Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Department of Commercial Taxes, Government of Uttar Pradesh: Upvat - Xxiv

Caricato da

rajiv29Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Department of Commercial Taxes, Government of Uttar Pradesh: Upvat - Xxiv

Caricato da

rajiv29Copyright:

Formati disponibili

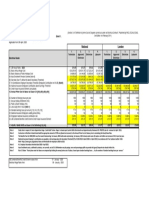

UPVAT - XXIV

Department of Commercial Taxes, Government of Uttar Pradesh

[See Rule-45(2) of the UPVAT Rules, 2008] Return of Tax Period - monthly / quarterly

[To be filled in block letters only]

1. 2. 3. 4. 5. 6. 6A 7. a-

Assessment Year Tax Period Ending on Designation of Assessing Authority Name of Circle / Sector Name / address of the dealer -

- d d -

m m y y y y

Taxpayer's Identification Number [TIN] Taxpayer's PAN (Permanent Account Number ) Details of Purchase [in Rs.] Vat Goods i. Purchase in own a/c against tax invoice (annexure-A Part-I ) ii. Purchase in own a/c from person other than registered dealer iii. Purchase of exempted goods iv. Purchase from Ex U.P. v. Purchase in Principal's A/c (a) U.P. principal (a-i) Purchase against tax invoice (annexure-A Part-II ) (a-ii) Other purchases (b) Ex. U.P. principal vi. Any other purchase Total : vii. Less purchase return (annexure A-1) viii. Net amount of purchase Non Vat Goods i. Purchase from registered dealers ii. Purchase from person other than registered dealer iii. Purchase of exempted goods iv. Purchase from Ex U.P. v. Purchase in Principal's A/c (a) U.P. principal (b) Ex. U.P. principal vi. Any other purchase Total : vii. Less purchase return (annexure A-1) viii. Net amount of purchase Grand Total : Capital Goods purchased from within the State i Purchase against tax invoice (Annexure A-2) ii Purchase from person other than registered dealer Total :

b-

c-

d-

Purchases through commission agent for which certificate in form VI has been received Sl.No. Certificate No. Date value of goods purchased 1 2 3 Total :

Amount of tax paid

7A.

Purchases/value of goods received from outside State against Forms of declaration / certificates (a) Purchase against Form C / Form H / Form I (Details to be furnished in annexure C, D & E respectively) (b) Value of goods received from outside State against Form F (details to be furnished in annexure F) Total : Computation of tax on purchase Sl.No. Rate of tax Vat Goods i. 1% ii. 4% iii. 12.5% Additional Tax iv. 0.5% v. 1% Non Vat Goods vi. vii. viii. ix. x. Total : Grand Total : Commodity Turnover of Purchase Tax

8.

Total :

9. a-

Details of Sale Vat Goods i. Turnover of sale in own a/c against tax invoice (annexure-B Part-I) ii. Turnover of sale in own a/c other than in column- i. iii. Turnover of sale of exempted goods iv. Sales in Principals A/C (a) U.P. principal (a-i) Sales against tax invoice (annexure-B Part-II ) (a-ii) Other sales (b) Ex. U.P. principal v. Interstate sale against form 'C' vi. Interstate sale without form 'C' vii. Sale in course of export out of India viii Sale in course of import ix. Sale outside state x. Consignment sale /Stock Transfer xi. Any other sale Total xii. Less sales return (annexureB-1) xiii. Net amount of sales

-2-

b-

Non Vat Goods i. Taxable turnover of sale ii. Exempted turnover of sale iii. Tax paid turnover of goods iv. Sale in Principal's A/c (a) U.P. principal (b) Ex. U.P. principal v. Any other sale Total : vi. vii Less sales return (annexure B-1) Net amount of sales Grand Total :

c-

Sales through commission agent for which certificate in form V has been received Sl.No. Certificate No. Date i. ii. iii. Total :

value of goods sold

Amount of tax charged

10.

Computation of tax on sale Sl.No. Rate of tax Vat Goods i. 1% ii. 4% iii. 12.5% Additional tax i. 0.5% ii. 1% Non Vat Goods i. ii. iii. iv. v.

Commodity

Sale amount

Tax

Total :

Total : [Vat and Non Vat] Grand Total : 11. 12. 13. Installment of compounding scheme, if any Amount of T.D.S. Tax Payable [in rupees] i. Tax on purchase ii. Tax on sale iii. Installment of compounding scheme, if any iv. T.D.S. amount Total : -

-3-

14.

Detail of ITC i. ITC brought forward from previous tax period ii. ITC earned during the tax period (a) On purchases made in own account (b) On purchases made through purchasing commission agent against certificate in form VI Total : (c) Installment of ITC on opening stock due in the tax period (d) Installment of ITC on capital goods due in the tax period Total : (e) ITC reversed during the tax period (f) Admissible ITC in the tax period (a+b+c+d-e) iii. (a) Adjustment of ITC against tax payable (b) Adjustment of ITC against CST iv. ITC carried forward to the next tax period, if any Total : Net tax i. Total tax payable (serial no. 13) ii ITC adjustment [14 (vii)] iii Net tax Detail of tax deposited A- Tax deposited in Bank / Treasury Name of the bank / branch T.C. number

15.

16.

Date

Amount of tax

Total B- By adjustment against adjustment vouchers Adjustment Voucher No.

Date

Amount of tax

In figures In words Annexure- 1 - Annexure A / A-1 / A-2 / B / B-1/C/D/E/F whichever is applicable. 2 - Treasury Challan number / date . DECLARATION I.S/o,D/o,W/o/.Status.[i.e. proprietor, director, partner etc. as provided in rule-32(6)], do hereby declare and verify that, to the best of my knowledge and belief all the statements and figures given in this return are true and complete and nothing has been willfully omitted or wrongly stated. Date Signature Place Status -

Total C- Total tax deposited (A+B)

-4-

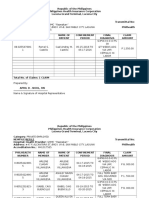

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV [See Rule-45(3) of the UPVAT Rules, 2008] .List (i) Name and address of purchasing dealer TIN Assessment year Tax period ending on d d m m y y y y

Annexure - A

of purchases made against tax invoice :

(ii) (iii)

Purchase in own account

(iv) Name and address of selling dealer TIN Taxinvoice No. Date of Tax invoice Description of commodity

Name Code Quantity / Measure

Part-I

Taxable value of goods Amount of tax charged. Total amount of taxinvoice

1 2 3 etc. Total :

Purchase in commission account

(iv) Name and address of selling dealer TIN Taxinvoice No. Date of Tax invoice Description of commodity

Name Code Quantity / Measure

Part-II

Taxable value of goods Amount of tax charged. Total amount of taxinvoice

1 2 3 etc. Total :

Name and signature of authorised person Date

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV

List of Purchase Returns.

(i) Name and address of purchasing dealer TIN Assessment year Name and address of selling dealer TIN Tax-invoice / Sale invoice/ Purchase invoice No. 4 Date Tax period ending on d d Taxable value of goods 8 m

Annexure A-1

(ii) (iii) (iv)

y Total (8+9)

Details of purchase returned

Name of commodity Quantity Amount of tax charged. 9

1 2 VAT goods 1 2 etc. Non VAT goods 1 2 etc.

10

Total :

Total : Quantity 11 VAT goods Taxable value of goods 12 Amount of Tax 13 Total (12+13) 14 Sl.no. of debit note issued 15 Date 16 Sl.no. of credit note received 17 Date 18

Non VAT goods

Total : (v) Taxable amount of goods returned which were purchased against Tax invoice (vi) Amount of Tax involved in such goods Rs Rs Name and signature of authorised person Date

-6-

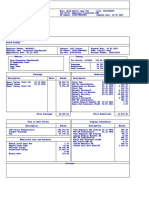

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV [See Rule-44(3) of the UPVAT Rules, 2007]

Annexure A-2

List of purchases of Capital goods made from within the State

(i) Name and address of purchasing dealer TIN Assessment year Name and address of selling dealer TIN Taxinvoice No. Date of Tax invoice Tax period ending on Description of commodity Name Quantity / Measure d d m m y y y y

(ii) (iii)

A-List of purchases of Capital goods made against tax invoice

Taxable value of goods Amount of tax charged. Total amount of taxinvoice

1 2 3 4 5 Total

B-List of purchases of Capital goods made from persons other than registered dealer

Description of commodity Name 1 2 3 4 5 Total Name and signature of authorised person Date Quantity / Measure Purchase invoice No. Date of Purchase invoice Taxable value of goods Amount of tax paid with return

-7-

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV (See Rule-45(3) of the UPVAT Rules, 2008)

Annexure - B

.List of sales made against tax invoice :

(i) Name and address of selling dealer TIN Assessment year Tax period ending on d d m m y y y y

(ii) (iii)

Sales in own account

(iv) Name and address of purchasing dealer TIN Taxinvoice No. Date of Tax invoice Description of commodity

Name Code Quantity / Measure

Part-I

Taxable value of goods Amount of tax charged. Total amount of taxinvoice

1 2 3 etc. Total :

Sales in commission account

(iv) Name and address of purchasing dealer TIN Taxinvoice No. Date of Tax invoice Description of commodity

Name Code Quantity / Measure

Part-II

Taxable value of goods Amount of tax charged. Total amount of taxinvoice

1 2 3 etc. Total : Name and signature of authorised person Date

-8-

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV

Annexure B-1

List of Sales Return.

(i) Name and address of selling dealer

(ii) (iii)

TIN Assessment year Tax period ending on d d m m y y y y

Details of sales returned

(iv) Name and address of selling dealer TIN Tax-invoice / Sale invoice/ Purchase invoice No 4 Date Name of commodity Quantity Taxable value of goods 8 Amount of tax charged. 9 Total (8+9)

1 2 VAT goods 1 2 Non VAT goods 1 2

10

Total :

Total : Taxable value of goods 12 Sl.no. of credit note issued 15 Sl.no. of debit note received 17

Quantity 11 VAT goods

Amount of Tax 13

Total (12+13) 14

Date 16

Date 18

Non VAT goods

Total

(v) Taxable amount of goods returned which were sold against Tax invoice Rs (vi) Amount of Tax charged on such goods Rs

Name and signature of authorised person Date

-9-

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV

Annexure - C

Taxable Amount

11

(Information to be furnished along with return of each tax-period in relation to purchases against Form-C) Sl. Name of No. the seller

1 2

TIN

Address

State

Purchase order no.

6

Purchase Invoice Invoice Description order date No. date of goods

7 8 9 10

CST

Total Invoice Value

13

Form-38 Purpose of purchase No. of goods (write code*)

14 15

12

1. 2. Total :

* Write 1 for resale, 2 for use in manufacture/ processing of goods for sale, 3 for mining, 4 for use in generation/ distribution of power, 5 for use in packing of goods for sale/resale and 6 for use in Telecommunication network.

Name and signature of authorised person Date

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV

Annexure - D

Details of RR/GR/Postal Date on which receipt any other the goods were document indicating the received by the means of transport transferee

(Information to be furnished along with return of each tax-period in relation to goods received from out side State against Form-F)

Sl. No. Name of the Consigner TIN Address State Details of challan / invoice/ other document under which the goods were sent Description of goods Quantity Value of Name of Railway or goods Station/ Post office/ weight Airport/ Transport Co.'s office from which the goods were dispatched

No. 1 1. 2. 2 3 4 5 6

Date 7 8

No. 12

Date 13 14

10

11

Total :

Name and signature of authorised person Date

- 10 -

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV

Annexure - E

Quantity Value

(Information to be furnished along with return of each tax-period in relation to purchases against Form-H) Sl. Name of the No. Seller

1 1. 2. Total : 2

TIN

Address

State

Purchase order No.

6

Purchase order date

7

Seller's bill/ Seller's Description Challan/ Cash bill/ Challan/ Cash of goods memo No. memo date

8 9 10

11

12

Details of Export Order/ Agreement No.

13

date

14

Name of airline/ Name of Airport/ Sea Details of consignment note/ port/ land customs Ship/ railway / goods bill of lading/ railway receipt station of export vehicle or other means or any other document in of export proof of export No Date

15 16 17 18

Description of goods exported

Total quantity of goods exported by the document referred to in column 17/18

20

Value of goods referred to in column 20

21

19

Total :

Name and signature of authorised person Date

Department of Commercial Taxes, Government of Uttar Pradesh

UPVAT - XXIV

Annexure - F

Invoice / Challan date.

9

(Information to be furnished along with return of each tax-period in relation to purchases against Form-I) Sl. No.

1 1. 2.

Name of the Seller

2

TIN

3

Address

4

State

5

Purchase order no

6

Purchase order date

7

Invoice / Challan no.

8

Description of goods

10

Value of goods

11

Total :

Name and signature of authorised person Date - 11 -

Potrebbero piacerti anche

- New Form 2550 M - Monthly VAT Return P 1-2Documento3 pagineNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDa EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNessuna valutazione finora

- Chapter-21 (Solved Past Papers of CA Mod CDocumento67 pagineChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- 2550MDocumento9 pagine2550MAngel AlfaroNessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNessuna valutazione finora

- Attendance and Punctuality PolicyDocumento4 pagineAttendance and Punctuality Policyrajiv29100% (3)

- Optus Australia Iphone XS 2018 PDFDocumento1 paginaOptus Australia Iphone XS 2018 PDFLavish Sood100% (1)

- Department of Commercial Taxes, Government of Uttar Pradesh: Upvat - XxivDocumento11 pagineDepartment of Commercial Taxes, Government of Uttar Pradesh: Upvat - Xxivpradeepji392Nessuna valutazione finora

- Upvat Xxvi-A Department of Commercial Taxes, Government of Uttar PradeshDocumento6 pagineUpvat Xxvi-A Department of Commercial Taxes, Government of Uttar PradeshShreya AgarwalNessuna valutazione finora

- Form - Xxvi: Department of Commercial Taxes, Government of Uttar PradeshDocumento14 pagineForm - Xxvi: Department of Commercial Taxes, Government of Uttar PradeshmgrfaNessuna valutazione finora

- Form Xxiv-A: 6A Taxpayer's PAN (Permanent Account Number)Documento3 pagineForm Xxiv-A: 6A Taxpayer's PAN (Permanent Account Number)Jayant SharmaNessuna valutazione finora

- Office of The Commissioner of Commercial Taxes: Orissa, CuttackDocumento17 pagineOffice of The Commissioner of Commercial Taxes: Orissa, CuttackJayant JoshiNessuna valutazione finora

- Mvat f231Documento5 pagineMvat f231pgotaphoeNessuna valutazione finora

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDocumento4 pagineComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- Form RT-II: Qua Rterly Statement Under Section 24 of The Bihar Value Added Tax Act, 2005Documento7 pagineForm RT-II: Qua Rterly Statement Under Section 24 of The Bihar Value Added Tax Act, 2005abhaysrNessuna valutazione finora

- CST Form 1Documento6 pagineCST Form 1Sarath Disha80% (5)

- Punjab Vat NoteDocumento12 paginePunjab Vat NoteSuraj SinghNessuna valutazione finora

- Form Jvat 409Documento2 pagineForm Jvat 409Suzanne BradyNessuna valutazione finora

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocumento4 pagineForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424Nessuna valutazione finora

- BAF 306 BAF 3 - Registration and DeregistrationDocumento18 pagineBAF 306 BAF 3 - Registration and Deregistrationyudamwambafula30Nessuna valutazione finora

- VAT Form 201 v1.0Documento27 pagineVAT Form 201 v1.0Bibhas KabiNessuna valutazione finora

- Form XxiiiDocumento2 pagineForm XxiiiJIYA KEJRIWALNessuna valutazione finora

- FORM 202: Popular EnterpriseDocumento4 pagineFORM 202: Popular Enterprisesam3461Nessuna valutazione finora

- Please Provide Us The Following Details:: Declarations For Transportation of GoodsDocumento4 paginePlease Provide Us The Following Details:: Declarations For Transportation of GoodsAarogyaBharadwajNessuna valutazione finora

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocumento4 pagineMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesNessuna valutazione finora

- Anf 5A Application Form For Epcg Authorisation IssueDocumento6 pagineAnf 5A Application Form For Epcg Authorisation IssueBaljeet SinghNessuna valutazione finora

- ASSESSEE PROFILE FORMAT BlankDocumento6 pagineASSESSEE PROFILE FORMAT BlankThanga Pandian SNessuna valutazione finora

- Form Lii ADocumento3 pagineForm Lii ARavi PathakNessuna valutazione finora

- New VAT Audit FormatDocumento12 pagineNew VAT Audit FormatparulshinyNessuna valutazione finora

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocumento9 pagineMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasAdriel Torreda NaturalNessuna valutazione finora

- Tnvat Form WW Fy 15-16Documento30 pagineTnvat Form WW Fy 15-16samaadhuNessuna valutazione finora

- 28689ipcc ST Vol1 cp7 PDFDocumento0 pagine28689ipcc ST Vol1 cp7 PDFGautam PradhanNessuna valutazione finora

- FAQ Invoice 2Documento4 pagineFAQ Invoice 2Niki MilaNessuna valutazione finora

- NNNDocumento4 pagineNNNJemely BagangNessuna valutazione finora

- Form Vat 240 Audited Statement of Accounts Under Section 31 (4) OF THE KVAT ACT, 2003 - CertificateDocumento5 pagineForm Vat 240 Audited Statement of Accounts Under Section 31 (4) OF THE KVAT ACT, 2003 - Certificatecharan srNessuna valutazione finora

- Dms TenderDocumento69 pagineDms TenderSunsmart SstplNessuna valutazione finora

- Value Added Taxes Part 2Documento15 pagineValue Added Taxes Part 2Deo CoronaNessuna valutazione finora

- Chapter 18 Spr. 24Documento12 pagineChapter 18 Spr. 24Asad HanifNessuna valutazione finora

- Monthly Value-Added Tax DeclarationDocumento17 pagineMonthly Value-Added Tax DeclarationMIRAHNELNessuna valutazione finora

- Statement of Submissin of Audit Report in Form-704Documento704 pagineStatement of Submissin of Audit Report in Form-704Suruchi Kejriwal GoyalNessuna valutazione finora

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasDocumento5 pagineQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloNessuna valutazione finora

- 38 Annexure 19Documento4 pagine38 Annexure 19ashwinrkghadgeNessuna valutazione finora

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocumento28 pagineInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNessuna valutazione finora

- Audit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryDocumento24 pagineAudit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryrockyrrNessuna valutazione finora

- Toshiba Vs CIRDocumento26 pagineToshiba Vs CIRivydeguzman12Nessuna valutazione finora

- G.R. No. 157594 March 9, 2010 Toshiba Information Equipment (Phils.), Inc., Petitioner, Commissioner of Internal Revenue, RespondentDocumento18 pagineG.R. No. 157594 March 9, 2010 Toshiba Information Equipment (Phils.), Inc., Petitioner, Commissioner of Internal Revenue, RespondentRJ MaligayaNessuna valutazione finora

- Vat Full CasesDocumento485 pagineVat Full CasesShiela MarieNessuna valutazione finora

- Vat AnnexuresDocumento11 pagineVat AnnexuresRanga ThiyagarajNessuna valutazione finora

- Lecture - Toshiba vs. CIRDocumento19 pagineLecture - Toshiba vs. CIRGilbert YapNessuna valutazione finora

- VALUE ADDED TAX ACT 1993 NO. 102, 1993.: - Laws - Subsidiary LegislationDocumento37 pagineVALUE ADDED TAX ACT 1993 NO. 102, 1993.: - Laws - Subsidiary LegislationKevin MonksNessuna valutazione finora

- G.R No.157594 FulltextDocumento41 pagineG.R No.157594 FulltextVerbena Daguinod - BalagatNessuna valutazione finora

- Toshiba vs. CIR - G.R. No. 157594, March 09, 2010Documento20 pagineToshiba vs. CIR - G.R. No. 157594, March 09, 2010Marian Dominique AuroraNessuna valutazione finora

- Form 704Documento704 pagineForm 704Dhananjay KulkarniNessuna valutazione finora

- EOU Audit ChecksDocumento5 pagineEOU Audit Checksశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNessuna valutazione finora

- Form-704 NewDocumento251 pagineForm-704 NewHusaina NasikwalaNessuna valutazione finora

- Cir V ToshibaDocumento9 pagineCir V ToshibaChanel GarciaNessuna valutazione finora

- GST Return Business Process For GSTDocumento72 pagineGST Return Business Process For GSTAccounting & Taxation100% (1)

- Definitions and Terms Reference To Sales Tax Act 1990Documento4 pagineDefinitions and Terms Reference To Sales Tax Act 1990Yasir FarooqNessuna valutazione finora

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Da EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Nessuna valutazione finora

- 2 - SAP - B1 QuestionDocumento16 pagine2 - SAP - B1 Questionrajiv29Nessuna valutazione finora

- CostingDocumento1 paginaCostingrajiv29Nessuna valutazione finora

- Falcon Apiontment Offer LetterDocumento2 pagineFalcon Apiontment Offer Letterrajiv29Nessuna valutazione finora

- Export Value DeclarationDocumento2 pagineExport Value Declarationrajiv29Nessuna valutazione finora

- SMUDE-Exam Result - DisplayDocumento1 paginaSMUDE-Exam Result - Displayrajiv29Nessuna valutazione finora

- Consumer Forum at KESCoDocumento1 paginaConsumer Forum at KESCorajiv29Nessuna valutazione finora

- Pembahasan Chapter 14Documento8 paginePembahasan Chapter 14Ai TanahashiNessuna valutazione finora

- IRSChange of AddressDocumento2 pagineIRSChange of AddressLynette SmithNessuna valutazione finora

- Sheet 1 Eca Rics Daywork Electrical April 2020Documento1 paginaSheet 1 Eca Rics Daywork Electrical April 2020ZzzdddNessuna valutazione finora

- Business Farm SupplementDocumento2 pagineBusiness Farm Supplementparth shuklaNessuna valutazione finora

- Essentials of Federal Taxation 3rd Edition Spilker Solutions ManualDocumento35 pagineEssentials of Federal Taxation 3rd Edition Spilker Solutions Manualxavialaylacs4vl4100% (26)

- First Lepanto Taisho Insurance Corporation vs. BirDocumento5 pagineFirst Lepanto Taisho Insurance Corporation vs. Birlaw mabaylabayNessuna valutazione finora

- Transmittal PhilhealthDocumento7 pagineTransmittal PhilhealthAnnette Aquino GuevarraNessuna valutazione finora

- Form-12BB FY 2021-22Documento2 pagineForm-12BB FY 2021-22Vinay JadhavNessuna valutazione finora

- 45Documento1 pagina45Nicola LendersNessuna valutazione finora

- TAXATIONDocumento2 pagineTAXATIONJoshua BrownNessuna valutazione finora

- Annexure IV Financial Bid Offer Letter To Be Given by The OwnerDocumento2 pagineAnnexure IV Financial Bid Offer Letter To Be Given by The OwneramareshluckyyNessuna valutazione finora

- HPCL Price List 16 - 10 - 21Documento1 paginaHPCL Price List 16 - 10 - 21Executive Engineer MylavaramNessuna valutazione finora

- Click Here For English Version: AVDPK3530D 2021-22 400162530310821Documento8 pagineClick Here For English Version: AVDPK3530D 2021-22 400162530310821Santoshi TanguduNessuna valutazione finora

- Unit 4 - Income From Capital GainsDocumento10 pagineUnit 4 - Income From Capital GainsAvin P RNessuna valutazione finora

- Opening My Account: Statement of AcceptanceDocumento6 pagineOpening My Account: Statement of AcceptanceMiroslav ŽivadinovićNessuna valutazione finora

- 620 Iova M SA100 11-12Documento16 pagine620 Iova M SA100 11-12Natalia Ciocirlan100% (1)

- 528419772Documento1 pagina528419772Hasib BillahNessuna valutazione finora

- Bogardus V CommissionerDocumento2 pagineBogardus V CommissionerPatrick Anthony Llasus-NafarreteNessuna valutazione finora

- Ranjan KumarDocumento2 pagineRanjan KumarRanjan KumarNessuna valutazione finora

- Module 8 - Inclusion of Gross IncomeDocumento4 pagineModule 8 - Inclusion of Gross IncomeReicaNessuna valutazione finora

- 15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176Documento1 pagina15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176DHANU DANGINessuna valutazione finora

- IRCTC Retiring RoomDocumento1 paginaIRCTC Retiring Roompavankumarannepu04Nessuna valutazione finora

- Met Loan & Life Suraksha - Sample Premium Rates UIN:117N080V01Documento6 pagineMet Loan & Life Suraksha - Sample Premium Rates UIN:117N080V01Sadasivuni007Nessuna valutazione finora

- ECON314 Nwu-Jun2022Documento17 pagineECON314 Nwu-Jun2022Mmabatho MosesiNessuna valutazione finora

- Invoice FormatsDocumento2 pagineInvoice FormatsVenu Madhav JNessuna valutazione finora

- Axis Bank LTD Payslip For The Month of May - 2021Documento2 pagineAxis Bank LTD Payslip For The Month of May - 2021Suman DasNessuna valutazione finora

- Chapter 8 - Income TaxesDocumento6 pagineChapter 8 - Income TaxesHaddy GayeNessuna valutazione finora

- Renunciation of InheritanceDocumento4 pagineRenunciation of InheritancemgeeNessuna valutazione finora