date) be converted forthwith into rupee balance. For e.g. A situation where a client has 100 USD in his EEFC account as of the reference date and he intends to make import payment of 80 USD on the 5th day from the reference date. In such a scenario whether he will be able to utilise the 80 USD or be restricted to 50 USD.

Customer has to convert USD 50. Thereafter, he has to utilise balance amount of USD 50 for partial import payment. Balance import payment of USD 30 will have to be purchased from the market. EEFC account holders who based on the business cycle, hold balances for less than a week may approach Reserve Bank of India separately through their ADs.

Whether the conversion of 50% of the balances ( stock balances) for No only the future forex earnings as mentioned in para 2(b) & 2(c) RFC and DDA should be converted like that in case of EEFC. Please of the circular. note that point 4 of the circular mentions that provisions of only 2(b) and 2(c) apply for RFC and DDA accounts Where client has EEFC accounts with other banks, can the EEFC Yes balances be moved from that bank to the remitting bank for effecting payment for outward remittances. As per RBI circular EEFC account holders henceforth will be No permitted to access the forex market for purchasing foreign exchange only after utilising fully the available balances in the EEFC accounts. Can client be allowed to book forward purchase contract for a forward date even he has enough balance in his EEFC account? An export client had availed a FCY export loan (PSCFC) of USD 50M against an export bill of USD 100M which is now realised. Client wishes to use USD 50 M out of the realisation to liquidate the PSCFC and retain the remaining USD 50M in his EEFC a/c. Export proceeds of USD 50 mio will be used for liquidating PSCFC account. 50 % of the balance amount $ 50 i.e. $ 25 will have to be converted and USD 25 can be parked in EEFC account.

10

Client has USD 100M in his EEFC a/c today. He has to mandatorily No. He will have to first convert USD 50 mio. He has to thereafter convert USD 50 M into INR balances within a fortnight. The client now utilise balance amount USD 50 mio to retire import bill of USD 50 wants to utilise USD 50 Mio for retiring an import bill (within this mio. fortnight). Subsequent to this import payment the clients EEFC balance will be USD 50 M and he wishes to not convert any more USD from his EEFC a/c.

11

Client has USD 100 M in EEFC a/c. He wishes to book import forward The options at (a) and (c) may be allowed. contract for USD 50 M. Since booking a forward contract also amounts to access to forex markets we ask him to utilise the EEFC first. The client has asked for clarifications on the following 4 alternatives he has : a) Liquidate EEFC balance of USD 100 M & book forward contract of USD 50 M b) Liquidate EEFC to the extent of USD 50 M i.e. equal to the amount of import forward contract to be booked. c) Instead of liquidating EEFC to the extent of USD 100 M, client books a sell USDINR forward contract of USD 100 M to sell EEFC balances forward and simultaneously books the Import contract for USD 50M d) Client books a sell USDINR forward contract of USD 50 M to sell USD 50 M of EEFC balances forward - equal to the amount of the import forward contract he wishes to book and then books the import forward contract. Client does not give directions within a fortnight to liquidate 50% of 9th Directions from client, mentioned in the circular, relate to the May EOD EEFC balance in his account. account to which the Rupee proceeds are to be credited and not for liquidation of the EEFC balances. Client has been accumulating EEFC balances to deliver against Customer may be allowed to hold export proceeds in EEFC option contracts booked to hedged exports against Past Performance. account to the extent amount earmarked in EEFC account for Forced conversion of 50% will mean, there will be less FCY to settle utilisation of forward contract the option hedges under PP. In this case at the time of forced EEFC liquidation to the extent of 50% the client would ideally be cancelling the export hedges to that extent (he cannot early deliver because these are option hedges). However as per the current regulations PP contracts should only be settled by delivery and in cases where the PP contracts have to be cancelled the gains cannot be passed to clients. So what does a client, who has in the money PP option hedges do with his option hedges, when he is forced to liquidate his EEFC balances?

12

13

14

Will the customer be allowed to book forward contract to buy dollars if If customer undertakes to utilise $ 50,000 for imports purpose, he they already have EEFC balances on the date of booking the forward can thereafter book forward contract for USD 150,000/cover? For example, if a customer has EEFC balance of USD 50,000 in his account but he wants to book a forward contract for purchase of USD 200,000 value 31 May 2012, then will he be allowed to book a contract for USD 200,000 or he will be allowed to book only USD 150,000 (USD 200,000 less EEFC balance of USD 50,000). Declaration while selling foreign exchange to their constituents Yes. The customers need to declare that they have exhausted the Should it cover other banks also? EEFC/RFC/DDA account balances maintained with other banks also. Treatment of FCY transactions done on the same value date Can be netted off. Whether this regulations would also apply to foreign currency The regulations are only applicable to EEFC, RFC and DDA accounts opened by SEZ units accounts as mentioned in the circular.

15

16 17

Potrebbero piacerti anche

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Da EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Valutazione: 5 su 5 stelle5/5 (1)

- Letters of Credit and Documentary Collections: An Export and Import GuideDa EverandLetters of Credit and Documentary Collections: An Export and Import GuideValutazione: 1 su 5 stelle1/5 (1)

- FEMA Declaration PDFDocumento3 pagineFEMA Declaration PDFPratibha GahlotNessuna valutazione finora

- TF Important IssuesDocumento32 pagineTF Important Issuesgopalusha100% (1)

- FOREX Cir1684 12Documento12 pagineFOREX Cir1684 12sunilNessuna valutazione finora

- JM Transaction Slip 31-03-10Documento2 pagineJM Transaction Slip 31-03-10arshadjafri123Nessuna valutazione finora

- Types of Advances by MCBDocumento7 pagineTypes of Advances by MCBGhulam AbbasNessuna valutazione finora

- EFDAIDocumento5 pagineEFDAIJanardhana JaanuNessuna valutazione finora

- External Commercial BorrowingDocumento23 pagineExternal Commercial BorrowingAnshika SharmaNessuna valutazione finora

- PCFCDocumento6 paginePCFCambrosialnectarNessuna valutazione finora

- Multiple Bank Accounts Registration FormDocumento2 pagineMultiple Bank Accounts Registration FormgoutamNessuna valutazione finora

- Chapter On Export and Import CreditDocumento8 pagineChapter On Export and Import CreditGeorgeNessuna valutazione finora

- Import Bill, Scrutiny, LodgementDocumento41 pagineImport Bill, Scrutiny, Lodgementomi0855Nessuna valutazione finora

- Accounts in Foreign Currency: Section-IDocumento2 pagineAccounts in Foreign Currency: Section-IFaysal HaqueNessuna valutazione finora

- SyllabusDocumento24 pagineSyllabusRipon DebNessuna valutazione finora

- JM Transaction SlipDocumento2 pagineJM Transaction SlipAuthentic StagNessuna valutazione finora

- HKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyDocumento25 pagineHKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyParamu NatarajanNessuna valutazione finora

- Cridit Managment: MBA Banking & Finance 3 TermDocumento20 pagineCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬Nessuna valutazione finora

- BDL Circular 158 - Gradual Withdrawal of Deposits - Melki & AssociatesDocumento5 pagineBDL Circular 158 - Gradual Withdrawal of Deposits - Melki & AssociatesKhattar AounNessuna valutazione finora

- General BankingDocumento24 pagineGeneral BankingMD. JAHIDNessuna valutazione finora

- ESOPs DeclarationDocumento2 pagineESOPs Declarationbijli.boy3Nessuna valutazione finora

- Buyers CreditDocumento8 pagineBuyers Creditsudhir.kochhar3530Nessuna valutazione finora

- FCNR (B) LoansDocumento12 pagineFCNR (B) LoansGeorgeNessuna valutazione finora

- Trade Certification Level 3 AllDocumento8 pagineTrade Certification Level 3 AllRAHUL BISHWASNessuna valutazione finora

- FBP BasicsDocumento4 pagineFBP BasicsManohar VeeraNessuna valutazione finora

- Knowledge Bank: Fedai RulesDocumento10 pagineKnowledge Bank: Fedai RulesRohan Singh100% (1)

- Opening of AccountsDocumento6 pagineOpening of AccountswubeNessuna valutazione finora

- Fe 25 CircularDocumento10 pagineFe 25 CircularMaria ChaudhryNessuna valutazione finora

- Disposal Instructions Retail FormatDocumento2 pagineDisposal Instructions Retail FormatPrince SharmaNessuna valutazione finora

- Terms and ConditionsDocumento3 pagineTerms and Conditionsempsckatta2017Nessuna valutazione finora

- Heritage Funds Trade Program Hong KongDocumento5 pagineHeritage Funds Trade Program Hong Kongmunkarobert100% (1)

- Fedai Rule - 2012 (Circular)Documento15 pagineFedai Rule - 2012 (Circular)Ramam Remo RemoNessuna valutazione finora

- EDF L/C Master Circular by BB 2009Documento6 pagineEDF L/C Master Circular by BB 2009Mohammad Shafiqul Islam RoneeNessuna valutazione finora

- Advance 202104Documento14 pagineAdvance 202104Nino NinosNessuna valutazione finora

- Advance 201212Documento14 pagineAdvance 201212Lam TranNessuna valutazione finora

- FAQs Redemption of Tranche 2 LTIBsDocumento7 pagineFAQs Redemption of Tranche 2 LTIBsKaran KaranNessuna valutazione finora

- Execution of Forward Contracts in Foreign Exchange MarketsDocumento7 pagineExecution of Forward Contracts in Foreign Exchange Marketsmohanbaskar87Nessuna valutazione finora

- Sample Import Bill For CollectionDocumento6 pagineSample Import Bill For CollectionjgaeqNessuna valutazione finora

- Terms and Conditions For Notice Term DepositDocumento2 pagineTerms and Conditions For Notice Term DepositdoctorirfanNessuna valutazione finora

- Banking Principle,,,Ch - 2Documento11 pagineBanking Principle,,,Ch - 2Mubarik AhmedinNessuna valutazione finora

- Corporate Insolvency Resolution Process Insolvency and Bankruptcy Code (IBC)Documento36 pagineCorporate Insolvency Resolution Process Insolvency and Bankruptcy Code (IBC)Prajwal WakhareNessuna valutazione finora

- KCC CompleteDocumento94 pagineKCC CompleteRonit HrishikeshNessuna valutazione finora

- EEFC Account - Review of GuidelinesDocumento2 pagineEEFC Account - Review of GuidelinesAnkit PatodiaNessuna valutazione finora

- Buyers CreditDocumento2 pagineBuyers Creditrao_gmailNessuna valutazione finora

- Acc Opening Terms N ConditionsDocumento33 pagineAcc Opening Terms N ConditionsSana mohsinNessuna valutazione finora

- Ce 25062012 EcDocumento3 pagineCe 25062012 EcprahladtripathiNessuna valutazione finora

- Multiple Bank Account MandateDocumento2 pagineMultiple Bank Account Mandateanaga1982Nessuna valutazione finora

- Overdraft Against Property Loan AgreementDocumento56 pagineOverdraft Against Property Loan Agreementkirubaharan2022Nessuna valutazione finora

- Form HBL4Documento3 pagineForm HBL4klerinetNessuna valutazione finora

- Exchange Arithmetic: Exercise 1Documento2 pagineExchange Arithmetic: Exercise 1Rohit AggarwalNessuna valutazione finora

- Exchange Control?: MF0007 - International Financial ManagementDocumento14 pagineExchange Control?: MF0007 - International Financial ManagementAmbrishNessuna valutazione finora

- 28 March 2024 - DEA Fund Scheme - Finance 360Documento17 pagine28 March 2024 - DEA Fund Scheme - Finance 360Aniket RathoreNessuna valutazione finora

- Foreign ExchangeDocumento21 pagineForeign Exchangedamodar.kunchala1Nessuna valutazione finora

- Auto FD DeclarationDocumento2 pagineAuto FD DeclarationsumitNessuna valutazione finora

- CanaraMF Change of Bank Mandate FormDocumento1 paginaCanaraMF Change of Bank Mandate FormDheeraj RavichandranNessuna valutazione finora

- Role and Function of Brokerage FirmDocumento29 pagineRole and Function of Brokerage FirmSrinibash BehuraNessuna valutazione finora

- A. P. (DIR. Series) Circular No. 12, Dated July 31, 2012Documento3 pagineA. P. (DIR. Series) Circular No. 12, Dated July 31, 2012Anurag ShuklaNessuna valutazione finora

- 2 Weeks Maturity DepositDocumento2 pagine2 Weeks Maturity DepositStorm CastleNessuna valutazione finora

- International Finance Pre Shipments FinanceDocumento14 pagineInternational Finance Pre Shipments FinanceKiran AwasthiNessuna valutazione finora

- Libor TrendDocumento2 pagineLibor TrendcallvkNessuna valutazione finora

- Service Tax Presentation On Changes by MOFDocumento64 pagineService Tax Presentation On Changes by MOFcallvkNessuna valutazione finora

- Foreign Remittance 15 CA& 15 CBDocumento3 pagineForeign Remittance 15 CA& 15 CBcallvkNessuna valutazione finora

- 21 Tax Compliance ChartsDocumento23 pagine21 Tax Compliance ChartscallvkNessuna valutazione finora

- NPV IRRCalculatorDocumento9 pagineNPV IRRCalculatorcallvkNessuna valutazione finora

- Service Tax Act Update 01.07.2012Documento66 pagineService Tax Act Update 01.07.2012callvkNessuna valutazione finora

- Eefc Queries - FedaiDocumento4 pagineEefc Queries - FedaicallvkNessuna valutazione finora

- Import Export TermsDocumento1 paginaImport Export TermscallvkNessuna valutazione finora

- Land Conversion ChartDocumento1 paginaLand Conversion ChartcallvkNessuna valutazione finora

- Enterprise ValueDocumento3 pagineEnterprise ValuecallvkNessuna valutazione finora

- IBA Format Status ReportDocumento1 paginaIBA Format Status Reportcallvk38% (8)

- RBI Circular On External Commercial Borrowings (ECB)Documento60 pagineRBI Circular On External Commercial Borrowings (ECB)vhkprasadNessuna valutazione finora

- Inter Corporate LoansDocumento3 pagineInter Corporate LoanscallvkNessuna valutazione finora

- EEFCDocumento2 pagineEEFCcallvkNessuna valutazione finora

- Average Maturity CalculationDocumento2 pagineAverage Maturity CalculationcallvkNessuna valutazione finora

- Calculate Prin&Intin EMIDocumento2 pagineCalculate Prin&Intin EMIcallvkNessuna valutazione finora

- Customer Declaration EEFCDocumento1 paginaCustomer Declaration EEFCcallvkNessuna valutazione finora

- Bank RecoDocumento8 pagineBank RecocallvkNessuna valutazione finora

- Highlights of Union Budget 2010Documento4 pagineHighlights of Union Budget 2010callvkNessuna valutazione finora

- Union Budget 2012-13: HighlightsDocumento15 pagineUnion Budget 2012-13: HighlightsNDTVNessuna valutazione finora

- Union Budget 2012-13: HighlightsDocumento15 pagineUnion Budget 2012-13: HighlightsNDTVNessuna valutazione finora

- Highlights of Union Budget 2010Documento4 pagineHighlights of Union Budget 2010callvkNessuna valutazione finora

- PCFCDocumento6 paginePCFCcallvkNessuna valutazione finora

- Calculate EmiDocumento2 pagineCalculate EmicallvkNessuna valutazione finora

- Average Tenure&NPVDocumento6 pagineAverage Tenure&NPVcallvkNessuna valutazione finora

- Circular From Rbi For Home Loan ClosureDocumento1 paginaCircular From Rbi For Home Loan Closurekirang gandhiNessuna valutazione finora

- External Commercial Borrowings and Trade CreditsDocumento51 pagineExternal Commercial Borrowings and Trade CreditsgauravvssNessuna valutazione finora

- ECB Return June - 2012Documento10 pagineECB Return June - 2012callvkNessuna valutazione finora

- FORM 83 - FormDocumento7 pagineFORM 83 - FormcallvkNessuna valutazione finora

- Export Credit RefinanceDocumento1 paginaExport Credit RefinancecallvkNessuna valutazione finora

- Senior Solution Architect in Amazon CV Samle - KickresumeDocumento4 pagineSenior Solution Architect in Amazon CV Samle - KickresumeIndra SarNessuna valutazione finora

- Ade Siti Mariam 183112340350061Documento2 pagineAde Siti Mariam 183112340350061Ade siti mNessuna valutazione finora

- SCC Members List 2019Documento12 pagineSCC Members List 2019Sam ShindeNessuna valutazione finora

- Documents of TitleDocumento5 pagineDocuments of TitleNeil MayorNessuna valutazione finora

- International Rules For Demand Guarantees - URDG 758Documento16 pagineInternational Rules For Demand Guarantees - URDG 758Amit Bhushan86% (7)

- Bba 6th Sem Project ReportDocumento65 pagineBba 6th Sem Project Reportbhaktasika2004Nessuna valutazione finora

- 05 Swink Moas 4e Ch04Documento38 pagine05 Swink Moas 4e Ch04isfi23001Nessuna valutazione finora

- Group Assignment - Semester-Long Marketing Plan Project Group ReportDocumento12 pagineGroup Assignment - Semester-Long Marketing Plan Project Group ReportAaditi guptaNessuna valutazione finora

- Account ReceivableDocumento14 pagineAccount ReceivableMahdi ManNessuna valutazione finora

- Zara Marketing PlanDocumento52 pagineZara Marketing Planshiva5717Nessuna valutazione finora

- ProposalDocumento17 pagineProposalHimanshuNessuna valutazione finora

- Chapter 5 - Strategies in Action Chapter 5 - Strategies in ActionDocumento23 pagineChapter 5 - Strategies in Action Chapter 5 - Strategies in ActionSadaqat AliNessuna valutazione finora

- MA Thesis The Role of The Ombudsman in I PDFDocumento159 pagineMA Thesis The Role of The Ombudsman in I PDFSweta ToppoNessuna valutazione finora

- Entrep DLP 1Documento3 pagineEntrep DLP 1Gevelyn BautistaNessuna valutazione finora

- This Spreadsheet Supports STUDENT Analysis of The Case "Transportation and Consolidation at Elevalt LTD." (UVA-OM-1490)Documento7 pagineThis Spreadsheet Supports STUDENT Analysis of The Case "Transportation and Consolidation at Elevalt LTD." (UVA-OM-1490)rakeshNessuna valutazione finora

- Partially Revised-By AO 3 S 2021 Comprehensive Rules On Land Use Conversion FINALDocumento36 paginePartially Revised-By AO 3 S 2021 Comprehensive Rules On Land Use Conversion FINALDar AntiqueNessuna valutazione finora

- Chapter10 Ethics DLSDocumento28 pagineChapter10 Ethics DLSsarah smith100% (1)

- Ac2206c - Group 4 - Slides - Case 1Documento10 pagineAc2206c - Group 4 - Slides - Case 1MOHAMMAD ASYRAF NAZRI SAKRINessuna valutazione finora

- KEVIN KIMUNGA KIMANI - MSC FINANCE RESEARCH PROJECTDocumento52 pagineKEVIN KIMUNGA KIMANI - MSC FINANCE RESEARCH PROJECTabhijeet falaneNessuna valutazione finora

- Tiffany & Co. 8-K (LVMH)Documento4 pagineTiffany & Co. 8-K (LVMH)The Fashion LawNessuna valutazione finora

- Chevrolet and Manchester United: A Transformational Sponsorship in A Traditional IndustryDocumento10 pagineChevrolet and Manchester United: A Transformational Sponsorship in A Traditional IndustryArgeadNessuna valutazione finora

- Vendor Management: Definition and UsesDocumento3 pagineVendor Management: Definition and UsessnowFlakes ANessuna valutazione finora

- CMAT 2024 Innovation Entrepreneurship - mBX6GlTDocumento80 pagineCMAT 2024 Innovation Entrepreneurship - mBX6GlTushajaisur123Nessuna valutazione finora

- 2.5 Energy Managment Systems and ISO 50001Documento44 pagine2.5 Energy Managment Systems and ISO 50001AbdullahNessuna valutazione finora

- Larrys Bicycle Shop - Annual Financial Statements - Original HardcodedDocumento4 pagineLarrys Bicycle Shop - Annual Financial Statements - Original HardcodedLarry MaiNessuna valutazione finora

- Accounting Study PlanDocumento9 pagineAccounting Study PlanOuis MistarihiNessuna valutazione finora

- Addmrpt 1 36561 36562Documento5 pagineAddmrpt 1 36561 36562Anonymous ZGcs7MwsLNessuna valutazione finora

- Mahindra Tractors - Promotion of New Product Yuvraj215 - Summer Training ReportDocumento85 pagineMahindra Tractors - Promotion of New Product Yuvraj215 - Summer Training Reportneha satish pawarNessuna valutazione finora

- Bmt5121 Corporate Goverance and Ethics Digital Assignment 3Documento17 pagineBmt5121 Corporate Goverance and Ethics Digital Assignment 3Barani Kumar NNessuna valutazione finora

- Bank-Reconciliation IADocumento10 pagineBank-Reconciliation IAAnaluz Cristine B. CeaNessuna valutazione finora