Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Form 16

Caricato da

jwadje1Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Form 16

Caricato da

jwadje1Copyright:

Formati disponibili

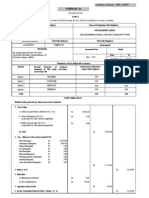

[See rule 31(1)(a)] Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source

from income chargeable under the head "Salaries". Name and Address of the Employer Name and Designation of the Employee

FORM NO. 16

PAN No. of the Deductor

TAN No. of the Deductor

PAN No. of the Employee PERIOD Assessment Year

Acknowledgement Nos. of all quarterly statements of TDS under sub-section (3) of section 200 as provided by TIN Facilitation Center or NSDL web-site Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Acknowledgement No. From

To

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1. Gross Salary (a) Salary as per provisions contained in section 17(1) (b) Value of perquisites under section 17(2) (as per Form No. 12BA, wherever applicable) (c) (d) Profits in lieu of salary under section 17(3) (as per Form No. 12BA, wherever applicable) Total Rs. Rs. Rs. 3. Balance (1-2) 4. Deductions : (a) Entertainment allowance (b) Tax on Employment Rs. Rs. Rs. Rs. Rs. Rs. Rs. 8. Gross total income (6 +7) 9. Deductions Under Chapter VI-A (A) sections 80C,80CCC and 80CCD

Gross Amount Qualifying Amount Deductible Amount

Rs. Rs. Rs. Rs.

2. Less : Allowance to the extent exempt under section 10

Rs. Rs.

5. Aggregate of 4(a) and (b) 6. Income chargeable under the Head ' Salaries' (3-5) 7. Add : Any other income reported by employee

Rs. Rs.

(a) section 80C (i) (ii) (iii) (iv)

Rs. Rs. Rs. Rs.

Rs. Rs. Rs. Rs.

Rs. Rs. Rs. Rs.

(v) (vi) (b) section 80CCC (c) section 80CCD

Rs. Rs.

Rs. Rs. Rs. Rs. Gross Amount

Rs. Rs. Rs. Rs. Rs. Rs.

(B) Other sections (e.g. 80E,80G,ect.) Under Chapter VI-A

Qualifying Amount Deductible Amount Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs.

(a) (b) (c) (d) (e)

section section section section section

Rs. Rs. Rs. Rs. Rs.

Rs.

10. Aggregate of deductible amount under Chpater VI-A 11. Total income (8-10) 12. Tax on total income 13. Surcharge(on tax computed at S.No.12)

Rs. Rs. Rs.

Rs. Rs. Rs.

Rs. Rs. Rs. Rs. Rs.

14. Education Cess @ 2% on (tax at S.No.12 Rs. plus surcharge at S.No.13) Rs. 15. Tax payable (12+13+14) 16. Relief Under Section 89 (attach details) 17. Tax payable (15-16) 18. Less : (a) Tax deducted at source u/s 192(1) (b) Tax Paid by the employer on behalf of the employee 19. Tax payable/refundable (17-18)

AMOUNT DATE OF PAYMENT Rs. Rs. Rs. Rs.

Rs. Rs. Rs.

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO GOVERNMENT ACCOUNT

NAME OF BANK AND BRANCH WHERE TAX DEPOSITED

I working in the capacity of

son of (designation) do hereby certify that a sum of Rs.

[Rupees (in words) has been deducted at source and paid to the credit of the Central Government. I further certify that the information given above is true and correct based on book of accounts, documents and other available records. Place Date Signature of the person responsible for deduction of tax Full Name Designation

Potrebbero piacerti anche

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- Form 16Documento2 pagineForm 16Hari Krishnan ElangovanNessuna valutazione finora

- Form 16Documento6 pagineForm 16Ravi DesaiNessuna valutazione finora

- Form No 16 in Excel With FormuleDocumento3 pagineForm No 16 in Excel With FormuleSayal Ji33% (6)

- Form No 16Documento5 pagineForm No 16Rabiul KhanNessuna valutazione finora

- Form 16Documento3 pagineForm 16api-247505461Nessuna valutazione finora

- Form 16Documento6 pagineForm 16Pulkit Gupta100% (1)

- Form 16Documento2 pagineForm 16orkid2100Nessuna valutazione finora

- Form No. 16: Finotax 1 of 3Documento3 pagineForm No. 16: Finotax 1 of 3dugdugdugdugiNessuna valutazione finora

- 1 Form 16 16a LatestDocumento25 pagine1 Form 16 16a LatestNishant GhaseNessuna valutazione finora

- New Form 16 AY 11 12Documento4 pagineNew Form 16 AY 11 12Sushma Kaza DuggarajuNessuna valutazione finora

- Form No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocumento2 pagineForm No. 16: Details of Salary Paid and Any Other Income and Tax DeductedSundaresan ChockalingamNessuna valutazione finora

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocumento6 pagineIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNessuna valutazione finora

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocumento4 pagineForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNessuna valutazione finora

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Documento3 pagineLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Nessuna valutazione finora

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocumento2 pagineForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNessuna valutazione finora

- Form 16Documento4 pagineForm 16Aruna Kadge JhaNessuna valutazione finora

- Cit (TDS) : Emp CodeDocumento3 pagineCit (TDS) : Emp CodeMahaveer DhelariyaNessuna valutazione finora

- Summary of Tax Deducted at Source: TotalDocumento2 pagineSummary of Tax Deducted at Source: Totaladithya604Nessuna valutazione finora

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Documento4 paginePrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNessuna valutazione finora

- A SimDocumento4 pagineA Simsana_rautNessuna valutazione finora

- Form 16 Excel FormatDocumento12 pagineForm 16 Excel Formatankeet3Nessuna valutazione finora

- Form 16 For The AY 2017-18Documento4 pagineForm 16 For The AY 2017-18Suman HalderNessuna valutazione finora

- Form 16Documento3 pagineForm 16Bijay TiwariNessuna valutazione finora

- Form No 16Documento4 pagineForm No 16Md ZhidNessuna valutazione finora

- Form No 16 - Ay0607Documento4 pagineForm No 16 - Ay0607api-3705645100% (1)

- Form 16 FormatDocumento2 pagineForm 16 FormatParthVanjaraNessuna valutazione finora

- Form 16 651746Documento4 pagineForm 16 651746Arslan1112Nessuna valutazione finora

- 6-3-569/1, Surana House Somajiguda, Hyderabad-83Documento2 pagine6-3-569/1, Surana House Somajiguda, Hyderabad-83seshu18098951Nessuna valutazione finora

- Form 16Documento3 pagineForm 16tid_scribdNessuna valutazione finora

- Form 16Documento1 paginaForm 16Manish Varghese MathewNessuna valutazione finora

- Form 16 Part A: WWW - Taxguru.inDocumento10 pagineForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNessuna valutazione finora

- Income Tax FormatDocumento2 pagineIncome Tax FormatmanmohanibcsNessuna valutazione finora

- Form No. 16: (See Rule 31 (1) (A) )Documento5 pagineForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNessuna valutazione finora

- Form 16 in Excel Format For AY 2020 21Documento8 pagineForm 16 in Excel Format For AY 2020 21Vikas PattnaikNessuna valutazione finora

- Tds 16 NDocumento3 pagineTds 16 Nssanju_bhatNessuna valutazione finora

- Itr 62 Form 16Documento4 pagineItr 62 Form 16Hardik ShahNessuna valutazione finora

- Form16.pdf HIRA PDFDocumento2 pagineForm16.pdf HIRA PDFSuchitra BakulyNessuna valutazione finora

- Form No 16Documento2 pagineForm No 16Anonymous 7KR8DpqNessuna valutazione finora

- Form 16aaDocumento2 pagineForm 16aaJayNessuna valutazione finora

- R.V. Nerurkar High School - Form 16 1Documento180 pagineR.V. Nerurkar High School - Form 16 1rvnjcNessuna valutazione finora

- Thirumoorthy Form16Documento4 pagineThirumoorthy Form16sundar1111Nessuna valutazione finora

- Form 16 Word FormatDocumento4 pagineForm 16 Word FormatVenkee SaiNessuna valutazione finora

- (See Rule 31 (1) (A) ) : Form No. 16Documento8 pagine(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNessuna valutazione finora

- 103497Documento5 pagine103497Ashok PuttaparthyNessuna valutazione finora

- Form2FandInstructions 06062006Documento11 pagineForm2FandInstructions 06062006Mnaoj PatelNessuna valutazione finora

- Ganaesmurthy Form16Documento4 pagineGanaesmurthy Form16sundar1111Nessuna valutazione finora

- Form16 Applicable From 01.04Documento3 pagineForm16 Applicable From 01.04Vishaal TalwarNessuna valutazione finora

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesDa EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNessuna valutazione finora

- Problems and Possibilities of the Us EconomyDa EverandProblems and Possibilities of the Us EconomyNessuna valutazione finora

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24Da EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24Nessuna valutazione finora

- Federal Income Tax: a QuickStudy Digital Law ReferenceDa EverandFederal Income Tax: a QuickStudy Digital Law ReferenceNessuna valutazione finora

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryDa EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryDa EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Standard Notes To Form No. 3CD (Revised 2019) CleanDocumento8 pagineStandard Notes To Form No. 3CD (Revised 2019) CleanRahul LaddhaNessuna valutazione finora

- 3874105301112018Documento2 pagine3874105301112018Aryan SharmaNessuna valutazione finora

- Illustration - 2022-11-03T115112.732Documento3 pagineIllustration - 2022-11-03T115112.732BLOODY ASHHERNessuna valutazione finora

- Invoice Ofice BagDocumento1 paginaInvoice Ofice BagRanvijay Azad50% (6)

- DineroDocumento4 pagineDineroValeria Amaya Burgos0% (1)

- Welcome To Ten Dollar ClickDocumento2 pagineWelcome To Ten Dollar Clicktonio1015494167% (3)

- Account Summary Payment Information: New Balance: $261.55Documento6 pagineAccount Summary Payment Information: New Balance: $261.55AriadnaUrsachi100% (2)

- Boat Airdopes 141 PDFDocumento1 paginaBoat Airdopes 141 PDFSantosh SharmaNessuna valutazione finora

- Batangas State University: Taxation and Land ReformDocumento4 pagineBatangas State University: Taxation and Land ReformMeynard MagsinoNessuna valutazione finora

- RMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFDocumento12 pagineRMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFCkey ArNessuna valutazione finora

- 3333Documento3 pagine3333ßhăñĕ ßîñğhNessuna valutazione finora

- Ticket 2021 Mathematics Challenge For Young Australians (MCYA)Documento3 pagineTicket 2021 Mathematics Challenge For Young Australians (MCYA)Michael ChenNessuna valutazione finora

- TataSky Broadband-07 Oct 2023Documento6 pagineTataSky Broadband-07 Oct 2023mayank jainNessuna valutazione finora

- Accounting Past Paper 2Documento2 pagineAccounting Past Paper 2Noshair AliNessuna valutazione finora

- Chapter 4 - Reveneus and Other ReceiptsDocumento18 pagineChapter 4 - Reveneus and Other Receiptsweddiemae villariza100% (8)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocumento1 paginaIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruProfit MartNessuna valutazione finora

- Account StatementDocumento10 pagineAccount StatementVinod KumarNessuna valutazione finora

- Develop Understanding of TaxationDocumento14 pagineDevelop Understanding of Taxationnatanme794Nessuna valutazione finora

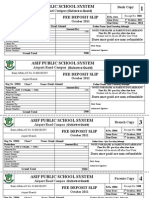

- Asif Public School System: Fee Deposit SlipDocumento1 paginaAsif Public School System: Fee Deposit SlipIrfan YousafNessuna valutazione finora

- Investor Agreement PDFDocumento2 pagineInvestor Agreement PDFRam Kumar BasakNessuna valutazione finora

- 2016 Bar Questions On Taxation Gen Pri and IncomeDocumento4 pagine2016 Bar Questions On Taxation Gen Pri and IncomeSheena PalmaresNessuna valutazione finora

- Income Tax Calculator Fy 2020 21 v2Documento12 pagineIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1Nessuna valutazione finora

- Coinify Inwallet Buy - SellDocumento2 pagineCoinify Inwallet Buy - SellmehocayNessuna valutazione finora

- SODA Report For R70Documento378 pagineSODA Report For R70Reji ThomasNessuna valutazione finora

- 596 Idbi StatementDocumento11 pagine596 Idbi Statementsri harshaNessuna valutazione finora

- Pin 10594Documento1 paginaPin 10594r_targettNessuna valutazione finora

- Your BillDocumento4 pagineYour BillPruthviraj JuniNessuna valutazione finora

- Bir Form No. 2304Documento2 pagineBir Form No. 2304mijareschabelita2Nessuna valutazione finora

- CIR V CTA Smith Kilne & Fresh OverseasDocumento2 pagineCIR V CTA Smith Kilne & Fresh OverseasGRNessuna valutazione finora

- A. Adjusting Entries Description Debit CreditDocumento4 pagineA. Adjusting Entries Description Debit CreditRocel Avery SacroNessuna valutazione finora