Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

HDFC Bank Impressive Performance Bright Prospects

Caricato da

Pankaj MishraDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

HDFC Bank Impressive Performance Bright Prospects

Caricato da

Pankaj MishraCopyright:

Formati disponibili

HDFC BANK LTD RESEARCH

EQUITY RESEARCH

RESULTS REVIEW

P

August 4, 2008

HDFC Bank

Impressive performance: Bright Prospects

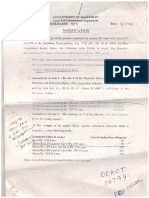

Rs. 470.8 bn Rs. 1,108.65 14,577.87 HDBK.BO HDFCB IN 0.13 mn Rs. 1787.90 / Rs. 903.60 424.6 mn

Buy

Share Data Market Cap Price BSE Sensex Reuters Bloomberg Avg. Volume (52 Week) 52-Week High/Low Shares Outstanding Valuation Ratios (Standalone) Year to 31 March EPS (Rs.) +/- (%) PER (x) P / PPP (x) P / BV (x) Shareholding Pattern (%) Promoter FIIs Institutions Public & Others 23 26 8 43 2009E 54.1 16.8% 20.5x 8.4x 3.5x 2010E 66.0 21.9% 16.8x 7.1x 3.4x

HDFC Bank reported impressive results for Q109, post its merger with Centurion Bank of Punjab (CBoP), which came into effect from May 23, 2008. Year-over- year, net profit surged 44.6% to Rs. 4.6 bn, net interest income rose by 74.9% to Rs. 17.2 bn, and fee income increased by 37.3%. Advances grew by 79.8%, while deposits grew by 60.4%. Post the merger, key metrics of HDFC Bank are as follows: Strong core performance: The Banks core performance remained strong despite the mergernet interest income (NII) increased by 52.5% yoy on a proforma basis. However, the net interest margin (4.1%) and CASA (44.9%) were impacted adversely. We expect the NIM and CASA to bounce back once CBoP is completely assimilated in its existing network. Pressure on margins: Year over year, net advances grew 79.8% while deposits grew 60.4%. However, these enlarged deposits and advances can pressurise margins in a slowing economy and a rising interest rate scenario. Asset quality moderated: Maintaining asset quality has been HDFC Banks forte. This quarter, however, the Bank recorded a 111.6% yoy increase in its gross NPAs. This, we believe is more on account of the merger with CBoP than due to a deterioration in asset quality,

Relative Performance

since HDFC Banks net NPA ratio stood at 0.5% of net advances this quarter.

Key Figures Quarterly Data Q1'08 Q4'08 Q1'09 YoY % QoQ% (Figures in Rs mn, except per share data) Net Interest Income Operating Income Pre-Prov Profit Net Profit

1,800 1,600 1,400 1,200 1,000 800

FY07

FY08 YoY %

Aug-07 Sep-07 Oct-07 Nov-07 Dec-07 Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08

10,422 16,421 17,235 65.4% 5.0% 34,685 52,279 50.7% 26,417 21,914 23,169 (12.3%) 5.7% 49,847 75,110 50.7% 7,837 10,887 10,275 31.1% (5.6%) 25,639 37,654 46.9% 3,212 4,711 4,644 44.6% (1.4%) 11,415 15,902 39.3% 3.0% (20.1%) 14.6% (16.0%) 48.4% (3.3%) 48.6% 49.9% 0.4% 0.5% 81.1 36.1 201.4 -

HDFCB

Rebased BSE Index

Cost/Operating Income(%) 43.1% 50.3% 55.7% NIM ratio 4.2% 4.4% 4.1% NPA ratio 0.4% 0.5% 0.5% Per Share Data (Rs.) PPP per share EPS BVPS 23.5 30.3 24.2 9.6 13.1 11.0 211.5 324.4 313.8

108.0 33.2% 45.6 26.3% 324.4 61.0%

Please see the end of the report for disclaimer and disclosures.

-1-

HDFC BANK LTD RESEARCH

EQUITY RESEARCH August 4, 2008

Result Highlights HDFC Banks total income for Q109 grew by 59.6% yoy and stood at Total income and NII surged while NIM was affected adversely Rs. 42.2 bn. The NII increased 74.9% yoy to Rs. 17.2 bn, driven by an increase in interest on investments and interest on advances. The NIM declined from its Q408 level and stood at a little over 4.1%. This fall was due to the merger with CBoP and a massive rise in deposits. Non-interest income increased by 3.6% yoy to Rs. 5.9 bn. Fees and commission, a major constituent of other income, increased by 37.3%. This increase in fee income was marred by a loss on revaluation/sale of investments of Rs. 0.8 bn. Foreign exchange/derivative revenues accounted for the remaining portion of other income. We expect noninterest income to keep growing as fees and commission account for a large proportion of the total other income. Operating expenses shot up 66.4% yoy on account of the merger. Provisions and contingencies increased 12.2% yoy. After providing Rs. 2.2 bn for taxation, the Bank earned a net profit of Rs. 4.6 bn, a yoy growth of 44.6%. The above results of HDFC Bank cannot be compared to Q108 results because of the merger with CBoP. An apt apple-to-apple comparison, adding CBoPs Q108s results to HDFCs, is as follows: Remarkable performance despite proforma comparison of Q109 with Q108 Interest earned grew by 44% yoy and interest expended rose by 37.1%. This resulted in a rise of 52.5% in the NII. Other income decreased by 16.9% yoy and operating expenses rose by 32.9%, resulting in a 17.5% rise in operating profit. However, net profit surged 31.1% yoy due to a slight decrease in provisions other than tax. Thus the Banks performance has been remarkable.

The balance sheet of the Bank increased by 59.5% yoy post the merger as deposits grew by 60.4% to exceed Rs. 1.3 tn and advances grew by 79.8%. The CASA ratio fell to 44.9%. The Banks total customer assets, (including advances, corporate debentures, and investments in

Please see the end of the report for disclaimer and disclosures.

-2-

HDFC BANK LTD RESEARCH

EQUITY RESEARCH August 4, 2008 securitised paper, etc. net of loans securitised and participated out) were Rs. 995.5 bn.

Outlook Sound fundamentals make HDFC Bank a strong performer. Despite Merger with CBoP: an essential determinant of growth taking a nominal hit on its NIM post the merger with CBoP, NII grew by 74.9% yoy and fee income by 37.3% yoy. This pulled up net profit by 44.6% and on a proforma basis, by 31.1%. The merger with CBoP is an essential determinant of HDFC Banks growth. On the one hand, deposit and advances base has enlarged; on the other, this has exerted pressure on margins as well as increased the NPAs. Also, the merger has given HDFC Bank access to 394 more branches, which increases its coverage considerably and will lead to strengthening of the core business and earnings. At the same time, this will mean enlarged operating costs, which have been increasing at a steady rate. Given HDFC Banks sentient management, we believe that the Bank will revert back to its more profitable numbers once CBoP is integrated in the formers existing network.

Valuation We have valued HDFC Bank by using the three-stage Discounted Equity Cash Flow Model. Assuming a sustainable ROE of 15%, we arrive at a terminal growth rate of 8.78%. Cost of equity is assumed at 15%. The stock quotes a forward P/ABV of 3.5x for 2009 as against 4.1x for 2008. We maintain our Buy rating on the stock with a revised target price of Rs. 1,400 for FY09.

Please see the end of the report for disclaimer and disclosures.

-3-

HDFC BANK LTD RESEARCH

EQUITY RESEARCH August 4, 2008

Income Statement

(Rs mn, Yr. ending March 31) Interest Income Interest Expense Net Interest Income YoY Growth (%) Other Income Operating Income YoY Growth (%) Operating Expense Pre-Provisioning Profit Provisions and Contingencies Profit Before Tax Tax Net Profit

YoY Growth (%)

Key Ratios

FY07 66,462 31,793 34,669 36.2% 15,773 50,441 36.3% 24,740 25,702 9,251 16,450 5,016 11,435

30.6%

FY08 101,170 48,874 52,297 50.8% 23,758 76,054 50.8% 38,264 37,791 14,849 22,942 7,020 15,922

39.2%

FY09E 166,709 88,234 78,475 50.1% 36,299 114,773 50.9% 59,019 55,755 21,985 33,770 10,806 22,963

44.2%

FY10E 191,315 105,563 85,752 9.3% 50,247 135,999 18.5% 70,116 65,883 24,712 41,171 13,175 27,996

21.9%

FY07 Per share data (Rs.) Shares outstanding (mn) Basic EPS Diluted EPS Book value per share Adj. book value per share 319.4 36.6 36.4 202.6 202.6

FY08

FY09E

FY10E

354.4 46.4 45.7 325.5 325.5

424.6 54.1 53.5 313.8 313.8

424.6 66.0 65.3 327.5 327.5

Valuation ratios (x) P/PPP P/E P/B P/ABV 11.8x 25.9x 4.7x 4.7x 12.4x 28.5x 4.1x 4.1x 8.4x 20.5x 3.5x 3.5x 7.1x 16.8x 3.4x 3.4x

Performance ratio (%) Return on avg. assets 1.4% 19.3% 1.4% 17.6% 1.4% 18.0% 1.2% 18.2%

Balance Sheet

(Rs mn, as on March 31) Cash and balances with RBI Investments YoY Growth (%) Advances YoY Growth (%) Fixed Assets (Net) Other Assets Total Assets FY07 90,734 305,670 7.7% 469,448 33.9% 9,875 37,355 913,083 FY08 148,280 492,880 61.2% 634,269 35.1% 11,963 44,539 1,331,931 FY09E 225,585 769,795 56.2% 974,027 53.6% 13,267 67,661 2,050,335 FY10E 264,369 923,755 20.0% 1,168,832 20.0% 14,322 80,923 2,452,201

Return on avg. net worth

Balance Sheet ratios (%) Advances to deposits Borrowings to advances Investments to assets Investments to deposits Net Worth to assets 68.8% 6.0% 33.5% 44.8% 7.1% 63.0% 7.1% 37.0% 49.0% 8.7% 62.0% 7.5% 37.5% 49.0% 6.8% 62.0% 6.9% 37.7% 49.0% 6.8%

Productivity ratio (Rs. mn) Opt. expense per employee 1.2 0.5 42.5 1.0 0.4 35.2 1.2 0.5 41.0 1.4 0.6 49.0

Deposits YoY Growth (%) Borrowings YoY Growth (%) Other Liabilities & Provisions Total Liabilities

682,643 22.5% 28,154 -1.5% 137,296 848,093

1,006,314 47.4% 44,789 59.1% 165,108 1,216,210

1,571,011 56.1% 73,299 63.7% 266,544 1,910,853

1,885,213 20.0% 80,628 10.0% 318,786 2,284,628

Net profit per employee Asset per employee

Operating ratios (%) Operating cost to operating income Operating cost to avg. assets 49.0% 3.0% 50.3% 3.4% 51.4% 3.5% 51.6% 3.1%

Share Capital Reserves & Surplus Total Equity & Liabilities

3,480 61,510 913,083

3,914 111,807 1,331,931

4,682 134,799 2,050,335

4,749 162,824 2,452,201

Source: Bank data, Indiabulls research Note: Some ratios are as per Indiabulls definitions and may not match figures declared by the Bank

Please see the end of the report for disclaimer and disclosures.

-4-

HDFC BANK LTD RESEARCH

EQUITY RESEARCH August 4, 2008

Disclaimer

This report is not for public distribution and is only for private circulation and use. The Report should not be reproduced or redistributed to any other person or person(s) in any form. No action is solicited on the basis of the contents of this report. This material is for the general information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be considered as an offer to sell or the solicitation of an offer to buy any stock or derivative in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Indiabulls Securities Limited. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You are advised to independently evaluate the investments and strategies discussed herein and also seek the advice of your financial adviser. Past performance is not a guide for future performance. The value of, and income from investments may vary because of changes in the macro and micro economic conditions. Past performance is not necessarily a guide to future performance. This report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Any opinions expressed here in reflect judgments at this date and are subject to change without notice. Indiabulls Securities Limited (ISL) and any/all of its group companies or directors or employees reserves its right to suspend the publication of this Report and are not under any obligation to tell you when opinions or information in this report change. In addition, ISL has no obligation to continue to publish reports on all the stocks currently under its coverage or to notify you in the event it terminates its coverage. Neither Indiabulls Securities Limited nor any of its affiliates, associates, directors or employees shall in any way be responsible for any loss or damage that may arise to any person from any error in the information contained in this report. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject stock and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in any form and/or redistributed without Indiabulls Securities Limited prior written consent. The information given herein should be treated as only factor, while making investment decision. The report does not provide individually tailor-made investment advice. Indiabulls Securities Limited recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial adviser. Indiabulls Securities Limited shall not be responsible for any transaction conducted based on the information given in this report, which is in violation of rules and regulations of National Stock Exchange or Bombay Stock Exchange.

Indiabulls (H.O.), Plot No- 448-451, Udyog Vihar, Phase - V, Gurgaon - 122 001, Haryana. Ph: (0124) 3989555, 3989666

-5-

Potrebbero piacerti anche

- WhiteMonk HEG Equity Research ReportDocumento15 pagineWhiteMonk HEG Equity Research ReportgirishamrNessuna valutazione finora

- 09 JAZZ Equity Research ReportDocumento9 pagine09 JAZZ Equity Research ReportAfiq KhidhirNessuna valutazione finora

- JPM研报 ELDocumento34 pagineJPM研报 ELMENGWEI ZHOUNessuna valutazione finora

- Initiating Coverage Maruti SuzukiDocumento13 pagineInitiating Coverage Maruti SuzukiAditya Vikram JhaNessuna valutazione finora

- Eimco Elecon Equity Research Report July 2016Documento19 pagineEimco Elecon Equity Research Report July 2016sriramrangaNessuna valutazione finora

- Novulis - Organizational Structure - Revised - The Strategist - 05012024Documento16 pagineNovulis - Organizational Structure - Revised - The Strategist - 05012024neelimaNessuna valutazione finora

- Equity Research ReportDocumento7 pagineEquity Research Reportjyoti_prakash_11Nessuna valutazione finora

- Starboard Value LP LetterDocumento4 pagineStarboard Value LP Lettersumit.bitsNessuna valutazione finora

- Aegis Logistics-Initiating Coverage - 10.07.2020 - EquirisDocumento49 pagineAegis Logistics-Initiating Coverage - 10.07.2020 - EquirisP VinayakamNessuna valutazione finora

- WTW 3Q12 Earnings TranscriptDocumento14 pagineWTW 3Q12 Earnings Transcriptrtao719Nessuna valutazione finora

- Ch10 Martingale Lowvol RGDocumento14 pagineCh10 Martingale Lowvol RGmaciel.gabrielaNessuna valutazione finora

- The Joint Corp: A Franchise Concept With Significant Growth RunwayDocumento38 pagineThe Joint Corp: A Franchise Concept With Significant Growth RunwayJerry HsiangNessuna valutazione finora

- Accounting! What's It All About?: THE Business CycleDocumento10 pagineAccounting! What's It All About?: THE Business CycleMarcinNessuna valutazione finora

- CFA Research Challenge Report on ACB BankDocumento21 pagineCFA Research Challenge Report on ACB BankNguyễnVũHoàngTấnNessuna valutazione finora

- Ratio InterpretationDocumento15 pagineRatio InterpretationAsad ZainNessuna valutazione finora

- JPM - 021914 - 123336 Bloomberg Report (Luxottica Group)Documento6 pagineJPM - 021914 - 123336 Bloomberg Report (Luxottica Group)reginetalucodNessuna valutazione finora

- Equity ResearchDocumento3 pagineEquity Researchanil100% (2)

- European World-Class Results Are Close To Overall Results, But Fewer Top Performers On CostDocumento35 pagineEuropean World-Class Results Are Close To Overall Results, But Fewer Top Performers On Costkapnau007Nessuna valutazione finora

- Equity ResearchDocumento4 pagineEquity ResearchDevangi KothariNessuna valutazione finora

- Pershing Square 1Q17 Shareholder Letter May 11 2017 PSHDocumento11 paginePershing Square 1Q17 Shareholder Letter May 11 2017 PSHmarketfolly.comNessuna valutazione finora

- Industry Handbook - The Banking IndustryDocumento9 pagineIndustry Handbook - The Banking IndustryTMc1908Nessuna valutazione finora

- Chief Operating Officer CFO in New York City Resume Mark YoungDocumento3 pagineChief Operating Officer CFO in New York City Resume Mark YoungMarkYoungNessuna valutazione finora

- 2019 q1 Earnings Results PresentationDocumento23 pagine2019 q1 Earnings Results PresentationValter SilveiraNessuna valutazione finora

- Helius Medical Technologies Mackie Initiation June 2016Documento49 pagineHelius Medical Technologies Mackie Initiation June 2016Martin TsankovNessuna valutazione finora

- Pre-Trade Analysis (MSEOOPEN)Documento4 paginePre-Trade Analysis (MSEOOPEN)tul SanwalNessuna valutazione finora

- Exam 1 Study Guide S15Documento1 paginaExam 1 Study Guide S15Jack JacintoNessuna valutazione finora

- Jordan Telecom 04jan11Documento26 pagineJordan Telecom 04jan11papuNessuna valutazione finora

- Large Cap Equity Strategy HSPDocumento2 pagineLarge Cap Equity Strategy HSPLoganBohannonNessuna valutazione finora

- RC Equity Research Report Essentials CFA InstituteDocumento3 pagineRC Equity Research Report Essentials CFA InstitutetheakjNessuna valutazione finora

- Minor Project Report on Financial ModelingDocumento104 pagineMinor Project Report on Financial ModelingFarhan khanNessuna valutazione finora

- Cirtek Holdings Corp. Equity Research ReportDocumento5 pagineCirtek Holdings Corp. Equity Research ReportunicapitalresearchNessuna valutazione finora

- Equity Research Report ExpediaDocumento18 pagineEquity Research Report ExpediaMichelangelo BortolinNessuna valutazione finora

- Q3 2021 - Investor LetterDocumento2 pagineQ3 2021 - Investor LetterMessina04Nessuna valutazione finora

- CampelloSaffi15 PDFDocumento39 pagineCampelloSaffi15 PDFdreamjongenNessuna valutazione finora

- The GIC Weekly Update November 2015Documento12 pagineThe GIC Weekly Update November 2015John MathiasNessuna valutazione finora

- Sector GuideDocumento194 pagineSector Guidebookworm1234123412341234Nessuna valutazione finora

- Nintendo Equity Report 1.4 Large FontsizeDocumento41 pagineNintendo Equity Report 1.4 Large FontsizeAnthony ChanNessuna valutazione finora

- Foreign Fund Management China 11Documento89 pagineForeign Fund Management China 11Ning JiaNessuna valutazione finora

- JP Morgan Best Equity Ideas 2014Documento61 pagineJP Morgan Best Equity Ideas 2014Sara Lim100% (1)

- Quiz1 PDFDocumento45 pagineQuiz1 PDFShami Khan Shami KhanNessuna valutazione finora

- Reverse Discounted Cash FlowDocumento11 pagineReverse Discounted Cash FlowSiddharthaNessuna valutazione finora

- Starboard Value LP Letter To NWL Shareholders 03.05.2018Documento10 pagineStarboard Value LP Letter To NWL Shareholders 03.05.2018marketfolly.com100% (1)

- Myriad Genetics Coverage ReportDocumento8 pagineMyriad Genetics Coverage ReportChazz262Nessuna valutazione finora

- Chapter 10: Equity Valuation & AnalysisDocumento22 pagineChapter 10: Equity Valuation & AnalysisMumbo JumboNessuna valutazione finora

- India Pharma Sector - Sector UpdateDocumento142 pagineIndia Pharma Sector - Sector Updatekushal-sinha-680Nessuna valutazione finora

- Becton Dickinson BDX Thesis East Coast Asset MGMTDocumento12 pagineBecton Dickinson BDX Thesis East Coast Asset MGMTWinstonNessuna valutazione finora

- Equity ResearchDocumento15 pagineEquity ResearchBronteCapitalNessuna valutazione finora

- Ame Research Thesis 11-13-2014Documento890 pagineAme Research Thesis 11-13-2014ValueWalkNessuna valutazione finora

- PdfsDocumento9 paginePdfsjoeNessuna valutazione finora

- 16.02 RWC GIAA PresentationDocumento35 pagine16.02 RWC GIAA PresentationGIAANessuna valutazione finora

- IDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital AllocatorsDocumento55 pagineIDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital Allocatorsatgy1996Nessuna valutazione finora

- Investment Outlook 2020 enDocumento35 pagineInvestment Outlook 2020 entuanNessuna valutazione finora

- Discussion at Markel 2Documento35 pagineDiscussion at Markel 2mirceaNessuna valutazione finora

- Transforming Office Depot: A Plan For Renewal and ReinvigorationDocumento113 pagineTransforming Office Depot: A Plan For Renewal and ReinvigorationAnonymous Feglbx5Nessuna valutazione finora

- The GIC WeeklyDocumento12 pagineThe GIC WeeklyedgarmerchanNessuna valutazione finora

- Fairholme Fund Annual Report 2014Documento36 pagineFairholme Fund Annual Report 2014CanadianValueNessuna valutazione finora

- NCBC SaudiFactbook 2012Documento232 pagineNCBC SaudiFactbook 2012vineet_bmNessuna valutazione finora

- Dewan Housing Finance Corporation Limited 4 QuarterUpdateDocumento7 pagineDewan Housing Finance Corporation Limited 4 QuarterUpdatesandyinsNessuna valutazione finora

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Da EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Nessuna valutazione finora

- Algo TradingDocumento8 pagineAlgo TradingPankaj MishraNessuna valutazione finora

- IPO Grading Guide - Factors, Process & How Grades Help InvestorsDocumento4 pagineIPO Grading Guide - Factors, Process & How Grades Help InvestorsSachin SharmaNessuna valutazione finora

- Promoter Lock-In - DIP GuidelinesDocumento7 paginePromoter Lock-In - DIP Guidelinesbhawin_89Nessuna valutazione finora

- Bank Finance To Assist Employees To Buy Shares of Their Own CompaniesDocumento4 pagineBank Finance To Assist Employees To Buy Shares of Their Own CompaniesPankaj MishraNessuna valutazione finora

- Promoter Lock-In - DIP GuidelinesDocumento7 paginePromoter Lock-In - DIP Guidelinesbhawin_89Nessuna valutazione finora

- Bank Finance To Assist Employees To Buy Shares of Their Own CompaniesDocumento4 pagineBank Finance To Assist Employees To Buy Shares of Their Own CompaniesPankaj MishraNessuna valutazione finora

- Working Capital FinanceDocumento1 paginaWorking Capital FinancePankaj MishraNessuna valutazione finora

- Indian Banking Industry: Challenges and Opportunities: Dr. Krishna A. GoyalDocumento11 pagineIndian Banking Industry: Challenges and Opportunities: Dr. Krishna A. GoyalKalyan VsNessuna valutazione finora

- CL JMDocumento23 pagineCL JMSana KhanNessuna valutazione finora

- Definition of NonDocumento4 pagineDefinition of NonPankaj MishraNessuna valutazione finora

- Exim BankDocumento2 pagineExim BankPankaj MishraNessuna valutazione finora

- MIS Case Study-Banking-Cost SavingDocumento3 pagineMIS Case Study-Banking-Cost SavingPankaj MishraNessuna valutazione finora

- ISS22 ShababiDocumento36 pagineISS22 ShababiAderito Raimundo MazuzeNessuna valutazione finora

- Final Accounts QuestionsDocumento6 pagineFinal Accounts QuestionsGandharva Shankara Murthy100% (1)

- Equity Research AssignmentDocumento3 pagineEquity Research Assignment201812099 imtnagNessuna valutazione finora

- Absorption CostDocumento2 pagineAbsorption Costsidra khanNessuna valutazione finora

- Notes ReceivablesDocumento5 pagineNotes ReceivablesDianna DayawonNessuna valutazione finora

- Marketing Mix Strategies of McDonald's in IndiaDocumento7 pagineMarketing Mix Strategies of McDonald's in IndiaSimona GrNessuna valutazione finora

- Bearish PatternsDocumento41 pagineBearish PatternsKama Sae100% (1)

- Backup of Group3 - MalaysiaHydro - Case AnswersDocumento4 pagineBackup of Group3 - MalaysiaHydro - Case Answersshirley zhangNessuna valutazione finora

- Bata Company Term PaperDocumento20 pagineBata Company Term Paperahmadksath100% (1)

- Agreement DetailsDocumento43 pagineAgreement DetailsTejbirNessuna valutazione finora

- Invoice: (This Is Computer Generated Receipt and Does Not Require Physical Signature.)Documento2 pagineInvoice: (This Is Computer Generated Receipt and Does Not Require Physical Signature.)ndprajapatiNessuna valutazione finora

- Haribo: The Story of the Iconic German Candy CompanyDocumento3 pagineHaribo: The Story of the Iconic German Candy CompanyTupa TudorNessuna valutazione finora

- CPD - Procurement of Public Works in UgandaDocumento32 pagineCPD - Procurement of Public Works in UgandaIvan BuhiinzaNessuna valutazione finora

- Fatty Acids - Emery Oleo - KAODocumento1 paginaFatty Acids - Emery Oleo - KAOKimberly ConleyNessuna valutazione finora

- BVT 1 SolDocumento5 pagineBVT 1 SolJimmy JenkinsNessuna valutazione finora

- Organisational Strategic Choice - ToyotaDocumento13 pagineOrganisational Strategic Choice - ToyotaSajedul Islam Chy100% (2)

- Black Friday Directions: Read The Following Passage and Answer The Questions That FollowDocumento3 pagineBlack Friday Directions: Read The Following Passage and Answer The Questions That FollowFernanda Sales100% (1)

- Autocall Certificate With Memory Effect On DowDocumento1 paginaAutocall Certificate With Memory Effect On Dowapi-25889552Nessuna valutazione finora

- Chapter 3Documento143 pagineChapter 3Ashik Uz ZamanNessuna valutazione finora

- Standard Costing AnalysisDocumento106 pagineStandard Costing AnalysisUsama RiazNessuna valutazione finora

- Crossword Marketing PricingBasics - KeyDocumento1 paginaCrossword Marketing PricingBasics - KeyShaikh GhaziNessuna valutazione finora

- ACCA FR D19 Notes PDFDocumento152 pagineACCA FR D19 Notes PDFMohammed DanishNessuna valutazione finora

- Module 1: Introduction To Business Taxation: Nature of Business TaxDocumento67 pagineModule 1: Introduction To Business Taxation: Nature of Business TaxRenz LinatocNessuna valutazione finora

- Organize Chess ClubDocumento7 pagineOrganize Chess ClubIbrahimMehmedagićNessuna valutazione finora

- Endogeneity, Simultaneity and Logit Demand Analysis of Competitive Pricing and AdvertisingDocumento28 pagineEndogeneity, Simultaneity and Logit Demand Analysis of Competitive Pricing and AdvertisingbhaskkarNessuna valutazione finora

- Healthcare Reform Timeline For Self-Funded PlansDocumento1 paginaHealthcare Reform Timeline For Self-Funded PlansPayerFusionNessuna valutazione finora

- Philippine Acetylene V CIR DIGESTDocumento3 paginePhilippine Acetylene V CIR DIGESTGretchen MondragonNessuna valutazione finora

- Maths WorksheetDocumento7 pagineMaths Worksheetridridrid50% (4)

- Motorola Innovation Success and FailureDocumento5 pagineMotorola Innovation Success and FailureumaNessuna valutazione finora

- Fonderia Di Torino SDocumento15 pagineFonderia Di Torino SYrnob RokieNessuna valutazione finora