Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Online Trading Securities

Caricato da

tusharsatheDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Online Trading Securities

Caricato da

tusharsatheCopyright:

Formati disponibili

DEFINITION Online stock trading is a method of investing in stocks, mutual funds and other exchange-traded securities through an Internet-based

stock brokerage service. A stock brokerage is a company that makes stock trades on behalf of its clients. Online stock trading services allow users to place trades using a Web-based interface without interacting with an actual stock broker. Function Online stock trading services work like other online financial accounts, such as Web-based savings accounts. To start trading online, you must typically set up an account at the website of an online stock broker and then link an external checking account to the stock trading account. You can then transfer funds from the checking account to the online stock trading account, which can in turn be invested in the stocks and other investment opportunities available through the service. Benefits Online stock brokers have several benefits. First, it allows you to invest on your own time without interacting with human brokers. This can be attractive for knowledgeable investors who want to direct their own portfolio. Another benefit is that trades placed through an online service are often cheaper than making trades through a traditional broker. Drawbacks Online stock trading services may be dangerous for inexperienced investors. When you place stock trades through a traditional broker, he can give you advice about trades and help shape your stock holdings to mitigate risk. When you choose your own investments, you might make bad decisions or pursue an undisciplined investment strategy. For instance, online trading allows you to buy and sells stocks at any time, which might tempt you to make transactions too frequently. Day trading (trading a stock more than once over the course of a day) is a highly risky practice. Time Frame Investments made with an online stock trading service have the potential to increase or decrease in value on any given day. One of the best ways to avoid the impacts of daily price fluctuations is to hold onto investments for long periods of time. Considerations The more often you place trades, the more often you will incur transaction fees. It is better to make a few large transactions than many small ones to avoid incurring transaction fees.

How Online Stock Trading Works There are a number of companies, such as E-Trade, that offer potential investors the opportunity to sign up for their services, set up and fund an account, and then perform their own stock trades. Quite often they also permit access to bonds, options trading, as well as mutual fund trades. Other online finance service companies include Scottrade and Share Builder. (Links are provided in the Resources section.) Online stock trading is a fee-based activity, and depending on the abilities you want to have during your trading, you may need to pay more in fees and access charges. In addition, remember that the financial services provider receives a fee for the trades you make; the more you trade, the more you have to pay to the online company. Price shop to get the least expensive service, and also to find one that has all the financial tools and help options you require. Once an account is set up and funded, the online stock trader needs to think of which account alerts and defaults to set up. There is the possibility of setting up automatic buy and sell options, real time trading, buy and sell alert notifications that go directly to email or phone, or margin borrowing. These features allow the online trader to make the most of his investment experience and to buy or sell when the market is hot. Generally speaking, these tools mostly benefit the more involved traders who like to deal with the investment portfolios once a day or even more often. They are usually not as commonly used by the hobbyist who checks in once a week or even less frequently. If you would prefer to set up an automated weekly, biweekly or even monthly investment, you may do so with an automatic funding deposit and buy order. This is usually not recommended, since the volatility of the stock market has proven that investment strategies that work today may not be appropriate tomorrow or next week. Real time online stock trading works only when the stock market is open; it is not available after the market closes or during a federal holiday. If you participate in real time stock trading, you are buying and selling stocks at the current price, thereby putting yourself in the driver's seat of mitigating damages and realizing profits. This is suggested for those who are highly educated about the process of securities purchasing, and who also have a well defined investment strategy.

INTERNET TRADING / ONLINE TRADING 1 What is online trading in securities? Online trading in securities refers to the facility of investor being able to place his own orders using the internet trading platform offered by the trading member viz., the broker. The orders so placed by the investor using internet would be routed through the trading member.

2 How can one start trading online? To start with, investor needs to identify a trading member who offers internet trading facility and register with the trading member for availing the internet trading facility.

3 How to choose an online stock broker? Many of the big and medium sized trading members offer internet trading facility. Investor can get the details of trading members of the Exchange on the website www.nseindia.com. Identify brokers offering internet trading facility; check their references from persons having knowledge about financial markets and select a broker who has good reputation and capability to deliver all the services that are expected by the investor. Particular attention should be paid by the investor to the availability of support in case of technical problems while choosing the broker.

4 Who could use online trading? Usually, a person familiar in using computer, conversant with the use of internet and who is able to tackle routine problems associated with use of personal computers may opt for online trading.

5 Are there additional documents to be executed for registering as internet customer? As per SEBI and Exchange stipulations, in addition to execution of regular KYC documents, the investor would have to execute a specific Member- client agreement for internet trading which broadly spells out the rights and obligations of trading member and Investor besides alerting on system related risk, confidentiality of user id and password. Further, Member and investor may also agree amongst themselves in execution of other documents like Power of Attorney for DP operations, Opening of DP and bank account etc.,

6 What documents are received usually after registration as an online trading client? On registering as online trading client with the trading member, normally investor receives a welcome kit containing the user-id and password allotted to the client.

7 What precautions an online investor must take on starting online trading? Investor has to take care that:

1. The Default password provided by the broker is changed before placing of order. Ensure that password is not shared with others. Change password at periodic interval. 2. He has understood the manner in which the online trading software has to be operated. 3. He has received adequate training on usage of software 4. The system has facility for order and trade confirmation after placing the orders

8 What should investor know about failure of system that is being used for placing orders? Every online trading client should understand that there could be a possibility of failure of system which could include failure at various points including net work failure, connectivity failure etc.

Generally, the trading members have alternate ways of servicing the investors in the eventuality of such failures. In order to mitigate risks arising from such failures, investor before starting trading should understand from the trading member about ways and means of dealing with such failures, steps that investor needs to take for knowing his position, closing the position etc.

9 What are the other safety measures online client must observe? 1. Avoid placing order from the shared PCs / through cyber cafs. 2. Log out after having finished trading to avoid misuse. 3. Ensure that one does not click on remember me option while signing on from nonregular location. 4. Do not leave the terminal unattended while one is signed-on to the trading system. 5. Protect your personal computer against viruses by placing firewall and an anti-virus solution. 6. You should not open email attachments from people you do not know.

10 How can one investor make sure that his access to trading is continuously available? In the course of his dealing, investor should always make sure that sufficient funds and securities are available in his account with the trading member and that he is regular in payment of margins so as to avoid blocking of account by the trading member. Where due to shortage of margin or funds not paid, the account is blocked and positions are squared off or securities are sold by the trading member, investor may get the details of such square-up, sales from the trading member.

11. Where online trades are being done is there any documents that I need to receive from the trading member for the trades executed? For every trade that takes place on the Exchange, the trading member needs to issue contract note within 24 hours from the date of execution of the trade. Generally, internet based investors opt for Digital contract notes. Hence, at the time of client registration investor should provide an email id which is regularly used. In case investor wishes to receive physical contract notes, he may specify so in the client registration document and cut off the email id column. Investor needs to regularly check the contract notes and if any variation in the trades is found needs to take up the issue with the trading member immediately. Besides the Contract Notes, trading member needs to issue quarterly statement of funds and securities to the investor and such statement can be digitally issued if investor has opted for digital document.

The Securities Exchange Board of India has approved the report on Internet Trading brought out by the SEBI Committee on Internet Based Trading and Services. This is what the report said:

Internet-based trading can take place through order routing systems, which will route client orders, to exchange trading systems, for execution of trades on the existing stock exchanges. SEBI registered brokers can introduce the service after obtaining permission from respective stock exchanges. Exchanges, while giving permission, will be required to ensure minimum conditions specified in the report which is available on the SEBI's web site. The salient conditions to be met are:

Application for Permission by Brokers SEBI registered stock brokers interested in providing Internet-based trading services will be required to apply to the respective stock exchange for a formal permission. The stock exchange should grant approval or reject the application as the case may be, and communicate its decision to the member within 30 calendar days of the date of completed application submitted to the exchange. The stock exchange, before giving permission to brokers to start Internet-based services, shall ensure the fulfillment of the following minimum conditions:

Net worth Requirement The broker must have a minimum net worth of Rs 50 lakhs if the broker is providing the Internet-based facility on his own. However, if some brokers collectively approach a service provider for providing the Internet trading facility, net worth criteria as stipulated by the stock exchange will apply. The net worth will be computed as per the SEBI circular no FITTC/DC/CIR-1/98 dated June 16, 1998.

Operational and System Requirements Operational Integrity: The stock exchange must ensure that the system used by the broker has provision for security, reliability and confidentiality of data through use of encryption technology. (Basic minimum security standards are specified in following paras). The stock exchange must also ensure that records maintained in electronic from by the broker are not susceptible to manipulation.

System Capacity: The stock exchange must ensure that the brokers maintain adequate backup systems and data storage capacity. The stock exchange must also ensure that the brokers have adequate system capacity for handling data transfer, and arranged for alternative means of communications in case of Internet link failure.

Qualified Personnel: The stock exchange must lay down the minimum qualification for personnel to ensure that the broker has suitably qualified and adequate personnel to handle communication including trading instructions as well as other back office work which is likely to increase because of higher volumes.

Written Procedures: The stock exchange must develop uniform written procedures to handle contingency situations and for review of incoming and outgoing electronic correspondence.

Signature Verification/Authentication: It is desirable that participants use authentication technologies. For this purpose it should be mandatory for participants to use certification agencies as and when notified by Government/SEBI. They should also clearly specify when manual signatures would be required.

Client Broker Relationship Know Your Client: The stock exchange must ensure that brokers comply with all requirements of 'Know Your Client' and have sufficient, verifiable information about clients, which would facilitate risk evaluation of clients.

Broker-Client Agreement: Brokers must enter into an agreement with clients spelling out all obligations and rights. This agreement should also include inter alia, the minimum service standards to be maintained by the broker for such services specified by SEBI/exchanges for the Internet based trading from time to time. Exchanges will prepare a model agreement for this purpose. The broker agreement with clients should not have any clause that is less stringent/contrary to the conditions stipulated in the model agreement.

Investor Information: The broker web site providing the Internet-based trading facility should contain information meant for investor protection such as rules and regulations affecting client broker relationship, arbitration rules, investor protection rules etc. The broker web site providing the Internet-based trading facility should also provide and display prominently, hyper link to the web site/page on the web site of the relevant stock exchange(s) displaying rules/regulations/circulars. Ticker/quote/order book displayed on the web-site of the broker should display the time stamp as well as the source of such information against the given information.

Order/Trade Confirmation: Order/Trade confirmation should also be sent to the investor through email at client's discretion at the time period specified by the client in addition to the other mode of display of such confirmations on real time basis on the broker web site. The investor should be allowed to specify the time interval on the web site itself within which he would like to receive this information thorough e-mail. Facility for reconfirmation of orders which are larger than that specified by the member's risk management system should be provided on the Internet-based system.

Handling Complaints by Investors: Exchanges should monitor complaints from investors regarding service provided by brokers to ensure a minimum level of service. Exchange should have separate cell specifically to handle Internet trading related complaints. It is desirable that exchanges should also have facility for on-line registration of complaints on their web site.

Risk Management Exchanges must ensure that brokers have a system-based control on the trading limits of clients, and exposures taken by clients. Brokers must set pre-defined limits on the exposure and turnover of each client. The broker systems should be capable of assessing the risk of the client as soon as the order comes in. The client should be informed of acceptance/rejection of the order within a reasonable period. In case system-based control rejects an order because of client having exceeded limits etc, the broker system may have a review and release facility to allow the order to pass through. Reports on margin requirements, payment and delivery obligations, etc should be informed to the client through the system. Contract Notes Contract notes must be issued to clients as per existing regulations, within 24 hours of the trade execution. Cross Trades As in the case of the existing system, brokers using Internet-based systems for routing client orders will not be allowed to cross trades of their clients with each other. All orders must be offered to the market for matching.

It is emphasised that in addition to the requirements mentioned above, all existing obligations of the broker as per current regulations will continue without changes. Exchanges may also like to specify more stringent standards as they may deem fit for allowing Internet-based trading facilities to their brokers.

Network Security Protocols and Interface Standards At present the Indian laws are silent on the security of Internet information. However, the draft ECommerce Act focuses on this issue and prescribes the requirements like electronic certification, digital signatures etc which will play an important role on the authenticity of such information gathered from the Internet. These requirements will also have to be met by Internet trading systems, as when they come into force.

Network Security The following security features are mandatory for all Internet based trading systems: i. User id ii. First Level Password (Private code) iii. Automatic expiry of passwords at the end of a reasonable duration. Reinitialise access on entering fresh passwords. iv. All transaction logs with proper audit facilities to be maintained in the system. v. Secured Socket Level Security for server access through Internet vi. Suitable firewalls between trading set-up directly connected to an exchange trading system and the Internet trading set-up.

The following advanced security products are advisable. a. Microprocessor based SMART cards b. Dynamic Password (Secure ID Tokens) c. 64bit/128 bit encryption ** d. Second Level password (personal information e.g. village name, birth date etc.) ** DOT policy and regulations will govern the level of encryption.

Standards for Web Interfaces and Protocols Between a trading web server and Trading Client Terminals, Interfaces /standards as per recommendations of IEFT (Internet Engineering Task Force) and W3C (World Wide Web Consortium) may be adopted. Eg: HTTP Ver 4or above HTML Ver4/XML.

Systems Operations a. Brokers should follow the similar logic/priorities used by the exchange to treat client orders. b. Brokers should maintain all activities/alerts log with audit trial facility. c. Broker Web Server should have internally generated unique numbering for all client order/trades. d. Brokers should seek permission from the exchange before commencement of Internet trading facility after providing complete details of the features of implemented systems. e. Brokers should make periodic reporting to the exchange as specified by the exchange.

Exchanges are requested to make necessary arrangements for early approval of the Internet trading systems submitted by their members for examination, so that Internet trading services can commence without delay.

Securities include stocks, bonds, notes, mortgages, bills of lading, and bills of exchange. http://www.tcs-ca.tcs.co.in/pdf/SPEED-E_Brokerage.pdf

The Risky Business of Online Stock Trading

Online securities trading was a big fad a few years ago, but some of the major players disappeared from the scene after the dot-com fallout. However, many do-it-from-home traders cannot resist the Internet's speed and convenience, and there are still plenty of firms to accommodate them.

Although some major brokerage companies swore they would never offer access to electronic trading tools, many quickly learned that customers were eager to trade via the Internet, and realized they would need to provide services or lose them to the competition.

Currently, online trading is gaining credibility.

Electronic storefronts offer consumers dedicated Web sites, software and online trading tools to help them go it alone. Some online investing firms have begun offering limited to full professional investment consulting services for a fee.

"Online trading is more than a passing fad. Many individual investors are using online brokers today," Fred Ruffy, an analyst at Optionetics, told TechNewsWorld.

The cost of trading online is generally lower than at brickand-mortar brokerage houses. In addition, improvements in technology and security have made online trading an efficient and safe experience. In fact, some online brokers, such as E-Trade and TD Ameritrade, offer more than just trading. They also provide credit cards, mortgages, bonds and mutual funds, for example.

Stiff Competition Online trading has rendered phone brokers obsolete. Before the dot-com bubble burst, a phone trader working late at night at a big-name brokerage firm would field roughly 300 calls per shift.

When online trading began to gain popularity, many phone traders were laid off, due in part to a decline in sales volume. The interest in online trading is even more intense now.

"We see a burst of activity. It's going up and down, but always there are those investors who want to do it themselves," said Andy Rolfe, CTO of Authentify.

The number of online traders has been increasing, apparently in spite of scams -- or the fear of scams. "People believe in the institutions that exist online," said Rolfe.

Falling Rates Falling revenue from commissions has been the challenge for many online brokers, according to Ruffy. In October 2006, for example, many online brokers lost share value after Bank of America (NYSE: BAC) announced that it would offer free stock trades to select customers.

"This is part of a trend. Many of the big players try to get customers by offering cheap stock trades and then selling them other products or services," Ruffy noted.

Consolidation is another reality for the survivors of the dotcom boom, he said. Many small players have been forced to partner with others in order to avoid going out of business. Those intent on resisting the merger trend must carve out a niche in order to succeed.

"The outlook is for more of the same. However, there are fewer and fewer brokers out there. The main players in online trading will probably remain the same," Ruffy predicted.

Lay of the Land The online trading industry is now comprised of two groups: online discount brokers and trading software platform providers. Companies in both categories provide low-cost commissions and fees for stock trades and other investment

activity, said Kenneth Prather, owner of Prather Investment Management.

Online discount trading commissions range from US$4.95 to $14.95 per trade, noted Prather. By comparison, full-service brokerage firms may combine counseling and trading fees; customers can pay as much as $100 in fees and commissions per trade, he pointed out.

Online discount brokers cater to investors who are looking for low-cost brokerage services. They are very active online traders who remain loyal to a particular broker's site, according to Prather.

The leading players in this field are Fidelity, Schwab, E-Trade and Ameritrade.

The second group is comprised of online trading companies that rely on providers of trading software or a specific platform. These companies also offer brokerage services for additional fees. Some of the well-known players in this category are eSignal, MetaStock and TradeStation.

"These trading companies offer pretty low commission rates, usually offering trades for pennies per share. Traders can get any stock on the market," Prather said. "It is a full range

service industry, including equity, futures and options. It is a very open business."

Security Concerns From a security standpoint, online traders may face considerable risk, but the investment industry has started responding to security issues -- in part, because of federal compliance regulations.

"Growing security concerns stem from the use of passwords as the sole form of identification online," said Rolf. "Federal regulators are starting to insist on multi-factor identification."

As a result, online trading is becoming safer. However, as ecommerce in general becomes more lucrative, the number of identity thefts and threat attempts is growing. This is driven by the increasing number of users who do business online, as well as the sophistication of hackers, noted Rolf.

"We have always known that hackers had an automatic repeat and remove vehicle to steal users' IDs," he added. "That is where the problem lies: using phony accounts to push up or down the price of stock."

Avoiding Pitfalls Aside from the security concerns that impact all aspects of ecommerce, there are other threats unique to do-it-yourself online trading. If the investor does not already use a system, it is only a matter of time before he loses his money, Prather warned.

The bottom line is that online traders can become too aggressive, and it can be very easy to lose one's shirt. It is not uncommon for avid traders to roll over their 401k funds or other investments -- only to lose everything in the stock market.

"Online trading is a double-edged sword. Users get more access and more trading tools. That is the advantage," Prather said. "The downside is when users think they can become a real stock trader at home working towards getting rich. Online trading can be very seductive.

Potrebbero piacerti anche

- MRPDocumento52 pagineMRPJAI SINGHNessuna valutazione finora

- Order Management A Complete Guide - 2021 EditionDa EverandOrder Management A Complete Guide - 2021 EditionNessuna valutazione finora

- Chapter 2 Study of Online Trading and Brokerage IndustryDocumento6 pagineChapter 2 Study of Online Trading and Brokerage IndustryAvi DVNessuna valutazione finora

- The Four Walls: Live Like the Wind, Free, Without HindrancesDa EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesValutazione: 5 su 5 stelle5/5 (1)

- Mobile Shop SynopsisDocumento14 pagineMobile Shop SynopsisReem You100% (1)

- Digital Marketing Trends and Prospects: Develop an effective Digital Marketing strategy with SEO, SEM, PPC, Digital Display Ads & Email Marketing techniques. (English Edition)Da EverandDigital Marketing Trends and Prospects: Develop an effective Digital Marketing strategy with SEO, SEM, PPC, Digital Display Ads & Email Marketing techniques. (English Edition)Nessuna valutazione finora

- Implementation of Solar Inverter For Home, Garden, Streetlight ApplicationsDocumento3 pagineImplementation of Solar Inverter For Home, Garden, Streetlight ApplicationsPravat SatpathyNessuna valutazione finora

- Trading in Stock (SHIKHAR)Documento86 pagineTrading in Stock (SHIKHAR)Arvind Sanu MisraNessuna valutazione finora

- CS-803 Assignment No-1: Q. Explain Innovation and Its ClassificationDocumento8 pagineCS-803 Assignment No-1: Q. Explain Innovation and Its ClassificationPROFESSIONAL SOUNDNessuna valutazione finora

- Biometric Smart Ration Card Project ReportDocumento29 pagineBiometric Smart Ration Card Project Reportदिवेश चव्हाणNessuna valutazione finora

- Ind As 1Documento64 pagineInd As 1vijaykumartaxNessuna valutazione finora

- 4th Semester Online Vs Retail MaretDocumento46 pagine4th Semester Online Vs Retail MaretAyush PatelNessuna valutazione finora

- Manage Exams EasilyDocumento7 pagineManage Exams Easilybishant0% (1)

- Osei-Nyarko GeorgeDocumento71 pagineOsei-Nyarko Georgechetan joshiNessuna valutazione finora

- ECommerce - Module IDocumento9 pagineECommerce - Module IsmritisambitNessuna valutazione finora

- Call Money Market in IndiaDocumento37 pagineCall Money Market in IndiaDivya71% (7)

- Stock Exchange of IndiaDocumento32 pagineStock Exchange of IndiaNishant9999766815Nessuna valutazione finora

- Derivatives: The Important Categories of DerivativesDocumento10 pagineDerivatives: The Important Categories of DerivativesShweta AgrawalNessuna valutazione finora

- Depository System in IndiaDocumento4 pagineDepository System in Indiaaruvankadu100% (1)

- Online Jewellery Shop A Project Report SDocumento60 pagineOnline Jewellery Shop A Project Report SAbhishekNessuna valutazione finora

- Black Book Project 12Documento102 pagineBlack Book Project 12Manoj PatilNessuna valutazione finora

- Anand Rathi ReportDocumento31 pagineAnand Rathi Reportdev0078950% (2)

- A Summer Internship Project Report On A Study of Online Trading in Indian Stock Market at Mudrabiz LTDDocumento15 pagineA Summer Internship Project Report On A Study of Online Trading in Indian Stock Market at Mudrabiz LTDRupali BoradeNessuna valutazione finora

- Services Retailing AND LOGISTIICSDocumento47 pagineServices Retailing AND LOGISTIICSPink100% (2)

- Online Trading DerivativesDocumento35 pagineOnline Trading DerivativesAmol Kadam100% (2)

- Competitive Bidding and LeasingDocumento3 pagineCompetitive Bidding and LeasingNavathej BangariNessuna valutazione finora

- Sip Proposal Sip ProposedDocumento3 pagineSip Proposal Sip Proposedsaurabh agarwalNessuna valutazione finora

- Stock Market Analysis of Steel City Securities LtdDocumento86 pagineStock Market Analysis of Steel City Securities LtdKella PradeepNessuna valutazione finora

- Crowdfunding in India: An Emerging TrendDocumento14 pagineCrowdfunding in India: An Emerging TrendYA100% (1)

- Finance TopicsDocumento3 pagineFinance TopicsansukrNessuna valutazione finora

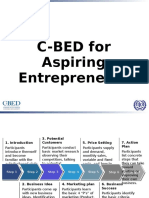

- Aspiring EntrepreneurDocumento63 pagineAspiring EntrepreneurJeb BajariasNessuna valutazione finora

- Online Offline Trading in Stock MarketDocumento7 pagineOnline Offline Trading in Stock Marketkumar4243Nessuna valutazione finora

- A Marketing Project On Online Shopping Prakash Chandra NaikDocumento65 pagineA Marketing Project On Online Shopping Prakash Chandra Naiksharique khanNessuna valutazione finora

- Paper 59-Customer Value Proposition For e Commerce PDFDocumento6 paginePaper 59-Customer Value Proposition For e Commerce PDFSyifa AuliyaNessuna valutazione finora

- Genral Store Billing System Project Report SynopsisDocumento19 pagineGenral Store Billing System Project Report SynopsisprathamNessuna valutazione finora

- FCI ReportDocumento69 pagineFCI ReportAnkitsharma03100% (3)

- Online Shopping PortalDocumento26 pagineOnline Shopping PortalELECTRONICSROYALSNessuna valutazione finora

- MBA Project on Working of Stock Market in IndiaDocumento67 pagineMBA Project on Working of Stock Market in IndiasunitgargNessuna valutazione finora

- Procedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarDocumento57 pagineProcedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarAarti Kulkarni0% (2)

- Capital & RevenueDocumento10 pagineCapital & Revenuegoodabhi_99Nessuna valutazione finora

- Top 10 AMCs in India Manage Over Rs 32 TrillionDocumento32 pagineTop 10 AMCs in India Manage Over Rs 32 Trillionalek pandaNessuna valutazione finora

- A Study About Investment & Transition in Indian Derivative Markets.Documento79 pagineA Study About Investment & Transition in Indian Derivative Markets.SurajKashidNessuna valutazione finora

- Mutual FundDocumento18 pagineMutual FundAkash PatilNessuna valutazione finora

- Dissertation On ICICI BankDocumento86 pagineDissertation On ICICI BankSubhendu Ghosh100% (1)

- HDFC - Company Analysis - SAMNIDHY INSTAGRAM - 4 PDFDocumento10 pagineHDFC - Company Analysis - SAMNIDHY INSTAGRAM - 4 PDFAsanga KumarNessuna valutazione finora

- Project ReportDocumento51 pagineProject Reportvishal141993Nessuna valutazione finora

- Capital Market FundamentalsDocumento27 pagineCapital Market FundamentalsAbin VargheseNessuna valutazione finora

- A Case Study On Merger and Acquisition On Indian Bank Since 1991Documento16 pagineA Case Study On Merger and Acquisition On Indian Bank Since 1991International Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Bussiness Idea: Farmfresh: Submitted By: Gaurav Chaturvedi Mudit KhanpuriDocumento13 pagineBussiness Idea: Farmfresh: Submitted By: Gaurav Chaturvedi Mudit KhanpuriMudit KumarNessuna valutazione finora

- And Long Term" Which Is Accomplished During The Training Bank of Baroda, SME LOANDocumento246 pagineAnd Long Term" Which Is Accomplished During The Training Bank of Baroda, SME LOANkanchanmbmNessuna valutazione finora

- Financial Ratios for Project SelectionDocumento77 pagineFinancial Ratios for Project SelectionNakul JainNessuna valutazione finora

- Stock Brokers Role in Nepal Docx - PDF (MAHESH) PDFDocumento6 pagineStock Brokers Role in Nepal Docx - PDF (MAHESH) PDFMahesh JoshiNessuna valutazione finora

- Online Trading at Unicon - Final1Documento79 pagineOnline Trading at Unicon - Final1Pooja Kaushiki ShandilyaNessuna valutazione finora

- Non Resident Ordy Rupee Nro AccountDocumento5 pagineNon Resident Ordy Rupee Nro AccountAmar SinhaNessuna valutazione finora

- HDFC Bank Digital Services PDFDocumento13 pagineHDFC Bank Digital Services PDFhtNessuna valutazione finora

- Exploring the Indian Stock Market: A Guide to Key Exchanges, Trading Systems and RegulationsDocumento104 pagineExploring the Indian Stock Market: A Guide to Key Exchanges, Trading Systems and RegulationsRamesh ChandNessuna valutazione finora

- Role, Meaning, Importance of Financial Institutions An Banks in The Emerging New Environment of Privatization and GlobalizationDocumento87 pagineRole, Meaning, Importance of Financial Institutions An Banks in The Emerging New Environment of Privatization and GlobalizationSumit SharmaNessuna valutazione finora

- Mlupy 1Documento1 paginaMlupy 1Bhagya Shri MaheshwariNessuna valutazione finora

- Pamantasan NG Lungsod NG Maynila: Intramuros, ManilaDocumento10 paginePamantasan NG Lungsod NG Maynila: Intramuros, Manilacan_marge1008Nessuna valutazione finora

- DGS 1510 Series Datasheet en EUDocumento7 pagineDGS 1510 Series Datasheet en EUHector LoaizaNessuna valutazione finora

- Oracle: Question & AnswersDocumento122 pagineOracle: Question & AnswersViswa TejaNessuna valutazione finora

- RNC V4.14.10.14 Alarm Handling ReferenceDocumento37 pagineRNC V4.14.10.14 Alarm Handling ReferenceMuhammad Rizki0% (1)

- Opic 3 Security: Network ProtocolsDocumento1 paginaOpic 3 Security: Network ProtocolsRohan PangotraaNessuna valutazione finora

- Rouzan Fiqri Abdullah: ProfilDocumento12 pagineRouzan Fiqri Abdullah: ProfilDexa CareerNessuna valutazione finora

- Secure temporary email addressesDocumento2 pagineSecure temporary email addressesMapenis TavaginaNessuna valutazione finora

- Digital Marketing and Adtech Important TermsDocumento8 pagineDigital Marketing and Adtech Important TermsAnuj BhattNessuna valutazione finora

- Digital Marketing PPT 2018 SlideshareDocumento32 pagineDigital Marketing PPT 2018 SlideshareNorman PritchardNessuna valutazione finora

- We Like ProjectDocumento61 pagineWe Like ProjectLavina Tauro100% (1)

- SIMATIC IOT2040 - Ứng Dụng Và Chức Năng Cơ BảnDocumento124 pagineSIMATIC IOT2040 - Ứng Dụng Và Chức Năng Cơ BảnTạ Điền Minh Ẩn100% (1)

- Lesson 12: The Web and The Internet Web 1.0: Web 2.0: Web 3.0Documento22 pagineLesson 12: The Web and The Internet Web 1.0: Web 2.0: Web 3.0Panes GrenadeNessuna valutazione finora

- Mikrotik Crs Switches Vlan TrunkingDocumento62 pagineMikrotik Crs Switches Vlan TrunkingnormangonNessuna valutazione finora

- Checkout - RobuDocumento4 pagineCheckout - RobuBinode SarkarNessuna valutazione finora

- OSI ModelDocumento16 pagineOSI ModelFaran Ul GhaniNessuna valutazione finora

- Palo Alto Networks NGFW - Vs - Fortinet NGFW - FireCompassDocumento4 paginePalo Alto Networks NGFW - Vs - Fortinet NGFW - FireCompassIct labNessuna valutazione finora

- Digital Transformation of Bulgaria For THE PERIOD 2020-2030: Sofia 2020Documento31 pagineDigital Transformation of Bulgaria For THE PERIOD 2020-2030: Sofia 2020Ilija MilosavljevicNessuna valutazione finora

- Intro To JavaDocumento14 pagineIntro To JavaFranklin TamayoNessuna valutazione finora

- Harsh Bhatia - Full Stack Developer with experience in React, Nodejs and MongoDBDocumento1 paginaHarsh Bhatia - Full Stack Developer with experience in React, Nodejs and MongoDBharsh bhatiaNessuna valutazione finora

- SBC SetupDocumento10 pagineSBC Setupdouglas.esaNessuna valutazione finora

- Huawei - Configuring Signaling Transport DataDocumento100 pagineHuawei - Configuring Signaling Transport DatacolscribNessuna valutazione finora

- 2010 Torrens Geojournal Geography and Computational Social ScienceDocumento16 pagine2010 Torrens Geojournal Geography and Computational Social ScienceGargi ChaudhuriNessuna valutazione finora

- ICT Skills Assessment Booklet 2020Documento35 pagineICT Skills Assessment Booklet 2020Neel BC100% (1)

- Backlinks Subdomains Live 13 Nov 2019 - 14 49 07Documento2.956 pagineBacklinks Subdomains Live 13 Nov 2019 - 14 49 07Muhammad Azam BouchalNessuna valutazione finora

- Choosing Nport: Nport Number of Com Ports FeaturesDocumento1 paginaChoosing Nport: Nport Number of Com Ports FeaturesBoudam BoudjemaNessuna valutazione finora

- LTRUCC-2150 Berlin2017Documento44 pagineLTRUCC-2150 Berlin2017Ezo'nun BabasıNessuna valutazione finora

- 3GPP TS 29.205Documento8 pagine3GPP TS 29.205Moh TempNessuna valutazione finora

- User Manual For Online Admission SystemDocumento8 pagineUser Manual For Online Admission SystemZaid WaryahNessuna valutazione finora

- Topics: Introduction To Online AdvertisingDocumento34 pagineTopics: Introduction To Online AdvertisingGada TejNessuna valutazione finora

- Acer Liquid Z110 Duo User Manual PDFDocumento56 pagineAcer Liquid Z110 Duo User Manual PDFEdgar Jose Aranguibel MorilloNessuna valutazione finora

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Profit First for Therapists: A Simple Framework for Financial FreedomDa EverandProfit First for Therapists: A Simple Framework for Financial FreedomNessuna valutazione finora

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDa EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyValutazione: 5 su 5 stelle5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- Basic Accounting: Service Business Study GuideDa EverandBasic Accounting: Service Business Study GuideValutazione: 5 su 5 stelle5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDa EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesValutazione: 4.5 su 5 stelle4.5/5 (30)

- Project Control Methods and Best Practices: Achieving Project SuccessDa EverandProject Control Methods and Best Practices: Achieving Project SuccessNessuna valutazione finora

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungDa EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungValutazione: 4 su 5 stelle4/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyDa EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyValutazione: 4 su 5 stelle4/5 (4)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora