Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Four-S Fortnightly Mediatainment Track 11th Feb - 24the Feb 2012

Caricato da

seema1707Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Four-S Fortnightly Mediatainment Track 11th Feb - 24the Feb 2012

Caricato da

seema1707Copyright:

Formati disponibili

Vol.

36, 11th February 24th February 2012

Mediatainment Track

Fortnightly Update on Indian Media & Entertainment Industry

In the Spotlight

2012: year of Indian Hockey Our national game Hockey has for long been dominated by cricket. But 2012 is going to be the year of Hockey getting its place due. The two major Indian Hockey bodies Indian Hockey Federation and Hockey India are getting an IPL like event each. Indian Hockey Federation and Nimbus Sports have joined hands to launch World Series Hockey (WSH) in India. Tyre maker Bridgestone, which sponsors F1events, has come on board as the title sponsor. WSH will have 200 players - Indian and international - playing 59 matches. The format would be multi-city franchise based with eight teams out of Mumbai, Delhi, Chennai, Hyderabad, Bangalore, Chandigarh, Pune, Bhopal, Punjab, Ranchi and Rourkela. All star players have already signed up in an event thats serving as a comeback for Dhanraj Pillay and Viren Rasquinha. The inaugural match is on 29 of February and the final st match is on 1 of April. The prize money is ~$2mn. Nimbus will spend Rs.400mn in marketing WSH on TV, Print, Radio, Digital and On-ground events. Digital and Social media campaign is handled by Red Digital while for print, WSH has entered into a strategic alliance with Dainik Bhaskar. Not to be left behind Hockey India has partnered International Hockey Federation for an Indian Hockey League later this year. India is making the right moves to emerge as Hockey hub of the world.

th

Content

Private Equity Mergers & Acquisitions Corporate Developments News Update Stock Market Update Financial Benchmarking About Four-S

Content

2 2 3 3 5 5 7

About Four-S Services

Four-S Services is India's leading provider of Research, Financial Consulting and Investment Banking services with offices in Gurgaon, Mumbai and Bangalore. We have a proven track record of consistently delivering high quality solutions, enabling our clients to improve the effectiveness of decision making and acting as a catalyst in achieving business success. We have executed more than 120 mandates across diverse range of industries including Education, Financial Services, Infrastructure, M&E, IT-ITeS, Auto and Auto ancillaries, Retail, Real Estate and Textile etc

Our Services:

Strategy Consulting Business Planning Investment Banking Research Support Valuation Services Investor Relations & IPO Consulting

For further information, please contact Seema Shukla atseema@four-s.com or reach us as http://www.four-s.com

FOUR-S Mediatainment Track

Investment Activity

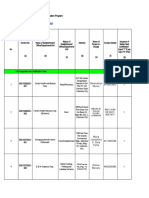

Private Equity deals in M&E and Mobile VAS till 24 February, 2012

Date Investors 20-Feb 17-Feb 15-Feb 8-Feb 31-Ja n 27-Ja n Oja s Venture Pa rtners Upda ta , Wes tBri dge & Intel Ca pi ta l Ci s co Sys tems Indi a n Angel Network Oja s Ventures NA Target Bri zzTV Medi a La b Jul y Sys tems Qyuki Ga mi a na Di gi ta l Ga mi ng Venturenet Pa rtners Pvt Ltd InRev Stake % Amount $mn Business NA NA 17 NA NA NA NA NA NA 15.0 5.5 1.0 NA NA NA 6.6 Di gi ta l medi a mVAS Di gi ta l medi a Ga mi ng Di gi ta l Ra di o Soci a l medi a product Stage

th

Early Late Early Early Early

Ea rl y

19-Jan CCube

19-Ja n Sequoi a Ca pi ta l

MyAdCorner.com

Knowl a ri ty Communi ca ti ons

Online ad booking

Early

mVAS - Cl oud Tel ephony Growth

2012 has seen 8 deals for more than $28.1mn till date.

Merger & Acquistions in M&E and Mobile VAS till 24 February, 2012

Date Acquiror 10-Feb GigaOM 3-Feb Persistent Systems 2-Feb Walt Disney 25-Jan Gujarat Telelinks

4-Ja n Wa y2Onl i ne 3-Ja n Network 18 Group 2-Ja n Undi s cl os ed buyer

th

Target Openwave Location Business UTV Software V&S

160by2 Eena du Ba l a ji Tel efi l ms - educa ti on/ mobi l e

Stake (%) Amount ($ mn) Business NA

NA 446* 0.2 NA NA 395.0 1.6

NA Guardian News & Media - PaidContent, other assets

100.0 NA 51.0 1.1 100.0 NA NA

Content mVAS - Location services Broadcasting, Production Distribution - MSO Distribution - Cable

Onl i ne porta l - mes s a gi ng Broa dca s ti ng Content/ Medi a educa ti on

19-Jan Reliance Strategic Investments DEN Networks

*estimated value 2012 has seen 8 deals happening in the segment, worth more than $842mn.

Four-S Indian PE Directory 2012 A Guide to choosing private equity partners

Detailed listing of ~330 Active PE/VC Investors in India - PE/VC players that have invested in the past 3 years. A first-of-its-kind, the directory offers Deal History in India for individual investor. Management, investment profile and Contact details. User-friendly Spreadsheet Format. It comes from Four-S Services, the most trusted deal information bank in India.

Research Desk

Four-S Services is India's leading provider of high-end research, financial consulting and Investment banking services. We have executed projects for prestigious Indian as well as global corporations, investment banks, private equity funds, venture capitalists and hedge funds including Indias Top 5 PE Funds. For further information, please contact Seema Shukla at seema@four-s.com or reach us as http://www.four-s.com

FOUR-S Mediatainment Track

Corporate Developments

BrizzTV Media raises funding from Ojas Brizz TV Media Lab has raised Series A funding from Ojas Venture Partners. The funding amount was undisclosed. BrizzTV is a digital media technology company that uses DTH enabled TVs to deliver personal content. BrizzTV has partnered with Airtel Digital TV. The company was incubated at NSRCEL (IIM Bangalore). This is Ojas Ventures second investment in less than a month. Both investments have been in digital media space. Connected TVs are a new trend globally. BrizzTV has an advantage in emerging markets with low internet penetration as it does not require internet to operate. It can run on simple DTH infrastructure. Qyuki gets $5.5mn from Cisco Qyuki has raised $5.5mn in funding from Cisco system in exchange for 17% stake, at a valuation of over $32mn. Qyuki is a media firm based in Bangalore started by industry stalwarts AR Rahman and Shekhar Kapur. Qyuki will be in digital content creation and distribution in new media platforms of mobile and internet. The service is expected to go live in May 2012. This is Shekhar Kapurs second digital venture, first being Liquid Comics that had recently launched a digital comic books platform Graphic India. July Systems gets $15mn in funding July Systems has received $15mn in funding in a round led by Updata Partners with Intel Capital and WestBridge Capital also participating. The company has raised over $30mn in multiple rounds of funding so far. July Systems is in cross-platform mobile content applications space with brands like ESPN, Toys R Us, Intel, Unilever, CBS, and the NBA as its customers. In earlier rounds, July Systems had raised funding from Intel Capital, Sequoia Capital, Footprint Ventures, Westbridge Capital and Acer Technology Ventures. Chinese mobile marketing firm enters India: WPP to pick stake Chinese mobile marketing and advertising firm Madhouse has started its Indian operations as Madhouse India. WPP is a strategic partner in Madhouse India and will also pick stake later. Rovio Entertainment, of Angry Birds game fame, may also become a strategic investor in the firm. Chinese firm Madhouse has over 120 clients and has its investors include TDF Capital, Nokia Growth partners and Gobi Partners. India offers a huge potential as a mobile market with over 850mn mobile subscribers. Digital advertising is growing faster at 40% than traditional advertising media (15-20%). The company expects the Rs. 1.25bn Indian mobile marketing to reach Rs. 10bn by 2014. Gamiana raises Series A funding Gamiana has received an undisclosed amount of Series A funding from Indian Angel Network. Chetan Sharma of IAN will join on Gamians board. The company will use the funds to increase their customer base and in software development. Gamiana is an online entertainment company using games to build online communities. Its offerings include Jamia Online, a virtual world game targeted at teens and Vinashi, a real-time strategy game. Gamiana was founded in 2008. Gartner estimates global online gaming market to be over $11mn and will reach $28bn by 2015.

News Update

Mahindra Satyam in talks with ComVIVa Mahindra Satyam is looking to acquire 20-30% in ComVIVA in a deal that could be worth $100mn. ComVIVA is a Bharti Group owned mVAS player. It has more than 110 customers spread across 90 countries. It provides Apps, Platforms, Financial Solutions and customer solutions for mobile. A sister company TechMahindra runs another mVAS company CanvasM jointly with Motorola. India in Oscars with Anil Ambanis Dreamworks Anil Ambanis JV with Steven Speilberg, Dreamworks Studios had three films getting 11 Oscar Nominations this year The Help, War Horse and Real Steel. Out of the 11 nominations, The Help fetched an Oscar for Best Supporting Actress to Octavia Spencer. Anil Ambani owns 51% in Dreamworks Studios having invested $325mn in it in 2009. 500mn high for Dabangg2 In another milestone for Bollywood, Salman Khan has hit a jackpot by selling statellite rights of Dabangg2 for Rs. 500mn to Star Network. This is much higher than Rs. 400mn deal for Hrithik starrer Agneepath. The music rights have also been sold to T-Series for over Rs. 100mn.

DeskResearch DeskResearch Desk research, financial consulting and Investment banking services. We have executed projects for prestigious Indian as well leading provider of high-end

as global corporations, investment banks, private equity funds, venture capitalists and hedge funds including Indias Top 5 PE Funds. For further information, please contact SeemaShukla at seema@four-s.com or reach us as http://www.four-s.comFour-S Services is India's leading provider of highend research, financial consulting and Investment banking services. We have executed projects for prestigious Indian as well as global corporations, investment banks, private equity funds, venture capitalists and hedge funds including Indias Top 5 PE Funds. For further information, please contact

FOUR-S Mediatainment Track

Stock Market Update (Returns)

Stock Zee Entertai nment Sun TV Network Di s h TV UTV Softwa re DB Corp Ja gra n Pra ka s ha n HT Medi a Ha thwa y ca bl e Eros Interna tiona l Den Networks TV 18 Broa dca s t ENIL Decca n Chroni cl e Onmobi l e Pri me Focus Rel i a nce Medi a works PVR Ba l a ji Tel efi l ms Ni fty Sens ex MCap (Feb 24) Price (Feb 24) 1,22,234 1,20,117 57,905 43,751 36,295 32,892 32,680 21,286 16,890 13,310 11,080 10,631 8,977 8,444 7,131 3,690 3,593 2,661 131.5 318.2 57.5 1068.0 198.9 107.0 144.3 156.6 186.2 105.2 31.9 233.6 45.2 73.2 54.8 82.5 140.7 43.0 5429.3 17923.6 15 days 2% -7% -14% 1% -1% -1% 1% -14% -14% 16% 3% 7% -10% -4% -11% -3% -1% 0% 1% 1% 1m 10% 11% 1% 2% 6% 9% 13% 19% -9% 34% 5% 16% 9% 0% -3% 3% -2% 16% 6% 5% 3m 10% 18% -6% 13% -1% 4% 24% 50% -13% 86% -10% 1% 1% 10% 16% -2% 11% 46% 14% 13% 6m 10% 6% -26% 14% -18% 0% -1% 84% -2% 154% -28% -5% -20% 20% 0% -6% 20% 50% 11% 10% 14% -16% 1% 123% -17% -2% 1% 34% 32% 5% -66% 13% -28% -27% 28% -41% 28% 21% 3% 2%

Market Cap in .`mn

1 yr P/E (TTM) 19.7 16.1 NA NA 18.0 18.4 16.1 NA 13.1 97.8 NA 18.9 111.8 8.0 7.9 NA 10.0 29.8

Financial Benchmarking - Quarter 3, FY12 Results

Quarter ending 31 December, 2011

Company

Zee Entertai nment Sun TV Network* Di s h TV* UTV Softwa re DB Corp Ja gra n Pra ka s ha n* HT Medi a Ha thwa y ca bl e* Eros Interna tiona l Den Networks TV 18 Broa dca s t ENIL Decca n Chroni cl e* Rel i a nce Medi a OnMobi l e Gl oba l Pri me Focus PVR

st

Revenue Q3, FY'11 Q3, FY'12 8,249 5,980 3,732 2,559 3,482 2,860 4,651 1,199 2,798 2,644 2,362 1,458 1,996 2,423 1,486 1,269 1,336 395 7,548 4,251 4,905 1,654 3,956 3,240 5,266 1,277 4,084 2,782 3,428 768 2,316 2,111 1,688 2,128 1,390 346 y-o-y -8% -29% 31% -35% 14% 13% 13% 6% 46% 5% 45% -47% 16% -13% 14% 68% 4% -12% 2,241 5,018 667 534 1,148 897 883 214 619 268 321 308 754 167 336 369 216 -4

EBITDA 2,160 1,202 -686 -4% 80% NM 1,600 2,255 -443 400 659 526 478 -124 428 92 198 -52 352 -570 209 175 -48 12

PAT 1,393 -13% 1,679 -26% -430 -962 NM NM

Q3, FY'11 Q3, FY'12 y-o-y Q3, FY'11 Q3, FY'12 y-o-y 3,411 -32%

1,018 -11% 723 -19% 777 -12% 221 1,010 -341 3% 63% NM

554 -16% 413 -22% 482 1% -183 691 -535 184 -1,511 263 90 11 NM 61% NM NM NM 50% NM -8%

235 -12% 257 -16% 502 -33% -454 391 613 240 -19 NM 16% 66% 11% NM

35 -62%

213 -39% 178 -15%

Balaji Telefilms*

* Standalone results

Figures in Rs.`mn

Research Desk

Four-S Services is India's leading provider of high-end research, financial consulting and Investment banking services. We have executed projects for prestigious Indian as well as global corporations, investment banks, private equity funds, venture capitalists and hedge funds including Indias Top 5 PE Funds. For further information, please contact Seema Shukla at seema@four-s.com or reach us as http://www.four-s.com

FOUR-S Mediatainment Track

Nine Months ending 31 December, 2011

Company

Zee Entertai nment Sun TV Network* Di s h TV* UTV Softwa re DB Corp Ja gra n Pra ka s ha n* HT Medi a Ha thwa y ca bl e* Eros Interna tiona l Den Networks TV 18 Broa dca s t ENIL Decca n Chroni cl e* Rel i a nce Medi a works OnMobi l e Gl oba l Pri me Focus PVR

st

Revenue 9M, FY'11 9M, FY'12 22,134 14,632 10,036 7,041 9,479 8,327 13,116 3,484 5,927 7,641 5,984 3,709 6,681 6,970 4,039 4,262 3,717 1,085 21,715 13,304 14,331 6,118 11,032 9,341 15,143 3,787 7,370 8,177 9,107 2,156 6,592 6,385 4,605 5,828 3,947 991 y-o-y -2% -9% 43% -13% 16% 12% 15% 9% 24% 7% 52% -42% -1% -8% 14% 37% 6% -9% 5,997 11,940 1,487 1,479 3,235 2,708 2,482 696 1,419 892 391 495 3,412 505 899 1,294 708 -82

EBITDA 9M, FY'11 9M, FY'12 5,796 10,725 3,542 -742 2,793 2,468 2,392 640 1,723 658 -36 504 1,724 -1,051 986 1,652 727 -64 y-o-y -3% -10% 138% NM -14% -9% -4% -8% 21% -26% NM 2% -49% NM 10% 28% 3% NM 4,402 5,639 -1,526 1,214 1,905 1,637 1,280 -229 1,041 297 -43 -31 2,090 -1,554 623 659 93 -23

PAT 9M, FY'11 9M, FY'12 4,290 5,356 -1,098 -1,281 1,567 1,368 1,435 -434 1,151 98 -404 360 546 -3,918 783 783 387 101 y-o-y -3% -5% NM NM -18% -16% 12% NM 11% -67% NM NM -74% NM 26% 19% 317% NM

Balaji Telefilms*

* Standalone results TTM Dec-11 Results

Company

Zee Entertai nment Sun TV Network* Di s h TV* UTV Softwa re DB Corp Ja gra n Pra ka s ha n* HT Medi a Ha thwa y ca bl e* Eros Interna tiona l Den Networks TV 18 Broa dca s t ENIL Decca n Chroni cl e Rel i a nce Medi a OnMobi l e Gl oba l Pri me Focus PVR

Figures in Rs.`mn

Revenue TTM Dec10 TTM Dec11 28,627 18,551 13,068 8,347 12,050 10,690 16,999 4,484 7,555 10,104 7,672 4,911 8,598 9,266 5,268 5,143 4,592 1,532 29,695 17,909 18,661 8,546 14,206 12,167 19,871 5,022 8,513 10,998 11,165 3,083 9,673 7,777 5,938 6,596 4,842 1,436 4% -3% 43% 2% 18% 14% 17% 12% 13% 9% 46% -37% 13% -16% 13% 28% 5% -6% 7,833 15,249 1,835 1,886 3,931 3,340 3,402 908 1,721 1,162 416 776 3,945 746 1,118 1,287 818 16

EBITDA y-o-y TTM Dec10 TTM Dec11 8,064 14,364 4,443 -442 3,589 2,910 3,268 807 1,856 889 35 814 1,166 -1,692 1,293 2,033 912 -68 3% -6% 142% NM -9% -13% -4% -11% 8% -24% -91% 5% -70% NM 16% 58% 12% NM 5,607 7,290 -2,124 1,539 2,212 2,001 1,808 -322 1,236 625 -267 147 2,155 -2,009 700 788 20 11

PAT y-o-y TTM Dec10 TTM Dec11 6,196 7,440 -1,469 -1,120 2,022 1,789 2,025 -609 1,292 136 -680 561 80 -5,624 1,052 903 359 89 y-o-y 11% 2% NM NM -9% -11% 12% NM 4% -78% NM 282% -96% NM 50% 15% 1679% 688%

Balaji Telefilms*

* Standalone results

Figures in Rs.`mn

Research Desk

Four-S Services is India's leading provider of high-end research, financial consulting and Investment banking services. We have executed projects for prestigious Indian as well as global corporations, investment banks, private equity funds, venture capitalists and hedge funds including Indias Top 5 PE Funds. For further information, please contact Seema Shukla at seema@four-s.com or reach us as http://www.four-s.com

FOUR-S Mediatainment Track

Four-S Services Pvt Ltd

Founded in 2002, Four-S has a strong & successful track record of genuine, accurate and objective advice to top Indian & global companies & PE Firms. Four-S has already proven success in corporate finance, strategy consulting, fund-raising, investment banking and investor relations mandates with 100+ corporates and large PE funds

Four-S, trusted advisor to top Indian & Global Cos

Offering comprehensive bouquet of services to SMEs, Corporates and PE Funds

Target Identification Portfolio Benchmarking Post investment Review

Sector Research

Investor Relations

Investment Banking

Entry Strategy

Independent Valuation

FOUR-S Mediatainment Track

About Four-S Services

Four-S Services provides customized business and financial research to organizations across the globe. The company also provides Investor Relations consulting to corporate based on in-depth sectoral and company research. The company has an impressive client profile and a team of senior analysts covering key sectors including Finance & Banking, IT & Telecom, Retail, Media & Entertainment, Pharmaceuticals, Infrastructure and Manufacturing amongst others. For further information on the company please visit www.four-s.com

Disclaimer

The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. No representation, warranty, guarantee or undertaking, express or implied, is made as to the fairness, accuracy or completeness of any information, projections or opinion contained in this document or upon which any such projections or opinions have been based. Four-S Services Pvt Ltd. will not accept any liability, whatsoever with respect to the use of this document or its content. This document has been distributed for information purposes only and does not constitute or form part of any offer or solicitation of any offer to buy or sell any securities. This document shall not form the basis of and should not be relied upon in connection with any contract or commitment whatsoever. This document is not to be reported or copied or made available to others. The Company may from time to time solicit from, or perform consulting, or other services for, any company mentioned in this document.

Potrebbero piacerti anche

- Four-S Fortnightly Mediatainment Track 16th March - 30th March 2012Documento8 pagineFour-S Fortnightly Mediatainment Track 16th March - 30th March 2012seema1707Nessuna valutazione finora

- Saif PartnersDocumento17 pagineSaif Partnerspranav sarawagiNessuna valutazione finora

- The Indian E-Commerce Euphoria - A Bubble About To Burst?Documento5 pagineThe Indian E-Commerce Euphoria - A Bubble About To Burst?IOSRjournalNessuna valutazione finora

- Four-S Fortnightly Mediatainment Track 1st September - 14th September 2012Documento8 pagineFour-S Fortnightly Mediatainment Track 1st September - 14th September 2012seema1707Nessuna valutazione finora

- 1 Dream 11Documento15 pagine1 Dream 11joel joyNessuna valutazione finora

- STARTUPSDocumento17 pagineSTARTUPSSaniya Kazi100% (1)

- Tech Unicorn Companies (Edited)Documento21 pagineTech Unicorn Companies (Edited)Bharat DhodyNessuna valutazione finora

- The Top Finance Companies Are Playing A Key Role in The Huge Growth of The Economy of IndiaDocumento3 pagineThe Top Finance Companies Are Playing A Key Role in The Huge Growth of The Economy of IndiaArulp44Nessuna valutazione finora

- Case StudyDocumento8 pagineCase StudyManiya JigarNessuna valutazione finora

- 3.2 FINANCE A Info Edge LTDDocumento35 pagine3.2 FINANCE A Info Edge LTDSohanNessuna valutazione finora

- Assignment No. 4 Harsh TaydeDocumento11 pagineAssignment No. 4 Harsh TaydeFridyNessuna valutazione finora

- Tech Start-Ups in India Across Various Sectors: 1. Practo (Healthcare)Documento11 pagineTech Start-Ups in India Across Various Sectors: 1. Practo (Healthcare)SHIKHAR MOHANNessuna valutazione finora

- GICTS (Marketing Idea)Documento57 pagineGICTS (Marketing Idea)vishnu0751Nessuna valutazione finora

- Shri Ram Case Cognition: 2 RoundDocumento10 pagineShri Ram Case Cognition: 2 RoundMudrikaNessuna valutazione finora

- WIPRO Make Progress & ThriveDocumento5 pagineWIPRO Make Progress & ThriveVeronica TripathiNessuna valutazione finora

- Assignment NoDocumento6 pagineAssignment NoShubham DimriNessuna valutazione finora

- IT Sector and Its CompaniesDocumento11 pagineIT Sector and Its Companiespriyanka_joshi_31Nessuna valutazione finora

- To Loan Frame: Building India's Largest SME Lending PlatformDocumento4 pagineTo Loan Frame: Building India's Largest SME Lending PlatformDanish KhanNessuna valutazione finora

- WiproDocumento4 pagineWiproritvikjindalNessuna valutazione finora

- ReportDocumento64 pagineReportSTAR PRINTINGNessuna valutazione finora

- Chapter 2Documento22 pagineChapter 2Aditya Chowdary KesineniNessuna valutazione finora

- Top 10 IT Companies in India 2020Documento7 pagineTop 10 IT Companies in India 2020MALATHI MNessuna valutazione finora

- HDFC LifeDocumento87 pagineHDFC LiferehanfrzNessuna valutazione finora

- MR - Reliance and Disney Announce Strategic Joint VentureDocumento5 pagineMR - Reliance and Disney Announce Strategic Joint Ventureishare digitalNessuna valutazione finora

- Business Environment AssignmentDocumento5 pagineBusiness Environment AssignmentNaman KansalNessuna valutazione finora

- Project Mahindra & Mahindra Limited: Submitted by Dhruv Kumar 2K11B11 Submitted To DR - Prachee MishraDocumento25 pagineProject Mahindra & Mahindra Limited: Submitted by Dhruv Kumar 2K11B11 Submitted To DR - Prachee MishraDhruv KumarNessuna valutazione finora

- TcsDocumento13 pagineTcsnafis20Nessuna valutazione finora

- Company Overview 3 1Documento78 pagineCompany Overview 3 1Vivek Vikram SinghNessuna valutazione finora

- ISM Project ReportDocumento18 pagineISM Project ReportRaj Kothari M100% (1)

- Company Information: Click Here To View The Complete ListDocumento10 pagineCompany Information: Click Here To View The Complete ListNiks KanungoNessuna valutazione finora

- Merger of Snapdeal With Free ChargeDocumento11 pagineMerger of Snapdeal With Free ChargePrateek LoganiNessuna valutazione finora

- Motivation ProjectDocumento50 pagineMotivation ProjectYoddhri DikshitNessuna valutazione finora

- Enterprenurship Project - EndrosDocumento25 pagineEnterprenurship Project - EndrospulkitNessuna valutazione finora

- US India Foundry Industry OpportunitiesDocumento4 pagineUS India Foundry Industry Opportunitieskshitij-mehta-4210Nessuna valutazione finora

- IDEA Project ReportDocumento43 pagineIDEA Project Reportkamdica75% (4)

- Four-S Weekly PE Track 19th March - 25th March 2012Documento6 pagineFour-S Weekly PE Track 19th March - 25th March 2012seema1707Nessuna valutazione finora

- Competitors: Share Broking, Relligare, Angel Broking and Many MoreDocumento34 pagineCompetitors: Share Broking, Relligare, Angel Broking and Many MoreAnonymous 1TmZEYNessuna valutazione finora

- Idea 443Documento43 pagineIdea 443Sindhur KotagiriNessuna valutazione finora

- India: Venture Capital ReportDocumento15 pagineIndia: Venture Capital ReportHarsh KediaNessuna valutazione finora

- Individual Assignment: Efore OU Tart UPDocumento13 pagineIndividual Assignment: Efore OU Tart UPATUL YADAVNessuna valutazione finora

- Avendus Deal SVG April 2017Documento2 pagineAvendus Deal SVG April 2017avendusNessuna valutazione finora

- Indian Financial System CIA-1bDocumento21 pagineIndian Financial System CIA-1bprince chaudharyNessuna valutazione finora

- Team A6 EnvcDocumento11 pagineTeam A6 Envcfaraz.22pgdm024Nessuna valutazione finora

- Os Chap 1Documento7 pagineOs Chap 1Akshay K SNessuna valutazione finora

- Four-S Weekly PE Track 28th May-3rd June2012Documento6 pagineFour-S Weekly PE Track 28th May-3rd June2012seema1707Nessuna valutazione finora

- CIA-1 (Financial Management) ReportDocumento14 pagineCIA-1 (Financial Management) Reportabhishek anandNessuna valutazione finora

- Helion Ventures PartnersDocumento4 pagineHelion Ventures Partnersaimanfatima100% (1)

- India: A Study of Indian Companies and Their Approach To Brand ValuationDocumento4 pagineIndia: A Study of Indian Companies and Their Approach To Brand ValuationRaghavendra HaveriNessuna valutazione finora

- PPTDocumento29 paginePPTSuman Sourav Raj0% (1)

- Nanon Ives HDocumento7 pagineNanon Ives Hprince1900Nessuna valutazione finora

- Summer Training Project Report ON: Submitted byDocumento55 pagineSummer Training Project Report ON: Submitted byVivian Clement100% (2)

- Gaurav Radheshyam Khaitan PevcDocumento9 pagineGaurav Radheshyam Khaitan PevcGAURAV KHAITANNessuna valutazione finora

- Weekend News: Bhawana Chawla MBA-2CDocumento13 pagineWeekend News: Bhawana Chawla MBA-2CBHAWANACHAWLANessuna valutazione finora

- MARKETING MIX & 4P's OF RELIANCE JIODocumento13 pagineMARKETING MIX & 4P's OF RELIANCE JIOYash KarandeNessuna valutazione finora

- Vijayanagara Sri Krishnadevaraya UniversityDocumento38 pagineVijayanagara Sri Krishnadevaraya Universitybaburao1762Nessuna valutazione finora

- Nana9215 FinalDocumento52 pagineNana9215 Finalshridhar9215Nessuna valutazione finora

- Outbound Hiring: How Innovative Companies are Winning the Global War for TalentDa EverandOutbound Hiring: How Innovative Companies are Winning the Global War for TalentNessuna valutazione finora

- Making Big Data Work for Your Business: A guide to effective Big Data analyticsDa EverandMaking Big Data Work for Your Business: A guide to effective Big Data analyticsNessuna valutazione finora

- 10 Great Ways to Earn Money Through Artificial Intelligence(AI)Da Everand10 Great Ways to Earn Money Through Artificial Intelligence(AI)Valutazione: 5 su 5 stelle5/5 (1)

- Venus Remedies Report Update PDFDocumento11 pagineVenus Remedies Report Update PDFseema1707Nessuna valutazione finora

- Company Report - Venus Remedies LTDDocumento36 pagineCompany Report - Venus Remedies LTDseema1707Nessuna valutazione finora

- Four-S Fortnightly Logistics Track 7th August - 20th August 2012Documento12 pagineFour-S Fortnightly Logistics Track 7th August - 20th August 2012seema1707Nessuna valutazione finora

- Four-S Fortnightly Logistics Track 7th August - 20th August 2012Documento12 pagineFour-S Fortnightly Logistics Track 7th August - 20th August 2012seema1707Nessuna valutazione finora

- Four-S Weekly PE Track 28th May-3rd June2012Documento6 pagineFour-S Weekly PE Track 28th May-3rd June2012seema1707Nessuna valutazione finora

- Logistics Report SampleDocumento10 pagineLogistics Report Sampleseema1707Nessuna valutazione finora

- Four-S Monthly Cleantech Track February 2012Documento9 pagineFour-S Monthly Cleantech Track February 2012seema1707Nessuna valutazione finora

- Four-S Fortnightly PharmaHealth Track 23rd April - 5th May 2012Documento10 pagineFour-S Fortnightly PharmaHealth Track 23rd April - 5th May 2012seema1707Nessuna valutazione finora

- Four-S Weekly PE Track 19th March - 25th March 2012Documento6 pagineFour-S Weekly PE Track 19th March - 25th March 2012seema1707Nessuna valutazione finora

- Four-S Monthly Edutrack - 8th January - 5th Febuary 2012Documento7 pagineFour-S Monthly Edutrack - 8th January - 5th Febuary 2012seema1707Nessuna valutazione finora

- FMTI Company ProfileDocumento4 pagineFMTI Company ProfileFirst Metro Travel Inc.Nessuna valutazione finora

- Corporate Management JurisprudenceDocumento37 pagineCorporate Management Jurisprudencegilberthufana446877Nessuna valutazione finora

- New Microsoft Office Word DocumentDocumento74 pagineNew Microsoft Office Word DocumentGanesh AdityaNessuna valutazione finora

- Consolidated Digest of Case Laws Jan 2012 Sept 2012 PDFDocumento371 pagineConsolidated Digest of Case Laws Jan 2012 Sept 2012 PDFAnand PrakashNessuna valutazione finora

- Golangco SyllabusDocumento3 pagineGolangco SyllabusMaria Cresielda EcalneaNessuna valutazione finora

- Individual Assignment Pricing Strategy For Mcdonald'SDocumento6 pagineIndividual Assignment Pricing Strategy For Mcdonald'SfatruroziNessuna valutazione finora

- Product & Services of Oriental Insurance CompanyDocumento87 pagineProduct & Services of Oriental Insurance CompanyKamal MakkarNessuna valutazione finora

- Equity Pick-Up Module & Customized Intercompany Matching: Fusion 11.1.1.2, HFM & ReportsDocumento20 pagineEquity Pick-Up Module & Customized Intercompany Matching: Fusion 11.1.1.2, HFM & Reportssagiinfo1Nessuna valutazione finora

- Technopreneurship Part1Documento13 pagineTechnopreneurship Part1jocansino4496Nessuna valutazione finora

- AmwayDocumento12 pagineAmwayAshna SharmaNessuna valutazione finora

- Mojo Portfolio Jun2015 SmallDocumento21 pagineMojo Portfolio Jun2015 SmallenricoNessuna valutazione finora

- KelloggDocumento23 pagineKelloggAnish JohnNessuna valutazione finora

- Report-on-Safety-Seal-Certification-2021 (October 21-27, 2021)Documento4 pagineReport-on-Safety-Seal-Certification-2021 (October 21-27, 2021)Mecs NidNessuna valutazione finora

- Trademark 2014 SyllabusDocumento8 pagineTrademark 2014 SyllabusMaya Julieta Catacutan-EstabilloNessuna valutazione finora

- Approved Materials ListDocumento225 pagineApproved Materials Listronit13Nessuna valutazione finora

- Errata, Rule Clarifications, Timing Structures, and Frequently Asked Questions V2.2Documento19 pagineErrata, Rule Clarifications, Timing Structures, and Frequently Asked Questions V2.2MasterofsanctityNessuna valutazione finora

- Republic Act No 8424Documento206 pagineRepublic Act No 8424YanoNessuna valutazione finora

- Perman SDN BHD & Ors V European CommoditiesDocumento14 paginePerman SDN BHD & Ors V European Commoditieslionheart88880% (1)

- Methods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Documento21 pagineMethods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Precious MamigoNessuna valutazione finora

- High-Tech SMEs in EuropeDocumento64 pagineHigh-Tech SMEs in EuropedmaproiectNessuna valutazione finora

- SAMPLE Client Satisfaction SurveyDocumento5 pagineSAMPLE Client Satisfaction SurveyDevikaNessuna valutazione finora

- Tax Structure 1Documento2 pagineTax Structure 1clash clanNessuna valutazione finora

- Performance Apprisal For Mba HRMDocumento100 paginePerformance Apprisal For Mba HRMPankaj SharmaNessuna valutazione finora

- HERO GROUP and DR Brij Mohal Lall MunjalDocumento14 pagineHERO GROUP and DR Brij Mohal Lall MunjalAzhar k.pNessuna valutazione finora

- Chapter 4 Internal Control CashDocumento24 pagineChapter 4 Internal Control CashHenry CardyNessuna valutazione finora

- Swiss Bank ListDocumento30 pagineSwiss Bank ListAngah Syud100% (2)

- BBG-CIR-Personal-09-06-2017 (BDO Open Account Form) PDFDocumento2 pagineBBG-CIR-Personal-09-06-2017 (BDO Open Account Form) PDFiam cjNessuna valutazione finora

- Styling Notebook: Air France Reinvents Flying PleasureDocumento33 pagineStyling Notebook: Air France Reinvents Flying PleasureDat NguyenNessuna valutazione finora

- 162106-235503 20190630 PDFDocumento8 pagine162106-235503 20190630 PDFanon_566961526Nessuna valutazione finora

- Painting The Future Bright - The Daily StarDocumento5 paginePainting The Future Bright - The Daily StarAkash79Nessuna valutazione finora