Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

5 - Cost-Volume-Profit (CVP) Analysis

Caricato da

malingapereraDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

5 - Cost-Volume-Profit (CVP) Analysis

Caricato da

malingapereraCopyright:

Formati disponibili

Cost-Volume-Profit (CVP) Analysis

Cost volume-profit analysis basically identifies the relationship between those three terms. Use for profit planning process of the firm. Its most common application is break-even analysis. Cost-Volume-Profit (CVP) Assumptions All cost can be separated in to fixed and variable. Total fixed cost does not change over the given volume range. Per unit selling price and per unit variable cost do not change In the multi product situations, sales mix of the products does not change.

Graphical Representation (Break Even Chart) It is a diagrammatic presentation of the break even point, margin of safety and values of profits and losses at different levels of activity Break even analysis highlights the concept of contribution. Break-even analysis indicates the level of sales at which costs and revenue are in equilibrium. Break-even point can be computed in terms of unit or in terms of monitory value of sales volume or as a percentage of capacity.

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

The Profit/Volume Graph (P/V graph) The P/V graph is another type of break-even chart which shows the profit or loss at different levels of activity, usually in terms of sales The profit/loss at a given level of activity is shown clearly in this diagram which could be considered a further refinement of previous diagram However variation of revenue and cost are lost sight of which is an inherent weakness in this graph

Contribution Margin (CM) The CVP model can be re-written as Profit (P) = Contribution [(p-v)x] Fixed Cost (f)

This equation implies that profit fluctuates with changes in contribution Hence, profit is dependent on contribution More specifically, profit is directly proportional to contribution It is that level of activity (output or sales since production is assumed to equal sales) at which the firm neither enjoys any profit nor incurs any loss That is the level of output whose contribution margin just covers the fixed costs Beyond the break-even point every unit sold brings in contribution, which is termed profit

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Break even point (BEP)

In order to find out the break-even point in revenue terms the break-even equation can be multiplied by the price per unit on both sides =

The BEP tends to increase with increase of fixed cost or variable cost per unit Further BEP tends to decrease with the decrease of fixed costs or variable cost per unit or increase of selling price per unit It is preferable for any organization to conduct its business with a low break-even point The break even point (units or revenue ) is a very useful summary statistic of the three parameters o Price o Variable cost o Fixed cost Which enables the manager to judge whether a given product line or entire production division will be profitable at a given level of activity or if not Also when it will start generation profits

Margin of Safety (MS) It is the excess of sales (assuming production equals sales) over the break-even level sales It indicates the amount by which sales can drop before loss making will occur MS (Rs) = Sales value BE sales The margin of safety can also be expressed as a percentage MS (%) = MSx100/ Sales Value It acts as a measure of safety towards a possible fluctuation of sales about the budget value Margin of safety is the distance between the given level of activity and the break-even point In P/V graph the margin of safety is the distance between the maximum given level of activity and the break even point Safety of the firm depends on profitability. Profitability depends on margin of safety. Hire the margin of safety higher the profitability. = 100

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Break Even Chart Uses Determination of the break-even point and margin of safety Estimation of profits associated with a given level of activity Estimation of the level of activity at which a given profit/loss is recorded Observation of the variation of costs and sales with level of activity

Break-even analysis under Multi-product situation This example describe how we can do break-even analysis under multi-product situation Limitations of CVP analysis Sometimes it is difficult to separate cost in to fixed and variable components Difficult to use break-even analysis for multi product firm. This is a short run concept and limited use in long run planning. Assumptions of constant selling price, unit variable cost and fixed cost is not valid

Full note set with Examples and Questions: http://www.executioncycle.lkblog.com/2012/06/mybusiness-economics-and-financial.html

Potrebbero piacerti anche

- The Real Book of Real Estate - Robert KiyosakiDocumento513 pagineThe Real Book of Real Estate - Robert Kiyosakiroti0071558100% (3)

- Mod BDocumento32 pagineMod BRuwina Ayman100% (1)

- Part 1 Building Your Own Binary Classification ModelDocumento6 paginePart 1 Building Your Own Binary Classification ModelWathek Al Zuaiby38% (13)

- Porcini Analysis CaaDocumento9 paginePorcini Analysis Caaapi-36667301667% (3)

- Welfare Economics and the EnvironmentDocumento125 pagineWelfare Economics and the EnvironmentAljun TusiNessuna valutazione finora

- MG6863 ENGINEERING ECONOMICS REPLACEMENT AND MAINTENANCE ANALYSISDocumento30 pagineMG6863 ENGINEERING ECONOMICS REPLACEMENT AND MAINTENANCE ANALYSISSrinivasNessuna valutazione finora

- ENS191: Engineering Economy Benefit/Cost Ratio: Chapter 11 (Sta. Maria)Documento22 pagineENS191: Engineering Economy Benefit/Cost Ratio: Chapter 11 (Sta. Maria)Karl Pepon AyalaNessuna valutazione finora

- Production N Cost AnalysisDocumento71 pagineProduction N Cost AnalysisAnubhav PatelNessuna valutazione finora

- Trust and CommitmentDocumento11 pagineTrust and CommitmentdjumekenziNessuna valutazione finora

- Social Cost Benefit Analysis Overview About Two Approaches of SCBADocumento79 pagineSocial Cost Benefit Analysis Overview About Two Approaches of SCBASunny NischalNessuna valutazione finora

- Capital Budgeting Techniques PDFDocumento57 pagineCapital Budgeting Techniques PDFMecheal ThomasNessuna valutazione finora

- Designing A Microsoft SharePoint 2010 Infrastructure Vol 2Documento419 pagineDesigning A Microsoft SharePoint 2010 Infrastructure Vol 2Angel Iulian PopescuNessuna valutazione finora

- Cement IndustryDocumento6 pagineCement Industrye6l3nn100% (1)

- Social Cost Benefit AnalysisDocumento60 pagineSocial Cost Benefit AnalysisAmmrita SharmaNessuna valutazione finora

- Eir January2018Documento1.071 pagineEir January2018AbhishekNessuna valutazione finora

- St. Columba's English Revision WorksheetDocumento2 pagineSt. Columba's English Revision WorksheetMohammed NaumanNessuna valutazione finora

- RIMS School Magazine Project ManagementDocumento40 pagineRIMS School Magazine Project ManagementAditya Vora75% (12)

- Learning ObjectivesDocumento10 pagineLearning ObjectivesShraddha MalandkarNessuna valutazione finora

- Aggregate Problem2Documento1 paginaAggregate Problem2Sai Dheerendra PalNessuna valutazione finora

- Chapter 1 - Construction EconomicsDocumento41 pagineChapter 1 - Construction EconomicsNejib Ghazouani50% (2)

- Select the most profitable capital investment alternativeDocumento24 pagineSelect the most profitable capital investment alternativeDave DespabiladerasNessuna valutazione finora

- Costing & FM J 2021Documento147 pagineCosting & FM J 2021Priya RajNessuna valutazione finora

- 1.2 Alteration of Share CapitalDocumento5 pagine1.2 Alteration of Share CapitalSakshi chauhanNessuna valutazione finora

- TransportationDocumento155 pagineTransportationAnand100% (3)

- BUSINESS STATISTICS Important Questions M.B.A. Trimester Examination Answer ALL QuestionsDocumento3 pagineBUSINESS STATISTICS Important Questions M.B.A. Trimester Examination Answer ALL QuestionsDon RockerNessuna valutazione finora

- A Numerical Example of Target and Lifecycle CostingDocumento2 pagineA Numerical Example of Target and Lifecycle CostingAtulSinghNessuna valutazione finora

- Vanraj Mini TractorsDocumento2 pagineVanraj Mini TractorsshagunparmarNessuna valutazione finora

- Practice Problems For Mid Term TestDocumento11 paginePractice Problems For Mid Term TestAkshada VinchurkarNessuna valutazione finora

- Graphical Method in ORDocumento8 pagineGraphical Method in ORAli MemonNessuna valutazione finora

- Master Minds CA/CWA & MEC/CEC marginal costing solutionsDocumento14 pagineMaster Minds CA/CWA & MEC/CEC marginal costing solutionsHaresh KNessuna valutazione finora

- Economics Chapter 8 PPT For ConsumptionDocumento13 pagineEconomics Chapter 8 PPT For ConsumptionBereket MekonnenNessuna valutazione finora

- Chapter 5Documento26 pagineChapter 5Hoàng Phương ThảoNessuna valutazione finora

- Appointment Letter PDFDocumento1 paginaAppointment Letter PDFShobhranNessuna valutazione finora

- Impact of marginal costing and leverages on cement industriesDocumento10 pagineImpact of marginal costing and leverages on cement industriesrakeshkchouhanNessuna valutazione finora

- Engineering Economics and Finance - 2 Marks - All 5 UnitsDocumento16 pagineEngineering Economics and Finance - 2 Marks - All 5 UnitsMohan Prasad.M100% (2)

- LIC NEFT Mandate Form for Policy Payment TransferDocumento1 paginaLIC NEFT Mandate Form for Policy Payment TransfervigneswaranqcNessuna valutazione finora

- Cost ClassificationDocumento12 pagineCost ClassificationAjay VatsavaiNessuna valutazione finora

- SimplexDocumento12 pagineSimplexnisarg_0% (1)

- CH 6 - Cost EstimatingDocumento30 pagineCH 6 - Cost Estimatingkaif100% (1)

- Annual Equivalence Analysis - Engineering EconomicsDocumento27 pagineAnnual Equivalence Analysis - Engineering EconomicsQuach NguyenNessuna valutazione finora

- Aggregate Bitumen Adhesion Test: Presented By: Group 5Documento20 pagineAggregate Bitumen Adhesion Test: Presented By: Group 5jennifer FernanNessuna valutazione finora

- Unit 5Documento15 pagineUnit 5Ramesh Thangavel TNessuna valutazione finora

- Law of Variable ProportionsDocumento5 pagineLaw of Variable ProportionsVinod Gandhi100% (1)

- PGDM - Market StructuresDocumento13 paginePGDM - Market StructuresRavi ChoubeyNessuna valutazione finora

- True False and MCQ Demand and Supply.Documento2 pagineTrue False and MCQ Demand and Supply.Nikoleta TrudovNessuna valutazione finora

- The Time Value of MoneyDocumento79 pagineThe Time Value of MoneyShivanitarunNessuna valutazione finora

- Monopolistic Competition WorksheetDocumento2 pagineMonopolistic Competition WorksheetnullNessuna valutazione finora

- Dec-13 Leasing Vs Borrowing SolutionDocumento1 paginaDec-13 Leasing Vs Borrowing Solutiondon_mahinNessuna valutazione finora

- Financial Management I - Chapter 4Documento54 pagineFinancial Management I - Chapter 4Mardi UmarNessuna valutazione finora

- Provisional Acceptance Format 2Documento1 paginaProvisional Acceptance Format 2nidamahNessuna valutazione finora

- Measuring Bitumen DuctilityDocumento2 pagineMeasuring Bitumen Ductilitysenadi14Nessuna valutazione finora

- Math Project-2 Section CDocumento6 pagineMath Project-2 Section CMeena LadlaNessuna valutazione finora

- Meaning, Nature & Scope, Micro, MacroDocumento16 pagineMeaning, Nature & Scope, Micro, MacroKetaki Bodhe100% (4)

- MET's Institute Final Project Report on Exploring Tyre Market Potential in Raigad DistrictDocumento32 pagineMET's Institute Final Project Report on Exploring Tyre Market Potential in Raigad DistrictgoswamiphotostatNessuna valutazione finora

- Quality Control Tests - MoRTH 4th vs 5th RevisionDocumento5 pagineQuality Control Tests - MoRTH 4th vs 5th RevisionAbdullah RafeekNessuna valutazione finora

- Wind Rose Diagram - ExamplesDocumento13 pagineWind Rose Diagram - ExamplesAbhyuday SharmaNessuna valutazione finora

- Karimganj College Online Commerce AssignmentDocumento8 pagineKarimganj College Online Commerce AssignmentJohn MilanNessuna valutazione finora

- Factors of Production: Land, Capital, Labor and EntrepreneurshipDocumento14 pagineFactors of Production: Land, Capital, Labor and Entrepreneurshipadjora6939Nessuna valutazione finora

- Engineering Economics: ST ND RD TH THDocumento4 pagineEngineering Economics: ST ND RD TH THniteshNessuna valutazione finora

- Technical Review On Biomass Conversion Processes Into Required Energy FormDocumento6 pagineTechnical Review On Biomass Conversion Processes Into Required Energy FormRicardo ValenciaNessuna valutazione finora

- Engineering Economy Chapter 5xDocumento130 pagineEngineering Economy Chapter 5xalfaselNessuna valutazione finora

- Practice of Cost Volume Profit Breakeven AnalysisDocumento4 paginePractice of Cost Volume Profit Breakeven AnalysisHafiz Abdulwahab100% (1)

- Supply and Demand Revision SheetDocumento4 pagineSupply and Demand Revision Sheetapi-365698728Nessuna valutazione finora

- Cost Volume Profit Analysis ExplainedDocumento3 pagineCost Volume Profit Analysis Explainedshygirl7646617Nessuna valutazione finora

- COST - VOLUME-PROFIT AnalysisDocumento17 pagineCOST - VOLUME-PROFIT Analysisasa ravenNessuna valutazione finora

- CVP Analysis ExplainedDocumento20 pagineCVP Analysis ExplainedRoyalNessuna valutazione finora

- Break Even Analysis Chapter IIDocumento7 pagineBreak Even Analysis Chapter IIAnita Panigrahi100% (1)

- CVP Analysis: Shiri PaduriDocumento9 pagineCVP Analysis: Shiri Padurivardha rajuNessuna valutazione finora

- Prepaire A Statement of CostDocumento2 paginePrepaire A Statement of CostmalingapereraNessuna valutazione finora

- OligopolyDocumento1 paginaOligopolymalingapereraNessuna valutazione finora

- Monopoly - Short Run EquilibriumDocumento3 pagineMonopoly - Short Run EquilibriummalingapereraNessuna valutazione finora

- Question TOFDocumento1 paginaQuestion TOFmalingapereraNessuna valutazione finora

- ExampleDocumento3 pagineExamplemalingapereraNessuna valutazione finora

- Example: The Annual Overheads Are As FollowsDocumento22 pagineExample: The Annual Overheads Are As FollowsmalingapereraNessuna valutazione finora

- Example - Income and SpendingDocumento10 pagineExample - Income and SpendingmalingapereraNessuna valutazione finora

- Example MonopolisticDocumento2 pagineExample Monopolisticmalingaperera0% (1)

- ExampleDocumento3 pagineExamplemalingapereraNessuna valutazione finora

- Financial Statement AnalysisDocumento12 pagineFinancial Statement AnalysismalingapereraNessuna valutazione finora

- Example 2Documento5 pagineExample 2malingapereraNessuna valutazione finora

- Example Cost-Volume-Profit (CVP) AnalysisDocumento5 pagineExample Cost-Volume-Profit (CVP) AnalysismalingapereraNessuna valutazione finora

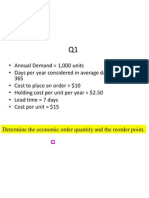

- EOQ QuestionsDocumento3 pagineEOQ QuestionsmalingapereraNessuna valutazione finora

- 7 - Monopolistic Competition & OligopolyDocumento3 pagine7 - Monopolistic Competition & OligopolymalingapereraNessuna valutazione finora

- 7 - Standard CostingDocumento4 pagine7 - Standard CostingmalingapereraNessuna valutazione finora

- 6 - MacroeconomicsDocumento5 pagine6 - MacroeconomicsmalingapereraNessuna valutazione finora

- 1 - Introduction To EconomicsDocumento5 pagine1 - Introduction To EconomicsmalingapereraNessuna valutazione finora

- 8 - Income and SpendingDocumento6 pagine8 - Income and SpendingmalingapereraNessuna valutazione finora

- 4 - Accounting For Overheads and Marginal CostingDocumento6 pagine4 - Accounting For Overheads and Marginal CostingmalingapereraNessuna valutazione finora

- 5 - Perfect Competition and MonopolyDocumento4 pagine5 - Perfect Competition and MonopolymalingapereraNessuna valutazione finora

- 6 - Inventory ManagementDocumento6 pagine6 - Inventory ManagementmalingapereraNessuna valutazione finora

- 2 - Cash Flow and Financial Statement AnalysisDocumento14 pagine2 - Cash Flow and Financial Statement AnalysismalingapereraNessuna valutazione finora

- Python 3000 and You: Guido Van Rossum Europython July 7, 2008Documento21 paginePython 3000 and You: Guido Van Rossum Europython July 7, 2008malingapereraNessuna valutazione finora

- 4 - The Theory of The Firm and The Cost of ProductionDocumento11 pagine4 - The Theory of The Firm and The Cost of ProductionmalingapereraNessuna valutazione finora

- 3 - Demand, Supply and The MarketDocumento12 pagine3 - Demand, Supply and The MarketmalingapereraNessuna valutazione finora

- 2 - Net Present Value ExDocumento4 pagine2 - Net Present Value ExmalingapereraNessuna valutazione finora

- 3 - Cost Terms, Concepts, and ClassificationsDocumento10 pagine3 - Cost Terms, Concepts, and ClassificationsmalingapereraNessuna valutazione finora

- Strength Enhancement in Concrete Confined by SpiralsDocumento43 pagineStrength Enhancement in Concrete Confined by SpiralsmalingapereraNessuna valutazione finora

- Imagine Cup 2012 Software Design RulesDocumento11 pagineImagine Cup 2012 Software Design RulesmalingapereraNessuna valutazione finora

- Exploring The Continuum of Social and Financial Returns: Kathy BrozekDocumento11 pagineExploring The Continuum of Social and Financial Returns: Kathy BrozekScott OrnNessuna valutazione finora

- 26Documento31 pagine26Harish Kumar MahavarNessuna valutazione finora

- Developing Lean CultureDocumento80 pagineDeveloping Lean CultureJasper 郭森源Nessuna valutazione finora

- Merits and DemeritsDocumento2 pagineMerits and Demeritssyeda zee100% (1)

- Powell 3543Documento355 paginePowell 3543Ricardo CaffeNessuna valutazione finora

- ARIA Telecom Company - DialerDocumento9 pagineARIA Telecom Company - DialerAnkit MittalNessuna valutazione finora

- Admission2023 MQProvisionalMeritList 26June2023V2Documento50 pagineAdmission2023 MQProvisionalMeritList 26June2023V2NISARG PATELNessuna valutazione finora

- Ghani Glass AccountsDocumento28 pagineGhani Glass Accountsumer2118Nessuna valutazione finora

- 21 Cost Volume Profit AnalysisDocumento31 pagine21 Cost Volume Profit AnalysisBillal Hossain ShamimNessuna valutazione finora

- 2013 Ar En18Documento35 pagine2013 Ar En18zarniaung.gpsNessuna valutazione finora

- Measuring The Efficiency of Decision Making Units: CharnesDocumento16 pagineMeasuring The Efficiency of Decision Making Units: CharnesnnleNessuna valutazione finora

- Putting The Balanced Scorecard To Work: Rockwater: Responding To A Changing IndustryDocumento2 paginePutting The Balanced Scorecard To Work: Rockwater: Responding To A Changing IndustrySakshi ShahNessuna valutazione finora

- Hinduja Ventures Annual Report 2015Documento157 pagineHinduja Ventures Annual Report 2015ajey_p1270Nessuna valutazione finora

- Audit Practice Manual - IndexDocumento4 pagineAudit Practice Manual - IndexIftekhar IfteNessuna valutazione finora

- Unit 32 QCF Quality Management in BusinessDocumento6 pagineUnit 32 QCF Quality Management in BusinessdrakhtaraliNessuna valutazione finora

- NebicoDocumento6 pagineNebicomaharjanaarya21Nessuna valutazione finora

- Renewallist Postmatric 2012-13 PDFDocumento472 pagineRenewallist Postmatric 2012-13 PDFImraz khanNessuna valutazione finora

- RSHDP WB Fin Mannual 13 MayDocumento31 pagineRSHDP WB Fin Mannual 13 MaysombansNessuna valutazione finora

- Competitiveness, Strategy and Productivity: Operations ManagementDocumento5 pagineCompetitiveness, Strategy and Productivity: Operations ManagementJansNessuna valutazione finora

- TRACKING#:89761187821: BluedartDocumento2 pagineTRACKING#:89761187821: BluedartStone ColdNessuna valutazione finora

- Asturias Sugar Central, Inc. vs. Commissioner of CustomsDocumento12 pagineAsturias Sugar Central, Inc. vs. Commissioner of CustomsRustom IbanezNessuna valutazione finora

- Types of TaxesDocumento6 pagineTypes of TaxesRohan DangeNessuna valutazione finora