Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cravatex Result Updated

Caricato da

Angel BrokingDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cravatex Result Updated

Caricato da

Angel BrokingCopyright:

Formati disponibili

Advisory Desk

May 16, 2012

Cravatex

Cravatex Ltd. (Cravatex) is a market leader in providing fitness equipment distribution under its brand Proline Fitness and represents the 100-year old Italian brand, FILA, in India. Cravatex has recently acquired sub-license to distribute the products of FILA in the United Kingdom (UK) and Ireland. The company has also been forming strategic partnerships with various health club chains in India such as Talwalkars and Gold Gym in the fitness equipment segment. Cravatex is trading at an attractive 9.8x PE and 0.5x EV/Sales on FY2014E. We recommend Buy on Cravatex with a target price of `800, based on target PE of 12x and implied EV/Sales of 0.6x for FY2014E

BUY

CMP Target Price

Investment Period

`655 `800

12 Months

Investment rationale

Strategic partnership and organic growth to drive 45% growth

Owing to robust organic growth and strategic partnerships the net revenue for the fitness equipment segment is expected to grow at 45% CAGR over FY2011-14E. Cravatex is a market leader in fitness equipment distribution and operates through a wide network of 51 retail stores across India. The company has recently entered into strategic partnership with reputed health club chains in India such as Talwalkars and Gold Gym to provide them with high-quality equipment and customer service.

Sportswear segment to grow at 67% CAGR

On the back of acquisition of subsidiary, M/s BB (UK) Ltd, Cravatex aims to acquire sub-license for certain distribution channels for FILA in the UK and Ireland. The subsidiary will design, develop and supply FILA apparel to other markets in Europe. The acquisition is expected to deliver potential annual revenue of around 10mn for the next two years. Overall revenue from the sportswear segment is therefore expected to grow at CAGR of 67% over FY2011-14E.

Strong parentage of FILA

FILA is a 100-year old Italian sportswear brand with a strong parentage in sports apparel, sports accessories and sports footwear industry. The brand plans to set up 60-70 stores across India by 2014. FILA has plans to be present in almost all large retail formats such as Shoppers Stop, Westside and Lifestyle. Kim Clijsters, US open singles champion is the brand ambassador for FILA.

Outlook and valuation

Cravatex net revenue is expected to grow at a 58% CAGR over FY2011-14E. EBITDA for the company is expected to grow from `6.9cr in FY2011 to `21cr in FY2014E, at a 45% CAGR. Net profit of the company is expected to grow from `6.4cr in FY2011 to `17.2cr in FY2014E. At the CMP of `655, the stock is trading at PE of 9.8x and EV/Sales of 0.5x of FY2014E. We recommend Buy on Cravatex with a target price of `800, offering an upside of 22% from current levels.

Key financials

Cravatex FY2011 FY2012E FY2013E FY2014E Net sales OPM (` cr) (%) 93 7.4 230 301 361 5.7 4.3 5.8 PAT (` cr) 6 9 11 17 EPS (`) 25 36 42 67 ROIC (%) 15 21 18 24 P/E (x) 26.5 18.1 15.5 9.8 P/BV EV/ EBITDA EV/ Sales (x) (x) (x) 7.1 27.1 2.0 5.3 4.0 2.9 14.7 14.9 9.1 0.8 0.6 0.5

Twinkle Gosar

Tel: 022- 3935 7800 Ext: 6848 Gosar.twinkle@angelbroking.com

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

Advisory Desk Cravatex

Investment arguments

Strategic partnership and organic growth to drive 45% growth

Cravatex is a market leader in fitness equipment distribution through its brand Proline Fitness. The company distributes products of Johnson Health Tech, the third largest fitness company in the world. Cravatex operates through a wide network of 51 retail stores across India. The company has recently entered into strategic partnership with reputed health club chains in India such as Talwalkars and Gold Gym to provide them with highquality equipment and customer service. Talwalkars expectation of around 30% growth in its business provides growth visibility for Cravatex. Owing to robust organic growth and strategic partnerships the net revenue for the fitness equipment segment is expected to grow at 45% CAGR over FY2011-14E.

Healthy lifestyle and underpenetration provide growth visibility

The base for people using fitness equipment or enrolling for fitness programs is expanding rapidly, with an increase in the standard of living of people and increased awareness about fitness. In 2010, ~39% of Indias total population of 1.2bn was in the 20-44 years age group. According to Planning Commission of India, the countrys population is expected to increase to 1.3bn by 2020. Thus, the company will also have a significant base of potential consumers even if a modest 1% of the countrys population aged 20-44 years is concerned about fitness. The Indian fitness industry is highly underpenetrated compared to developed countries, with only 0.4% population compared to 16% in the US possessing membership in fitness clubs in 2008 (as per The IHRSA Asia Pacific Market Report 2008). This provides a potential opportunity to the company.

Increased urban disposable income

According to Mckinsey Global Institutes recent research study, Indias urban population is expected to rise from 340mn in 2008 to 590 mn in 2030, urbanization rate of 40% (lower than seen in most Asian countries due to strict definition of Indian Census).The average household disposable income in urban areas is expected to grow at CAGR of 6.4% from ~`60,000 in 2008 to ~`239,000 in 2030 with an overall growth rate of 6.1% to ~`136,000 considering the GDP growth rate of 7.4%. Thus, with such a rise in disposable income it provides strong growth visibility for the companys fitness segment.

Sportswear segment to grow at 67% CAGR

Cravatex has acquired 100% of M/s BB (UK) Ltd., which is its wholly owned subsidiary with effect from February 2011. Through this subsidiary, Cravatex aims to acquire sub-license for certain distribution channels for FILA in the UK and Ireland. The subsidiary will design, develop and supply FILA apparel to other markets in Europe. The acquisition is expected to deliver potential annual revenue of around 10mn for the next two years. Overall revenue from the sportswear segment is therefore expected to grow at CAGR of 67% over FY2011-14E.

May 16, 2012

Advisory Desk Cravatex

Strong parentage of FILA

FILA is a 100-year old Italian sportswear brand with a strong parentage in sports apparel, sports accessories and sports footwear industry. The brand plans to set up 60-70 stores across India by 2014. FILA has plans to be present in almost all large retail formats such as Shoppers Stop, Westside and Lifestyle. Kim Clijsters, US open singles champion is the brand ambassador for FILA.

Sports events to provide growth opportunities

The Indian sportswear industry is at a nascent stage with increasing organized retail space. Increasing number of sports events and activities such as CWG and IPL are also providing scope and growth opportunities for players in the industry. Thus, on the back of mounting popularity of sports with increasing number of events the sportswear industry is expected to grow at a CAGR 15% over 2011-14 as per the companys estimation.

May 16, 2012

Advisory Desk Cravatex

Financials

Key assumptions

Revenue from the sportswear segment is expected to grow at a CAGR of 67% over FY2011-14E, owing to acquisition of the sub-license for distribution through specified channels in the UK and Ireland. It is also expected that the retail-led approach of FILA along with governments reform to allow up to 51% FDI in the retail sector will together enhance the companys earnings. In case of the fitness equipment segment, revenue is expected to grow at a CAGR of 45% over FY2011-14E on the back of expansion plans of health club chains such as Talwalkars and Gold Gym, with whom the company has signed strategic partnerships. Also, Cravatex plans to expand its existing network of retail stores, which will provide it greater visibility among retail consumers.

Exhibit 1: Key assumptions

Particulars Total revenue growth (%) Sportswear segment Volume growth (%) Change in price/unit (%) Revenue growth (%) Fitness equipment segment Volume growth (%) Change in price/unit (%) Revenue growth (%)

Source: Angel Research

FY2010 32.2 66.1 49.5 148.2 (10.2) 5.1 (5.6)

FY2011 58.4 49.0 33.4 98.8 12.8 7.9 21.7

FY2012E 148.5 125.0 22.2 175.0 90.0 10.5 110.0

FY2013E 30.7 5.0 33.4 40.0 10.0 7.3 18.0

FY2014E 20.2 5.0 14.3 20.0 14.0 7.9 23.0

Net sales to grow at 58% CAGR over FY2011-14E

We expect the companys net sales to register a CAGR of 58% over FY2011-14E, increasing from `93cr in FY2011 to `361cr in FY2014E.

Exhibit 2: Net sales and net sales growth

(`cr) 400 350 300 250 200 150 100 50 0 FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E

Source: Company, Angel Research

Net sales (LHS)

Net sales growth (RHS)

(%) 160 120 80 40 0 (40)

May 16, 2012

Advisory Desk Cravatex EBITDA to grow at a CAGR 45% over FY2011-14E

On the back of robust top-line growth of 58%, the companys EBITDA is expected to grow at a CAGR of 45% over FY2011-14E, from `6.9cr in FY2011 to `21cr in FY2014E.

Exhibit 3: EBITDA and EBITDA margin

(` cr) 24 20 16 12 8 4 0 (4) FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E

Source: Company, Angel Research

EBITDA (LHS)

EBITDA margin (RHS)

(%) 8 6 4 2 0 (2) (4)

Net profit of the company is expected to grow at a CAGR of 39% over FY2011-14E, from `6.4cr in FY2011 to `17.2cr in FY2014E.

Exhibit 4: PAT and PAT growth

(` cr) 20 16 12 8 4 0 FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E (%) PAT (LHS) PAT growth (RHS) 120 100 80 60 40 20 0

Source: Company, Angel Research

May 16, 2012

Advisory Desk Cravatex

Risks

High cost of equipment

India does not have quality equipment manufacturers due to which majority of the equipment are been imported (largely from USA). The duty structure on imported equipment is around 23%. Thus, considering the original cost of fitness equipment, imports duty inflates their cost, which further leads to higher fixed cost for consumers both individuals and institutions.

Euro slowdown

Subsidiary in UK which, Cravatex has recently acquired is expected to deliver potential annual revenue of around 10mn for coming two years. This revenue potential may be adversely impacted due to recent slowdown in Euro zone.

Currency Impact

Cravatex imports most of its equipment from outside country. Rupee depreciation will make the imports expensive and increase the cost of acquiring the equipment. High procurement cost will thereby impact the margins of the company.

Lack of government focus

Unlike most developed countries, the fitness equipment and sportswear sectors in India lack industry status. Consequently, the governments focus to enhance awareness regarding fitness and sports-related products is quite low.

Inflation to impact growth

Rising inflation has caused the RBI to continue interest rate hikes and, thereby, sacrifice growth to stabilize inflation. Higher inflation, rising interest rates and a weak economic environment are expected to hold up consumers disposable income and, thereby, impact growth.

May 16, 2012

Advisory Desk Cravatex

Fitness equipment industry

The fitness equipment industry is witnessing significant growth as Indians are increasingly becoming conscious about their health and fitness and since only a fraction of urban India practices regular workout sessions. The industry is presently estimated to reach `63.3bn by 2012 and grow by 25% for at least next five years as quoted by Stag International. The end-user segment includes individuals using fitness equipment at home and institutions such as health clubs and corporate houses. The Indian fitness industry is highly underpenetrated as compared to developed and several developing countries in the world. For instance, 16% of the population in the US possesses fitness club membership compared to mere 0.4% (considering the top seven cities) in India. In 2010, ~39% of Indias total population of 1.2bn was in the 20-44 years age group. According to Planning Commission of India, the countrys population is expected to increase to 1.3bn by 2020. Thus, the company will also have a significant base of potential consumers even if a modest 1% of the countrys population aged 20-44 years is concerned about fitness. The fitness industry in India continues to grow at a rapid pace on the back of expansion of health club chains such as Talwalkars and Golds Gym and entry of foreign fitness chains/clubs in the country. Penetration of these brands is creating awareness about healthy lifestyles among people. The key trends identified include health chains entering the equipment retail market, introduction of innovative products and emergence of new distribution channels. Foreign brands are known for their quality and durability in the Indian market. Therefore, a large share of fitness equipment is imported from the US and Europe. Various government policies such as FDI and franchise route of market entry in India have a significant impact on the development of the fitness equipment industry in India. Key challenges identified in the industry include: Lack of R&D facilities in the country Lack of consumer confidence in Indian equipment Lack of good trainers Lack of space in residential complexes

May 16, 2012

Advisory Desk Cravatex

Sportswear industry

The sportswear industry in India includes sports apparel, sports footwear and accessories. The market for premium sports apparel and footwear industry in India is currently worth `2,500cr as specified by the management. On the back of mounting popularity of sports, higher disposable income and changing lifestyle and consumer preferences, the sports apparel and footwear industry is expected to grow at 15% CAGR over FY2011-14 as per the companys estimations. Increasing number of sports events and activities such as CWG and IPL are providing scope and growth opportunities for players in the industry. The Indian sportswear industry is at a nascent stage with increasing organized retail space. Moreover, the trend of sportswear brand endorsements by prominent celebrities is helping in boosting awareness among people. However, the industry has to cope with price-conscious customers, extensive competition and limited channels for distribution. Key challenges identified in the sportswear industry include poor state of sports infrastructure in the country, imposition of excise duty and competition from unorganized players. Further, competition from organized, international players such as Nike, Adidas, FILA and Reebok continues to grab the industry share of players in the Indian sportswear industry.

May 16, 2012

Advisory Desk Cravatex

Company background

Cravatex mainly operates in two segments a) distribution of fitness equipment and b) distribution of sports footwear and apparel of the brand FILA. Contribution from the sportswear segment to the companys revenue has increased from 24% of the total revenue in FY2007 to 56% in FY2011, while contribution of the fitness segment has reduced from 49% in FY2007 to 40% in FY2011. Cravatex has recently issued bonus shares in the ratio of 1:1 by capitalizing the subsequent amount from the General Reserve account of the company.

Exhibit 5: Revenue streams

TotalRevenue (92.6crforFY2011)

FitnessEquipment Segment(40%)

Sportswear Segment(56%)

OtherServices (4%)

ProlineFitness

Distributors

Healthclub chains

Franchisee

Homeuse equipments

Shopinshops

MBO's

Source: Company, Angel Research

Distribution of fitness equipment

Cravatex is a market leader in fitness equipment distribution through its brand Proline Fitness. The company distributes products of several international brands like Johnson Health Tech (the third largest fitness company in the world), Horizon, Vision, Body Solid and Magnum. Cravatex is the only ISO certified public listed company dealing with fitness equipments. In context to fitness at home, Proline Fitness has created the retail network of around 51 stores with a complete range of home-use fitness equipment. The company is also concentrating retail expansion by opening more stores and maintaining a competitive product mix. The company has been continuously forming strategic partnerships with various health club chains such as Talwalkars and Gold Gym and is providing them with high-quality equipment and customer service. Talwalkars, which has a presence in nearly 50 cities including metros, mini metros and tier II and tier III cities with over 100 health clubs on a consolidated basis, provides promising growth visibility to the company.

May 16, 2012

Advisory Desk Cravatex Distribution of sports footwear and apparel

In the sports apparel and footwear industry, Cravatex represents the 100-year old Italian brand FILA. In India, FILA has entered by opening four retail stores this year and plans a more retail-led approach in the coming years. The company is present in over 1,135 footwear stores, 105 apparel stores and 200 shop-in-shops stores in large retail formats. FILA aims to have a market share of 12-15% in next 2-3 years, with a yoy growth rate of 25-30% as quoted by the companys management. Sports footwear: On the global front, Cravatex has acquired 100% of M/s BB (UK) Ltd., which is its wholly owned subsidiary with effect from February 2011. Through its subsidiary, Cravatex aims to acquire sub-license for certain distribution channels for FILA in the UK and Ireland. The subsidiary will design, develop and supply FILA apparel to other markets in Europe. The acquisition is expected to deliver revenue of around 10mn in the next two years. Founded in Italy in 1926, FILA is one of the most famous fashion sports shoes in the world. Kim Clijsters, US open singles champion is the brand ambassador for FILA. Sports apparel: FILA entered India in 2009 and is now focusing on increasing its presence by expanding its product portfolio and retail stores. The brand has launched its sports apparel range and plans to set up 60-70 stores across India by 2014. Cravatex management quotes that the sports apparel industry in India is growing at a healthy rate of 15-18% per year. In large retail formats, as per availability of space, the brand is present in shop-in-shops stores and expects to be present in all large retail formats such as Shoppers Stop, Westside and Lifestyle. Starting with metros and then mini metros and smaller towns, the company is also looking forward to penetrate tier II-III cities. The company may opt for a franchise depending on its location and store size.

May 16, 2012

10

Advisory Desk Cravatex

Profit and loss statement (Standalone)

Y/E March (` cr) Gross sales Less: Excise duty Net Sales Other operating income Total operating income % chg Net Raw Materials (% of Net Sales) Other Mfg costs % chg Personnel % chg Other % chg Total Expenditure EBITDA % chg (% of Net Sales) Depreciation & Amortization EBIT % chg (% of Net Sales) Interest & other charges Other Income (% of Net Sales) Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg Dividend Retained Earning

FY2009 FY2010 FY2011 FY2012E 44 44 44 (12.6) 28 62.2 1 48.9 4 0.5 12 2.2 45 (1) (138.1) (2.5) 1 (2) (202.1) (4.4) 1 6 13.2 (0) 3 1 31.2 2 2 2 20.3 4.2 7 7 20.3 0 1 58 58 58 32.2 33 56.8 1 (25.4) 5 19.3 16 31.9 55 3 (378.9) 5.2 1 2 (218.4) 4.0 1 6 9.5 (0) 7 3 47.5 4 4 4 98.7 6.4 14 14 98.7 1 3 93 93 93 58.4 51 54.9 3 159.0 9 84.5 23 42.9 86 7 125.7 7.4 1 6 160.2 6.5 2 5 5.2 9 3 31.4 6 6 6 71.4 6.9 25 25 71.4 1 6 230 230 230 148.5 148 64.5 6 148.7 18 109.1 44 86.1 217 13 91.1 5.7 1 12 100.9 5.3 3 4 1.7 13 4 30.0 9 9 9 46.6 4.1 36 36 46.6 1 8

FY2013E FY2014E 301 301 301 30.7 194 64.4 8 30.7 29 55.2 57 30.7 288 13 (1.7) 4.3 1 12 (1.8) 3.9 2 6 2.1 16 5 30.0 11 11 11 16.7 3.6 42 42 16.7 1 10 361 361 361 20.2 227 62.9 10 20.2 34 20.2 69 20.2 340 21 62.8 5.8 1 20 67.4 5.5 3 8 2.1 25 7 30.0 17 17 17 58.1 4.8 67 67 58.1 1 16

May 16, 2012

11

Advisory Desk Cravatex

Balance sheet (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Lease adjustment Goodwill Investments Current Assets Cash Loans & Advances Inventory Debtors Current liabilities Net Current Assets Misc. Exp. not written off Deferred Tax Asset Total Assets 20 9 11 1 0 2 27 3 11 7 7 13 15 0 29 20 8 11 1 0 2 41 2 12 12 16 21 20 0 35 21 9 12 0 60 1 13 21 25 27 32 0 45 24 10 13 0 108 1 23 39 46 62 47 0 60 26 11 15 0 137 2 25 50 60 82 55 0 70 28 12 16 0 167 3 31 61 72 97 70 0 86 1 14 15 11 3.4 29 1 17 18 13 3.4 35 1 22 24 18 3.4 45 1 31 32 25 3.4 60 1 41 42 25 3.4 70 1 57 58 25 3.4 86 FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E

May 16, 2012

12

Advisory Desk Cravatex

Cash flow statement (Standalone)

Y/E March (` cr) Profit Before Tax Depreciation Other Income Change in WC Direct taxes paid Others Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/Dec. In Investments Other Income Others Cash Flow from Investing Issue of Equity/Preference Inc./(Dec.) in Debt Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) In Cash Opening Cash balance Closing cash balance FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E 3 1 (6) 2 (1) 6 5 0 (2) 6 (6) (2) 0 (1) (0) 0 (2) 1 2 3 7 1 (6) (6) (3) 5 (2) 1 0 6 (7) (1) 0 3 (1) 0 2 (1) 3 2 9 1 (5) (13) (3) 5 (6) (2) 2 5 (4) 1 0 4 (1) 0 4 (1) 2 1 13 1 (4) (14) (4) (8) (2) 0 4 2 0 7 (1) 6 0 1 1 16 1 (6) (7) (5) (2) (2) 0 6 4 0 0 (1) (1) 1 1 2 25 1 (8) (14) (7) (3) (3) 0 8 5 0 0 (1) (1) 1 2 3

May 16, 2012

13

Advisory Desk Cravatex

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Net sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset TO (Gross Block) Inventory / Net sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to Equity Net debt to EBITDA Int. Coverage (EBIT/ Int.)

FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E 90.4 61.9 11.3 0.3 4.0 (160.4) 6.0 7 7 11 2 58 (4.4) 0.7 2.3 (6.9) 7.9 0.4 (12.7) (6.7) (10.0) 12.5 2.2 61 67 99 108 0.4 (5.4) (1.6) 45.5 38.0 9.4 0.3 3.1 58.7 5.1 14 14 17 2 69 4.0 0.5 2.2 4.7 3.3 0.5 5.4 6.6 8.9 20.7 3.0 59 70 110 95 0.5 3.1 2.7 26.5 23.4 7.1 0.4 2.0 27.1 4.2 25 25 28 3 92 6.5 0.7 2.3 10.2 6.0 0.7 13.2 13.4 14.9 26.9 4.3 63 81 103 99 0.7 2.5 3.9 18.1 16.3 5.3 0.6 0.8 14.7 3.2 36 36 40 3 124 5.3 0.7 3.9 14.3 7.7 0.7 19.2 20.1 20.5 29.2 9.8 61 72 104 97 0.7 1.8 4.4 15.5 14.2 4.0 0.6 0.6 14.9 2.7 42 42 46 3 162 3.9 0.7 4.4 12.2 7.0 0.5 15.1 16.9 17.5 26.0 11.6 61 72 104 64 0.5 1.7 4.8 9.8 9.2 2.9 0.6 0.5 9.1 2.2 67 67 71 3 225 5.5 0.7 4.3 16.7 7.7 0.4 20.1 23.0 23.9 29.6 12.7 62 72 104 68 0.4 1.0 7.3

May 16, 2012

14

Advisory Desk Cravatex

Advisory Team Tel: (91) (022) 39500777

E-mail: advisory@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Cravatex No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

May 16, 2012

15

Potrebbero piacerti anche

- Final Report Dissertation After CorrectionDocumento63 pagineFinal Report Dissertation After CorrectionAnnu PriyaNessuna valutazione finora

- Indian Institute of Management Kozhikode: About WalkarooDocumento3 pagineIndian Institute of Management Kozhikode: About WalkarooDeep AgrawalNessuna valutazione finora

- SANDEEP BRM ReportDocumento45 pagineSANDEEP BRM ReportAnonymous BHFvPgNOJiNessuna valutazione finora

- Bata India LTD PDFDocumento4 pagineBata India LTD PDFparchure123Nessuna valutazione finora

- Walkaroo: Contact Person: Siddharth Mobile No: 9928692111Documento3 pagineWalkaroo: Contact Person: Siddharth Mobile No: 9928692111Shiny SNessuna valutazione finora

- Industrial Visit in Lunar Private (Sivya)Documento20 pagineIndustrial Visit in Lunar Private (Sivya)Sivya SolomonNessuna valutazione finora

- Shoe IndustryDocumento6 pagineShoe IndustryVikash AgarwalNessuna valutazione finora

- Hawai Chappals 1 PDFDocumento4 pagineHawai Chappals 1 PDFKarishmaJunejaNessuna valutazione finora

- Company & Industry ProfileDocumento27 pagineCompany & Industry ProfileShahnasinuNessuna valutazione finora

- Minor Project Report On Adidas Vs Nike BbaDocumento53 pagineMinor Project Report On Adidas Vs Nike BbaEkampreet SinghNessuna valutazione finora

- BATA INDIA LIMITED Final OneDocumento65 pagineBATA INDIA LIMITED Final OneGaurav MudgalNessuna valutazione finora

- Assessment of Distribution Channel and Opportunities For Improvement of Sales in B2B SegmentDocumento58 pagineAssessment of Distribution Channel and Opportunities For Improvement of Sales in B2B SegmentAkshit GuptaNessuna valutazione finora

- Study of Effectiveness of Training and Development With Special Reference To Veekesy Polymers PVT LTDDocumento98 pagineStudy of Effectiveness of Training and Development With Special Reference To Veekesy Polymers PVT LTDBinoj MNessuna valutazione finora

- Mbahrprojectontraininganddevelopment 150731090756 Lva1 App6892Documento98 pagineMbahrprojectontraininganddevelopment 150731090756 Lva1 App6892satvinderNessuna valutazione finora

- Ey Weekly Pricing BudgetingDocumento4 pagineEy Weekly Pricing BudgetingAltafNessuna valutazione finora

- Resolution After MergerDocumento3 pagineResolution After Mergerbhushan0% (1)

- ASICS Annual Report 2019 - Original - OriginalDocumento49 pagineASICS Annual Report 2019 - Original - OriginalVera Valenzuela HinojosaNessuna valutazione finora

- Jaipuria Institute of Management, Vineet Khand, Gomti Nagar Lucknow - 226 010Documento4 pagineJaipuria Institute of Management, Vineet Khand, Gomti Nagar Lucknow - 226 010Saurabh SinghNessuna valutazione finora

- Decathlon Sports India Pvt. Ltd. Proline India FILA IndiaDocumento2 pagineDecathlon Sports India Pvt. Ltd. Proline India FILA IndiaNilesh kumarNessuna valutazione finora

- Best VKC Wholesale Dealers - Wholesale Bulk Shoes Supplier - Saleem GroupDocumento8 pagineBest VKC Wholesale Dealers - Wholesale Bulk Shoes Supplier - Saleem Groupvkc footwearNessuna valutazione finora

- #Skechers Cost CardDocumento19 pagine#Skechers Cost CardAurel KhanNessuna valutazione finora

- Wa Resume - Ashok Khatua - Format3Documento2 pagineWa Resume - Ashok Khatua - Format3AshokNessuna valutazione finora

- VKC OsDocumento16 pagineVKC Osapplesby100% (1)

- Air India LTDDocumento79 pagineAir India LTDmohit_tandel8Nessuna valutazione finora

- ECODocumento24 pagineECOArpita GuptaNessuna valutazione finora

- Asian FootwearDocumento14 pagineAsian FootwearMegha Agarwal100% (1)

- Steel Fabrication ProfileDocumento4 pagineSteel Fabrication Profilepradip_kumarNessuna valutazione finora

- Untitled PresentationDocumento1 paginaUntitled Presentationsudhirkishor3Nessuna valutazione finora

- THAELYDocumento11 pagineTHAELYAyush GuptaNessuna valutazione finora

- Woodland AssignmentDocumento18 pagineWoodland Assignmentkalpan345Nessuna valutazione finora

- 40 Best Ways To Sell SandalsDocumento7 pagine40 Best Ways To Sell SandalsRajubaiNessuna valutazione finora

- ShoesDocumento53 pagineShoesMajibul RehmanNessuna valutazione finora

- Asian Footwear & Rubber Corporation vs. SorianoDocumento1 paginaAsian Footwear & Rubber Corporation vs. SorianoClaire CulminasNessuna valutazione finora

- WoodlandDocumento17 pagineWoodlandvivekch06Nessuna valutazione finora

- School Shoes CatalogueDocumento23 pagineSchool Shoes CatalogueVIVEK SHAKYANessuna valutazione finora

- Mochiko ShoesDocumento9 pagineMochiko ShoesPraveen SehgalNessuna valutazione finora

- Local Conveyance ReimbursementDocumento2 pagineLocal Conveyance Reimbursementkamil100% (1)

- Daily Collection ReportDocumento48 pagineDaily Collection ReportAmit SengarNessuna valutazione finora

- VKC Group of Companies Industry ProfileDocumento5 pagineVKC Group of Companies Industry ProfilePavithraPramodNessuna valutazione finora

- Bata India Limited (Hosur) - ProductsDocumento2 pagineBata India Limited (Hosur) - ProductsHARISHRUTHINessuna valutazione finora

- Footwear Sector June 2018 (HDFC)Documento6 pagineFootwear Sector June 2018 (HDFC)dilip kumarNessuna valutazione finora

- Company Profile: Product Name Units Installed Capacity Production Quantity Sales Quantity Sales Value (Rs CR.)Documento18 pagineCompany Profile: Product Name Units Installed Capacity Production Quantity Sales Quantity Sales Value (Rs CR.)Senthil KarthikeyanNessuna valutazione finora

- Swot Analysis of NikeDocumento4 pagineSwot Analysis of NikeGaurav MahajanNessuna valutazione finora

- Ajanta 2 BillDocumento3 pagineAjanta 2 BillkamilNessuna valutazione finora

- Ref No. - Date: 09/08/2019Documento1 paginaRef No. - Date: 09/08/2019Saif AliNessuna valutazione finora

- Sno. AM ZM Branch Ncompanyitem Namlot Numblot Numbageing MRPDocumento198 pagineSno. AM ZM Branch Ncompanyitem Namlot Numblot Numbageing MRPsatya prakash reddyNessuna valutazione finora

- Footwear in IndiaDocumento9 pagineFootwear in Indiahimanshu111992Nessuna valutazione finora

- Footwear Industry of India-The Present Scenario, Scope and ChallengesDocumento32 pagineFootwear Industry of India-The Present Scenario, Scope and ChallengesRajesh KumarNessuna valutazione finora

- Woodland Portfolio FDocumento37 pagineWoodland Portfolio FNalnesh AryaNessuna valutazione finora

- OS LunarDocumento28 pagineOS LunarJose JamesNessuna valutazione finora

- Paragon HistoryDocumento19 pagineParagon Historyphani_rapNessuna valutazione finora

- Brand Exclusion List - BTL Coupon Dec To April 23Documento4 pagineBrand Exclusion List - BTL Coupon Dec To April 23Jithu MonNessuna valutazione finora

- Catwalk: Presented ByDocumento25 pagineCatwalk: Presented ByShruti ShrivastavaNessuna valutazione finora

- Crocs CaseDocumento12 pagineCrocs CaseMNessuna valutazione finora

- Flipkart Labels 16 Jan 2022 09 40Documento45 pagineFlipkart Labels 16 Jan 2022 09 40Akshay SharmaNessuna valutazione finora

- Converse FinalDocumento22 pagineConverse FinalSubinNessuna valutazione finora

- BATA vs. WOODLANDDocumento13 pagineBATA vs. WOODLANDmahima sweetNessuna valutazione finora

- Marketing Activities of Woodland Company LTD.: Assignment ONDocumento18 pagineMarketing Activities of Woodland Company LTD.: Assignment ONMara khaNessuna valutazione finora

- Cravatex: Performance HighlightsDocumento14 pagineCravatex: Performance HighlightsAngel BrokingNessuna valutazione finora

- Cravatex: Strategic Partnerships To Be Key DriverDocumento14 pagineCravatex: Strategic Partnerships To Be Key DriverAngel BrokingNessuna valutazione finora

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 pagineRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 16 2013Documento6 pagineDaily Metals and Energy Report September 16 2013Angel BrokingNessuna valutazione finora

- Oilseeds and Edible Oil UpdateDocumento9 pagineOilseeds and Edible Oil UpdateAngel BrokingNessuna valutazione finora

- WPIInflation August2013Documento5 pagineWPIInflation August2013Angel BrokingNessuna valutazione finora

- International Commodities Evening Update September 16 2013Documento3 pagineInternational Commodities Evening Update September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 16 2013Documento9 pagineDaily Agri Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 16 2013Documento2 pagineDaily Agri Tech Report September 16 2013Angel BrokingNessuna valutazione finora

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 pagineTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 14 2013Documento2 pagineDaily Agri Tech Report September 14 2013Angel BrokingNessuna valutazione finora

- Currency Daily Report September 16 2013Documento4 pagineCurrency Daily Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 pagineDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Derivatives Report 8th JanDocumento3 pagineDerivatives Report 8th JanAngel BrokingNessuna valutazione finora

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 paginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 13Documento2 pagineMetal and Energy Tech Report Sept 13Angel BrokingNessuna valutazione finora

- Currency Daily Report September 13 2013Documento4 pagineCurrency Daily Report September 13 2013Angel BrokingNessuna valutazione finora

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 pagineJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento12 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 12 2013Documento2 pagineDaily Agri Tech Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Currency Daily Report September 12 2013Documento4 pagineCurrency Daily Report September 12 2013Angel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 12 2013Documento6 pagineDaily Metals and Energy Report September 12 2013Angel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 12Documento2 pagineMetal and Energy Tech Report Sept 12Angel BrokingNessuna valutazione finora

- Daily Agri Report September 12 2013Documento9 pagineDaily Agri Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNessuna valutazione finora

- RR 10-76Documento4 pagineRR 10-76cheska_abigail950Nessuna valutazione finora

- Foxit PhantomPDF For HP - Quick GuideDocumento32 pagineFoxit PhantomPDF For HP - Quick GuidekhilmiNessuna valutazione finora

- Policarpio Vs Manila Times - Unprotected Speech LibelDocumento3 paginePolicarpio Vs Manila Times - Unprotected Speech LibelStef BernardoNessuna valutazione finora

- A Guide To Relativity BooksDocumento17 pagineA Guide To Relativity Bookscharles luisNessuna valutazione finora

- ESU Mauritius Newsletter Dec 2014Documento8 pagineESU Mauritius Newsletter Dec 2014Ashesh RamjeeawonNessuna valutazione finora

- Final PS-37 Election Duties 06-02-24 1125pm)Documento183 pagineFinal PS-37 Election Duties 06-02-24 1125pm)Muhammad InamNessuna valutazione finora

- Developing Global LeadersDocumento10 pagineDeveloping Global LeadersDeepa SharmaNessuna valutazione finora

- Review Questions Operational Excellence? Software WorksDocumento6 pagineReview Questions Operational Excellence? Software WorksDwi RizkyNessuna valutazione finora

- CIP Program Report 1992Documento180 pagineCIP Program Report 1992cip-libraryNessuna valutazione finora

- Alexander Blok - 'The King in The Square', Slavonic and East European Review, 12 (36), 1934Documento25 pagineAlexander Blok - 'The King in The Square', Slavonic and East European Review, 12 (36), 1934scott brodieNessuna valutazione finora

- The Preparedness of The Data Center College of The Philippines To The Flexible Learning Amidst Covid-19 PandemicDocumento16 pagineThe Preparedness of The Data Center College of The Philippines To The Flexible Learning Amidst Covid-19 PandemicInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Balezi - Annale Générale Vol 4 - 1 - 2 Fin OkDocumento53 pagineBalezi - Annale Générale Vol 4 - 1 - 2 Fin OkNcangu BenjaminNessuna valutazione finora

- MCN Drill AnswersDocumento12 pagineMCN Drill AnswersHerne Balberde100% (1)

- Hercules Industries Inc. v. Secretary of Labor (1992)Documento1 paginaHercules Industries Inc. v. Secretary of Labor (1992)Vianca MiguelNessuna valutazione finora

- Nature, and The Human Spirit: A Collection of QuotationsDocumento2 pagineNature, and The Human Spirit: A Collection of QuotationsAxl AlfonsoNessuna valutazione finora

- Case Blue Ribbon Service Electrical Specifications Wiring Schematics Gss 1308 CDocumento22 pagineCase Blue Ribbon Service Electrical Specifications Wiring Schematics Gss 1308 Cjasoncastillo060901jtd100% (132)

- A Passage To AfricaDocumento25 pagineA Passage To AfricaJames Reinz100% (2)

- WFRP - White Dwarf 99 - The Ritual (The Enemy Within)Documento10 pagineWFRP - White Dwarf 99 - The Ritual (The Enemy Within)Luife Lopez100% (2)

- 1.quetta Master Plan RFP Draft1Documento99 pagine1.quetta Master Plan RFP Draft1Munir HussainNessuna valutazione finora

- Dispersion Compensation FibreDocumento16 pagineDispersion Compensation FibreGyana Ranjan MatiNessuna valutazione finora

- Algebra. Equations. Solving Quadratic Equations B PDFDocumento1 paginaAlgebra. Equations. Solving Quadratic Equations B PDFRoberto CastroNessuna valutazione finora

- Sample Midterm ExamDocumento6 pagineSample Midterm ExamRenel AluciljaNessuna valutazione finora

- Concentrating Partial Entanglement by Local OperationsDocumento21 pagineConcentrating Partial Entanglement by Local OperationsbhpliaoNessuna valutazione finora

- IBM System X UPS Guide v1.4.0Documento71 pagineIBM System X UPS Guide v1.4.0Phil JonesNessuna valutazione finora

- Apache Hive Essentials 2nd PDFDocumento204 pagineApache Hive Essentials 2nd PDFketanmehta4u0% (1)

- HW 2Documento2 pagineHW 2Dubu VayerNessuna valutazione finora

- La Navassa Property, Sovereignty, and The Law of TerritoriesDocumento52 pagineLa Navassa Property, Sovereignty, and The Law of TerritoriesEve AthanasekouNessuna valutazione finora

- Chhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDFDocumento18 pagineChhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDF余鸿潇Nessuna valutazione finora

- Long 1988Documento4 pagineLong 1988Ovirus OviNessuna valutazione finora

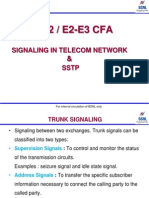

- Signalling in Telecom Network &SSTPDocumento39 pagineSignalling in Telecom Network &SSTPDilan TuderNessuna valutazione finora

- The United States of Beer: A Freewheeling History of the All-American DrinkDa EverandThe United States of Beer: A Freewheeling History of the All-American DrinkValutazione: 4 su 5 stelle4/5 (7)

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterDa EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterValutazione: 3.5 su 5 stelle3.5/5 (487)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedDa EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedValutazione: 2.5 su 5 stelle2.5/5 (5)

- All The Beauty in the World: The Metropolitan Museum of Art and MeDa EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeValutazione: 4.5 su 5 stelle4.5/5 (83)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesDa EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesValutazione: 4.5 su 5 stelle4.5/5 (9)

- System Error: Where Big Tech Went Wrong and How We Can RebootDa EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootNessuna valutazione finora

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyDa EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNessuna valutazione finora

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeDa EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeValutazione: 4 su 5 stelle4/5 (88)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerDa EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerValutazione: 4 su 5 stelle4/5 (121)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumDa EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumValutazione: 3 su 5 stelle3/5 (12)

- AI Superpowers: China, Silicon Valley, and the New World OrderDa EverandAI Superpowers: China, Silicon Valley, and the New World OrderValutazione: 4.5 su 5 stelle4.5/5 (399)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomDa EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNessuna valutazione finora

- All You Need to Know About the Music Business: Eleventh EditionDa EverandAll You Need to Know About the Music Business: Eleventh EditionNessuna valutazione finora

- All You Need to Know About the Music Business: 11th EditionDa EverandAll You Need to Know About the Music Business: 11th EditionNessuna valutazione finora

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseDa EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseValutazione: 3.5 su 5 stelle3.5/5 (12)

- What Customers Hate: Drive Fast and Scalable Growth by Eliminating the Things that Drive Away BusinessDa EverandWhat Customers Hate: Drive Fast and Scalable Growth by Eliminating the Things that Drive Away BusinessValutazione: 5 su 5 stelle5/5 (1)

- Real Life: Construction Management Guide from A-ZDa EverandReal Life: Construction Management Guide from A-ZValutazione: 4.5 su 5 stelle4.5/5 (4)

- Build: An Unorthodox Guide to Making Things Worth MakingDa EverandBuild: An Unorthodox Guide to Making Things Worth MakingValutazione: 5 su 5 stelle5/5 (123)

- The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportDa EverandThe Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportValutazione: 4 su 5 stelle4/5 (1)

- The World's Most Dangerous Geek: And More True Hacking StoriesDa EverandThe World's Most Dangerous Geek: And More True Hacking StoriesValutazione: 4 su 5 stelle4/5 (50)

- Getting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsDa EverandGetting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsValutazione: 4.5 su 5 stelle4.5/5 (10)