Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Note On Salary Tax

Caricato da

natarajevDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Note On Salary Tax

Caricato da

natarajevCopyright:

Formati disponibili

TAXATION ON SALARY Salary under Income tax Act comprises remuneration in any form [including perquisites] due for

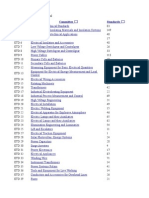

personal service under a contract of employment Components Basic Special allowance Commutation Allowance LTA QPLC PF Pension Medical Additional Allowance Awards / Incentives etc WBP Notice pay Annual Allowance Taxability Taxable Taxable Non Taxable [to the extent of Rs. 800 per month] refer to below table for more details. Non Taxable to the extent of proof submitted (see note below) Taxable Non Taxable Non Taxable Non taxable [to the extent of Rs. 15000 per annum, 20000 for senior Citizens] Taxable Taxable non taxable to the extent of proof submitted for Telephone Expenditure, Sodexho etc. Taxable. Taxable

The above regular salary components except QPLC, paid in the starting month of the Financial year is projected in the future months of the financial year to arrive at the Gross Salary. Perquisites [non monetary benefits like Company leased accommodation, company leased car, interest free loan] are also added to the Gross salary which has been discussed at the end EXEMPTIONS HRA [House rent allowance] Least of the following three is exempted: a. 40% of the Basic (50% in case of employees at Metro cities) b. Rent Paid (as per declaration, refer note below) 10% of Basic c. HRA paid in salary While declaring in IT declaration the following has to be noted. The details of rent paid should be updated for each month separately in myWipro under IT Declaration. To claim the benefit of HRA all employees in Band C1 and above should declare HRA in WBP and get the same through salary. LTA [Leave Travel allowance] Leave Travel Concession NOTE: To claim the exemption employee has to declare LTA in WBP and get the same through salary in the period in which exemption will be claimed.

Leave travel concession or assistance (LTA) received or due to an employee from his employer (or former employer) is exempt under Section 10(5) read with Rule 2B. The exemption is available for: a) The employee and his family in connection with his proceeding on leave to any place in India. The employee must proceed on leave (at least one day). The employee & family should travel to any place in India. The travel by family need not coincide with the travel by the employee. b) The employee and his family in connection with his proceeding to any place in India after retirement from service or after termination of his service. The travel should commence after retirement / resignation. The employee & family should travel to any place in India. The travel by the family need not coincide with the travel by the employee. Family in relation to an employee means: a) The spouse and children of the employee b) The parents, brothers and sisters of the employee who are wholly or mainly dependent on the employee. Only economic dependence is intended. For journeys performed after October 1, 1998: a) The exemption will be admissible to all surviving children born before October 1, 1998; and b) The exemption will be admissible to only two surviving children born on or after October 1, 1998. In reckoning the limit of two children, children born out of multiple births after the first child will be treated as one child only. Exemption Limit The exemption under Section 10(5) is subject to the following limits prescribed in Rule 2B: Situation Where journey is performed by air Where journey is performed by rail Where the places of origin of journey and destination are connected by rail and journey is performed by any other mode of transport Where the places of origin of journey and destination (or part thereof) are not connected by rail Where a recognized public transport First class or deluxe class fare on such Amount of exemption (for journeys performed on or after October 1, 1997) Amount of air economy class fare of the National Carrier by the shortest route to the place of destination or the amount actually spent, whichever is less. Amount of air-conditioned first class rail fare by the shortest route to the place of destination or the amount actually spent, whichever is less. Amount equal to the air-conditioned first class rail fare by the shortest route to the place of destination or the amount actually spent, whichever is less.

exists Where no recognized public transport system exists

transport by the shortest route to the place of destination or the amount actually spent, whichever is less. Air-conditioned first class rail fare by the shortest route to the place of destination (as if the journey has been performed by rail) or the amount actually spent whichever is less.

Care should be exercised while exempting LTA. The situations should be properly applied with reference to the above table. For example, where a car is used to travel from Bangalore to Chennai, the exemption cannot be based on the economy class airfare of Indian Airlines. For airfare exemption, the journey should be performed by air.

The amount of exemption can in no case exceed the expenditure actually incurred for the purpose of travel. In other words, without performing journey and incurring expenses thereon, no exemption can be claimed or allowed.

The exemption is strictly limited to expenses on airfare, rail fare, bus fare etc. No other expenses such as local conveyance at the places of origin or destination, porterage expenses, lodging / boarding expenses will qualify for exemption. Where the journey is performed by a circuitous route, the exemption is limited to what is admissible by the shortest route. Likewise, where the journey is performed in a circular form touching different places, the exemption will be restricted to what is admissible for the journey from the place of origin to the farthest point reached, by the shortest route.1 Travel the basis of exemption a) The amount of LTA may be received in advance or after the completion of the travel or partly in advance and partly after the travel. The event for exempting LTA will be the performance of travel. b) There could be administrative issues with regard to LTA received in March but where the travel is performed in the next financial year, say in April. In such cases, it is better to get a declaration from the employee that he / his family will be performing the journey in April and the taxability can be evaluated after the journey is completed. If the employee furnishes a declaration to that effect, the LTA amount paid should be retained as an advance and adjusted after the employee completes the journey. If the employee fails to furnish a declaration, then the LTA should be regarded as a cash allowance and taxed accordingly. Only two journeys in a block of four years Exemption is available only in respect of two journeys in a block of four calendar years commencing from 1986. The different concluded blocks are: a) b) c) d) e) f) 1986-1989 (1st January 1986 to 31st December 1989) 1990-1993 (1st January 1990 to 31st December 1993) 1994-1997 (1st January 1994 to 31st December 1997) 2002-2005 (1st January 2002 to 31st December 2005) 2006-2009 (1st January 2006 to 31st December 2009) 2010-2013 (1st January 2010 to 31st December 2013)

Actual Expenditure Fixed allowance paid to employees as leave travel allowance on the basis of self-declaration made by the employees would not be exempt under Section 10(5). The company should seek proof of the expenses incurred. a) For journeys performed by air, the passengers counterfoil should be verified. Travel agents bills could also be relied upon. Travel agents commission / charges is not eligible for exemption. Original boarding passes are mandatory as the proof travel. b) For train travel, a photocopy of the ticket will be appropriate. However, if the employee declares the ticket numbers, it could be taken at face value to be true. Bills issued by travel agents can also be relied upon. Travel agents commission / charges is not eligible for exemption. c) For journeys performed by car, the bills of travel agents can be relied upon. The company will have to rely on the declaration of the employees in respect of the number of passengers in order to grant the exemption. The passengers declared should be within the definition of family. The exemption will be pro-rated to the passengers falling within the meaning of family. d) For journeys performed using employees own car, the company could rely on the declaration of the employee with regard to the expenses incurred for running the vehicle, destination and the number of passengers. The reasonability of the exemption should be judged, taking into account all the circumstances of the case. A declaration to the effect the emp has not used the company car to be provided. e) For journeys performed using Companys car, no exemption should be granted as the Company in any case, meets all the running costs. In case the employee incurs the running expenses of the car, then the same can be allowed. f) There is no stipulation that Leave Travel Concession received in the subsequent block of 4 years cannot exceed the amount incurred in the previous block of 4 years.

While effort should be taken to ensure that apparent fictitious claims are not allowed as exemption, the Company is not expected to carryout an investigation to verify the genuinity of the expenses incurred. Companys rules The discussion in this article is with only regard to exemption of LTA under the Income-tax Act. The benefits could be availed of only as per the internal rules of the Company. LTA and House Perquisite Leave Travel Allowance is in the nature of cash allowance, if it is not actually spent on travel. All cash allowances are to be reckoned for evaluating the perquisite value of residential accommodation provided by the Company to the employee. The following situations should be evaluated and recommended action should be implemented:

a) Where the employee avails of LTA and submits no details of the expenses incurred, the entire LTA should be treated as a cash allowance. The same should be reckoned for evaluating 10% house perk value. b) Where the employee avails of LTA and submits details of the expenses incurred only for a part, the balance should be treated as cash allowance. The said balance will have to be reckoned for evaluating 10% house perk value. c) Where the employee avails of LTA and submits details of expenses incurred which covers fully the amount of LTA, there will not be any impact on the house perk value. Expenses incurred need not be eligible for exemption under Section 10(5). For example, the expenditure, if permitted by the Company rules, could be for boarding / lodging. Though, the expenditure will not qualify for exemption under Section 10(5), it will be regarded as a taxable perquisite and not as a cash allowance. Taxable perquisite will not affect the perk value of house while cash allowance will. Commutation allowance / Bus Pass /CRM The tax exemption for commutation / Buss pass / CRM are given as per the below table. All employees in band C1 and above employees who have not opted for the company car and intend to claim the exemption on Commutation allowance must declare it under WBP and get the same paid through salary. For C1 and Above Scenario 1 2 3 Company car Yes No No Bus pass No Yes No Conveyance No No Yes CRM Yes No No Tax benefit details Tax benefit to CRM only Tax benefit to bus pass AND NO tax benefit to conveyance Tax benefit to conveyance only

For B2 and Below Scenari o 1 2 Bus pass Yes No conveyance No Yes Tax benefit details Tax benefit to bus pass AND NO tax benefit to conveyance Tax benefit to conveyance only

STATUTORY DEDUCTIONS [Two] 1. Professional Tax Deducted in the salary is deducted from the gross salary 2. Entertainment Allowance - not relevant in our context.

Income or Loss from House property declared by the employee Income from house property will be added to the Taxable Income based on the employee declaration on the myWipro Loss only in case of the house property can be set off against salary Income 1. 2. 3. 4. Rent received [Nil in case of self occupied] Less: 30% of rent received for repairs & maintenance Less: Interest Paid (Limited to Rs.1,50,000 if the property is self occupied ) Net Income / Loss from house property

Deduction from the taxable Income

Deduction u/s.80C Description: This Section was newly inserted into The Income Tax Act 1961 from FY 05-06 to provide for eligible savings that can be deducted from Gross Total Income. The earlier Section 88 is deleted from FY 05-06. Limit: Upto Rs. 100000/- of investment Avenues: Investments/payments made towards any of the following avenues are allowed - PPF/EPF/VPF - ELSS Mutual Funds - NSC - ULIP/Traditional - Principal repayment of housing loan - Children Tuition expenses - Insurance Premium - Premium Paid towards 80 CCC Pension Scheme - Fixed Deposit (Deposit should be five or more than five years in scheduled banks) Infrastructure Bond: Rs 20000 is can be claimed on the investments done in Infrastructure

Bond, in addition to section 80C Rs. 100000 limit.

An individual assesses, can claim a deduction for any amount paid or deposited by him in any annuity plan of the Life Insurance Corporation or any other insurance companies for receiving pension from a fund set up by the said corporation Deduction up to Rs.10,000 (80CCC) An assessee under section 80D is entitled to deduction upto Rs.15,000 a year in respect of premium paid by him/her by cheque for insurance on his health or on the health of his spouse or dependent parents or children. Additional 15000 is allowed for the premium paid for the parental insurance (Rs. 20000/- applicable for Senior Citizen)

Deduction in respect of maintenance including Medical treatment of Handicap & Handicapped dependent Sec 80 DD Rs.50,000 and if the person with severe disability deduction is Rs. 1,00,000/- - Supporting documents will be: 1. Proof of expenditure incurred for the medical treatment (including nursing), training and rehabilitation of a dependent being a person with disability or 2. Proof of amount paid or deposited under any scheme framed in this behalf by the LIC or any other insurer or the administrator or the specified company and 3. Certificate issued from a government doctor (who is a physician, a surgeon, an oculist or a psychiatrist) which is issued in 2010-11 financial year. If the certificate date is before the beginning of this financial year then the exemption will not be given. Deduction in respect of Medical treatment incurred In respect of the following diseases under sec 80 DDB 1.Cancer 2.Neurological 3.Aids 5.Chronic renal failure 6.Hemophilia 7.Thalassaemia Deduction will be allowed actual paid or Max Rs.40,000 whichever is less for senior citizen Max Rs. 60,000 Supporting documents will be: Prescribed Certificate from a government doctor & Medical bills. Section 80E [deduction on the Interest paid on Education loan] is available to an individual assessee if the following conditions are satisfied 1. The loan was taken from any financial institution [i.e., any banking company or notified financial institution] or an approved charitable institution [i.e., an institution approved for the purpose of section 10(23C) or 80G(2)(a)] 2. The loan was taken for the purpose of pursuing higher education (i.e., full-time studies for any graduate or post graduate course in engineering [including technology/architecture], medicine, management or for post-graduate course in applied sciences or pure sciences including mathematics and statistics) Tax Rates for the FY 2011-12 (will be updated once the budget approved in gazette) Income Level Up to Rs. 180,000 (Men) Up to Rs. 190,000 (Women) Up to Rs. 240,000 (Senior Citizen) Rs. 180,001 to Rs.500,000 Rs. 500,001 to Rs.800,000 Tax Rate Applicable Nil 10% of the amt exceeding 180,000 Rs.32,000+20% of the amt exceeding 500,000 Rs.31,000+20% of the amt exceeding 500,000 (Women) Rs. 26,000+20% of the amt exceeding 500,000 (Senior Citizen) Rs.92,000+30% of the amt exceeding 800,000 Rs.91,000+30% of the amt exceeding 800,000 on the dependent Relative

Rs. 800,001 & above

(Women) Rs.86,000+30% of the amt exceeding 800,000 (Senior Citizens) Education Cess of 3% is applicable on the tax. General IT declaration form will be available for updating / changes between 5th to 20th of every month. You can see your Tax calculations in IT Projections in myWipro, IT Projections will be updated once in a month (i.e after the salary process), Changes made in IT Declaration form in between the month will be reflected in IT Projections only after salary process. Update your Savings declaration in the beginning of the financial year or during the year so that excess tax will not be deducted. At the same time keep the declaration close to the planned investments so that Tax deductions in February & March will not be huge. Excess tax deducted in the earlier months (due to change in the saving declaration in the latter months) can not be refunded by WIPRO you can claim the refund from the Income tax department by filing IT returns (in the month of May / June) Proofs for the tax saving declaration will be collected in the month of January of every year

PERQUISITES Perquisite is calculated on some of the benefits provided to the employees other than the salary, perquisites has to be added to the Taxable Income of the employee on the pro-rata basis only for the Period benefit is availed I. Company Leased Accommodation 15% of the Gross salary or Rent paid which ever is lower is the perquisite Value Gross salary includes the total salary paid & projected for the financial year If the employee uses the CLA only for the specific period, Gross salary of only that period will be considered for the CLA perquisite valuation. II. Company Leased Car Usage perquisite will be charged at fixed rate of 1800 per month if the cubic capacity of the car is below 1600CC and if it is above 1600CC 2400 per month will be charged. If the chauffer is provided additional Rs. 900 per month will be charged as Perquisite on Driver.

Buy Back. Cost of the Car reduced by 20% depreciation [reducing balance method for only completed years] to arrive at the NET CURRENT VALUE. The difference in the NET VALUE & the BUY BACK amount is the Notional profit which will be added as perquisite

III. Company leased furniture & equipments Usage 10% of cost of the asset will be taxed as perquisite, for computers there is no usage perquisite. Buy Back. Transfer of any moveable assets actual cost to the employer less 10% of such cost for each completed year of use by the employer. (Rate for computers, mobile & Electronic items it is 50% computed on reducing balance method.) IV. Interest free loan provided by the company If the outstanding loan balance of the employee (aggregate of all the loans) of is exceeding Rs 20,000 as on beginning of the Financial Year Then the perquisite value will be :On Vehicle Loan - Simple Interest Computed at rate of 13% from 1-04-2010 on reducing balance till the Loan becomes 20000 or till 31st March 2011 On other Loans Simple Interest computed at rate of 13% from 1-04-2010 on reducing balance till the loan becomes 20000 or till 31st March 2011 PREVIOUS EMPLOYER SALARY only for the employee joined Wipro after 1st April 2011 If the assessee has joined Wipro after 01-04-2010, may furnish the details of the salary Income received by him from the previous / other employer in form 12 B which is available in myWipro - IT Declaration Form (Sl.No.20) and the Original FORM-16 issued by your previous employer should be submitted at the time of IT Proofs submission. Please note that, if the original Form-16 is not submitted, your previous employment salary, the same will not be considered for tax computation. Component wise break up of the salary is required to be updated. PAN PERMANENT ACCOUNT NUMBER It is mandatory that all assesses must have a PAN. If you have already been allotted with a PAN [which is unique & holds good all over India] update the number in myWipro. Those who are not having the PAN No. please apply immediately and provide the same, if not provided your

salary will be withheld and all your tax remittance will not be accounted with the income tax department and also form 16 will not be issued to those employees. If you have already applied for PAN & you dont know the status 1. Go to http://incometaxbangalore.org/ 2. Click on "Know your PAN" link. 3. Enter you data of birth and last name If you have still not applied for PAN Please do it right NOW you can buy the applications at Income tax department or UTI bank or HDFC bank. Fill up the form attach photographs & submit the application in any of the above places mentioned or you can apply PAN directly in online at http://incometaxindia.gov.in IF YOU HAVE ANY QUESTIONS PLEASE LOG A CALL IN SERVICE CONNECT.

Potrebbero piacerti anche

- Company Leased Vehicle PolicyDocumento5 pagineCompany Leased Vehicle PolicyGunjan Sharma100% (2)

- Essay Benefits, ATT Verizon SprintDocumento10 pagineEssay Benefits, ATT Verizon Sprintvajanie100% (1)

- Leave Travel AllowanceDocumento12 pagineLeave Travel AllowanceRahul SinghNessuna valutazione finora

- Domestic Travel HR PolicyDocumento9 pagineDomestic Travel HR PolicyrahulvaliyaNessuna valutazione finora

- HPWS PDFDocumento34 pagineHPWS PDFZebaNessuna valutazione finora

- Reward & Recognition PolicyDocumento11 pagineReward & Recognition PolicyMargaret Butler100% (1)

- Internal Consulting Projects (ICPs)Documento63 pagineInternal Consulting Projects (ICPs)etherel90Nessuna valutazione finora

- Section 10Documento42 pagineSection 10Mrigendra MishraNessuna valutazione finora

- Proof of travel not required for LTA claims: SCDocumento3 pagineProof of travel not required for LTA claims: SCyagayNessuna valutazione finora

- LEAVE TRAVEL ALLOWANCE POLICYDocumento6 pagineLEAVE TRAVEL ALLOWANCE POLICYVipin SinghNessuna valutazione finora

- Taxation ProjectDocumento12 pagineTaxation ProjectVeronicaNessuna valutazione finora

- Hindalco LTA Policy: Tax Rules and Claim Process in 38 CharactersDocumento7 pagineHindalco LTA Policy: Tax Rules and Claim Process in 38 CharactersSharun JacobNessuna valutazione finora

- 4thSem ImportantArea of Tax SunitaSaha 03May2020Documento59 pagine4thSem ImportantArea of Tax SunitaSaha 03May2020Sumat SharmaNessuna valutazione finora

- Notes On LTA, Car Lease and Home InternetDocumento3 pagineNotes On LTA, Car Lease and Home InternetRiu TypoNessuna valutazione finora

- Taxation Project 1Documento15 pagineTaxation Project 1VeronicaNessuna valutazione finora

- Valuation of PerquisitesDocumento9 pagineValuation of PerquisitesAbhishek ChandorkarNessuna valutazione finora

- Reimbursement Guidelines FY2122Documento3 pagineReimbursement Guidelines FY2122Ravi TejaNessuna valutazione finora

- Travelling Allowance Rules of Coal India LimitedDocumento12 pagineTravelling Allowance Rules of Coal India LimitedTowshif SkNessuna valutazione finora

- Tax-Free Incomes ExplainedDocumento37 pagineTax-Free Incomes ExplainedsaandoNessuna valutazione finora

- SBI LFC Circular PDFDocumento10 pagineSBI LFC Circular PDFGuru SrinivasanNessuna valutazione finora

- Lta GuidelineDocumento2 pagineLta Guidelinevenkatesh8919chNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento35 pagine11.tax Free Incomes Finalpraveenr5883Nessuna valutazione finora

- FAQ Reimbursement and Investment ProofsDocumento8 pagineFAQ Reimbursement and Investment ProofsPrashant TiwariNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento29 pagine11.tax Free Incomes FinalRaun JainNessuna valutazione finora

- Unit 1: Income From Salaries: Key PointsDocumento220 pagineUnit 1: Income From Salaries: Key PointsAnkIt KRNessuna valutazione finora

- Lta, Telephone & Professional Development GuidelinesDocumento1 paginaLta, Telephone & Professional Development GuidelinesMani Shankar RajanNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento42 pagine11.tax Free Incomes FinalAmit PandeyNessuna valutazione finora

- HP - Practice Manual PDFDocumento225 pagineHP - Practice Manual PDFtfytf7Nessuna valutazione finora

- LTC exemption and tax on retrenchment compensationDocumento2 pagineLTC exemption and tax on retrenchment compensationhanumanthaiahgowdaNessuna valutazione finora

- LTA Guidelines and FAQ DocumentDocumento3 pagineLTA Guidelines and FAQ DocumentdsdsNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento40 pagine11.tax Free Incomes FinalKARTHIK ANessuna valutazione finora

- Income From SalaryDocumento18 pagineIncome From SalaryKejal JainNessuna valutazione finora

- Travel Allow Apr 2012Documento5 pagineTravel Allow Apr 2012Rajthilak_omNessuna valutazione finora

- What Is Leave Travel Allowance or LTADocumento3 pagineWhat Is Leave Travel Allowance or LTAMukesh UpadhyeNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento38 pagine11.tax Free Incomes FinalshineNessuna valutazione finora

- Vehicle & Travel Reimbursement Policy SummaryDocumento2 pagineVehicle & Travel Reimbursement Policy SummaryRiyaan SultanNessuna valutazione finora

- LTC - Procedural Requirements - NewDocumento3 pagineLTC - Procedural Requirements - NewKausik GangopadhyayNessuna valutazione finora

- LTA Policy SummaryDocumento4 pagineLTA Policy SummaryRavi KumarNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento40 pagine11.tax Free Incomes FinalGhs ShahpurkandiNessuna valutazione finora

- 11 TaxDocumento37 pagine11 TaxArpita KapoorNessuna valutazione finora

- Income Tax Provision - 2010-11Documento7 pagineIncome Tax Provision - 2010-11KIshore KunalNessuna valutazione finora

- Note On Medical and Lta - 2010-11Documento2 pagineNote On Medical and Lta - 2010-11Raj_Malhotra_9479Nessuna valutazione finora

- A Guide To Your Personal Income TaxDocumento7 pagineA Guide To Your Personal Income TaxRekha SinghNessuna valutazione finora

- Leave Travel Allowance Policy Effective April 2020Documento6 pagineLeave Travel Allowance Policy Effective April 2020Ajay MaryaNessuna valutazione finora

- Differences Between Allowances and Perquisites ExplainedDocumento6 pagineDifferences Between Allowances and Perquisites ExplainedXenqiyj XyenttukNessuna valutazione finora

- Travel Planning and Expense ManagementDocumento9 pagineTravel Planning and Expense Managementswagatika karNessuna valutazione finora

- Investment Types and Guidlines FY 2022 23Documento39 pagineInvestment Types and Guidlines FY 2022 23Jyoshna NookalaNessuna valutazione finora

- Income From SalariesDocumento24 pagineIncome From SalariesvnbanjanNessuna valutazione finora

- Employee Reimbursement PolicyDocumento11 pagineEmployee Reimbursement Policygemconsulting limitedNessuna valutazione finora

- Travelling PolicyDocumento12 pagineTravelling Policyhr_nishNessuna valutazione finora

- Leave Travel ConcessionDocumento4 pagineLeave Travel Concessionnandi_scrNessuna valutazione finora

- Income Tax Bba 5 Sem QuestionDocumento18 pagineIncome Tax Bba 5 Sem QuestionArun GuptaNessuna valutazione finora

- Module 6 TaxDocumento6 pagineModule 6 TaxEunice OriasNessuna valutazione finora

- NTPC Tax CircularDocumento20 pagineNTPC Tax CircularKundan RathodNessuna valutazione finora

- FlexiDocumento4 pagineFlexiManish Mani100% (1)

- Payroll Tax InformationDocumento16 paginePayroll Tax InformationVibhor MehtaNessuna valutazione finora

- LTA PolicyDocumento2 pagineLTA PolicyAnuradha ParasaramNessuna valutazione finora

- Institute of Nuclear Medicine and Allied Sciences (INMAS), TimarpurDocumento24 pagineInstitute of Nuclear Medicine and Allied Sciences (INMAS), TimarpurRambres SainiNessuna valutazione finora

- PAYE Scheme (Chapter XIV of The Inland Revenue Act No 10 of 2006)Documento12 paginePAYE Scheme (Chapter XIV of The Inland Revenue Act No 10 of 2006)Audithya KahawattaNessuna valutazione finora

- Guidelines For Submission of Investment Proof FY 2023-24Documento11 pagineGuidelines For Submission of Investment Proof FY 2023-24Dhana Sekaran100% (1)

- Commission On Audit Circular NoDocumento7 pagineCommission On Audit Circular NojeceyNessuna valutazione finora

- Leave Travel Allowance Rules & Exemption GuideDocumento11 pagineLeave Travel Allowance Rules & Exemption GuideRuhita ThakurNessuna valutazione finora

- Transfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Documento11 pagineTransfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Vishal DubeyNessuna valutazione finora

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsDa Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNessuna valutazione finora

- Electrotechnical StdsDocumento2 pagineElectrotechnical StdsnatarajevNessuna valutazione finora

- Songs LyricsDocumento11 pagineSongs LyricsnatarajevNessuna valutazione finora

- AdvertisementDocumento1 paginaAdvertisementnatarajevNessuna valutazione finora

- Efficiency of PA Catheters in The ICU of A Tertiary Care HospitalDocumento3 pagineEfficiency of PA Catheters in The ICU of A Tertiary Care HospitalnatarajevNessuna valutazione finora

- Station Grounding CalculationDocumento7 pagineStation Grounding CalculationhamgaiNessuna valutazione finora

- PFC ReviewDocumento3 paginePFC ReviewnatarajevNessuna valutazione finora

- AP Electricity Regulatory CommissionDocumento129 pagineAP Electricity Regulatory CommissionAnand AgrawalNessuna valutazione finora

- PFC ModuleDocumento24 paginePFC ModulenatarajevNessuna valutazione finora

- Glossary of NotationsDocumento4 pagineGlossary of NotationsnatarajevNessuna valutazione finora

- Deferred Compensation PlansDocumento5 pagineDeferred Compensation Plansreggie1010Nessuna valutazione finora

- Topic 3 Employment Income Part IDocumento33 pagineTopic 3 Employment Income Part IBaby Khor100% (2)

- HRM9Documento23 pagineHRM9Sushant GawandNessuna valutazione finora

- Paychex Flex Payroll Plan, Taxpay Service, Reporting, Human Resources Online Services 03-03-15Documento29 paginePaychex Flex Payroll Plan, Taxpay Service, Reporting, Human Resources Online Services 03-03-15L. A. PatersonNessuna valutazione finora

- Compensation and Benefits at The Industry LevelDocumento20 pagineCompensation and Benefits at The Industry LevelNithin Prasad100% (1)

- Employee RetaintionDocumento37 pagineEmployee Retaintionsurbhi_sharma_2613Nessuna valutazione finora

- Case study on motivating a loyal long-term employeeDocumento3 pagineCase study on motivating a loyal long-term employeeankuaaaNessuna valutazione finora

- Exit Interview Form Sample 2Documento4 pagineExit Interview Form Sample 2iuliahaNessuna valutazione finora

- (Journal) Dongho Kim - Employee Motivation Just Ask Your Employees PDFDocumento18 pagine(Journal) Dongho Kim - Employee Motivation Just Ask Your Employees PDFAzwinNessuna valutazione finora

- Hiring, Training, and Evaluating EmployeesDocumento25 pagineHiring, Training, and Evaluating EmployeessolvituxNessuna valutazione finora

- Vice President Human Resources in Cincinnati OH Resume Richard FitzpatricDocumento4 pagineVice President Human Resources in Cincinnati OH Resume Richard FitzpatricrichardfitzpatricNessuna valutazione finora

- HR Policy Edited of TATA AIGDocumento20 pagineHR Policy Edited of TATA AIGManisha VermaNessuna valutazione finora

- Memory Aid - LABORDocumento70 pagineMemory Aid - LABORKat Pichay100% (6)

- Human Resource Management: Finding and Keeping The Best EmployeesDocumento13 pagineHuman Resource Management: Finding and Keeping The Best EmployeesTheresia Sukma LarasatiNessuna valutazione finora

- Sanjay ProjectDocumento139 pagineSanjay Projectanupt90Nessuna valutazione finora

- Employee Retention, Engagement and CareersDocumento16 pagineEmployee Retention, Engagement and CareersAnonymous LGdZXxNessuna valutazione finora

- Compensation and Benefits Administration Module-7Documento30 pagineCompensation and Benefits Administration Module-7Deepak KumarNessuna valutazione finora

- Types of EmployeeDocumento2 pagineTypes of EmployeeAlyssa PaularNessuna valutazione finora

- Ambreen Farooqui 118466388Documento4 pagineAmbreen Farooqui 118466388zigzagzodiacNessuna valutazione finora

- Self Directed Work Team FinalDocumento9 pagineSelf Directed Work Team FinalMuneergurmaniNessuna valutazione finora

- PAS19 RDocumento1 paginaPAS19 RRarajNessuna valutazione finora

- PSA 300 RedraftedDocumento5 paginePSA 300 RedraftedKenneth M. GonzalesNessuna valutazione finora

- KK MSDM MMT ItsDocumento5 pagineKK MSDM MMT ItsLutfi PragolaNessuna valutazione finora

- HRM KolsonDocumento18 pagineHRM KolsonFarah IshaqueNessuna valutazione finora

- UN Salary ScaleDocumento8 pagineUN Salary Scalemaconny20Nessuna valutazione finora

- Manage Control Systems at InfosysDocumento11 pagineManage Control Systems at InfosysSanam Lakhani0% (1)