Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

465

Caricato da

Effendi Nanang SuwantoDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

465

Caricato da

Effendi Nanang SuwantoCopyright:

Formati disponibili

QUESTIONS FOR DISCUSSION

465

5. Estimate your income, consumption, and saving- for last year. If you dissaved (consumed more than your income), how did you finance your dissaving? Estimate the composition of your consumption in terms of each of the major categories listed in Table 22-1. 6. "Along the consumption function, income changes more than consumption." What docs this imply for the MPCand MPS? 7. "Changes in disposable income lead to movements along the consumption function; changes in wealth or other factors lead to a shih of the consumption fUIICtion." Explain this statement with an illustration of

8.

What would be the effects of the following on the investment demand function illustrated in Table 22-!1 and Figure 22-10? a. A doubling of the annual revenues per $1000 invested shown in column (3) b. A rise in interest rates to 15 percent per year c. The addition-of a ninth project with data in the first three columns of (.J, 10, 70) d. A 50 percent t;IX on net profits shown in columns (li) and (7) 9. Using the augmcnted invcxuncnt dcmnnd schednk Irom question H(c) and ;lssulTling that the interest rate is 10 percellt, calculate the level of investment for cases a through d in question 8.

each ~ase:

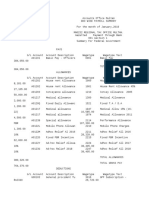

Ill. Advanced problem: According- to the life-cycle model, people consume each year an amount that depends upon their lifetime income rather than upon their current income. Assume that you expect to receive future income (in constant dollars) according to the schedule ill Table 22-G. 2. Assume that there is no interest paid on savings, You have no initial savings. Further assume that you want to "smooth" your consumption (enjoying equal consumption each year) because of diminishing- extra satisfaction from extra consumption. Derive yom best consumption trajectory for the 5 years, and write the figures in column (3). Then calculate your saving and enter the amounts in column (4); put your end-of-period wealth, or cumulative saving, for cach year into column (5). What is your average saving rate in the first 4 years? b. Next, assume that a government social security program taxes you $2000 in each of your working years and provides you with an $8000 pension in ycar 5. If you still desire to smooth consumption, calculate your revised saving plan. How has the social security progr;ull afkCled your consumption? What is the efli.'u on your average, sowing rate ill the lirst ,1 yell's) Can you see why some economists claim t h.u social security Gin lower saving?

(1)

(2)

Income

(3)

(4 )

(5 )

Consumption

Saving

Cumulative saving (end of year)

Year

1

($)

30,000

($)

($)

($)

2

3

4 5*

*Relired.

30,000 25,000 15,000 ' 0

TABLE 22-6.

Potrebbero piacerti anche

- The Art of Selling To The AffluentDocumento256 pagineThe Art of Selling To The Affluentwestelm12100% (12)

- Instructions To Use Tax CalculatorDocumento5 pagineInstructions To Use Tax Calculatormadhuri priyankaNessuna valutazione finora

- Questions and AnswersDocumento3 pagineQuestions and AnswersSenelwa AnayaNessuna valutazione finora

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsDa EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNessuna valutazione finora

- StarWars Sketchbook PDFDocumento84 pagineStarWars Sketchbook PDFsamuraichoco100% (4)

- Percentage WorksheetDocumento5 paginePercentage WorksheetLeong SamNessuna valutazione finora

- Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsDa EverandCocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsNessuna valutazione finora

- CAE Separate Financial Statements 31-03-2022 EnglishDocumento77 pagineCAE Separate Financial Statements 31-03-2022 EnglishMuhammad TohamyNessuna valutazione finora

- ECON 203 Midterm 2013W FaisalRabbyDocumento7 pagineECON 203 Midterm 2013W FaisalRabbyexamkillerNessuna valutazione finora

- Econ 203 Midterm Fall 2011 VBDocumento8 pagineEcon 203 Midterm Fall 2011 VBJonathan RuizNessuna valutazione finora

- 2 Elements of AccountingDocumento4 pagine2 Elements of Accountingapi-299265916Nessuna valutazione finora

- ECON 203 Midterm 2012W AncaAlecsandru SolutionDocumento8 pagineECON 203 Midterm 2012W AncaAlecsandru SolutionexamkillerNessuna valutazione finora

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Da EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Nessuna valutazione finora

- Econ 203 Tt2Documento7 pagineEcon 203 Tt2examkillerNessuna valutazione finora

- ICARE Preweek FAR by Sir RainDocumento13 pagineICARE Preweek FAR by Sir Rainjohn paulNessuna valutazione finora

- Adjusting Journal EntriesDocumento11 pagineAdjusting Journal EntriesGianna PeñalosaNessuna valutazione finora

- Bahan Presentasi - Kel 1 - Financial Statement, Cash Flow and Analysis of Financial StatementDocumento32 pagineBahan Presentasi - Kel 1 - Financial Statement, Cash Flow and Analysis of Financial StatementNASYRUDDIN HARAHAPNessuna valutazione finora

- Corporate Finance - Solution For Chapter 3Documento11 pagineCorporate Finance - Solution For Chapter 3Vân Anh Đỗ LêNessuna valutazione finora

- Directory DelhiDocumento298 pagineDirectory DelhiPallavi Maggon0% (1)

- The Impact of Keke Napep As Poverty Alleviation StrategyDocumento60 pagineThe Impact of Keke Napep As Poverty Alleviation StrategyDaniel Obasi100% (1)

- E - Portfolio Assignment MacroDocumento8 pagineE - Portfolio Assignment Macroapi-316969642Nessuna valutazione finora

- Compound Interest ProjectDocumento1 paginaCompound Interest ProjectJeffrey DavisNessuna valutazione finora

- 2015 Qualified Plan Conversion & Tax Strategy PlanDocumento12 pagine2015 Qualified Plan Conversion & Tax Strategy PlanMark HoustonNessuna valutazione finora

- Economics Assignment QuestionsDocumento5 pagineEconomics Assignment Questionsعبداللہ احمد جدرانNessuna valutazione finora

- Tutorial Test Question PoolDocumento6 pagineTutorial Test Question PoolAAA820Nessuna valutazione finora

- ADocumento5 pagineARaye ↙↘↗↖ ChinNessuna valutazione finora

- Final Econ e PortfolioDocumento7 pagineFinal Econ e Portfolioapi-317164511Nessuna valutazione finora

- E - Portfolio Assignment-1 Econ 2020 Valeria FinisedDocumento7 pagineE - Portfolio Assignment-1 Econ 2020 Valeria Finisedapi-317277761Nessuna valutazione finora

- AB204 Final AssignmentDocumento13 pagineAB204 Final AssignmentCarmen ParksNessuna valutazione finora

- E - Portfolio Assignment Mike KaelinDocumento9 pagineE - Portfolio Assignment Mike Kaelinapi-269409142Nessuna valutazione finora

- Questions: Basic Macroeconomic RelationshipsDocumento7 pagineQuestions: Basic Macroeconomic Relationshipsayesha iftikharNessuna valutazione finora

- Macroeconomics Theories and Policies 10th Edition Froyen Test Bank 1Documento14 pagineMacroeconomics Theories and Policies 10th Edition Froyen Test Bank 1jeffrey100% (46)

- tham khảo ECO kì 2Documento49 paginetham khảo ECO kì 2Vũ Nhi AnNessuna valutazione finora

- Epp - Exam2 - Spring2023 - MOD 2Documento10 pagineEpp - Exam2 - Spring2023 - MOD 2MasaNessuna valutazione finora

- M09 Berk0821 04 Ism C091Documento15 pagineM09 Berk0821 04 Ism C091Linda VoNessuna valutazione finora

- Answer:: The Aggregate Expenditures Model QuestionsDocumento19 pagineAnswer:: The Aggregate Expenditures Model Questions张敏然Nessuna valutazione finora

- Sample Exam QuestionsDocumento8 pagineSample Exam QuestionsEmmanuel MbonaNessuna valutazione finora

- PS5 - F10 KZ v3Documento7 paginePS5 - F10 KZ v3Vaid RamNessuna valutazione finora

- Econ Practice CH 8,9,11Documento6 pagineEcon Practice CH 8,9,11clearblue13Nessuna valutazione finora

- E - Portfolio Assignment 2Documento8 pagineE - Portfolio Assignment 2api-248058538Nessuna valutazione finora

- Tutorial 3 PresentDocumento13 pagineTutorial 3 PresentLi NiniNessuna valutazione finora

- Sample Examination PaperDocumento4 pagineSample Examination PapernuzhatNessuna valutazione finora

- Economics Previous PapersDocumento6 pagineEconomics Previous PapersmurthyNessuna valutazione finora

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocumento4 pagineMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionTrúc LinhNessuna valutazione finora

- Assignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeDocumento8 pagineAssignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeLeo ChristNessuna valutazione finora

- Sample Questions Exam 1Documento7 pagineSample Questions Exam 1Mindy Tweet NogNessuna valutazione finora

- E-Portfolio - Signature Assignment: Professor: Heather A SchumackerDocumento8 pagineE-Portfolio - Signature Assignment: Professor: Heather A Schumackerapi-317520509Nessuna valutazione finora

- Bài tập ôn tậpDocumento7 pagineBài tập ôn tậpLinh NguyễnNessuna valutazione finora

- Macro Tut 8Documento7 pagineMacro Tut 8Nguyễn Hữu HoàngNessuna valutazione finora

- Lesson 02c Time Value of MoneyDocumento32 pagineLesson 02c Time Value of MoneyVjion BeloNessuna valutazione finora

- Week 4 Economics Graded AssignmentDocumento14 pagineWeek 4 Economics Graded AssignmentJackie TaylorNessuna valutazione finora

- AP Macro Problem Set 3 StudentDocumento2 pagineAP Macro Problem Set 3 Studentspfitz11Nessuna valutazione finora

- Macsg09: The Government and Fiscal PolicyDocumento24 pagineMacsg09: The Government and Fiscal PolicyJudith100% (1)

- Original 1436552353 VICTORIA ProjectDocumento12 pagineOriginal 1436552353 VICTORIA ProjectShashank SharanNessuna valutazione finora

- SS12 Problem SetsDocumento6 pagineSS12 Problem SetsMark DonesNessuna valutazione finora

- Chap 007Documento7 pagineChap 007caspersoongNessuna valutazione finora

- Econs Macro PP2 ReviewDocumento5 pagineEcons Macro PP2 ReviewLinh (Viso) DoNessuna valutazione finora

- Assignment 2part1Documento8 pagineAssignment 2part1Febri EldiNessuna valutazione finora

- Assignment01 ECN 301 W23Documento3 pagineAssignment01 ECN 301 W23Lanre WillyNessuna valutazione finora

- 2021 en Tutorial 7Documento5 pagine2021 en Tutorial 7Hari-haran KUMARNessuna valutazione finora

- Qns Sec 222Documento8 pagineQns Sec 222Haggai SimbayaNessuna valutazione finora

- Homework 3Documento5 pagineHomework 3CHUA JO ENNessuna valutazione finora

- PS4Documento7 paginePS4Steven Hyosup KimNessuna valutazione finora

- ECON 318/2 Fall 2017 - ASSIGNMENT 1: Answer Key Question #1.inflation Targeting and Unemployment (15 Marks)Documento5 pagineECON 318/2 Fall 2017 - ASSIGNMENT 1: Answer Key Question #1.inflation Targeting and Unemployment (15 Marks)Vin HNessuna valutazione finora

- Final Exam December 2020Documento5 pagineFinal Exam December 2020Ikhwan RizkyNessuna valutazione finora

- Answer Guide and Final Exam EWMBA201B Spring 2018 - RedactedDocumento11 pagineAnswer Guide and Final Exam EWMBA201B Spring 2018 - Redactedkr6ftymgq7Nessuna valutazione finora

- Exam1Answers 1Documento6 pagineExam1Answers 1Ай МөлдирNessuna valutazione finora

- Macro 21 MT RudraDocumento7 pagineMacro 21 MT RudraHashmita MistriNessuna valutazione finora

- Topic 4: Product Market: Topic Questions For Revision s2 2020Documento3 pagineTopic 4: Product Market: Topic Questions For Revision s2 2020eugene antonyNessuna valutazione finora

- Beunit IiDocumento104 pagineBeunit Iivijay ancNessuna valutazione finora

- FoE Unit IVDocumento31 pagineFoE Unit IVDr Gampala PrabhakarNessuna valutazione finora

- What Is The Difference Between Cold and Cool?Documento2 pagineWhat Is The Difference Between Cold and Cool?Effendi Nanang SuwantoNessuna valutazione finora

- 5 Ed CH 06Documento31 pagine5 Ed CH 06Ebrahim AlalmaniNessuna valutazione finora

- Soal UTS Semester 2 Kelas 7 SMPDocumento3 pagineSoal UTS Semester 2 Kelas 7 SMPSitta Murti50% (2)

- Router Upgrade HelpDocumento2 pagineRouter Upgrade HelpSersson JohnNessuna valutazione finora

- 13 Management ScienceDocumento38 pagine13 Management Scienceakram75zaaraNessuna valutazione finora

- Robbins PPT03 (Atifbutt)Documento30 pagineRobbins PPT03 (Atifbutt)Effendi Nanang SuwantoNessuna valutazione finora

- Router Upgrade HelpDocumento2 pagineRouter Upgrade HelpSersson JohnNessuna valutazione finora

- 13 Management ScienceDocumento38 pagine13 Management Scienceakram75zaaraNessuna valutazione finora

- Time Management BooksDocumento1 paginaTime Management BooksEffendi Nanang SuwantoNessuna valutazione finora

- Router Upgrade HelpDocumento2 pagineRouter Upgrade HelpSersson JohnNessuna valutazione finora

- Higher Algebra - Hall & KnightDocumento593 pagineHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Q.1a Feelings About Current Time Use?Documento3 pagineQ.1a Feelings About Current Time Use?Effendi Nanang SuwantoNessuna valutazione finora

- Checklist - DescriptionDocumento1 paginaChecklist - DescriptionEffendi Nanang SuwantoNessuna valutazione finora

- A. Business FluctuationsDocumento1 paginaA. Business FluctuationsEffendi Nanang SuwantoNessuna valutazione finora

- CA Foundation BCK ICAI Updated ModuleDocumento220 pagineCA Foundation BCK ICAI Updated ModuleRahulNessuna valutazione finora

- Module 2 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsDocumento66 pagineModule 2 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsFreddy MolinaNessuna valutazione finora

- BUS. MATH Q2 - Week3Documento4 pagineBUS. MATH Q2 - Week3DARLENE MARTINNessuna valutazione finora

- Tire City Case AnalysisDocumento10 pagineTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Nessuna valutazione finora

- Chapter 1 - Understanding Personal FinanceDocumento16 pagineChapter 1 - Understanding Personal FinanceRolavilla BartolomeNessuna valutazione finora

- Chapter 1 PartnershipsDocumento46 pagineChapter 1 PartnershipsAkkamaNessuna valutazione finora

- House Property IncomeDocumento21 pagineHouse Property IncomekhNessuna valutazione finora

- 0206 - Soal Esai Teori AkuntansiDocumento5 pagine0206 - Soal Esai Teori AkuntansiLaela NovitaNessuna valutazione finora

- 43A, 43AA, MAT and DTDocumento23 pagine43A, 43AA, MAT and DTsaransidharth12Nessuna valutazione finora

- Economics Study Yr 11Documento37 pagineEconomics Study Yr 11dgfdgNessuna valutazione finora

- Aula 0. HALE, Robert L. Coercion and Distribution in A Supposedly Noncoe..Documento26 pagineAula 0. HALE, Robert L. Coercion and Distribution in A Supposedly Noncoe..bornon8thofjulyNessuna valutazione finora

- Astra Agro Lestari TBK Aali: Company History Dividend AnnouncementDocumento3 pagineAstra Agro Lestari TBK Aali: Company History Dividend AnnouncementJandri Zhen TomasoaNessuna valutazione finora

- BUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONDocumento14 pagineBUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONJASON DAVID AMARILANessuna valutazione finora

- Ecological Economics ConceptsDocumento51 pagineEcological Economics ConceptsDarryl LemNessuna valutazione finora

- Adjustments Financial Accounting IOBMDocumento46 pagineAdjustments Financial Accounting IOBMWahaj noor SiddiqueNessuna valutazione finora

- Basics On Income Tax PDFDocumento10 pagineBasics On Income Tax PDFHannan Mahmood TonmoyNessuna valutazione finora

- S 0232 01Documento50 pagineS 0232 01Shahaan ZulfiqarNessuna valutazione finora

- Financial Statement Analysis Study Guide Solutions Fill-in-the-Blank EquationsDocumento26 pagineFinancial Statement Analysis Study Guide Solutions Fill-in-the-Blank EquationsSajawal KhanNessuna valutazione finora

- Financial StatementsDocumento12 pagineFinancial StatementsDino DizonNessuna valutazione finora