Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Shelly

Caricato da

poojatyagi2008Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Shelly

Caricato da

poojatyagi2008Copyright:

Formati disponibili

AGRICULTURE FINANCE IN INDIA

INTRODUCTION Finance in agriculture is as important as development of technologies. Technical inputs can bep u r c h a s e d a n d u s e d b y f a r me r o n l y i f h e h a s mo n e y ( f u n d s ) . B u t h i s o wn mo n e y i s a l w a ys inadequate and he needs outside finance or credit.Professional money lenders were the only source of credit to agriculture till 1935. They use tocharge unduly high rates of interest and follow serious practices while giving loans andrecovering them. As a result, farmers were heavily burdened with debts and many of themperpetuated debts. There were widespread discontents among farmers against these practicesand there were instances of riots also.With the passing of Reserve Bank of India Act 1934, District Central Co-op. Banks Act and LandDevelopment Banks Act, agricultural credit received impetons and there were improvements inagricultural credit. A powerful alternative agency came into being. Large-scale credit becameavailable with reasonable rates of interest at easy terms, both in terms of granting loans andrecovery of them. Although the co-operative banks started financing agriculture with their establishments in 1930s real impetons was received only after Independence when suitablelegislation were passed and policies were formulated. There after, bank credit to agriculturemade phenomenal progress by opening branches in rural areas and attracting deposits.Till 14 major commercial banks were nationalized in 1969, co-operative banks were the maininstitutional agencies providing finance to agriculture. After nationalization, it was mademandatory for these banks to provide finance to agriculture as a priority sector. These banksundertook special programs of branch expansion and created a network of banking servicesthroughout the country and started financing agriculture on large scale. Thus agriculture creditacquired multi-agency dimension. Development and adoption of new technologies andavailability of finance go hand in hand. In bringing "Green Revolution", "White Revolution" andnow "Yellow Revolution" finance has played a crucial role. Now the agriculture credit, throughmulti agency approach has come to stay.The procedures and amount of loans for various purposes have been standardized. Among thevarious purposes "Crop loans" (Shortterm loan) has the major share. In addition, farmers getloans for purchase of electric motor with pump, tractor and other machinery, digging wells or boring wells, installation of pipe lines, drip irrigation, planting fruit orchards, purchase of dairyanimals and feeds/fodder for them, poultry, sheep/goat keeping and for many other alliedenterprises.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Florida Real Estate Post Licensing ExamDocumento16 pagineFlorida Real Estate Post Licensing ExamJules100% (6)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- PDFDocumento3 paginePDFaru76767650% (2)

- Problems ConditionalProbabilityDocumento8 pagineProblems ConditionalProbabilitySANIA0% (1)

- Case Digests in Civil LawDocumento4 pagineCase Digests in Civil LawareanneNessuna valutazione finora

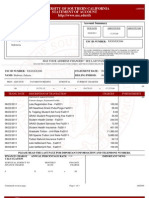

- University of Southern California Statement of Account: Account Summary Current AddressDocumento3 pagineUniversity of Southern California Statement of Account: Account Summary Current AddressNorisk NanungNessuna valutazione finora

- A Study On Fixed Income Securities and Their Awareness Among Indian InvestorsDocumento82 pagineA Study On Fixed Income Securities and Their Awareness Among Indian InvestorsSourav LodhaNessuna valutazione finora

- By LawsDocumento9 pagineBy LawsLowell ValienteNessuna valutazione finora

- Banking Was in Existence in India During The Vedic Times (2000 BC To 1400 BC) - MoneyDocumento6 pagineBanking Was in Existence in India During The Vedic Times (2000 BC To 1400 BC) - MoneysadathnooriNessuna valutazione finora

- Presentation On Mathematics For FinanceDocumento14 paginePresentation On Mathematics For FinanceShakil Ahmed IsrafilNessuna valutazione finora

- Corporate Finance: The Time Value of MoneyDocumento35 pagineCorporate Finance: The Time Value of MoneyRodrigoNessuna valutazione finora

- Jack Johnson IndictmentDocumento31 pagineJack Johnson IndictmentTBDNeighborhoods100% (1)

- Metrobank Vs SLGT HoldingsDocumento2 pagineMetrobank Vs SLGT HoldingsnikkimaxinevaldezNessuna valutazione finora

- Acme Shoe Rubber V CA 1996Documento3 pagineAcme Shoe Rubber V CA 1996John Basil ManuelNessuna valutazione finora

- Whitney Tilson T2 Partners October09Documento73 pagineWhitney Tilson T2 Partners October09marketfolly.com100% (1)

- Security Bank and Trust Company v. Rodolfo CuencaDocumento7 pagineSecurity Bank and Trust Company v. Rodolfo CuencabearzhugNessuna valutazione finora

- Santana IPODocumento246 pagineSantana IPOyaoanmin2005Nessuna valutazione finora

- Indoor Management and Constructive NoticeDocumento11 pagineIndoor Management and Constructive NoticeAvinandan KunduNessuna valutazione finora

- TVM Assignment 1Documento1 paginaTVM Assignment 1Mohammad TayyabNessuna valutazione finora

- FN1623-2406 - Footnotes Levin-Coburn ReportDocumento1.036 pagineFN1623-2406 - Footnotes Levin-Coburn ReportRick ThomaNessuna valutazione finora

- Eulogio Vs BellDocumento7 pagineEulogio Vs Bellada9ablaoNessuna valutazione finora

- Standard Cipher Code American Railway 1906Documento776 pagineStandard Cipher Code American Railway 1906Max Power100% (1)

- 2 Cagayan Fishing Vs Sandiko 65 Phil 223Documento3 pagine2 Cagayan Fishing Vs Sandiko 65 Phil 223GigiRuizTicarNessuna valutazione finora

- Marcela S. Velandres: To: Address: !Documento3 pagineMarcela S. Velandres: To: Address: !Honeybunch MelendezNessuna valutazione finora

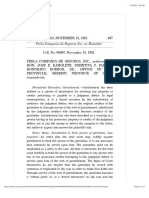

- Perla Compania de Seguros, Inc. vs. RamoleteDocumento11 paginePerla Compania de Seguros, Inc. vs. RamoletedelbertcruzNessuna valutazione finora

- Analyzing Organizational Behavior of Bangladesh BankDocumento8 pagineAnalyzing Organizational Behavior of Bangladesh Bankسرابوني رحمانNessuna valutazione finora

- 03 Laluan V MalpayaDocumento11 pagine03 Laluan V MalpayaMichael Parreño VillagraciaNessuna valutazione finora

- Macapagal vs. Remorin Et. Al. G.R. No. 158380. May 16, 2005 DIGESTEDDocumento1 paginaMacapagal vs. Remorin Et. Al. G.R. No. 158380. May 16, 2005 DIGESTEDJacquelyn AlegriaNessuna valutazione finora

- Important Document Indian Service and Ex - Service MenDocumento70 pagineImportant Document Indian Service and Ex - Service MenAnil UniyalNessuna valutazione finora

- Draft Mortgage Deed-ConsortiumDocumento26 pagineDraft Mortgage Deed-ConsortiumNilesh Pius KujurNessuna valutazione finora

- 1996 Ann Surv SAfrican L272Documento17 pagine1996 Ann Surv SAfrican L272SCRUPEUSSNessuna valutazione finora