Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

100% FDI in Retail in India, Good or Bad

Caricato da

Arun BatraDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

100% FDI in Retail in India, Good or Bad

Caricato da

Arun BatraCopyright:

Formati disponibili

100% FDI in retail in India, good or bad...

November 28, 2011 11:19 AM Veeresh Malik

There is a lot to be said for big retail to come to India, but we cannot simply be taken in and mimic something which is being pushed down our throats because those who make the policy appear to not have the faintest clue on how retail really works in India If there were clear answers in black and white to the question, there would really be no need for any debate on the issue, but the truth is that it is simply not that simple. On a philosophical and emotional level, the answer could be that any form of foreign participation in a domestic market is rife with dangers of the colonialism sort, but in this day and age, while the core concept of being wary of foreign dominance may still be true, the fact remains that there are plenty of ways to ensure that it works on a win-win basis for all concerned. The main problem with the current status of foreign direct investment (FDI)in retail in India is that it does not provide a level playing field to other players of the domestic and small sort. In addition, it appears to take a rather naive and simplistic view on certain aspects, which like myths being repeated, tend to become urban legends. On the other hand, no country can afford to take on an isolationist approach. To start with, it may help to go through the background and policy note on the Cabinet decision on FDI in retail, as put up on various places on the internet. (Facebook, PIB) As this writer sees it, with a holistic view of the subject and not just based on jingoism of the burn down the malls (right view) and bad for farmers (left view) sort, but on rational evaluation of larger issues, there are some points which need to be straightened out. Large retail is inevitable, and that is a simple truth, but there has to be larger perspective for public good which seems to be missing from this policy. The people of India come first, including those who want a better product or service buying or selling experience, and at the end of the day it is their wallets which will decide where they go. But at the same time, the government, with the policy as outlined above, cannot sell the baby with the bath-water, and make things worse. Some suggestions: 1) The present Agriculture Produce Market Committee (APMC) Act requires urgent revamp if we really want to help the rural and agricultural sectors with a better go to market scenario. This, along with rapid introduction of the goods and services tax (GST) as well as ease of inter- and intra-state movement of foodgrain, agri products and fresh produce, would do more to improve matters, as well as do wonders for our economy in a variety of waysmost of all in terms of controlling prices as well as reducing storage and transit losses. 2) The policy shown above makes a case that brands by big FDI retailers need to be carried across borders without in any way making it clear that the quality of those brands needs to be same across

borders, too. As of now we see that with these manufacturers and retailers there is one lower quality for sale in India and there is a better quality for sale in developed countriescase in point being soft drinks, processed foods, confectionery, electronics, motor vehicles and others. If anything is by way of a different quality for India for price or other reasons, then let it be clearly marked as such. 3) Specifically in the case of packaged and processed foods, the policy does not say anything about adherence to best case scenarios in terms of labelling of ingredients and avoiding misleading marketing ploys, thereby leading to a situation where outright dangerous products are foisted on Indian consumers. The amount of product detail available for consumers in developed countries must be matched for India, too. India cannot become a vast chemistry lab for processed foods or anything else. 4) More empirical data needs to be provided on subjects like improvement in supply chain. India is the country where the passenger rail ticket deliveries, fresh hot cooked food by dabbawallas and diamonds as well as other precious stones by angadias have set better than global standards in supply chains, so the same standards need to be quantified and applied to those seeking 100% FDI in retail. It is not too much to ask for them to match the Indian standardsunless those who made the policy are ashamed of our prowess. 5) The investments in retail by the FDI route, when they come, should come only through a short-list of recognised tax adherence countries. The misused option of FDI coming in through known or suspect tax havens needs to be blockedfirmly. Likewise, full disclosures of the strictest sort need to be made on who the investors areagain, these cannot be suitcase corporate identities hiding behind consultants and banks in shady tax havens or other countries. Unlike what happened in, for example, airlines, Indians need to know who is investing and from where. And in case there are legal issues, then we need to know who the faces are who will go through the Indian legal system, unless those who made the policy are ashamed of our legal system. 6) The payment processing and cash management as well as tax adherence part of this industry, both in terms of procurement and sale, need to be through the Indian banking system. And by fully transparent methods, so that float as well as control remains in India at all times, as is the case in developed countries. Proprietary payment processing and cash management methods of the sort that take this control out of India need to be firmly deniedthe FDI retailer needs to be on a level playing field here with other Indian domestic retailersinsistence on co-opting RuPAY needs to be part of this policy. 7) Since such huge benefits are being provided to these FDI retailers by India, it must be imperative that these large retailers subscribe and adhere to the RTI Act of India 2005 from day one, along with their firstapplication. This will be in addition to all other requirements that other large retailers in India, like government controlled Canteen Stores Department (Armed Forces), Super Bazaar (ministry of urban development), central government and state government co-op stores, Khadi Bhandars, state emporia and others adhere toincluding best of breed hiring policies. 8) It appears that the policymakers subscribe to the view that more wastage is generated by the present retail system in India and that FDI will reduce wastage. Bearing in mind the huge problem that developed countries have with handling wastage especially of the packaging sort, it will be necessary to

quantify this wastage from the outset itself, instead of propagating further the myth that the Indian system generates more waste. And then control the said wastage, again, by defined means. 9) Supermarket design in India should be defined in such a way that fresh food and produce needs to be in front, unlike in other big box shops where it is right at the back or hidden along the sides, forcing people to walk through row after row of packaged and processed foods. This is very important if FDI in retail really means it when they say that they wish to bring the farmers produce to the customer with minimal transaction losses in between of the multiple middlemen sort. And finally, most importantly, 10) The big box FDI model in retail cannot be the reason to do away with the small shopkeeper earning his livelihood on the peripheries of the traditional marketplaces. The big retailer will have to, as policy, provide for space as well as timing to set up options like weekly haats and farmer's markets, either in parking lots or in specially designated stalls set aside for this. Certainly, there is a lot to be said for big retail to come to India, but we cannot simply be taken in and mimic something which is being pushed down our throats because those who make the policy appear to not have the faintest clue on how retail really works in India. The concept of big retail is inevitable, in some ways it is already there, but the way this present policy has been structured appears to be a sellout of the worst sortdesigned to destroy the nations core competencies in trading. It will be a shame, as well as a major electoral issue, if the present policy is permitted to proceed along its current path. Because it is wide open and visible that it appears that the present retail FDI policy of the present government is to try and make big retail the only port of call for both seller and buyer. That, most certainly, spells death for the countrys independence.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Sew Infrastructure 1 Ebs Case Study 214465Documento6 pagineSew Infrastructure 1 Ebs Case Study 214465Arun BatraNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Group12 Snooker CenterDocumento10 pagineGroup12 Snooker CenterArun Batra100% (2)

- HRM Assignment - Arun BatraDocumento7 pagineHRM Assignment - Arun BatraArun BatraNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- HRM Assignment - Arun BatraDocumento7 pagineHRM Assignment - Arun BatraArun BatraNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

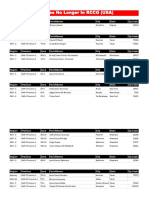

- Churches That Have Left RCCG 0722 PDFDocumento2 pagineChurches That Have Left RCCG 0722 PDFKadiri JohnNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Effect of Added Sodium Sulphate On Colour Strength and Dye Fixation of Digital Printed Cellulosic FabricsDocumento21 pagineEffect of Added Sodium Sulphate On Colour Strength and Dye Fixation of Digital Printed Cellulosic FabricsSumaiya AltafNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Account Intel Sample 3Documento28 pagineAccount Intel Sample 3CI SamplesNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Outline - Criminal Law - RamirezDocumento28 pagineOutline - Criminal Law - RamirezgiannaNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Science Project FOLIO About Density KSSM Form 1Documento22 pagineScience Project FOLIO About Density KSSM Form 1SarveesshNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Conceptual Diagram of Ways To Increase SalesDocumento1 paginaConceptual Diagram of Ways To Increase SalesO6U Pharmacy RecordingsNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- CHIR12007 Clinical Assessment and Diagnosis Portfolio Exercises Week 5Documento4 pagineCHIR12007 Clinical Assessment and Diagnosis Portfolio Exercises Week 5api-479849199Nessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hydraulics Experiment No 1 Specific Gravity of LiquidsDocumento3 pagineHydraulics Experiment No 1 Specific Gravity of LiquidsIpan DibaynNessuna valutazione finora

- Scientific Errors in The QuranDocumento32 pagineScientific Errors in The QuranjibranqqNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Mathematics Into TypeDocumento114 pagineMathematics Into TypeSimosBeikosNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- What Is SCOPIC Clause - A Simple Overview - SailorinsightDocumento8 pagineWhat Is SCOPIC Clause - A Simple Overview - SailorinsightJivan Jyoti RoutNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Genomics - FAODocumento184 pagineGenomics - FAODennis AdjeiNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Ollie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Documento2 pagineOllie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Scribd Government DocsNessuna valutazione finora

- Vce Smart Task 1 (Project Finance)Documento7 pagineVce Smart Task 1 (Project Finance)Ronak Jain100% (5)

- Matthew DeCossas SuitDocumento31 pagineMatthew DeCossas SuitJeff NowakNessuna valutazione finora

- Jaimini Astrology and MarriageDocumento3 pagineJaimini Astrology and MarriageTushar Kumar Bhowmik100% (1)

- Materials System SpecificationDocumento14 pagineMaterials System Specificationnadeem shaikhNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Adverbs Before AdjectivesDocumento2 pagineAdverbs Before AdjectivesJuan Sanchez PrietoNessuna valutazione finora

- Project Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantDocumento40 pagineProject Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantTefera AsefaNessuna valutazione finora

- Harvard ReferencingDocumento7 pagineHarvard ReferencingSaw MichaelNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- DLL LayoutDocumento4 pagineDLL LayoutMarife GuadalupeNessuna valutazione finora

- Debarchana TrainingDocumento45 pagineDebarchana TrainingNitin TibrewalNessuna valutazione finora

- Karnu: Gbaya People's Secondary Resistance InspirerDocumento5 pagineKarnu: Gbaya People's Secondary Resistance InspirerInayet HadiNessuna valutazione finora

- RESO NO. 4 - LANYARD FinalDocumento1 paginaRESO NO. 4 - LANYARD FinalsharonleefulloNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Government by Algorithm - Artificial Intelligence in Federal Administrative AgenciesDocumento122 pagineGovernment by Algorithm - Artificial Intelligence in Federal Administrative AgenciesRone Eleandro dos SantosNessuna valutazione finora

- Grammar For TOEFLDocumento23 pagineGrammar For TOEFLClaudia Alejandra B0% (1)

- Lista Agentiilor de Turism Licentiate Actualizare 16.09.2022Documento498 pagineLista Agentiilor de Turism Licentiate Actualizare 16.09.2022LucianNessuna valutazione finora

- Ain Tsila Development Main EPC Contract A-CNT-CON-000-00282: Visual Inspection Test Procedure B-QAC-PRO-210-39162Documento14 pagineAin Tsila Development Main EPC Contract A-CNT-CON-000-00282: Visual Inspection Test Procedure B-QAC-PRO-210-39162ZaidiNessuna valutazione finora

- Psychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFDocumento56 paginePsychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFdiemdac39kgkw100% (9)

- DMSCO Log Book Vol.25 1947Documento49 pagineDMSCO Log Book Vol.25 1947Des Moines University Archives and Rare Book RoomNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)