Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Final Micrfnace

Caricato da

Thulasi KrishnaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Final Micrfnace

Caricato da

Thulasi KrishnaCopyright:

Formati disponibili

WOMEN EMPOWERMNET THROUGH MICRO FINANCE

By

Jaganmohan Rao

Dr.S.Raghunatha Reddy

Associate Professor Kandula School of Management, KADAPA.

Mr. Thulasi Krishna, K. Research Scholar Department Of Management Studies S.V. University, TIRUPATI.

WOMEN EMPOWERMNET THROUGH MICRO FINANCE 1. INTRODUCTION The non-availability of credit and banking facilities to the poor and underprivileged segments of the society has always been a major concern in India. Accordingly, both the Government and the Reserve Bank have taken several initiatives, from time to time, such as nationalisation of banks, prescription of priority sector lending norms and concessional interest rate for the weaker sections. It was, however, realised that further direct efforts were required to address the credit needs of poor. In response to this requirement, the concept of micro finance movement has evolved in India in early 1990s. The term micro finance is of recent origin and is commonly used in addressing issues related to poverty alleviation (make easy), financial support to micro entrepreneurs, gender development etc. Micro finance is the provision of thrift, credit and other financial services and products of very small amounts to the poor for enabling them to raise their income levels and improve their living standards. It has been recognised that micro finance helps the poor people meet their needs for small credit and other financial services. The informal and flexible services offered to low-income borrowers for meeting their modest consumption and livelihood needs have not only made micro finance movement grow at a rapid pace across the world, but in turn has also impacted the lives of millions of poor positively. This movement not only proved to be very successful, but has also emerged as the most popular form of micro finance in India. RESEARCH METHODOLOGY Need for the study Now a days the women also playing a vital role in the economic development of the country by actively participating in various activities like managing the businesses, establishing business units, going abroad for the employment, indulging in research and developmental activities, contesting in elections apart from managing household bearing children. But there is no exception for rural women. They are bringing income with productive activities such as field working, running small and petty businesses etc. They

have also proven that they can be better entrepreneurs and development managers in any kind of human development activities. Therefore, it is important to make rural women empowered in taking decisions to enable them to take part of economic development of the country. The empowerment of women also considered as an active process enabling women to realize their full identity and power in all spheres of life. In this regard government has introduced several schemes to empower rural women through Self-Help Groups and funding for these programmes through micro finance system, popularly known as Pavala Vaddi incentive. But how far the scheme is successful in meeting the objectives of the scheme is Question Mark? Hence it is needed to study the results of the scheme implemented by the government of Andhra Pradesh. Objectives The following are the objectives set for the present study1. To understand the importance of Micro Finance for women empowerment; 2. To evaluate the effectiveness of Pavala Vaddi strategy for DWCRA groups; 3. To find out the problems of Pavala Vaddi incentive scheme; and 4. To suggest the suitable measures for effective utilization of the incentives offered to SHGs. Sampling A survey is being conducted in order to arrive a meaningful results. For this, out of 53 mandals of Kadapa District one fourth of the mandals i.e. 13 mandals were taken as sample for the study as per convenience sampling. 3. MICRO FINANCE FOR WOMENS EMPOWERMENT The programme has since come a long way from the pilot project of financing 500 SHGs across the country. It has proved its efficacy as a mainstream programme for banking with the poor, who mainly comprise the marginal farmers, landless labourers, artisans and craftsmen and others engaged in small businesses such as hawking and vending in the rural areas. The main advantages of the programme are timely repayment of loans to banks, reduction in transaction costs both to the poor and the banks, doorstep

saving and credit facility for the poor and exploitation of the untapped business potential of the rural areas. The programme, which started as an outreach programme has not only aimed at promoting thrift and credit, but also contributed immensely towards the empowerment of the rural women. Micro finance is emerging as a powerful instrument for poverty alleviation in the new economy. In India, micro finance scheme is dominated by Self Help Groups (SHGs) Bank linkage programme, aimed at providing a cost effective mechanism for providing financial services to the Un reached poor. The SHG programme has been successful in not only in meeting peculiar needs of the rural poor, but also in strengthening collective self help capacities of the poor at the local level, leading to their empowerment. Micro Finance for the poor and women has gained expensive recognition as a strategy for poverty eradication and for economic empowerment. Finance for empowerment is about organizing people, particularly around credit and building capacities to manage money. The concentration is on making the poor to mobilize their own funds, building their capacities and empowering them. They will learn to manage money and rotate funds, builds womens capacities and confidence. Before 1990s, credit schemes for rural women were almost negligible. The concept of micro finance for women empowerment was both on the insistence by women oriented studies that highlighted the discrimination and struggle of women in having the access of credit. The Government measures have attempted to help the poor by implementing different poverty alleviation programmes but with little success. One among such measures is DWCRA. This programme is intended to develop the women and children of rural areas. The brief description, objectives, features, implementing agency and the incentives offered under this programme etc. are discussed below. 4. INTRODUCTION TO DWCRA In the year 1982, the Govt. of India launched Development of women and children in Rural Area (DWCRA) as a sub-scheme of the integrated Rural Development Programme (IRDP). It aims at involving the women in development activities by organizing them into

groups. Besides, it focuses on social issued such as health, education, sanitation, nutrition and safe drinking water in rural areas. As the financial assistance to women was too marginal to enable them to cross the poverty line, it was felt, therefore, that a separate scheme should be drawn up, which would motivate women to come together and engage themselves in economically viable activities. With this in view, the union Government in September 1982 launched DWCRA on a pilot basis as a sub-scheme of the IRDP. Objective of the scheme The main objectives of the scheme are 1. Promotion of self-employment among rural women below the poverty line by providing them with skill training in vocations which are acceptable to them by encouraging productivity in their existing vocations and by introducing new activities wither to undertaking. 2. Organising the beneficiaries on the basis of group activity and promote economic and social self-reliance. 3. Generation of income for the rural poor by providing avenues for production of goods and services. 4. Promotion of production enhancing programmes in rural areas and 5. Provision of facilities for care of children of working women. Salient Features The salient features of the scheme are a) It is exclusively meant for women members of rural households, and to provide then avenues of income generation according to their skills, attitudes and local conditions. b) For better inter-communication amongst women, group approach is adopted. The scheme envisages formation of groups of women within the age group of 18-65 years. From April 1991 onwards, each DWCRA group consist of 10-15 women c) Each group is given a one-time grant. The amount of grant was Rs.15,000/- but has since been raised to Rs.25,000/-. The grant serves as a revolving fund to be used for marketing, child care activities and purchase of few materials.

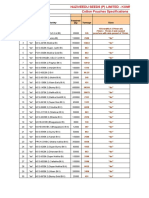

d) The group members, apart from deceiving benefits under DWIRA, are also entitled to loan and subsidy facilities under IRDP scheme. e) Provision exists for opening multi purpose community centre for the groups to early an their economic and related activities. f) Each group selects one of its members as Group organiser who main function is to help in a) Selection of an economic activity b) Procurement of raw materials c) marketing of finished products and d) operation of bank account of the revolving fund. g) Supportive services like mother and child care, immunization, provision for working conveniences, adult education etc. are provided to rural women to improve their efficiency. h) The main activities undertaken by there groups under this scheme are bee-keeping and honey, fruit processing, sericulture, tailoring, basket weaving, match box, dress making, soap and candle making, knitting and weaving, poultry raising etc. 5. PAVALA VADDI INCENTIVE TO DWCRA (SHG) GROUPS To encourage the womens groups further and also to achieve 100% repayment, the State Government has introduced the PAVALA VADDI scheme, where in the Government is reimbursing to the members any interest paid by the SHGs over and above 3% per annum. This has led to significant improvement in loan repayment. The following table describes the statistics of SHGs and Pavala vaddi incentives. Table 1: statistics of SHGs and Pavala vaddi incentives as on 31.01.2009 Particulars Number of SHGs Number of members Number of Village Organisations Number of Mandal Samakhyas Number of Zilla Samakhyas Total savings in Crores Total Corpus in Crore Source: www.rd.ap.gov.in Figures as on 31.01.2009 8,50,671 1,01,82,151 35,525 1,098 22 1,962.50 4,210.81

There are 1,01,82,151 members in 8,50,671 SHGs exclusively for women. A total of 35,525 Village Organizations (VOs), 1098 Mandal Samakhyas (MSs) and 22 Zilla Samakhyas have come into existence in 22 districts. As on today, the total Savings and Corpus of SHG Members are Rs.1962.50 Crores and Rs.4210.81 crores respectively. Bank Loans and Pavala Vaddi During this financial year up to January 2009, Rs.5934.52 crores of bank loans are given under Pavala Vaddi incentive as against annual target of Rs. 11037 Crores. Rs.339.15 Crores is given to SHG members as Pavala Vaddi Incentive. 6. PROBLEMS In spite of many advantages, the Pavala Vaddi incentive scheme of DWCRA is suffering from few problems which are as under1. DWCRA is a group activity obtaining co-ordination among all members is becoming difficult. 2. There is no provision for regular meetings to discuss credit needs, to establish priorities and to acquire the skills necessary to build and manage the institution. 3. If the products produced by DWCRA groups are not purchased by the Government then marketing of that product is a major problem. 4. Many of the members are illiterates. They know only how to make their signature. 5. Still there is gender inequality. 6. Many of the DWCRA members doesnt have knowledge of the market and potential marketability for their products. 7. The local political leaders are influencing the sanction and allocation of credit. 8. Few of the Government Officials are not serious about the implementation of this programme. 9. Critical credit policies of Banks. 10. Many of the group leaders are collecting commission from the members for their services. 7. SUGGESTIONS

The following are the suggestions for achieving the targeted results of Micro finance for women empowerment. 1. The Government needs to increase and expand their support in a liberal manner. 2. The eligibility criteria for sanctioning micro finance should also be based on the location or atmospheric conditions. 3. Training programmes should be conducted for women who borrowed Micro finance for the effective utilization of that amount. 4. More emphasis should also be given to educate the rural women. 5. Political interference should be minimized 6. Cost of Micro finance or interest rates of Micro finance should be still reduced to the groups which repay debt on time. 7. The training programmes should be conducted seriously.

8.

CONCLUSION

Though there are some problems prevailed in the utilization of the funds. However, the scheme is reaching the objectives laid by the government. But for getting perfectness in implementing the scheme the government has to consider the above suggestions.

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- TCS Digital - Quantitative AptitudeDocumento39 pagineTCS Digital - Quantitative AptitudeManimegalaiNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Effect of Innovative Leadership On Teacher's Job Satisfaction Mediated of A Supportive EnvironmentDocumento10 pagineEffect of Innovative Leadership On Teacher's Job Satisfaction Mediated of A Supportive EnvironmentAPJAET JournalNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Lunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Documento2 pagineLunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Kiwanis Club of WaycrossNessuna valutazione finora

- ViTrox 20230728 HLIBDocumento4 pagineViTrox 20230728 HLIBkim heeNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Facilities Strategic Asset Management Plan TemplateDocumento85 pagineFacilities Strategic Asset Management Plan Templateoli mohamedNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Module 5amp6 Cheerdance PDF FreeDocumento27 pagineModule 5amp6 Cheerdance PDF FreeKatNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Task 2 - The Nature of Linguistics and LanguageDocumento8 pagineTask 2 - The Nature of Linguistics and LanguageValentina Cardenas VilleroNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- AX Series Advanced Traffic Manager: Installation Guide For The AX 1030 / AX 3030Documento18 pagineAX Series Advanced Traffic Manager: Installation Guide For The AX 1030 / AX 3030stephen virmwareNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Vocabulary Words - 20.11Documento2 pagineVocabulary Words - 20.11ravindra kumar AhirwarNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Robot 190 & 1110 Op - ManualsDocumento112 pagineRobot 190 & 1110 Op - ManualsSergeyNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Pencak Silat New Rules 2020 - Slides Presentation (International) - As of 22 Aug 2020 - 1000hrs (1) (201-400)Documento200 paginePencak Silat New Rules 2020 - Slides Presentation (International) - As of 22 Aug 2020 - 1000hrs (1) (201-400)Yasin ilmansyah hakimNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Cotton Pouches SpecificationsDocumento2 pagineCotton Pouches SpecificationspunnareddytNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Test Bank For Cognitive Psychology Connecting Mind Research and Everyday Experience 3rd Edition e Bruce GoldsteinDocumento24 pagineTest Bank For Cognitive Psychology Connecting Mind Research and Everyday Experience 3rd Edition e Bruce GoldsteinMichaelThomasyqdi100% (49)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- CA39BDocumento2 pagineCA39BWaheed Uddin Mohammed100% (2)

- Self Authoring SuiteDocumento10 pagineSelf Authoring SuiteTanish Arora100% (3)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Guidebook On Mutual Funds KredentMoney 201911 PDFDocumento80 pagineGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNessuna valutazione finora

- God Whose Will Is Health and Wholeness HymnDocumento1 paginaGod Whose Will Is Health and Wholeness HymnJonathanNessuna valutazione finora

- Grade 10 Science - 2Documento5 pagineGrade 10 Science - 2Nenia Claire Mondarte CruzNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- TG - Health 3 - Q3Documento29 pagineTG - Health 3 - Q3LouieNessuna valutazione finora

- PH Water On Stability PesticidesDocumento6 paginePH Water On Stability PesticidesMontoya AlidNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Living in IT Era OutputDocumento6 pagineLiving in IT Era OutputDanica Rose SaludarNessuna valutazione finora

- Bus Organization of 8085 MicroprocessorDocumento6 pagineBus Organization of 8085 MicroprocessorsrikrishnathotaNessuna valutazione finora

- Statement 876xxxx299 19052022 113832Documento2 pagineStatement 876xxxx299 19052022 113832vndurgararao angatiNessuna valutazione finora

- Design and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionDocumento11 pagineDesign and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionTejas PanchalNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Anti Dump ch-84Documento36 pagineAnti Dump ch-84Tanwar KeshavNessuna valutazione finora

- God's Word in Holy Citadel New Jerusalem" Monastery, Glodeni - Romania, Redactor Note. Translated by I.ADocumento6 pagineGod's Word in Holy Citadel New Jerusalem" Monastery, Glodeni - Romania, Redactor Note. Translated by I.Abillydean_enNessuna valutazione finora

- Anglicisms in TranslationDocumento63 pagineAnglicisms in TranslationZhuka GumbaridzeNessuna valutazione finora

- Danese and Romano (2011) ModerationDocumento14 pagineDanese and Romano (2011) ModerationUmer NaseemNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Why Nations Fail - SummaryDocumento3 pagineWhy Nations Fail - SummarysaraNessuna valutazione finora

- Soal Pas Myob Kelas Xii GanjilDocumento4 pagineSoal Pas Myob Kelas Xii GanjilLank BpNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)