Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

AP Macroeconomics Study Sheet

Caricato da

epiphanyyDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

AP Macroeconomics Study Sheet

Caricato da

epiphanyyCopyright:

Formati disponibili

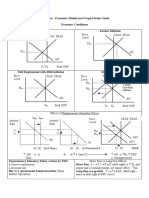

AP MACROECONOMICS

Factors of Production Land: all non-manmade natural resources Ex: water, sunlight, cows Labor: human activity that produce something Capital: any manmade machine and tools used to produce things Ex: buildings, factories, tractors, computer Entrepreneur: Three basic questions How to produce What to produce For whom to produce Economic systems Command economies [socialism/communism]: central government decides the 3 economic questions; government owns societys productive resources Advantages-ability to change major economic directions quickly, little career uncertainty Disadvantages-inefficient, consumer wants ignored, little incentive to work hard Market economies [capitalism]: individual and firms answer the three basic questions; private property Ex: Japan, US, EU Advantages: freedom of choice, efficiency; higher level of consumer satisfaction Disadvantages: basic needs of many are not met, market can become corrupt; more economic uncertainty, less job security Opportunity Cost The amount of one good that must be sacrificed to obtain another good GDP Gross Domestic Product Total value of all final goods and services produced within a given country in a given period of time Consumption: household spending Investment: capital goods, all construction, changes in inventories Government Spending: public works, goods/ services, salaries Net Exports INTERMEDIATE GOODS [flour, fabric] , STOCKS, TRANSFER PAYMENTS (WELFARE), SECOND HAND SALES ARE NOT COUNTED. ONLY FINAL GOODS AND SERVICES, CURRENTLY PRODUCED ITEMS, PRODUCTION WITHIN OUT BORDERS ARE COUNTED. Nominal GDP VS Real GDP Nominal GDP: production of goods and services at current prices [current dollars] Real GDP: nominal GDP adjusted for inflation [constant dollars] Price Index 100 = Price index in year z

GDP Price Index (GDP deflator) 100 = Real GDP If NGDP > RGDP, inflate If RGDP > NGDP, deflate Consumer Price Index How much consumer price changes Inflation rate is based on the CPI CPI is used to adjust past amounts into current dollars Price in earlier year = Current dollars Types of Unemployment Frictional [ ]: new entrants, qualified workers with transferable skills who change jobs Structural [ ]: geographic industry shifts, workers lack of required skills, technological innovation and consumer preferences Cyclical [ ]: during recessions or times of slow macroeconomic demand Seasonal: workers laid off during slow months Natural Rate of Unemployment NRU = + = U NRU If is zero, we are at the NRU, full employment. Aggregate Demand/ Aggregate Supply AD: total demand for goods and services Shifts occur from changes in C, I, G, NX AS Shifts occur from changes in availability of resources, cost of resources, technology and productivity, taxes, subsides, regulations LRAS: the economy is operating in its long run equilibrium Shifts occur when there is an increase in our potential output [capital, resources, technology] The Multiplier Multiply amount spent/invested/consumed by MPC to reflect total impact on AD Multiplier = Multiplier = MPC = MPS =

Tax Multiplier

Changes in T have smaller impact on AD than changes in G Tax multiplier = =

Tax multiplier is always (multiplier) + 1 Balanced Budget Multiplier is 1; if G and T both increase by the same amount, AD increases by that same amount. Fiscal Policy Government attempt to regulate the economy through the budget Recession (Low GDP, high unemployment): increase government spending, decrease taxes [expansionary fiscal policy] Inflation (High GDP, but price levels increasing too fast): decrease government spending, increase taxes [contractionary fiscal policy]

Federal Reserve System Central bank of the US Conducts monetary policy and regulates the banking system Head of the Reserve: Ben Bernanke Monetary Policy Reserve Requirement Percentage of each deposit that must be held as reserves rr decrease, SM increase Discount Rate What the Fed charges banks when they loan them money Dr decrease, SM increase Open Market Operations The Fed buys or sells government bonds Buy bonds, SM increase Sell bonds, SM decrease Money Multiplier Money Multiplier = Comparative Advantage and Absolute Advantage Absolute advantage Compares the productivity of one person Comparative advantage The person (or country) that can produce an item at a smaller opportunity cost has the comparative advantage in producing that item Link between currency prices and NX When the dollar appreciates.. imports increase because foreign goods seem cheaper, but exports decrease because our goods seem more expensive to foreigners

Potrebbero piacerti anche

- Economics Definitions IB DPDocumento11 pagineEconomics Definitions IB DPKrish Madhav ShethNessuna valutazione finora

- IB Macro Study GuideDocumento19 pagineIB Macro Study GuidePaola Fernanda Montenegro100% (3)

- AP MacroEconomics Study GuideDocumento14 pagineAP MacroEconomics Study GuideRon GorodetskyNessuna valutazione finora

- Econ 101 Cheat Sheet (FInal)Documento1 paginaEcon 101 Cheat Sheet (FInal)Alex MadarangNessuna valutazione finora

- Macro Final Cheat SheetDocumento2 pagineMacro Final Cheat SheetChristine Son100% (1)

- Macroeconomics FINAL Cheat SheetDocumento1 paginaMacroeconomics FINAL Cheat Sheetcarmenng1990Nessuna valutazione finora

- AP Macroeconomics Review Sheet 2013Documento7 pagineAP Macroeconomics Review Sheet 2013Crystal Farmer100% (4)

- Macro Study GuideDocumento21 pagineMacro Study GuideJohn WoodNessuna valutazione finora

- Essential Graphs For AP MicroeconomicsDocumento5 pagineEssential Graphs For AP Microeconomicsjlvmrbd777100% (7)

- Macroeconomics Equations Cheat SheetDocumento2 pagineMacroeconomics Equations Cheat SheetSami B83% (12)

- AP Macroeconomic Models and Graphs Study GuideDocumento23 pagineAP Macroeconomic Models and Graphs Study GuideAznAlexT90% (20)

- Microecon Cheat Sheet - FinalDocumento3 pagineMicroecon Cheat Sheet - FinalDananana100100% (3)

- AP Macro Cheat SheetDocumento23 pagineAP Macro Cheat SheetGabriel Jimenez100% (7)

- Microeconomics Study Sheet Microeconomics Study Sheet: More Free Study Sheet and Practice Tests atDocumento3 pagineMicroeconomics Study Sheet Microeconomics Study Sheet: More Free Study Sheet and Practice Tests atanandsemails6968100% (1)

- Economics Cheat SheetDocumento2 pagineEconomics Cheat Sheetalysoccer449100% (2)

- MacroDocumento6 pagineMacrocorvids75% (4)

- Economics Cheat SheetDocumento5 pagineEconomics Cheat Sheetcaitobyrne341275% (4)

- Macroeconomics Key GraphsDocumento5 pagineMacroeconomics Key Graphsapi-243723152Nessuna valutazione finora

- AP Macroeconomics TestDocumento10 pagineAP Macroeconomics TestTomMusic100% (1)

- Economics Cheat Sheet - Ellie Tragakes 2Documento108 pagineEconomics Cheat Sheet - Ellie Tragakes 2Ishaan Tandon50% (2)

- Ap Macroeconomics NotesDocumento40 pagineAp Macroeconomics NotesBrandon Piyevsky100% (1)

- Micro Formula PacketDocumento2 pagineMicro Formula Packetlhv48Nessuna valutazione finora

- 90,95,2000 Macro Multiple ChoiceDocumento37 pagine90,95,2000 Macro Multiple ChoiceAaron TagueNessuna valutazione finora

- 2000 AP Microeconomics Released ExamDocumento17 pagine2000 AP Microeconomics Released ExamJoseph Weng100% (3)

- Economics Edexcel AS Level Microeconomics GlossaryDocumento7 pagineEconomics Edexcel AS Level Microeconomics Glossarymarcodl18Nessuna valutazione finora

- AP Macroeconomics - Models & Graphs Study GuideDocumento22 pagineAP Macroeconomics - Models & Graphs Study GuideLynn Hollenbeck Breindel100% (2)

- IB Economics SL4 - Government InterventionDocumento7 pagineIB Economics SL4 - Government InterventionTerran100% (5)

- Essential Graphs For MicroeconomicsDocumento12 pagineEssential Graphs For MicroeconomicsSayed Tehmeed AbbasNessuna valutazione finora

- Econ Cheat SheetDocumento3 pagineEcon Cheat SheetadviceviceNessuna valutazione finora

- AP Macroeconomics Unit 1Documento2 pagineAP Macroeconomics Unit 1Emily Flores100% (1)

- Macroeconomics Class NotesDocumento83 pagineMacroeconomics Class NotesGreta Schneider100% (1)

- Eco MCQ CombinedDocumento30 pagineEco MCQ CombinedAnil VermaNessuna valutazione finora

- 100 Questions On Economics PDFDocumento9 pagine100 Questions On Economics PDFPardeep Singh KadyanNessuna valutazione finora

- Elasticity Cheat SheetDocumento4 pagineElasticity Cheat Sheetnreid2701100% (2)

- AP Microeconomics Multiple-ChoiceDocumento13 pagineAP Microeconomics Multiple-Choicethemadhatter10667% (3)

- MicroeconomicsDocumento10 pagineMicroeconomicsVishal Gattani100% (5)

- Economics - Market StructuresDocumento5 pagineEconomics - Market Structureshelixate67% (3)

- Microeconomics Notes (Advanced)Documento98 pagineMicroeconomics Notes (Advanced)rafay010100% (1)

- Economic Indicators & The Business CycleDocumento7 pagineEconomic Indicators & The Business CyclePinky100% (1)

- Coach Huber AP Macroeconomics: Gross Domestic ProductDocumento18 pagineCoach Huber AP Macroeconomics: Gross Domestic Productapi-255899090Nessuna valutazione finora

- Ib Economics Study Guide MacroDocumento43 pagineIb Economics Study Guide Macroapi-196719233Nessuna valutazione finora

- Macro Cheat SheetDocumento3 pagineMacro Cheat SheetMei SongNessuna valutazione finora

- Microeconomics Summary NotesDocumento14 pagineMicroeconomics Summary NotesNg Chai SheanNessuna valutazione finora

- IB Economics FINAL EXAM REVIEWDocumento6 pagineIB Economics FINAL EXAM REVIEWkrip2nite918100% (4)

- Cheat Sheet - CHE374Documento26 pagineCheat Sheet - CHE374JoeNessuna valutazione finora

- Economics IA MicroEconomicsDocumento4 pagineEconomics IA MicroEconomicsMələk Ibrahimli67% (3)

- AP Economics FRQ ReviewDocumento6 pagineAP Economics FRQ ReviewBilal QureshiNessuna valutazione finora

- IB Business Command Terms - Final PDFDocumento4 pagineIB Business Command Terms - Final PDFYushin OhNessuna valutazione finora

- Microeconomics: (S A M (P 1) )Documento3 pagineMicroeconomics: (S A M (P 1) )Niaz MahmudNessuna valutazione finora

- HL Economics Cheat SheetDocumento39 pagineHL Economics Cheat SheetBanjot100% (1)

- IB Business Management NotesDocumento11 pagineIB Business Management NotesuzairNessuna valutazione finora

- Macro EcDocumento34 pagineMacro EcSeymaNessuna valutazione finora

- Notes-Intro To MacroeconomicsDocumento14 pagineNotes-Intro To MacroeconomicsDickhao Lew100% (2)

- IB ECON Chapter 1 Notes (Basics of Econ)Documento6 pagineIB ECON Chapter 1 Notes (Basics of Econ)H15T0RYK1NGNessuna valutazione finora

- Economics Midterm ReviewDocumento5 pagineEconomics Midterm ReviewAmyNessuna valutazione finora

- Eco - NotesDocumento4 pagineEco - NotesMukunth KLNessuna valutazione finora

- Economic Growth Is Defined As TheDocumento20 pagineEconomic Growth Is Defined As TheAsma ShamsNessuna valutazione finora

- Introduction To EconomicsDocumento12 pagineIntroduction To EconomicsBaro LeeNessuna valutazione finora

- Developing The Asian Markets For Non-Performing Assets - India's ExperienceDocumento32 pagineDeveloping The Asian Markets For Non-Performing Assets - India's ExperienceRAJESH MAHTO 2058Nessuna valutazione finora

- Financial Management 2iu3hudihDocumento10 pagineFinancial Management 2iu3hudihNageshwar singhNessuna valutazione finora

- Andhra Bank Account Opening FormDocumento2 pagineAndhra Bank Account Opening FormSanthosh Reddy BNessuna valutazione finora

- A DokumentDocumento2 pagineA Dokumentamberjain41Nessuna valutazione finora

- Arnold Van Den Berg Power Point Jan 29 2020Documento60 pagineArnold Van Den Berg Power Point Jan 29 2020Gonzalo Vera MirandaNessuna valutazione finora

- Advantages and Disadvantages of Different Methods of Payment-2Documento21 pagineAdvantages and Disadvantages of Different Methods of Payment-2api-549594574Nessuna valutazione finora

- The Legend of Situ BagenditDocumento3 pagineThe Legend of Situ BagenditVisby NNessuna valutazione finora

- SAP FICO Transaction CodesDocumento38 pagineSAP FICO Transaction Codesdjtaz13100% (1)

- Assignment 2 PFMDocumento3 pagineAssignment 2 PFMWasif Imran RARE0% (1)

- PF Form 19 10 - CDocumento4 paginePF Form 19 10 - CMadhaw KumarNessuna valutazione finora

- A Using The Financial Statements Shown Here For LanDocumento2 pagineA Using The Financial Statements Shown Here For LanAmit PandeyNessuna valutazione finora

- Corporate Finance Cheat SheetDocumento3 pagineCorporate Finance Cheat Sheetdiscreetmike50Nessuna valutazione finora

- Exchange Rate Policy and Modelling in IndiaDocumento117 pagineExchange Rate Policy and Modelling in IndiaArjun SriHariNessuna valutazione finora

- S Bica 20221226000911705529Documento20 pagineS Bica 20221226000911705529Mr. RajkumarNessuna valutazione finora

- Change in Profit RatioDocumento10 pagineChange in Profit RatioHansika SahuNessuna valutazione finora

- Net National Product and Net Domestic IncomeDocumento3 pagineNet National Product and Net Domestic IncomeLalithya Sannitha MeesalaNessuna valutazione finora

- Argentina Localization Tax ReportsDocumento37 pagineArgentina Localization Tax ReportsMarcos PauloNessuna valutazione finora

- The Effects of Changes in Foreign Exchange Rates PDFDocumento13 pagineThe Effects of Changes in Foreign Exchange Rates PDFChelsy SantosNessuna valutazione finora

- Module 2 Sources of Intermediate and Long-Term FinancingDocumento24 pagineModule 2 Sources of Intermediate and Long-Term Financingcha11Nessuna valutazione finora

- History: MoneyDocumento68 pagineHistory: MoneyDomenico BevilacquaNessuna valutazione finora

- SAP FicoDocumento184 pagineSAP FicoSrikanth Nagula100% (1)

- Marketing Mix of Bank Al Habib PakistanDocumento6 pagineMarketing Mix of Bank Al Habib Pakistankhalid100% (2)

- Accounting TextbookDocumento498 pagineAccounting Textbookeli.israel07Nessuna valutazione finora

- BNPL Model PDFDocumento19 pagineBNPL Model PDFSunnyNessuna valutazione finora

- Chapter 11 Bonds PayableDocumento27 pagineChapter 11 Bonds PayableNicho Deven HamawiNessuna valutazione finora

- Maceda Law - Default ExplainedDocumento6 pagineMaceda Law - Default ExplainedQuin BalboaNessuna valutazione finora

- Unit 2 Time Value of MoneyDocumento4 pagineUnit 2 Time Value of MoneyNeelabhNessuna valutazione finora

- EC4177/BA4177 Test 2 Study Guide CH 12 Exchange Rate DeterminationDocumento2 pagineEC4177/BA4177 Test 2 Study Guide CH 12 Exchange Rate DeterminationSandip AgarwalNessuna valutazione finora

- Care RatingsDocumento32 pagineCare Ratingskrishna_buntyNessuna valutazione finora

- Perpetual Non Cumulative Preference ShareDocumento11 paginePerpetual Non Cumulative Preference ShareSiddhartha YadavNessuna valutazione finora