Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CAPE ECONOMICS PAST PAPER SOLUTIONS

Caricato da

AkeemjosephDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CAPE ECONOMICS PAST PAPER SOLUTIONS

Caricato da

AkeemjosephCopyright:

Formati disponibili

CAPE ECONOMICS PAST PAPER SOLUTIONS June 2008 Unit 2 Paper 2 1 a) Real Gross Domestic Product (GDP) measures

es the value of output produced by an economy using a base year or constant price level. The base year price level refers to the price level in a particular year. This is done to compare the value of output produced in different years using the same set of prices. As such differences in the value of output would be attributable purely to differences in the quantity of goods and services produced. Nominal GDP measures the value of output produced by an economy using the current prices of goods and services. If the same quantity of goods and services are produced in two consecutive years and the price level increases over the period, then the value of nominal GDP would increase in the volume of output produced is the same. Nominal GDP can be converted to real GDP using the GDP deflator which is a price index to remove the effects of price changes in the measurement of national income. The formula used in the conversion is given by: Nominal GDP 100 Real GDP = GDP Deflator 1 1b) Two methods of calculating National Product The expenditure approach in calculating gross domestic product focuses on summing all expenditures on goods and services generated within an economy. This includes: consumption expenditure, investment expenditure, Government expenditures as well as expenditure by foreigners in the form of exports. Imports are deducted as this represents goods and services which are consumed domestically but produced in foreign countries. By using the expenditure approach, Gross Domestic Product = AE = C + I + G + X M Under the income approach gross domestic product is measured by summing all forms of income throughout the economy. This basically consists of the factor incomes of: wages, rent, interest, and profit By using the income approach, Gross Domestic Product = wages + rent + interest + profit Gross National Product is then calculated by adjusting gross domestic product for net property income from abroad. This requires that receipts of factor incomes from the rest of the world are added to GDP, while payments of factor incomes to the rest of the world are subtracted. 1ci) Injections/withdrawals approach of determining national income equilibrium 1c ii) Deflationary gap 1c iii) The gap in income is $2000 1 c iv) An increase in expenditure expansionary fiscal or monetary policy. 1 d) Equilibrium Aggregate Income At the equilibrium: Y = AE AE = C + I + G + X - M C = 0.8Y I = 100 G = 80 X = 500 M = 180 AE = 0.8Y + 100 + 80 + 500 180 AE = 0.8Y + 500 Y = AE = 0.8Y + 500 Y 0.8Y = 500 0.2Y = 500 Y = 500/0.2 = 2500 The equilibrium level of national income is $2,500.

2a) i) Natural rate of unemployment or equilibrium unemployment 2a) ii) and iii) Equilibrium and Disequilibrium Unemployment 4. EDWARD BAHAW CAPE ECONOMICS PAST PAPER SOLUTIONS Labour Supply Average Excluding Natural Wage Unemployment Rate Disequilibrium Labour Supply Unemployment Including Natural Unemployment Equilibrium W2 Unemployment WE Labour Demand Number of workers employed 2 b) If the average wage rate is above the market equilibrium wage rate then disequilibrium unemployment is created. This is because at the higher wage rate the amount of labour which firms hirer would be a smaller than the amount of labour being supplied to the market. As long as the wage rate remains above the equilibrium, the surplus labour or disequilibrium unemployment would continue to exist in the market. 2c) Any disequilibrium unemployment that exists in the economy implies that a surplus amount of labour exists in the labour market. This surplus would induce workers to offer their labour services at lower wage rates to employers. In response, firms would be encouraged to hire more labour as labour cost decline. Overall wages would continue to fall and firms would continue to hire more labour up to a point where all surplus labour or disequilibrium unemployment is eliminated from the market. 2d) Types of Unemployment 1. General or Cyclical unemployment - this is unemployment which is associated with the trade cycle. The trade cycle refers to the tendency of national income to fluctuate both upwards and downwards in a sequential fashion. As economic activity varies in this fashion, so too does the level of employment, since labour requirements in production processes adjust to suit aggregate demand levels in the economy. Particularly during a recession, when aggregate demand is low, this type of unemployment would be high, while in times of recovery when aggregate demand is high, cyclical unemployment would be low. 2. Structural unemployment - this occurs when there is a mismatch between the skills Firstly, new technology makes certain jobs redundant and unemployment increases as a result. required to perform a job and the skills possessed by workers. This could be the result of structural changes in the economy where the industrial composition changes. An imbalance is therefore caused in terms of the demand for different types of labour from the decline of a certain industry and the rise of another. Unemployment results when new industries do not create enough jobs to employ those made redundant or because the new industry is in a different area or requires different skills. Most economists agree that production processes and

other operations in many industries which previously required manual skills, now require labour with a higher mental capacity. 3. Technological - this occurs when an improvement in technology reduces the demand for labour and hence many workers become unemployed. New technologies affect unemployment in two ways:

Secondly, new technology creates new jobs that require different skills, which many of the unemployed do not possess and are incapable of doing. In this case technological progress perpetuates unemployment similar to structural unemployment. 4. Seasonal unemployment - this type of unemployment arises due to seasonal patterns in consumer demand in various markets. In such cases, production follows a similar seasonal nature and thus the demand for labour in these industries would vary accordingly. In periods of low seasonal demand, production may decline and hence seasonal employment would be high. Conversely, during peak demand seasons, production would have to be increased and thus unemployment declines. Although it may be possible to smooth out production and thus employment over an entire year by building up inventories during low seasonal demand periods and consequently using the buffer stocks in peak demand periods, this may not be applicable to all cases. The provision of services for instance, may not be practical to manipulate in this way. Tourism services in the Caribbean are very susceptible to seasonal demand conditions. During tourism off seasons, tourism capacity may be highly underutilized and thus labour requirements would follow suit. 5. Frictional unemployment This type of unemployment is purely short term associated with the normal working of the labour market. It occurs when individuals enter the labour market for the first time, say on completion of schooling and are thus unemployed for the period it takes them to find a satisfactory job. Frictional unemployment also occurs when people from time to time change jobs (i.e. leave one job in the hope of acquiring another) and is unemployed for some time as they wait to take up the next job. 3a)i) Money can be defined as anything which is generally acceptable as a means of settling a debt obligation. A debt could arise under many different circumstances. For instance if a good or service is purchased on credit, then a debt is incurred. In this case, money can be subsequently used to settle the outstanding obligations. Another way of defining money is in terms of the functions it serves in the economy. This is outlined in the section which follows. 3a) ii) Three Functions of Money

Medium of exchange 2. Standard of deferred payment 3. Unit of account 3b) Four Tools used to Influence the Money Supply 1. Issue of Notes and Coins the Central Bank can increase the money supply by print new bank notes and minting new coins. The Central Bank is the only institution which has the authority to create new cash. As this money is spent by the government, the amount of money in circulation within the economy increases. 2. Reserve Requirements This is a banking regulation which requires that a percentage of commercial banks deposits must be kept at the Central Bank. As the reserve requirement ratio changes, so too does the banking multiplier. As the reserve requirement ratio is increased, the banking multiplier decreases, as banks are obligated to keep a larger proportion of their deposits in liquid form. As a consequence, less money is lent and the credit creation process is diminished. As a result, the money supply contracts and this causes the rate of interest to increase lead to a contraction of aggregate expenditure. This may not have any impact on the banking multiplier if commercial banks kept excess reserves. As such as reserves requirements commercial banks would be able to meet the new level without reducing lending. This can therefore make the use of this instrument ineffective. 3. Open Market Operations Open Market Operations involve the buying and selling of Government securities in the open capital market. If the Central Bank purchases securities from the public, then this increases the amount of money in circulation which eventually finds itself into the commercial banking system. This therefore leads to a multiple expansion of deposits and hence an increase in the money supply. The rate of interest consequently decreases and the aggregate expenditure expands. If however, as the Central purchases securities and the recipients of the money invests it abroad instead then the domestic money supply would not increase rendering this tool ineffective. 4. Moral suasion the Central Bank may attempt to extend its monetary policy stance on the economy by simply communicating its wishes to the financial sector. If the Central Bank wanted to effect a monetary contraction, the monetary authorities may request, without any compulsory consequences, that commercial banks increase their liquidity ratio or reduce the amount of loans issued. If commercial banks choose to comply then this would lead to a decrease in the money supply and a reduction the level of aggregate expenditure. It is likely though that as commercial banks are not obligated to comply with such requests this tool may not be an effective monetary policy weapon. 3c) i) The money multiplier refers to the increase in total bank deposit is in response to an initial deposits. This occurs from the creation of several rounds of additional deposit creation from an initial deposit. The additional deposits arise from loans made by the bank to borrowers which

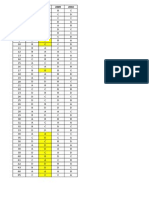

are used to purchase goods and services. As this money is spent EDWARD BAHAW CAPE ECONOMICS PAST PAPER SOLUTIONS 7. EDWARD BAHAW CAPE ECONOMICS PAST PAPER SOLUTIONS the economic agents who collect these sums make deposits at the commercial banks. Therefore the money which is lent out is returned to the bank in the form or derivative deposits. As such money is received the bank keeps some in cash reserves as determined by the cash reserve ratio and then lends out the rest. The cash reserve ratio refers to the proportion of cash to total deposit is which the bank must maintained in liquid form. This ratio is set by the Central Bank. Each time a loan is made from a derivative deposit the sum is smaller. If the total deposits increase by ten times the initial deposit then the money multiplier is ten. The money multiplier is given by the following formula: Money Multiplier = 1 / (Cash Reserve Ratio) 3c) ii) If a bank receives an initial deposit of $100 and the cash reserve ratio is 10 percent it would lend out $90 to a borrower. Subsequently the $90 would be returned to the bank by another party in the form of a derivative deposit. Here the $10 or the 10 percent not lent out is called the cash reserve or the proportion of a deposit which is kept in the form of cash at the bank. As the $90 derivative deposit is collected, 10 percent is kept in liquid form at the Depositor Deposits Loans Reserves Initial Deposit 1st $100 $90 $10 Derivative Deposit 2nd $90 $81 $9 Derivative Deposit 3rd $81 $73 $8 Derivative Deposit 4th $73 $64 $7 Derivative Deposit . . . Derivative Deposit . . . Derivative Deposit . . . Total Deposits $1000 $900 $100 commercial bank. This amounts to $9 and the remaining $81 is lent out. Eventually the remaining $81 lend out, is re-deposited at the commercial bank of which $73 is lent out and $7 kept in liquid form. 3d) i) Quantity theory of money - Irving Fishers equation of exchange as given by: MV = PY, 3d) ii) where: M is the money stock (supply of money). V is the velocity of circulation or the number of times each unit of money is used to purchase a final good or service. P is the general level of prices. Y is the number of final goods and services produced. EDWARD BAHAW CAPE ECONOMICS PAST PAPER SOLUTIONS 8. EDWARD BAHAW CAPE ECONOMICS PAST PAPER SOLUTIONS 4 a) i) Monetary policy is one of the tools that the Government can use to influence the macro economy. This is done through the control of the supply of money and the rate of interest. 4a) Macroeconomic Variable Monetary Policy i) ii) iii) Inflation Increase the interest rate ii) Aggregate Demand Lower the interest rate iii) Unemployment Lower the interest rate

If policy makers wanted to implement a measure to achieve a positive effect on the rate of inflation then this would require contractionary monetary policy. This is achieved through an

increase in the interest rate. This is because if the rate of interest is increases private investors are discouraged from undertaken investments. An increase in the interest rate also dampens private consumption, especially expenditure on consumer durables which are typically purchased through hire purchase or borrowed funds. These two responses to the rise in the rate of interest would lead to a downward shift of the aggregate demand curve resulting in a fall in the average price level which would have a positive effect on inflation. A positive effect on aggregate demand would be needed when there is a recession and the economy needs a boost. This would require a lowering of the interest rate which encourages greater investment as the cost of borrowing to finance capital formation is lowered. Furthermore a lower rate of interest makes it cheaper to borrow for consumption purposes especially for consumer durables. As a result of these two effects the overall level aggregate demand increases. A positive effect on unemployment requires an increase in aggregate demand in the economy. As aggregate demand increases cyclical unemployment is eliminated as the increase in production requires an increase in the level of employment. This would also require a decrease in the rate of interest which would encourage greater consumption and investment. Such increase in spending would stimulate the increase in production. 4b) Macroeconomic Variable Fiscal Policy i) ii) iii) iv) Budget Deficit Expansionary fiscal policy Aggregate Demand Contractionary monetary policy Inflation Expansionary fiscal policy Unemployment Contractionary monetary policy Fiscal

Policy is the management of the economy through the level of Government expenditure and taxation. A negative effect on the budget deficit arises from the implementation of expansionary fiscal policy. This requires an increase in the level of government spending and a decrease in taxation. Although this would result in an increase in the level of aggregate expenditure in the economy the budget deficit would increase. This is considered negative as the government may have to resort to borrowing. A negative effect on aggregate demand refers to a decrease. This can arise from a decrease in government spending and increase in taxation. As a result the government injection into the economy decreases which causes the level of aggregate demand to fall. A negative effect on inflation refers to an increase in its rate. This can arise from an increase in government spending and a fall in taxation. As a result there is a net injection into the economy which causes aggregate demand to increase. This increase in demand for goods and services would lead to an increase in the average price level. A negative effect on the unemployment refers to a rise it the rate. This arises from a decrease in government spending and an increase in government spending. As a result the net government

injection into the economy falls causing a fall in the level of aggregate demand. This leads to fall in the level of output produced which causes an increase in the rate of unemployment. 4c) i) Automatic stabilizers are mechanisms that automatically increase the net injection from the government sector during recessions and contract it during booms. In other words an automatically stabilizer offsets the current economic climate without any active policy decision by the government. 4c) ii) Two examples of automatic stabilizers 1. Unemployment Benefits 2. Direct taxes 4d) i) The National Debt also known as the public sector debt is the accumulated debt built up by the Government over a number of years that has not yet been repaid. Governments typically borrow to finance its expenditure when its revenue is insufficient. The national debt therefore represents the total amount owed by the Government which can be domestic debt as well as the amount owed to foreigners which is external debt. 4d) ii) Burden of Public Debt 1. Recurrent vs Capital Expenditure - The money borrowed may be used for recurrent expenditure by the government which benefits only the current populations and the not the future generation. If however the borrowed funds is used for capital expenditure in the form of improvements to infrastructure which last several decades then this can benefit future generations. 2. Interest Payments - interest payments and the repayment of principal on debt reduces the amount of money which the government has to devote towards other uses such as spending on educational facilities for instance. This may also result in an increase in taxes which may not be favoured by tax payers. 3. Foreign exchange drain - The repayment of interest and principal on external debt has to be made using foreign currency. This causes a significant drain of foreign exchange which negatively affects the balance of payments. 5a) i) Two Benefits of Exporting Goods and Services 1. Generate vitally needed foreign exchange exporting goods and services enables a country to earn foreign exchange. This is important as it provides valuable foreign exchange to purchase vitally needed goods and services from abroad.

2. Earn income from Larger Markets exports enable producers in the domestic economy to access larger foreign markets especially when the domestic market is small. Access to these markets are extremely beneficial as it enables large scale production and hence the achievement of economies of scale. In this context, the exporting country benefits from increased competitiveness and increased income. 5 a) ii) Two problems resulting from the importation of goods and services 1.Current account deficits. If imports become greater than export then a current account deficit would exist. This is problem as it represents a major drain in foreign exchange. 2.Competition with Domestic Producers. Imported goods and services may provide serious competition to domestically produced goods and services. This may put domestic firms out of business and thus cause unemployment. 5a) iii) Commodity Terms of Trade This is relative measure of export prices and import prices. It is calculated as an index number using the following formula: XPI The terms of trade index = 100 MPI where : XPI - Average export price index MPI - Average import price index 5 a) iv) Two factors which determine export revenue 1. The price of exported goods as determined in international markets 2. World income or the level of income in export markets. 5b) Factors Influencing Economic Growth Economic growth implies a rise in the productive capacity of an economy, which results in an outward shift of the production possibility frontier. Three factors which can lead to an increase in the productive capacity of the economy are: 1. Increase in Labour Resources Economic growth depends on the quality and size of the labour force. Increasing the quality of the workforce through better education and training increases the value of human capital and makes workers more productive. Also as the labour force becomes larger, the productive deployment of the additional workers enables more output to be produced. 2. Increase in Capital Resources Increasing, the stock of physical capital such as new factories, machinery and equipment, is critical in achieving economic growth as it enables a more efficient use of other factors of production such as labour. Investments in human capital formation enable the quality High Public Debt - Another major problem faced in the Caribbean is the high level of debt carried by various economies. The main reason why governments borrow is because revenue is insufficient. This high level of debt means that every year the government has to pay interest

which would reduce the amount of money the government has available for spending on other important uses such as housing programs or unemployment relief programs. Imports manufactured goods, capital goods and technology - Caribbean countries import manufactured goods and technology from abroad such as computers and other electronics, machinery, tools, cars, and even food and clothing. Technology is very important for economic growth. Caribbean countries however do not create their own technology instead they depend on foreign countries for technological innovations. Exports mainly primary products and tourism countries of the Caribbean export mostly primary products and tourism. This is different from the exports of most developed countries which export a lot more manufactured goods and services. Unstable Growth - Economic growth in the Caribbean has been quite unstable where growth is achieved in some years followed by economic recession in other years. This means economic growth in these countries is not stable. This is a major economic problem which the Caribbean faces. In developed countries such as the United States, the United Kingdom and Canada growth is more stable as national income increases year after year. of labour to improve. This implies that labour productivity rises, enabling greater output from labour resources. 3. Improvements in Technology Technological advances enable the production of more output from a given amount of resources. This means that scarce resources are more productively utilized which reduces the real costs of supplying goods and services and this leads to an outward shift in a countrys production possibility frontier. This means that technological progress accelerates economic growth for any given rate of growth in the labour force and the capital stock. 5c) Low rates of growth in the Caribbean Countries due to restrictions in: 1. Limited Improvement in Technology one reason why Caribbean countries may not always have high rates of growth is because of limited improvements in technology. Caribbean countries mostly rely on foreign more developed countries for technological improvements. As such technology would always have to be imported and be limited by the availability of foreign exchange. Furthermore since the technology is created in more developed economies it would not always be appropriate to the conditions of the Caribbean. 2. Limited Savings for Capital formation another reason for slower growth in Caribbean countries is limited resources for capital formation. This is because in most Caribbean countries income and savings are limited which places a major restriction on the amount of capital which can be accumulated. 5d) Structural Characteristics of Caribbean Economies

6 a) i) The balance of trade This is the difference between the monetary value of exports and imports in an economy over a certain period of time. 6a) ii) Trade Deficit This refers to the difference between imports and exports if imports are greater than exports 6a) iii) Trade Surplus This refers to the difference between imports and exports if exports are greater than imports 6b) i) Absolute Advantage Absolute advantage is enjoyed by a country if it can produce more goods and services compared to other countries with the same amount of resources. In such a case, the country would be able to produce the good cheaper than other countries. In this case it makes sense for the country to specialise in the production of that good. 6 b) ii) Comparative Advantage A country has a comparative advantage in the production of a good if the opportunity cost from producing the good is lower than that in other countries. In this case it makes sense for the country to specialise in the production of that good. 6 b) iii) The exchange Rate An exchange rate is simply the price of a foreign currency. In 2005, the exchange rate between the Trinidad and Tobago dollar and the United States dollar was: TT$6.30 = US$1.00 or TT$1.00 = US$0.16 6 c) Determination of the Free -Floating Exchange Rate Under the free-floating exchange rate system, the exchange rate between the domestic currency and the foreign currency is determined by the demand and supply in the foreign exchange market. The demand for foreign currency arises whenever there is need to exchange domestic currency in return for foreign currency. The supply of foreign currency arises from all inflows of foreign exchange in the balance of payments. Jamaica is one county which ahs adopted the floating exchange rate. Determination of the Fixed Exchange Rate The fixed exchange rate or pegged exchange rate is one means by which an exchange rate can be determined. Under the fixed exchange rate system, the exchange rate is set by the Government and maintained by Government intervention in the foreign exchange markets. In Barbados for instance, a fixed exchange rate is adopted with the United States dollar where Bds$2 = US$1. If the official rate coincides with the equilibrium rate in the foreign exchange market, then there is no need for Government intervention. If, however, the official rate differs from the equilibrium rate, then Government intervention is necessary through the manipulation of the foreign exchange reserves of foreign currency or even foreign exchange control measures. EDWARD BAHAW CAPE ECONOMICS PAST PAPER SOLUTIONS 6 d) Measures to alleviate a trade deficit Expenditure Reducing Measures - deflationary or contractionary measures that decrease national income. This is because imports are said to be

induced i.e. rise as income increases and likewise fall as income decreases. Exports on the other hand are said to be autonomous to the level of national income. Hence, as income decreases, imports fall while exports remain unchanged causing the deficit to be eliminated. Expenditure switching This includes all measures designed to switch expenditure away from imports and towards domestically produced goods such as a devaluation or depreciation of the exchange rate. A devaluation applies if there is a fixed exchange rate, while a depreciation occurs if there is a floating exchange rate regime. Both measures result in an increase in the price of foreign currencies and by extension, imports become more expensive and domestic exports become cheaper in foreign markets. Assuming that demand for imports is elastic, then overall, as imports become more expensive and exports become cheaper, expenditure on imports would fall, leading to a decline in outflows in the current account. If the demand for exports is elastic, export revenues would rise, leading to an increase in inflows in the current account. Both of these effects reinforce each other as a means of eliminating the deficit in the current account. 6 e) A Free Trade Area refers to an organization of nations whose members engage in free trade among themselves. That is, member countries belonging to the free trade area have no trade barriers among themselves but have individual trade barriers with countries outside the free trade area. (CARIFTA) A Customs Union is a trade agreement among countries whose members have no trade barriers among themselves but impose common trade barriers on non members. For instance, the member of the customs union may impose common external tariff (CET) on all imports from countries outside the customs union. An example of this type of economic integration is Caricom. A Common Market is a trading bloc is a customs union, which includes the additional feature of the free movement of factors of production such as labour and capital between the member countries without restriction. The intended Caribbean Single Market and Economy (CSME) arrangement among countries of the Caribbean region is another example of a common market.

Potrebbero piacerti anche

- Money UCON UNIT 2 CAPEDocumento16 pagineMoney UCON UNIT 2 CAPErobert903Nessuna valutazione finora

- CAPE Economics 2015 U2 Paper 2Documento7 pagineCAPE Economics 2015 U2 Paper 2Ronaldo Taylor100% (3)

- Economics IA-Verenna AtwellDocumento25 pagineEconomics IA-Verenna Atwellannmaria singh100% (1)

- CAPE Economics 2015 U2 P1 PDFDocumento9 pagineCAPE Economics 2015 U2 P1 PDFamrit100% (1)

- CAPE Economics Unit 1 2004 Paper 2Documento5 pagineCAPE Economics Unit 1 2004 Paper 2sashawoody167100% (1)

- Fiscal policy definition and toolsDocumento7 pagineFiscal policy definition and toolsrobert903Nessuna valutazione finora

- CAPE Economics 2011 U2 P1Documento8 pagineCAPE Economics 2011 U2 P1Anonymous O6jv4YHPm100% (1)

- SMART Objectives Module Explains Characteristics and ImportanceDocumento63 pagineSMART Objectives Module Explains Characteristics and ImportanceSheldane Mitchell100% (1)

- Econ IADocumento7 pagineEcon IADA1000039% (18)

- Spec 2008 - Unit 2 - Paper 1Documento11 pagineSpec 2008 - Unit 2 - Paper 1capeeconomics83% (12)

- Impact of Grace Kennedy in JamaicaDocumento36 pagineImpact of Grace Kennedy in JamaicaSheka Talya Henry67% (9)

- Balanced Budget Multiplier HandoutDocumento1 paginaBalanced Budget Multiplier HandoutrobtriniNessuna valutazione finora

- CSEC Economics GlossaryDocumento7 pagineCSEC Economics Glossaryrobtrini33% (3)

- 2009 - Unit 1 - Paper 1Documento7 pagine2009 - Unit 1 - Paper 1capeeconomics89% (9)

- 2008 - Unit 1 - Paper 1Documento12 pagine2008 - Unit 1 - Paper 1capeeconomics100% (4)

- Economics Unit 2 Revision NotesDocumento16 pagineEconomics Unit 2 Revision NotesJustin Davenport67% (6)

- CAPE Economics 2016 U1 P2Documento20 pagineCAPE Economics 2016 U1 P2roxanne taylorNessuna valutazione finora

- CAPE Economics 2016 U2 P2Documento20 pagineCAPE Economics 2016 U2 P2Ronaldo Taylor100% (1)

- Accounting Unit 1 NotesDocumento20 pagineAccounting Unit 1 NotesNiranjan Sathianathen0% (2)

- CAPE Economics 2014 U1 P1Documento12 pagineCAPE Economics 2014 U1 P1C H LNessuna valutazione finora

- Definitions For Cape Economics Unit 1Documento3 pagineDefinitions For Cape Economics Unit 1Rafena Mustapha100% (1)

- Cape Mob 2020 U1 P1Documento8 pagineCape Mob 2020 U1 P1Mia100% (2)

- Cape Economics Module 1 NotesDocumento48 pagineCape Economics Module 1 NotesVarin Edwards75% (4)

- CAPE Economics 2011 U1 P1Documento9 pagineCAPE Economics 2011 U1 P1aliciaNessuna valutazione finora

- Econ 2017 Spec Paper 1Documento12 pagineEcon 2017 Spec Paper 1Ronaldo Taylor67% (3)

- Cape Economics Specimen U1 p1Documento10 pagineCape Economics Specimen U1 p1Wade Brown75% (4)

- Cape Economics Sba Outline 1Documento3 pagineCape Economics Sba Outline 1Carlos WebsterNessuna valutazione finora

- Cape Unit 2 Economics Module 1 - Topic 1 - National Income AccountingDocumento22 pagineCape Unit 2 Economics Module 1 - Topic 1 - National Income AccountingJayChiAsh89% (9)

- CAPE Economics 2013 U1 P1 PDFDocumento10 pagineCAPE Economics 2013 U1 P1 PDFlalalandNessuna valutazione finora

- Cape Mob 2015 U1 P1-2 PDFDocumento7 pagineCape Mob 2015 U1 P1-2 PDFNavindra Jaggernauth100% (1)

- Unit 2 Multiple Choice AnswersDocumento1 paginaUnit 2 Multiple Choice AnswersEdward Bahaw50% (4)

- Summary Points For Accounting Unit 1 Module 1Documento20 pagineSummary Points For Accounting Unit 1 Module 1abbyplexx0% (1)

- FORM TP 2013166: InstructionsDocumento10 pagineFORM TP 2013166: InstructionsSHABBA MADDA POTNessuna valutazione finora

- Social Studies Unit TopicDocumento1 paginaSocial Studies Unit Topicapi-290917899Nessuna valutazione finora

- Cape Mob 2014 U1 P1Documento7 pagineCape Mob 2014 U1 P1danielle manleyNessuna valutazione finora

- Economic Sectors and Legal StructuresDocumento21 pagineEconomic Sectors and Legal Structuresdanielwilo100% (1)

- 2007 - Unit 2 - Paper 1Documento9 pagine2007 - Unit 2 - Paper 1capeeconomics88% (8)

- Management of Business CAPEDocumento2 pagineManagement of Business CAPERoland ConnorNessuna valutazione finora

- Cape Management of Business Internal AssesstmentDocumento29 pagineCape Management of Business Internal AssesstmentKristopher Allen100% (3)

- CAPE Accounting Unit 1 2011 P2Documento7 pagineCAPE Accounting Unit 1 2011 P2Sachin BahadoorsinghNessuna valutazione finora

- Mobu20114 PDFDocumento7 pagineMobu20114 PDFPutiel Kelly100% (1)

- CAPE Economics 2017 U1 P1Documento10 pagineCAPE Economics 2017 U1 P1Kush BeanNessuna valutazione finora

- CAPE Accounting Unit 2 2016 P2Documento7 pagineCAPE Accounting Unit 2 2016 P2Sachin Bahadoorsingh0% (1)

- Form5 PobDocumento2 pagineForm5 PobAsiff MohammedNessuna valutazione finora

- Business Concepts and Definitions: 1. Enterprise: 2. EntrepreneurshipDocumento22 pagineBusiness Concepts and Definitions: 1. Enterprise: 2. EntrepreneurshipNatalieNessuna valutazione finora

- CAPE Accounting Entire SBA (Merlene)Documento8 pagineCAPE Accounting Entire SBA (Merlene)Merlene Dunbar56% (9)

- Caribbean Examinations Council: Caribbean Secondary Education Certificate Examination 07 JANUARY 2021 (A.m.)Documento32 pagineCaribbean Examinations Council: Caribbean Secondary Education Certificate Examination 07 JANUARY 2021 (A.m.)Tavia LordNessuna valutazione finora

- Economics Sba GuidelineDocumento30 pagineEconomics Sba GuidelineSHABBA MADDA POT33% (3)

- CAPE Accounting 2017 U2 P2 PDFDocumento8 pagineCAPE Accounting 2017 U2 P2 PDFHuey F. Kapri0% (1)

- CAPE Economics 2007 U1 P1Documento10 pagineCAPE Economics 2007 U1 P1aliciaNessuna valutazione finora

- CAPE Accounting Unit 1 2013 P2Documento8 pagineCAPE Accounting Unit 1 2013 P2Sachin BahadoorsinghNessuna valutazione finora

- CAPE Accounting Unit 2 Paper 1 2014Documento10 pagineCAPE Accounting Unit 2 Paper 1 2014leah hosten100% (2)

- Econ 2017 SpecimenDocumento8 pagineEcon 2017 SpecimenRonaldo Taylor100% (1)

- ECON 1002 NOTES ON CHAPTERS 15-17Documento52 pagineECON 1002 NOTES ON CHAPTERS 15-17sashawoody167Nessuna valutazione finora

- CAPE Accounting Unit 1 2009 P2Documento8 pagineCAPE Accounting Unit 1 2009 P2Sachin BahadoorsinghNessuna valutazione finora

- Cape Communication Studies: Practical Exercises for Paper 02 EssaysDa EverandCape Communication Studies: Practical Exercises for Paper 02 EssaysNessuna valutazione finora

- Jamaica Driver's Education Handbook: A Comprehensive Driver Training GuideDa EverandJamaica Driver's Education Handbook: A Comprehensive Driver Training GuideNessuna valutazione finora

- Test Bank for Introductory Economics: And Introductory Macroeconomics and Introductory MicroeconomicsDa EverandTest Bank for Introductory Economics: And Introductory Macroeconomics and Introductory MicroeconomicsValutazione: 5 su 5 stelle5/5 (1)

- Communication Studies: Preparing Students for CapeDa EverandCommunication Studies: Preparing Students for CapeValutazione: 4.5 su 5 stelle4.5/5 (4)

- MacroeceonomicsDocumento70 pagineMacroeceonomicsHundeNessuna valutazione finora

- U.S. Army Summary Judgment Response Negligent Estimate AGTDocumento71 pagineU.S. Army Summary Judgment Response Negligent Estimate AGTpbclawNessuna valutazione finora

- CS Form No. 212 Revised Personal Data Sheet New 2Documento3 pagineCS Form No. 212 Revised Personal Data Sheet New 2ChAi CuNessuna valutazione finora

- Integrated Profit and Loss, Balance Sheet & Cash Flow Financial Model For HotelsDocumento67 pagineIntegrated Profit and Loss, Balance Sheet & Cash Flow Financial Model For HotelsHa TruongNessuna valutazione finora

- Incremental QuestionsDocumento5 pagineIncremental QuestionsANessuna valutazione finora

- Araxxe Whitepaper Revenue Assurance and Digital RevolutionDocumento21 pagineAraxxe Whitepaper Revenue Assurance and Digital RevolutionAli babaNessuna valutazione finora

- Sebi Grade A 2020: Economics-Consumption & Investment FunctionDocumento11 pagineSebi Grade A 2020: Economics-Consumption & Investment FunctionThabarak ShaikhNessuna valutazione finora

- ENTREPRENEURSHIP FINALS - 2018-19.docx Version 1Documento4 pagineENTREPRENEURSHIP FINALS - 2018-19.docx Version 1Gerby Godinez100% (1)

- 2B - 800MWKudgi - Ash Handling Vol I NTPC TenderDocumento616 pagine2B - 800MWKudgi - Ash Handling Vol I NTPC Tendersreedhar_blueNessuna valutazione finora

- CH 12 Student KrajewskiDocumento28 pagineCH 12 Student KrajewskiprasanthmctNessuna valutazione finora

- 123Documento373 pagine123Roshanlal123Nessuna valutazione finora

- Economy PerformanceDocumento16 pagineEconomy PerformanceMuhammad UmarNessuna valutazione finora

- Inventory Optimization Problems and FormulasDocumento6 pagineInventory Optimization Problems and FormulasShreya GanguliNessuna valutazione finora

- COSTING Chapter 2Documento14 pagineCOSTING Chapter 2Raksha ShettyNessuna valutazione finora

- 4.export Channels of DistributionDocumento24 pagine4.export Channels of DistributionRayhan Atunu50% (2)

- Dan Lok - 6 Steps To 6 FiguresDocumento3 pagineDan Lok - 6 Steps To 6 FiguresRushil67% (3)

- 2 Production: Cbi Market Survey: The Stationery, Office and School Supplies Market in The EuDocumento4 pagine2 Production: Cbi Market Survey: The Stationery, Office and School Supplies Market in The Euthomas_joseph_18Nessuna valutazione finora

- AGRICULTUREDocumento17 pagineAGRICULTURESamantha JoseNessuna valutazione finora

- Finance Notes SifdDocumento104 pagineFinance Notes SifdSuresh KumarNessuna valutazione finora

- Clique Pens Case AnalysisDocumento8 pagineClique Pens Case AnalysisShweta Verma100% (1)

- 2013 Risk Premium Report Excerpt DP PDFDocumento124 pagine2013 Risk Premium Report Excerpt DP PDFJuan GSNessuna valutazione finora

- NCC CaseDocumento13 pagineNCC CaseDaniel FilipeNessuna valutazione finora

- An Organizational Study Report On Western India Plywoods LTDDocumento78 pagineAn Organizational Study Report On Western India Plywoods LTDAshwin vkNessuna valutazione finora

- Attitudes of European Entrepreneurs Towards Eco-Innovation Analytical ReportDocumento162 pagineAttitudes of European Entrepreneurs Towards Eco-Innovation Analytical ReportitamarcostNessuna valutazione finora

- Day Trading For Dummies Cheat SheetDocumento3 pagineDay Trading For Dummies Cheat SheetJay Mel75% (4)

- Castorama 3DDocumento4 pagineCastorama 3Dmarc johanNessuna valutazione finora

- Annrep2017 PDFDocumento152 pagineAnnrep2017 PDFgeca coracheaNessuna valutazione finora

- EserciziDocumento3 pagineEserciziAnnagrazia ArgentieriNessuna valutazione finora

- International MarketingDocumento18 pagineInternational MarketingHimanshu BansalNessuna valutazione finora

- Case OverviewDocumento9 pagineCase Overviewmayer_oferNessuna valutazione finora

- Concept of Business Profit Holding Gains/lossesDocumento9 pagineConcept of Business Profit Holding Gains/lossesPutriNessuna valutazione finora