Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2009-10-26 GF&Co - TBTF (Too Bought To Function)

Caricato da

Joshua RosnerTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2009-10-26 GF&Co - TBTF (Too Bought To Function)

Caricato da

Joshua RosnerCopyright:

Formati disponibili

October 26, 2009

Joshua Rosner 646/652-6207 jrosner@graham-fisher.com

Congress and TBTF Too Bought To Function

The House draft bill written by Rep. Barney Frank (D - MA) along with several former Fed attorneys and Treasury staff and consultants -- includes the resolution authority language discussed in the press. It will also generally mimic the White House's systemic risk regulator language, its securitization language, and the language of Financial Institutions Subcommittee Chairman Luis V. Gutierrez (D-IL), which directs the FDIC to assess deposit insurance fees based on assets rather than deposits. Unfortunately, this bill is one more act of sleigh of hand by congress intent on doing the bidding of bankers to the detriment of the public. An honest bill would recognize that any institution that is "Too Big to Fail" should be given economic incentives (through prohibitively high capital levels and insurance assessments) to shrink or sell off business units. The notion that we do not have the right to break up anti-competitive and oligopolistic businesses flies in the face of antitrust laws and ignores the valuable lessons in growth demonstrated by Teddy Roosevelts trust busting. Those legislators who are truly seeking to protect the public interest and desiring to be worthy of re-election, should demand that legislation spell out, in plain English, that the entire capital structure of a TBTF institution be wiped out, and its holding company held responsible as a source of strength, before taxpayers are exposed to a single dollar of loss. If leadership wont add such language, call your elected official and ask how much it actually costs to get them to put on the kneepads. Rather than require the break-up or shrinkage of those institutions, this bill suggests we leave the institution in tact until it becomes troubled and instead subject it to greater oversight by the same Fed that mismanaged prudential oversight of precisely those largest financial holding companies at the center of the crisis. Keep in mind that even on the 1-5, best to worst, secret rating scale regulators use to define troubled institutions BofA was only a 3 and it has been speculated that Citi was only a 2 even as they were begging the government for support. Should we wait until an institution is really even worse then they were? This Trojan horse of a bill will recognize and codify the view that we must accept and agree to live in a world where there are institutions that are TBTF. We have chosen to head in the opposite direction from the responsible approach suggested by both Bank of England Governor Mervyn King1, who wants to break up TBTF institutions, and other European regulators who are likely to oversee the breakup of TBTF institutions ING and Lloyds.

1

http://www.scribd.com/doc/21406275/Mervyn-King-Speech-Break-Up-Banks

Please refer to important disclosures at the end of this report.

Weekly Spew

October 2009

Each of the elements of this historic and flawed approach was carefully negotiated in close coordination with most of the interested parties well, at least the bankers and their friends. Mock hearings will be this week and the complete bill will be marked up midweek next week. When the hearings begin, the public should demand to know how many of these experts have ever taken monies as consultants or employees of the Too Big To Fail (TBTF) banks or the Federal Reserve System. You can play along with the game show at home by watching the testifying experts closely. Try to keep score of how many of them identified the collapse of our credit markets in 2006 or 2007. You can go on to the bonus round and score which of these experts expressed a view or highlighted the risk that the Feds emergency powers would create a moral hazard and be used to bail out our banks. Importantly, Senator Chris Dodd put these powers into legislation in the dark of night in 1991 at the request of Goldman Sachs and other large beneficiaries of government support in this crisis 2. Perhaps I expect too much of these policy experts, after all, in May 2007 even Tim Geithner3 and the intelligent and considered Fed Vice Chairman Don Kohn4 didnt, in the face of over 100 mortgage lender failures and specific direct warnings5, fully consider the risks that a crisis was already upon us. As part of this Japanese-style kick-the-losses-down-the-road kabuki style drama, Secretary Geithner desires that TBTF institutions to write a "living will" so that when (not if) they end up in trouble, there will be a road map for investors and regulators to follow. This is honorable, but far from requiring banks or their managements to submit to the still more honorable tradition of Hara-kiri.

2 3

http://www.washingtonpost.com/wp-dyn/content/article/2009/05/29/AR2009052903403.html?hpid=topnews http://www.ny.frb.org/newsevents/speeches_archive/2007/gei070515.html (see: The dramatic changes weve seen in the structure of financial markets over the past decade and more seem likely to have reduced this vulnerability. The larger global financial institutions are generally stronger in terms of capital relative to risk. Technology and innovation in financial instruments have made it easier for institutions to manage risk. Risk is less concentrated in the banking system, where moral hazard concerns and other classic market failures are more likely to be an issue, and spread more broadly across a greater diversity of institutions.) 4 http://www.federalreserve.gov/newsevents/speech/kohn20070516a.htm (see: There are good reasons to think that these developments have made the financial system more resilient to shocks originating in the real economy and have made the economy less vulnerable to shocks that start in the financial system. Borrowers have a greater variety of credit sources and are less vulnerable to the disruption of any one credit channel; risk is dispersed more broadly to people who are most willing to hold and manage it. One can see the effects of these changes in the reduced incidence of financial crises in recent years.) 5 http://www.hudson.org/index.cfm?fuseaction=hudson_upcoming_events&id=350 February 15, 2007, Hudson Institute: How Resilient Are Mortgage Backed Securities to Collateralized Debt Obligation Market Disruptions? (See, as example: We therefore maintain that the shrinkage in RMBS sector is likely to arise from decreased funding by the CDO markets as defaults accumulate. Of course, mortgage markets are socially and economically more important than manufactured housing, aircraft leases, franchise business loans, and 12-b1 mutual fund fees. Decreased funding for RMBS could set off a downward spiral in credit availability that can deprive individuals of home ownership and substantially hurt the U.S. economy. As described in detail in section II.A, the CDO market adds liquidity to the RMBS market in a highly leveraged fashion by funding lower-tranche MBS securities, and the experience of the ABS markets in the early 2000s illustrates that the liquidity provided by CDOs is very fragile.)

-2-

Weekly Spew

October 2009

The story of an unlevel playing field: Those who argue against a more proactive reduction in risk and size of TBTF institutions will, as they always do, revert to an argument that strikes a natural chord in every Americans heart: Doing so would create an unleveled international playing field for our institutions relative to their international competitors. Level playing fields are a worthy goal; this is not a relevant argument. Instead, this tired line must be resoundingly dismissed on several counts: Those countries with the largest banks as a percentage of GDP (Iceland, Ireland, Switzerland) demonstrated that a concentration of banking power can cause significant sovereign risk and tilt global economic playing fields away from you. The likely breakups of ING, Lloyds and KBC suggest that it is we who seek to support an unlevel playing field where we subsidize our TBTF banks while other nations recognize the policy failures of moral hazard. If we continue down this path we will likely be at risk of violating international fair trade regimes. When the unlevel playing field argument is cited, why dont community bankers demand to know why it is ok to disadvantage the 8000+ community banks relative to our largest banks, all in the name of protecting big banks from governmentally- subsidized international competition? There is no longer any evidence that, beyond a cost of capital advantage that comes with implied government support, there are sustainable and tangible economies of scale arising from being the largest. The financial supermarket concept has been proven a failure. We must demand that our legislators no longer allow unelected officials at the independent Federal Reserve to sign international accords created by the TBTF banks through supra-national bodies like the Basel Committee. Are we to believe that if we did not have such large and globally dominant firms, US borrowers might be paying more that the 29% interest that several of the TBTF firms are now charging on their card accounts? Perhaps we should think about what advantage our population has gained as a result of our financial institutions being such a large part of our economy or being globally dominant6. Since when did we accept a national strategy of following rather than leading? When we do what is right, others follow. As example, consider the bank secrecy havens they made money for a bit. Now, even the

6

http://www.creditcardguide.com/creditcards/news/credit-card-interest-rates-jump-29-99/

-3-

Weekly Spew

October 2009

Swiss and the Cayman authorities are coming around to our view. We are already at a disadvantage given that the largest foreign banks operate in the US without any tier one capital requirement and yet most large foreign banks have not built a bricks and mortar presence here. Nobody screams about their undercapitalization nor has that undercapitalization caused deposits to migrate to foreign banks. Having provided preemptive arguments against their notion I would point out that by getting out of the TBTF game, we will have a more robust and economically competitive economy where no players have a governmentally-conferred advantage or subsidy. Such a leveled playing field will begin the process of regaining credible markets and attracting stable foreign capital. Let other nations pursue misguided policies of protecting uneconomic and anticompetitive businesses. Such an approach will allow our taxpayers to avoid having to be part of the next banking bailout crisis. New GSEs for you and me: The Administrations preferred approach, which is politically cynical, re-creates a class of special public companies that, because of their ties to the government, receive the benefit of a GSE-like implied government guarantee. For background, for the better part of the past 10-years market participants were increasingly convinced the GSEs (Fannie and Freddie) could become unstable. Even so bondholders viewed the companies as low credit risks. It was assumed that if they into trouble they would be bailed out with taxpayer dollars and without significant losses being forced upon bondholders. As a result of this belief, the GSEs had a significantly lower cost of capital than their non-special and fully private competitors. No matter how much Treasury, the Fed, the White House or Congress said that the government did not stand behind the obligations of the GSEs the markets did not accept that view and, when push came to shove and the GSEs were taken over by the government last September it was the taxpayer that was place on the hook for up to $400 billion of GSE losses. GSE creditors walked away from the accident and even equity holders, who had always been paid to take the first loss, were not wiped out. So, are we expected to believe that these TBTF institutions will not be provided a lower cost of capital by the markets based on the understanding that the government will always stand ready to fund their losses? Moreover, from where in history can we draw comfort that when a macro crisis hits, regulators and policymakers will assess the cost of the losses on other TBTF institutions rather than arguing that that might lead to a contagion risk? As witnessed in this crisis, a withdrawal of liquidity from one systemically risky institution can lead to both a withdrawal of liquidity to its peers and also a contagious decline in asset values leaving all undercapitalized at the same time. If there is a positive to the GSE model and the implied government guarantee it is that these companies will provide all legislators, regardless of their political affiliation, with a

-4-

Weekly Spew

October 2009

constant stream of lobbying dollars in return for help in stymieing regulators. The lobbying and campaign dollars the TBTF banks are spending to convince officials that their derivatives books were never at risk and their credit trends are stronger are welcome in Washington. In a testament to Washingtons love affair with large financial firms Jamie Dimon has been repeatedly dubbed Obamas favorite banker7. Even so, there is still a massive lobbying dollar hole left by the withdrawal of the largess that disappeared with the predictable collapse of Fannie and Freddie8 Contingent capital is neither contingent nor capital: While it is not yet clear if the absurd notion of "contingent capital" (define this term in parentheses the first time you use it) will be referenced in legislation or left to the regulatory hacks to codify in rulemaking, it is gaining support in the Fed as witnessed by recent comments from Governor Tarullo9 and NY Fed President Dudley10. Rather than requiring banks to raise and hold significantly more (good, old fashioned) equity capital, they want banks to use "contingent capital" or debt that converts to equity in cases of precipitously falling equity values. Contingent capital is a deeply flawed notion proposed by academic economists who should either be permanently be locked up in institutions or sent off to a vast wilderness where they can no longer threaten the broader population. Equity is equity, there is no substitute. As long as the Federal Reserve retains the "13.3" emergency powers11 one must expect that when a TBTF institution is imperiled or required to convert their contingent debt to contingent equity the TBTF institution will lobby hold legislators and regulators hostage to the notion that such a conversion would cause a market panic and lead to counterparties pulling secured lines and withdrawing

7 8

http://open.salon.com/blog/saturn_smith/2009/07/20/the_delicious_jamie_dimon_obamas_favorite_banker (see, as example: A Coming Nightmare of Homeownership By GRETCHEN MORGENSON Published: October 3, 2004 http://query.nytimes.com/gst/fullpage.html?res=9D04E2D81338F930A35753C1A9629C8B63&sec=&spon=&pagewa nted=all and WALL STREET COVERS ITS FANNIE MAE NEWSWEEK From the magazine issue dated Oct 18, 2004 http://www.newsweek.com/id/55276 and Fannie's Fans Must Be in Denial Published: December 19, 2004 http://www.nytimes.com/2004/12/19/business/yourmoney/19watch.html and Why Fannie And Freddie Are Fidgety Businessweek, July 30 2007 http://www.businessweek.com/magazine/content/07_31/b4044051.htm 9 http://www.federalreserve.gov/newsevents/testimony/tarullo20090930a.htm (see: A number of other initiatives are at an earlier stage of policy development. A good deal of attention right now is focused on mitigating the risks of systemically important financial firms. Two of the more promising ideas are particularly worth mentioning. One is for a requirement for contingent capital that converts from debt to equity in times of stress or for comparable arrangements that require firms themselves to provide for back-up sources of capital.) 10 http://newyorkfed.org/newsevents/speeches/2009/dud091013.html (see: For initiatives in this area to be effective, we need to make progress on tougher regulatory requirements, including the use of a contingent capital instrument that would automatically replenish equity capital in times of stress.) 11 Supported by former Administration Treasury nominee and lawyer to the industry, H. Rodgin Cohen (see: http://newsbusters.org/blogs/tom-blumer/2009/03/13/so-why-did-h-rodgin-cohen-withdraw-treasurys-no-2-presscuriously-not-cu who also provided support for Citis move into insurance before Glass Stegal was repealed) and placed in legislation by Chris Dodd at the request of the Empire Goldman Sachs (http://www.washingtonpost.com/wpdyn/content/article/2009/05/29/AR2009052903403.html )

-5-

Weekly Spew

October 2009

liquidity hmmm, sound familiar? Moreover, unless there are clear and specific prohibitions against banks investing in each others contingent capital notes, we will increase systemic risk by engendering precisely the entanglement and interconnectedness that defines systemic risk. We have witnessed the problem of interconnectedness in this crisis in at least two situations; banks and insurers investing in each others trust preferred securities (TRUPS) and becoming exposed to not only declines in the equity value of their TRUPS but also to losses on their investments in other banks TRUPS. We have also seen the damage caused by regional banks outsized exposure to GSE preferreds. Lastly, unless market participants saw through the contingent capital notion and considered it to carry an implied government guarantee, the cost of issuance of the notes would be at a prohibitively high rates. Salvaging regulatory reform for the good of our public: There remains some hope for those who would like to see real regulatory reform. The first chance for the public to force a more real reform on Washington will come as the public, begins to wake to the realization that, absent the government largess, bank credit trends demonstrate the economy is hardly stable and the banks credit trends can no longer be hidden behind unsustainable improvements in capital markets business. A second chance for meaningful reform might come as a result of a more disturbing change. If the governments reckless a golden egg in every pot approach to trying to pull forward future demand is stopped by an unlikely bout of mass sanity or by a U.S. variant of the Soros v the Bank of England12 moment that too could be a catalyst for meaningful reform. To be clear, passage of the components of this set of House Financial Services Committee regulatory reform bills does not ensure that Senator Dodd (D - CT), who intends to introduce his bill in November, will have any luck moving it. In fact, sources suggest that Mitch McConnell (R - Kentucky) sees Senator Dodd as vulnerable in his re-election campaign and is encouraging Republicans not to support his bill. Senate Banking Committee Minority Leader Richard Shelby (R - ALA) continues to suggest he will not negotiate any regulatory reform legislation unless it meaningfully addresses GSE reform. While it is unclear if this is a hard line or an opening position but he has also made it clear he will not entertain the Fed in the role of either il capo di tutti capo of prudential financial regulators nor will he accept Ben Bernanke wearing a pinky ring and playing systemic risk regulator. On the later Dodd is seemingly in agreement. Democrat leadership appears to believe Shelby is merely posturing and that, even though the reform language on OTS derivatives, consumer protection, TBTF, and

12

http://en.wikipedia.org/wiki/Black_Wednesday

-6-

Weekly Spew

October 2009

systemic risk are laughably weak, it will be impossible for Republicans to convince the public that they are holding up reform legislation for honest and political reasons, rather than merely political ones. Democrats expect that they will be able to shift the debate from a debate on what would constitute good public policy to one of "the Republicans are a party of "No" ". I will predict that passage of this legislation on a partisan vote would have more negative implications for Democrat re-elections than the passage of a healthcare reform bill on a party-line vote. Americans hate their healthcare insurers but like their pharmacists and doctors. Americans hate their banks and have grown to hate bankers and their bailouts far more. Even so, populist acrimony should not be directed at "the" bankers, rather it should be focused on the Too Big to Fail bankers. Perhaps we will ultimately force them to wear scarlet letters. Maybe we will tie them to rocks and throw them in water to determine if they are witches. It is urgent for the public to see that their greatest allies in pursuit of good public policy on most of these issues are institutional investors, who bet that market forces ultimately prevail and rebalance to equilibrium, and also those small community bankers who largely stuck to their knitting, made plain vanilla loans, didn't arbitrage regulatory capital rules, remained sufficiently well capitalized relative to their exposures. It is those two groups that suffer because the implied government backstop of the TBTF crowd is resulting in small banks being forced to compete for business at an economic disadvantage. It is institutional investors that now have to chase assets bid up by to those TBTF institutions that speculate and take on more risk as a result of their implied government guarantee. Make no mistake, the TBTF crowd is still controlling both Congress and most regulators as witnessed by all the focus on secondary reform items rather than resolution authority and an end to TBTF. If you are TBTF you are too big and must shrink or be broken up. If we achieve this these bankers will be better and more focused on risk management and we wouldn't have to even care as much about other secondary issues.

-7-

Potrebbero piacerti anche

- Fairy Tale Capitalism: Fact and Fiction Behind Too Big to FailDa EverandFairy Tale Capitalism: Fact and Fiction Behind Too Big to FailNessuna valutazione finora

- FinTech Rising: Navigating the maze of US & EU regulationsDa EverandFinTech Rising: Navigating the maze of US & EU regulationsValutazione: 5 su 5 stelle5/5 (1)

- 2009-10-27 GF&Co - Bring in The Bomb SquadDocumento9 pagine2009-10-27 GF&Co - Bring in The Bomb SquadJoshua RosnerNessuna valutazione finora

- 2009-09-26 GF&Co - A Systemically Risky BillDocumento8 pagine2009-09-26 GF&Co - A Systemically Risky BillJoshua RosnerNessuna valutazione finora

- 2009-11-20 Too Big To Fail: An Insufficient and Excessive $200 Billion ConDocumento4 pagine2009-11-20 Too Big To Fail: An Insufficient and Excessive $200 Billion ConJoshua RosnerNessuna valutazione finora

- William C Dudley: Solving The Too Big To Fail ProblemDocumento9 pagineWilliam C Dudley: Solving The Too Big To Fail ProblemForeclosure FraudNessuna valutazione finora

- HHRG 113 Ba00 Wstate Rfisher 20130626Documento22 pagineHHRG 113 Ba00 Wstate Rfisher 20130626richardck61Nessuna valutazione finora

- Alan Greenspan UpDocumento14 pagineAlan Greenspan UpEric WhitfieldNessuna valutazione finora

- 2008 Walking Down The FailureDocumento10 pagine2008 Walking Down The FailureJames BradleyNessuna valutazione finora

- The Six Root Causes of The Financial Crisis: Blog Posts Future of FinanceDocumento4 pagineThe Six Root Causes of The Financial Crisis: Blog Posts Future of Financeankit kumarNessuna valutazione finora

- Print ArticleDocumento2 paginePrint ArticleJinwoo KimNessuna valutazione finora

- Wall Street Lies Blame Victims To Avoid ResponsibilityDocumento8 pagineWall Street Lies Blame Victims To Avoid ResponsibilityTA WebsterNessuna valutazione finora

- The Myth of Financial ReformDocumento6 pagineThe Myth of Financial ReformManharMayankNessuna valutazione finora

- What If Nothing Is Risk Free?: SATURDAY, JULY 24, 2010Documento11 pagineWhat If Nothing Is Risk Free?: SATURDAY, JULY 24, 2010priyankaaneja24gmailNessuna valutazione finora

- Pham Letter Final GrassleyDocumento5 paginePham Letter Final GrassleyMartin AndelmanNessuna valutazione finora

- Ferguson 2009 1Documento4 pagineFerguson 2009 1Tom DavisNessuna valutazione finora

- Capitalism in AmericaDocumento6 pagineCapitalism in AmericaK.D.McCoyNessuna valutazione finora

- 11-03-01 Book Review: Matt Taibbi, Griftopia (2010) - Stupidity, Greed, and Criminality in The Financial CrisisDocumento7 pagine11-03-01 Book Review: Matt Taibbi, Griftopia (2010) - Stupidity, Greed, and Criminality in The Financial CrisisHuman Rights Alert - NGO (RA)Nessuna valutazione finora

- Hoenig DC Women Housing Finance 2-23-11Documento13 pagineHoenig DC Women Housing Finance 2-23-11jallan1984Nessuna valutazione finora

- Esr Assignmt 1nov11Documento12 pagineEsr Assignmt 1nov11hashimhafiz10% (1)

- 03-17-08 CP-The Fed's Wall Street Dilemma by PAM MARTENSDocumento4 pagine03-17-08 CP-The Fed's Wall Street Dilemma by PAM MARTENSMark WelkieNessuna valutazione finora

- Derivative:: Derivatives: "Tic Tock, Tick Tock"Documento3 pagineDerivative:: Derivatives: "Tic Tock, Tick Tock"JRCNessuna valutazione finora

- Inside JobDocumento5 pagineInside Jobpkb0% (1)

- Legg Mason StrategyDocumento6 pagineLegg Mason Strategyapi-26172897Nessuna valutazione finora

- Too Big To Fail ProblemDocumento13 pagineToo Big To Fail ProblemNgọc ChâuNessuna valutazione finora

- National Debt ThesisDocumento6 pagineNational Debt Thesisbrandygranttallahassee100% (2)

- Alow 21 Book ReviewDocumento29 pagineAlow 21 Book ReviewianseowNessuna valutazione finora

- Why We Must End Too Big To FailDocumento21 pagineWhy We Must End Too Big To FailBryan CastañedaNessuna valutazione finora

- Static PPM156 Johnson Testimony 120711Documento7 pagineStatic PPM156 Johnson Testimony 120711000000tvNessuna valutazione finora

- TIE W08 FinSafetyNetDocumento14 pagineTIE W08 FinSafetyNetRadhya KhairifarhanNessuna valutazione finora

- Ignou Mba MsDocumento22 pagineIgnou Mba MssamuelkishNessuna valutazione finora

- En The Credit CrisisDocumento3 pagineEn The Credit CrisisDubstep ImtiyajNessuna valutazione finora

- Inside Job - Financial Crisis Klara KomenDocumento1 paginaInside Job - Financial Crisis Klara KomenKlaraKomenNessuna valutazione finora

- BaselineScenario TestimonyJECApril202009FINALDocumento11 pagineBaselineScenario TestimonyJECApril202009FINALZerohedgeNessuna valutazione finora

- Liquidity Crises: Understanding Sources and Limiting Consequences: A Theoretical FrameworkDocumento10 pagineLiquidity Crises: Understanding Sources and Limiting Consequences: A Theoretical FrameworkAnonymous i8ErYPNessuna valutazione finora

- Global Market Outlook July 2011Documento8 pagineGlobal Market Outlook July 2011IceCap Asset ManagementNessuna valutazione finora

- The Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.Documento17 pagineThe Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.brundbakenNessuna valutazione finora

- Surviving A Global CrisisDocumento98 pagineSurviving A Global CrisisCristiano Savonarola100% (1)

- When Catastrophes ColludeDocumento9 pagineWhen Catastrophes ColludeMohammed SalahNessuna valutazione finora

- ASF Journal Summer Spring 2011Documento42 pagineASF Journal Summer Spring 2011Adam HayaNessuna valutazione finora

- Notes Austerity BlythDocumento4 pagineNotes Austerity BlythPan PapNessuna valutazione finora

- Andreas Whittam Smith: We Could Be On The Brink of A Great DepressionDocumento4 pagineAndreas Whittam Smith: We Could Be On The Brink of A Great DepressionBarbosinha45Nessuna valutazione finora

- Final Paper (Final Draft)Documento11 pagineFinal Paper (Final Draft)gko2408Nessuna valutazione finora

- GlobalcreditcrisisDocumento3 pagineGlobalcreditcrisisFazulAXNessuna valutazione finora

- What Is A Subprime Mortgage?Documento5 pagineWhat Is A Subprime Mortgage?Chigo RamosNessuna valutazione finora

- Ellen Brown 24032023Documento7 pagineEllen Brown 24032023Thuan TrinhNessuna valutazione finora

- Guaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceDa EverandGuaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceValutazione: 2 su 5 stelle2/5 (1)

- Why Did Obama and Cameron Save A Criminal Enterprise Like HSBCDocumento4 pagineWhy Did Obama and Cameron Save A Criminal Enterprise Like HSBC83jjmackNessuna valutazione finora

- Reinventing Banking: Capitalizing On CrisisDocumento28 pagineReinventing Banking: Capitalizing On Crisisworrl samNessuna valutazione finora

- Bunk Runs, Deposit Insurance and LiquidityDocumento19 pagineBunk Runs, Deposit Insurance and LiquidityGIMENEZ PUENTES MARIA PIANessuna valutazione finora

- Financial News Articles - COMPLETE ARCHIVEDocumento319 pagineFinancial News Articles - COMPLETE ARCHIVEKeith KnightNessuna valutazione finora

- Phishing For Phools and The Financial Crisis: (Spears, 2016)Documento6 paginePhishing For Phools and The Financial Crisis: (Spears, 2016)Abiodun Ayo-baliNessuna valutazione finora

- Habitat For Insanity": Share ThisDocumento10 pagineHabitat For Insanity": Share ThisAnonymous Feglbx5Nessuna valutazione finora

- FIRE 441 Summer 2015 Final Examination Review Guide.Documento3 pagineFIRE 441 Summer 2015 Final Examination Review Guide.Osman Malik-FoxNessuna valutazione finora

- MML WhitepaperDocumento5 pagineMML WhitepaperKors van der WerfNessuna valutazione finora

- Financial Crises: Past, Present and Future: James J. Angel, PHD, Cfa Georgetown University Mcdonough School of BusinessDocumento39 pagineFinancial Crises: Past, Present and Future: James J. Angel, PHD, Cfa Georgetown University Mcdonough School of BusinessnitikanNessuna valutazione finora

- Safe Banking Act FaqDocumento4 pagineSafe Banking Act FaqZerohedgeNessuna valutazione finora

- The Changing Landscape of The Financial Services Industry: What Lies Ahead?Documento17 pagineThe Changing Landscape of The Financial Services Industry: What Lies Ahead?saadsaaidNessuna valutazione finora

- Financial CrisesDocumento24 pagineFinancial CrisesMaria Shaffaq50% (2)

- Libor Scandal ThesisDocumento6 pagineLibor Scandal Thesiskarenthompsonnewark100% (2)

- 2007-05-2007 Where Did The Risk Go? How Misapplied Bond Ratings Cause Mortgage Backed Securities and Collateralized Debt Obligation Market Disruptions PDFDocumento87 pagine2007-05-2007 Where Did The Risk Go? How Misapplied Bond Ratings Cause Mortgage Backed Securities and Collateralized Debt Obligation Market Disruptions PDFJoshua Rosner100% (1)

- Argentina: Closing The Gap Between Policy and Public Opinion.Documento28 pagineArgentina: Closing The Gap Between Policy and Public Opinion.Joshua RosnerNessuna valutazione finora

- HHRG 113 Ba16 Wstate Jrosner 20130306Documento10 pagineHHRG 113 Ba16 Wstate Jrosner 20130306DinSFLANessuna valutazione finora

- 2014-05-13 Rosner Testimony On Dodd Frank Act - Title II Orderly ResolutionDocumento10 pagine2014-05-13 Rosner Testimony On Dodd Frank Act - Title II Orderly ResolutionJoshua RosnerNessuna valutazione finora

- UntitledDocumento37 pagineUntitledapi-120169318Nessuna valutazione finora

- Rosner Testimony March 30 2011Documento12 pagineRosner Testimony March 30 2011DinSFLANessuna valutazione finora

- JSF Winter 2009 RosnerDocumento17 pagineJSF Winter 2009 RosnerJoshua RosnerNessuna valutazione finora

- Nov 2011 - Libertad y Progreso Paper Rosner-ArgentinaDocumento19 pagineNov 2011 - Libertad y Progreso Paper Rosner-ArgentinaJoshua RosnerNessuna valutazione finora

- 2008-09-26 BuggyBanksDocumento5 pagine2008-09-26 BuggyBanksJoshua RosnerNessuna valutazione finora

- GF&Co - April 21 What Does Today's Announcement by Fannie & Freddie Mean?Documento3 pagineGF&Co - April 21 What Does Today's Announcement by Fannie & Freddie Mean?Joshua RosnerNessuna valutazione finora

- 2015-12-15 GSE REFORM PAPER Something Old, Somethng New, Something BorrowedDocumento78 pagine2015-12-15 GSE REFORM PAPER Something Old, Somethng New, Something BorrowedJoshua RosnerNessuna valutazione finora

- GF&Co - April 21 What Does Today's Announcement by Fannie & Freddie Mean?Documento3 pagineGF&Co - April 21 What Does Today's Announcement by Fannie & Freddie Mean?Joshua RosnerNessuna valutazione finora

- 2007-11-26 Financial Services Exposures To Subprime, Why We Are Not Seeing Red' Weekly July 27 2007Documento9 pagine2007-11-26 Financial Services Exposures To Subprime, Why We Are Not Seeing Red' Weekly July 27 2007Joshua RosnerNessuna valutazione finora

- GF&Co - Why The GSEs Should Relist TodayDocumento15 pagineGF&Co - Why The GSEs Should Relist TodayJoshua RosnerNessuna valutazione finora

- GF&Co - FHFA's Proposed Capital RuleDocumento5 pagineGF&Co - FHFA's Proposed Capital RuleJoshua Rosner100% (1)

- GF&Co - April 13 - Mortgage Servicing, Forbearance & GSEs - Liquidity Events Versus Credit EventsDocumento5 pagineGF&Co - April 13 - Mortgage Servicing, Forbearance & GSEs - Liquidity Events Versus Credit EventsJoshua Rosner100% (1)

- Geithner Treasury Intent To Violate HERA LawDocumento66 pagineGeithner Treasury Intent To Violate HERA LawJoshua RosnerNessuna valutazione finora

- GF&Co - GSE Reform - Truths, Myths and PowerDocumento23 pagineGF&Co - GSE Reform - Truths, Myths and PowerJoshua Rosner100% (1)

- Treasury & Fhfa Documents Demonstrating Obama Admin Violation of LawDocumento144 pagineTreasury & Fhfa Documents Demonstrating Obama Admin Violation of LawJoshua Rosner100% (3)

- Context FHFA Dir. Calabria's Latest Comments The Non-Fake-News VersionDocumento5 pagineContext FHFA Dir. Calabria's Latest Comments The Non-Fake-News VersionJoshua RosnerNessuna valutazione finora

- 2015-12-15 GF&Co - GSE Reform Presentation - Something Old, Something NewDocumento15 pagine2015-12-15 GF&Co - GSE Reform Presentation - Something Old, Something NewJoshua RosnerNessuna valutazione finora

- Redline Comments On Bob Corker's Gse Bill Draft 29Documento80 pagineRedline Comments On Bob Corker's Gse Bill Draft 29Joshua RosnerNessuna valutazione finora

- Brief Markup of Milken Blueprint For GSE ReformDocumento28 pagineBrief Markup of Milken Blueprint For GSE ReformJoshua RosnerNessuna valutazione finora

- MBA's Mortgage Reform Voodoo EconomicsDocumento7 pagineMBA's Mortgage Reform Voodoo EconomicsJoshua RosnerNessuna valutazione finora

- GOVT GUARANATEE ON MBS & Bank Capital ReliefDocumento1 paginaGOVT GUARANATEE ON MBS & Bank Capital ReliefJoshua RosnerNessuna valutazione finora

- GF&Co: Initial Comment's On BlackRock's Housing Finance Reforms PaperDocumento15 pagineGF&Co: Initial Comment's On BlackRock's Housing Finance Reforms PaperJoshua RosnerNessuna valutazione finora

- GOVT GUARANATEE ON MBS & Bank Capital ReliefDocumento1 paginaGOVT GUARANATEE ON MBS & Bank Capital ReliefJoshua RosnerNessuna valutazione finora

- Governor Powell's Housing SpeechDocumento13 pagineGovernor Powell's Housing SpeechJoshua RosnerNessuna valutazione finora

- 05-11-17 GF&Co - GSE Reform - FHFA Watt On The HillDocumento8 pagine05-11-17 GF&Co - GSE Reform - FHFA Watt On The HillJoshua Rosner100% (1)

- GF&Co - The MBA Plan For GSE ReformDocumento5 pagineGF&Co - The MBA Plan For GSE ReformJoshua RosnerNessuna valutazione finora

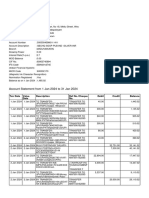

- Personal Loan-3500Documento156 paginePersonal Loan-3500EconaurNessuna valutazione finora

- Negotiable Instruments LawDocumento78 pagineNegotiable Instruments LawKatherine Mae AñonuevoNessuna valutazione finora

- Eddp Project (Cu) PDFDocumento41 pagineEddp Project (Cu) PDFHarsh Doshi100% (3)

- Mtpub 2Documento20 pagineMtpub 2plato363Nessuna valutazione finora

- Unit 1 Introdution To BankingDocumento2 pagineUnit 1 Introdution To Bankingaakash patilNessuna valutazione finora

- Perfect Hedge: What It IsDocumento7 paginePerfect Hedge: What It IsEvan JordanNessuna valutazione finora

- 4073xxxxxxxx4016 32545 Retail MMT NormDocumento4 pagine4073xxxxxxxx4016 32545 Retail MMT NormAishwarya MandhalkarNessuna valutazione finora

- HLB BSDocumento6 pagineHLB BSanisNessuna valutazione finora

- 3 - Accounting For Loans and ImpairmentDocumento1 pagina3 - Accounting For Loans and ImpairmentReese AyessaNessuna valutazione finora

- Monetary Policy and Operating ProcedureDocumento3 pagineMonetary Policy and Operating ProcedureLado BahadurNessuna valutazione finora

- Entrep DLP 15 - Albios, Joyce AnnDocumento2 pagineEntrep DLP 15 - Albios, Joyce AnnJoyce Ann AlbiosNessuna valutazione finora

- Madokero Client Update 43 - Payment Platforms PDFDocumento4 pagineMadokero Client Update 43 - Payment Platforms PDF123owenNessuna valutazione finora

- Project On Punjab National BankDocumento86 pagineProject On Punjab National BankRohit ChauhanNessuna valutazione finora

- ComputerDocumento4 pagineComputersanthoshjee73Nessuna valutazione finora

- Ibs F y B.com (H) Unit 1Documento18 pagineIbs F y B.com (H) Unit 1Nikunj PatelNessuna valutazione finora

- Wake Up and Smell The CoffeeDocumento6 pagineWake Up and Smell The CoffeeAeyNessuna valutazione finora

- Axis Interest Certificate 2021 2022 1668998098463Documento2 pagineAxis Interest Certificate 2021 2022 1668998098463Lovely PavaniNessuna valutazione finora

- BITS HD-2013 Print Challan Form .Documento1 paginaBITS HD-2013 Print Challan Form .Naveen Kumar SinhaNessuna valutazione finora

- CBP ResearchDocumento18 pagineCBP ResearchDonita MantuanoNessuna valutazione finora

- Bank Teller - Job DescriptionDocumento2 pagineBank Teller - Job DescriptionBayt.comNessuna valutazione finora

- Chapter15 - Capital BaselDocumento5 pagineChapter15 - Capital BaselAmira GawadNessuna valutazione finora

- Sip ReportDocumento52 pagineSip ReportRavi JoshiNessuna valutazione finora

- Holder's Name No of Shares % Share Holding: Mr. Sunil MehtaDocumento7 pagineHolder's Name No of Shares % Share Holding: Mr. Sunil Mehtashraddha anandNessuna valutazione finora

- CARO Question and AnswerDocumento3 pagineCARO Question and AnswerraviNessuna valutazione finora

- Commands (1) .PDF 1Documento1 paginaCommands (1) .PDF 1Faizan NazirNessuna valutazione finora

- March 06 2017Documento10 pagineMarch 06 2017Anonymous u7HLgyXDTNessuna valutazione finora

- Call Money Market in IndiaDocumento37 pagineCall Money Market in IndiaDivya71% (7)

- Term Sheet: Original Borrowers) Material Subsidiaries/jurisdiction) )Documento16 pagineTerm Sheet: Original Borrowers) Material Subsidiaries/jurisdiction) )spachecofdz0% (1)

- E-Commerce: Slide 1-1Documento12 pagineE-Commerce: Slide 1-1haleemNessuna valutazione finora

- 2014-2015 Kumari Bank Annual ReportDocumento104 pagine2014-2015 Kumari Bank Annual Reportdevi ghimireNessuna valutazione finora