Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cityam 2012-05-24

Caricato da

City A.M.Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cityam 2012-05-24

Caricato da

City A.M.Copyright:

Formati disponibili

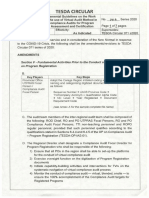

n Markets spooked as

officials tell EU leaders to

prepare for a Greek exit

BUSINESS WITH PERSONALITY

MORE BLACK CABS THAN

TRIES AT TWICKENHAM

Facebook hit

by lawsuit

over its float

FACEBOOK shares rose three per

cent to $32 yesterday, reversing the

stocks two-day slide.

But the internet idols IPO woes

are far from over after Facebook

was yesterday hit by lawsuits from

disgruntled shareholders.

US law firm Robbins Geller filed

a class action on behalf of new

Facebook investors, alleging that

the prospectus issued ahead of the

IPO was false and misleading.

The suit, which is also directed at

Morgan Stanley and Mark

Zuckerberg, claims that Facebook

revenue forecasts which were

downgraded just days before the

flotation were selectively disclosed

by the defendants to certain

preferred investors.

The complaint, one of four filed

in the last two days, said: The

value of Facebook common stock

has declined substantially and

plaintiffs and the class have

sustained damages as a result.

But Facebook, in its first public

statement since its float last week,

said: We believe the lawsuit is

without merit and will defend

ourselves vigorously.

The legal filing has triggered

debate about the fairness of the

rule which prevents analysts linked

to the advising banks publishing

forecasts on a company about to

float, but allows them to discuss

the guidance verbally.

Morgan Stanley was issued with

a subpoena on Tuesday night over

the same issue of analysts sharing

forecasts with select investors.

Nasdaq is also yet to escape the

firing line after receiving a claim

for financial compensation from

Knight Capital, which said last

night it expects to suffer up to a

$35m loss due to trading glitches

during Facebooks market debut.

The NYSE last night

denied it was

courting Facebook

in the hope the tech

giant would

transfer its listing

from Nasdaq.

EUROPEAN shares tumbled again

yesterday as leaders failed to come to

an agreement on how to end the

debt crisis and Eurozone officials

told member states to prepare for

Greece to leave the currency.

The UK, Germany and Finland all

saw borrowing costs fall to record

lows as investors fled risky assets in

favour of their safe haven bonds,

while yields jumped again for gov-

ernments in Italy, Spain and Greece.

Last nights informal EU summit,

as expected, reached no conclusions

on how to deal with the crisis.

Ahead of the summit, European

Council leader Herman van Rompuy

insisted that the meeting was only

set to discuss what how we can

stimulate growth and jobs, rather

than being aimed at coming up with

hard proposals.

We are preparing the group for

firm decisions in June, he said.

The stage had already been set for

deadlock as French President

Francois Hollande argued in favour

of jointly-guaranteed eurobonds as a

means of extending German finan-

cial power to troubled Greece, Spain

and Italy.

However, German chancellor

Angela Merkel made it clear she

would not spend more German cash

supporting weak governments debt.

Meanwhile documents emerged

showing the Eurogroup Working

Group (EWG) has advised Eurozone

www.cityam.com FREE

BY LAUREN DAVIDSON

FTSE 100 5,266.41 -136.87 DOW 12,496.15 -6.66 NASDAQ2,850.12 +11.04 /$ 1.57 -0.01 / 1.24 unc /$ 1.26 -0.01

INVESTORS FLEE

TO SAFE HAVENS

ISSUE 1,639 THURSDAY 24 MAY 2012

MORE: Page 9

Certified Distribution

02/04/2012 till 29/04/2012 is 100,668

BY TIM WALLACE

n Summit fails to reach

agreement over how to

contain Eurozone crisis

n Strong demand for

German and UK bonds as

yields sink to record lows

members to prepare contingency

plans to work out how they will

cope with a Greek exit.

Belgian finance minister Steven

Vanackere confirmed he was look-

ing at how best to cope with the fall-

out of a country leaving.

We must insist on efforts to avoid

an exit scenario but that doesnt

mean we are not preparing for even-

tualities, he said. I believe many

countries have their contingency

plans for the things they want to

avoid at all cost, and to say that we

dont have a contingency plan

would be irresponsible.

Markets tumbled on the uncer-

tainty, with the Italian FTSE MIB

falling 3.68 per cent, Spains IBEX

dropping 3.31 per cent, Frances

CAC losing 2.62 per cent and the

FTSE 100 falling 2.53 per cent.

Investors also sold weak govern-

ments bonds 10-year borrowing

costs for Italy rose 8.9 basis points

(bp) to 5.667 per cent while Spains

jumped 12.6bp to 6.204 per cent.

Meanwhile safe haven bonds fell

even further, as Germany sold two-

year debt with a zero per cent

coupon and its 10-year borrowing

costs dropped 8.4bp to 1.38 per cent,

while the UKs fell 9.9bp to 1.77 per

cent.

Prime Minister David Cameron arrived in Brussels last night

Mark Zuckerberg

faces legal action

Knighthood

for Apples

design guru

See Page 13

German bond yields hit new lows

May Mar Apr

1.6

1.8

2

2.2 %

1.38

23May

The FTSE dropped sharply yesterday

May Mar Feb Dec 2012 Apr

5,250

5,500

5,750

6,000

5,266.41

23May

DEBATE: Page 23

MORE: Page 5, Page 18-19

G

E

T

T

Y

allister.heath@cityam.com

Follow me on Twitter: @allisterheath

HEWLETT-Packard yesterday

unveiled a restructure which will see

Autonomy founder Mike Lynch leave

the company and 27,000 employees

lose their jobs.

British entrepreneur Mike Lynch,

dubbed the British Bill Gates, is a

founder of tech company Autonomy,

which was bought by HP in August

for 6.2bn. At the time it was the

UKs most valuable software firm.

Lynch will be replaced by HPs

chief strategy officer Bill Veghte.

Hewlett-Packard also announced a

slew of job cuts which will reduce its

work force by eight per cent. The

move, to be implemented largely

through early retirements, will

generate annual savings of up to

$3.5bn, the company said.

The revelations came as the US

tech company published its second

quarter results.

HP posted a $1.59bn profit, down

30 per cent on the same period last

year, and said revenue fell by three

per cent to $30.7bn.

Chief executive Meg Whitman

said, We are making

progress in our multi-year

effort to make HP simple,

more efficient and

better... but we still have a

lot of work to do.

Mike Lynch to

leave HP amid

27,000 job cuts

BY LAUREN DAVIDSON

Fresh blow to London as

Tungsten delays its float

TUNGSTEN, the British bid vehicle

founded by Edmund and Danny

Truell, yesterday announced a

raincheck on its IPO.

Citing adverse market conditions,

the financial services investment

fund said it was postponing its flota-

tion, set to raise 200m.

The announcement will come as a

blow to the London Stock Exchange,

which was expecting to list

Tungsten shares in June.

The Truell brothers unveiled the

IPO plans on 4 May, saying the newly

incorporated company intended to

take advantage of the value opportu-

nity within the financial services

sector.

The proceeds, to be raised from

selling shares at 5, were expected

to be used to fund acquisitions or to

recapitalise and grow the companys

current assets.

The float delay will also be a let-

down for UBS and Numis, the joint

bookrunners on the deal.

Tungsten gave no indication yes-

terday as to whether it plans to

return to the markets in the near

future.

In a reflection of the tough market

conditions, the disappointing news

emerged just two weeks after O1

Properties, the Russian real estate

investment firm, postponed its IPO.

Web pioneer sues over iTunes

A General Electric-owned company is

squaring up to Apple in a Pennsylvania

courtroom over whether its patents were

infringed when Apple launched its iTunes

platform. The case, which pits two of the

USs biggest companies against each

other, is the latest in a string of high-

profile patent disputes involving

technology companies.

Copper plan would wreak havoc

US manufacturers have attacked plans by

JPMorgan Chase to launch an exchange-

traded fund backed by physical copper,

arguing that the product would grossly

and artificially inflate prices and wreak

havoc on the US and global economy.

Normal planning service resumed

The worlds largest companies have

resumed normal patterns of succession

planning, suggesting they believe the

worst of the downturn is over. Among the

2,500 biggest groups by market value,

355 replaced their chief executives last

year, compared with just 290 in 2010,

according to research by Booz &

Company.

Force end of free current accounts

Banks in Britain should be forced to start

charging customers for their current

accounts, according to Andrew Bailey,

executive director of the Bank of England,

who will call today for an end to so-called

free banking.

Twickenham Studios back on market

The studio is back on the market after its

mystery buyer pulled out. The unnamed

purchaser of Twickenham Film Studios

had put forward a 100,000 deposit to

buy the studio out of administration.

Battersea bidder plans car park

One of the leading bidders for Battersea

Power Station is planning to build a multi-

storey car park inside the historic site. The

plans are likely to be hugely controversial

with English Heritage and the Mayor.

FSA warns banks over interest rates

The Financial Services Authority, chaired

by Adair Turner, has warned banks it will

take action over the alleged mis-selling

of interest rate swaps to small businesses

if it finds widespread evidence of

breaches of our rules.

Pandoras loss widens, as sales jump

Pandora Media yesterday reported a

wider loss for its fiscal first quarter on

higher costs, but its revenue jumped 58

per cent and the internet radio company

raised its outlook. Its shares rose 11 per

cent to $11.45 in after-hours trading.

Gupta trial zones in on GS salesman

Prosecutors publicly acknowledged

outside the presence of the federal jury

yesterday that David Loeb, a senior

Goldman salesman, provided information

about Intel, Apple and HP to Rajaratnam.

WHAT THE OTHER PAPERS SAY THIS MORNING

BRITISH engineering got a boost

yesterday when BAE Systems

secured a 1.6bn deal to equip and

train the Saudi Arabian military.

BAE said it will supply 22 new

Hawk advanced trainer jets, most

of which will be made in Britain,

as well as 55 Swiss-made Pilatus

aircraft and other training and

support services.

The contract provides some

welcome relief for the British

defence giant, which is battling

against shrinking European and

American defence budgets and

fierce competition.

Saudi Arabias official news

agency SPA quoted an unnamed

official at the Saudi defence

ministry as saying the Hawks

would help train the Saudi air

force to be able to use the fighter

jets ... efficiently.

Most of the Hawks will be made

at BAEs plants in Samlesbury and

Warton in Lancashire according to

BAEs statement yesterday. The

planes are not due to be delivered

until 2016.

Yesterdays deal is the second

big contract win for BAE in as

many days it also bagged a

328m deal to supply Britains

next generation of submarines.

Shares in BAE closed down one

per cent at 271.5p, outperforming

a broader fall in the FTSE 100.

BAE wins 1.6bn

deal to build

Saudi airplanes

Edmund Truells investment vehicle has postponed its London flotation

2

NEWS

BY HARRY BANKS

BY LAUREN DAVIDSON

To contact the newsdesk email news@cityam.com

W

HEN in doubt, blame

traders. After all, its easier

to attack anglo-saxon

speculators than to actually

try and sort out massive government

over-spending, a corporatist and

uncompetitive economy, an

imploding welfare state and a dodgy

currency. So it should have come as

no surprise that the latest assault on

the City was led by Anni Podimata, a

Greek socialist European

Parliamentarian and a member of

one of the parties that helped destroy

Greece. MEPs yesterday voted to

impose a pan-EU financial

transactions tax, a move which the

UK government has pledged to block.

The idea of a Tobin tax is based on

the flawed view that trading or spec-

ulation is a bad thing. The reverse is

true. Individuals buying and selling to

make a profit (with or without the

EDITORS

LETTER

ALLISTER HEATH

UK must lead by example and abolish stamp duty on shares

THURSDAY 24 MAY 2012

use of high-frequency programmes)

help the process of price discovery,

make markets work better, enhance

liquidity, ensure resources are priced

correctly and help oil the cogs of the

economy. Exchanges must of course

put in place robust systems to avoid

flash crashes but that is no argu-

ment in favour of taxes. Things only

go truly wrong when there is a bubble

but these are usually caused by cen-

tral banking errors and traders are

the ones who help to deflate them

again. Rather than making the econo-

my more stable, most empirical stud-

ies find that transactions taxes

actually increase the volatility of

prices by reducing the depth of mar-

kets, at least in the short term.

The biggest losers from a transac-

tion tax would be investors and

savers, including pensioners. As a

recent IMF paper put it, the burden

would fall on owners of traded secu-

rities, at the time the tax was intro-

duced, as the value of stocks, bonds

and derivatives fell. By making it

more expensive for companies to

raise finance, a Tobin tax would

depress investment and thus growth.

As the IMF says: In the long run, cap-

ital owners would therefore not bear

the burden; it would fall on workers,

who as a result of the smaller capital

stock would be less productive and

receive lower wages. Once again,

merely opposing the EU. It should

also axe our disastrously inefficient

stamp duty on equities, our very own,

albeit more limited version of the

Tobin tax. A report by Lord Forsyth

found that the higher transaction

costs caused by stamp duty depress

share prices by up to 10 per cent. One

study suggests that if the levy were

abolished the increase in the market

cap of the FTSE All Share could hit

150bn; the 4bn a year the tax raises

is poor value. Oxera found that abol-

ishing it would cut the cost of equity

for firms raising capital by 7-8.5 per

cent, with technology firms paying

up to 12 per cent less. The govern-

ment should not just oppose the EUs

plans it should lead by example and

abolish stamp duty on shares.

socialist politicians who believe they

are helping the poor will actually

hurt them.

Proponents of the tax are wrong to

believe that it would have helped pre-

vent the crisis. Its root cause was that

banks were exposed to unreliable

loans based on bubble-level property

prices. Many collateralised debt obli-

gations were held for long periods,

not constantly traded; a Tobin tax

would have done nothing to prevent

their popularity. The Eurozones crisis

has nothing to do with traders either.

Even the European Commissions

own impact assessment found that a

transaction tax on securities could,

without the application of mitigating

effects, reduce future GDP growth.

The Danish economy minister said

the measure could destroy hundreds

of thousands of jobs.

The UK should go further than

The $425m flotation was also

booked for the London Stock

Exchange.

At the time, a spokesperson for O1

Properties said it would consider

relaunching its flotation at another

time, and its delay was not due to a

lack of interest from prospective

shareholders.

Richard Cormack, co-head of equity

capital markets at Goldman Sachs,

told City A.M.: Its not an enormous

surprise that [O1 Properties] did not

make it to the finish line. The London

IPO market has had a more difficult

time lately than certain others.

Worried eyes will now be turned in

the direction of Megafon, another

high-profile listing expected to land in

London later this year.

Goldman Sachs and Morgan Stanley

are advising the Russian telco, con-

trolled by Alisher Usmanov, on its

$4bn flotation.

Tungsten hit the headlines earlier

this month when its founder Edmund

Truell said the fund would consider

making an offer for the insurance

units of RBS and Lloyds, although it

had yet to approach either bank.

Autonomy founder

Mike Lynch will

leave HP

The new jobs website for London professionals

CITYAMCAREERS.com

THAI energy giant PTT yesterday

trumped Shells offer for Cove Energy

with a 1.22bn bid.

The board of Cove recommended

the new offer equivalent to 240p

per share leaving Shell to decide

on whether to try to outgun PTT.

Cove has an 8.5 per cent stake in

massive gas finds offshore northern

Mozambique and its east African

assets have attracted suitors.

Just hours before a deadline for

investors to accept Shells 1.1bn bid,

the companys management said

that it had switched to the improved

offer from PTT.

It had previously supported Shells

offer, which followed a PTT bid that

beat Shells opening salvo in

February. Cove shares yesterday

jumped by more than 10 per cent

after PTTs fresh bid was confirmed.

Whoever buys Cove will have to pay

a capital gains tax to Mozambique,

which Shell has estimated at around

$200m. Cove will also be forced to

PTT beats Shell

offer for Cove

in bidding war

BY JOHN DUNNE

pay Shell a 11.1m break fee under

the terms of the deal agreed in April.

Cove chief executive John Craven

and two other directors are in line for

a combined windfall of more than

35m under the proposals and the

figure ticks up with every bid.

Craven said in a statement yester-

day: The bid from PTT represents sig-

nificant value for shareholders and

confirms the world class nature of

Coves East African assets. Coves

main asset is an 8.5 per cent stake in

the Rovuma Offshore Area 1 in

Mozambique.

Spain completes 9bn rescue of

Bankia, but debt woes continue

SPAIN said yesterday its rescue of

problem lender Bankia would cost

at least 9bn (7.2bn), while also

saying that it is seeking ways to help

its highly indebted regions meet

huge refinancing needs.

The countrys weak banks and

overspending regions are at the

heart of the European debt crisis

due to concerns that expensive bail-

outs of ailing lenders and regions

could force the country to seek

international aid.

BY HARRY BANKS

Losses at Bankia, Spains fourth

largest bank, are central to investor

fears that the fragile financial

system could become more

vulnerable as default rates rise in a

recession.

Economy minister Luis de Guindos

told a congressional committee that

the state would have to put at least

9bn into saving Bankia, which he

said would be fully nationalised in

the process.

At the same time government

sources said de Guindos and other

top officials were at odds over how to

help the countrys 17 autonomous

regions refinance 36bn in debt that

comes due this year.

Bankias new management team

will undertake a complete

assessment of the lenders capital

needs and will present its plan in

mid-June, de Guindos said.The

government will recapitalise

Bankias parent group BFA using the

state-backed bank restructuring

fund, the FROB, and then will fund

Bankia through a capital increase

including preferential shares for

existing shareholders.

GOOGLES Android mobile platform has not infringed Oracle's patents, a California

jury decided yesterday, in a boon for its chairman Eric Schmidt. The verdict puts an

indefinite hold on Oracles quest for damages in a legal fight between the two Silicon

Valley giants over smartphone technology.

JURY DEALS BLOW TO ORACLE IN GOOGLE CASE

THURSDAY 24 MAY 2012

3

NEWS

cityam.com

SHARES in the London Stock

Exchange sank seven per cent

yesterday after two Italian banks

sold their stakes at the bottom end

of the price range offered.

UniCredit and Intesa Sanpaolo,

the third and fourth-largest

shareholders respectively, sold a

combined 11.5 per cent stake at

960p a share, just days after they

were downgraded by a credit

ratings agency.

Shares in LSE group fall after

major Italian banks cash out

BY PETER EDWARDS

The price was at the very bottom

of the 960p-1,000p range provided

by the offer terms sheet on

Tuesday, valuing UniCredits 6.1

per cent stake at 197.6m (158m)

and Intesas 5.4 per cent holding

at 172.5m.

The sale price was 5.6 per cent

below the LSEs closing share price

on Tuesday of 1,017p and the

banks holdings were placed

through an accelerated book

build, with Morgan Stanley acting

as bookrunner.

Cove Energy PLC

23May 17May 18May 21 May 22May

230

235

225

240

245

250

255 p

250.00

23May

A SUPREME Court ruling that the

government had breached an aspect

of EU law yesterday brought the

prospect of 5bn-worth of tax refunds

closer for companies.

The ruling means that British

American Tobacco, lead claimant in

the case alongside five other multi-

national companies, now has the

right to recover any tax wrongly paid

extended back until 1973.

The long-running Franked Investment

Income case will now be referred to the

EU Court of Justice meaning a conclusive

victory remains elusive.

Ruling suggests

5bn tax refund

BY KATIE HOPE

G

E

T

T

Y

BARCLAYS lost $650m (414m) on its

sale of a $6.1bn stake in US fund man-

ager BlackRock yesterday after it

scrambled to offload the shares to

comply with incoming capital regula-

tions.

The sale, which was managed by a

list of 36 book runners led by Barclays,

Bank of America Merrill Lynch and

Morgan Stanley, valued the shares at

$160 each. They were given a valua-

tion of $182 when Barclays acquired

them in 2009 as part payment for its

sale of Barclays Global Investors to

BlackRock.

Yesterdays sale price of $160

marked a two per cent discount to

their closing price on Tuesday, which

was $163. BlackRock itself bought

back $1bn of the shares.

Since Barclays acquired them, hold-

ing onto large equity stakes in finan-

cial firms has become extremely

expensive for British banks because

the FSA is enforcing a strict version of

the Basel III capital rules.

That is in contrast to the rules

enforced on the continent, where cap-

Barclays loses

$650m on sale

of BlackRock

BY JULIET SAMUEL

ital regulations do not attach such a

high risk-weighting to equity in other

firms.

In the UK, the BlackRock holding

incurs a 250 per cent risk-weighting,

meaning that Barclays had to hold

reserve capital against losses in the

stake as if it owned 10bns worth of

stock.

The high opportunity cost of doing

so meant the bank was keen to sell up

as soon as the three-year lock-in period

it had agreed with BlackRock expired.

The banks next accounts could

book the sale as a profit, because

Barclays wrote them down to a value

of $148 at the end of last year.

Barclays Bob Diamond has to deal with regulations that dont affect his French rivals

Barclays PLC

23May 17May 18May 21 May 22May

180.0

182.5

177.5

185.0

187.5

190.0

192.5 p

180.50

23May

THURSDAY 24 MAY 2012

5

NEWS

cityam.com

A deal that shows Europes

uneven playing field in action

T

HREE weeks ago, George

Osborne told other EU finance

ministers that he was not

prepared to sign up to capital

rules that would make him look

like an idiot due to their huge

loopholes for French and German

banks.

One week ago, Osborne signed up to

those rules.

So while Barclays took a 400m hit

from selling off its BlackRock shares

due to the FSAs punitive treatment of

the asset in regulations, the banks

French rivals, many of which own

stakes in insurers, will have not have

to contend with such inconveniences.

This is precisely the kind of cost that

UK banks are referring to when they

moan about an un-level playing

field. Alone, it is hardly crippling, but

it is one of many examples.

The rule itself is one of Basels less

unreasonable ones, if you accept the

premise of standardising risk assess-

ment. Letting banks count minority

stakes in other firms towards their

core capital means the capital is

counted twice, by the bank and the

firm whose shares it owns. And it can

be hard to turn stock into cash quickly.

Osbornes capitulation shows that

defending the Citys long-term competi-

tiveness is low on his list of priorities.

BOTTOM

LINE

JULIET SAMUEL THE head of global sales at Research

In Motion has left to take on a

leadership role in another industry,

the BlackBerry maker said last night.

London-based Patrick Spence was a

14 year company veteran widely

considered a rising star for RIM. He

was promoted to the global sales role

in July last year after serving as

managing director for Europe, the

Middle East and Africa. RIM has seen

a steady stream of departures in the

past year as its once-dominant market

share has slipped amid fierce

competition from Apple.

RIM loses head

of global sales

BY KATIE HOPE

IN BRIEF

Ireland to invest 2bn in property

nIrelands bad bank plans to invest

2bn (1.6bn) in building projects in

an attempt to bolster jobs in the

countrys property sector. NAMA, set

up in 2009 to take property loans off

the books of Irelands struggling

banks, said it will plough cash into

both half-finished projects and new

builds with a focus on commercial real

estate.

Fears over bailout fund staff

nAn external consulting firm charged

with evaluating the structure of

Europes new permanent rescue facility

has raised questions about whether it

will have enough staff to function

effectively. In a 12 May letter addressed

to Klaus Regling, the head of the blocs

temporary rescue fund, partners at A.T.

Kearney warn that the approved staff

of 75 for the European Stability

Mechanism (ESM) may prove too

small if the debt crisis rumbles on for

several years.

EU members most open to trade

n EU member countries and their close

partners in north and central Europe

make up 12 of the 20 nations that are

most open to international trade,

according to the World Economic

Forum. Its latest Enabling Trade Index

puts the US at 23, down from 19 in 2010.

Finland rose by six places to sixth place,

and Britain, at 11th place, rose from 17th.

G

E

T

T

Y

IMF leader Christine Lagarde has

warned Greece that it must pay the

price of remaining in the Eurozone

as she marvelled at the inconsisten-

cies in the countrys recent elec-

tions that favoured anti-bailout

parties.

Lagarde said: Efforts have to be

made and have to be shared. Greece

has to be a member that also imple-

ments its programme and also

undertakes efforts, which it has to a

point.

It has to do a lot more. That is

absolutely the case. It had a long way

to go, it has made efforts, and the

Greek population has made huge

efforts, but they have more to do,

said Lagarde, who leads the fund

helping to bail out Greece.

There are more structural reforms

to be had, there is more tax to be col-

Lagarde tells

Greece to take

its medicine

BY MARION DAKERS

lected and that has a price.

She told the BBC that the Eurozone

nations had to be prepared for all sit-

uations and solutions including

Greece leaving the currency bloc.

She added that it is quite remark-

able that the Greek population has

voted in a way that is not conducive

to the formation of a government

while continuing to take bailout

funds.

There is an inconsistency between

sending away those political groups

that support the Eurozone and by

the same token saying we want to be

part of the Eurogroup and have the

euro as our currency, but it has a

price.

She said the other euro bloc nations

should weigh up further support of

Greece, depending on whether they

consider the integrity of the zone as

sufficiently beneficial so as to justify

additional investment.

Consumer sentiment plummets

as Italians fear deepening crisis

CONSUMER confidence plummeted

in Italy this month, official survey

data showed yesterday, as the

country continues to struggle

through tough economic reforms.

The confidence climate index fell

from 88.8 to a record low of 86.5,

according to statistics agency

ISTAT.

The drop was led by a fall in the

economic climate component from

71.6 to 64.4, while the balance

concerning the unemployment

outlook rose from 106 to 113.

Confidence had remained

BY TIM WALLACE

surprisingly strong early in the year,

rising from 91.4 in January to 93.8

in February and 96.1 in March

despite Prime Minister Mario

Montis planned austerity measures.

However, the deepening of the

crisis in Greece, building worries in

Spain and the implementation of

some structural reforms in Italy

have all knocked confidence since

then, leading to the two consecutive

monthly falls in the index.

Inflexible labour markets have

been blamed for much of the loss of

competitiveness in Italy, and Monti

hopes that liberalising the

industries, including taxi driving

and pharmacy, will give the

economy a boost in the medium

and long-term, despite the short-

term disruption it causes for those

already in the sectors affected.

Christine Lagarde told Greece there is a price to pay if it wants to stay in the Eurozone

Italian consumer condence hits record low

12 10 08 06 04 02 00 98 96 94 92

80

90

100

110

120

130

THE EUROPEAN Parliament voted

overwhelmingly in favour of an EU-

wide financial transactions tax

(FTT) yesterday, with leading

proponents arguing the FTT is an

integral part of an exit from crisis.

The tax, of 0.1 per cent on equity

trades and 0.01 per cent on

derivatives, was supported by 487

MEPs and opposed by 152.

Finnish MEP Sirpa Pietikainen

said the tax represents a fair

contribution from the financial

sector for the damage caused in the

financial crisis, and that it will stop

damaging speculation in markets.

She called for the tax to cover the

whole EU, hitting out at opposition

MEPs demand transactions tax

on European financial sector

BY TIM WALLACE

from countries like the UK which

are holding negotiations hostage,

and suggested the tax could

initially cover a smaller group of

more cooperative nations before

later expanding.

To cover the whole EU, the tax

would need the unanimous

agreement of all member states.

Greek MEP Anni Podimata said

this is a strong signal of what the

European Parliament can achieve

despite different national views.

This is what we can achieve

when we put EU citizens interests

above everything else.

Podimata rejected claims that

trading activity will simply move

out of the EU to avoid the tax,

arguing the cost of relocation is

higher than paying the tax.

THURSDAY 24 MAY 2012

7

NEWS

cityam.com

Explore new horizons

from London

Dubai

from

341

Johannesburg

from

515

Buenos Aires

from

663

Return fares, including taxes

Fares quoted are for return economy class ights from London Heathrow via Amsterdam, including taxes and charges, and are subject to change.

Fares are also subject to availability and exchange rate variation. Please check for exact fare at klm.com at time of booking. Book by 12/06/12.

Travel periods vary. Credit card surcharge will apply. Specic booking conditions and the General Conditions of Transportation of KLM and AIR FRANCE

apply. Prices correct at 10/05/12.

INCREASED popularity of buy-to-let

mortgages powered lender Paragon

to a 13.4 per cent rise in profit to

44.8m for the six months to March.

Chief executive Nigel Terrington

told City A.M. he is delighted that

the profit growth was driven by

improved revenues rather than cost-

cutting.

For the first time since the credit

crunch [the buy-to-let] balance sheet

has expanded. At the same time we

did the UKs first buy-to-let

securitisation since 2007, he said.

Buy-to-let is a very strong and

robust market for many years to

come were only halfway through

a transformation of the market.

Banks are not actively chasing new

business so it presents

opportunities for smaller lenders.

Paragon has used its strong

cashflow to enable Idem Capital

its portfolio investment business

to acquire loan portfolios from

banks as they deleverage.

Shares in the FTSE 250 firm

closed yesterday up more than five

per cent.

Paragon profit

rises on return

of buy-to-let

BY JAMES WATERSON

G

E

T

T

Y

THE INVESTMENTS made by private

equity and venture capital firms

have continued to outperform rival

asset classes despite a turbulent year

for the industry.

The internal rate of return the

average annual return over each of

the past ten years hit 14.3 per cent

in 2011, compared to 5.9 per cent for

total pension fund assets and 4.8 per

cent for the FTSE All-share index,

according to research from the

British Private Equity & Venture

Capital Association (BVCA). This was

down from the 14.6 per cent

achieved in 2010.

Over a five year period, UK private

equity produced an annual return

of eight per cent, in contrast to

pension fund assets that generated

3.5 per cent and the All-Share index,

which returned 1.2 per cent.

The survey of 501 UK managed

funds showed that BVCA members

invested 18.6bn globally in 2011,

BY PETER EDWARDS

down nine per cent from 2010.

The figures come after a turbulent

period for buyout firms, with the

European sovereign debt crisis

depressing deal values. The industry

also had to withstand a series of

attacks, with Labour leader Ed

Miliband criticising asset strippers

and vultures and US Republican

presidential candidate Mitt Romney

coming under fire for his previous

role as a co-founder of Bain Capital.

These data show that private

equity and venture capital continue

to weather the UKs weak economic

climate and deliver long-term

returns to investors, said Joe Steer,

research director at the BVCA, which

produced the report with PwC and

Capital Dynamics.

In the face of uncertainty of the

direction of the global economy,

prolonged Eurozone weakness and

financial market volatility, returns

this year remained positive, and over

the longer term continue to

outperform other asset classes.

Buyout firms beat

the slump to record

major gains for 2011

A BATTLE between two Israeli-

Russian billionaires over profits

from the Angolan diamond indus-

try kicked off yesterday in the High

Court, with witnesses including a

chief Rabbi and the former head of

Israeli intelligence agency Mossad.

Arkady Gaydamak is suing his ex-

business partner Lev Leviev in an

attempt to enforce an agreement

that he claims was signed in 2001,

detailing how profits from the

pairs mutual interests in Angola

should be split.

Cross examination of Gaydamak

began yesterday, with the Russian

businessman claiming in a written

statement that he was the victim

of a conspiracy between Mr Leviev,

[and his associates] General

Kopelipa and Mr Sumbala seeking

to deceive me into agreeing to settle

my well-founded claims against Mr

Leviev for nothing.

Gaydamak spoke to the court via

BY ELIZABETH FOURNIER

a video link from Israel.

He claims he is entitled to roughly

half Levievs diamond assets in

Angola as a result of an agreement

signed in December 2001, defining

the pairs business relationship and

distributing assets from their busi-

nesses.

But the only signed copy was

placed

wi t h

t h e

chief

Rabbi

o f

Russia

Rabbi Berel Lazar who says he has

since lost or destroyed the document.

Gaydamak says Leviev made partial

payments under the agreement until

2005, but that since then he has been

denied commission and dividends

worth as much as 3m per month.

Leviev, however, denies that the

agreement was ever signed, and is also

disputing its contents.

The so-called King of Diamonds,

who made his fortune battling De

Beers monopoly over the sale of rough

diamonds, also claims Gaydamak

signed away his rights to the assets in

2011, in a disputed settlement agree-

ment, without payment.

Gaydamak says he was induced to

sign the settlement by General Manuel

Helder Viera Dias an Angolan state

minister known as Kopelipa who is

also head of the countrys security

service. Leviev denies Kopelipa was act-

ing as his agent. The case continues.

Arkady Gaydamak (left) is suing Lev

Leviev in the High Court

BUILDING society Nationwide

recorded a 10 per cent rise in

profits to 304m during the year to

April 2012 as it ramped up

mortgage lending and retreated

from commercial real estate.

The mutual also said yesterday

that it is planning to diversify into

small business (SME) lending and

will over time develop and offer a

full range of services to SMEs.

Nationwide boosts mortgage

lending and expands into SMEs

BY JULIET SAMUEL Nationwide is keen to expand

into the space left by larger players

that are deleveraging. Its gross

mortgage lending grew by 44 per

cent to 18.4bn in part by buying

1.2bns worth of housing assets.

It wants to grow its retail

business in part to make up for

shrinking its portfolio of

commercial property assets, which

total 11.2bn. It also took a 103m

charge to compensate customers

for mis-sold insurance products.

THE SERIOUS Fraud Office has

begun the defence of its actions

following the controversial arrest

of property tycoons Vincent and

Robert Tchenguiz last year.

SFO counsel James Eadie told the

High Court that at the time of

Kaupthings collapse Robert and

companies connected to him owed

the bank around 1.6bn.

Robert Tchenguiz owned shares

Robert Tchenguiz and allies owed 1.6bn to

Kaupthing, fraud office tells the High Court

BY HARRY BANKS in Kaupthing as well as its largest

shareholder Exista, also the banks

second-largest debtor.

Icelands Special Investigation

Committee has already noted a big

increase in loan facilities to the

younger Tchenguiz between

January 2007 and October 2008.

According to the minutes of the

loan committee of Kaupthings

board, the bank lent money to

Tchenguiz in order for him to meet

margin calls from other banks.

Vincent Tchenguiz has already

pursued Kaupthing for damages

after the banks winding-up

committee refused to recognise his

trust as a priority creditor. He

reached a settlement last year.

The brothers this week began a

judicial review into their arrests.

Neither man was charged and they

continue to protest their

innocence. The SFO has admitted

errors and is reviewing Vincents

status as a suspect.

Nationwide chief executive Graham Beale is expanding the mutuals loan book.

THURSDAY 24 MAY 2012

8

NEWS

cityam.com

Russian billionaires in

High Court showdown

THE WORLD Bank yesterday cut its

growth forecasts for China this year

as it called on the country to rely on

easier fiscal policy to boost

consumption rather than state

investment.

The bank now expects the

countrys economy to expand 8.2 per

cent in 2012, down from an earlier

forecast of 8.4 per cent and down

sharply from the 9.2 per cent

expansion recorded for last year.

The slower rate of increase forecast

for Chinese growth, the worlds

second largest economy and heavily

exposed to the Eurozone through its

exports, is stark enough to drag

down the World Banks forecast for

all East Asia from 7.8 to 7.6 per cent.

Chinas near-term policy

challenge is to sustain growth

through a soft landing, it said.

With external demand likely to

remain weak for the foreseeable

future, East Asias continued high

growth rates will need to be linked

less to an export-oriented model.

It suggested measures to support

consumption such as tax cuts, while

steering clear of huge state

infrastructure spending, which the

Chinese government relied upon

during a similar downturn in 2008.

Elsewhere, recovery in Thailand

and Japan following last years

natural disasters is lifting growth.

World Bank

cuts its China

growth figures

BY MARION DAKERS

WHEN former New York prosecutor

Eliot Spitzer led his assault on Wall

Street investment banks in the wake

of the dot com crash, his brief was to

separate analysts from the bankers

selling a deal like Facebook.

Whereas pre crash, analysts used to

join a companys management dur-

ing a share sale roadshow and get

subsumed into the whole process,

these days those aligned with the

sponsoring banks are required to

keep their distance and are not even

allowed to publish research.

The rules brought in by Spitzer

were designed to prevent analysts

from bigging up clients shares to

investors mainly for the purpose of

helping their counterparts in the

corporate finance department to sell

the deal.

On the increasingly problematic

Spitzer reforms

fail to prevent

IPO squabbles

flotation of Facebook, it is the nega-

tive view of lead bank Morgan

Stanleys analyst in the wake of a reg-

ulatory filing from the company that

is causing some investors blood to

boil. The analysts negative views

were conveyed orally because they

arent able to be published these days

during the float process, yet this has

led to claims that some investors have

been favoured over others.

One lawsuit filed yesterday claims

that Morgan Stanley selectively dis-

closed to certain preferred investors

its view that Facebooks forecasts

were being revised downwards.

Morgan Stanley says the new infor-

mation was already in the market

but unless Facebook shares recover,

the bank will face a testing few days,

especially since it increased its price

range ahead of the float.

HAS FACEBOOKS FLOAT FLOP

SURPRISED YOU? Interviews by Anaam Raza

I was a little surprised and Id like to know the

reasoning behind it, but I dont think it deserved

it. If it had started off low and let the shares appreciate then it

could have prevented embarrassing headlines.

These views are those of the individuals above andnot necessarily those of their company

JONATHON DRYER

DEUTSCHE BANK

Not really. And in the current economic climate

theyre bound to come down even further. I

didnt buy the shares because there was no point in pay-

ing the difference in currency but now Im glad I didnt.

KETAN PATEL

HSBC

Not at all. Its social media how do you really

ascertain the value of this stuff? Facebooks

shares were denitely over hyped and over priced and I

think theyre going to come further down.

MUKESH HIRANI

BANK OF AMERICA

Write-off costs drag Pinewood

down despite revenue growth

PINEWOOD Shepperton made a loss

last year as the film studio took a hit

from the failure of its movie set

development project.

Project Pinewood a plan to build

replicas of landmarks including

famous cities, a castle and a college

campus was blocked in January,

costing the company 7.6m in write-

off costs.

Expenses relating to the Peel

Group offer, in which the property

BY LAUREN DAVIDSON

investment company gained 73 per

cent of Pinewoods shares after

attempting a hostile takeover, set the

studio back 3.3m.

Pinewood Shepperton posted a

2.9m loss for the 15 months to 31

March, compared to a profit of

5.8m for calendar 2010.

But one-off costs aside, business

was booming at the film production

group, with revenues up

substantially to 62.9m. Film

revenues grew to 44.9m, boosted by

the filming of blockbusters Dark

Shadows, starring Jonny Depp and

Helena Bonham Carter, at Pinewood

Studios and Wrath of the Titans at

Shepperton Studios.

The group said it was in good

shape looking ahead, with the new

James Bond film Skyfall still in

production at Pinewood and a

continuing rising demand for the

studios facilities.

Pinewoods mega portfolio

includes most James Bond films as

well as the Harry Potter series.

Its shares rose 9.2 per cent to 332p.

CITYVIEWS

Eliot Spitzer changed the way that US IPOs could be marketed by investment banks

Morgan Stanley pays price for having

independent analyst, writes David Hellier

THURSDAY 24 MAY 2012

9

NEWS

cityam.com

Float away

Stretch out in KLM Business Class from London

Lima

from

1,743

Bangkok

from

1,913

New York

from

2,215

Return fares, including taxes

Fares quoted are for return business class ights from London Heathrow via Amsterdam, including taxes and charges, and are subject to change. Fares are

also subject to availability and exchange rate variation. Please check for exact fare at klm.com at time of booking. Book by 12/06/12 (except New York

nonstop ights operated by Delta, book by 29/05/12). Travel periods vary. Credit card surcharge will apply. Specic booking conditions and the General

Conditions of Transportation of KLM and AIR FRANCE apply. Prices correct at 10/05/12.

JP MORGAN Chase & Co has been

hit with a lawsuit brought on

behalf of employees whose

retirement holdings fell in value

after the largest US bank revealed a

surprise $2bn (1.3bn) trading loss

earlier this month.

The complaint, filed in the US

District Court in Manhattan, also

names individual defendants,

including chief executive Jamie

Dimon and Ina Drew, who stepped

down last week as head of

JPMorgans chief investment office,

where the loss occurred.

JPMorgan sued over employee

retirement plan losses in the US

BY CITY A.M. REPORTER

The defendants were accused of

violating their duties to 401(k) and

other retirement plan participants

by including company stock as an

investment option, hiding the

stocks risk, and failing to move

participants to safer choices.

The plans suffered hundreds of

millions of dollars of losses, the

complaint said. If defendants had

discharged their fiduciary duties to

prudently manage and invest the

plans assets, the losses suffered by

the plans would have been

minimized or avoided.

JPMorgan did not immediately

respond to requests for comment.

IN BRIEF

Tetley tea owner sees income fall

nTata Global Beverages suffered a 36

per cent drop in net income in the

latest quarter, as the owner of Tetley

tea was hit by one-off costs, it

announced yesterday. Sales rose 11 per

cent to 17.24bn rupees (198m) but

restructuring expenses knocked net

income for the three months to March

down to 542.1m rupees. The firm,

which has a tie-up with Starbucks, is

on track to open its first Indian stores

this year.

Hogg Robinson upbeat for 2012

nHogg Robinson, the corporate travel

services group, yesterday reported a 18

per cent rise in annual pre-tax profit to

34.1m while revenues grew from

358m to 374.2m. Chief executive

David Radcliffe said the difficult

macroeconomic outlook will keep

trading conditions challenging but said

Hogg Robinsons strong pipeline of

new business opportunities will allow

the company to make good progress

in the year ahead.

Dell shares hit by weak outlook

nShares of Dell plunged 17 per cent

yesterday after a disappointing revenue

forecast spurred fears that global tech

spending is weakening faster than

anticipated and raised doubts about

the PC makers strategy. The stock

plunge erased more than $4bn from

the companys market cap. Dell shares

closed 17.2 per cent lower at $12.49 on

the Nasdaq. Earlier in the day, it fore-

cast revenue of $14.7bn to $15bn in the

current quarter, well short of analysts

average forecast of $15.4bn.

G

E

T

T

Y

G

E

T

T

Y

House of Fraser earnings drop

as it invests in new warehouse

HOUSE of Fraser saw adjusted

earnings before interest, tax,

depreciation and amortisation drop

16 per cent to 58.6m in the year to

28 January as it invested in a second

distribution centre.

The department store, which

runs 63 sites across the UK and

Ireland, said it built a new

warehouse in Northamptonshire,

BY KASMIRA JEFFORD

last summer, to help support its

online business, after relaunching

and redesigning its website.

Don McCarthy, chairman of

House of Fraser said: Considering

the market conditions, uncertainty

in the economy and the

unseasonably warm autumn we

believe our results are in line with

fashion retailers in our sector. 2011

was another year of investment for

us, as we continued to focus on the

fastest growing areas of our

business.

Despite the fall in earnings, gross

profits were up 3.8m to 399.1m

and like-for-like sales over the year

nudged up three per cent. Own

brand sales also jumped 17 per cent

helped by the launch of Mary by

Mary Portas in womenswear and

Howick Tailored in menswear.

In the first 13 weeks of the year,

like-for-like sales rose by 2.6 per cent.

THURSDAY 24 MAY 2012

cityam.com

10

NEWS

BURBERRY yesterday said it had seen

an outperformance in mens clothing

and tailoring as the luxury brand

reported a 26 per cent jump in full-

year profits.

The 156-year old British heritage

brand reported an underlying pre-tax

profit of 376m in the year to 31

March, on revenues up 24 per cent to

almost 1.9bn.

Chief executive Angela Ahrendts

said the success of its new London tai-

loring initiative helped drive

menswear sales up by 26 per cent in

the period, while sales of non-cloth-

ing products such as leather goods

saw a 50 per cent increase in sales.

Ahrendts said Burberry would be

opening its first menswear-only store

in Knightsbridge in the fall, as it looks

to benefit from a growing trend of

men dressing smartly.

The launch is part of a wider expan-

sion plan to increase store space by 12-

14 per cent in the year, opening a net

15 new outlets in both flagship and

emerging markets.

Burberry said it will spend around

Male shoppers

help Burberry

beat recession

BY KASMIRA JEFFORD

180-200m, with about one third of it

going towards larger format stores

such as its new Regent Street store

opening in the autumn.

Sixty to seventy per cent of all the

luxury goods sold around the world

take place in just 25 cities. Burberry

has been underpenetrated in these

flagship markets versus our peers,

Ahrendts said.

Burberry said wealthy shoppers from

Asia, the Middle East and emerging

markets remained sheltered from the

global economic downturn.

Its shares closed 1.2 per cent lower

yesterday at 1,369p hit by profit taking.

Burberry Group PLC

23May 17May 18May 21 May 22May

1,350

1,375

1,300

1,325

1,400

1,425

1,450

1,475 p

1,369.00

23May

A 24 per cent rise in pre-tax prots dees some of the economic gloom,

whilst the companys exposure to some strong local markets continues to propel

prospects...Whether this momentum can be maintained is of some concern

to investors, while the situation in Europe is undoubtedly a drag on growth.

ANALYST VIEWS

Burberry has excellent strategic growth opportunities in a luxury mar-

ket with strong long term growth credentials. There are signicant geographical

and product mix opportunities plus operational leverage still to come

from infrastructure investment over recent years.

Burberry reported another strong set of results, in line with expectations.

The very creditable outcome reected continued buoyancy in the global luxury

market, the addition of new space, extension of the Burberry franchise into

new product areas and further improvements in operational efciency.

HOW ARE BURBERRYS

PROSPECTS FOLLOWING

THESE RESULTS? Interviews by Kasmira Jefford

RICHARD HUNTER HARGREAVES LANSDOWNE

FREDDIE GEORGE SEYMOUR PIERCE

SAM HART CHARLES STANLEY

Own brand sales jumped 17 per cent helped by the launch of Mary Portas in womenswear

Angela Ahrendts has defied the downbeat economy to deliver booming sales

A

L

A

M

Y

ONLINE supermarket Ocado yester-

day announced an acceleration in

sales growth for the second quarter,

raising hopes that the firm has over-

come last years distribution prob-

lems that damaged consumer

confidence.

Shares in the company, whose

range includes products supplied by

upmarket grocer Waitrose, rose 6.8

per cent after it said sales in the quar-

ter to 13 May were likely to be 13 per

cent higher than the same period

last year.

This compares with 10.9 per cent

growth in the first quarter.

Operational performance at our

Hatfield customer fulfilment centre

continues to improve and is now

operating at record levels of capaci-

ty, the firm said in a statement.

A number of new enhancements

have gone live which will enable us

to continue to expand our capacity,

significantly extend our range, and

improve our operational efficiency.

Ocado also confirmed its second

fulfilment centre in Warwickshire is

Ocado points to

fresh growth as

revenues surge

BY JAMES WATERSON

on track to open in early 2013.

But Philip Gordon, an analyst at

Panmure Gordon, retains doubts

about the long-term viability of

Ocado in the face of strong chal-

lenges from rivals who include

Ocados key supplier Waitrose.

Ocado is still losing market share

online. With the competitive environ-

ment likely to get tougher, we think

that it will struggle to demonstrate

operational leverage...its competitors

have sharpened up their act, he said.

Ocado has yet to turn a year-end pre-

tax profit since it was founded in

2001 and its shares have slumped

from a 2010 IPO price of 180p.

Ocado Group PLC

23May 17May 18May 21 May 22May

117.50

115.00

112.50

110.00

107.50

105.00

102.50

100.00

p

107.80

23May

TRANSPORT operator FirstGroup

said yesterday that full-year profit

more than doubled a lift fuelled

by strong performances from its

UK rail and US coach businesses.

The bus and rail company

reported a pre-tax profit of

279.9m for the year to the end of

March, up from 126.5m last year.

It said revenues increased 4.1

per cent to 6.68bn but that the

outlook was uncertain.

The company said it expected

2012/13 margins at its British bus

unit to be hit by the tough

economic climate, especially in

FirstGroup profit doubles but

UK bus arm faces tough road

BY JOHN DUNNE the North of England and

Scotland, rising fuel costs and

reduced funding to the industry.

Chief executive Tim OToole said

the bus unit was in for a shake-up

with some parts of the business to

be offloaded.

He added: We are accelerating

a comprehensive plan that will

deliver sustainable growth in

revenue and patronage and

improved returns.

This includes repositioning our

UK Bus portfolio through a

programme of business and asset

disposals. The company hiked the

full-year dividend by seven per

cent to 23.67p.

THURSDAY 24 MAY 2012

11

NEWS

cityam.com

FirstGroup plans a shake-up of its UK bus business by offloading parts of the division

STANSTED Airport operated as

normal yesterday in spite of

industrial action by baggage

handlers.

Members of the Unite and GMB

unions working for contractor

Swissport staged the first of three

planned walkouts yesterday as part

of a dispute over work rotas.

Unite claims that Swissports

measures would mean ramp staff

work 14 extra days a year with no

additional pay.

Further strikes are planned for

over 26-28 May, and 2-6 June,

meaning disruption is possible over

the diamond jubilee bank holidays.

But Swissport said that

contingency plans meant passengers

did not experience delays yesterday.

The company handles cargo and

baggage for a number of airlines at

Stansted including Ryanair, Monarch

and Thomson.

Paul Bouch, Unite regional officer,

said: Swissport has forced our

members backs to the wall. After

eight weeks of talks the company is

still determined to press ahead with

its unreasonable roster and holiday

allocation changes.

The revised roster would avoid

the necessity of imposing

compulsory redundancies,

Swissports spokesman said.

Talks between the unions and

Swissport broke down last week.

No delays at

Stansted as

strikes begin

BY MARION DAKERS

Glaxo warns it will drop $2.6bn

bid unless poison pill removed

GLAXOSMITHKLINE (GSK) said

yesterday it would not proceed with

its $2.6bn (1.7bn) offer for Human

Genome Sciences unless the US

biotechnology company dropped a

poison pill shareholder rights plan

imposed to block the deal.

Human Genome adopted the

stockholder rights plan earlier this

month in an attempt to ward off

BY CITY A.M. REPORTER

GSK in what is becoming an

increasingly acrimonious battle

between the companies that

together sell new Lupus drug

Benlysta. The British company is

taking its $13-a-share offer direct to

investors after Human Genomes

board said it was inadequate.

The plan allows shareholders to

buy additional shares at a discount if

one investor buys or launches a

tender offer for more than 15 per

cent of the groups stock without the

boards approval, effectively blocking

an unwanted bidder.

Because Human Genome has

adopted a poison pill, GSK has added

a condition to its offer requiring

Human Genome to redeem the pill

or, alternatively, GSK being satisfied

in its reasonable judgment that the

pill has been invalidated or is

otherwise inapplicable to GSKs

acquisition, GSK said yesterday.

Serco in talks with Amec over

sale of nuclear advice business

OUTSOURCER Serco said yesterday

that it was in talks with Amec over

the sale of its technical consulting

business (TCS).

Sercos TCS provides provides

safety advice to the nuclear

industry.

Amec, an engineering

consultancy to the energy sector,

has yet to make any formal offer

the two companies said.

Serco bought TCS for 75m in

2001. It has revenues of 70m per

year.

Amec said last month it is

expecting double digit revenue

growth in 2012 and has a strong

order book.

Analysts had expected the

company to start making

acquisitions.

A statement from FTSE 100-

listed Serco said: There is no

certainty that a transaction will

proceed. A further announcement

will be made in due course.

BY JOHN DUNNE

Credit subject to acceptance. Credit is provided by external nance companies as determined by DFS. 4 years interest free credit from date of order. Delivery charges apply. After event prices apply from 28.05.12 - see instore or online for details. Accent cushions not included

unless otherwise stated. Mobile charges may apply when calling 0800 110 5000. DFS is a division of DFS Trading Ltd. Registered in England and Wales No 01735950. Redhouse Interchange, Doncaster, DN6 7NA.

Visit your nearest store, order direct at www.dfs.co.uk or call free on 0800 110 5000 24 hours a day, 7 days a week

4 years interest free credit on everything

Or pay nothing until January 2013 then take 3 years

interest free credit

0

%

REPRESENTATIVE

APR

No deposit with 4 years interest free credit. 48 equal monthly payments of 12.06. Or pay nothing until January 2013 then 36 equal monthly payments of 16.08. 0% APR. Total 579.

50%

OFF

NUVO COLLECTION

SOFAS

ABODE

3 SEATER

HALF PRICE

579

AFTER EVENT PRICE

1158

12.06

A MONTH

NO DEPOSIT

NO INTEREST

EVER

half price

ends Sunday

N

e

w

T

o

t

t

e

n

h

a

m

C

o

u

r

t

R

o

a

d

s

t

o

r

e

o

p

e

n

s

S

A

T

U

R

D

A

Y

9

A

M

G

E

T

T

Y

University. His lecturers remember a

bright student who had little interest

in computers; he took a first with

some ease. After college, Ive joined

London design agency Tangerine as a

consultant for bathroom fittings

maker Ideal Standard. It was in 1992,

when Apple hired Tangerine, that Ive

began dealing with the firm, then

struggling in the face of Microsofts

domination of the PCs. Fed up design-

ing taps, he soon moved to San

Francisco and joined the Apple staff.

When Jobs returned to Apple five

years later, he soon spotted Ive, and

promoted him to chief designer. The

pair enjoyed a warm and relatively

calm relationship, a rarity with the

famously irascible Jobs, although

regulator said it would now not

propose any remedial action. It

will review responses to its

revised finding before reaching

its final verdict.

The provisional finding was a

reprieve for BSkyB which has

clashed repeatedly with

regulators in recent years over

its dominance of pay-TV, putting

at risk its ability to lure

customers with the offer of

exclusive movie and sports

content.

The Competition Commission

had previously found that Sky's

subscriber base of more than

10m homes gave it an advantage

over rivals who struggled to bid

for the rights to first-run

Hollywood movies.

While the commission noted

yesterday that BSkyB still held

the rights to the movies of all six

major Hollywood studios for the

first subscription pay-TV

window, it said Netflix and the

Amazon-owned Lovefilm had

already acquired rights to

several other studios.

Virgin Media said it strongly

disagrees with the commission

and that Skys dominance had

led to higher prices and less

innovation.

A BT spokesman said: We

cannot see how this is in the best

interests of consumers.

DAVID CROW

British Sky Broadcasting Group PLC

23May 17May 18May 21 May 22May

680

685

690

695

700

705 p

693.00

23May

THURSDAY 24 MAY 2012

13

NEWS

cityam.com

NEW8 FROM THE

CTY OF LONDON

ADVERT8EMENT

The mosl famous bridge in lhe vorld vill hosl a 'sun-dovner' on

Friday 22 }une al 6.30m, as arl of Cc|c|ratc tnc Citq. jcur !aqs in

tnc Squarc Mi|c (21 24 }une). Admission is FRII and lhere is a

chamagne cash bar, so you and your friends can en|oy a glass or

lvo of bubbly vilh olher guesls as lhe sun casls a golden glov

over lhe cailal. Al 9:30m, lhe ridge vill lake cenlre slage as il

shovcases ils nev lighling dislay.

Cc|c|ratc tnc Citq. jcur !aqs in tnc Squarc Mi|c is an exciling and

varied rogramme of a mullilude of moslly free evenls in lhe

hearl of London's hnancial cenlre. There is somelhing for

everyone arl, music, lhealre, crafls, archileclure, hislory and

lileralure and YOU are inviled! Come and

en|oy lhe freedom of lhe Cily of London -

and discover ils secrels and lreasures over

lhe course of four very secial days in }une.

Go lo www.visiuhccity.cn.uk/cu!turc2012

and follov us al mcc!cbratcatcity and

www.Iaccbnnk.cnm/cc!cbratcthccity

News, info and offers at www.cityofIondon.gov.uk/eshot

Champagnc and City vicws at Tnwcr Bridgc

A

SK most Britons to name a

famous designer, and they will

probably offer Sir James Dyson

or Terence Conran. Although

both are distinguished, neither can

lay claim to something as

generation-defining as the iPhone. It

was designed by Essex boy Jonathan

Ive, who was yesterday knighted for

services to design. Its strange, then,

that Ive or Jony to his friends

isnt better known, but it is a state of

affairs that perfectly suits the

publicity-shy 45 year-old.

When his late boss Steve Jobs was

still alive, Ive was always in his shad-

ow. Jobs cult status meant that other

Apple executives took a back seat. Yet

Ive is almost as important as Jobs was

to the companys success. He has

designed every Apple product since

the firms renaissance, from the orig-

inal Bondi-Blue iMac and white iPod

to the iPhone and iPad.

Born in Chingford in 1967 and

brought up by his teacher father, Ive

was educated at the local compre-

hensive before studying at Newcastle

Polytechnic, now Northumbria

Jobs tendency to take credit for

Apples designs could sometimes

wound Ive. Those who know Ive say

his capacity for hard graft is the key

to his success. Often working 70-hour

weeks, he involves himself in every-

thing from initial design to manufac-

turing, regularly travelling to China

to oversee work in Apples factories;

when working on a new product, he

has little time for anything else.

During Ives first five years at Apple,

his talent went unspotted. At the

time, the firm was rudderless,

obsessed with market research, con-

stantly trying to conform to industry

stereotypes in order to take on

Microsoft instead of finding a niche

of its own. Legend has it that Ive had

already designed the Bondi-Blue iMac

long before Jobs returned, but the

then Apple management thought it

too avant-garde.

Apple has barely put a step wrong

since Jobs died, and much of that is

down to his hard-headed replacement,

former chief operating officer Tim

Cook. But it is in Ive make that Sir

Jony that the soul of Jobs lives on.

Essex boy who became

designer to a generation

Apple designer Jonathan Ive was knighted for services to design yesterday

New movie streaming services let Sky of the hook

SKY

Subscribers: 10m to general pay-TV packages

Price: 20 for basic TV package, plus individual rental prices

Exclusive contracts with: all big six Hollywood studios;

MGMs entire Bond back catalogue from October 2012

AMAZONS LOVEFILM

Subscribers: 2m as of January 2012

Price: from 4.99/month for online streaming

Exclusive contracts with: Exclusive contracts with:

Sony, Warner Bros, STUDIOCANAL, ITV, ABC, and BBC

NETFLIX

Subscribers: International streaming members totalled

3m in March 2012 does not provide a UK breakdown

Price: Unlimited streaming from 5.99/month

Exclusive contracts with: DreamWorks Animation (from

2013); Lionsgate UK; MGM; Momentum

Sky Movies is cleared in probe

thanks to Lovefilm and Netflix

SATELLITE broadcaster BSkyB no

longer dominates the pay-TV

movie market following the

arrival of new entrants Lovefilm

and Netflix, the competition

watchdog said yesterday in a

reversal of its initial findings.

But the decision drew angry

responses from Skys main rivals

BT and Virgin, who said its Sky

Movies channel reduces

competition.

Laura Carstensen, chairman

of the Competition Commission

investigation, said: Lovefilm

and Netflix offer services which

are attractive to many

consumers and they appear

sufficiently well resourced to be

in a position to improve the

range and quality of their

content further.

Given the findings, the

BY HARRY BANKS

I

f you werent at the Le Meridien

Hotel last night, theres a good

chance youre behind on the latest

City gossip.

The Piccadilly hotspot played host to

the third annual M&A Network din-

ner, chaired by former Sunday Times

business editor and FTI Consulting

guru John Waples. Proceeds went to

the charity Norwood.

The panel included Mark Florman,

chief executive of BVCA; Richard

Clarke, KPMGs UK head of corporate

finance; Michael Kalb, senior manag-

ing director at private equity firm Sun

European Partners; and Claude

Littner, chairman of Viglen and regu-

lar interviewer on The Apprentice.

The well-informed group debated

the reputation of private equity and

the state of the M&A market whats

hot and whats not.

Norwood, a favourite of celebs such

as Simon Cowell and Richard

Desmond, offers community support

to people with learning disabilities

and children and families in need.

Not too different, Norwood M&A

Network member Marc Cohen tells The

Capitalist, from the M&A world.

Everyone knows everyone it has its

own special community bond.

The new notes will be donated to charity and sold to the public as part of the Royal Bank of Scotlands jubilee celebrations

There was a sea

of blue over the

weekend after

Chelsea won the

European Champions

League. But yesterday

there was a splash of

red as Spanish

models converged on

the City to advertise

BetVictors money

back deal on a

Spanish victory in the

upcoming European

football finals.

Got A Story? Email

thecapitalist@cityam.com

14

cityam.com

cityam.com/the-capitalist

THECAPITALIST

Patriotic celebration, or

quantitative easing by the back

door? The Royal Bank of Scotland has

unveiled its contribution to the

Diamond Jubilee festivities in the form

of a commemorative 10 note.

The bailed-out bank yesterday showed

its appreciation for its de facto owner

with 2m worth of royal purple and

green tenners.

RBS needed to replace some of its

ageing notes anyway, so sadly the issue

wont do much to pour cash into the