Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Private Sec Banks

Caricato da

karunDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Private Sec Banks

Caricato da

karunCopyright:

Formati disponibili

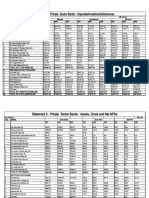

Statement I : Private Sector Banks : Deposits/Investments/Advances

( ` Crore)

As on March 31

S.No.

BANKS

Deposits

2009

2010

Investments

2011

2009

2010

Advances

2011

2008

2009

2010

2011

I

1

City Union Bank Ltd.

8207

10285

12914

2397

3210

3616

5645

6833

9255

ING Vysya Bank Ltd.

24889

25865

30194

10496

10473

11021

16756

18507

23602

SBI Commercial & International Bank Ltd.

588

492

513

296

319

286

311

205

270

Tamilnad Mercantile Bank Ltd.

9566

11639

13793

3207

3499

3767

6572

8288

10759

The Bank of Rajasthan Ltd. *

15187

15062

6809

6723

7781

8329

The Catholic Syrian Bank Ltd.

6333

6978

8726

2184

2289

2690

3684

4467

6620

The Dhanalakshmi Bank Ltd.

4969

7098

12530

1567

2028

3640

3196

5006

9065

The Federal Bank Ltd.

32198

36058

43015

12119

13055

14538

22392

26950

31953

The Jammu & Kashmir Bank Ltd.

33004

37237

44676

10736

13956

19696

20930

23057

26194

10

The Karnataka Bank Ltd.

20333

23731

27336

8961

9992

11506

11810

14436

17348

11

The Karur Vysya Bank Ltd.

15101

19272

24722

4716

6602

7732

10410

13447

17814

12

The Lakshmi Vilas Bank Ltd.

7361

9075

11150

1863

2983

3519

5236

6277

8094

13

Nainital Bank Ltd.

2137

2507

2825

561

707

791

1131

1288

1678

14

The Ratnakar Bank Ltd.

1307

1585

2042

404

507

892

801

1170

1905

15

18092

23012

29721

6075

7156

8924

11848

15823

20489

The South Indian Bank Ltd.

TOTAL OF 15 PVT BANKS [I]

199274

229897

264157

72393

83499

92617

128504

154085

185047

II

NEW PRIVATE SECTOR BANKS

16

Axis Bank Ltd.

117374

141300

189238

46330

55975

71992

81557

104341

142408

17

Development Credit Bank Ltd.

4647

4787

5610

1622

2018

2295

3274

3460

4271

18

HDFC Bank Ltd.

142812

167404

208586

58818

58608

70929

98883

125831

159983

19

ICICI Bank Ltd.

218348

202017

225602

103058

120893

134686

218311

181206

216366

20

Indusind Bank Ltd.

22110

26710

34365

8083

10402

13551

15771

20551

26166

21

Kotak Mahindra Bank Ltd.

15644

23886

29261

9110

12513

17121

16625

20775

29329

22

16169

26799

45939

7117

10210

18829

12403

22193

34364

II

YES Bank

TOTAL OF 7 NEW PVT BANKS [II]

537104

592904

738602

234139

270618

329403

446824

478356

612886

III

TOTAL OF 22 PVT BANKS [I+II]

736378

822801

1002759

306531

354117

422020

575328

632441

797934

* Merger of BORajasthan with ICICI Bk w.e.f.13.08.2010

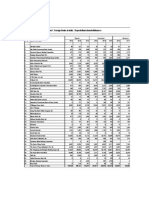

Statement II : Private Sector Banks : Assets, Gross and Net NPAs

As on March 31

S.No. BANKS

( ` Crore)

Total Assets

2008

2009

2010

Gross NPA

2011

2009

2010

Net NPA

2011

2008

2009

2010

2011

I

1

City Union Bank Ltd. *

9251

11559

14592

102

94

112

61

40

48

ING Vysya Bank Ltd.

31864

33880

39014

209

235

155

200

222

235

SBI Commercial & International Bank Ltd.

730

642

665

Tamilnad Mercantile Bank Ltd.

11244

13586

16117

120

115

141

22

20

29

The Bank of Rajasthan Ltd.

17224

17300

161

294

57

134

The Catholic Syrian Bank Ltd.

7040

7689

9829

172

149

192

88

71

108

7

8

The Dhanalakshmi Bank Ltd.

The Federal Bank Ltd.

5643

38851

8087

43676

14268

51456

64

590

78

821

67

1148

28

68

42

129

27

191

The Jammu & Kashmir Bank Ltd.

37693

42547

50508

559

462

519

288

64

53

10

The Karnataka Bank Ltd.

22858

27022

31693

443

550

702

116

189

280

11

The Karur Vysya Bank Ltd.

17061

21935

28225

206

235

228

26

31

14

12

The Lakshmi Vilas Bank Ltd.

8308

10486

13301

144

325

158

65

258

73

13

14

15

2439

1707

20379

2877

2086

25534

3292

3230

32820

19

17

261

21

28

211

23

22

230

0

5

134

0

11

62

0

7

60

Nainital Bank Ltd.

The Ratnakar Bank Ltd.

The South Indian Bank Ltd.

TOTAL OF 15 PVT BANKS [I]

232292

268905

309011

3072

3620

3701

1159

1271

1126

II

NEW PRIVATE SECTOR BANKS

16

Axis Bank Ltd.

147722

180648

242713

898

1318

1599

327

419

410

17

Development Credit Bank Ltd.

5943

6137

7372

290

319

264

127

108

41

18

HDFC Bank Ltd.

183271

222459

277353

1988

1817

1694

628

392

296

19

ICICI Bank Ltd.

379301

363400

406234

9649

9481

10034

4554

3841

2407

20

Indusind Bank Ltd.

27615

35370

45636

255

255

266

179

102

73

21

Kotak Mahindra Bank Ltd.

28712

37436

50851

689

767

603

397

360

211

22

22901

36383

59007

85

60

81

41

13

II

YES Bank

TOTAL OF 7 NEW PVT BANKS [II]

795464

881831

1089165

13854

14018

14541

6253

5235

3448

III

TOTAL OF 22 PVT BANKS [I+II]

1027756

1150736

1398176

16927

17638

18243

7412

6506

4574

* Gross NPA includes ` 5.27 cr of Interest Reserve

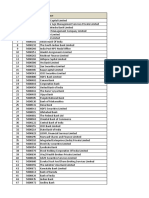

Statement III: Private Sector Banks : Income

As on March 31

S.No. BANKS

I

2009

Interest Income

2010

2011

2008

Other Income

2010

2009

(Rs.crore)

Total Income

2009

2010

2011

( ` Crore)

2011

City Union Bank Ltd.

804

957

1218

124

143

157

928

1100

1376

ING Vysya Bank Ltd.

2240

2233

2694

548

620

655

2788

2853

3349

SBI Commercial & International Bank Ltd.

54

40

36

57

46

42

Tamilnad Mercantile Bank Ltd.

1559

The Bank of Rajasthan Ltd.

The Catholic Syrian Bank Ltd.

The Dhanalakshmi Bank Ltd.

408

535

906

The Federal Bank Ltd.

3315

3673

4052

The Jammu & Kashmir Bank Ltd.

2972

3057

3713

10

The Karnataka Bank Ltd.

1949

1976

2371

11

The Karur Vysya Bank Ltd.

1446

1758

12

The Lakshmi Vilas Bank Ltd.

658

909

13

Nainital Bank Ltd.

209

224

14

The Ratnakar Bank Ltd.

15

I

The South Indian Bank Ltd.

TOTAL OF 15 PVT BANKS [I]

II

NEW PRIVATE SECTOR BANKS

16

Axis Bank Ltd.

17

Development Credit Bank Ltd.

18

977

1118

1371

136

173

188

1113

1291

1376

1359

131

130

1507

1489

557

578

762

100

74

75

656

652

837

79

91

147

488

626

1053

516

531

517

3831

4204

4569

261

416

365

3233

3473

4078

322

379

292

2271

2355

2663

2218

265

247

264

1711

2005

2482

1065

107

104

137

765

1013

1202

257

10

16

11

219

240

268

138

144

189

16

13

19

154

157

208

1687

1936

2446

164

208

197

1851

2144

2643

18790

20497

23299

2782

3152

3029

21572

23649

26328

10835

11638

15155

2897

3946

4632

13732

15584

19787

645

459

536

120

107

112

765

566

648

HDFC Bank Ltd.

16332

16173

19928

3291

3983

4335

19623

20156

24263

19

ICICI Bank Ltd.

31093

25707

25974

7604

7478

6648

38696

33185

32622

20

Indusind Bank Ltd.

2309

2707

3589

456

553

714

2766

3260

4303

21

Kotak Mahindra Bank Ltd.

3065

3256

4304

274

628

633

3339

3884

4937

22

2001

2370

4042

437

576

623

2438

2945

4665

II

YES Bank

TOTAL OF 7 NEW PVT BANKS [II]

66282

62310

73528

15078

17271

17697

81360

79580

91225

III

TOTAL OF 22 PVT BANKS [I+II]

85071

82807

96827

17860

20422

20726

102932

103229

117553

Statement IV: Private Sector Banks : Expenditure

As on March 31

S.No. BANKS

I

2011

2011

562

678

798

140

166

216

701

844

1015

1403

1688

772

808

1026

2363

2211

2714

36

33

26

10

10

10

46

43

36

4 Tamilnad Mercantile Bank Ltd.

643

744

827

204

231

298

848

975

1125

5 The Bank of Rajasthan Ltd.

998

1024

315

493

1313

1517

6 The Catholic Syrian Bank Ltd.

391

455

514

187

189

289

577

644

803

287

394

641

113

193

344

400

587

986

8 The Federal Bank Ltd.

2000

2262

2305

571

677

836

2571

2939

3142

9 The Jammu & Kashmir Bank Ltd.

1988

1938

2169

471

577

759

2459

2515

2928

10 The Karnataka Bank Ltd.

1444

1708

1758

347

386

549

1790

2094

2307

11 The Karur Vysya Bank Ltd.

1036

1193

1451

258

349

431

1293

1542

1881

12 The Lakshmi Vilas Bank Ltd.

504

660

700

152

186

228

656

847

928

13 Nainital Bank Ltd.

116

131

141

39

45

56

155

175

197

74

85

94

33

39

94

108

124

189

1164

1367

1655

328

366

463

1493

1734

2117

12834

14076

14768

3939

4715

5600

16773

18791

20368

7149

6634

8592

2858

3710

4779

10007

10343

13371

448

317

347

242

201

215

690

518

562

18 HDFC Bank Ltd.

8911

7786

9385

5533

5940

7153

14444

13726

16538

19 ICICI Bank Ltd.

15 The South Indian Bank Ltd.

TOTAL OF 15 PVT BANKS [I]

NEW PRIVATE SECTOR BANKS

16 Axis Bank Ltd.

17 Development Credit Bank Ltd.

III

2009

1590

14 The Ratnakar Bank Ltd.

II

2011

Total Expenditure#

2009

2010

2 ING Vysya Bank Ltd.

7 The Dhanalakshmi Bank Ltd.

II

2009

Operating Expenses

2010

1 City Union Bank Ltd.

3 SBI Commercial & International Bank Ltd.

( ` Crore)

Interest Expended

2010

22726

17593

16957

7045

5860

6617

29771

23452

23574

20 Indusind Bank Ltd.

1850

1821

2213

547

736

1008

2397

2557

3221

21 Kotak Mahindra Bank Ltd.

1547

1397

2058

1196

1189

1553

2743

2587

3612

22 YES Bank

TOTAL OF 7 NEW PVT BANKS [II]

1492

1582

2795

419

500

680

1911

2082

3475

44123

37130

42347

17840

18136

22006

61964

55265

64354

56957

51206

57115

21779

22851

27606

78737

74057

84722

TOTAL OF 22 PVT BANKS [I+II]

#Excludes Provisions& Contingencies

Statement V: Private Sector Banks : Profit

( ` Crore)

As on March 31

S.No. BANKS

I

2009

2010

2011

2009

2010

2011

256

361

105

103

146

122

153

215

425

642

635

236

400

317

189

242

319

12

11

4 Tamilnad Mercantile Bank Ltd.

265

316

434

115

131

183

150

185

251

5 The Bank of Rajasthan Ltd.

194

-28

76

74

118

-102

79

34

42

21

37

12

8 The Federal Bank Ltd.

9 The Jammu & Kashmir Bank Ltd.

88

39

67

30

15

41

57

23

26

1260

1265

1427

759

800

840

500

465

587

774

958

1149

365

446

534

410

512

615

10 The Karnataka Bank Ltd.

480

261

355

214

94

151

267

167

205

11 The Karur Vysya Bank Ltd.

418

463

601

182

127

185

236

336

416

12 The Lakshmi Vilas Bank Ltd.

109

166

274

59

136

173

50

31

101

13 Nainital Bank Ltd.

64

65

71

28

22

26

36

43

46

14 The Ratnakar Bank Ltd.

46

33

19

15

14

31

19

12

359

411

525

164

177

233

195

234

293

4799

4858

5959

2390

2545

2858

2409

2312

3101

3725

5241

6416

1910

2726

3027

1815

2515

3388

75

48

86

163

127

65

-88

-78

21

18 HDFC Bank Ltd.

5179

6430

7725

2934

3481

3799

2245

2949

3926

19 ICICI Bank Ltd.

15 The South Indian Bank Ltd.

TOTAL OF 15 PVT BANKS [I]

NEW PRIVATE SECTOR BANKS

16 Axis Bank Ltd.

17 Development Credit Bank Ltd.

III

2009

227

7 The Dhanalakshmi Bank Ltd.

II

2011

Net Profit

2 ING Vysya Bank Ltd.

6 The Catholic Syrian Bank Ltd.

II

2010

Provisions & Contingencies

1 City Union Bank Ltd.

3 SBI Commercial & International Bank Ltd.

Operating Profit

8925

9732

9048

5167

5707

3896

3758

4025

5151

20 Indusind Bank Ltd.

368

704

1082

220

354

504

148

350

577

21 Kotak Mahindra Bank Ltd.

596

1297

1325

320

736

507

276

561

818

22 YES Bank

TOTAL OF 7 NEW PVT BANKS [II]

528

863

1190

224

386

463

304

478

727

19396

24315

26871

10937

13516

12261

8459

10799

14610

24195

29173

32831

13327

16061

15119

10868

13111

17712

TOTAL OF 22 PVT BANKS [I+II]

Statement VI : Private Sector Banks: Ratios

As on March 31

Credit-Deposit Ratio

[ in Per Cent ]

Spread as % of Assets

Investment-Deposit Ratio

S.No.

I

BANKS

City Union Bank Ltd.

68.79

66.44

71.67

29.21

31.22

28.00

2.62

2.41

2.88

ING Vysya Bank Ltd.

67.32

71.55

78.17

42.17

40.49

36.50

2.04

2.45

2.58

SBI Commercial & International Bank Ltd.

52.88

41.73

52.56

50.30

64.95

55.65

2.47

1.16

1.54

Tamilnad Mercantile Bank Ltd.

68.70

71.20

78.00

33.53

30.06

27.31

2.97

2.76

3.37

The Bank of Rajasthan Ltd.

51.23

55.30

0.00

44.83

44.63

0.00

2.19

1.94

0.00

The Catholic Syrian Bank Ltd.

58.17

64.01

75.87

34.49

32.81

30.83

2.35

1.60

2.52

The Dhanalakshmi Bank Ltd.

64.32

70.53

72.35

31.54

28.57

29.05

2.16

1.74

1.86

The Federal Bank Ltd.

69.54

74.74

74.28

37.64

36.20

33.80

3.39

3.23

3.39

The Jammu & Kashmir Bank Ltd.

63.42

61.92

58.63

32.53

37.48

44.09

2.61

2.63

3.06

10

The Karnataka Bank Ltd.

58.08

60.83

63.46

44.07

42.11

42.09

2.21

0.99

1.93

11

The Karur Vysya Bank Ltd.

68.93

69.78

72.06

31.23

34.26

31.27

2.41

2.58

2.72

12

The Lakshmi Vilas Bank Ltd.

71.14

69.17

72.60

25.31

32.87

31.56

1.85

2.38

2.74

13

Nainital Bank Ltd.

52.94

51.38

59.41

26.23

28.18

27.99

3.80

3.25

3.52

14

The Ratnakar Bank Ltd.

61.29

73.84

93.29

30.95

32.00

43.70

3.72

2.82

2.95

15

65.49

68.76

68.94

33.58

31.10

30.03

2.57

2.23

2.41

The South Indian Bank Ltd.

TOTAL OF 15 PVT BANKS [I]

64.49

67.02

70.05

36.33

36.32

35.06

2.56

2.39

2.76

II

NEW PRIVATE SECTOR BANKS

16

Axis Bank Ltd.

69.48

73.84

75.25

39.47

39.61

38.04

2.50

2.77

2.70

17

Development Credit Bank Ltd.

70.46

72.27

76.14

34.90

42.15

40.91

3.32

2.31

2.57

18

HDFC Bank Ltd.

69.24

75.17

76.70

41.19

35.01

34.00

4.05

3.77

3.80

19

ICICI Bank Ltd.

99.98

89.70

95.91

47.20

59.84

59.70

2.21

2.23

2.22

20

Indusind Bank Ltd.

71.33

76.94

76.14

36.56

38.94

39.43

1.66

2.51

3.02

21

Kotak Mahindra Bank Ltd.

106.27

86.97

100.23

58.23

52.38

58.51

5.29

4.96

4.42

22

76.71

82.81

74.80

44.02

38.10

40.99

2.22

2.17

2.11

II

YES Bank

TOTAL OF 7 NEW PVT BANKS [II]

83.19

80.68

82.98

43.59

45.64

44.60

2.79

2.86

2.86

III

TOTAL OF 22 PVT BANKS [I+II]

78.13

76.86

79.57

41.63

43.04

42.09

2.74

2.75

2.84

2009

2010

2011

2009

2010

2011

2009

2010

2011

Statement VII : Private Sector Banks: Ratios

As on March 31

S.No. BANKS

I

Opr.Exp.As % to Total

Expenses

2009

2010

2011

Return on Assets (in %)

2009

2010

2011

Capital Adequacy - Basel

I

2009

2010

2011

Capital Adequacy - Basel II

2009

2010

2011

City Union Bank Ltd.

19.89

19.64

21.32

1.50

1.52

1.67

12.49

12.09

11.09

12.69

13.46

12.75

ING Vysya Bank Ltd.

32.69

36.55

37.81

0.70

0.80

0.89

11.68

11.65

14.91

12.94

SBI Commercial & International Bank Ltd.

20.97

23.33

28.48

1.52

0.49

0.63

23.81

32.00

29.89

21.24

27.31

28.16

Tamilnad Mercantile Bank Ltd.

24.10

23.73

26.49

1.51

1.54

1.74

14.48

14.09

13.87

16.05

15.54

15.13

The Bank of Rajasthan Ltd.

23.98

32.48

0.00

0.74

-0.58

0.00

12.00

7.74

0.00

11.50

7.52

0.00

The Catholic Syrian Bank Ltd.

32.30

29.35

35.99

0.57

0.02

0.14

N.A.

12.29

10.82

11.22

The Dhanalakshmi Bank Ltd.

28.28

32.86

34.94

1.21

0.35

0.23

14.44

12.47

10.81

15.38

12.99

11.80

The Federal Bank Ltd.

22.22

23.03

26.62

1.48

1.15

1.34

20.14

17.27

15.39

20.22

18.36

16.79

The Jammu & Kashmir Bank Ltd.

19.15

22.96

25.92

1.09

1.20

1.22

13.46

14.81

13.30

14.48

15.89

13.72

10

The Karnataka Bank Ltd.

19.35

18.44

23.79

1.25

0.67

0.72

13.54

13.48

12.37

13.33

11

The Karur Vysya Bank Ltd.

19.92

22.61

22.89

1.49

1.76

1.71

13.08

14.92

14.49

14.41

12

The Lakshmi Vilas Bank Ltd.

23.13

22.02

24.59

0.71

0.33

0.91

10.09

14.21

12.09

10.29

14.82

13.19

13

Nainital Bank Ltd.

25.07

25.54

28.43

1.68

1.73

1.56

13.89

15.53

17.49

13.10

15.68

16.35

14

The Ratnakar Bank Ltd.

30.88

31.23

50.12

1.96

1.05

0.53

44.87

36.01

59.42

42.30

34.07

56.41

15

22.01

21.12

21.84

1.09

1.07

1.05

13.89

14.73

13.17

14.76

15.39

14.01

The South Indian Bank Ltd.

AVERAGE OF 15 PVT BANKS [I]

23.49

25.09

27.49

II

NEW PRIVATE SECTOR BANKS

16

Axis Bank Ltd.

28.56

35.87

35.74

1.44

1.67

1.68

13.69

15.80

12.65

17

Development Credit Bank Ltd.

35.07

38.75

38.27

-1.25

-1.30

0.30

13.44

13.30

14.85

13.25

18

HDFC Bank Ltd.

38.31

43.27

43.25

1.28

1.53

1.58

15.09

16.45

15.32

15.70

17.44

16.22

19

ICICI Bank Ltd.

23.66

28.79

28.07

0.98

1.13

1.35

15.92

19.14

17.63

15.53

19.41

19.54

20

Indusind Bank Ltd.

22.82

28.79

31.31

0.58

1.14

1.46

12.33

13.40

14.39

12.55

15.33

15.89

21

Kotak Mahindra Bank Ltd.

43.62

45.98

43.01

1.03

1.72

1.77

19.86

18.05

18.73

20.01

18.35

19.92

22

21.91

28.79

24.02

32.82

19.56

1.59

1.79

1.58

14.50

16.60

20.61

16.50

II

YES Bank

AVERAGE OF 7 NEW PVT BANKS [II]

III

AVERAGE OF 22 PVT BANKS [I+II]

27.66

30.86

32.58

34.20

Statement VIII : Private Sector Banks: Ratios

( ` lacs)

As on March 31

S.No. BANKS

I

Net NPA to Net Advances ( in %) Business Per Employee

Cr)

2009

2010

2011

2009

2010

City Union Bank Ltd.

1.08

0.58

0.52

5.65

ING Vysya Bank Ltd.

1.20

1.20

0.39

SBI Commercial & International Bank Ltd.*

0.00

0.00

0.00

Tamilnad Mercantile Bank Ltd.

0.34

0.24

The Bank of Rajasthan Ltd.

0.73

1.60

The Catholic Syrian Bank Ltd.

2.39

The Dhanalakshmi Bank Ltd.

The Federal Bank Ltd.

9

10

(`

2011

Profit Per Employee

2009

6.51

7.81

6.06

6.24

9.60

10.55

0.27

6.79

0.00

5.33

1.58

1.74

0.88

0.84

0.30

0.48

The Jammu & Kashmir Bank Ltd.

1.37

The Karnataka Bank Ltd.

0.98

11

The Karur Vysya Bank Ltd.

12

The Lakshmi Vilas Bank Ltd.

13

2010

2011

4.98

5.81

8.00

6.75

3.03

3.88

4.53

9.55

13.17

4.43

5.85

8.70

9.59

6.43

8.14

9.91

5.70

0.00

2.89

-2.56

0.00

3.74

4.19

5.37

1.39

0.06

0.45

0.30

5.86

3.70

5.89

4.10

0.71

0.71

0.60

7.50

8.13

9.23

6.90

6.01

7.26

0.28

0.20

5.00

7.31

8.56

7.00

7.00

8.00

1.31

1.62

6.49

7.27

7.71

5.00

3.00

4.00

0.25

0.23

0.07

6.38

7.89

9.35

5.98

8.05

9.09

1.24

4.11

0.90

5.10

5.60

7.19

2.07

1.13

3.85

Nainital Bank Ltd.

0.00

0.00

0.00

4.25

5.21

5.85

6.00

6.00

6.00

14

The Ratnakar Bank Ltd.

0.68

0.97

0.36

3.73

3.91

4.35

5.00

3.00

1.00

15

1.13

0.39

0.29

6.45

7.71

9.18

4.31

5.00

5.00

The South Indian Bank Ltd.

AVERAGE OF 15 PVT BANKS [I]

0.90

0.83

0.61

II

NEW PRIVATE SECTOR BANKS

16

Axis Bank Ltd.

0.40

0.40

0.29

10.60

11.11

13.66

10.02

12.00

14.00

17

Development Credit Bank Ltd.

3.88

3.11

0.97

3.79

5.15

5.06

-4.00

-5.00

1.00

18

HDFC Bank Ltd.

0.63

0.31

0.19

4.46

5.90

6.53

4.18

5.98

7.37

19

ICICI Bank Ltd.

2.09

2.12

1.11

11.54

7.65

7.35

11.00

9.00

10.00

20

Indusind Bank Ltd.

1.14

0.50

0.28

8.36

8.37

8.44

3.49

6.51

8.24

21

Kotak Mahindra Bank Ltd.

2.39

1.73

0.72

3.47

4.87

5.35

3.00

7.00

8.00

22

YES Bank

AVERAGE OF 7 NEW PVT BANKS [II]

0.33

0.06

0.03

9.88

16.24

22.20

11.38

16.75

20.89

1.40

1.29

1.09

1.03

0.56

0.57

II

III

AVERAGE OF 22 PVT BANKS [I+II]

* Net NPA is arrived at netting off Floating Provision from Gross NPAs

Potrebbero piacerti anche

- Private Sec BanksDocumento9 paginePrivate Sec BanksMohsin TamboliNessuna valutazione finora

- PVT Sec BKS 2012 14Documento32.767 paginePVT Sec BKS 2012 14Shital AndhariaNessuna valutazione finora

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Private Sector Banks: Deposits/Investments/Advancesprakasht_1Nessuna valutazione finora

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Private Sector Banks: Deposits/Investments/AdvancesGyanendra AgrawalNessuna valutazione finora

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Private Sector Banks: Deposits/Investments/AdvancesanandbhawanaNessuna valutazione finora

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocumento9 pagineStatement I: Public Sector Banks: Deposits/Investments/AdvancesNekta PinchaNessuna valutazione finora

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Private Sector Banks: Deposits/Investments/AdvancesShajin SanthoshNessuna valutazione finora

- Branch and ATM Data March 2010Documento3 pagineBranch and ATM Data March 2010Kapil Dev KumarNessuna valutazione finora

- Table B6: Movement of Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2012 and 2013Documento3 pagineTable B6: Movement of Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2012 and 2013Hitesh MittalNessuna valutazione finora

- Private Sec Banks 3806Documento9 paginePrivate Sec Banks 3806Ganesh RamaiyerNessuna valutazione finora

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Public Sector Banks: Deposits/Investments/AdvancesNirmal SinghNessuna valutazione finora

- Public Sec Banks 1Documento8 paginePublic Sec Banks 1ajsharma8Nessuna valutazione finora

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocumento25 pagineStatement I: Foreign Banks in India: Deposits/Investments/Advancesmkapoor5686Nessuna valutazione finora

- Nepse DataDocumento291 pagineNepse DataGsUpretiNessuna valutazione finora

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Foreign Banks in India: Deposits/Investments/Advancespankajp100Nessuna valutazione finora

- Top 10 Private Sector Banks by AssetsDocumento129 pagineTop 10 Private Sector Banks by AssetsrohitcshettyNessuna valutazione finora

- Bank Wise RTGS Inward and Outward - August 2013Documento8 pagineBank Wise RTGS Inward and Outward - August 2013Santosh KardakNessuna valutazione finora

- Structure and Functions of Commercial BanksDocumento6 pagineStructure and Functions of Commercial BanksShanky RanaNessuna valutazione finora

- Pu Workers Bank DetailsDocumento2 paginePu Workers Bank DetailsJagadish JagsNessuna valutazione finora

- Final Manila Cities 2005 - 2009.BSPDocumento7 pagineFinal Manila Cities 2005 - 2009.BSPJoelene LopezNessuna valutazione finora

- Desert Public Sec SinglDocumento49 pagineDesert Public Sec SinglPankaj KumarNessuna valutazione finora

- Company Name Contact NoDocumento50 pagineCompany Name Contact NoAkanksha SinghNessuna valutazione finora

- Appendix: Table 8.1: Non Performing Assets of Different BanksDocumento8 pagineAppendix: Table 8.1: Non Performing Assets of Different Banksshreeya salunkeNessuna valutazione finora

- Specialized Bank DataDocumento11 pagineSpecialized Bank DataTalha A SiddiquiNessuna valutazione finora

- Small Medium EnterpriseDocumento45 pagineSmall Medium EnterpriseSahil MehtaNessuna valutazione finora

- 2009 2010 2011 Bills Purchased and Discounted Name of The Bank S.NoDocumento14 pagine2009 2010 2011 Bills Purchased and Discounted Name of The Bank S.NomuruganvgNessuna valutazione finora

- 51 Acp-March2015Documento3 pagine51 Acp-March2015Projects ScholarsDenNessuna valutazione finora

- Demand Forecasting - Economics Exam Date: 08/05/2022 Roll No. Student NameDocumento12 pagineDemand Forecasting - Economics Exam Date: 08/05/2022 Roll No. Student NameAakash WaliaNessuna valutazione finora

- Year Bank Total Assets I.Interest Earned III. Interest ExpendedDocumento36 pagineYear Bank Total Assets I.Interest Earned III. Interest ExpendedRITIKANessuna valutazione finora

- ATM & Card Statistics For March 2018 POS AtmsDocumento6 pagineATM & Card Statistics For March 2018 POS AtmsMathews KunnekkadanNessuna valutazione finora

- Fund Release During June-2011Documento2 pagineFund Release During June-2011rattanbansalNessuna valutazione finora

- TB6 STST1118Documento3 pagineTB6 STST1118rajsirwaniNessuna valutazione finora

- Samples DetailsDocumento4 pagineSamples Detailsswaroop shettyNessuna valutazione finora

- STRBI Table No. 12 Selected Ratios of Scheduled Commercial BanksDocumento266 pagineSTRBI Table No. 12 Selected Ratios of Scheduled Commercial BanksPruthviraj RathoreNessuna valutazione finora

- Composition of Assets of SCBsDocumento102 pagineComposition of Assets of SCBsmohitash23Nessuna valutazione finora

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Foreign Banks in India: Deposits/Investments/Advancesramkumar6388Nessuna valutazione finora

- POP Detials 090323Documento6 paginePOP Detials 090323Dr.Milan MehtaNessuna valutazione finora

- Names of BanksDocumento26 pagineNames of BanksWaleed ButtNessuna valutazione finora

- Annex: Annex 1: List of Commercial Banks in NepalDocumento5 pagineAnnex: Annex 1: List of Commercial Banks in NepalRabindra RajbhandariNessuna valutazione finora

- Appendix Table Iv.6: Branches and Atms of Scheduled Commercial Banks (Continued)Documento3 pagineAppendix Table Iv.6: Branches and Atms of Scheduled Commercial Banks (Continued)swaraj_07Nessuna valutazione finora

- Credit Card ProvidersDocumento6 pagineCredit Card ProvidersVijay Pal SinghNessuna valutazione finora

- Full Name in English Bank Name Ifsccode Account NumberDocumento7 pagineFull Name in English Bank Name Ifsccode Account NumberVarun MarwahaNessuna valutazione finora

- Year Banks Total Assets 3A.1. Demand Deposits - x000DDocumento105 pagineYear Banks Total Assets 3A.1. Demand Deposits - x000Dayush singlaNessuna valutazione finora

- Weekly Market Outlook 25.03.13Documento5 pagineWeekly Market Outlook 25.03.13Mansukh Investment & Trading SolutionsNessuna valutazione finora

- Acp 2015 16 March16Documento2 pagineAcp 2015 16 March16L Sudhakar ReddyNessuna valutazione finora

- Bank - Wise Appropriation of Profit of Scbs (Strbi - b08)Documento78 pagineBank - Wise Appropriation of Profit of Scbs (Strbi - b08)ahujavivekNessuna valutazione finora

- Chapter 4Documento31 pagineChapter 4koushik kumarNessuna valutazione finora

- Private Sector Banks 2020-22Documento8 paginePrivate Sector Banks 2020-22Sidharth Sankar RathNessuna valutazione finora

- Advances Public & Private Sector BanksDocumento1 paginaAdvances Public & Private Sector BanksPankaj MaryeNessuna valutazione finora

- Economics - Demand ForecastingDocumento23 pagineEconomics - Demand ForecastingKLN CHUNessuna valutazione finora

- UntitledDocumento12 pagineUntitledshrikrushna javanjalNessuna valutazione finora

- Bonus AdlinDocumento44 pagineBonus AdlinAdlin Mas Hadi WaluyoNessuna valutazione finora

- Bank - Missed CallsDocumento1 paginaBank - Missed CallsKAVEEN PRASANNAMOORTHYNessuna valutazione finora

- Bank FinstatementDocumento19 pagineBank FinstatementCool BuddyNessuna valutazione finora

- Determinants of Profitability of Banks in India: A Multivariate AnalysisDocumento19 pagineDeterminants of Profitability of Banks in India: A Multivariate AnalysisNeelNessuna valutazione finora

- Fmi 1Documento4 pagineFmi 1askdgasNessuna valutazione finora

- Annexure-I Regionwise Deployment of Atms For The Quarter Ended March 2020Documento2 pagineAnnexure-I Regionwise Deployment of Atms For The Quarter Ended March 2020JNR ENTERPRISESNessuna valutazione finora

- Shortlisted Lending InstitutionsDocumento4 pagineShortlisted Lending InstitutionsDikshant AroraNessuna valutazione finora

- TODAY Tourism & Business Magazine, Volume 22, December, 2015Da EverandTODAY Tourism & Business Magazine, Volume 22, December, 2015Nessuna valutazione finora

- Small Money Big Impact: Fighting Poverty with MicrofinanceDa EverandSmall Money Big Impact: Fighting Poverty with MicrofinanceNessuna valutazione finora

- Ifcb2009 - 10 - Bank of IndiaDocumento510 pagineIfcb2009 - 10 - Bank of IndiaVikas DevreNessuna valutazione finora

- Suspence AccountDocumento66 pagineSuspence AccountRadha ChoudhariNessuna valutazione finora

- List of Banks Headquarters and Taglines PDF DreamBigInstitutionDocumento12 pagineList of Banks Headquarters and Taglines PDF DreamBigInstitutionWasif AkhtarNessuna valutazione finora

- Bank-Name HeadquartersDocumento2 pagineBank-Name HeadquartersKaran RajbhojNessuna valutazione finora

- Factsheet GSDocumento18 pagineFactsheet GSbshriNessuna valutazione finora

- WMCDocumento116 pagineWMCarjun_871645652Nessuna valutazione finora

- BOIUPIDocumento231 pagineBOIUPIchauhan0124urwanNessuna valutazione finora

- Swift CodeDocumento1 paginaSwift CodeLamHotNessuna valutazione finora

- POSDocumento42 paginePOSa k singhNessuna valutazione finora

- Daftar Nama Belum Absen MaretDocumento25 pagineDaftar Nama Belum Absen MaretAsriani JunaediNessuna valutazione finora

- POP-SP Details.Documento5.052 paginePOP-SP Details.upsc.bengalNessuna valutazione finora

- Table 1: Bank Group-Wise Weighted Average Lending Rates (WALR) (On Outstanding Rupee Loans) Scheduled Commercial BanksDocumento5 pagineTable 1: Bank Group-Wise Weighted Average Lending Rates (WALR) (On Outstanding Rupee Loans) Scheduled Commercial BanksShiva MehtaNessuna valutazione finora

- Stock Split DataDocumento110 pagineStock Split DataAmit HedauNessuna valutazione finora

- BSNL MTNL PrivatisationDocumento1 paginaBSNL MTNL PrivatisationRicky GNessuna valutazione finora

- 2015 Jan HR ListDocumento210 pagine2015 Jan HR ListKapda Fashion100% (1)

- Bse 20180627Documento51 pagineBse 20180627BellwetherSataraNessuna valutazione finora

- CEO DatabaseDocumento180 pagineCEO DatabaseGanesh Mali67% (6)

- Sr. No POP Reg No POP NameDocumento8 pagineSr. No POP Reg No POP NameSwati Rohan JadhavNessuna valutazione finora

- CISS12Documento14 pagineCISS12anahh ramakNessuna valutazione finora

- FK KKDocumento104 pagineFK KKKishore KunalNessuna valutazione finora

- 6 MNTH STMNTDocumento22 pagine6 MNTH STMNTVikrant VermaNessuna valutazione finora

- ZPP Current StockDocumento625 pagineZPP Current StockPratik JainNessuna valutazione finora

- Bali TW 1Documento6 pagineBali TW 1arykurniawanNessuna valutazione finora

- Types of Banks in The PhilippinesDocumento13 pagineTypes of Banks in The PhilippinesHarka MeeNessuna valutazione finora

- Mumbai Data Ceo PDFDocumento1.463 pagineMumbai Data Ceo PDFSaurabh Jain0% (1)

- Sri City CompaniesDocumento5 pagineSri City CompaniessriduraiNessuna valutazione finora

- Bse 20180202Documento54 pagineBse 20180202BellwetherSataraNessuna valutazione finora

- ESinghbhum PDFDocumento38 pagineESinghbhum PDFTumpa DasNessuna valutazione finora

- Ifcb2009 36Documento135 pagineIfcb2009 36Gourav VermaNessuna valutazione finora