Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Introduction

Caricato da

Sanith S NairDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Introduction

Caricato da

Sanith S NairCopyright:

Formati disponibili

INTRODUCTION

ITC made its entry into the branded & packaged Foods business in August 2001 with the launch of the Kitchens of India brand. A more broad-based entry has been made since June 2002 with brand launches in the Confectionery, Staples and Snack Foods segments. For ITC, the packaged foods is an ideal business to utilize ITC's proven strengths in the areas of hospitality, branded cuisine, contemporary packaging and sourcing of agricultural commodities. ITC's world famous restaurants like the Bukhara and the Dum Pukht, nurtured by the Company's Hotels business, demonstrate that ITC has a deep understanding of the Indian taste and the expertise required to translate this knowledge into delightful dining experiences for the consumers. ITC has stood for quality products for over 98 years to the Indian consumer and several of its brands are today internationally benchmarked for quality. All products of ITC's Foods business available in the market today have been crafted based on consumer insights developed through extensive market research. Apart from the current portfolio of products, several new and innovative products are under development in ITC's state-of-the-art Product Development facility located at Bengaluru. ITC has over the last 98 years established a very close business relationship with the farming community in India and is currently in the process of enhancing the Indian farmer's ability to link to global markets, through the e-Choupal initiative, and produce the quality demanded by its customers. This long-standing relationship is being utilized in sourcing best quality agricultural produce for ITC's Foods business. The Foods business is today represented in 4 categories in the market. These are: 1. 2. 3. 4. Ready To Eat Foods Staples Confectionery Snack Foods

In order to assure consumers of the highest standards of food safety and hygiene, ITC is engaged in assisting outsourced manufacturers in implementing world-class hygiene standards through HACCP certification. The unwavering commitment to internationally benchmarked quality standards enabled ITC to rapidly gain market standing in all its 6 brands: 1. 2. 3. 4. Kitchens of India Aashirvaad Sunfeast mint-o

5. Candyman 6. Bingo!

Recently, on Aug 1, 2008, ITC Foods has drawn up plans to extend its Kitchen of India brand to frozen foods. ITCs Branded Packaged Foods business continues to expand with sales growing by 23% over the previous year. Apart from the development costs of new products, the business has had to contend with the recent economic slowdown and severe cost increases in input commodities including wheat, vegetable oil, maize and skimmed milk powder, in addition to the soaring fuel prices. Having acquired reasonable scale in a relatively short span of time, the business is progressively focusing on consolidating the portfolio in certain categories, improving market servicing and driving supply chain efficiencies.

BACKGROUND NOTE (ITC)

ITC was established on August 24, 1910 as the Imperial Tobacco Company of India Limited in Kolkata. Initially, the company was involved in the trading of imported cigarettes. In 1925, in a backward integration move, the company started a packaging and printing business. The name of the company was changed to India Tobacco Company Limited (I.T.C. Ltd.) in 1974. In 1975, I.T.C. Ltd., through ITC-Welcomgroup, tied up with the US-based Sheraton Corporation to enter the hospitality industry. It acquired its first hotel in Madras (later renamed Chennai) in Tamil Nadu and called it the Welcomgroup Chola Sheraton. I.T.C. Ltd established ITC Bhadrachalam Paperboards Ltd. (IBPL) in 1975. The company started production at its integrated pulp and paper/board manufacturing facility at Bhadrachalam, Andhra Pradesh, in 1979. In 1990, I.T.C. Ltd. set up an International Business Division (IBD) for export of agricommodities. I.T.C. started a greeting cards business under the brand name Expressions in the year 2000. In the same year, I.T.C. also entered the fashion retailing business by extending its well known cigarette brand Wills. The retail outlets were called Wills Lifestyle and offered premium leisure wear for men and women under the Wills Sport brand. In September 2001, the company was renamed ITC Ltd (without full stops, and with no meaning attributed to the alphabets). In 2001, ITC made an entry into the foods business. In 2002, the company launched another clothing brand, John Players, which targeted the urban youth. In 2004, ITC was one of eight Indian companies to make it to the Forbes A List8 which featured 400 of the worlds best big companies. In Oct 2005, ITC has launched an exclusive line of prestige fine fragrances and personal care products under the Essenza Di Wills brand. In late 2007, ITC launched Fiama Di Wills soaps and shampoos following the success of Essenza Di Wills. In Dec 2007 ITC launches ECF (Elemental Chlorine Free). ITC is the first and only Company in India using the ECF technology.

Market and Competition

Indian Foods market is a monopolistic market. There are many competitors in all the categories and although they all have similar products available at similar prices, they are trying to prove themselves different through their marketing strategies. However, entry to this business is easy and ITC has utilized this fact very efficiently to their benefit as they entered into the several categories among this Foods business.

READY TO EAT ITC entered into the branded and packaged foods business in with the launch of Kitchens of India brand. In 2004, the company launched KoI brand fruits and spice conserves and cooking pastes. The fruits and spice conserves, were developed jointly with Karen Anand, a food expert. Priced at Rs. 70, these were targeted at the premium segment. The KoI cooking pastes, which were priced at Rs.30 for a 100g pack, also targeted the high-end market. Multi-purpose cooking pastes were also launched under the Aashirvaad brand and these were priced at Rs. 10 for 80g pack. The manufacturing of these products was outsourced to contract manufacturers for saving the operating cost. ITC entered the branded spices market in 2005 and the Instant Mix segment in 2006, both under the Aashirvaad Brand. As on April 2006, the total turnover in the Indian ready-to-eat and readyto-cook segments was only around Rs. 700 million, but it continued to post an annual growth of 20%. By early 2006, though ITC had captured a 35% market share in the ready-to-eat segment, MTR was the clear market leader with close to 60% in market share. ITC exported 40-50% of KoI brand products (in terms of volumes) to the US, Canada, the UK, Switzerland, and Australia. In May 2006, ITC planned to introduce ten more varieties under the KoI brand within a price range of Rs. 35 to Rs. 98. In 2007, some new products have been launched under Ready To Eat category like chutneys, curries, conserves, biryanis (Noor Mahal, Bhori Biryani and some new range of products under Gharana (Paneer Malai, Keema Mutter). After launching all these products ITC FOODS is looking to share 50 to 60% of market by 2008-2009.Following are the major competitors ITC is competing with in Ready to Eat category:

Brands Gits

Description Gits produces the selected range of popular ready to cook and instant foods that cover a range of ethnic Indian cuisine-and where the recipes have "Global pallete acceptance". Offers packaged Bhel puri chats such as Sev Puri, Chana Masala, Samosa, Pakoras, Alu Tikki, Pao Bhaji, Gol Gappa, Dhokla among others Offers packaged sweets,syrups,namkeens, cookies, pickles, aloo Masala, Bhujia, Bhelpuri, Chana Dal, Kajui Ladoo and many more items. MTR foods currently comprise twenty-two delicious and completely authentic Indian curries, gravies and rice. Priya has a range of popular traditional recipes starting from Dal Makhani, Navaratan Kurma to Palak Paneer, Paneer Butter Masala, Punjabi Chhole and Rajma Masala along with true southern delicacies like Andhra Veg Pulav, Mango Dal, Gongura Dal.

Haldirams

Ethnic Kitchens MTR

Priyafoods

Market Share - Ready To Eat

9% 8%

ITC Ltd. MTR 48% Kohinoor

35%

Others(Gits, Priya Foods etc.)

as on June, 2008 CONFECTIONERY Confectionary market in India is about Rs.2500 crore. It is loosely divided into seven categories: 1. Hard boiled candies 2. Toffies

3. 4. 5. 6. 7.

Eclairs Chewing gum Bubble gum Mints lozenges

ITC has currently in market with its two brands Mint-o and Candyman. ITCs Mint-O fresh secured a 17% share of Indian cough lozenges market ahead of former leader Perfetti which only achieved 14.3% with chloromint. The Indian giant marked the confectionary sector in 2002 and has only two brands mint-o fresh and Candyman. But in overall confectionary market they are lagging behind having just 3% market share as compared to market leader Perfetti with more than 37% market and providing larger number of brands.

Perfetti van melle Alpenliebe Alpenliebe Creamfills Alpenliebe Lollipop Big Babol Center Fresh Center Fruit Center Shock Chatar Patar Chlor-mint Chocotella Cofitos Fruittella Happydent White Protex Happydent Marbels Mentos Chocoliebe

ITC Ltd. Candyman Minto

Nestle . Kit Kat . Kit Kat Lite . Milky Bar . Munch . Milk Chocolate . Fun Bar . Polo . Polo Power mint . Munch Pop Choc . clairs

Cadbury Bubbaloo Dairymilk Eclairs % Star Gems Perk Halls

Market Share - Confectionery

3%

ITC Ltd. Perfetti Van Melle

42%

37%

Cadbury Nestle

7%

11%

Others(Parle, Joyco, HUL etc.)

as on June, 2008

STAPLES ITC entered the staples market in 2002 with wheat flour under the Aashirvaad brand. In 2003, ITC extended the Aashirvaad brand to edible salt. By early 2006, ITC had a 40% market share in the Rs. 6 billion packaged flour business. Its closest competitor HLLs Annapurna brand was trailing behind with a market share of 18%. The market was growing at 12%. Under its Aashirvad brand ITC FOODS also launched salt, mixers, ready to cook pastes. In the Rs. 4 billion organized salt market (as of 2006), Tata Salt was the market leader with a 28% market share. ITC had only a 5% share of the market. Other players in this business are HLL (Knorr Annapurna), Nirma (Shudh), Marico Industries (Saffola), etc.

Market Share - Staples

ITC Ltd. 24% 42% Pillsbury 13% Others(Sri Lal Mahal, Local Brands etc.)

HLL

21%

as on June, 2008

BISCUITS: Indian biscuit market is estimated to be around 5000 crore. Biscuit industry in India in the organized sector produces around 60% of the total production, the balance 40% being contributed by the unorganized bakeries. ITC with its premium product, SUNFEAST, is acquiring a big share of market. Within few years, they are able to get 12% share of the market.

Britannia Tiger Nutrichoice Junior Good Day, 50 50, Treat Pure Magic, Milk Bikis Good Morning.

ITC Ltd (Sunfeast) Marie Dream cream Milky Magic Fit kit Choco Nut Butter Nut

Parle Parle-g Krack-Jack Monaco Kreams Hide and Seek Milk Shakti

Priyagold Butter Bite Classic Cream Butter Lite Big Boss Marie Lite Magic Gold

Market Share - Biscuits

8%

ITC Ltd. 12% 10% Priyagold Britannia Parle 38% Others(Bonn, Anmol etc.)

32%

as on June, 2008

SNACKS:

Snacks industry overview Snacks industry in India is worth 1800 Crores of Rs. and growing at 10% is one of the largest markets in the world, out of which potato chips holds the major market share of around 85%.

Product Price (ITC Ltd) Bingo Rs. 5 Rs. 10 Rs. 20

Product Price (Frito Lay) Lays Rs. 5 Rs. 10 Rs. 20 Lehar Namkeen Rs. 5 Rs. 20 Kurkure Rs. 5 Rs. 10 Rs. 20

Product Price (Haldiram) Namkeen Rs. 5 Rs. 10 Rs. 20

Market Sahre - Snacks

12%

16% ITC Ltd. FritoLay India

27%

Haldiram's Others 45%

as on June, 2008

FINANCIAL DATA

ITC Ltd. started their food division in the year 2001. Since then the growth has been fantabulous. Their investment has increased year by year considering the scope of food market. However, they could not sustain the constantly increasing profit margins, mainly because of their valuable investment in market research, surveys, R&D, costly advertisements and expansion plan. Moreover they entered in a whole new market of food, but for this market they already had strong distribution market, which they are using for their tobacco product. So considering all these factors and short span of time period, surprisingly they did good job, particularly in snacks, biscuits, Ready to Eat and staples market.

Annual Results (ITC)

In Rs. Crores Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04

Sales Operating profit Interest Gross profit EPS (Rs)

13,947.53 12,369.30 9,790.53 7,639.45 6,470.44 4,403.94 4.61 5,010.23 8.28 3,956.41 3.28 4,289.62 7.18 3,327.38 2,792.56 2,360.59 11.93 5.95 42.43 8.79 24.79 6.43 3,601.53 2,985.94 2,560.68

Annual results in details Mar ' 08 610.90 4,639.35 733.32 Mar ' 07 336.49 5,644.34 630.15 Mar ' 06 286.08 4,124.90 541.40 Mar ' 05 Mar ' 04 235.81 224.88 2,837.40 2,572.78 467.26 416.48

Other income Raw material Employee expenses

Other expenses Provisions made Depreciation Taxation Net profit / loss

4,176.61 438.46 1,451.67 3,120.10

2,397.88 362.92 1,226.73 2,699.97

1,938.52 332.34 988.82 2,235.35

1,610.08 312.87 836.00 2,191.40

1,310.04 241.62 726.21 1,592.85

Rate of Increase

Sales

Operating profit

Net profit

ACTO RS AFFEC TING NET PROFI T

raw material

employ ee cost

interest

/ loss 18.0 2005 7 28.1 2006 6 26.3 2007 4 12.7 2008 6 21.3 Projection for 2009 3

18.30 19.15 18.90 11.31 16.92

37.58 2.01 20.79 15.56 18.98

10.29% 45.38% 36.84% -17.81% 18.67%

12.19% 15.87% 16.39% 16.37% 15.21%

71.16% -71.88% -72.51% 40.55% -8.17%

The selling of 13544 crores, with net turnover at 3900 crores registered a growth of 18.4% driven by the non-cigarette business, which grew by 29% due to new investments in FMCG market. Overall projection for the year 2009, for sales is projected to be at growth rate of 21.33%.

SALES OF FOOD SECTOR AND ITS PROJECTION: 2006 1230.54 2007 1698.53 2008 2526.60 2009(projected) 3410

Sales (crores)

The foods business is expanding rapidly with sales growth of 35% in the year 2007. This range of product includes more than 150 different products. The growth of this sector in terms of product categorization is as follows. Sales in biscuits category grew by 55%. Sales in staples category grew by 52% Sales in confectionary grew by 51%. Sales in RTE grew by 35% ITC Food is looking to expand its RTE category to maximize its profit.

ITCS NEW CHALLENGES:

This food industry is the industry with very less profit margins. So low operation cost is the key. Also, Indian middle class is price sensitive. In this area international, national and also regional competition is very tough. With that wheat, petrol and labor cost is increasing day by day. Different types of restrictions imposed by the government are also playing a vital role in reducing profit margins. For example, exporting non-vegetarian foods out of India is restricted. To cover this up, ITC is trying to reduce cost of its biscuits by acquiring mass production of wheat directly from farmers through its E-chaupal initiatives. Also in this way ITC is able to reduce the price of its staples. As far as Confectionary market is concerned, ITC is looking to launch its brand of chocolate in collaboration with an American company. After analyzing the food sector, one can say that it is one of the toughest market to compete in as all the market giants are already there.

GROWTH AND INVESTMENT PLANS: This food sector is the most promising field and has already overtaken IT and PHARMACEUTICALS Sector of India. Even Indian Government is looking to develop this sector. Thats the reason central Government has already passed several projects for food parks. In this way FDI in this sector is possible. Also government in its 2006 budget has reduced custom duty from 16% to 8% on packaged food and also excises duty on instant food mixes. This will help ITC to be competitive in the market. Recently ITC has started exporting packaged food from its Bangalore plant. It is also planning to open one more new plant in Calcutta for Indian market. They are looking to add several products in their RTE list which will be exported as well. Also in late 2007 ITC has acquired one Australian Plant and seed technology industry. Through this they will provide highly valuable seeds and other solutions to farmers in India, which ultimately will increase the productivity and cost effectiveness for their staples and biscuits business. Its turnover in the foods business was around Rs. 8 billion in 2005-06 which further increased to Rs. 10.2 billion in year 2006-2007. ITC has decided to make an investment of 300 crores over a period of 5 years. ITC Foods has also decided not to make heavy investments in manufacturing unless volumes pick up. As of today ITC has invested 20 crores in R & D and planning to invest further 15 crores to produce new products in different categories. Thus looking at all the strategy of ITC future investment and planning. The future investment plan is as follows

Rate of Increase 2005 2006

Sales 18.07 28.16

Operating Profits 18.30 19.15

Net Profit/loss 37.58 2.01

2007 2008 2009(Projected)

26.34 12.76 21.33

18.90 11.31 16.92

20.79 15.56 18.98

Rate of Increase of Sales with Projection for 2009

30.00 percent increase 25.00 20.00 15.00 12.76 10.00 5.00 0.00 2005 2006 2007 years 2008 Projection for 2009 18.07

28.16

26.34 21.33

Rate of Increase of Operating Profit with Projection for 2009

25.00 Percent Increase 20.00 15.00 10.00 5.00 0.00 2005 2006 2007 Years 2008 Projection for 2009 11.31 18.30 19.15 18.90

16.92

Rate of Increase of Net Profit/Loss with Projection for 2009

40.00 35.00 30.00 25.00 20.00 15.00 10.00 5.00 0.00

37.58

Percent Increase

20.79 15.56

18.98

2.01 2005 2006 2007 years 2008 Projection for 2009

Major Strategies Adopted by ITC Foods

Entering the foods business was itself a strategic decision for ITC. While ITCs core business, tobacco, was under pressure owing to several factors like government bans on advertising and on smoking in public places, hikes in the excise duty for cigarettes, and anti tobacco campaigns, ITC planned to deploy its surplus in the packaged food business where it saw huge business potential. Following are some of the strategies that ITC adopted to make its food business a success:

Entering into less competitive or unexplored markets (Ready to eat, Staples, Wafers): When ITC entered into the foods business in 2001, it focused on unleashing the areas where the competition is very less or there is no competition. It started with packaged ready to eat food and later extended that to Aashirvaad brand of edible salt and Atta. Recently ITC has announced its desire to forge in the frozen foods category in the

domestic market. Players in this category are limited and ITC hope to exploit this fact. Also, in Bingo, although the competition is tough but there is only one player with whom ITC has to compete i.e. Frito Lay. This strategy has helped ITC to quickly establish itself in the above mentioned businesses.

Distribution Network: ITC already had a huge distribution network due to its tobacco business. ITC used this network to distribute their biscuits and wafers. This not only provided a good launch to their products but also helped in boosting sales. Today, ITCs Bingo and Sunfeast are available at nearly 1.8 million outlets whereas Parle is available at only 1.5 million outlets.

Market differentiation (Ready to eat, Biscuits): ITC started packaged foods business with the KoI brand of ready-to cook products. They were positioned as premium products with target groups including tourists, NRIs, etc. In Biscuits also, ITC launched differentiated products in each and every segment. For e.g. it introduced an Orange Marie, a butterscotch cream biscuit, chilli flakes in a biscuit and even honey flavor under the Sunfeast brand. In March 2005, ITC Foods launched Sunfeast Pasta, a whole wheat based product targeted at children. It was expected to compete with products like Nestles Maggie noodles. With this strategy ITC built for itself new markets.

Cost control strategy (all products): When ITC started the foods division, its main challenge was to compete with the players who were already there. To overcome this challenge, ITC realized that they have to offer products at a price which is either equal or less than what the competitors are offering. To do this, they planned to capitalize by leveraging the strength of the groups other businesses. ITCs printing and packaging business provided high-quality, cost-effective, and innovative packaging. ITC also enjoyed cost advantages over its competitors owing to its electronic procurement system called e-Choupal. This helped ITC to compete with the best. Diversification of products (Biscuits, Wafers, and Ready to Eat): One of the ITCs successful strategies has been the method of diversifications among its various products. If we talk just about Bingo, ITC has come up with 16 flavors in comparison to its competitor Lays of Frito Lay which has only 4 major flavors. Same is the case with Ready to Eat food category and Biscuits. This strategy has helped ITC to attract a wide range of market.

Extensive advertising (Biscuit, confectionary, wafers): Just like a Bollywood movie needs good publicity to be a super hit, every new product launched in the market needs to be known to the consumers before it is launched. Advertising is where ITC made the difference in comparison to its competitors. They hired the best professionals and the best ambassadors in the country to make their products famous. This is evident form the award winning marketing campaign for Bingo and Minto Fresh. The tagline "Jab Laila ko karna tha impress to majnu ne khayi mint o fresh" has stood the test of times and is still widely known and remembered. Hiring the best people from the film industry and sports (Sharukh Khan and Sachin Tendulkar for Biscuits, Rakhi Sawant for Minto Fresh) showed ITCs urge to be the best. On television, the company booked 10 to 15 spots per channel per day on youth channels such as MTV and Star World, mass Hindi channels like Zee and Star TV, and news channels. It also had around 20 spots on a variety of radio channels and advertised in most leading national dailies. In the top-30 cities, over 1,000 outdoor hoardings advertised the product. According to industry estimates, ITC spent close to Rs 100 crore on marketing. This kind of promotion of products helped ITC to make its products known to everyone and now it was not difficult to attract consumers.

Regular introduction of new products (all products): Having acquired reasonable scale in a relatively short span of time, ITC realized that, to remain in the competition it had to introduce new products regularly. ITC has been expanding its distribution network aggressively and also their product range. In biscuits and wafers range, it is launching new products or flavors week after week. Same is the case with Ready to Eat and Kitchen of India.

Innovation (all products): When the need to introduce new products arrived, ITC shifted its focus on to the innovation. Also, ITC was innovative in identifying the market or niche for all its products.

Maintenance of freshness and hygiene (all products): ITC positioned its wheat flour on the health & hygiene and value for money terms. Success in the staples business, especially in the branded and packaged wheat flour business, depended on two factors an effective distribution network and the quality of the product. Therefore, ITC attempted to ensure that the supply chain was responsive, and laid emphasis on making accurate sales forecasts using inputs from distributors, sales personnel and a well-managed MIS system. To maintain freshness of the product, the company strove to minimize the transit

time by regulating the shippers to maintain company-specific transit norms. The physical aspects of the supply chain like warehouses and trucks were closely monitored to maintain cleanliness.

From Analyzers to Prospectors (Biscuits): When ITC entered the biscuits market with Sunfeast in 2003, with three varieties of biscuits - glucose, marie, and cream, they did what any new player in the market does, imitating and emulating the leader that was Britannia. Their strategy was to manufacture those products which are already a success in the market. But, as ITC got hold of the market, it started to manufacture flavors which were never heard of. This was the result of ITCs desire to exploit new product and market opportunities.

All the above strategies and with the help of launch of Bingo in 2007, ITC finally tasted success in its food business in 2008 when it became a profitable business for the first time since its launch in 2001

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Effectiveness of Celebrity Endorsements On Brand and Brand BuildingDocumento103 pagineEffectiveness of Celebrity Endorsements On Brand and Brand BuildingSanith S NairNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- 1.1 Background To The TopicDocumento4 pagine1.1 Background To The TopicSanith S NairNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Value ChainDocumento4 pagineValue ChainNadeem AnsariNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Engineering course timetable for week 3Documento1 paginaEngineering course timetable for week 3Nisa BoodooNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Questionnaire: On Consumer Behaviour and A Source of Brand Building". For This Purpose I Need YourDocumento4 pagineQuestionnaire: On Consumer Behaviour and A Source of Brand Building". For This Purpose I Need YourSanith S NairNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Once Twice Thrice More Than Thrice: Survey AnalysisDocumento10 pagineOnce Twice Thrice More Than Thrice: Survey AnalysisSanith S NairNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- SIP Summary & FormatDocumento8 pagineSIP Summary & FormatSanith S NairNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Questionnaire - Brand EffectivenessDocumento4 pagineQuestionnaire - Brand EffectivenessSanith S NairNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Questionnaire FinalDocumento4 pagineQuestionnaire FinalSanith S NairNessuna valutazione finora

- King's SpeechDocumento2 pagineKing's SpeechSanith S NairNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- A Nag HaDocumento4 pagineA Nag HaSanith S NairNessuna valutazione finora

- People's Support for Tobacco Tax to Fund Healthcare in IndonesiaDocumento78 paginePeople's Support for Tobacco Tax to Fund Healthcare in Indonesiaulyati ulfahNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- CTA upholds Fortune Tobacco tax refundDocumento1 paginaCTA upholds Fortune Tobacco tax refundlenvfNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Market Power and Externalities: Understanding Monopolies, Monopsonies, and Market FailuresDocumento19 pagineMarket Power and Externalities: Understanding Monopolies, Monopsonies, and Market FailuresLove Rabbyt100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Mighty Corporation Vs e J Gallo WineryDocumento6 pagineMighty Corporation Vs e J Gallo WineryJames Glendon PialagoNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- A Project Report ON "Cancer Awareness Among Smokers"Documento4 pagineA Project Report ON "Cancer Awareness Among Smokers"jesal_nribm13Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Prime Minister'S Employment Generation Programme (Pmegp)Documento30 paginePrime Minister'S Employment Generation Programme (Pmegp)deepakmukhiNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- Bir Form 0605Documento2 pagineBir Form 0605alona_245883% (6)

- Sales-Distribution-Report MARLBORO Cigerete 1Documento64 pagineSales-Distribution-Report MARLBORO Cigerete 1Md. ShakirNessuna valutazione finora

- Tobacco Asia Media Planning GuideDocumento4 pagineTobacco Asia Media Planning GuideBambang IrawanNessuna valutazione finora

- John Stewart of Corporate Accountability International Presents in WNTD 2016 WebinarDocumento15 pagineJohn Stewart of Corporate Accountability International Presents in WNTD 2016 WebinarbobbyramakantNessuna valutazione finora

- Rhetorical AnalysisDocumento5 pagineRhetorical AnalysisMatthew EilbacherNessuna valutazione finora

- Test Bank For Microeconomics Fifth EditionDocumento99 pagineTest Bank For Microeconomics Fifth Editionmichaelmckayksacoxebfi100% (22)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Project Report: Comprative Study of Buying Prefrences of Wills & Gold FlakeDocumento67 pagineProject Report: Comprative Study of Buying Prefrences of Wills & Gold FlakeAroraphotosta and commNessuna valutazione finora

- IndianDocumento16 pagineIndianArun ThakurNessuna valutazione finora

- David Sedaris - Letting GoDocumento8 pagineDavid Sedaris - Letting Goapi-273904792Nessuna valutazione finora

- Pakistan Tobacco Company AnalysisDocumento35 paginePakistan Tobacco Company AnalysisHamza AmanullahNessuna valutazione finora

- Agricultural IncomeDocumento5 pagineAgricultural Incomeskn092Nessuna valutazione finora

- Key-Word Transformation ExercisesDocumento30 pagineKey-Word Transformation ExercisesBasil AngelisNessuna valutazione finora

- 03 CIR V La Campana Fabrica de TobacosDocumento10 pagine03 CIR V La Campana Fabrica de TobacosAna Marie LomboyNessuna valutazione finora

- Tacoma-Pierce County Health Department - E-Cigarette E-Mails April 2011 Part 1Documento292 pagineTacoma-Pierce County Health Department - E-Cigarette E-Mails April 2011 Part 1American Vaping AssociationNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Get Out 2017 720p HC HDRip XviD AC3-EVO (EtHD)Documento60 pagineGet Out 2017 720p HC HDRip XviD AC3-EVO (EtHD)wawanNessuna valutazione finora

- ITC Financial Analysis and SWOT of Leading ConglomerateDocumento7 pagineITC Financial Analysis and SWOT of Leading ConglomeratePrashant AminNessuna valutazione finora

- Chaparral Pointe: Board of Directors MessageDocumento6 pagineChaparral Pointe: Board of Directors MessagecmcderreNessuna valutazione finora

- 7 in 1 SmokerDocumento12 pagine7 in 1 SmokerNick CulianosNessuna valutazione finora

- Tobacco Industry Strategies in Latin AmericaDocumento103 pagineTobacco Industry Strategies in Latin AmericaMiguel JimenezNessuna valutazione finora

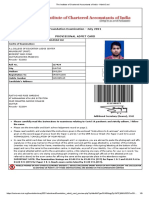

- Foundation Examination - July 2021 Provisional Admit CardDocumento9 pagineFoundation Examination - July 2021 Provisional Admit CardVivekNessuna valutazione finora

- Zippo Click Magazine 3 - 2005Documento20 pagineZippo Click Magazine 3 - 2005navybrat22Nessuna valutazione finora

- The Tobacco AtlasDocumento54 pagineThe Tobacco AtlasIndonesia Tobacco100% (1)

- Rainbow Salt Lamp 1Documento20 pagineRainbow Salt Lamp 1pcohonta100% (2)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Audit Corrective Action Plan 2023 For The Contractor For January 2023 Audi FindingsDocumento2 pagineAudit Corrective Action Plan 2023 For The Contractor For January 2023 Audi FindingsmandlaNessuna valutazione finora