Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bofa Approval Letter

Caricato da

Steve Mun Group0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

426 visualizzazioni3 pagineBank of america, n.a. Has agreed to accept a short payoff involving the above referenced property and the referenced account(s) this approval is exclusive to the offer from the buyer referenced in this letter. The deficiency is the difference between the remaining amount due under the mortgage note and market value of the property plus any cash contribution you make or amount you agree to repay in the future. If it is later determined that the approval of the short sale was based, in part, on information

Descrizione originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBank of america, n.a. Has agreed to accept a short payoff involving the above referenced property and the referenced account(s) this approval is exclusive to the offer from the buyer referenced in this letter. The deficiency is the difference between the remaining amount due under the mortgage note and market value of the property plus any cash contribution you make or amount you agree to repay in the future. If it is later determined that the approval of the short sale was based, in part, on information

Copyright:

Attribution Non-Commercial (BY-NC)

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

426 visualizzazioni3 pagineBofa Approval Letter

Caricato da

Steve Mun GroupBank of america, n.a. Has agreed to accept a short payoff involving the above referenced property and the referenced account(s) this approval is exclusive to the offer from the buyer referenced in this letter. The deficiency is the difference between the remaining amount due under the mortgage note and market value of the property plus any cash contribution you make or amount you agree to repay in the future. If it is later determined that the approval of the short sale was based, in part, on information

Copyright:

Attribution Non-Commercial (BY-NC)

Sei sulla pagina 1di 3

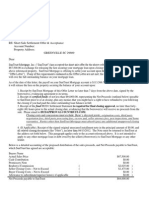

Short Sale Approval Letter

IMPORTANT MESSAGE ABOUT THIS ACCOUNT

This letter will serve as Bank of America, N.A.'s demand for payment and advises you that Bank of America, N.A. and/or its

nvestors and/or nsurers have agreed to accept a short payoff involving the above referenced property and the referenced

account(s). This demand should be used by the closing agent as our formal demand statement. No additional statement will be

issued. This approval is exclusive to the offer from the buyer referenced in this letter.

WHAT THIS MEANS TO THE SELLER

The owner of your mortgage note, the mortgage insurer, if your loan is covered by mortgage insurance, and Bank of America, N.A.

waive their right to pursue collection of any deficiency following the completion of your short sale and your debt is considered

settled. The deficiency is the difference between: (1) the remaining amount due under the mortgage note and mortgage or deed of

trust; and, (2) the current market value of the property plus any cash contribution you make or amount you agree to repay in the

future. The amount of the deficiency will be reported to the nternal Revenue Service (RS) on the appropriate 1099 Form or Forms.

We suggest that you contact the RS or your tax preparer to determine if you have any tax liability.

Bank of America, N.A. will report the debt to the credit reporting agencies as "paid in full for less than the full balance". To learn

more about the potential impact of a short sale on your credit, visit http://www.ftc.gov/bcp/edu/pubs/consumer/credit/cre24.shtm.

f it is subsequently determined that the approval of the short sale was based, in part, on information which Bank of America, N.A.

later determined to be false or misrepresented or fraudulent, Bank of America, N.A. reserves the right to pursue the remaining

balance of the note.

The difference between the current amount due under your mortgage or deed of trust and the current market value of the Property

must be reported to the nternal Revenue Service (RS) on the appropriate 1099 Form or Forms. We suggest that you contact the

RS or your tax preparer to determine if you have any tax liability.

The conditions of the approval are as follows:

Closing must take place no later than July 06, 2012 or this approval is void. f an extension is requested and/or approved,

then per diem interest will be charged through closing. Should the closing be delayed and the nvestor/nsurer agree to an

extension of the original closing date, the Borrower(s)/Seller(s) will be responsible for any per diem fees through the new

date(s) of closing, extension fees and foreclosure sale postponement fees. The Borrower(s)/Seller(s) will be responsible for

any additional costs or fees over the stated approved amounts.

1.

The approved buyer(s) is/are and the sales price for the property is $205,000.00. 2.

Another buyer cannot be substituted without the prior written approval of Bank of America, N.A.. 3.

Closing costs have been negotiated and agreed upon with the authorized agent as of May 31, 2012

Total Closing Costs not to exceed $17,847.71 a.

Maximum commission paid $12,300.00 b.

Maximum allowed to the Jr. Lien Holder $1,644.80 c.

Maximum allowed for HOA liens $200.00 (if applicable) d.

Maximum allowed for repairs N/A (if applicable) e.

Maximum allowed for termite inspection/repairs N/A (if applicable) f.

Any additional fees that were not approved on May 31, 2012 will not be covered by Bank of America, N.A. and become the

sole responsibility of the agent, the buyer or the seller to pay at closing.

4.

Net proceeds to Bank of America, N.A. to be no less than

1st Lien Loan Number

5.

Notice Date: May 31, 2012

Account No.:

Property Address:

Bank of America, N.A.

Proceeds from SaIe $187,152.29

Cash Contribution N/A

Promissory Note N/A

The property is being sold in "AS S" condition. No repairs will be made or be paid out of the proceeds, unless specifically

stated otherwise.

6.

As stated in #5, the Seller is to contribute $0.00, to assist in the closing of this transaction. This contribution will be in the

form of:

PROMSSORY NOTE(s) (Signed, notarized and returned at closing):

1st Lien Loan Number

Promissory Note N/A

f a promissory note(s) is required, it must be signed and uploaded to the Short Sale System prior to the close of escrow.

t is the responsibility of the closing agent to ensure that the executed and notarized promissory note is returned to Bank of

America, N.A.

f a promissory note(s) has already been signed and agreed to between the seller, investor and the Mortgage nsurance

Company, a signed certified copy must be provided to Bank of America, N.A. at the close of the short sale transaction. t is

the responsibility of the closing agent to ensure that Bank of America, N.A. receives the copy.

*** SaIes proceeds wiII be returned if the note has not been received. This wiII resuIt in a deIay of the transaction

and/or possibIe canceIIation of this short saIe transaction. ***

a.

CERTFED FUNDS CONTRBUTON (Due at closing):

1st Lien Loan Number

Cash Contribution N/A

b.

7.

The sellers will not receive any proceeds from this short sale transaction. f there are any remaining escrow funds or

refunds, it will not be returned to the seller; it will be sent to Bank of America, N.A. to offset the loss.

8.

Completed Assignment of Unearned premium is to be uploaded to the Short Sale System along with the final Settlement

Statement.

9.

There are to be no transfers of property within 30 days of the closing of this transaction. 10.

The property must be free and clear of liens and encumbrances other than those recognized and accounted for in the

HUD-1 approval, on which this approval is based.

11.

Bank of America, N.A. does not charge the borrower for statement, demand, recording, and reconveyance fees on short

payoff transactions. Do not include them in your settlement statement. Bank of America, N.A. prepares and records its own

reconveyances.

12.

All funds must be wired. Any other form of payment of funds will be returned. Payoff funds must be received within 48

business hours of the HUD-1 settlement date.

13.

f the terms and conditions of the short sale approval are not met, we will cancel the approval of this offer and continue the

foreclosure process as permitted by the mortgage documents.

14.

f the seller is entitled to receive any proceeds based on a claim for damage to the property under any policy of insurance,

including homeowner's, lender-placed, casualty, fire, flood, etc., or if seller is entitled to receive other miscellaneous proceeds, as

that term is defined in the deed of trust/mortgage (which could include Community Development Block Grant Program (CDBG)

funds), these proceeds must be disclosed before we will consider the request for short sale. f we receive a check for insurance or

miscellaneous proceeds that were not previously disclosed, Bank of America, N.A. will have the right to keep the proceeds and

apply them to Bank of America, N.A.'s loss after the short sale. We similarly would have the right to claim the proceeds to offset our

losses if it were not previously disclosed and it was sent directly to the borrower.

Bank of America, N.A. reserves the right to revoke and / or modify the terms and conditions of this short sale approval in the event

that 1) any information provided and used as the basis for our approval changes and / or 2) if we discover any evidence of fraud

and / or misrepresentation by any parties involved in the transaction.

Bank of America, N.A.

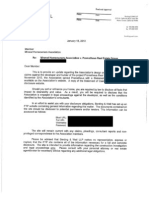

WHAT YOU NEED TO DO

******************* MPORTANT NSTRUCTONS *********************

The cIosing agent must upIoad a certified copy of the finaI estimated SettIement Statement to the Short SaIe System 72

hours prior to CIosing. You cannot cIose without finaI approvaI of the cIosing costs.

Payoff funds must be wired unless otherwise specified to:

Reference loan#

WIRES MUST CONTAIN THE LOAN NUMBER, BORROWER'S NAME AND PROPERTY ADDRESS. IF WE CANNOT IDENTIFY

THE FUNDS, THEY WILL BE RETURNED.

***A certified copy of the FinaI SettIement Statement must be upIoaded to the Short SaIe System at the time of cIosing.

Upon receipt of the above stated items, Bank of America, N.A. will issue a release of lien on its mortgage loan.

Bank of America, N.A. appreciates all your efforts and cooperation in this matter. f you feel there is additional information you

would like to provide, or if you need additional information, please contact us at 1.866.880.1232. Please continue to work closely

with your real estate agent to finalize your short sale.

Home Loan Team

Bank of America, N.A.

Bank of America, N.A. is required by law to inform you that this communication is from a debt collector. However, the purpose of

this communication is to let you know about your potential eligibility for this program to help you avoid foreclosure.

_____________________________________

Borrower Printed Name

_____________________________________

Co-Borrower Printed Name

_____________________________________

Borrower Signature

_____________________________________

Co-Borrower Signature

_____________________________________

Date

_____________________________________

Date

Bank of America, N.A.

Potrebbero piacerti anche

- Bank of America Cooperative Short Sale ApprovalDocumento3 pagineBank of America Cooperative Short Sale ApprovalkwillsonNessuna valutazione finora

- BofA Approval Letter 2Documento3 pagineBofA Approval Letter 2Steve Mun GroupNessuna valutazione finora

- Bofa 5Documento3 pagineBofa 5Steve Mun Group100% (1)

- WF Approval LetterDocumento6 pagineWF Approval LetterSteve Mun GroupNessuna valutazione finora

- SunTrust Short Sale Approval (Fannie Mae)Documento3 pagineSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- #154590294 HallDocumento4 pagine#154590294 Halltingoat59Nessuna valutazione finora

- Sales Contract ResidentialDocumento6 pagineSales Contract Residentialapi-320542467Nessuna valutazione finora

- Castle BOA - Bergman 7-28-14 PDFDocumento6 pagineCastle BOA - Bergman 7-28-14 PDFDarian MooreNessuna valutazione finora

- Promissory Note With Balloon PaymentsDocumento6 paginePromissory Note With Balloon PaymentsRocketLawyerNessuna valutazione finora

- ResalesDocumento11 pagineResalesapi-212566936Nessuna valutazione finora

- 501 - Contract To Purchase Real Estate (C) 2012 - ID-WATERMARKDocumento2 pagine501 - Contract To Purchase Real Estate (C) 2012 - ID-WATERMARKRichard Vetstein29% (7)

- Wells Fargo FHA Pre-Foreclosure Short Sale Approval LetterDocumento6 pagineWells Fargo FHA Pre-Foreclosure Short Sale Approval Letterkev1970Nessuna valutazione finora

- North Carolina Residential Real Estate Purchase AgreementDocumento9 pagineNorth Carolina Residential Real Estate Purchase Agreementnida batoolNessuna valutazione finora

- Loan Agreement Part B General Terms and Conditions: Info@homecredit - PHDocumento3 pagineLoan Agreement Part B General Terms and Conditions: Info@homecredit - PHBarbara Gracia RomeroNessuna valutazione finora

- Foreclosure Limited Guarantee 2009bDocumento2 pagineForeclosure Limited Guarantee 2009bDebra PrestonNessuna valutazione finora

- Accepted Offer Addendum-CounterDocumento16 pagineAccepted Offer Addendum-Counterrealestate6199Nessuna valutazione finora

- MORIGINADocumento7 pagineMORIGINAatishNessuna valutazione finora

- Sample-Loan Commitment LetterDocumento3 pagineSample-Loan Commitment LetterJustice Williams100% (1)

- Missouri Loan Agreement Promissory Note - 2023 - 01 - 21 PDFDocumento3 pagineMissouri Loan Agreement Promissory Note - 2023 - 01 - 21 PDFSOSA RIVERANessuna valutazione finora

- Loan Agreement Promissory NoteDocumento3 pagineLoan Agreement Promissory NoteWright AddilynNessuna valutazione finora

- Promissory Note Due On A Specific DateDocumento2 paginePromissory Note Due On A Specific DateRocketLawyer100% (3)

- General Closing Requirements - GuideDocumento29 pagineGeneral Closing Requirements - GuideRicharnellia-RichieRichBattiest-CollinsNessuna valutazione finora

- 6314534c617b3d29ef80ad92 - Purchase and Sale Contract (Between U &Documento4 pagine6314534c617b3d29ef80ad92 - Purchase and Sale Contract (Between U &anas imranNessuna valutazione finora

- Sample Land ContractDocumento8 pagineSample Land ContractAileen Salviejo100% (1)

- Loan Assumption Addendum: To Contract Concerning The Property atDocumento2 pagineLoan Assumption Addendum: To Contract Concerning The Property atsureshNessuna valutazione finora

- Loan Life CycleDocumento7 pagineLoan Life CyclePushpraj Singh Baghel100% (1)

- AnswerDocumento8 pagineAnswerRohan ShresthaNessuna valutazione finora

- Promissory Note With Installment PaymentsDocumento8 paginePromissory Note With Installment PaymentsRocketLawyerNessuna valutazione finora

- 2Documento11 pagine2charlesgoodman010Nessuna valutazione finora

- Loan Agreement: Parties PartyDocumento5 pagineLoan Agreement: Parties PartyMicoNessuna valutazione finora

- Contract To Purchase Real Estate - 2014 Ts90045Documento2 pagineContract To Purchase Real Estate - 2014 Ts90045Anthony Cogliano75% (4)

- Ocwen HAFA MatrixDocumento5 pagineOcwen HAFA MatrixkwillsonNessuna valutazione finora

- PurchaseDocumento2 paginePurchaseNorNessuna valutazione finora

- Note Payable: I. Terms of Repayment A. PaymentsDocumento8 pagineNote Payable: I. Terms of Repayment A. PaymentsRocketLawyer100% (1)

- Loan Agreement (3743902)Documento5 pagineLoan Agreement (3743902)Nichole Joy XielSera TanNessuna valutazione finora

- PART B General Terms and Conditions 2023 52de0762ebDocumento6 paginePART B General Terms and Conditions 2023 52de0762ebRexel May SuicoNessuna valutazione finora

- Promissory NoteDocumento6 paginePromissory NoteRocketLawyer75% (8)

- Solitude - Lockett - BOA 2-13 PDFDocumento3 pagineSolitude - Lockett - BOA 2-13 PDFDarian MooreNessuna valutazione finora

- Promissory Note: First Digital Finance CorporationDocumento5 paginePromissory Note: First Digital Finance CorporationJL RangelNessuna valutazione finora

- Loan Agreement (2148839)Documento5 pagineLoan Agreement (2148839)Brio RicaNessuna valutazione finora

- Chapter 15 Closing The Real Estate Transaction CombinedDocumento54 pagineChapter 15 Closing The Real Estate Transaction CombinedRain BidesNessuna valutazione finora

- Loan Agreement: Parties PartyDocumento5 pagineLoan Agreement: Parties PartyNurseklistaNessuna valutazione finora

- Forensic Mortgage Fraud Audit Report (MFI Miami) Echeverria, Et Al Vs Bank of America, Et Al.Documento7 pagineForensic Mortgage Fraud Audit Report (MFI Miami) Echeverria, Et Al Vs Bank of America, Et Al.Isabel Santamaria100% (7)

- Promissory Note Due On DemandDocumento3 paginePromissory Note Due On DemandRocketLawyer100% (3)

- Offer To Purchase Real Estate 32Documento6 pagineOffer To Purchase Real Estate 32Umma BanchanNessuna valutazione finora

- Cash Loan Specific Terms and Conditions PDFDocumento2 pagineCash Loan Specific Terms and Conditions PDFGina ContilloNessuna valutazione finora

- Cash Loan Specific Terms and Conditions PDFDocumento2 pagineCash Loan Specific Terms and Conditions PDFDanny AcohonNessuna valutazione finora

- HUD PEMCO Forfeiture and Extension Policy (Revised 031212)Documento3 pagineHUD PEMCO Forfeiture and Extension Policy (Revised 031212)ACGRealEstateNessuna valutazione finora

- Credit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationDocumento10 pagineCredit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationTestingNessuna valutazione finora

- Residential-Purchase-and-Sale-Agreement-Template (1) - 副本Documento9 pagineResidential-Purchase-and-Sale-Agreement-Template (1) - 副本792920321Nessuna valutazione finora

- Promissory Note: Plantation Fund Loan ContractDocumento3 paginePromissory Note: Plantation Fund Loan ContractSeth BecerraNessuna valutazione finora

- Bank of America HELOC Short Sale ApprovalDocumento2 pagineBank of America HELOC Short Sale ApprovalkwillsonNessuna valutazione finora

- Promissory NoteDocumento4 paginePromissory NotePaula Gail CarpenaNessuna valutazione finora

- Loan AgreementDocumento8 pagineLoan AgreementRocketLawyer100% (2)

- Mortgage Commitment Lu MF LiDocumento5 pagineMortgage Commitment Lu MF Lidonnytan6688Nessuna valutazione finora

- MortgageDocumento31 pagineMortgagedmccallum4Nessuna valutazione finora

- Demand NoteDocumento4 pagineDemand NoteLuke CooperNessuna valutazione finora

- Promissory NoteDocumento3 paginePromissory NoteABNessuna valutazione finora

- How to Avoid Foreclosure in California, 2012 EditionDa EverandHow to Avoid Foreclosure in California, 2012 EditionNessuna valutazione finora

- Cliff Deal Keeps Tax Hel.Documento1 paginaCliff Deal Keeps Tax Hel.Steve Mun GroupNessuna valutazione finora

- Redacted Attorney Letter Jan 2013Documento2 pagineRedacted Attorney Letter Jan 2013Steve Mun GroupNessuna valutazione finora

- Redfin DSLR StudyDocumento2 pagineRedfin DSLR StudySteve Mun GroupNessuna valutazione finora

- Banks Bail Out Thousands of California Homeowners Under MortgDocumento2 pagineBanks Bail Out Thousands of California Homeowners Under MortgSteve Mun GroupNessuna valutazione finora

- 2012 Base API County List of Schools - SANTA CLARA CountyDocumento15 pagine2012 Base API County List of Schools - SANTA CLARA CountySteve Mun GroupNessuna valutazione finora

- Redfin DSLR StudyDocumento2 pagineRedfin DSLR StudySteve Mun GroupNessuna valutazione finora

- Cash Incentives FlyerDocumento1 paginaCash Incentives FlyerSteve Mun GroupNessuna valutazione finora

- Attorney General Kamala HarrisDocumento2 pagineAttorney General Kamala HarrisSteve Mun GroupNessuna valutazione finora

- Coakley Joins 41 Attorney GeneralsDocumento2 pagineCoakley Joins 41 Attorney GeneralsSteve Mun GroupNessuna valutazione finora

- Coakley Joins 41 Attorney GeneralsDocumento2 pagineCoakley Joins 41 Attorney GeneralsSteve Mun GroupNessuna valutazione finora

- Loan Mod Secrets ReportDocumento4 pagineLoan Mod Secrets ReportSteve Mun GroupNessuna valutazione finora

- Ocwen ApprovalDocumento3 pagineOcwen ApprovalSteve Mun GroupNessuna valutazione finora

- Lawyer Letter RedactedDocumento2 pagineLawyer Letter RedactedSteve Mun GroupNessuna valutazione finora

- Ha Fa UpdatesDocumento1 paginaHa Fa UpdatesSteve Mun GroupNessuna valutazione finora

- Notice of Commencement of Proceeding RedactedDocumento5 pagineNotice of Commencement of Proceeding RedactedSteve Mun GroupNessuna valutazione finora

- The Modesto Bee - Jail Time in Stanislaus Real Estate FraudDocumento1 paginaThe Modesto Bee - Jail Time in Stanislaus Real Estate FraudSteve Mun GroupNessuna valutazione finora

- BofA HAFA ApprovalDocumento3 pagineBofA HAFA ApprovalSteve Mun GroupNessuna valutazione finora

- Notice of Commencement of ProceedingsDocumento5 pagineNotice of Commencement of ProceedingsSteve Mun GroupNessuna valutazione finora

- Banks Paying Homeowners To Avoid ForeclosuresDocumento5 pagineBanks Paying Homeowners To Avoid ForeclosuresSteve Mun GroupNessuna valutazione finora

- Ha Fa UpdatesDocumento1 paginaHa Fa UpdatesSteve Mun GroupNessuna valutazione finora

- Robo Signing Settlement Fact SheetDocumento2 pagineRobo Signing Settlement Fact SheetSteve Mun GroupNessuna valutazione finora

- Tipping The Scales Toward ForeclosureDocumento3 pagineTipping The Scales Toward ForeclosureSteve Mun GroupNessuna valutazione finora

- Chase Approval LetterDocumento3 pagineChase Approval LetterSteve Mun GroupNessuna valutazione finora

- FBI StatsDocumento1 paginaFBI StatsSteve Mun GroupNessuna valutazione finora

- Wells Fargo ApprovalDocumento3 pagineWells Fargo ApprovalSteve Mun GroupNessuna valutazione finora

- Bofa AnnouncementDocumento2 pagineBofa AnnouncementSteve Mun GroupNessuna valutazione finora

- Mortgage Payments Weighing You Down ReportDocumento3 pagineMortgage Payments Weighing You Down ReportSteve Mun GroupNessuna valutazione finora

- Member, National Gender Resource Pool Philippine Commission On WomenDocumento66 pagineMember, National Gender Resource Pool Philippine Commission On WomenMonika LangngagNessuna valutazione finora

- Tax Compliance, Moral..Documento52 pagineTax Compliance, Moral..PutriNessuna valutazione finora

- Dirac Equation Explained at A Very Elementary LevelDocumento16 pagineDirac Equation Explained at A Very Elementary Levelsid_senadheera100% (2)

- LIVING IN THE WORLD OF WARCRAFT: Construction of Virtual Identities Among Online GamersDocumento81 pagineLIVING IN THE WORLD OF WARCRAFT: Construction of Virtual Identities Among Online GamersVirginia Bautista100% (2)

- Leaving Europe For Hong Kong and Manila and Exile in DapitanDocumento17 pagineLeaving Europe For Hong Kong and Manila and Exile in DapitanPan CorreoNessuna valutazione finora

- Bethany Pinnock - Denture Care Instructions PamphletDocumento2 pagineBethany Pinnock - Denture Care Instructions PamphletBethany PinnockNessuna valutazione finora

- PD10011 LF9050 Venturi Combo Lube Filter Performance DatasheetDocumento2 paginePD10011 LF9050 Venturi Combo Lube Filter Performance DatasheetCristian Navarro AriasNessuna valutazione finora

- Chicago Citation and DocumentDocumento8 pagineChicago Citation and DocumentkdemarchiaNessuna valutazione finora

- Gaffney S Business ContactsDocumento6 pagineGaffney S Business ContactsSara Mitchell Mitchell100% (1)

- Econ 281 Chapter02Documento86 pagineEcon 281 Chapter02Elon MuskNessuna valutazione finora

- How To Get Into Top IIMs - Ahmedabad, Bangalore, Calcutta and Lucknow - CareerAnnaDocumento97 pagineHow To Get Into Top IIMs - Ahmedabad, Bangalore, Calcutta and Lucknow - CareerAnnaMoinak94Nessuna valutazione finora

- Seafood Serving Tools Make The Task of Cleaning Seafood and Removing The Shell Much Easier. ForDocumento32 pagineSeafood Serving Tools Make The Task of Cleaning Seafood and Removing The Shell Much Easier. Forivy l.sta.mariaNessuna valutazione finora

- With Us You Will Get Safe Food: We Follow These 10 Golden RulesDocumento2 pagineWith Us You Will Get Safe Food: We Follow These 10 Golden RulesAkshay DeshmukhNessuna valutazione finora

- B Blunt Hair Color Shine With Blunt: Sunny Sanjeev Masih PGDM 1 Roll No.50 Final PresentationDocumento12 pagineB Blunt Hair Color Shine With Blunt: Sunny Sanjeev Masih PGDM 1 Roll No.50 Final PresentationAnkit Kumar SinghNessuna valutazione finora

- NE5000E V800R003C00 Configuration Guide - QoS 01 PDFDocumento145 pagineNE5000E V800R003C00 Configuration Guide - QoS 01 PDFHoàng Tùng HưngNessuna valutazione finora

- Rubrics For Movie AnalysisDocumento1 paginaRubrics For Movie AnalysisJnnYn PrettyNessuna valutazione finora

- Godfrey David KamandeDocumento19 pagineGodfrey David KamandeDismus Ng'enoNessuna valutazione finora

- Molecular Docking Terhadap Senyawa Kurkumin Dan Arturmeron Pada Tumbuhan Kunyit (Curcuma Longa Linn.) Yang Berpotensi Menghambat Virus CoronaDocumento7 pagineMolecular Docking Terhadap Senyawa Kurkumin Dan Arturmeron Pada Tumbuhan Kunyit (Curcuma Longa Linn.) Yang Berpotensi Menghambat Virus Coronalalu reza rezki muanggaraNessuna valutazione finora

- Dairy IndustryDocumento11 pagineDairy IndustryAbhishek SharmaNessuna valutazione finora

- May 11-Smart LeadersDocumento28 pagineMay 11-Smart LeaderstinmaungtheinNessuna valutazione finora

- X-by-Wire: Fred SeidelDocumento9 pagineX-by-Wire: Fred SeidelHồng TháiNessuna valutazione finora

- The Cornerstones of TestingDocumento7 pagineThe Cornerstones of TestingOmar Khalid Shohag100% (3)

- The Prediction of Travel Behaviour Using The Theory of Planned BehaviourDocumento16 pagineThe Prediction of Travel Behaviour Using The Theory of Planned Behaviourhaneena kadeejaNessuna valutazione finora

- I Wanted To Fly Like A ButterflyDocumento12 pagineI Wanted To Fly Like A ButterflyJorge VazquezNessuna valutazione finora

- Math Grade 7 Q2 PDFDocumento158 pagineMath Grade 7 Q2 PDFIloise Lou Valdez Barbado100% (2)

- Food Drug InteractionDocumento23 pagineFood Drug Interactionayman_fkirin100% (5)

- Becg Unit-1Documento8 pagineBecg Unit-1Bhaskaran Balamurali0% (1)

- Advances in Ergonomic Design of Systems, Products and ProcessesDocumento370 pagineAdvances in Ergonomic Design of Systems, Products and ProcessesLeticia FerreiraNessuna valutazione finora

- Intel Corporation Analysis: Strategical Management - Tengiz TaktakishviliDocumento12 pagineIntel Corporation Analysis: Strategical Management - Tengiz TaktakishviliSandro ChanturidzeNessuna valutazione finora

- Hamlet Test ReviewDocumento3 pagineHamlet Test ReviewAnonymous 1iZ7ooCLkj100% (2)