Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IDR-Indian Depository Receipt Explained

Caricato da

rahul_chaudhari733380Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

IDR-Indian Depository Receipt Explained

Caricato da

rahul_chaudhari733380Copyright:

Formati disponibili

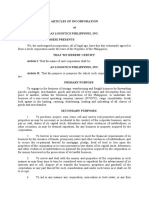

ABM-953 Self Study On

INDIAN DEPOSITORY RECEIPT

Under the Supervision of: Dr.Swami Prasad Saxena Associated Professor Department of Appl. Bus. Economics Faculty of Commerce

Submitted By: Vipul Khandelwal M.PHIL.1th Sem.

DAYALBAGH EDUCATIONAL INSTITUTE (DEEMED UNIVERSITY) DAYALBAGH, AGRA FEBUARY 2012

Indian Depository Receipt

A foreign company can access Indian securities market for raising funds through issue of Indian Depository Receipts (IDRs). An IDR is an instrument denominated in Indian Rupees in the form of a depository receipt created by a Domestic Depository (custodian of securities registered with the Securities and Exchange Board of India) against the underlying equity of issuing company to enable foreign companies to raise funds from the Indian securities markets. Introduction The world has become global village due to advancement in technology in recent years and information can be shared very rapidly across the globe. As a result, the securities markets have become international and it has become easier to trade on international markets. Also, a lot of countries have opened their securities markets to foreign investors and abolished laws restricting their citizens from investing abroad. Companies that previously had to raise capital in the domestic market can now tap foreign sources of capital. Indian companies have listed American Depository Receipts (ADRs), Global Depository Receipts (GDRs) and Foreign Currency Convertible Bonds (FCCBs) in overseas markets like New York, London, Luxembourg, Singapore etc. since 90s to raise funds from international investors. As the Indian securities markets have become deeper and with the BSE - Sensex and NSE - Nifty giving higher returns as compared to other indices in the world, global companies have started showing interest in the Indian capital markets. In keeping with India's ongoing popularity as a preferred investment destination among international investors and India's aspirations to become a financial hub in the South Asian region, the Government of India has consistently introduced and modified various instruments through which investments can be made. Now a new beginning has been made. The Government of India has introduced the concept of Indian Depository Receipts (IDRs) to facilitate listing by foreign companies on Indian stock exchanges. A foreign company can access Indian securities market for raising funds through issue of IDRs. A recent example is that of the global banking giant Standard Chartered Plc. which has raised up to $1 billion (` 4,500 crore approximately) through IDRs. Further, foreign subsidiaries of Indian companies can use IDR route for fund raising in India

Background An IDR is an instrument denominated in Indian Rupees in the form of a depository receipt created by a Domestic Depository (custodian of securities registered with SEBI) against the underlying equity of the issuing company in order to enable foreign companies to raise funds from the Indian securities markets. The receipts are based on a ratio of shares equivalent to depository receipts. Eligible companies resident outside India are allowed to issue IDRs through a Domestic Depository pursuant to Circular No. SEBI / CFD / DIL / DIP / 20 /2006 / 3 / 4 dated April 3, 2006 and the provisions of Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009 (which replaced the SEBI (Disclosure and Investor Protection) Guidelines, 2000). In addition, the Circular and the ICDR Regulations 2009, permit persons resident in India and outside India to purchase, possess, transfer and redeem IDRs. Qualifying companies resident outside India issue IDRs through a Domestic Depository subject to compliance with the Companies (Issue of Depository Receipts) Rules, 2004 and subsequent amendments made thereto and the ICDR Regulations, 2009. In addition, the regulations state that in the case of raising of funds through the issuance of IDRs by financial/banking companies having a presence in India, either through a branch or subsidiary, the approval of the sectoral regulator(s) should be obtained before the issuance of IDRs. Therefore, the approval of the Reserve Bank of India (RBI) will need to be obtained for the Standard Chartered IDR. The SEBI guidelines permit only those companies listed in their home market for at least three years and which have been profitable for three of the preceding five years to make IDRissues. As the issuance of the IDR by SCP would be the first IDR ever undertaken, there will be a number of challenges including the structure of the instrument, how one trades in it, what kind of returns can be made on the instrument, and what are the risks involved.

An Indian Depository Receipt is an instrument denominated in Indian Rupees in the form of a depository receipt created by a Domestic Depository (custodian of securities registered with the Securities and Exchange Board of India) against the underlying equity of issuing company to enable foreign companies to raise funds from the Indian securities Markets. The foreign company IDRs will deposit shares to an Indian depository. The depository would issue receipts to investors in India against these shares. The benefit of the underlying shares (like bonus, dividends etc) would accrue to the depository receipt holders in India. The Ministry of Corporate Affairs of the Government of India, in exercise of powers available with it under section 642 read with section 605A had prescribed the Companies (Issue of Indian Depository Receipts) Rules, 2004 (IDR Rules) vide notification number GSR 131(E) dated February 23, 2004. Standard Chartered PLC became the first global company to file for an issue of Indian depository receipts in India. (a) Eligibility for issue of IDRs (b) Procedure for making an issue of IDRs (c) Other conditions for the issue of IDRs (d) Registration of documents (e) Conditions for the issue of prospectus and application (f) Listing of Indian Depository Receipt (g) Procedure for transfer and redemption (h) Continuous Disclosure Requirements

(i) Distribution of corporate benefits. These rules (principal rules) were operationalised by the Securities and Exchange Board of India (SEBI)the Indian markets regulator in 2006. Operation instructions under the Foreign Exchange Management Act were issued by the Reserve Bank of India on July 22, 2009.The SEBI has been notifying amendments to these guidelines from time to time. Eligibility of companies to issue IDRs The regulations relating to the issue of IDRs is contained in Securities and Exchange Board of India (Issue of capital and disclosure requirements) Regulations, 2009, as revised from time to time. According to Clause 26 in Chapter III (Provisions as to public issue), the following are required of any company intending to make a public issue in India:

it has net tangible assets of at least Indian Rupee three crore in each of the preceding three full years (of twelve months each), of which not more than fifty per cent are held in monetary assets: Provided that if more than fifty per cent. of the net tangible assets are held in monetary assets, the issuer has made firm commitments to utilise such excess monetary assets in its business or project;

it has a track record of distributable profits in terms of section 205 of the Companies Act, 1956, for at least three out of the immediately preceding five years: Provided that extraordinary items shall not be considered for calculating distributable profits;

it has a net worth of at least INR one crore in each of the preceding three full years (of twelve months each); the aggregate of the proposed issue and all previous issues made in the same financial year in terms of issue size does not exceed five times its pre-issue net worth as per the audited balance sheet of the preceding financial year;

if it has changed its name within the last one year, at least fifty per cent. of the revenue for the preceding one full year has been earned by it from the activity indicated by the new name.

Further, Clause 97 in Chapter X stipulates additional requirements from a foreign company intending to make an issue of IDRs: An issuing company making an issue of IDR shall also satisfy the following:

the issuing company is listed in its home country; the issuing company is not prohibited to issue securities by any regulatory body; the issuing company has track record of compliance with securities market regulations in its home country.

IDR issue Process According to SEBI guidelines, IDRs will be issued to Indian residents in the same way as domestic shares are issued. The issuer company will make a public offer in India, and residents can bid in exactly the same format and method as they bid for Indian shares. The issue process is exactly the same: the company will file a draft red herring prospectus (DRHP), which will be examined by SEBI. The general body of investors will get a chance to read and review the DRHP as it is a public document, available on the websites of SEBI and the book running lead managers. After SEBI gives its clearance, the company sets the issue dates and files the document with the Registrar of Companies. In the next step, after getting the Registrars registration ticket, the company can go ahead with marketing the issue. The issue will be kept open for a fixed number of days, and investors can submit their application forms at the bidding centers. The investors will bid within the price band and the final price will be decided post the closure of the Issue. The receipts will be allotted to the investors in their demat account as is done for equity shares in any public issue. On 256th October 2010, SEBI notified the framework for rights issue of Indian Depository Receipts (IDRs). Disclosure requirement for IDR rights would more or less be in line with the reduced requirement applicable for domestic rights issue. IDR Fungibility The Indian depository Receipts shall not be automatically fungible into underlying equity shares of issuing company. IDR Holders can convert IDRs into underlying equity shares only with the prior approval of the Reserve Bank of India (RBI). Upon such exchange, individual persons resident in India are allowed to hold the underlying shares only for the purpose of sale within a period of 30 days from the date of conversion of the IDRs into underlying shares. Current regulations do not provide for exchange of equity shares into IDRs after the initial issuance i.e. reverse fungibility is not allowed.

Eligibility for investors According to Sebi guidelines, the minimum bid amount in an IDR issue is Rs 20,000 per applicant. Like in any public issue in India, resident Indian retail (individual) investors can apply up to an amount of INR 2,00,000 and Non-institutional investors (also called high networth individuals) can apply above INR 1,00,000 but up to applicable limits.

Reservations in IDR issues (clause 98, Chapter X) According to current regulations, at least 50% of the Issue is to be allocated to qualified Institutional Buyers (QIBs), 30% of the issue to the retail individual investors and balance 20% of the issue to non-institutional investors and employees. The ratio of non-institutional investors and employees is at the discretion of the company to decide. The issue will fail if the company does not get QIB investors to the extent of 50% of the issue size. Taxation Corporate lawyer Cyril Shroff of law firm Amarchand & Mangaldas & Suresh A. Shroff & Co. explain the tax implications. IDRs would also help improve the Sharpe's ratio of domestic portfolios by reducing home bias, that is either rooted in mistakes on the part of fund managers or in capital controls, says Professor Ajay Shah of the Indira Gandhi Institute of Developmental Research.

Government of India Securities and Exchange Board of India Reserve Bank of India

Tax issues: Related to IDRs Indian investors need to consider the tax implications of investment in the IDRs. While Section 605A of the Companies Act, 1956 (the Companies Act) discusses IDRs, there are no specific provisions regarding capital gains taxation of IDRs in the Companies Act or in the Income Tax Act, 1961. Therefore, the general rules relating to capital gains taxation apply and no benefits for long term holders of IDRs (ie. if the Securities Transaction Tax is

paid, there is no capital gains tax on long term holders of listed securities) are available. It is possible that the upcoming Direct Tax Code may clarify the issue but as of now the capital gains tax treatment of IDRs is not favorable An issuing company making an issue of IDR is required to satisfy the following: (a) it should be listed in its home country1. (b) it should not be prohibited to issue securities by any regulatory body. (c) it should have a track record of compliance with securities market regulations in its home country. Conditions for issue of IDR. An issue of IDR is subject to the following conditions: (a) issue size should not be less than Rs.50 crore. (b) procedure to be followed by each class of applicant for applying should be mentioned in the prospectus; (c) minimum application amount should be Rs.20,000; (d) at least 50 %. of the IDR issued should be allotted to qualified institutional buyers on proportionate basis. (e) the balance 50 % may be allocated among the categories of non-institutional investors and retail individual investors including employees at the discretion of the issuer and the manner of allocation has to be disclosed in the prospectus. Allotment to investors within a category will be on proportionate basis. Further, atleast 30% of the IDRs issued will be allocated to retail individual investors and in case of under-subscription in retail individual investor category, spill over to other categories to the extent of under-subscription may be permitted. (f) At any given time, there will be only one denomination of IDR of the issuing company. Standard Chart IDR Issue Standard Chartered plc is the first foreign company to have publicly elicited interest in making an IDR issue in India. The company is already listed on the London and Hong Kong stock Exchanges. Standard Chartered CEO Peter Sands is quoted in the Indian media as saying the "IDR listing (is) to enhance StanChart's commitment to India."

Recent news reports suggest Standard Chartered PLC may be inching closer to an issue. "We have already got advisors and we will file for the IDR issue after our (India) results are published by March-end," said Neeraj Swaroop, Regional Chief Executive, India and South Asia of Standard Chartered. Patrick Hosking, financial editor of the Times reports that Standard Chartered (may) offer up to $750 million of new shares to Indians.but Indias top financial portal reported top officials as suggesting the amount could be anywhere between $500 million and $750 million. Follow up to earlier reports cited, Standard Chartered Plc files DRHP to issue IDRs in India with SEBI on March 30, 2010. Standard Chartered Bank is set to become the first foreign company to list in India through an Indian depository receipts (IDR) issue. StanChart expects to raise around $500-750 million (Rs 2,250-3375 crore) to grow its businesses globally. Standard Chartered opened its IDR offering to Indian investors on May 25 2010, as reported by BBC News. The price band for the offering is 100 (1.47; $2.10) to 115 rupees per IDR. The bank, which makes most of its profits in Asia, will issue 240 million IDRs through the offer. In an interview with NDTV India, Neeraj Swaroop, CEO - South Asia at Standard Chartered Bank, said that the decision to list in India through an Indian depository receipts (IDR) issue, was not about raising capital but it is about a message of commitment to India. Standard Chartered fixed its issue price for Indian Depository Receipts at Rs 104 per unit. At this issue price, the bank will raise Rs. 2,490 crore ($530 million) by selling 24 crore IDRs.Every 10 IDRs represents one share of the bank. The IDRs opened at the Bombay Stock Exchange and National Stock Exchange on June 11. Standard Chartered PLCs Indian Depository Receipt, listed at Rs 106, and exceeded expectations by Rs 2 or 1.92 per cent on the National Stock Exchange. For more frequently asked questions on Indian Depository receipts refer The Economic Times & Business Standard

Present scenario In recent years, the securities markets have become increasingly international and it has become easier to trade internationally around the world. A growing number of countries have opened their stock markets to foreign investors and abolished laws restricting their citizens from investing abroad. Companies that previously had to raise capital in the domestic market can now tap foreign sources of capital. Indian companies such as VSNL, MTNL, BPL, etc. have since the mid-90s listed American Depository Receipts (ADRs) and Global Depository Receipts (GDRs) in London, Luxembourg and New York to raise funds from international sources. The trend now is moving the other way. As the Indian stock markets have become deeper and with the BSE Sensex now above 17,000, global companies have become interested in tapping the Indian markets for funds. A recent example is that of the global banking giant Standard Chartered PLC (SCP) which is likely to raise up to $1 billion (over Rs 4,500 crore) through Indian Depository Receipts (IDRs). SCP is currently in discussions with anchor investors for its IDR issue. The issue is likely to come out in June. The bank had filed a draft red herring prospectus (DRHP) for its IDR with capital market regulator Securities and Exchange Board of India (SEBI) in March 2010. According to Union budget: Standard Chartered Plc's (STAN.L) Indian shares rose as much as 20 percent, their maximum upper limit, after the union budget on Friday proposed permitting "twoway fungibility" for Indian depositary receipts, or IDRs. U.K.-based Standard Chartered listed on the Indian stock exchanges in 2010 by issuing depositary receipts in a move to strengthen its brand and presence in Asia's third-largest economy, which was its biggest market that year. The issue of IDRs was aimed at encouraging foreign companies to tap the Indian capital markets, but the absence of two-way fungibility has hurt liquidity with no other company subsequently tapping the instrument.

Making the receipts two-way fungible would allow Standard Chartered's India shareholders to convert their shares into underlying London stocks of the bank and vice versa, to gain from arbitrage opportunity, dealers said. Standard Chartered India shares (STNCy.NS) were up nearly 20 percent at 93.80 rupees after the budget proposal, while the BSE Sensex was trading lower. Finance Minister Pranab Mukherjee said he proposed allowing IDRs to become two-way fungible with the aim of boosting foreign participation in the Indian capital market Standard Chartered IDR was locked at 20% upper circuit after the Finance Minister proposed 2-way fungibility of IDR (Indian Depositary Receipt) in his Union Budget 2012-13.

GDR should be directly regulated by SEBI: Experts

There was an interesting report that was published by Crisil about Global Depository Receipts (GDRs), bank certificates issues to Indian companies to give them access to foreign investors. Their data indicated that 40 GDRs were issued by Indian companies in 2010 and investors have lost money in 85% of them. Four out of the five issues have given negative returns of 35%, which means 80% of the issues are giving negative returns of a very high magnitude of 35%. In comparison to that, the CNX 500 fell by only 7% in the same period. Thus, it is clear that huge underperformance is coming from the GDR market. Benefits of IDRs for Indian Investors and Rights No resident Indian individual can hold more than $200,000 worth of foreign securities purchased per year as per Indian foreign exchange regulations. However, this will not be applicable for IDRs which gives Indian residents the chance to invest in an Indian listed foreign entity. Additional key requisites for investing in foreign securities such as a securities trading account outside India to hold foreign securities, know your customer norms (KYC) with foreign broker and foreign bank account to hold funds are generally too cumbersome for most Indian investors. Such requirements are avoided in holding IDRs. Whatever benefits accrue to the shares, by way of dividend, rights, splits or bonuses would be passed on to IDR holders also, to the extent permissible under Indian law.

Benefits for International Issuers The main benefit would be in terms of branding, besides allowing foreign companies to access Indian capital. IDRs also allow the creation of acquisition currency and a management incentive tool. Issuers have the option to reserve a proportion of the issue for their employees. Challenges for IDRs There is the possibility of IDR issues being undersubscribed if they are not well marketed or fail to catch the imagination of investors. In addition, the challenges mentioned below are certain challenges with respect to the issuance of IDRs. Stringent eligibility norms: The stringent eligibility criteria, disclosure and corporate

governance norms (Although in the investors interests, they compare unfavourably with listing norms on other tier II global exchanges such as Luxembourg, Londons Alternate Investment Market (AIM) and Dubai. This could result in higher compliance costs for companies seeking to tap the Indian capital markets). Fungibility: Current regulations do not provide for the exchange of equity shares into IDRs after the initial issuance i.e. reverse fungibility is not allowed. Tradability of IDRs: How one trades in the instrument/how the instruments are traded. Returns on IDRs: What kind of returns would be made on the instrument. Risks: What risks are involved given that the same shares would be simultaneously trading in London and Hong Kong. Taxation: Lack of clarity on taxation. It is not clear whether IDRs are exempt from capital gains tax. Voting Rights: It is not entirely clear whether IDR holders will have voting rights or not the SEBI guidelines do not specifically mention voting rights, it leaves that to the discretion of the issuer. Market: Indian financial markets are still considered volatile and contain emerging market risk.

Conclusion IDRs are a significant step towards the internationalization of the Indian security markets which would also be a potential benefit for the domestic investors in India. There remain a number of challenges as detailed above. However, if the Standard Chartered IDR is successful, it may herald a new trend of international companies listing IDRs in India. In the future, India may become a source for capital for international issuers. Because of Indian market highly potential in future .

Potrebbero piacerti anche

- A Practical Approach to the Study of Indian Capital MarketsDa EverandA Practical Approach to the Study of Indian Capital MarketsNessuna valutazione finora

- Indian Depository ReceiptDocumento4 pagineIndian Depository ReceipthrshtsoniNessuna valutazione finora

- Sub Section - Ii Issues by Foreign Companies in India (Indian Depository Receipts) (Idrs)Documento4 pagineSub Section - Ii Issues by Foreign Companies in India (Indian Depository Receipts) (Idrs)Ahkam KhanNessuna valutazione finora

- Sub Section - Ii Issues by Foreign Companies in India (Indian Depository Receipts) (Idrs)Documento4 pagineSub Section - Ii Issues by Foreign Companies in India (Indian Depository Receipts) (Idrs)vishal kasaudhanNessuna valutazione finora

- Indian Depository ReceiptsDocumento16 pagineIndian Depository Receipts777priyanka100% (1)

- IDR FungibilityDocumento3 pagineIDR FungibilityDealCurryNessuna valutazione finora

- Issue ManagementDocumento22 pagineIssue Managementayush_singhal27Nessuna valutazione finora

- Dr. Shakuntala Misra National Rehabilitation University LucknowDocumento15 pagineDr. Shakuntala Misra National Rehabilitation University LucknowM b khanNessuna valutazione finora

- Indian Depository RecieptDocumento24 pagineIndian Depository Recieptadilfahim_siddiqi100% (1)

- SL& C Study 17Documento34 pagineSL& C Study 17abhibth151Nessuna valutazione finora

- Indian Depository ReceiptsDocumento6 pagineIndian Depository ReceiptsKirti SrivastavaNessuna valutazione finora

- IDR Mechanism for Foreign Firms to Raise Funds in IndiaDocumento11 pagineIDR Mechanism for Foreign Firms to Raise Funds in IndiaZoheb SayaniNessuna valutazione finora

- IDR Introduction: Benefits for Foreign Companies and Indian Investors/TITLEDocumento17 pagineIDR Introduction: Benefits for Foreign Companies and Indian Investors/TITLERupa SinghNessuna valutazione finora

- Capital Market Regulatory Insight - P.S.rao & AssociatesDocumento43 pagineCapital Market Regulatory Insight - P.S.rao & AssociatesSharath Srinivas Budugunte100% (1)

- GDRDocumento9 pagineGDRSameer KathuriaNessuna valutazione finora

- IDR Indian Depository: ReceiptsDocumento16 pagineIDR Indian Depository: Receiptstakshu29Nessuna valutazione finora

- GDR & ADRsDocumento4 pagineGDR & ADRsShub SidhuNessuna valutazione finora

- Securities and Exchange Board of IndiaDocumento7 pagineSecurities and Exchange Board of IndiaShyam SunderNessuna valutazione finora

- Indian Depository Receipts (IDR)Documento14 pagineIndian Depository Receipts (IDR)Syed IliyasNessuna valutazione finora

- ISAS Brief: Raising Money in Indian Markets - The Indian Depository Receipts OptionDocumento3 pagineISAS Brief: Raising Money in Indian Markets - The Indian Depository Receipts OptionorlandoyingNessuna valutazione finora

- MM M M MMDocumento17 pagineMM M M MMDhiraj K DalalNessuna valutazione finora

- Capital Market Regulatory Insight - P.S.rao & AssociatesDocumento43 pagineCapital Market Regulatory Insight - P.S.rao & AssociateshiteshvNessuna valutazione finora

- Appendix 18: A.18.1 Launching A GDR IssueDocumento15 pagineAppendix 18: A.18.1 Launching A GDR IssuePrasad NambiarNessuna valutazione finora

- How DRs WorkDocumento5 pagineHow DRs Worktp4fNessuna valutazione finora

- Investment LawDocumento27 pagineInvestment LawHarmanSinghNessuna valutazione finora

- ADR/GDR Guidelines AmendedDocumento2 pagineADR/GDR Guidelines AmendedFilan SejpalNessuna valutazione finora

- Indian Depository Receipts (Idrs) : Presented To: Mrs. Garima Sahgal Presented By: Arvind Yadav Eiilm University SikkimDocumento6 pagineIndian Depository Receipts (Idrs) : Presented To: Mrs. Garima Sahgal Presented By: Arvind Yadav Eiilm University SikkimarvindrinkuNessuna valutazione finora

- By Geet Arora Bba 3 Year Roll No - 4204Documento15 pagineBy Geet Arora Bba 3 Year Roll No - 4204geet882004Nessuna valutazione finora

- Depository ReceiptDocumento4 pagineDepository ReceiptRavinder SinghNessuna valutazione finora

- Answer Paper-1 MBL2Documento7 pagineAnswer Paper-1 MBL2Matin Ahmad KhanNessuna valutazione finora

- QIPsDocumento19 pagineQIPsJyothsna RanganathNessuna valutazione finora

- SEBI Framework For Issuance of Depository Receipts: An Analysis By: S&R AssociatesDocumento3 pagineSEBI Framework For Issuance of Depository Receipts: An Analysis By: S&R AssociatesLatest Laws TeamNessuna valutazione finora

- Euro Issues & GdrsDocumento25 pagineEuro Issues & Gdrsvred4uNessuna valutazione finora

- ADR:gdrDocumento7 pagineADR:gdrramyadav00Nessuna valutazione finora

- Commercial PaperDocumento15 pagineCommercial PaperKrishna Chandran Pallippuram100% (1)

- IDR Mechanism: How Indian Depository Receipts WorkDocumento3 pagineIDR Mechanism: How Indian Depository Receipts WorkMorajkar VaishnaviNessuna valutazione finora

- Law MantraDocumento20 pagineLaw MantraSakshi JhaNessuna valutazione finora

- Foreign Investment Through GdrsDocumento6 pagineForeign Investment Through GdrsRadha Krishna BhimavarapuNessuna valutazione finora

- SEBI's regulatory environment for hedge funds in India and Participatory NotesDocumento4 pagineSEBI's regulatory environment for hedge funds in India and Participatory NotesAdarsh BhandariNessuna valutazione finora

- Ebcl Update June 2020 PDFDocumento141 pagineEbcl Update June 2020 PDFAbhay DixitNessuna valutazione finora

- Capital Market Related Topics, Regulatory Insights and Exchange Related IssuesDocumento43 pagineCapital Market Related Topics, Regulatory Insights and Exchange Related IssuesmandarNessuna valutazione finora

- Alternative Investment Fund RegistrationDocumento6 pagineAlternative Investment Fund RegistrationParas MittalNessuna valutazione finora

- QIP Guide for Listed Companies Under 40 CharactersDocumento11 pagineQIP Guide for Listed Companies Under 40 Characterssandeep-bhatia-911Nessuna valutazione finora

- Foreign Direct InvestmentDocumento6 pagineForeign Direct Investmentrohitalbert5Nessuna valutazione finora

- Payal Ghose and Aparna Raja, Changing Dynamics of Debt Funding in India, Economic Research and Surveillance Department, CCILDocumento3 paginePayal Ghose and Aparna Raja, Changing Dynamics of Debt Funding in India, Economic Research and Surveillance Department, CCILKunwar AbhudayNessuna valutazione finora

- Adr, GDR and EcgcDocumento12 pagineAdr, GDR and EcgcRaghu Veera SaikumarNessuna valutazione finora

- II Regulations in India:: Foreign Institutional Investors (FII's) SebiDocumento17 pagineII Regulations in India:: Foreign Institutional Investors (FII's) SebiKumar DayanidhiNessuna valutazione finora

- BFM CH 21 PDFDocumento27 pagineBFM CH 21 PDFKiran KotlapatiNessuna valutazione finora

- Raising Funds from Public in India under Companies Act and SEBI RegulationsDocumento18 pagineRaising Funds from Public in India under Companies Act and SEBI RegulationssatyajitNessuna valutazione finora

- Fmbo Sebi LDDocumento10 pagineFmbo Sebi LDPournima KoliNessuna valutazione finora

- Scope and Role of Key Financial Institutions in India's Money MarketDocumento5 pagineScope and Role of Key Financial Institutions in India's Money MarketVishnu JadhavNessuna valutazione finora

- Group IV FMRDocumento14 pagineGroup IV FMRkanak kathuriaNessuna valutazione finora

- Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 - Taxguru - inDocumento63 pagineForeign Exchange Management (Non-Debt Instruments) Rules, 2019 - Taxguru - inAbhay GuptaNessuna valutazione finora

- Permission To Issue Global Depositary Receipts/American Depositary ReceiptsDocumento2 paginePermission To Issue Global Depositary Receipts/American Depositary ReceiptsPankajSheteNessuna valutazione finora

- (FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaDocumento16 pagine(FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaUditanshu MisraNessuna valutazione finora

- Ecl Updates June 2020Documento121 pagineEcl Updates June 2020Zamr GNessuna valutazione finora

- FII Flows Could Increase in Spells, Says RBI: The Securities and Exchange Board of India DataDocumento11 pagineFII Flows Could Increase in Spells, Says RBI: The Securities and Exchange Board of India DataPooja MaanNessuna valutazione finora

- In 1988 The Securities and Exchange Board of IndiaDocumento3 pagineIn 1988 The Securities and Exchange Board of Indiadeepbisht007Nessuna valutazione finora

- AIFs in GIFT City: Understanding the Legal Framework and GrowthDocumento12 pagineAIFs in GIFT City: Understanding the Legal Framework and GrowthAnkitNessuna valutazione finora

- Group I:: Discount and Finance House of INDIA and Clearing Corporation of India LTDDocumento14 pagineGroup I:: Discount and Finance House of INDIA and Clearing Corporation of India LTDpankajbhatt1993Nessuna valutazione finora

- Mcdonald ProjectDocumento8 pagineMcdonald ProjectHelpdesk0% (1)

- Data Representation: Computer Architecture and Assembly LanguageDocumento28 pagineData Representation: Computer Architecture and Assembly Languagerahul_chaudhari733380Nessuna valutazione finora

- BUSN3025 Seminar 1 Introduction To IHRMa-1Documento25 pagineBUSN3025 Seminar 1 Introduction To IHRMa-1rahul_chaudhari733380Nessuna valutazione finora

- Electrcal Engineering: Jayvir Singh 106064Documento1 paginaElectrcal Engineering: Jayvir Singh 106064rahul_chaudhari733380Nessuna valutazione finora

- Foreign Exchange Risk Management Practices - A Study in Indian ScenarioDocumento11 pagineForeign Exchange Risk Management Practices - A Study in Indian ScenariobhagyashreeNessuna valutazione finora

- 2 - Example Business PlanDocumento14 pagine2 - Example Business Planmuftahmail721Nessuna valutazione finora

- 2015 Accountancy Question PaperDocumento4 pagine2015 Accountancy Question PaperJoginder SinghNessuna valutazione finora

- L5M4 New PaperDocumento9 pagineL5M4 New PaperibraokelloNessuna valutazione finora

- Form 2106Documento2 pagineForm 2106Weiming LinNessuna valutazione finora

- Guruswamy Kandaswami Memo A.y-202-23Documento2 pagineGuruswamy Kandaswami Memo A.y-202-23S.NATARAJANNessuna valutazione finora

- Basic Accounting Worksheet ColumnsDocumento26 pagineBasic Accounting Worksheet ColumnsApril Joy EspadorNessuna valutazione finora

- AAIB Mutual Fund (Shield) : Fact Sheet June 2014Documento2 pagineAAIB Mutual Fund (Shield) : Fact Sheet June 2014api-237717884Nessuna valutazione finora

- LATAM Airlines Group 20F AsFiledDocumento394 pagineLATAM Airlines Group 20F AsFiledDTNessuna valutazione finora

- Beam March 2018 PDFDocumento2 pagineBeam March 2018 PDFShyam BhaskaranNessuna valutazione finora

- LLP Notes As Per DU SyllabusDocumento39 pagineLLP Notes As Per DU SyllabusAryan GuptaNessuna valutazione finora

- Sesi 13 - 17dec20 - Completing The AuditDocumento40 pagineSesi 13 - 17dec20 - Completing The Auditstevany rutina sohNessuna valutazione finora

- ProblemsDocumento28 pagineProblemsKevin NguyenNessuna valutazione finora

- 100 Trading Youtube Channels For TradersDocumento2 pagine100 Trading Youtube Channels For TradersViệt Anh NguyễnNessuna valutazione finora

- FX Fluctuations, Intervention, and InterdependenceDocumento9 pagineFX Fluctuations, Intervention, and InterdependenceRamagurubaran VenkatNessuna valutazione finora

- (Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsDocumento185 pagine(Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsFaridElAtracheNessuna valutazione finora

- Introduction To Insurance IndustriesDocumento37 pagineIntroduction To Insurance IndustriesNishaTambeNessuna valutazione finora

- Template Excel Pengantar AkuntansiiDocumento15 pagineTemplate Excel Pengantar AkuntansiiKim SeokjinNessuna valutazione finora

- Articles of IncorporationDocumento4 pagineArticles of IncorporationRuel FernandezNessuna valutazione finora

- Ifric 12Documento12 pagineIfric 12Cryptic LollNessuna valutazione finora

- Interim Report On Devolved GovernmentDocumento341 pagineInterim Report On Devolved GovernmentSpartacus OwinoNessuna valutazione finora

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocumento27 pagineBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1Nessuna valutazione finora

- PreferenceSharesDocumento1 paginaPreferenceSharesTiso Blackstar GroupNessuna valutazione finora

- Profitability INTRODUCTIONDocumento19 pagineProfitability INTRODUCTIONDEEPANessuna valutazione finora

- EquityDocumento29 pagineEquityThuy Linh DoNessuna valutazione finora

- Financial MarketDocumento8 pagineFinancial Marketindusekar83Nessuna valutazione finora

- Ofqual Accredited Qualifications: Ofqual No. EDI Qualification Code LCCI Qualification Title Ofqual TitleDocumento4 pagineOfqual Accredited Qualifications: Ofqual No. EDI Qualification Code LCCI Qualification Title Ofqual TitleWutyee LynnNessuna valutazione finora

- AF308 Tutorial 7Documento2 pagineAF308 Tutorial 7Elisa SharmaNessuna valutazione finora

- Financial Accounting P 1 Quiz 3 KeyDocumento6 pagineFinancial Accounting P 1 Quiz 3 KeyJei CincoNessuna valutazione finora

- Consolidated CSOFP of Jasin Bhd GroupDocumento4 pagineConsolidated CSOFP of Jasin Bhd GroupNoor ShukirrahNessuna valutazione finora

- Export & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesDa EverandExport & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesValutazione: 5 su 5 stelle5/5 (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDa EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingValutazione: 4.5 su 5 stelle4.5/5 (97)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesDa EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesValutazione: 4 su 5 stelle4/5 (1)

- Introduction to Negotiable Instruments: As per Indian LawsDa EverandIntroduction to Negotiable Instruments: As per Indian LawsValutazione: 5 su 5 stelle5/5 (1)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpDa EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpValutazione: 4 su 5 stelle4/5 (214)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsDa EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsValutazione: 5 su 5 stelle5/5 (24)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorDa EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorValutazione: 4.5 su 5 stelle4.5/5 (132)

- Richardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesDa EverandRichardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesNessuna valutazione finora

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorDa EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorValutazione: 4.5 su 5 stelle4.5/5 (63)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessDa EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNessuna valutazione finora

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASDa EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASValutazione: 3 su 5 stelle3/5 (5)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooDa EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooValutazione: 5 su 5 stelle5/5 (2)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementDa EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementValutazione: 4.5 su 5 stelle4.5/5 (20)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesDa EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesValutazione: 5 su 5 stelle5/5 (1)

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceDa EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNessuna valutazione finora

- The Streetwise Guide to Going Broke without Losing your ShirtDa EverandThe Streetwise Guide to Going Broke without Losing your ShirtNessuna valutazione finora

- Learn the Essentials of Business Law in 15 DaysDa EverandLearn the Essentials of Business Law in 15 DaysValutazione: 4 su 5 stelle4/5 (13)

- How to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionDa EverandHow to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionNessuna valutazione finora

- The HR Answer Book: An Indispensable Guide for Managers and Human Resources ProfessionalsDa EverandThe HR Answer Book: An Indispensable Guide for Managers and Human Resources ProfessionalsValutazione: 3.5 su 5 stelle3.5/5 (3)