Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tds Rates A y 2013 14

Caricato da

Ravindra JainDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tds Rates A y 2013 14

Caricato da

Ravindra JainCopyright:

Formati disponibili

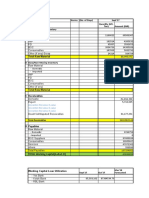

Exhibit No. 2 TDS/ TCS Rates - Financial Year - 2012-13 Tax deducted at source (TDS) Sr No.

Section Head

1 2 3 4 5 6 7 8 9

192 193 194 194A 194A 194B 194BB 194C 194C

Salaries Interest on securities Deemed Dividend Interest from Banking Company Interest other than from a banking Company Lottery / Crossword Puzzle Winning from Horse Races Payment to Contractors (Aggregate payment Rs. 75000) Contractor/ Sub Contractors Transport Business (If PAN quoted) (Aggregate payment Rs. 75000) Payment to sub contractor (Aggregate payment Rs. 75000) Insurance Commission Non Resident Sportsman or Sports Association Payment out of deposit deposits under NSS Repurchase of units by MF/ UTI Commission on sale of lottery tickets Commission / Brokerage Rent on Plant & Machinery Rent other than Plant & Machinery Fees for Technical / Professions services Any Remuneration or commission paid to director of the company w.e.f. 1-7-2012 Compensation on Acquisition of immovable property (other than agricultural land)

Rate % Any other entity Individual/ HUF Salary ncome must be more than Average Tax Not Applicable exemption after deductions Rates Cut off Amount (Rs) 01-04-2012 01-07-2012 2500 10000 5000 10000 5000 30000 30000 5000 10000 5000 10000 5000 30000 30000 10% 10% 10% 10% 30% 30% 1% NIL 10% 10% 20% 10% 30% 30% 2% NIL

10 11 12

194C 194D 194E

30000 20000

30000 20000

1% 10% 10% 20% 20% 10% 10% 2% 10% 10% 10% 10% 1%

2% 10% 10% 20% 10% 10% 2% 10% 10% 10% 10% 1%

13 194EE 14 194F 15 194G 16 194H 17 194I 18 194I 19 194J 20 194J(1) (ba) 21 194LA

2500 1000 1000 5000 180000 180000 30000 N.A. 100000

2500 1000 1000 5000 180000 180000 30000 0 200000

22 194LLA Payment on transfer of certain immovable property other than agricultural land (applicable only if amount exceeds : (a) INR 50 lakhs in case such property is situated in a specified urban agglomeration; or(b) INR 20 lakhs in case such property is situated in any other area) (Effective from 1 October 2012)

N.A. INR 50 lakhs in case such property is situated in a specified urban agglomeration; or(b) INR 20 lakhs in case such property is situated in any other area) (Effective from 1 October 2012)

Notes

1 No Education Cess on payment made to resident-Education Cess is not deductible/collectible at source in case of resident Individual/HUF /Firm/ AOP/ BOI/ Domestic Company in respect of payment of income other than salary. Education Cess @ 2% plus secondary & Higher Education Cess @ 1% is deductible at source in case of non-residents and foreign company. 2 Surcharge on Income-tax - Surcharge on Income-tax is not deductible/collectible at source in case of individual/ HUF /Firm/ AOP / BOI/Domestic Company in respect of payment of income other than salary. 3 The NIL rate will be applicable if the transporter quotes his PAN 4 If there is no PAN details; then from 1st April, 2010 TDS shall be deducted at the rate as applicable or 20% whichever is higher

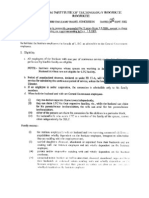

Exhibit No. 3 Tax Collected at source (TCS) Rates for the Financial Year 2012-13 Sl.No. Nature of Goods 1 Alcoholic liquor for human Consumption 2 Tendu leaves 3 Timber obtained under forest lease 4 Timber obtained by any mode other than a forest lease 5 Any other forest produce not being timber or tendu leaves 6 Scrap 7 Parking lot 8 Toll plaza 9 Mining & Quarrying 10 Minerals, being coal or lignite or iron ore 11 Bullion or jewellery (if the sale consideration is paid in cash exceeding INR 2 lakhs) Rates in % 01.07.2012 1 5 2.5 2.5 2.5 1 2 2 2 NA NA

01.04.2012

1 5 2.5 2.5 2.5 1 2 2 2 1 1

No Education Cess on payment made to resident-Education Cess is not deductible/collectible at source in case of resident Individual/HUF /Firm/ AOP/ BOI/ Domestic Company in respect of payment of income other than salary. Education Cess @ 2% plus secondary & Higher Education Cess @ 1% is deductible at source in case of non-residents and foreign company.

Surcharge on Income-tax - Surcharge on Income-tax is not deductible/collectible at source in case of individual/ HUF /Firm/ AOP / BOI/Domestic Company in respect of payment of income other than salary.

Potrebbero piacerti anche

- 541 MovementDocumento1 pagina541 MovementRavindra JainNessuna valutazione finora

- 941 MovementDocumento1 pagina941 MovementRavindra JainNessuna valutazione finora

- Inventory and working capital norms for September 2017Documento3 pagineInventory and working capital norms for September 2017Ravindra JainNessuna valutazione finora

- Practice Manual AmaDocumento9 paginePractice Manual AmaRavindra JainNessuna valutazione finora

- Central Excise FormsDocumento7 pagineCentral Excise FormsRavindra JainNessuna valutazione finora

- Sms UssdDocumento3 pagineSms UssdAmit PaulNessuna valutazione finora

- Assets Capitalization Routing Through CWIP or AuC With IODocumento3 pagineAssets Capitalization Routing Through CWIP or AuC With IORavindra Jain100% (2)

- How One Can Create Huf (Hindu Undivided Family)Documento7 pagineHow One Can Create Huf (Hindu Undivided Family)Ravindra JainNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Our Common Future, Chapter 2 Towards Sustainable Development - A42427 Annex, CHDocumento17 pagineOur Common Future, Chapter 2 Towards Sustainable Development - A42427 Annex, CHShakila PathiranaNessuna valutazione finora

- Governors of India GK Notes in PDFDocumento4 pagineGovernors of India GK Notes in PDFJani Basha ShaikNessuna valutazione finora

- Islam Today: Syed Abul Ala MawdudiDocumento21 pagineIslam Today: Syed Abul Ala MawdudiArap MamboNessuna valutazione finora

- The Sanctuary Made Simple Lawrence NelsonDocumento101 pagineThe Sanctuary Made Simple Lawrence NelsonSulphur92% (12)

- Act 201 Chapter 02 Debit & CreditDocumento72 pagineAct 201 Chapter 02 Debit & Credittanvir ahmedNessuna valutazione finora

- IBS AssignmentDocumento4 pagineIBS AssignmentAnand KVNessuna valutazione finora

- TESCO Business Level StrategyDocumento9 pagineTESCO Business Level StrategyMuhammad Sajid Saeed100% (4)

- Lecture 4 The Seven Years' War, 1756-1763Documento3 pagineLecture 4 The Seven Years' War, 1756-1763Aek FeghoulNessuna valutazione finora

- Main MenuDocumento9 pagineMain MenueatlocalmenusNessuna valutazione finora

- Winston Finds Relics of the Past in an Antique ShopDocumento4 pagineWinston Finds Relics of the Past in an Antique ShopmadefromthebestNessuna valutazione finora

- Complete Spanish Grammar 0071763430 Unit 12Documento8 pagineComplete Spanish Grammar 0071763430 Unit 12Rafif Aufa NandaNessuna valutazione finora

- List of applicants for admission to Non-UT Pool categoryDocumento102 pagineList of applicants for admission to Non-UT Pool categoryvishalNessuna valutazione finora

- Ch9A Resource Allocation 2006Documento31 pagineCh9A Resource Allocation 2006daNessuna valutazione finora

- Joyce Flickinger Self Assessment GuidanceDocumento5 pagineJoyce Flickinger Self Assessment Guidanceapi-548033745Nessuna valutazione finora

- New Jersey V Tlo Research PaperDocumento8 pagineNew Jersey V Tlo Research Paperfvg7vpte100% (1)

- Biswajit Ghosh Offer Letter63791Documento3 pagineBiswajit Ghosh Offer Letter63791Dipa PaulNessuna valutazione finora

- Leave Travel Concession PDFDocumento7 pagineLeave Travel Concession PDFMagesssNessuna valutazione finora

- Predictions of Naimat Ullah Shah Wali by Zaid HamidDocumento55 paginePredictions of Naimat Ullah Shah Wali by Zaid HamidBTghazwa95% (192)

- 79 Fair Empl - Prac.cas. (Bna) 1446, 75 Empl. Prac. Dec. P 45,771, 12 Fla. L. Weekly Fed. C 540 Mashell C. Dees v. Johnson Controls World Services, Inc., 168 F.3d 417, 11th Cir. (1999)Documento9 pagine79 Fair Empl - Prac.cas. (Bna) 1446, 75 Empl. Prac. Dec. P 45,771, 12 Fla. L. Weekly Fed. C 540 Mashell C. Dees v. Johnson Controls World Services, Inc., 168 F.3d 417, 11th Cir. (1999)Scribd Government DocsNessuna valutazione finora

- Harmony Ville, Purok 3, Cupang, Muntinlupa CityDocumento2 pagineHarmony Ville, Purok 3, Cupang, Muntinlupa CityJesmar Quirino TutingNessuna valutazione finora

- Impact of Information Technology On The Supply Chain Function of E-BusinessesDocumento33 pagineImpact of Information Technology On The Supply Chain Function of E-BusinessesAbs HimelNessuna valutazione finora

- Amplus SolarDocumento4 pagineAmplus SolarAbhishek AbhiNessuna valutazione finora

- Political Science Assignment Sem v-1Documento4 paginePolitical Science Assignment Sem v-1Aayush SinhaNessuna valutazione finora

- Apgenco 2012 DetailsOfDocuments24032012Documento1 paginaApgenco 2012 DetailsOfDocuments24032012Veera ChaitanyaNessuna valutazione finora

- E-Waste & Electronic Recycling: Who Will Pay?: Congressional BriefingDocumento14 pagineE-Waste & Electronic Recycling: Who Will Pay?: Congressional BriefingSrivatsan SeetharamanNessuna valutazione finora

- Annexure ADocumento7 pagineAnnexure ABibhu PrasadNessuna valutazione finora

- Tender18342 PDFDocumento131 pagineTender18342 PDFKartik JoshiNessuna valutazione finora

- Abyip MagcagongDocumento10 pagineAbyip MagcagongJhon TutorNessuna valutazione finora

- Treasurer-Tax Collector Rewrites Investment Policy: Safety Net GoneDocumento36 pagineTreasurer-Tax Collector Rewrites Investment Policy: Safety Net GoneSan Mateo Daily JournalNessuna valutazione finora

- 8 Edsa Shangri-La Hotel Vs BF CorpDocumento21 pagine8 Edsa Shangri-La Hotel Vs BF CorpKyla Ellen CalelaoNessuna valutazione finora