Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Maxim Afanasyev (2010) Service Provider Competition - Delay Cost Structure-Segmentation and Cost Advantage

Caricato da

Ramesh K T GowdaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Maxim Afanasyev (2010) Service Provider Competition - Delay Cost Structure-Segmentation and Cost Advantage

Caricato da

Ramesh K T GowdaCopyright:

Formati disponibili

MANUFACTURING & SERVICE

OPERATIONS MANAGEMENT

Vol. 12, No. 2, Spring 2010, pp. 213235

issn1523-4614[ eissn1526-5498[ 10[ 1202[ 0213

informs

doi 10.1287/msom.1090.0266

2010 INFORMS

Service Provider Competition: Delay Cost Structure,

Segmentation, and Cost Advantage

Maxim Afanasyev, Haim Mendelson

Graduate School of Business, Stanford University, Stanford, California 94305

{mafanasyev@mafanasyev.com, haim@stanford.edu}

W

e model competition between two providers who serve delay-sensitive customers. We compare a gen-

eralized delay cost structure, where a customers delay cost depends on her service valuation, with the

traditional additive delay cost structure, where the delay cost is independent of the customers service valua-

tion. Under the additive delay cost structure, service providers offer different prices and expected delays, but

customers are indifferent between the providers. Under the generalized delay cost structure, when the providers

have different capacity or operating costs, we obtain value-based market segmentation, whereby higher-value

customers choose one provider and lower-value customers choose the other. We study how the delay cost

parameters, the market size, and the service providers costs affect the structure of the equilibrium.

Key words: delay cost structure; value-based market segmentation; service competition

History: Received: May 23, 2008; accepted: March 22, 2009. Published online in Articles in Advance

September 14, 2009.

1. Introduction

In this paper we model competition between service

providers when their customers are sensitive to delay.

Our primary focus is on how the customers delay

cost structure and the asymmetry in the providers

costs affect the market equilibria. In most previous

research, customers were assumed to have an addi-

tive delay cost structure. In reality, however, we often

observe interdependence between customers service

valuations and their delay costs. We argue that this

interdependence gives rise to major changes both in

the structure of the market equilibrium and in the

levels of arrival rates, prices, and service capacities.

We show how the delay cost structure, market size,

and differences between the providers costs (capacity

costs or variable costs of providing the service) affect

service differentiation and market segmentation.

The assumption of an additive delay cost structure,

which is common in the literature on the economics

of congestion and delay, is reasonable in a variety of

settings. This assumption means that the cost of delay

is independent of the customers service valuation.

This would be the case, for example, if the delay cost

reects merely productivity losses or the value of lost

time, regardless of the nature of the service provided.

Consider, for example, the case of auto repair. While a

customer is waiting for her car to be repaired, she may

be using a rental car or public transportation. Thus,

her expected delay cost may be approximated by the

product of the expected number of days needed to

repair the car by the daily loss, the latter reect-

ing the value of lost time and the costs of alterna-

tive transportation.

1

Assume that this daily loss is

not related to the value of the repair service.

2

Then,

if a repair facility repairs the car a day faster (on

average) than its competitor but charges a premium

equal to the expected daily loss, all customers will be

indifferent between the competing facilities. Although

the repair facilities are differentiated (offering differ-

ent prices and expected delays), there is no market

segmentation.

However, there are numerous situations where the

delay cost and the value of service are interdepen-

dent. In electronic brokerage, for example, a delay in

1

Other opportunity costs of time may also be included in the daily

loss.

2

Across customers, the value of the repair service could be pos-

itively correlated with the daily loss, because higher-income cus-

tomers tend to have both higher opportunity costs and more

expensive cars.

213

Afanasyev and Mendelson: Service Provider Competition

214 Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS

trade execution deates the investors expected prot,

and customers who trade frequently are willing to

pay a larger premium for fast execution. Thus, there is

a positive relationship among an investors frequency

of trading, the total amount traded, and the delay cost

she incurs over, for example, a year, which creates an

interdependence between the value of the brokerage

service to the customer and her delay cost. A similar

relationship holds when the cost of execution delay is

proportional to the trading volume at the transaction

level (see Dewan and Mendelson 1998, 2001). Indeed,

major electronic brokerage rms (e.g., Ameritrade,

E*TRADE, and Scottrade) prominently advertise their

average or median execution speeds, and brokerages

that target frequent traders bear the additional costs

of colocating their servers inside the exchanges to

reduce delays (Martin and Malykhina 2007). In hospi-

tals, patients may incur a delay of weeks waiting for

surgery, and the longer the surgical delay, the higher

the mortality rate (Weller et al. 2005). We expect that

for patients in poor health, surgery is particularly

critical and they will suffer from a delay more than

patients whose condition is not as severe, implying

that the value of service and the delay cost are inter-

dependent. In online video streaming, transmission

delays affect the quality of the content viewed by the

customer. The higher the content quality, the more a

customer suffers if there are data transmission delays.

Thus, the delay cost is interdependent with the value

of the content to the customer.

Product development provides another example

of interdependence between service valuations and

delay costs. Adler et al. (1995) show that product

development can be modeled as a queue of projects

sharing common resources. While waiting in the

queue, new products become less attractive because

of changes in the marketplace and the competition.

A longer development lead time may result in a

loss of market leadership, a decrease in potential

revenue, and lower sales, as customers needs change

over time (see Takeuchi and Nonaka 1986, Stalk

1988, Gupta and Wilemon 1990, Mabert et al. 1992,

Millson et al. 1992). Gupta and Wilemon (1990) nd

that a six-month delay in the market introduction of

a high-tech product reduces average prot by 33%

over ve years. In the auto industry, the larger the

market potential for a new car model, the larger

the revenue loss resulting from model introduction

delays. Some well-known examples of companies

that achieved competitive advantage by reducing

their new product development times include

Toyotas introduction of the Prius, Sun Microsystems

in the workstation market, Sony in the CD market,

and Samsung in memory chips and LCD televisions

in the 2000s (Stalk and Hout 1990, Clark et al. 1987,

Smith and Reinertsen 1998, Sun et al. 2004).

In this paper we study how the delay cost structure

affects the competition between service providers and

the resulting market structure. In particular, we dis-

tinguish between service differentiation and market

segmentation (see Smith 1956, Fradera 1986). Whereas

the additive delay cost structure results in differen-

tiated services, interdependence between service val-

uations and delay costs leads to value-based market

segmentation. We give the following denitions.

Service differentiation occurs when at least one

rms services are different from those offered by its

competitor(s).

Market segmentation requires that, in addition, the

market is divided into customer segments so that

the customers in at least one segment strictly pre-

fer the services offered by one rm over the services

offered by its competitor(s).

Under service differentiation, (some) rms offer dif-

ferent service variants, typically at different prices,

but customers may be indifferent between these

alternative offerings. Under market segmentation,

different service variants attract different customer

segments. This means that some customers have a

strict preference for one rms offering. The segmen-

tation is value based if the customers are segmented

based on their valuations of the service.

We consider two competing service providers

whose customers are sensitive to delay. We model

interdependent service valuations and delay costs

using the generalized delay cost structure proposed

by Afeche and Mendelson (2004), which allows for

both additive and multiplicative delay cost compo-

nents. Earlier work assumed that customers util-

ity was additive in value and delay cost, namely

u(U, |) =U D(|), where U is the gross utility absent

delay, | is the delay in the system, equal to the sum

of the waiting time in the queue and the service

time, D(|) =d | is the expected delay cost, and u is

Afanasyev and Mendelson: Service Provider Competition

Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS 215

the customers expected net utility. Under the gen-

eralized delay cost structure, the expected utility is

u(U, |) = (|) U D(|), where (|) is a decreasing

function that deates the customers value for the

service. Each customer is self-interested and maxi-

mizes her own expected utility, which she forecasts

using the distribution of the steady-state delay; i.e.,

||u(U, |)] = ||(|) U D(|)]. In the linear case,

D(|) =d | and (|) =1 . |, so the expected utility

equals ||u(U, |)] =U (1.W) dW, where W is the

expected delay in the system.

We nd that the equilibrium is characterized by ser-

vice differentiation. Say one rm provides fast ser-

vice and charges a higher price and the other offers

slow service at a lower price. In addition, when the

service valuations and delay costs are interdependent

and the providers costs (capacity costs or operat-

ing costs) are asymmetric, we nd value-based mar-

ket segmentation into a high- and low-end customer

segment. We study how the delay sensitivity param-

eters and the total market size affect measures of

service differentiation and market segmentation. We

nd that an increase in the multiplicative delay sen-

sitivity affects service differentiation nonmonotoni-

cally and increases the level of market segmentation.

Growth in the total market size decreases both the

degrees of service differentiation and market segmen-

tation until they disappear at the limit.

Our results on value-based market segmentation

are consistent with what we observe in a number of

markets where customers are sensitive to delay. One

example is public transportation in the San Francisco

Bay Area, where Viton (1981) nds that the value of

service and the delay cost are interdependent. Con-

sidering the competition between bus service and the

Bay Area Rapid Transit system (BART), Viton (1981)

nds that the systems differentiate their services in

terms of delay, with BART having a lower average

delay than the bus system and charging a higher

fare. Viton (1981) further nds value-based market

segmentation, with BART focusing on wealthier cus-

tomers and the bus system targeting the lower-income

population.

Mortgage loan origination is another service ex-

hibiting both an interdependence between delay cost

and service value and value-based market segmen-

tation. The longer a customer waits for mortgage

approval, the more the home price and interest rates

uctuate and the higher the probability that the deal

will fall through before the loan is approved. Also,

the higher the home price, the greater the loss, so

the delay cost and the value of the origination ser-

vice are interdependent. In 1986, Citicorp launched

MortgagePower, a computer-based loan origination

system that dramatically reduced Citicorps mortgage

origination delay. In turn, Citicorp charged customers

higher processing fees, so its service was differenti-

ated by less delay and a higher price. Citicorp tar-

geted customers who borrowed larger amounts and

provided faster service in return for higher fees (Hess

and Kremer 1994, Stalk and Hout 1990). In con-

trast, traditional loan originators charged lower fees

and served lower-end customers whose loans were

smaller. A similar segmentation relating morgtgage

loan amounts, service fees, and average delay is

found by Guttentag (2001).

In the decorative laminates industry, customers

service values and delay costs are interdependent

because the disutility of construction delay is larger

for residential cabinetmakers and commercial speci-

cation customers, who typically work on expensive

projects, than for original equipment manufacturer

(OEM) direct purchasers. Accordingly, the former

are willing to pay a premium for fast delivery.

The industry has two major product offeringsfaster

but more expensive and slower but cheaperand is

also characterized by value-based market segmenta-

tion, with Ralph Wilsonart providing faster service to

residential cabinetmakers and commercial specica-

tion customers, and slower Formica dominating the

price-sensitive OEM segment (Stalk and Hout 1990,

Hamilton 2007, Feldman 2007).

In work under way, Afanasyev and Mendelson

(2009) consider movie production in Hollywood as a

special case of new product development. They esti-

mate the delay costs associated with this process and

show that value and delay cost are interdependent.

They then show how the market for studios is seg-

mentated based on movies market potential, with the

faster studios producing movies with higher expected

box ofce revenues. They also show that the lead time

in introducing movies into foreign markets exhibits

similar characteristics.

Afanasyev and Mendelson: Service Provider Competition

216 Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS

The remainder of this paper is organized as follows.

We review the literature in 2. Section 3 considers

our benchmark, additive delay cost model. In 4 we

study the effects of the generalized delay cost struc-

ture. In 5 and 6 we study the effects of market size

and differences in operating costs, and 7 offers our

concluding remarks.

2. Literature Review

In this section, we review the literature on delay sensi-

tivity and service provider (S) competition. Numerous

papers study markets with delay-sensitive customers

(see Hassin and Haviv 2002). Most of these papers

assume a discrete number of classes and consider the

optimal pricing or scheduling of services, or both,

among the classes, sometimes subject to incentive

compatibility constraints. Table 1 summarizes the lit-

erature on the effects of competition on queueing sys-

tems; we focus here on the rst four papers, which are

closest to ours. Unlike our model, capacity is exoge-

nous and service valuations are constant in Chen

and Wan (2003) and So (2000), service providers are

symmetric in Chen and Wan (2005), and in all four

models the service providers engage in price compe-

tition. Chen and Wan (2003) study how the market

structure changes as a function of market size. For a

small total arrival rate, the market is dominated by

one of the providers. As the arrival rate increases,

there is a unique equilibrium with both rms in the

market, and then no equilibrium, followed by a con-

tinuum of equilibria and nally, a noncompetitive

market. In a model with endogenous service capaci-

ties, Chen and Wan (2005) nd that although some of

the irregular equilibria in Chen and Wan (2003) are

eliminated, for a large market size there is a contin-

uum of equilibria. In contrast, we nd a more regular

effect of market size on market structure under our

model.

Cachon and Harker (2002) derive conditions under

which two competing service providers exist in the

market and study how scale economies affect the mar-

ket equilibrium. They nd that the lower-cost S may

have a higher market share as well as a higher price.

They also show that the full price (service fee plus

delay cost) is an increasing function of the operating

and capacity costs. To answer their research questions,

Cachon and Harker (2002) need not explicitly model

customer choice as we do. Unlike Cachon and Harker

(2002), where the rms choose prices and waiting

times and the capacities adjust in equilibrium, in our

model rms choose capacities and arrival rates and

prices adjust in equilibrium. This enables us to prove

the existence of an equilibrium.

In So (2000), heterogenous rms with exogenous

capacities compete by announcing their prices and

delivery time guarantees, again unlike our model.

The market has a xed size and all customers are

served, so each rm serves a portion of the market.

The lower a providers price and delivery time guar-

antee, the higher its market share. So (2000) nds that

providers exploit their relative advantage to differen-

tiate their services; e.g., the high-capacity S will offer

better time guarantees, whereas the lower-operating-

cost S charges a lower price.

The equilibria in Chen and Wan (2003) and So

(2000) are characterized by service differentiation but

no market segmentation, with one S offering shorter

delays and charging a price premium and the other

offering a longer delay and a lower price that exactly

offsets each customers delay cost savings. In Chen

and Wan (2005), there is no service differentiation (the

providers are symmetric), and in Cachon and Harker

(2002), there is service differentiation, but the underly-

ing customer choices are not specied in the demand

model.

With the exception of this paper, all the papers in

Table 1 that specify a delay cost structure assume

the additive cost structure, which (as we show) is

an important driver of the equilibria they obtain. To

date, few papers have considered a delay cost struc-

ture that is not additive, and none of them (to our

knowledge) studied the effects of competition. Afeche

and Mendelson (2004) present a generalized delay

cost structure and apply it to a single service facility

that has a xed capacity. They compare the revenue-

maximizing and socially optimal equilibria for a pri-

ority queue and show that some classical results may

not hold under the generalized delay cost structure.

3

They also compare the effects of bidding strategies

to uniform pricing under the generalized delay cost

3

For example, the classical results that the revenue-maximizing

admission price is higher than the socially optimal price, and the

revenue-maximizing use is lower than the socially optimal use.

Afanasyev and Mendelson: Service Provider Competition

Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS 217

T

a

b

l

e

1

C

o

m

p

a

r

i

s

o

n

o

f

T

h

i

s

P

a

p

e

r

t

o

t

h

e

R

e

l

e

v

a

n

t

L

i

t

e

r

a

t

u

r

e

S

t

u

d

y

S

e

r

v

i

c

e

p

r

o

v

i

d

e

r

s

S

e

r

v

i

c

e

p

r

o

v

i

d

e

r

d

e

c

i

s

i

o

n

s

S

e

r

v

i

c

e

v

a

l

u

a

t

i

o

n

s

D

e

l

a

y

c

o

s

t

s

t

r

u

c

t

u

r

e

R

e

s

e

a

r

c

h

q

u

e

s

t

i

o

n

s

/

R

e

s

u

l

t

s

S

o

(

2

0

0

0

)

A

a

s

y

m

m

e

t

r

i

c

P

r

i

c

e

,

t

i

m

e

g

u

a

r

a

n

t

e

e

D

e

m

a

n

d

b

a

s

e

d

o

n

p

r

i

c

e

,

t

i

m

e

g

u

a

r

a

n

t

e

e

s

N

o

t

a

p

p

l

i

c

a

b

l

e

(

t

i

m

e

g

u

a

r

a

n

t

e

e

m

o

d

e

l

)

F

i

n

d

s

t

h

a

t

p

r

o

v

i

d

e

r

s

e

x

p

l

o

i

t

t

h

e

i

r

c

a

p

a

c

i

t

y

a

d

v

a

n

t

a

g

e

t

o

d

i

f

f

e

r

e

n

t

i

a

t

e

t

h

e

i

r

p

r

i

c

e

s

a

n

d

s

e

r

v

i

c

e

s

,

a

n

d

s

t

u

d

i

e

s

d

e

t

e

r

m

i

n

a

n

t

s

o

f

e

q

u

i

l

i

b

r

i

u

m

p

r

i

c

e

s

C

a

c

h

o

n

a

n

d

H

a

r

k

e

r

(

2

0

0

2

)

2

a

s

y

m

m

e

t

r

i

c

P

r

i

c

e

,

d

e

l

a

y

D

e

m

a

n

d

f

u

n

c

t

i

o

n

A

d

d

i

t

i

v

e

F

i

n

d

t

h

a

t

s

c

a

l

e

e

c

o

n

o

m

i

e

s

i

n

c

r

e

a

s

e

i

n

c

e

n

t

i

v

e

s

t

o

o

u

t

s

o

u

r

c

e

a

n

d

t

h

e

l

o

w

e

r

-

c

o

s

t

S

h

a

s

h

i

g

h

e

r

m

a

r

k

e

t

s

h

a

r

e

a

n

d

h

i

g

h

e

r

p

r

i

c

e

C

h

e

n

a

n

d

W

a

n

(

2

0

0

3

)

2

a

s

y

m

m

e

t

r

i

c

P

r

i

c

e

C

o

n

s

t

a

n

t

A

d

d

i

t

i

v

e

S

t

u

d

y

h

o

w

m

a

r

k

e

t

s

i

z

e

a

f

f

e

c

t

s

m

a

r

k

e

t

s

t

r

u

c

t

u

r

e

C

h

e

n

a

n

d

W

a

n

(

2

0

0

5

)

2

s

y

m

m

e

t

r

i

c

P

r

i

c

e

,

c

a

p

a

c

i

t

y

C

o

n

s

t

a

n

t

A

d

d

i

t

i

v

e

S

t

u

d

y

h

o

w

m

a

r

k

e

t

s

i

z

e

a

f

f

e

c

t

s

m

a

r

k

e

t

s

t

r

u

c

t

u

r

e

L

u

s

k

i

(

1

9

7

6

)

,

L

e

v

h

a

r

i

a

n

d

L

u

s

k

i

(

1

9

7

8

)

2

s

y

m

m

e

t

r

i

c

P

r

i

c

e

C

o

n

s

t

a

n

t

A

d

d

i

t

i

v

e

/

h

e

t

e

r

o

g

e

n

e

o

u

s

C

o

n

d

i

t

i

o

n

s

f

o

r

s

e

r

v

i

c

e

d

i

f

f

e

r

e

n

t

i

a

t

i

o

n

R

e

i

t

m

a

n

(

1

9

9

1

)

A

s

y

m

m

e

t

r

i

c

P

r

i

c

e

,

c

a

p

a

c

i

t

y

C

o

n

s

t

a

n

t

A

d

d

i

t

i

v

e

/

h

e

t

e

r

o

g

e

n

e

o

u

s

C

o

n

d

i

t

i

o

n

s

f

o

r

s

e

r

v

i

c

e

d

i

f

f

e

r

e

n

t

i

a

t

i

o

n

L

o

c

h

(

1

9

9

1

)

2

s

y

m

m

e

t

r

i

c

T

w

o

m

o

d

e

l

s

:

(

1

)

p

r

i

c

e

;

(

2

)

p

r

i

c

e

a

n

d

c

a

p

a

c

i

t

y

H

e

t

e

r

o

g

e

n

e

o

u

s

A

d

d

i

t

i

v

e

C

o

n

d

i

t

i

o

n

s

f

o

r

a

s

y

m

m

e

t

r

i

c

e

q

u

i

l

i

b

r

i

a

D

e

n

e

c

k

e

r

e

a

n

d

P

e

c

k

(

1

9

9

5

)

A

s

y

m

m

e

t

r

i

c

P

r

i

c

e

,

c

a

p

a

c

i

t

y

C

o

n

s

t

a

n

t

N

o

t

s

p

e

c

i

e

d

S

t

u

d

y

e

x

i

s

t

e

n

c

e

o

f

e

q

u

i

l

i

b

r

i

u

m

L

e

d

e

r

e

r

a

n

d

L

i

(

1

9

9

7

)

L

a

r

g

e

A

,

a

s

y

m

m

e

t

r

i

c

S

c

h

e

d

u

l

i

n

g

p

o

l

i

c

y

D

e

m

a

n

d

f

u

n

c

t

i

o

n

N

o

t

s

p

e

c

i

e

d

S

h

o

w

t

h

a

t

l

o

w

e

r

-

c

o

s

t

a

n

d

l

o

w

e

r

-

v

a

r

i

a

b

i

l

i

t

y

S

h

a

v

e

l

a

r

g

e

r

m

a

r

k

e

t

s

h

a

r

e

,

h

i

g

h

e

r

c

a

p

a

c

i

t

y

u

t

i

l

i

z

a

t

i

o

n

,

a

n

d

h

i

g

h

e

r

p

r

o

t

s

G

i

b

b

e

n

s

e

t

a

l

.

(

2

0

0

0

)

2

s

y

m

m

e

t

r

i

c

P

r

i

c

e

,

o

p

t

i

o

n

t

o

c

r

e

a

t

e

s

u

b

n

e

t

w

o

r

k

C

o

n

s

t

a

n

t

A

d

d

i

t

i

v

e

/

h

e

t

e

r

o

g

e

n

e

o

u

s

F

i

n

d

t

h

a

t

u

n

d

e

r

c

o

m

p

e

t

i

t

i

o

n

w

i

t

h

t

w

o

c

l

a

s

s

e

s

,

e

a

c

h

S

f

o

c

u

s

e

s

o

n

l

y

o

n

o

n

e

c

l

a

s

s

A

r

m

o

n

y

a

n

d

H

a

v

i

v

(

2

0

0

3

)

2

s

y

m

m

e

t

r

i

c

P

r

i

c

e

C

o

n

s

t

a

n

t

w

i

t

h

i

n

e

a

c

h

o

f

t

w

o

c

u

s

t

o

m

e

r

c

l

a

s

s

e

s

A

d

d

i

t

i

v

e

w

i

t

h

i

n

e

a

c

h

c

l

a

s

s

A

n

a

l

y

z

e

c

o

m

p

e

t

i

t

i

o

n

a

n

d

n

d

s

e

r

v

i

c

e

d

i

f

f

e

r

e

n

t

i

a

t

i

o

n

A

l

l

o

n

a

n

d

F

e

d

e

r

g

r

u

e

n

(

2

0

0

6

)

2

,

d

i

f

f

e

r

e

n

t

m

a

r

g

i

n

a

l

c

o

s

t

s

T

h

r

e

e

m

o

d

e

l

s

:

(

1

)

p

r

i

c

e

,

(

2

)

c

a

p

a

c

i

t

y

,

(

3

)

s

i

m

u

l

t

a

n

e

o

u

s

p

r

i

c

e

a

n

d

c

a

p

a

c

i

t

y

D

e

m

a

n

d

f

u

n

c

t

i

o

n

N

o

t

s

p

e

c

i

e

d

F

i

n

d

t

h

a

t

o

u

t

s

o

u

r

c

i

n

g

(

s

e

r

v

i

c

e

p

o

o

l

i

n

g

)

i

s

b

e

n

e

c

i

a

l

A

l

l

o

n

a

n

d

F

e

d

e

r

g

r

u

e

n

(

2

0

0

7

)

2

a

s

y

m

m

e

t

r

i

c

T

h

r

e

e

m

o

d

e

l

s

:

(

1

)

d

e

l

a

y

f

o

l

l

o

w

e

d

b

y

p

r

i

c

e

,

(

2

)

p

r

i

c

e

f

o

l

l

o

w

e

d

b

y

d

e

l

a

y

,

(

3

)

s

i

m

u

l

t

a

n

e

o

u

s

p

r

i

c

e

a

n

d

d

e

l

a

y

D

e

m

a

n

d

f

u

n

c

t

i

o

n

N

o

t

s

p

e

c

i

e

d

C

o

m

p

a

r

e

t

h

e

t

h

r

e

e

m

o

d

e

l

s

,

s

h

o

w

i

n

g

t

h

a

t

m

o

d

e

l

1

l

e

a

d

s

t

o

h

i

g

h

e

s

t

w

a

i

t

i

n

g

t

i

m

e

a

n

d

l

o

w

e

s

t

p

r

i

c

e

s

P

e

k

g

u

n

e

t

a

l

.

(

2

0

0

8

)

2

a

s

y

m

m

e

t

r

i

c

P

r

i

c

e

,

l

e

a

d

t

i

m

e

(

c

e

n

t

r

a

l

i

z

e

d

v

s

.

d

e

c

e

n

t

r

a

l

i

z

e

d

)

D

e

m

a

n

d

f

u

n

c

t

i

o

n

A

d

d

i

t

i

v

e

S

t

u

d

y

e

f

f

e

c

t

s

o

f

d

e

c

e

n

t

r

a

l

i

z

a

t

i

o

n

o

n

p

r

i

c

e

a

n

d

l

e

a

d

-

t

i

m

e

d

e

c

i

s

i

o

n

s

T

h

i

s

p

a

p

e

r

2

a

s

y

m

m

e

t

r

i

c

A

r

r

i

v

a

l

r

a

t

e

a

n

d

c

a

p

a

c

i

t

y

H

e

t

e

r

o

g

e

n

e

o

u

s

/

d

e

m

a

n

d

f

u

n

c

t

i

o

n

G

e

n

e

r

a

l

i

z

e

d

E

f

f

e

c

t

s

o

f

g

e

n

e

r

a

l

i

z

e

d

d

e

l

a

y

c

o

s

t

s

t

r

u

c

t

u

r

e

;

c

o

n

d

i

t

i

o

n

s

f

o

r

a

n

d

i

m

p

l

i

c

a

t

i

o

n

s

o

f

m

a

r

k

e

t

s

e

g

m

e

n

t

a

t

i

o

n

Afanasyev and Mendelson: Service Provider Competition

218 Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS

structure. Katta and Sethuraman (2005) consider a

queue with priorities and customers with a gener-

alized delay cost structure. They propose an algo-

rithm that sorts customers into priority groups to

maximize the revenues of a monopoly. Kalvenes and

Keon (2007) consider an M/M/m loss system and

customers with a multiplicative delay cost structure

and propose a mechanism to reallocate customer ser-

vice times from periods when the system is highly

congested to periods when it is less congested. Our

paper studies the effects of interdependence between

customers service valuations and delay costs on S

competition. We show that when the delay cost and

service valuations are interdependent and the rms

costs are different, the equilibria must be character-

ized by value-based market segmentation.

3. Basic Model

We start with a traditional model of competition

between two Ss who serve customers with heteroge-

neous service valuations that are subject to an addi-

tive delay cost. We rst present our model of user

behavior and then proceed with a description of the

rms and the competition between them. This model

forms a foundation for the analyses that follow.

3.1. User Behavior

We rst present the underlying user behavior model

for a single system with no delays. Potential cus-

tomers arrive following a Poisson process with rate A.

The values they derive from receiving the ser-

vice when there is no delay are modeled as an

independent and identically distributed (i.i.d.) sam-

ple from a random variable U with cumulative dis-

tribution function (c.d.f.) . The probability that an

arriving customer values the service at or higher is

() =1 (). If only customers who value the ser-

vice at or higher join the system, the effective arrival

rate is \ = A

(), which gives rise to the inverse

demand function =

1

(\,A), or V

/

(\) =

1

(\,A)

(see Mendelson 1985, Dewan and Mendelson 1990),

where V(\) is the expected total value created for

users per unit of time when the (effective) arrival rate

is \, and V

/

(\) is the corresponding marginal value,

which is also equal to the cutoff value . Given the

c.d.f. , we can calculate V(\) and V

/

(\), the demand

curve when there is no delay.

Example. Let the distribution of consumer values

U be uniform on |0, 100] and the total arrival rate be

A = 300. Then the expected number of arriving cus-

tomers with service valuations above per unit of

time equals 300 Pr{U ], which gives rise to the

linear demand curve

V

/

(\) =100 \,3. (1)

We use this demand curve in our numerical examples

throughout the paper.

We assume that V

/

(\) is strictly decreasing, cor-

responding to the usual assumption of a monotone

decreasing demand curve, i.e.,

V

//

(\) -0 for \ 0, (2)

and that

V

//

(\

1

\

2

) \

1

V

///

(\

1

\

2

) -0 for \

1

, \

2

0. (3)

Assumption (3) is needed to ensure that the rms

prot functions are supermodular and is satised

by the commonly used linear V

/

(\) = o p\ (o >0,

p >0) and constant elasticity V

/

(\) = |\

p

(| > 0,

0 -p -1) demand curves.

Customers are sensitive to delay, and in this section

we follow the common assumption that the delay cost

is d per customer per unit of time. We assume that

the queue length is unobservable and that customers

make their decisions based on their expected through-

put time W. Let P be the price charged per job. It is

well known that the analogue of the demand curve

when delay costs are taken into account then becomes

P =V

/

(\) d W. (4)

This modeling approach is common in the economics

of queues literature. Note that the model can be spec-

ied in terms of the distribution of user valuations

or the inverse demand curve V

/

(\). If the model is

specied in terms of probabilities, the effective arrival

rate is A Pr{U d W P], reecting the fact that as

the expected delay W increases, customers are willing

to pay less for the service, hence the expected number

of customers decreases.

Afanasyev and Mendelson: Service Provider Competition

Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS 219

3.2. Service Providers

We consider a market with two competing Ss, S

1

and S

2

, with respective constant marginal capacity

costs g

1

and g

2

. We assume g

1

g

2

, so S

1

is the lower-

cost S. Each service provider S

is modeled as an

A,G,1 queue with arrival rate \

. We assume that a

customers service time is 8,j

, where 8 is a random

variable with coefcient of variation r (the same for

both rms) and mean 1, and j

is the service capac-

ity of S

. Thus, larger investments in service capacity

stochastically decrease each providers service time.

We further assume the rst-come, rst-served queue

discipline and unobservable customer service valua-

tions. The expected delay at S

with capacity j

expe-

riencing arrival rate \

is given by the Pollaczek-

Khinchin formula for the expected total time in the

system,

4

W

r

2

j

1

2j

. (5)

The expected delay at each S

increases in \

and r

and decreases in j

. We further assume that there is a

direct operating cost c of serving each customer.

5

We

assume that each S charges a single price and that the

demand is high enough for both Ss to be protable at

zero delay cost; i.e.,

V

/

(0) >c max{g

1

, g

2

]. (6)

To ensure internal solutions, we also assume that for

a high enough arrival rate \, it is unprotable to serve

additional customers; i.e., there is a \ satisfying

V

/

(\) -c min{g

1

, g

2

], (7)

where c is the rms unit operating cost and g

( =1, 2) is S

s unit capacity cost.

3.3. Game Structure and Equilibria

We model competition as a Cournot game between

the two rms with two stages: the rms choice of \

and j

( =1, 2), followed by customer choice (which,

as we show below, is degenerate in equilibrium).

In the rst stage of the game, each S

, =1, 2 decides

on its capacity j

and arrival rate \

, analogous to the

4

See, e.g., Equation (3.17) in Taylor and Karlin (1998) with =1,j

and t =r,j.

5

In 6 we allow the cs to be different across rms.

traditional Cournot model, where the rms rst set

their respective quantities. In the second stage, given

\

and j

for =1, 2, customers decide which (if any)

S to join, and the equilibrium prices are adjusted

accordingly. This ensures the existence of an equi-

librium. If the rms choose their prices and wait-

ing times rst and capacities then adjust to satisfy

the equilibrium conditions, an equilibrium does not

always exist (Cachon and Harker 2002).

What happens in the second stage of the game

depends on whether there are one or two rms in the

market.

6

If only S

is in the market, each customer

calculates the expected delay W

and service fee P

,

given \

and j

. The net utility of a customer with

service valuation U is U d W

if the customer is

served, or zero if the customer is not served. The cus-

tomer thus chooses to receive the service if and only

if U d W

> 0. In this case, there is obviously

a

U such that all customers with U >

U choose to

receive service, and all customers with U

U decline

the service. Because customer choice must satisfy the

individual rationality constraint, S

s prot maximiza-

tion problem in the rst stage is

max

\

, j

|\

c\

]

s.t. V

/

(\

) d W

=P

.

(8)

Next, consider the customer choice when two

providers are in the market. Now each customer has

three options to choose from:

(a) join S

1

(net utility equals U d W

1

P

1

),

(b) join S

2

(net utility equals U d W

2

P

2

), or

(c) do not join (net utility equals 0).

The customer decides among these alternatives by

comparing the net utilities in (a), (b), and (c) above.

When both providers serve customers, all cus-

tomers must be indifferent between S

1

and S

2

.

7

Indeed, if there exists a customer who strictly prefers

S

( =1, 2), namely, for some valuation U,

U d W

>U d W

, (9)

then all customers will strictly prefer S

(because

(9) will hold for all U), so S

will serve no cus-

tomers, which is a contradiction. This means that the

6

If there is no rm in the market, the solution is trivial.

7

We will show later that this is the direct result of the assumed

additive delay cost structure.

Afanasyev and Mendelson: Service Provider Competition

220 Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS

customer choice problem is degenerate (as all cus-

tomers are indifferent between the two rms). This

is often modeled by randomizing the choice between

the providers. Thus, there exists a service valua-

tion threshold

U such that the customers with ser-

vice valuations above

U are randomly allocated and

those below

U are not served (because their utilities

upon being served by either provider would be nega-

tive). Although customers are indifferent between the

two providers, consistency with the rst-stage deci-

sions requires that the probability of joining S

equals

\

,(\

1

\

2

) ( =1, 2).

To complete the specication of the game, recall

that each S

, = 1, 2 decides on j

and \

, building

on the customers decision criteria (which, as shown

above, are degenerate). Hence, a necessary condition

for an equilibrium is that each S

solves

max

\

, j

|\

c\

]

s.t. V

/

(\

1

\

2

) d W

=P

,

(10)

where W

is the expected delay given by Equation (5).

If S

decides to stay out of the market, it sets \

=

j

=0, and S

solves (8). In a mixed-strategy equilib-

rium, customers with valuations above some thresh-

old are randomly allocated between the two rms,

and customers with valuations below this threshold

are not served. It is clear from the above discussion

that under the additive delay cost structure, the only

possible equilibria are mixed-strategy equilibria.

The Cournot game is often presented as a

game with explicit or implicit probabilistic customer

choices. In our game, the probability that a customer

with service valuation U is served by S

equals

p

(U) =

\

1

\

2

if U >

U, =1, 2,

0 otherwise.

(11)

This also translates directly to probabilistic choice

models often used in the marketing literature (see

Currim 1982, Kamakura and Srivastava 1984, Grover

and Srinivasan 1987, Kamakura and Russell 1989).

The marketing literature also allows for more gen-

eral forms than (11), which is implied by our model.

This suggests that a more general model specication

might lead to a generalization of (11), such as that

corresponding to the multinomial logistic model.

3.4. Equilibrium

Intuitively, an increase in the delay sensitivity d in-

creases customers delay costs and lowers the effective

total demand. As a result, for small d, both providers

are in the market, but as d increases, only one S sur-

vives. For larger values of d, there is no S in the mar-

ket. Proposition 1 makes this intuition precise. Proofs

of propositions and corollaries are in the appendix.

Proposition 1. There exist constants 0 - d

1

d

2

d

3

d

4

such that the following applies.

(1) Duopoly solution: For d - d

1

, there is a mixed-

strategy equilibrium with both S

1

and S

2

in the market,

where the capacity j

and market size \

of S

are given by

the solution to the equations

8

(\

r

2

j

)j

(j

)

2

\

r

2

j

1

2j

2

=

g

d

, =1,2,

V

/

(\

1

\

2

)\

V

//

(\

1

\

2

)dW

d\

r

2

1

2(j

)

2

=c, =1,2,

(12)

where W

are given by (5).

(2) Single monopoly solution: For d |d

1

, d

2

)|d

3

, d

4

),

there is an equilibrium with only the low-cost provider, S

1

,

in the market. The equilibrium capacity j

1

and market size

\

1

are given by the solution to the equations

(\

1

r

2

j

1

)j

1

(j

1

\

1

)

2

\

1

r

2

j

1

\

1

1

1

2j

2

1

=

g

1

d\

1

,

V

/

(\

1

) \

1

V

//

(\

1

) dW

1

d\

1

r

2

1

2(j

1

\

1

)

2

=c,

(13)

where W

1

is given by (5) (with =1).

(3) Multiple monopoly solutions: For d |d

2

, d

3

), there

are two equilibria: one with only S

1

in the market and one

with only S

2

in the market. In the equilibrium with S

m

in

the market, the capacity j

m

of S

m

and its market size \

m

are given by the solutions to the equations

(\

m

r

2

j

m

)j

m

(j

m

\

m

)

2

\

m

r

2

j

m

\

m

1

1

2j

2

m

=

g

m

d\

m

,

V

/

(\

m

) \

m

V

//

(\

m

) dW

m

d\

m

r

2

1

2(j

m

\

m

)

2

=c,

(14)

where W

m

is given by (5) (with =m).

8

For d = 0, the equations are j

= \

and V

/

(\

1

\

2

)

\

V

//

(\

1

\

2

) =c.

Afanasyev and Mendelson: Service Provider Competition

Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS 221

(4) Market is not served: For d d

4

, there is no S in

the market, and \

1

=\

2

=j

1

=j

2

=0.

The sequence of market structures in Proposition 1

shows that for small delay sensitivities, both rms

are in the market. As the delay sensitivity increases,

the higher-cost S leaves the market. This happens

because, as a monopoly, S

2

can protably serve fewer

customers than S

1

; hence the entry barrier for S

1

is

lower than for S

2

. As the delay sensitivity increases

further, only one S can survive. As the delay sensitiv-

ity increases further, S

2

cannot obtain positive prots.

Because of its cost advantage, S

1

stays in the market

longer but eventually, for larger values of d, leaves the

market as well. Proposition 1 allows for multiple equi-

libria, so the constants d

1

through d

4

in Proposition 1

need not be unique. Furthermore, the interval |0, d

1

)

consists of up to three subintervals:

(i) |0, d

D

1

), where only duopoly equilibria exist;

(ii) |d

D

1

, d

A

1

), where duopoly and S

1

monopoly

equilibria exist; and

(iii) |d

A

1

, d

1

), where duopoly and two, S

1

or S

2

,

monopoly equilibria exist.

In 5 we study the progression of the different equi-

libria as a function of the market size A and discuss

these subintervals in more detail.

Proposition 1 also shows that when the two rms

are in the market, they may offer differentiated ser-

vices, but customers are always indifferent between

them; i.e., there is a mixed strategy equilibrium. If the

providers capacity costs are equal, the expected delay

and price are determined, so there is neither service

differentiation nor market segmentation. If g

1

-g

2

,

S

1

has a cost advantage: it sets a lower expected delay

than S

2

but in equilibrium charges a price premium

that exactly equals the delay cost savings of each cus-

tomer; i.e.,

P

1

P

2

=d (W

2

W

1

). (15)

This means that while the Ss offer differentiated ser-

vices, there is no market segmentation.

4. Generalized Delay Cost Structure

In 3 we found that under the additive delay cost

structure, there is no market segmentation. In this

section we show that under the generalized delay

cost structure, we may obtain value-based market seg-

mentation, where one S serves customers with higher

service valuations (the high-end segment) and the

other S serves customers with lower service valua-

tions (the low-end segment). In this equilibrium, the

high-end S offers a smaller delay but at a higher

price than the low-end S. Unlike in 3, high-value

customers strictly prefer the high-end S and low-

value customers strictly prefer the low-end S. More-

over, if the rms have different capacity costs, only an

equilibrium with value-based market segmentation is

possible.

The generalized delay cost specication allows the

delay cost of a customer to depend on his or her

service valuation. As described in the introduction,

such dependence is common in a variety of settings.

Under the generalized delay cost structure, the utility

derived by a customer with service valuation U and

delay | is (|) U D(|), where (|) is a decreasing

function that deates the customers service valuation

U, and D(|) is the additive component of the delay

cost. This means that the customers service valua-

tion and delay cost are interdependent. Each customer

with service valuation U maximizes his or her own

expected utility; i.e., ||u(U, |)] =||(|) U D(|)].

We assume for the most part that (|) is linear and

decreasing, (|) = 1 . |. Under the linear speci-

cation, a customer with service valuation U has util-

ity ||u(U, |)] = U (1 .W) dW, where W is the

expected delay in the system. Hence, the customer

incurs a delay cost of (.U d) W, where . > 0 is

a multiplicative coefcient and d 0 is an additive

coefcient of the delay cost. The demand curve (4)

becomes

P =V

/

(\) (1 . W) d W. (16)

Similar to Equation (8), if only S

is in the market, it

solves

max

\

, j

|\

c\

]

s.t. V

/

(\

) (1 . W

) d W

=P

.

(17)

When both rms are in the market, we structure the

game as a Cournot model, as before, where in the rst

stage S

decides on j

and \

( = 1, 2), and in the

second stage the customers decide which S to join,

if any. In 3.3 we showed that under the additive

delay cost structure, there was only a mixed-strategy

equilibrium; i.e., there was a service valuation

U such

Afanasyev and Mendelson: Service Provider Competition

222 Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS

that customers with service valuations above

U were

randomly allocated between the two rms, and those

below

U were not served. Another type of equilib-

rium is the value-based market segmentation equilibrium,

where customers are divided into three groups based

on their service valuations. The lowest value group

receives no service, the highest value group is served

by one S, and the intermediate group is served by the

other S. Formally, this means that

U

1

>

U

2

exist such

that a customer with service valuation U (a) joins S

,

if U

U

1

, (b) joins S

, if U |

U

2

,

U

1

), or (c) does not

join either S, if U -

U

2

.

Hence, all customers with service valuations above

U

1

form the high-end segment, served by S

, and

all customers with service valuations in the interval

|

U

2

,

U

1

) form the low-end segment, served by S

.

In our model, the only equilibrium structures pos-

sible are the mixed-strategy and value-based market

segmentation equilibria that we identied. We have

already shown in 3.3 that for . =0, we obtain only

the mixed-strategy equilibrium under a duopoly. If

for . >0 some customers with different valuations U

and U

8

are indifferent between S

1

and S

2

, then

U

(.U

d)W

1

P

1

=U

(.U

d)W

2

P

2

, and

U

8

(.U

8

d)W

1

P

1

=U

8

(.U

8

d)W

2

P

2

.

(18)

Then, by subtracting the two equations, we obtain that

W

1

= W

2

, which also implies that P

1

= P

2

. Thus, any

customer U

C

will also be indifferent between the two

providers. Similarly, if customers with valuations U

and U

8

strictly prefer S

, then any customer with valu-

ation U

C

(U

, U

8

) will also prefer S

. Indeed, if U

C

(U

, U

8

), then there exists an 0 -o -1 such that U

C

=

oU

(1 o)U

8

. Because U

and U

8

strictly prefer S

,

U

(.U

d)W

>U

(.U

d)W

, and

U

8

(.U

8

d)W

>U

8

(.U

8

d)W

.

(19)

Giving the two equations weights o and (1 o),

respectively, and summing up, we obtain that

U

C

(.U

C

d)W

>U

C

(.U

C

d)W

. (20)

We thus conclude that only our mixed-strategy

or value-based market segmentation equilibria are

possible.

We next derive the structure of the segmented equi-

libria for a market with asymmetric providers and a

generalized delay cost structure with . > 0 (symmet-

ric providers are considered later in this section). We

show that in such a market, there is no equilibrium

without value-based market segmentation; i.e., among

the customers who are served, those with service val-

uations above a threshold

U

1

choose the fast S, and

those with service valuations below that threshold but

above another threshold

U

2

choose the slow S. We

focus on the equilibrium in which the lower-cost S

1

serves the high-value segment

9

and show that for suf-

ciently small delay sensitivities, both Ss are in the

market and the market is segmented.

Proposition 2. There exist nested sets, with (0, 0)

+

1

, +

1

+

2

+

3

+

4

in (., d) space such that the fol-

lowing applies.

(1) Duopoly solution: For (., d) +

1

and . > 0, there

is an equilibrium with both rms in the market, where S

1

serves the high-end customers and S

2

serves the low-end

customers. The capacity j

and the arrival rates \

to each

S

are given by the solution to the following equations.

(\

1

r

2

j

1

)j

1

(j

1

\

1

)

2

\

1

r

2

j

1

\

1

1

1

2j

2

1

=

g

1

\

1

|V

/

(\

1

). d]

,

|V

/

(\

1

) \

1

V

//

(\

1

)].(W

2

W

1

)

|V

/

(\

1

\

2

) \

1

V

//

(\

1

\

2

)](1 .W

2

)

dW

1

\

1

|V

/

(\

1

). d]

r

2

1

2(j

1

\

1

)

2

=c

(21)

and

(\

2

r

2

j

2

)j

2

(j

2

\

2

)

2

\

2

r

2

j

2

\

2

1

1

2j

2

2

=

g

2

\

2

|V

/

(\

1

\

2

). d]

,

V

/

(\

1

\

2

) \

2

V

//

(\

1

\

2

)(1 .W

2

) dW

2

|V

/

(\

1

\

2

). d]

r

2

1

2(j

2

\

2

)

2

=c,

(22)

where W

are given by (5).

9

Under certain conditions, an equilibrium exists in which the

higher-cost S, S

2

, serves the high-value segment. It can be shown

that whenever such an equilibrium exists, there always exists an

equilibrium in which the lower-cost S serves the high-end segment.

Afanasyev and Mendelson: Service Provider Competition

Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS 223

(2) Single monopoly solution: For (., d) (+

2

+

1

)

(+

4

+

3

), there is an equilibrium with only S

1

in the mar-

ket. The equilibrium capacity j

1

and market size \

1

of S

1

are given by the solution to the following equations.

(\

1

r

2

j

1

)j

1

(j

1

\

1

)

2

\

1

r

2

j

1

\

1

1

1

2j

2

1

=

g

1

(V

/

(\

1

). d)\

1

,

|V

/

(\

1

) \

1

V

//

(\

1

)](1 .W

1

) dW

1

\

1

|V

/

(\

1

). d]

r

2

1

2(j

1

\

1

)

2

=c,

(23)

where W

m

is given by (5).

(3) Multiple monopoly solutions: For (., d) +

3

+

2

,

there are two equilibria: one with only S

1

in the market,

and one with only S

2

in the market. In the equilibrium with

S

m

in the market (m=1, 2), the equilibrium capacity j

m

and market size \

m

of S

m

are given by the solution to the

following equations.

(\

m

r

2

j

m

)j

m

(j

m

\

m

)

2

\

m

r

2

j

m

\

m

1

1

2j

2

m

=

g

2

(V

/

(\

m

). d)\

m

,

|V

/

(\

m

) \

m

V

//

(\

m

)](1 .W

m

) dW

m

\

m

|V

/

(\

m

). d]

r

2

1

2(j

m

\

m

)

2

=c,

(24)

where W

m

is given by (5).

(4) Market is not served: For (., d) ; +

4

, there is no S

in the market and \

1

=\

2

=j

1

=j

2

=0.

Proposition 2 shows that for small values of the

delay sensitivitiesi.e., in the set +

1

where we obtain

the duopoly solutionthere is a value-based mar-

ket segmentation equilibrium, where S

1

serves the

high-end segment and S

2

serves the low-end segment,

and customers are not indifferent between the two

providers. Market segmentation requires delay costs

that are low enough to support two rms in the mar-

ket. As the delay sensitivities increase, so (., d) is in

the set +

2

+

1

(the single monopoly solution region),

the only possible equilibrium is one with S

1

being

a monopoly. In this set, the lower-cost S enters and

crowds out the higher-cost S. As the delay sensitiv-

ities grow furtheri.e., in the set +

3

+

2

(the multi-

ple monopoly solutions region)two equilibria exist

with either of the Ss being a monopoly. This hap-

pens because as the delay sensitivities increase, S

( = 1, 2) cannot be protable if it enters the market

with S

already there. As . and d increase further, S

2

cannot survive even as a monopoly. Because of its cost

advantage, S

1

can survive for larger values of . and d,

but ultimately it cannot be protable and leaves the

market, too, so the market is not served. Note that

Proposition 2 allows for multiple equilibria, e.g., for

(., d) +

1

, there may also be monopoly solutions, and

for (., d) +

3

+

2

there are two monopoly equilibria.

Corollary 1. For . > 0 and g

1

- g

2

, any duopoly

equilibrium must be a value-based market segmentation

equilibrium.

Corollary 1 shows that market segmentation is

driven by the generalized delay cost structure as

well as by the rms cost asymmetry. Because the

providers capacity costs are different, we expect them

to choose different delays, and, because . >0, differ-

ent customers value the delays differently.

Similar to what we found in Proposition 1, the set

+

1

consists of up to three subsets:

(i) +

D

1

, where only duopoly equilibria exist;

(ii) +

A

1

+

D

1

, where duopoly and S

1

monopoly equi-

libria exist; and

(iii) +

1

+

A

1

, where duopoly and two, S

1

or S

2

,

monopoly equilibria exist.

We may also have in +

1

several duopoly equilibria.

For example, for sufciently small g

2

g

1

, there is

an equilibrium where S

2

serves the high-end segment

and S

1

focuses on the low-end segment. It can be

shown that if we have an equilibrium with the higher-

cost S serving the high-end segment, there is always

an equilibrium with the lower-cost S serving the high-

end segment.

Importantly, the structure of the equilibria obtained

under the generalized delay cost structure (Proposi-

tion 2) is substantively different from the structure

we obtained under the additive delay cost struc-

ture. In particular, the framework of an additive

delay cost structure does not adequately explain the

prevalence of value-based segmentation in markets

ranging from transportation to mortgage loan origi-

nation. With generalized delay costs, one of the rms

serves the higher-end segment and the other serves

Afanasyev and Mendelson: Service Provider Competition

224 Manufacturing & Service Operations Management 12(2), pp. 213235, 2010 INFORMS

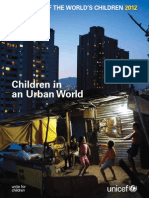

Figure 1 Distortions in Total Industry Prots (Solid Line, Left Axis)

and the Difference Between the Capacity of the High-End

and Low-End Service Providers (Broken Line, Right Axis) in

the Duopoly Equilibrium as Functions of the Multiplicative

Delay Sensitivity t

0 1 2 3 4

15

15

10

5

0

D

i

s

t

o

r

t

i

o

n

i

n

t

o

t

a

l

p

r

o

f

i

t

s

(

%

)

D

i

s

t

o

r

t

i

o

n

i

n

c

a

p

a

c

i

t

y

d

i

f

f

e

r

e

n

c

e

(

%

)

20

20

25

25

30

35

40

V

Notes. The distortions are caused by assuming that the delay cost is addi-

tive and the average delay cost remains the same. The distortion in total

prots is the change in total prot, I

1

I

2

, caused by not accounting for

the multiplicative structure of the delay sensitivity relative to the correct total

prots. The distortion in capacity differences is the change in capacity dif-

ference (p

1

p

2

) caused by not accounting for the multiplicative structure

of the delay sensitivity relative to the correct capacity difference. For both

line graphs, the service valuations u are uniformly distributed over the inter-

val |0, 100] and the market size is A =300 (which corresponds to l

/

(') =

100 ',3),

1

=29,

2

=31, c =5, and J =0.

the lower-end segment, resulting in a natural value-

based segmentation. In a market characterized by

multiplicative delay sensitivity, assuming an additive

delay cost structure leads to signicant deviations not

only in qualitative structure but also in the quanti-

tative results. Clearly, these deviations are increasing