Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Online Banking: A Project On

Caricato da

Sufiyan MohammadDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Online Banking: A Project On

Caricato da

Sufiyan MohammadCopyright:

Formati disponibili

ONLINE BANKING

160310737027 & 160310737035

A Project on

ONLINE BANKING

Mohammad Sufiyan 160310737027

1

Salman Khan 160310737035

ONLINE BANKING

160310737027 & 160310737035

DECCAN COLLEGE OF ENGINEERING & TECHNOLOGY Dar-us-Salam, Hyderabad -500 001.

DEPARTMENT OF INFORMATION TECHNOLOGY

MINI PROJECT

CERTIFICATE

This is to certify that MOHAMMAD SUFIYAN and SALMAN KHAN of B.E. (II/IV) II SEMESTER; I.T branch bearing roll number160310737027 and 160310737035 has successfully completed the Mini project work during the academic year 2012.

H.O.D

Internal Examiner

2

External Examiner

ONLINE BANKING

160310737027 & 160310737035

ACKNOWLEDGEMENT

We feel deeply in indebted towards people who hav e guided us in this project. It would have not have been possible to make such an extensive report without the help, guidance and inputs from them. Most of my information source has been from professional books of banking sector

Project Guide-

Asst Prof: Ms Imrana Ikram

We would firstly like to express my gratitude towards our college DECCAN COLLEGE OF ENGINEERING AND TECHNOLOGY which has given us an opportunity to do a project on ONLINE BANKING SYSTEM & guide ASST PROF: IMRANA IKRAM for having shown so much of flexibility & guiding in such a way that we were really learning the subject all the time . She helped us in deciding the project topic. She showed a lot of openness in her approach and I woul d like to thank her for her support in a way that has lead to proper & effective learning.

Secondly we would like to thank to Ms UZMA GOURI and Ms TAHNIYATH SHAHEEN.For spending there precious time for our project and giving me ample of good ideas about the project.

Last but not least we are grateful to all ours family members & friends for being our side always. Without their help and Motivation it would have been impossible to complete this project.

ONLINE BANKING

160310737027 & 160310737035

INDEX SNO

1

CONTENTS

List of figures

PGNO

History of the project

Reason for selecting topic

Abstract

Introduction

Implementation of project

Hurdles faced in the project

Advantages and Limitations

Future Enhancements

10

Conclusion

11

Bibliography

ONLINE BANKING

160310737027 & 160310737035

LIST OF FIGURES AND TABLES

ONLINE BANKING

160310737027 & 160310737035

HISTORY OF THE PROJECT

The concept of online banking as we know it today dates back to the early 1980s, when it was first envisioned and experimented with. However, it was only in 1995 (on October 6, to be exact) that Presidential Savings Bank first announced the facility for regular client use. The idea was quickly snapped up by other banks like Wells Fargo, Chase Manhattan and Security First Network Bank. Today, quite a few banks operate solely via the Internet and have no 'four-wall' entity at all. In the beginning, its inventors had predicted that it would be only a matter of time before online banking completely replaced the conventional kind. Facts now prove that this was an overoptimistic assessment - many customers still harbor an inherent distrust in the process. Others have opted not to use many of the offered facilities because of bitter experience with online frauds, and inability to use online banking services. Be that as it may, it is estimated that a total of 55 million families in America will be active users of online banking by the year 2010. Despite the fact that many American banks still do not offer this facility to customers, this may turn out to be an accurate prediction. The number of online banking customers has been increasing at an exponential rate. Initially, the main attraction is the elimination of tiresome bureaucratic red tape in registering for an account, and the endless paperwork involved in regular banking. The speed with which this process happens online, as well as the other services possible by these means, has translated into a literal boom in the banking industry over the last five years. Nor are there any signs of the boom letting up - in historical terms, online banking has just begun. Online Banking provides detailed information on Online Banking, History of Online Banking, Online Banking Services, Future of Online Banking and more. Online Banking is affiliated with Offshore Banking Accounts. The first online banking service in United States was introduced, in October 1994. The service was developed by Stanford Federal Credit Union, which is a financial institution. The online banking services are becoming more and more prevalent due to the well-developed systems. Though there are pros and cons of electronic cash technology, it has become a revolution that is enhancing the banking sector.

ONLINE BANKING

160310737027 & 160310737035

REASONS FOR SELECTING THIS TOPIC

KEEP CLIENTS SAFE

Protecting clients from financial malware makes clear business sense. But, too often computer security products offered to financial services clients rely on the client to make the effort of installing and confirming that the promised protection is working. In the end, clients are too often underwhelmed, dissatisfied, and the level of security and protection remain unchanged.

REDUCE RISK EXPOSURE

Criminals using financial malware have significantly increased the risk of offering online banking and customer requested services. Stolen funds may not be recoverable and institutions or clients are faced with significant losses and potential legal action. This risk exposure is significant enough for some institutions to consider not offering automated payments.

PAY BILLS ONLINE

You can use online banking to pay your bills. This will eliminate the need for stamps and protect you from the check being lost in the mail. Most banks will have a section in which you set up payees. You will need to fill out the information once, and then you can simply choose that profile every time you pay a bill online. If your bank will not pay bills online you may consider paying online through the company. Be careful since some of these companies may charge a convenience fee.

ONLINE BANKING

160310737027 & 160310737035

ABSTRACT

AIM

The aim of this project is to develop secured online banking with the following objectives Create a banking system that is easily accessible by customers from the comfort of their offices, homes,,etc.. Reduce the flow of human traffic and long queues in the bank. Reduce the time wasted in going to banks to stay on queues.

SCOPE OF THE PROJECT

The scope of the project is limited to the activities of the operations unit of the banking system which includes opening of an account, deposit of funds, withdrawal of funds and transfers.

SOFTWARE DESCRIPTION

HTML CSS

BRIEF DESCRIPTION OF PROJECT

ONLINE BANKING

Online banking services have grown from simply allowing customers to check balances, to trading assets. Today banks like ING Direct are functioning, entirely online with no brick and mortar building. With the costs saved by requiring fewer employees and the lack of facility expenses, these virtual banks can often offer highest interest rates than traditional counter parts. Internet banking gives u the power to control finances completely. Your no longer tied down to managing your money during the hours the bank is open. If u want to transfer the balances after the business hours, you can! If you have access to the internet and have a number of recurring bills, then you should use internet banking to make your life easier. Internet banking allows you to be able to do everything that that you can in regular banking institution, only with the benefit that you can do it all right from the convenience of your own home. Not is this great because you can be comfortable and have peace of mind knowing

8

ONLINE BANKING

160310737027 & 160310737035

that you can keep track yourself of all your banking issues, but as well it allows for more ease because you never have to worry about rushing out make it to the bank. If a customer clicks on account opening links, he is taken to page where he fills a form and clicks the submit button if he is through. A successful filling of the form gives response that confirms the customer account is open and activated. Thus such a customer can receive money into such an account through funds transfer. Account details are sent by the bank to the customers email box. Registered customers or Account holders of the bank can now login using the account details posted to their email box to login before they can perform financial transactions. The system is secured such you cannot operate another mans account even if you knew his account details because a new transaction number is always sent to a customer for each login. This transaction number is what will be used to authenticate any transaction per time.

ONLINE BANKING

160310737027 & 160310737035

INTRODUCTION

The main purpose that banks have been serving since their inception is keeping our money safe for us. While keeping our money safe, they also let us earn a certain amount of interest on the money deposited with them. Traditional banks have been doing this, and internet banks continue the same function. The only difference is in the way the transactions are made. We all know about internet banking and most of us use it quite often as well, but few of us actually understand about the history of internet banking and how it all came out. Knowing the history of internet banking can be incredibly useful, especially since it will allow us to have more respect for the little things that we take for granted.

Computers themselves have really come an enormous way since their initial establishment, as the earliest electronic computers were so large that they would take up the entire area of a room, while today some are so small that they can hardly be seen at all.

10

ONLINE BANKING

160310737027 & 160310737035

In today's world, computers play an incredibly large role in the way the world exists in general, and the majority of tasks could actually not be completed if not for the use of computers. Although there are certainly some areas and jobs that cannot yet be completed solely by computers and which thus still require actual manpower, for the most part, computers have helped to make life significantly easier, productive, and more convenient for us all. Internet banking has been around for quite a few years now, but has really only become prominent over the past year or so in particular. Internet banking offers an array of different advantages to the user, including: account balances and history including year-to-date information, the ability to transfer money from one account to another and to payees for bill payments, check history, reorders, and stop payments, check credit card balances and statements, complete online loan applications, secure interactive messaging with staff, and much more.

Internet banking basically allows you to be able to do everything that you can in your regular banking institution, only with the benefit that you can do it all right from the convenience of your own home. Not only is this great because you can be comfortable and have peace of mind knowing that you can keep track yourself of all your banking issues, but as well it allows for more ease because you never have to worry about rushing out and making it to the bank. With the problems and limitations associated with manual banking procedures as witnessed in most parastatals today, complied with the problems associated with the existing application programs even much more in the presence of serious technological advances aimed at improving information system. This is activities aimed at shedding light upon the need for improvement in accounting activities and the means of achieving its efficiency, effectiveness, reliability and success promising future through computer intervention. Internet banking identifies a particular set of technological solutions for the development and the distribution of financial services, which rely upon the open architecture of the Internet. With the implementation of an Internet banking system, the banks maintain a direct relationship with the end users via the web and are able to provide a personal characterization to the interface, by offering additional customized services.

11

ONLINE BANKING

160310737027 & 160310737035

DEFINING ONLINE BANKING

The term "online banking" or "internet banking" covers both computer and telephone banking. Using computer banking, a customer either uses his computer to dials directly into its bank's computer or gains access to the banks computer over the internet. Using telephone banking, the customer can controls its bank accounts by giving the bank instructions over the telephone. Both computer and telephone banking involve the use of passwords which give access to the customers accounts.

12

ONLINE BANKING

160310737027 & 160310737035

Using these methods, banking transactions can be auctioned 24 hours a day. Online banking allows the person, for instance, to view recent transactions, print out statements and transfer funds between accounts and make payments. Many banks also have the facility for someone to set up, amend or cancel standing orders. Internet banking also allows payments to be made to the customer, i.e. acceptance of credit card donations. Most people that use internet banking will also continue to use some of the elements of more traditional methods of banking, such as a cheque book. .

ONLINE-BANKING IN DEVELOPING COUNTRIES:

Just like Internet infrastructure, E-Banking in developing countries is at early stages; however there are some exceptions where countries like: Brazil have 75% of enterprises, excluding micro-enterprises using the Internet for banking in 2005. Morocco (34.9%). (United Nations Conference on Trade and Development, 2006), There is an increasing growth of online banking, indicating a promising future for online banking in these countries. In China, while banks issue credit cards and while many use debit cards to draw directly from their respective bank accounts, very few people use their credit cards for online payment. Cash-on-delivery is still the most popular mode of e-commerce payment. Nonetheless, online payment is gaining popularity because of the emergence of China pay and Cyber Beijing, which offer a city-wide online payment system. (Zorayda Ruth B. Andam, 2003). The Nigerian economy is largely cash-based with a lot of money residing outside the banking system. To a greater extent, this has hindered the participation of her citizens in ecommerce where online payment is the acceptable means of settling transactions. (Ayo Charles. K and Babajide Daniel O, 2006). In Nigeria, the modernization of the payment process started with the introduction of the MICR. This was followed by the establishment of ATMs for cash dispensing, account balance enquiry and payment of utility cheques. In 1993, the Central Bank of Nigeria (CBN), introduced the use of payment cards (smartcard) and paper-based instrument. Similarly in 2004, CBN introduced a broad guideline on e-banking which included the introduction of ATM, e money products such as credit and debit cards (Salimon, 2006). The Turkish banking sector has not only grown in numerical terms it has also expanded in terms of technology and the range of new services offered to its local and foreign customers. The sector has been viewed as the leader of technological innovations in Turkey. Although a lot of work and progress has been made in electronic banking by these countries, but these nations are still cash based economies largely. There needs to be a regulatory framework and awareness among the banks and the consumers about the benefits and drivers of such systems. Fast adoption of electronic form of banking is the need of the day for these developing nations to survive in todays hypercompetitive global world.

13

ONLINE BANKING

160310737027 & 160310737035

METHODOLOGY

This is an exploratory research that evaluated different factors that why consumers in Pakistan are reluctant to adopt e-banking. Data collection methods are an integral part of research design. Both primary and secondary data are used in this research. Three research methods; surveys, case studies and research articles had been used for this paper. A questionnaire was developed to gather data from the banking consumers, which consisted of two sections to which there were 145 respondents forming a Non Probability Sample. The sample data consisted of 34 Online Banking users while 111 were non-users.

Internet banking can be split into two distinct groups:

Traditional banks and building societies use the Internet as an add-on service with which to give businesses access to their accounts. New Internet-only banks have no bricks and mortar presence on the High Street. Therefore, they have lower overheads and can offer higher rates of interest and lower charges.

14

ONLINE BANKING

160310737027 & 160310737035

IMPLEMENTATION OF THE PROJECT

The aim of the proposed system is to address the limitations of the current system .The requirements for the system has been gathered from the defects recorded in the past and also based on the feedback users of the previous metrics tools. The development of the new system contains the following activities which try to automate the entire process keeping in view of the database integration approach. Following are the Objectives of the proposed system: 1. The administrators have grates accessibility in collecting the consistent information that is very much necessary for the system to exist and coordinate. 2. The system at any point of time can give the customers information related to their Accounts and accounts status The balance enquiry The fund transfer standards The cheque book request 3. The system can provide information related to the different types of accounts that are existing within the bank. 4. The system can provide the bank administration with information on the number of customers who are existing in the system. 5. The system at any point of time can provide the information related to the executed transactions by the customer. 6. The system with respect to the necessities can identify all the history details of the trial participants along with their outcome of the results. 7. The system with respect to the necessities can provide the status of research and development process that is under schedule within the organization currently. 8. With proper storage of the data in a relational environment the system can Applegate itself to cater to the standards of providing a clear and easy path for future research standards that may arise due to organizational policies.

15

ONLINE BANKING MODE OF OPERATION

160310737027 & 160310737035

WEB will contain self explanatory hyperlinks that customers can click to make any request or perform a task.

REQUEST

Customer

RESPONSE

Application server

REQUEST/REPLYO F CUSTOMER/ADMIN

Apache server

REQUEST

Administrator

RESPONSE

Data Base

If a customer clicks on account opening links, he is taken to page where he fills a form and clicks the submit button if he is through. A successful filling of the form gives a response that confirms the customer account is open and activated. Thus such a customer can receive money into such an account through funds transfer. Account details are sent by the bank to the customers email box. Registered customers or Account holders of the bank can now login using the account details posted to their email box to login before they can perform financial transactions. The system is secured such you cannot operate another mans account even if you knew his account details because a new transaction number is always sent to a customer for each login. This transaction number is what will be used to authenticate any transaction per time. IMPLEMENTATION Implementation of online banking helps us to know more about the topic. Basically it tells us what all have been studied while making the report.

16

ONLINE BANKING

160310737027 & 160310737035

The various implementations of online banking are: To study the internet banking facilities offered by the banks to its customers To study as to how much internet banking has penetrated in the minds of the customers To gain insights about functioning of internet banking. To explore the future prospects of internet banking. To study the benefits those are provided to the individual under internet banking.

To study the hazards in using internet banking.

17

ONLINE BANKING

160310737027 & 160310737035

FLOW CHART

START

HOMEPAGE

No ONLINE BANKING PERSONAL BANKING

No CORPORATE BANKING

No

Yes No No Opens the login ID

Yes

Yes Opens the Corporate banking page

No

MOBILE BANKING Opens the Submission form

PHONE BANKING

Opens the Online banking page

Opens the Mobile banking page

Opens the Phone banking page

STOP

18

ONLINE BANKING

160310737027 & 160310737035

SOURCE CODE

<HTML> <html> <head> <style type="text/css"> .clsinfo{ FONT-FAMILY: Verdana; FONT-SIZE: 9.5pt; BACKGROUND-COLOR:#003399; fontweight:bold; text-decoration: none; color : white; } </style> <title> ONLINE BANKING</title> </head> <body onload="loadCSSfile()" background="../image/image001.gif" margin:0';scrollbar=no > link=maroon bgcolor=white vlink="#666666" style='tab-interval:.5in;

<TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR height="8%" width="100%" bgcolor="#E0FFFF"> <TD valign="center" align="center"> <img class="Banklogo" src="unique bank.gif"> </TR> <TR height="92%" width="100%"><TD> <TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%" > <TR> <TD width="2%"></TD> <TD width="96%"> <TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%" >

19

</TD>

ONLINE BANKING <TR height="3%" width="100%"><TD></TD></TR> <TR height="40%" width="100%"> <TD> <TABLE border="0" columns="3"> <TR> <TD width="21%"> height="100%" cellpadding="0"

160310737027 & 160310737035

cellspacing="0"

width="100%"

<TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR> <TD width="95%"> <TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR height="12%"> <TD align="center" bgcolor="#FF0000"> <TABLE width="100%" height="100%"class="Internet"><TR><TD><A class="Internet" title="Click here to go to Internet Banking" href="code for login page.html"><font color="#ffffff">ONLINE BANKING</font></A></TD></TR></TABLE> </TD> </TR> <TR height="10%"><TD></TD></TR> <TR height="12%"> <TD align="center" bgcolor="#E5F3FF"> <TABLE width="100%" height="100%"class="Internet"><TR><TD><A class="Internet" href="code for login page2.html"><font color="#000000" style="font-size="80%">PERSONAL BANKING</font></A></TD></TR></TABLE> </TD> </TR> <TR height="10%"><TD> </TD></TR>

20

ONLINE BANKING <TR height="12%"> <TD align="center" bgcolor="#FFF7D5">

160310737027 & 160310737035

<TABLE width="100%" height="100%"class="Internet"><TR><TD><A class="Internet" href="code for login page3.html"><font color="#000000">CORPORATE BANKING</font></A></TD></TR></TABLE> </TD> </TR> <TR height="10%"><TD></TD></TR> <TR height="12%"> <TD align="center"bgcolor="#FF0000"> <TABLE width="100%" height="100%"class="Internet"><TR><TD><A class="Internet" href="mobile banking.html" target="_blank"><font color="#ffffff">MOBILE BANKING</font></A></TD></TR></TABLE></TD> </TR> <TR height="10%"><TD></TD></TR> <TR height="12%"> <TD align="center" bgcolor="#FF0000"> <TABLE width="100%" height="100%"class="Internet"><TR><TD><A class="Internet" href="Phone banking.html" target="_blank"><font color="#ffffff">PHONE BANKING</font></A></TD></TR></TABLE> </TD> </TR> </TABLE> </TD> <TD width="5%"></TD> </TR> </TABLE>

21

ONLINE BANKING </TD> <TD width="51%"> <TABLE class="InternetImage" width="100%"> <TR> <TD width="2.5%"></TD> <TD width="95%"> height="100%"

160310737027 & 160310737035

cellpadding="0"

cellspacing="0"

<TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR height="11%"><TD> </TD></TR> <TR height="10.5%"> <TD align="center" bgcolor="#E5F3FF"> <span class="InternetImage1">Unique Bank welcomes you to Online-Banking</span> </TD> </TR> <TR height="11%"><TD> </TD></TR> <TR height="35%"> <TD align="center"> <img src="online.jpg" width="50%" height="100%" alt="ONLINE BANKING"></img> </TD> </TR> <TR height="11%"><TD></TD></TR> <TR height="10.5%"> <TD align="center" bgcolor="#FFF7D5"> <span class="InternetImage2">Enjoy the Convenience of Banking at your Finger Tips !!</span> </TD>

22

ONLINE BANKING </TR> <TR height="11%"><TD></TD></TR> </TABLE> </TD> <TD width="2.5%"></TD> </TR> </TABLE> </TD> <TD width="28%">

160310737027 & 160310737035

<TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR> <TD width="3.5%"></TD> <TD width="96.5%"> <TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR height="9%"> <TD align="center" bgcolor="#FF0000"> <TABLE width="100%" height="100%"class="Internet"><TR><TD><font color="#ffffff">OTHER ONLINE PAYMENTS</font></TD></TR></TABLE> </TD> </TR> <TR height="4%"><TD></TD></TR> <TR height="9%"> <TD align="center" bgcolor="#E5F3FF"> <TABLE width="100%" height="100%"class="Internet"><TR><TD><A href="income tax.pdf"><font color="#000000">Income Tax Payments</font></A></TD></TR></TABLE>

23

class="Online" / TDS

ONLINE BANKING </TD> </TR> <TR height="4%"><TD> </TD></TR> <TR height="9%"> <TD align="center" bgcolor="#FFF7D5">

160310737027 & 160310737035

<TABLE width="100%" height="100%"class="Internet"><TR><TD><A href="service tax.pdf"><font color="#000000">Service Tax Excise</font></A></TD></TR></TABLE> </TD> </TR> <TR height="4%"><TD></TD></TR> <TR height="9%"> <TD align="center" bgcolor="#E5F3FF">

class="Online" / Central

<TABLE width="100%" height="100%"class="Internet"><TR><TD><A class="Online" href="login.html"><font color="#000000">Fund Transfers</font></A></TD></TR></TABLE> </TD> </TR> <TR height="4%"><TD></TD></TR> <TR height="9%"> <TD align="center" bgcolor="#FFF7D5"> <TABLE width="100%" height="100%"class="Internet"><TR><TD><A href="LIC.pdf"><font color="#000000">LIC Payments</font></A></TD></TR></TABLE> </TD> </TR> <TR height="4%"><TD></TD></TR> class="Online" Premium

24

ONLINE BANKING <TR height="9%"> <TD align="center" bgcolor="#E5F3FF">

160310737027 & 160310737035

<TABLE width="100%" height="100%"class="Internet"><TR><TD><A class="Online" href="Account Alerts.pdf"><font color="#000000">Account Alerts</font></A></TD></TR></TABLE> </TD> </TR> </TABLE> </TD> </TR> </TABLE> </TD> </TR></TABLE></TD></TR> <TR height="4%" width="100%"><TD></TD></TR> <TR height="3%" width="100%"> <TD bgcolor="#FF0000" > <marquee time=10 scrollamount="2" scrolldelay="5"><font color="white">Customers are requested to select "PERSONAL BANKING" or "ONLINE BANKIING" or Corporate Customers select "CORPORATE BANKING" to Login - SECURITY CAUTION: Please do not disclose your Account details / Debit / Credit Card / Personal Information to unknown sources through Internet . Keep your User-id and password(s) secret and difficult to guess. Use virtual keypad to enter login password while accessing from cyber-cafes or shared networks. </font></A></marquee> </TD> </TR> <TR height="30%" width="100%"> <TD> <TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%">

25

ONLINE BANKING <TR height="10%"><TD></TD></TR> <TR height="80%"><TD> <TABLE border="0" columns="3"> <TR> <TD width="20%" align="center"> height="100%" cellpadding="0"

160310737027 & 160310737035

cellspacing="0"

width="100%"

<A class="Internet" href="security tips.pdf" target="_blank"><font color="red"><B>Security Tips!</B></font></A> <BR> <A href="security tips.pdf" target="_blank"><IMG width="50%" height="80%" align=center src="image001.jpg" border="0" alt="Security Tips"/></A> </TD> <TD width="53%"> <TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR height="12%"> <TD align="center"> <B class="Internet">For more Uniquebank@gmail.com</B> <BR> </TD> </TR> <TR height="16%"><TD> </TD></TR> <TR height="22%"> <TD align="center"> <table> <tr><td align="center"><B class="Internet">We saves a lot of time of customers and</B></td></tr>

26

information

on

Services

please

us

to

ONLINE BANKING <tr><td align="center"><B access</B></td></tr> </table> </TD> </TR> <TR height="20%"><TD> </TD></TR> <TR height="10%"> <TD> class="Internet">We also

160310737027 & 160310737035 provides a great covienient

<TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR> <TD width="26%"></TD> <TD width="35%" bgcolor="#DDDDDD" style="border:.65pt solid black; "> <A class="Security" GRIEVANCES</A> <TD width="35%"></TD> </TR> </TABLE> </TD> </TR> <TR height="20%"><TD> </TD></TR> </TABLE> </TD> <TD width="28%"> <TABLE border="0" height="100%" cellpadding="0" cellspacing="0" width="100%"> <TR height="10%"><TD> </TD></TR> <TR height="60%">

27

href="CONTACT </TD>

US.pdf"> CONTACT

US

FOR

ONLINE BANKING <TD> <TABLE border="1" bordercolor="black"> <TR> <TD align="center"width="85%" bgcolor="white"> <span class="security"><B>Security Note:</B></span> <BR> height="100%" cellpadding="0"

160310737027 & 160310737035

cellspacing="0"

width="100%"

<span class="security">When you Login, Your User Id and Password travels in an encrypted and highly secured mode.</span> </TD> </TR> </TABLE> </TD> </TR> <TR height="10%"><TD> </TD></TR> </TABLE> </TD> </TR> </TABLE> </TD> </TR> <TR height="10%"><TD></TD></TR> </TABLE> </TD> </TR> <TR height="3%" width="100%">

28

ONLINE BANKING <TD> <TABLE border="1" bordercolor="black" > <TR> <TD bgcolor="#FF0000" align="center"width="20%"> height="100%" cellpadding="0"

160310737027 & 160310737035

cellspacing="0"

width="100%"

<A class="Internet" href="disclaimer.pdf" title="Click here to view Disclaimer"><font color="#FFFFFF">Disclaimer</font></a> </TD> <TD bgcolor="#FF0000" align="center"width="20%"> <A class="Internet" href="Phishing alert.pdf" title="Click here to view Security Tips"><font color="#FFFFFF">Phishing Alert</font></a> </TD> <TD bgcolor="#FF0000" align="center"width="20%"> <A class="Internet" href="Privacy policy.pdf" title="Click here to View Privacy policy"><font color="#FFFFFF">Privacy Policy</font></a> </TD> <TD bgcolor="#FF0000" align="center"width="20%"> <A class="Internet" href="application form.pdf" title="Click here to View Application for/Manual"><font color="#FFFFFF">Application Form/Manuals</font></a> </TD> </TR></TABLE></TD></TR> <TR height="10%" width="100%"> <TD align="center"> <B class="Internet">Head Office: Unique Bank,Darussalam,nampally</B> </TD></TR> <TR height="10%" width="100%"> </TD></TR>

29

ONLINE BANKING </TABLE> </TD> <TD width="2%"> </TD> </TR> </TABLE> </TD></TR></TABLE> </body> </html>

160310737027 & 160310737035

30

Potrebbero piacerti anche

- e Banking ReportDocumento40 paginee Banking Reportleeshee351Nessuna valutazione finora

- Customer Perception Towards Internet Banking PDFDocumento17 pagineCustomer Perception Towards Internet Banking PDFarpita waruleNessuna valutazione finora

- Project Report On Mobile Banking: Rayat Bahra University - Mohali (Usms)Documento43 pagineProject Report On Mobile Banking: Rayat Bahra University - Mohali (Usms)AnkitNessuna valutazione finora

- MJ Customer Satisfaction of BSNL ProductsDocumento97 pagineMJ Customer Satisfaction of BSNL ProductsMOHIT KASHYAP100% (1)

- Chapter IIDocumento13 pagineChapter IIeshu100% (1)

- Role of Technology in Banking Sector PDFDocumento2 pagineRole of Technology in Banking Sector PDFAbhishek AnandNessuna valutazione finora

- Project Report On e BankingDocumento216 pagineProject Report On e BankingSanjay TripathiNessuna valutazione finora

- Research ProposalDocumento3 pagineResearch ProposalAniket GangurdeNessuna valutazione finora

- Communication Practices: Dahabshiil BankDocumento7 pagineCommunication Practices: Dahabshiil BankJuweyriyaNessuna valutazione finora

- E Banking Consumer BehaviourDocumento116 pagineE Banking Consumer Behaviourrevahykrish93Nessuna valutazione finora

- Internet BankingDocumento16 pagineInternet BankingArpita barikNessuna valutazione finora

- The Preparation of Project Report For Computer Training InstituteDocumento3 pagineThe Preparation of Project Report For Computer Training InstitutesatikantNessuna valutazione finora

- A Project Report On HRDDocumento51 pagineA Project Report On HRDMuskan TanwarNessuna valutazione finora

- Impact of E-Banking Service Quality On Customer SatisfactionDocumento2 pagineImpact of E-Banking Service Quality On Customer SatisfactionKainath FarheenNessuna valutazione finora

- Customer Satisfaction Regarding Internet BankingDocumento21 pagineCustomer Satisfaction Regarding Internet BankingAditi AroraNessuna valutazione finora

- Black Book ProjectDocumento23 pagineBlack Book ProjectAtharv KoyandeNessuna valutazione finora

- Uttra ProjectDocumento76 pagineUttra Project9415697349100% (1)

- Project On AutomationDocumento37 pagineProject On AutomationLuke RobertsNessuna valutazione finora

- Presentation On Salient Features of The Electricity Act 2003 1231332387635957 1Documento14 paginePresentation On Salient Features of The Electricity Act 2003 1231332387635957 1Anonymous m8oCtJBNessuna valutazione finora

- Executive SummaryDocumento51 pagineExecutive SummaryDhawal TankNessuna valutazione finora

- Comparative Study of The Public Sector Amp Private Sector BankDocumento73 pagineComparative Study of The Public Sector Amp Private Sector BanksumanNessuna valutazione finora

- ABDUL RAHMAN - Role of ItDocumento20 pagineABDUL RAHMAN - Role of ItMOHAMMED KHAYYUM100% (1)

- Seminar Report On BankingDocumento14 pagineSeminar Report On BankingMohan Rao100% (1)

- BB178904 - Akhil SDocumento90 pagineBB178904 - Akhil SAmanNessuna valutazione finora

- E-Banking in India With Special Refernce To Rural Areas: Project ONDocumento20 pagineE-Banking in India With Special Refernce To Rural Areas: Project ONTaruna ShandilyaNessuna valutazione finora

- CRM Complete ProjectDocumento61 pagineCRM Complete ProjectPratik GosaviNessuna valutazione finora

- Mobile Banking Project BithoraiDocumento64 pagineMobile Banking Project BithoraiPrince Cious DaimariNessuna valutazione finora

- Questionnaire On Youth Preferences Towards E BankingDocumento2 pagineQuestionnaire On Youth Preferences Towards E BankingArchit AgarwalNessuna valutazione finora

- Summer Training Report Trends and Practices of HDFC Bank:-Retail Abnking Conducted at HDFC BANK, Ambala CityDocumento104 pagineSummer Training Report Trends and Practices of HDFC Bank:-Retail Abnking Conducted at HDFC BANK, Ambala Cityjs60564Nessuna valutazione finora

- Analysis of Major Segments For Current Account Business: Project Report OnDocumento9 pagineAnalysis of Major Segments For Current Account Business: Project Report OnAman NostalgicNessuna valutazione finora

- Questionnaire: IF You Bank With Kotak Mahindra Proceed To Question 3 Else Proceed To Question 6Documento4 pagineQuestionnaire: IF You Bank With Kotak Mahindra Proceed To Question 3 Else Proceed To Question 6Bobby ShrivastavaNessuna valutazione finora

- 13 Growth of e Banking Challenges and Opportunities in IndiaDocumento5 pagine13 Growth of e Banking Challenges and Opportunities in IndiaAyesha Asif100% (1)

- A Study On E-Banking Services by Commercial Banks in Madurai DistrictDocumento16 pagineA Study On E-Banking Services by Commercial Banks in Madurai DistrictSandyNessuna valutazione finora

- Online Banking RakeshDocumento39 pagineOnline Banking RakeshRakesh RoyNessuna valutazione finora

- Banking LawDocumento11 pagineBanking Lawrishiraj singhNessuna valutazione finora

- Accounting For Management (MBA) PDFDocumento63 pagineAccounting For Management (MBA) PDFAbhijeet Menon100% (1)

- Abhishek Tiwari Major Research Project Kotak Mahindra BankDocumento98 pagineAbhishek Tiwari Major Research Project Kotak Mahindra BankNikhilesh Katare100% (1)

- Dissertation On ICICI BankDocumento86 pagineDissertation On ICICI BankSubhendu Ghosh100% (1)

- Technology in BankingDocumento98 pagineTechnology in BankingkarenNessuna valutazione finora

- Proposal On E - BankingDocumento4 pagineProposal On E - BankingVivek RanaNessuna valutazione finora

- A Study On Customers Satisfaction Towards Public Distribution SystDocumento7 pagineA Study On Customers Satisfaction Towards Public Distribution SystRamasamy VelmuruganNessuna valutazione finora

- Rahul Mimani: Carrier ObjectiveDocumento3 pagineRahul Mimani: Carrier ObjectiveCa Rahul MimaniNessuna valutazione finora

- Customers' Perception Towards Internet Banking in Twin City of OdishaDocumento62 pagineCustomers' Perception Towards Internet Banking in Twin City of OdishaRajesh Kumar Sahoo100% (1)

- MY BOOK CART Project ReportDocumento125 pagineMY BOOK CART Project ReportSuraj SinghNessuna valutazione finora

- QuestionnaireDocumento3 pagineQuestionnaireAnkit Dokania100% (1)

- Project Net BankingDocumento37 pagineProject Net Bankingsamrat1988100% (1)

- Project Report On Selection and Recruitment Procedure of Axis BankDocumento12 pagineProject Report On Selection and Recruitment Procedure of Axis BankBryan Parker0% (1)

- Internet Banking Project DocumentationDocumento23 pagineInternet Banking Project DocumentationDilip ChudasamaNessuna valutazione finora

- Consumer Behaviour Towards E-Banking - Final ReportDocumento68 pagineConsumer Behaviour Towards E-Banking - Final ReportVivek Rana33% (9)

- Project On E-BankingDocumento64 pagineProject On E-BankingRamandeep Singh50% (2)

- Bank of IndiaDocumento15 pagineBank of Indiashreyaasharmaa100% (1)

- Comparative Analysis On Non Performing Assets of Private and Public Sector BanksDocumento108 pagineComparative Analysis On Non Performing Assets of Private and Public Sector BanksAmit SinghNessuna valutazione finora

- LRPDocumento29 pagineLRPvarshapadiharNessuna valutazione finora

- Jayesh Black Book ProjectDocumento80 pagineJayesh Black Book Projectnishanth naik100% (1)

- A Study On Financial Analysis of Diamond Engineering 2Documento51 pagineA Study On Financial Analysis of Diamond Engineering 2Priya VijayaNessuna valutazione finora

- Customer Satisfaction With Regard To ATM ServicesDocumento75 pagineCustomer Satisfaction With Regard To ATM Servicesdinesh_v_0076945100% (2)

- Itt ProjectDocumento18 pagineItt Projectankitsanganeria100% (1)

- Internet BankingDocumento8 pagineInternet BankingprojectessNessuna valutazione finora

- E - BankingDocumento32 pagineE - BankingSanoj Kumar Yadav0% (1)

- Hadoop Distributed File System: Presented by Mohammad Sufiyan Nagaraju Kola Prudhvi Krishna KamireddyDocumento17 pagineHadoop Distributed File System: Presented by Mohammad Sufiyan Nagaraju Kola Prudhvi Krishna KamireddySufiyan MohammadNessuna valutazione finora

- MATLAB Program For Sound Wave: Mohammad SufiyanDocumento1 paginaMATLAB Program For Sound Wave: Mohammad SufiyanSufiyan MohammadNessuna valutazione finora

- Frequency Domain Sampling & Reconstruction of Analog SignalsDocumento5 pagineFrequency Domain Sampling & Reconstruction of Analog SignalsSufiyan MohammadNessuna valutazione finora

- Array As An Abstract Data TypeDocumento179 pagineArray As An Abstract Data TypeSufiyan MohammadNessuna valutazione finora

- Dwnload Full Beckers World of The Cell 9th Edition Hardin Solutions Manual PDFDocumento35 pagineDwnload Full Beckers World of The Cell 9th Edition Hardin Solutions Manual PDFgebbielean1237100% (12)

- Expression of Interest (Consultancy) (BDC)Documento4 pagineExpression of Interest (Consultancy) (BDC)Brave zizNessuna valutazione finora

- Chinese Paper Cutting Work SheetDocumento4 pagineChinese Paper Cutting Work Sheet黃梓Nessuna valutazione finora

- Student Management SystemDocumento232 pagineStudent Management Systemslu_mangal73% (37)

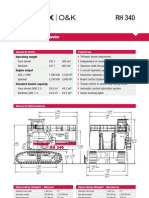

- Hydraulic Mining ExcavatorDocumento8 pagineHydraulic Mining Excavatorasditia_07100% (1)

- Syllabus PDFDocumento3 pagineSyllabus PDFBibin Raj B SNessuna valutazione finora

- Knee JointDocumento28 pagineKnee JointRaj Shekhar Singh100% (1)

- Binary OptionsDocumento24 pagineBinary Optionssamsa7Nessuna valutazione finora

- ETAP Power Station ErrorDocumento5 pagineETAP Power Station ErroryogacruiseNessuna valutazione finora

- Dec JanDocumento6 pagineDec Janmadhujayan100% (1)

- PE MELCs Grade 3Documento4 paginePE MELCs Grade 3MARISSA BERNALDONessuna valutazione finora

- Chemistry Investigatory Project (R)Documento23 pagineChemistry Investigatory Project (R)BhagyashreeNessuna valutazione finora

- Babe Ruth Saves BaseballDocumento49 pagineBabe Ruth Saves BaseballYijun PengNessuna valutazione finora

- TFGDocumento46 pagineTFGAlex Gigena50% (2)

- Feasibility Study For Cowboy Cricket Farms Final Report: Prepared For Prospera Business Network Bozeman, MTDocumento42 pagineFeasibility Study For Cowboy Cricket Farms Final Report: Prepared For Prospera Business Network Bozeman, MTMyself IreneNessuna valutazione finora

- SABRE MK-3 CFT Gel SpecDocumento1 paginaSABRE MK-3 CFT Gel Specseregio12Nessuna valutazione finora

- This Study Resource Was: For The Next 6 ItemsDocumento9 pagineThis Study Resource Was: For The Next 6 ItemsJames CastañedaNessuna valutazione finora

- Recruitment SelectionDocumento11 pagineRecruitment SelectionMOHAMMED KHAYYUMNessuna valutazione finora

- Project Document EiDocumento66 pagineProject Document EiPrathap ReddyNessuna valutazione finora

- Ecs h61h2-m12 Motherboard ManualDocumento70 pagineEcs h61h2-m12 Motherboard ManualsarokihNessuna valutazione finora

- 24 DPC-422 Maintenance ManualDocumento26 pagine24 DPC-422 Maintenance ManualalternativblueNessuna valutazione finora

- Intelligent DesignDocumento21 pagineIntelligent DesignDan W ReynoldsNessuna valutazione finora

- Previous Year Questions - Macro Economics - XIIDocumento16 paginePrevious Year Questions - Macro Economics - XIIRituraj VermaNessuna valutazione finora

- Colorfastness of Zippers To Light: Standard Test Method ForDocumento2 pagineColorfastness of Zippers To Light: Standard Test Method ForShaker QaidiNessuna valutazione finora

- Implications of A Distributed Environment Part 2Documento38 pagineImplications of A Distributed Environment Part 2Joel wakhunguNessuna valutazione finora

- IcarosDesktop ManualDocumento151 pagineIcarosDesktop ManualAsztal TavoliNessuna valutazione finora

- Artificial Intelligence Techniques For Encrypt Images Based On The Chaotic System Implemented On Field-Programmable Gate ArrayDocumento10 pagineArtificial Intelligence Techniques For Encrypt Images Based On The Chaotic System Implemented On Field-Programmable Gate ArrayIAES IJAINessuna valutazione finora

- Semi Detailed Lesson PlanDocumento2 pagineSemi Detailed Lesson PlanJean-jean Dela Cruz CamatNessuna valutazione finora

- Google Tools: Reggie Luther Tracsoft, Inc. 706-568-4133Documento23 pagineGoogle Tools: Reggie Luther Tracsoft, Inc. 706-568-4133nbaghrechaNessuna valutazione finora

- Bba VDocumento2 pagineBba VkunalbrabbitNessuna valutazione finora

- Dopamine Detox: Reduce Instant Gratification, Beat Social Media Addiction, and Stop Wasting Your LifeDa EverandDopamine Detox: Reduce Instant Gratification, Beat Social Media Addiction, and Stop Wasting Your LifeNessuna valutazione finora

- The Psychic Workbook: A Beginner's Guide to Activities and Exercises to Unlock Your Psychic SkillsDa EverandThe Psychic Workbook: A Beginner's Guide to Activities and Exercises to Unlock Your Psychic SkillsValutazione: 4.5 su 5 stelle4.5/5 (2)

- How to Win the Lottery: Simple Lottery Strategies for Beginners and the Very UnluckyDa EverandHow to Win the Lottery: Simple Lottery Strategies for Beginners and the Very UnluckyNessuna valutazione finora

- A Gentleman in Moscow by Amor Towles (Trivia-On-Books)Da EverandA Gentleman in Moscow by Amor Towles (Trivia-On-Books)Valutazione: 2.5 su 5 stelle2.5/5 (3)

- Embrace Your Weird: Face Your Fears and Unleash CreativityDa EverandEmbrace Your Weird: Face Your Fears and Unleash CreativityValutazione: 4.5 su 5 stelle4.5/5 (124)

- The Easy Way to Stop Gambling: Take Control of Your LifeDa EverandThe Easy Way to Stop Gambling: Take Control of Your LifeValutazione: 4 su 5 stelle4/5 (197)

- Phil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emDa EverandPhil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emValutazione: 4.5 su 5 stelle4.5/5 (39)

- 100 Endgame Patterns You Must Know: Recognize Key Moves & Motifs and Avoid Typical ErrorsDa Everand100 Endgame Patterns You Must Know: Recognize Key Moves & Motifs and Avoid Typical ErrorsValutazione: 5 su 5 stelle5/5 (2)

- Pojo's Unofficial Ultimate Pokemon Trainer's HandbookDa EverandPojo's Unofficial Ultimate Pokemon Trainer's HandbookNessuna valutazione finora

- Thinking, Fast and Slow: By Daniel Kahneman (Trivia-On-Book)Da EverandThinking, Fast and Slow: By Daniel Kahneman (Trivia-On-Book)Valutazione: 5 su 5 stelle5/5 (2)

- The No-Prep Gamemaster: Or How I Learned to Stop Worrying and Love Random TablesDa EverandThe No-Prep Gamemaster: Or How I Learned to Stop Worrying and Love Random TablesValutazione: 4.5 su 5 stelle4.5/5 (25)

- To Kill a Mockingbird: A Novel by Harper Lee (Trivia-On-Books)Da EverandTo Kill a Mockingbird: A Novel by Harper Lee (Trivia-On-Books)Valutazione: 3.5 su 5 stelle3.5/5 (7)

- Origami Masters Ebook: 20 Folded Models by the World's Leading Artists (Includes Step-By-Step Online Tutorials)Da EverandOrigami Masters Ebook: 20 Folded Models by the World's Leading Artists (Includes Step-By-Step Online Tutorials)Nessuna valutazione finora

- 1500 Interesting Facts You Didn’t Know - Crazy, Funny & Random Facts To Win TriviaDa Everand1500 Interesting Facts You Didn’t Know - Crazy, Funny & Random Facts To Win TriviaValutazione: 5 su 5 stelle5/5 (9)

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningDa EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningValutazione: 5 su 5 stelle5/5 (5)

- Why do we say that? - 202 Idioms, Phrases, Sayings & Facts! A Brief History On Where They Come From!Da EverandWhy do we say that? - 202 Idioms, Phrases, Sayings & Facts! A Brief History On Where They Come From!Valutazione: 4.5 su 5 stelle4.5/5 (3)

- Poker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerDa EverandPoker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerValutazione: 5 su 5 stelle5/5 (49)

- Big Book of Zelda: The Unofficial Guide to Breath of the Wild and The Legend of ZeldaDa EverandBig Book of Zelda: The Unofficial Guide to Breath of the Wild and The Legend of ZeldaValutazione: 4.5 su 5 stelle4.5/5 (5)

- Bored Games: 100+ In-Person and Online Games to Keep Everyone EntertainedDa EverandBored Games: 100+ In-Person and Online Games to Keep Everyone EntertainedValutazione: 5 su 5 stelle5/5 (1)

- Man's Search for Meaning by Viktor E. Frankl (Trivia-On-Books)Da EverandMan's Search for Meaning by Viktor E. Frankl (Trivia-On-Books)Valutazione: 3.5 su 5 stelle3.5/5 (8)

- The Way of Kings by Brandon Sanderson (Trivia-On-Books)Da EverandThe Way of Kings by Brandon Sanderson (Trivia-On-Books)Valutazione: 2.5 su 5 stelle2.5/5 (6)

- 1001 Chess Exercises for Advanced Club Players: Spot Those Killer Moves an Stun Your OpponentDa Everand1001 Chess Exercises for Advanced Club Players: Spot Those Killer Moves an Stun Your OpponentNessuna valutazione finora

- Japanese Coloring Book for Adults (Printable Version)Da EverandJapanese Coloring Book for Adults (Printable Version)Nessuna valutazione finora