Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Super Savings New

Caricato da

winnermeDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Super Savings New

Caricato da

winnermeCopyright:

Formati disponibili

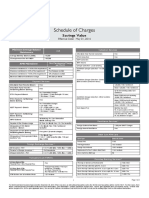

Super Savings Account (December 15, 2011)

Schedule of Facilities Charges are exclusive of service tax. Service Tax of 10.30% to be collected separately. In case the a/c has remained inactive for more than 2 years it will be categorised as inoperative account Scheme Code - RSNEW/RSNRE/RSNRO AOA Eligibility (Account Opening Amount) International Debit Cum ATM Card Annual Fee One/additional add-on card per account Replacement of damaged/lost/stolen card/ re - generation of Pin/ Copy retrieval IDBI Bank ATM Non Financial / Financial Transaction Free Free Free Free 5 transactions Free per month, thereafter Non Financial - Rs 8 per transaction Financial - Rs 20 per transaction Non Financial - Rs 30 per transaction Financial- Rs 140 per transaction Rs 25,000/- (Per Day) Rs 25,000/- (Per Day) Any amount less than Rs. 50,000/-

Other Bank ATM

International ATM ATM Cash Withdrawal Limit POS Limit (Point of Sale) Cheque Book Personalised Multicity book Account statements Passbook Monthly statement by e-mail Duplicate Statement at the branch Duplicate Passbook Hold mail facility Overseas mailing Request for duplicate statement through Phone banking & ATM Account closure charges Certificates Standing instructions Balance/Interest/Signature verification certificate/Banker's report Foreign inward remittance certificate Remittances Demand Drafts (Branch/Non Branch)/ Payorder Payable at Par utilisation Foreign currency demand drafts / international money orders DD/ payorder cancellation (Domestic/Foreign Currency)

20 leaves per quarter free and Rs 2 per cheque leaf above free limit.

Free Free Free Free Free Free Free Nil

Free Free Free

10 Transactions Free per month (Both inclusive) Above free limit Rs 2.50/1000, (Min.- Rs 25/- and Max. Rs 10,000/-) Free Free Free Upto Rs 1 Lakh - Rs 5 per transaction above Rs 1 Lakh to 2 Lakhs Rs 15 per transaction above Rs 2 Lakhs - Rs 25 per transaction Free Rs 2 lakh to Rs 5 Lakh - Rs 25 per transaction, Above Rs 5 lakh - Rs 50 per transaction.

NEFT

NEFT (Net Banking) RTGS

Any Branch Banking* Any branch cheque deposits and account to account transfers Cash deposits (Home Branch) Cash deposits (Non - Home Branch) (Max. Rs. 50,000/- per day) Free 15 transactions per month free Excess charged @Rs 2/1000. (Min. 25 and Max Rs. 10,000/-) (15 transactions includes both Home - Non Home Cash deposit)

Any Branch Cash withdrawal Free (upto Rs 50,000/- per day only) (By self only) The services allows you to operate your account from any IDBI bank branch across India. This service is not available for encashing FD, issuance of DD/PO and third party bearer cheque. These can be done only at Home Branch. Third party cash withdrawal is not allowed at Non-Home branch. Third party cash deposit is allowed to the maximum of Rs 50,000/- per day per account. NRE/NRO customers will get faciltiies as per RBI rules. Cheque transaction charges Cheque collections (Branch/Non branch locations)/Speed Clearing Foreign currency cheque collection Cheque stop payment instructions Old records / copies of paid cheques Alternate Channel Banking Internet / Mobile / Phone/ SMS Alerts Charges ECS/ Cheque issued and returned Financial reasons Technical reasons Cheque deposited and returned Local cheque Outstation cheque Technical reasons(Local or Outstation) Unarranged overdraft / Cheque Purchase (A + B) (Subject to approval) Per occasion (A) Interest (B) Rs.102 19.75% Rs 53 Rs 102 Free Rs 200 Free Free Only other bank commission will be recovered Only other bank commission will be recovered Free Free

Potrebbero piacerti anche

- Sabka Basic Savings Account Complete KYC 10-10-2013Documento2 pagineSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNessuna valutazione finora

- International Taxation In Nepal Tips To Foreign InvestorsDa EverandInternational Taxation In Nepal Tips To Foreign InvestorsNessuna valutazione finora

- Annex 2 Super Savings AccountDocumento2 pagineAnnex 2 Super Savings AccountPhani BhupathirajuNessuna valutazione finora

- Crown Salary Account 01042014Documento2 pagineCrown Salary Account 01042014Vikram IsgodNessuna valutazione finora

- Savings Account DetailsDocumento2 pagineSavings Account Detailsmysto9Nessuna valutazione finora

- Annex 3 Prime Salary AccountDocumento1 paginaAnnex 3 Prime Salary Accountfr123Nessuna valutazione finora

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Documento15 pagineSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarNessuna valutazione finora

- Islamic SOC Jan June 2013 FinalDocumento16 pagineIslamic SOC Jan June 2013 Finalfaisal_ahsan7919Nessuna valutazione finora

- "Being Me" Savings Account: W.E.F. 1st April 2014Documento2 pagine"Being Me" Savings Account: W.E.F. 1st April 2014praveenpersonelNessuna valutazione finora

- Schedule of ChargesDocumento14 pagineSchedule of ChargeskrishmasethiNessuna valutazione finora

- No Frill EnglishDocumento2 pagineNo Frill EnglishRupali WaliaNessuna valutazione finora

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Documento2 pagineParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNessuna valutazione finora

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountDocumento13 pagineSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyNessuna valutazione finora

- Schedule of Charges Deutsche BankDocumento3 pagineSchedule of Charges Deutsche BankSayantika MondalNessuna valutazione finora

- Account Tariff Structure Basic Savings AccountDocumento1 paginaAccount Tariff Structure Basic Savings Accountgaddipati_ramuNessuna valutazione finora

- From Kotak WebsiteDocumento20 pagineFrom Kotak WebsiteHimadri Shekhar VermaNessuna valutazione finora

- Regular Saving AccountDocumento92 pagineRegular Saving AccountSimu MatharuNessuna valutazione finora

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Documento2 pagineMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNessuna valutazione finora

- Schedule of Charges Deutsche Bank 4Documento3 pagineSchedule of Charges Deutsche Bank 4Sayantika MondalNessuna valutazione finora

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Documento5 pagineSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNessuna valutazione finora

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Documento2 pagineNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741Nessuna valutazione finora

- Schedule of Charges Deutsche Bank 3Documento3 pagineSchedule of Charges Deutsche Bank 3Sayantika MondalNessuna valutazione finora

- ICICI Bank Current Account ChargesDocumento3 pagineICICI Bank Current Account Chargesashishtiwari92100% (1)

- Schedule of Charges: Savings ValueDocumento2 pagineSchedule of Charges: Savings ValueNavjot SinghNessuna valutazione finora

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocumento2 pagineTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNessuna valutazione finora

- Pocket Savings Account Final UpdatedDocumento3 paginePocket Savings Account Final UpdatedDAYA VNessuna valutazione finora

- General Schedule of Features and Charges: Particulars Product Level Free Limits & Charges (In RS.)Documento2 pagineGeneral Schedule of Features and Charges: Particulars Product Level Free Limits & Charges (In RS.)Bella BishaNessuna valutazione finora

- RBI SBI Demand Draft Exchange RatesDocumento11 pagineRBI SBI Demand Draft Exchange RatesJithin VijayanNessuna valutazione finora

- (1.) Service Charges To Maintain A Ledger Accounts: P A G eDocumento17 pagine(1.) Service Charges To Maintain A Ledger Accounts: P A G eshaantnuNessuna valutazione finora

- Yes Bank Smart SalaryDocumento2 pagineYes Bank Smart SalaryVicky SinghNessuna valutazione finora

- Rca SocDocumento3 pagineRca SocKrishna Kiran VyasNessuna valutazione finora

- Broking Idirect Linked Savings AccountDocumento7 pagineBroking Idirect Linked Savings Accounttrue chartNessuna valutazione finora

- Preferred AccountDocumento2 paginePreferred AccountaurummaangxinchenNessuna valutazione finora

- HSBC Savings AccountDocumento3 pagineHSBC Savings AccountLavanya VitNessuna valutazione finora

- Multicity Cheque Facility-Current Account-Lakshmi Supreme: Details ChargesDocumento6 pagineMulticity Cheque Facility-Current Account-Lakshmi Supreme: Details ChargesEraivan EraiNessuna valutazione finora

- Select ChargesDocumento1 paginaSelect ChargesMd Imran ImuNessuna valutazione finora

- Basic Savings Bank Deposit Account SocsDocumento6 pagineBasic Savings Bank Deposit Account Socstrue chartNessuna valutazione finora

- Fees and Charges For Debit CardDocumento2 pagineFees and Charges For Debit CardAnandraojs JsNessuna valutazione finora

- Emirates NBD RatesDocumento1 paginaEmirates NBD Ratesmanish450inNessuna valutazione finora

- PersonalBanking SOC 26Dec13EnDocumento1 paginaPersonalBanking SOC 26Dec13EnHasnain MuhammadNessuna valutazione finora

- New Schedule of Charges For Current AccountDocumento2 pagineNew Schedule of Charges For Current AccountKishan DhootNessuna valutazione finora

- EDB Service Charges2011Documento8 pagineEDB Service Charges2011Imran Ali MirNessuna valutazione finora

- Schedule of Charges: Smart Salary ExclusiveDocumento2 pagineSchedule of Charges: Smart Salary ExclusivevedavakNessuna valutazione finora

- Personal Banking Personal Banking Personal BankingDocumento1 paginaPersonal Banking Personal Banking Personal BankingSaravanan ParamasivamNessuna valutazione finora

- Schedule of Charges Yes Bank 6Documento2 pagineSchedule of Charges Yes Bank 6Sayantika MondalNessuna valutazione finora

- Terms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMDocumento6 pagineTerms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMArnab Nandi100% (1)

- Saadiq SOCDocumento28 pagineSaadiq SOCAamir ShehzadNessuna valutazione finora

- Privilege Banking AccountsDocumento5 paginePrivilege Banking AccountsVinod MohiteNessuna valutazione finora

- Value Based Current Accounts Schedule of ChargesDocumento2 pagineValue Based Current Accounts Schedule of ChargesDhawan SandeepNessuna valutazione finora

- RB Chapter 2 - Current DepositsDocumento3 pagineRB Chapter 2 - Current DepositsRohit KumarNessuna valutazione finora

- KioskDocumento21 pagineKioskgollamandalaappaiahNessuna valutazione finora

- EmiratesNBD Schedule of ChargesDocumento3 pagineEmiratesNBD Schedule of ChargesbunklyNessuna valutazione finora

- HDFC Debit Cards ChargesDocumento1 paginaHDFC Debit Cards Chargesfriend120873Nessuna valutazione finora

- Saadiq SOCDocumento31 pagineSaadiq SOCjoshmalikNessuna valutazione finora

- Notification FinalDocumento4 pagineNotification FinalBrahmanand DasreNessuna valutazione finora

- PK Saadiq EnglishDocumento53 paginePK Saadiq EnglishZeeshan AshrafNessuna valutazione finora

- Oman Arab Bank RatesDocumento5 pagineOman Arab Bank Ratesakhilr141Nessuna valutazione finora

- Sme BookDocumento397 pagineSme BookVivek Godgift J0% (1)

- Key Fact StatementDocumento2 pagineKey Fact StatementsanjayNessuna valutazione finora

- Key Definitions - Financial RatiosDocumento25 pagineKey Definitions - Financial Ratioswinnerme100% (1)

- Student RegistrationDocumento17 pagineStudent RegistrationMohit SoodNessuna valutazione finora

- Super Savings NewDocumento2 pagineSuper Savings NewwinnermeNessuna valutazione finora

- What Has Worked in InvestingDocumento60 pagineWhat Has Worked in InvestinggsakkNessuna valutazione finora

- Petriwnicole AcpDocumento22 paginePetriwnicole Acpapi-194102575Nessuna valutazione finora

- The Pensford Letter - 8.31.15Documento4 pagineThe Pensford Letter - 8.31.15Pensford FinancialNessuna valutazione finora

- Submitted by SAKSHI Cse 8th SemDocumento21 pagineSubmitted by SAKSHI Cse 8th SemSakshi BindalNessuna valutazione finora

- Porter's Five Forces Analysis For The Indian Banking SectorDocumento4 paginePorter's Five Forces Analysis For The Indian Banking SectorVinayak Arun Sahi86% (7)

- London NPL Offcycle Internship Job DescriptionDocumento1 paginaLondon NPL Offcycle Internship Job DescriptionHitesh JainNessuna valutazione finora

- Latest Subsidiary BooksDocumento12 pagineLatest Subsidiary BooksRaghuNessuna valutazione finora

- Tugas 1 Akuntansi PengantarDocumento6 pagineTugas 1 Akuntansi PengantarblademasterNessuna valutazione finora

- Ranjith Complete ProjectDocumento95 pagineRanjith Complete Projectarjunmba119624Nessuna valutazione finora

- S. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchDocumento6 pagineS. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchNavil BordiaNessuna valutazione finora

- Corporate RestructuringDocumento40 pagineCorporate RestructuringSingh RahulNessuna valutazione finora

- Ross Corporate 13e PPT CH4A AccessibleDocumento15 pagineRoss Corporate 13e PPT CH4A AccessibleMai Le Thi PhuongNessuna valutazione finora

- Adarsh AssignmentDocumento21 pagineAdarsh AssignmentSudeepNessuna valutazione finora

- Ocampo - 2018 - Resetting The International Monetary (Non) System - Full BookDocumento296 pagineOcampo - 2018 - Resetting The International Monetary (Non) System - Full BookEdgars EihmanisNessuna valutazione finora

- Revision MAT Number Securing A C Sheet BDocumento1 paginaRevision MAT Number Securing A C Sheet Bmanobilli30Nessuna valutazione finora

- E Bucks Gold BusinessDocumento40 pagineE Bucks Gold BusinessDanielle Toni Dee NdlovuNessuna valutazione finora

- CH 15Documento15 pagineCH 15Yousef ShahwanNessuna valutazione finora

- Customers Perception On General Bamking Activities of Prime Bank Limited 3Documento49 pagineCustomers Perception On General Bamking Activities of Prime Bank Limited 3Shuvo DeyNessuna valutazione finora

- Commercial Bank of Ceylon, Service Marketing ConceptsDocumento14 pagineCommercial Bank of Ceylon, Service Marketing Conceptsert353592% (36)

- Sohrab Khalid 1 2Documento3 pagineSohrab Khalid 1 2Zafar HabibNessuna valutazione finora

- p1 24 Bonds PayableDocumento5 paginep1 24 Bonds PayablePrincess MangudadatuNessuna valutazione finora

- Annex C Bond RequirementsDocumento2 pagineAnnex C Bond RequirementsCecilia Umagtang0% (1)

- Case Study: Exchange Rate Policy at The Monetary Authority of SingaporeDocumento16 pagineCase Study: Exchange Rate Policy at The Monetary Authority of SingaporeDexpistol33% (3)

- 014 People v. Puig (Mozo)Documento3 pagine014 People v. Puig (Mozo)JUAN MIGUEL MOZONessuna valutazione finora

- Understanding The 2007-2008 Global Financial Crisis: Lessons For Scholars of International Political EconomyDocumento23 pagineUnderstanding The 2007-2008 Global Financial Crisis: Lessons For Scholars of International Political EconomyFred DuhagaNessuna valutazione finora

- List of BSP Registered Operator of Payment System (OPS)Documento11 pagineList of BSP Registered Operator of Payment System (OPS)Don Jose ReclamadoNessuna valutazione finora

- Sample QuotationDocumento1 paginaSample QuotationTri ChasanahNessuna valutazione finora

- Cashier:: Separated Series of Acknowledgement ReceiptsDocumento4 pagineCashier:: Separated Series of Acknowledgement ReceiptsMERCE LYSA BALIJONNessuna valutazione finora

- Funding Your StartupDocumento8 pagineFunding Your Startup153KAPIL RANKANessuna valutazione finora

- TabulationDocumento19 pagineTabulationcoolchethanNessuna valutazione finora

- Capital Structure DecisionsDocumento35 pagineCapital Structure DecisionskiruthekaNessuna valutazione finora