Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

5.capital Investment Decisions

Caricato da

giselekouassimaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

5.capital Investment Decisions

Caricato da

giselekouassimaCopyright:

Formati disponibili

Fundamentals of Corporate Finance

Colin Firer et al

Key Concepts and Skills

How to determine the relevant cash flows for a proposed investment How to analyze a projects cash flows

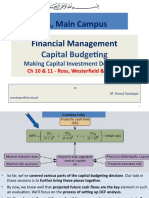

Chapter 10 Making Capital Investment Decisions

10-2

Project Cash Flows

Capital budgeting process

Project Cash Flows

Project

Establish which information should be considered

Decide whether or not to invest in a project

Changes cash flows of company

Today + future

Consider changes in cash flows and decide!!!

Do a discounted cash flow analysis

These cash flows are called incremental cash flows

Relevant Cash Flows

The cash flows that should be included in a capital budgeting analysis are those that will only occur if the project is accepted Cash flows

Not profits Depreciation irrelevant

Stand alone principle

The stand-alone principle allows us to analyze each project in isolation from the firm simply by focusing on incremental cash flows

Cash flow dependent on acceptance of the project.

These cash flows are called incremental cash flows

If the project is not accepted, the cash flow will not take place

Focus only on the cash flows of the specific project

10-6

10-5

Asking the Right Question

You should always ask yourself Will this cash flow occur ONLY if we accept the project?

If the answer is yes, it should be included in the analysis because it is incremental If the answer is no, it should not be included in the analysis because it will occur anyway If the answer is part of it, then we should include the part that occurs because of the project

10-7

Common Types of Cash Flows

Sunk costs Opportunity costs Side effects Changes in net working capital Financing costs Inflation

Cash flows that have already taken place in the past Cannot be changed or reversed by the decision costs of lost options Cash flows that could have been generated from the best alternative use of an asset

Positive side effects benefits to other projects Negative side effects costs to other projects

= loan Supplies NWC at the beginning and withdraw at the end.

Indeed a cash flow BUT cost of capital already includes the required return on debt

Long term investment inflation likely to occur Already included in discount rate

10-8

Example

Grasshopper (Pty) Ltd is considering a new contract to service the garden of a local townhouse complex. Which of the following costs is relevant to this decision? The salary of the receptionist Salary of the supervisor already employed by the company Rent of the office space Wages of extra staff to be employed for this contract

Fin Man 2A 9

Potrebbero piacerti anche

- Applied Corporate Finance. What is a Company worth?Da EverandApplied Corporate Finance. What is a Company worth?Valutazione: 3 su 5 stelle3/5 (2)

- 3 - Capital BudgetingDocumento60 pagine3 - Capital BudgetingValerie WNessuna valutazione finora

- Fin 3010 Week 5-6Documento34 pagineFin 3010 Week 5-6smwanginet7Nessuna valutazione finora

- 100 Case Study In Project Management and Right Decision (Project Management Professional Exam)Da Everand100 Case Study In Project Management and Right Decision (Project Management Professional Exam)Valutazione: 4 su 5 stelle4/5 (3)

- FM-Sessions 17-20 Capital Budgeting-Investment Decision (Complete)Documento62 pagineFM-Sessions 17-20 Capital Budgeting-Investment Decision (Complete)Umme HaniNessuna valutazione finora

- FM-Sessions 17-20 Capital Budgeting-Investment Decision CompleteDocumento61 pagineFM-Sessions 17-20 Capital Budgeting-Investment Decision CompleteSaadat ShaikhNessuna valutazione finora

- Capital Budgeting Process GuideDocumento74 pagineCapital Budgeting Process GuideMitul KathuriaNessuna valutazione finora

- CFA Level 1 Corporate Finance E Book - Part 1 PDFDocumento23 pagineCFA Level 1 Corporate Finance E Book - Part 1 PDFZacharia Vincent67% (3)

- UEU Manajemen Keuangan Pertemuan 7Documento42 pagineUEU Manajemen Keuangan Pertemuan 7HendriMaulanaNessuna valutazione finora

- Gitman Capital BudgetingDocumento51 pagineGitman Capital BudgetingjaneNessuna valutazione finora

- Chapter Four Capital BudgetingDocumento64 pagineChapter Four Capital BudgetingMelkam tseganew TigabieNessuna valutazione finora

- Capital Budgeting Analysis TechniquesDocumento63 pagineCapital Budgeting Analysis TechniquesSonali JagathNessuna valutazione finora

- Capital Budgeting Cash Flow PrinciplesDocumento37 pagineCapital Budgeting Cash Flow PrinciplesJoshNessuna valutazione finora

- Strategic Investment Decisions: Capital Budgeting TechniquesDocumento44 pagineStrategic Investment Decisions: Capital Budgeting TechniquesBharath50% (2)

- Chaptert 10 HW SolutionsDocumento79 pagineChaptert 10 HW SolutionsJoanne Mendiola100% (1)

- Investment Decisions FCF 2014Documento17 pagineInvestment Decisions FCF 2014Лера АношинаNessuna valutazione finora

- Fidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-5Documento17 pagineFidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-5Fidelia AgathaNessuna valutazione finora

- Capital Budgeting Decisions: DR R.S. Aurora, Faculty in FinanceDocumento31 pagineCapital Budgeting Decisions: DR R.S. Aurora, Faculty in FinanceAmit KumarNessuna valutazione finora

- Project Feasibility & Finance PrinciplesDocumento27 pagineProject Feasibility & Finance PrinciplesHimanshu DuttaNessuna valutazione finora

- Chapter 9 Project Cash FlowsDocumento28 pagineChapter 9 Project Cash FlowsGovinda AgrawalNessuna valutazione finora

- Financial management paper investment decisionsDocumento28 pagineFinancial management paper investment decisions2154 taibakhatunNessuna valutazione finora

- Law on Corporate Finance Module IDocumento50 pagineLaw on Corporate Finance Module ISrinibashNessuna valutazione finora

- Capital Budgeting Techniques: All Rights ReservedDocumento43 pagineCapital Budgeting Techniques: All Rights Reservedred8blue8Nessuna valutazione finora

- PPCH 08Documento41 paginePPCH 08Nady SouzaNessuna valutazione finora

- Unit 8 - Capital BudgetingDocumento25 pagineUnit 8 - Capital BudgetingParul SrivastavNessuna valutazione finora

- Profitabilty. AnalysisDocumento35 pagineProfitabilty. AnalysisSidharth RazdanNessuna valutazione finora

- Capital Budgeting: Mrs Smita DayalDocumento23 pagineCapital Budgeting: Mrs Smita Dayalkaran katariaNessuna valutazione finora

- CASH FLOW ESTIMATION Week 6Documento30 pagineCASH FLOW ESTIMATION Week 6adulmi325Nessuna valutazione finora

- Basics of Capital Budgeting: Should We Build This PlantDocumento217 pagineBasics of Capital Budgeting: Should We Build This PlantCV CVNessuna valutazione finora

- Capital BudgetingDocumento8 pagineCapital BudgetingCyrine JemaaNessuna valutazione finora

- Capital Budgeting SOBD-4Documento30 pagineCapital Budgeting SOBD-4shrutisirsa1Nessuna valutazione finora

- Chapter 10 Making Capital Investment DecisionsDocumento15 pagineChapter 10 Making Capital Investment DecisionsHồng HạnhNessuna valutazione finora

- Capital Budgeting-Investment DecisionDocumento31 pagineCapital Budgeting-Investment DecisionDRIP HARDLYNessuna valutazione finora

- Final Project Cash FlowsDocumento25 pagineFinal Project Cash FlowsLalit Sondhi100% (1)

- Capital Investment Decisions: NPV, IRR & Payback PeriodDocumento46 pagineCapital Investment Decisions: NPV, IRR & Payback Periodkundayi shavaNessuna valutazione finora

- UntitledDocumento3 pagineUntitledhena_hasina100% (1)

- Capital BudgetingDocumento35 pagineCapital BudgetingShivam Goel100% (1)

- Corporate Finance - SIGFi - Finance HandbookDocumento17 pagineCorporate Finance - SIGFi - Finance HandbookSneha TatiNessuna valutazione finora

- Capital Budgeting: CFA Exam Level-I Corporate Finance ModuleDocumento52 pagineCapital Budgeting: CFA Exam Level-I Corporate Finance ModuleawdheshNessuna valutazione finora

- CAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT CollegeDocumento39 pagineCAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT CollegeNAGESH GUTTEDARNessuna valutazione finora

- Estimating Capital Project Cash FlowsDocumento4 pagineEstimating Capital Project Cash FlowsRaquel, Harry JaponNessuna valutazione finora

- Capital Budgeting TechniquesDocumento11 pagineCapital Budgeting Techniquesnaqibrehman59Nessuna valutazione finora

- Capital Budgeting - Discounted and Undiscounted MethodDocumento47 pagineCapital Budgeting - Discounted and Undiscounted MethodTacitus KilgoreNessuna valutazione finora

- Project Costs & Benefits EstimationDocumento11 pagineProject Costs & Benefits Estimationdestinyrocks88Nessuna valutazione finora

- Capital Budgeting and The Case For NPVDocumento10 pagineCapital Budgeting and The Case For NPVJude Allan UrmenetaNessuna valutazione finora

- 1,,WEEK 1-2 - Introduction To Capital BudgetingDocumento31 pagine1,,WEEK 1-2 - Introduction To Capital BudgetingKelvin mwaiNessuna valutazione finora

- Capital BudgetingDocumento59 pagineCapital BudgetingJCGonzalesNessuna valutazione finora

- L1R32 Annotated CalculatorDocumento33 pagineL1R32 Annotated CalculatorAlex PaulNessuna valutazione finora

- Capital BudgetingDocumento30 pagineCapital BudgetingSyed Shaan KahnNessuna valutazione finora

- Study of Financial StatementsDocumento39 pagineStudy of Financial Statementsagrawalrohit_228384Nessuna valutazione finora

- MGMT2023 Lecture 8 - Capital Budgeting Part 1Documento44 pagineMGMT2023 Lecture 8 - Capital Budgeting Part 1Ismadth2918388Nessuna valutazione finora

- Capital Budgeting - December 2015Documento19 pagineCapital Budgeting - December 2015apoorv jindalNessuna valutazione finora

- Benchmarking: Efficiency, and Financial Leverage in Achieving An ROE Figure. For Example, A FirmDocumento8 pagineBenchmarking: Efficiency, and Financial Leverage in Achieving An ROE Figure. For Example, A FirmDavidHooNessuna valutazione finora

- Week 10 - 11 - Investment Appraisal TechniquesDocumento15 pagineWeek 10 - 11 - Investment Appraisal TechniquesJoshua NemiNessuna valutazione finora

- Solutions Manual: Introducing Corporate Finance 2eDocumento25 pagineSolutions Manual: Introducing Corporate Finance 2eJeremiahNessuna valutazione finora

- Capital Investment Decisions Analysis GuideDocumento28 pagineCapital Investment Decisions Analysis GuideGaurav YadnikNessuna valutazione finora

- Capital Budgeting and Decision ProcessDocumento14 pagineCapital Budgeting and Decision ProcessDIANNAKATE ORTENCIONessuna valutazione finora

- CAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT CollegeDocumento39 pagineCAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT Collegesharadggg8309Nessuna valutazione finora

- IIT Madras MBA Programme Curriculum (July 2018Documento93 pagineIIT Madras MBA Programme Curriculum (July 2018karanNessuna valutazione finora

- Tutorial Booklet For Tutors AnswersDocumento29 pagineTutorial Booklet For Tutors AnswersRodica BulargaNessuna valutazione finora

- Master's Research Assistant Experience in Agricultural EconomicsDocumento1 paginaMaster's Research Assistant Experience in Agricultural EconomicsSisir MahantaNessuna valutazione finora

- 11th Economics EM Quarterly Exam Model Question Paper 2022 2023 English Medium PDF DownloadDocumento3 pagine11th Economics EM Quarterly Exam Model Question Paper 2022 2023 English Medium PDF DownloadThiruNessuna valutazione finora

- Unit 7. Revision and ConclusionDocumento5 pagineUnit 7. Revision and ConclusionAryla AdhiraNessuna valutazione finora

- Economics For Today 5th Edition Layton Solutions ManualDocumento10 pagineEconomics For Today 5th Edition Layton Solutions Manualcassandracruzpkteqnymcf100% (31)

- Chapter 1 Microeconomics FTUDocumento17 pagineChapter 1 Microeconomics FTUVăn PhạmNessuna valutazione finora

- Ideas For SOPDocumento20 pagineIdeas For SOPsparkle shresthaNessuna valutazione finora

- DISS Module1 1 8Documento78 pagineDISS Module1 1 8chwe sevenith86% (7)

- Trader Monthly Research Report: April: by Alex HaywoodDocumento11 pagineTrader Monthly Research Report: April: by Alex Haywoodapi-213311303Nessuna valutazione finora

- Mineral Economics 2nd Ed. Monograph 29. AUSIMMDocumento311 pagineMineral Economics 2nd Ed. Monograph 29. AUSIMMMelody Maker93% (14)

- Brian Walters and Associates: Business Valuation/ Management Consulting ServicesDocumento28 pagineBrian Walters and Associates: Business Valuation/ Management Consulting Servicesbvwalters322Nessuna valutazione finora

- Class Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25Documento2 pagineClass Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25amrat meenaNessuna valutazione finora

- A Mathematical Model To Support Investment in Veneer and 2021 Forest PolicyDocumento14 pagineA Mathematical Model To Support Investment in Veneer and 2021 Forest PolicyFelipe DiezNessuna valutazione finora

- Supply & Demand PDFDocumento19 pagineSupply & Demand PDFJoel SepeNessuna valutazione finora

- Exchange Rate Volatility and International TR - 2023 - Journal of Business ReseaDocumento19 pagineExchange Rate Volatility and International TR - 2023 - Journal of Business ReseaNgọc Hân NgôNessuna valutazione finora

- Collector ManualDocumento1.206 pagineCollector ManualJayanti DaburiaNessuna valutazione finora

- Manish FinalDocumento44 pagineManish FinalMohit GahlawatNessuna valutazione finora

- Summary of Regression Results On The Effects of Demographic Change On Economic Growth, Selected Studies Based On Conditional Convergence ModelsDocumento2 pagineSummary of Regression Results On The Effects of Demographic Change On Economic Growth, Selected Studies Based On Conditional Convergence ModelssfdfsdfNessuna valutazione finora

- Eco NotesDocumento10 pagineEco NotesNicoleUmaliNessuna valutazione finora

- Kotler Pom16e Inppt 10Documento36 pagineKotler Pom16e Inppt 10Wan WannNessuna valutazione finora

- DTU Mid Sem 2017 Date SheetDocumento5 pagineDTU Mid Sem 2017 Date Sheetdeepak416Nessuna valutazione finora

- CV and EV explained: Calculating compensating and equivalent variationsDocumento8 pagineCV and EV explained: Calculating compensating and equivalent variationsRichard Ding100% (1)

- Chapter 1 SolutionDocumento2 pagineChapter 1 SolutionRicha Joshi100% (1)

- Economic Analysis of Proposed Changes in The Tax Treatment of Advertising ExpendituresDocumento79 pagineEconomic Analysis of Proposed Changes in The Tax Treatment of Advertising ExpendituresBerin SzókaNessuna valutazione finora

- SHIFTing Consumer Behavior: A Framework for SustainabilityDocumento28 pagineSHIFTing Consumer Behavior: A Framework for Sustainabilityrajat gargNessuna valutazione finora

- Unit 5 Balance of PaymentDocumento5 pagineUnit 5 Balance of PaymentAnime worldNessuna valutazione finora

- Chapter 3 BASIC ELEMENTS OF SUPPLY AND DEMANDDocumento1 paginaChapter 3 BASIC ELEMENTS OF SUPPLY AND DEMANDAiman RashidNessuna valutazione finora

- Economics Project Term 2Documento24 pagineEconomics Project Term 2TamannaNessuna valutazione finora

- The Framework of Contemporary BusinessDocumento19 pagineThe Framework of Contemporary BusinessLivingstone CaesarNessuna valutazione finora