Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 2

Caricato da

hazmi_omarDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 2

Caricato da

hazmi_omarCopyright:

Formati disponibili

i CONTENTS

TITLE TABLE OF CONTENTS LIST OF TABLES LIST OF FIGURES LIST OF NOMENCLATURES

PAGE i iii iv v

CHAPTER 2

MARKET ANALYSIS 2.1 2.2 Introduction Market Size 2.2.1 2.2.2 2.3 2.4 2.5 2.6 2.7 Phenol Supply Demand of Phenol

1 1 1 2 4 6 7 9 11 14 14 15 16 17 18 18 18 19 20 22 24 25

Market Forecasting Market Driver Target Customer Phenol Production Rate Price of Phenol 2.7.1 Thailand 2.7.2 2.7.3 2.7.4 Malaysia Taiwan Japan

2.8

By-Product Market Analysis 2.8.1 2.8.2 Acetone Price Analysis Acetone Price Forecast

2.9

Raw Material Supply 2.9.1 2.9.2 2.9.3 Benzene Propylene Catalyst

2.10 Break Even Point (BEP) Analysis

ii 2.10.1 Type of Expenses 2.10.1.1 2.10.1.2 2.10.1.3 2.10.1.4 2.10.2 2.10.3 2.10.4 Equipment Cost Fixed Capital Investment (FCI) Total Manufacturing Expenses (AME) Rate of Return 25 26 27 29 31 32 35 35

Cash Flow Data Without Discount Rate Payback Period Break Even Point (BEP)

APPENDICES APPENDIX A Phenols Buyers by Country for each Application 36

REFERENCES

39

iii LIST OF TABLES

TABLE 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 2.10 2.11 2.12 2.13 2.14 2.15 2.16 2.17 2.18

TITLE Phenol Major Producer in the World Quantity Phenol Import from Taiwan Quantity Phenol Import from Japan Project Detail of MITSUI Phenol Plant Phenol Price Offer by Thailand (RM per tonne) Phenol Price Offer by Malaysia (RM per tonne) Phenol Price Offer by Taiwan (RM per tonne) Phenol Price Offer by Japan (RM per tonne) Japan Benzene Price Offer Thailand Benzene Price Offer Japan Propylene Price Offer Thailand Propylene Price Offer Price of Catalyst Total Bare Module Cost for Equipment Fixed Capital Investment Summaries of Total Plant Expenses for 15 Years Plant Life Total Revenues And Expenses Over 15 Years Plant Life Net income cash and accumulation of ANNP for 15 years plant life

PAGE 3 10 10 12 15 15 16 17 21 21 23 23 24 26 27 32 33 34 36

2.19

Description of Phenolic Anti-Oxidants Plant

iv LIST OF FIGURES

FIGURE 2.1 2.2 2.3 2.4 2.5 2.6 2.7

TITLE Phenol Market Growth Global Phenol Consumption by Region Global phenol consumption by Application Maps of Asia Region Asia Benzene Market Price Offer Asia Propylene Market Price Offer Cumulative Net Cash Income vs. Years of Plant Life

PAGE 2 5 5 9 20 22 34

v LIST OF NOMENCLATURES

ROW MATRADE BPA SSMC GPCA CFR RMB RM ADD CMP US MMA MIBK CMAI TMC GRC FCI TCI AME AGE ATE ANP ANNP NCI PBR BEP

Region of Waterloo Malaysia External Trade Development Corporation Bisphenol A Shanghai Sinopec Mitsui Chemicals Gulf Petrochemicals and Chemicals Association Council on Foreign Relations Renminbi (Official Currency in China) Ringgit Malaysia Anti-Dumping Duty China Main Port United States Methyl Methacrylatemma Methyl Isobutyl Ketone Chemical Market Associates, Inc. Total Module Cost Gross Root Capital Fixed Capital Investment Total Capital Investment Total Manufacturing Expenses Total General Expenses Total Expenses Annual Profit Net Annual Profit Net Cash Income Payback Period Break Even Point

1 CHAPTER 2

MARKET ANALYSIS

2.1

INTRODUCTION

Market analysis is important in early stage of each new project. Market analysis used to determine the attractiveness of a market and to understand its evolving opportunities and threats as they relate to the strengths and weakness of the firm. The dimensions of market analysis should be consisting of: i. ii. iii. iv. v. vi. vii. current and future market size market growth rate market profitability industry cost structure distribution channels market trends key success factors

2.2

MARKET SIZE

Market size was evaluated based on present sales and on potential sales of the use of the product were expanded. The following are some information sources for determining market size: i. ii. iii. iv. Government data Malaysia External Trade Development Corporation (MATRADE) Financial data from major players Customer surveys

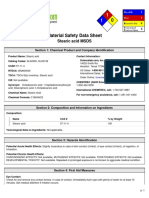

2 2.2.1 Phenol Supply

Phenol is one of the key-chemical products, which determines the progress first of all in the polymeric field. Without phenol the commercial development of the largetonnage engineering plastics polyamide, polycarbonate and a wide range of phenolics and epoxy acid is not possible. History of phenol market was started in 1960 when phenol market was discovered by USA region and they can still maintain until 1980. According to Figure 2.1, in 1980, West Europe and Asia were started to know and join the industry and they become growth from year to year. Thus, it can see that phenol industry is become more expand in Asia region and this give an opportunity to build a new phenol plant production in order to increase the phenol supplier capacity (Eurasian chemical market, 2005-2011).

Figure 2.1: Phenol Market Growth Source: KBR Phenol-Leading the Industry, 2009

According to the global phenol market report (2010) in 2008, production output shrank due to the recession and amounted 7.2 million tons. In 2009 relative improvement of the market was estimated for major regions, apart from the USA where the market showed a decline of 20% compared to 2008. The overall global production capacity was counted to reach 11.2 million tons per year (Phenol: 2010 World Market Outlook and Forecast)

3 According to the European chemical industry analysis, phenol is currently Asias largest manufacturer. Mitsui Chemicals, in 2006 the Japanese city of the original, Singapore Mitsui Phenol devices were amplified 2 ~ 50,000 tons per year to 21 ~ 240,000 tons per year, 5 ~ 100,000 tons per year to 30 ~ 350,000 tons per annual production capacity, while in 2009 the objective of building 25 to 300,000 tons per year plant, which it can yield from the current 750,000 tons per year expanded to 1.07 million tons per more than a year. At the present time, the global production of phenol reaches 10 million tons per year. The largest phenol manufacturers are: the company INEOS Phenol GmbH, American company Sunoco Chemicals, Japanese company Mitsui Chemicals, The Shell Chemical Company, Spanish company Ertisa, Japanese Company the Mitsui Chemicals, Russian phenol Company Ufaorgsintez JSC.

As in April this year, Changchun, China Taiwan region artificial resins 200,000 tons per year, South Korea Kumho P & B Chemicals 150,000 tons per year and LG Petrochemical 180,000 tons per year, China Petrochemical Takahashi 125,000 tons per devices have been put into production in Asia has become the global development of a strong push phenol, and phenol in the area of supply and demand tension is dissipating. Three leading Phenol producers are the USA, Taiwan and China. The leading region is Asia (40% of the total production capacity), followed by Europe (30.17%) and North America (26.7%). The largest world Phenol and Acetone producer is INEOS Phenol with annual production capacity is 1.87 million tons. It has plants situated in Germany, Belgium, the Alabama, and USA. Other phenol production by major phenol producer in the world was listed in Table 2.1 (Robroad.com, 2008). Table 2.1: Phenol major producer in the world Company Ineos Phenol Sunoco Mitsui Chemicals Shell CEPSA Quimica Polimeri Europa FCFC MtVernon Phenol (Sabic) Phenol capacity in thousands of tons per year 1,870 800 750 600 600 480 400 340

4 Kumho Dow Taiwan Prosperity Mitsubishi Chemicals Chiba Phenol Georgia Gulf LG Chem Chang Chun PC Rhodia NOVAPEX Source: M. Webber and M. Webber, 2010 2.2.2 Demand of Phenol 330 300 200 250 230 230 200 200 195 180

According to the phenol supply in the world, there are 10 millions tones per year currently. Phenol production is based on phenol demand and mostly coming from different regions. According to Figure 2.2, 2010 worlds phenol consumption was divided into 10 different regions. Phenols consumption in Western Europe region is the largest followed by United States and other Asia. In supply-demand theories, production for any products was come out from that regions demand itself. Mean that, as mention in section 2.2.1, major players for phenol production were from all of these three regions.

Growth rates for end-use markets vary by region. Consumption of phenol for bisphenol A will be driven by growth in Asia, the Middle East, and Central and South America. Increased demand and capacity for bisphenol A will result in strong demand for phenol in these regions. Global capacity utilization was 83% in 2010, down from 79% in 2009. Significant growth in the consumption of phenol for bisphenol A and phenol-formaldehyde resins occurred in 2010 on a global basis as economies improved from the lows of 2009 (Greiner and Funada, 2011). According to Figure 2.3, nearly half of all phenol produced globally is used for BPA, 31% is used for phenolic-formaldehyde resin, and 11% of phenol is converted to cyclohexanol, which is used to produce artificial fibers such as nylon. Bisphenol A and phenol-formaldehyde resins are produced in all regions; production of bisphenol A is more prevalent in developed economies.

Figure 2.2: Global phenol consumption by region Source: Greiner and Funada, 2011

Figure 2.3: Global phenol consumption by Application Source: SRI Consulting, 2011

6 2.3 MARKET FORECASTING

According to the European chemical industry analysis and forecast advisory body, in 2009 the global production capacity of phenol in 2005 reached 8.58 million tons of the 10.4 million tons growth in new capacity 1.12 million tons per year, an increase of more than 20% from Europe and Asia grew 8 points, the largest of Japans Mitsui Chemicals 320,000 tons per annual capacity.

In addition, according to Tony Crowling, Chairman of UK based TNS, Asia is now the hottest market worldwide for the market research industry and is growing by 10 to 11 percent a year. Asia region is included Thailand, Indonesia, Vietnam, Malaysia, Japan, China and etc. Since, the worldwide demand now focused on Asia thus Malaysia is the best point to join the phenol industry. Phenol demand and supply will be harmonized; however, analysts forecast a small deal of supply overbalance (Market research growth in Asia, 2005).

The phenol market is forecast to remain tight for the coming 2 years. Worldwide demand for Phenol as of 2008 was 9 million tons per year with a projected 3.5% annual growth rate through to 2015. In the next years the output of this product will increase, following the rising demand on the Phenol market. The production increase is projected to reach 1% annually, later in the forecast period up to 2.9% - 3.8%. Assuming that all the planned projects are implemented, the total production capacity will rise by 4 million tons per year by 2015. Major portion will be accounted for by the Asian region; itll retain its leadership in demand and increase production (Phenol: 2010 World Market Outlook and Forecast).

Phenol consumption in 2010 is estimated to have increased by 7% from 2009; it is expected to average growth of 4.5% per year from 2010 to 2015, and 2.3% per year from 2015 to 2020. Utilization rates are expected to increase gradually, ranging from the low 80s to the high 80s range (Phenol World Petrochemical report, 2011).

Last but not least, Michael Foeste, phenol product manager at Mitsui & Co Deutschland, said worldwide phenol growth was expected to be an around 5%, while acetone was not expected to grow by more than 4%. Acetone is a by-product of phenol and one ton of phenol produces 0.62 tons of acetone.

7 2.4 MARKET DRIVER

Each of the products has drivers to drive the market growth. This also called as a market factors. In phenol production, there were a few factors that drive the market growth. First is phenol demand was expected to grow which increment of 3.5% until 4% through 2015, four years from now. What market has now is 9 million tons per year of phenol production. With the growing of the demand, the phenol production might need more than 14 million tons per year of phenol to fulfill the demand.

Next, the high growths in polycarbonates demand. From the phenol world consumption, bisphenol A which is derivate from polycarbonates is contributed nearly half of the phenol consumption. Because of such strong demand in Asia, forecast a shortfall of some 340,000 tons of phenol in 2010 alone because demand for bisphenol A was so strong in than Asian markets (Meehan, 2010).

The global phenol market is largely reported to be tight. The demand is on the rise and there are no new capacities coming on stream, and some shutdowns are still underway. The phenol producers, most specifically from western countries, are facing challenges of lack of product (Phenol: 2011 World Market Outlook and Forecast, 2011).

In relation to the BPA market, Michael Foeste, phenol product manager at Mitsui & Co Deutschland, predicted that demand for BPA into polycarbonates in Asia would increase by 4% between the period 2010-2012, and dip 1% to 4% from 2012-2015. Epoxy resins growth would also remain strong at 5% over the next five years. However, BPA growth in Europe and the US was expected to dip by 3% from 2010-2012, with an expected growth of 1% from 2012-2015.

Asia will continue to play a large role in the global phenol market. In recent years, the significant increase in demand and lack of sufficient domestic phenol supply in the region helped boost phenol production in the developed regions for export to Asia. However, with the additional capacity that is slated to come on stream by 2013 (in Asia), particularly driven by phenol demand for bisphenol A and phenolic resins, export demand in developed regions will slow, translating into lower operating rates in these regions.

8 Meanwhile, refer on article Asia acetone prices to rise on feedstock costs, tight supply in ICIS by Felicia Loo and Yeow Pei Lin, from April and May onwards, China will receive less US supply. So the inventory levels will be drawn down. China remains awash in acetone supply, prompting domestic end-users to buy the product locally, traders said. Inventories at eastern China ports were estimated to be at a record high of 110,000-120,000 tons, while some China-based traders were offloading cargoes at lower prices on inventory pressure and cash flow concerns. Looking ahead, traders said stock levels are expected to fall. China is expected to receive 50,000 tons of acetone imports this month, down from 83,000 tons imported for February as a result of plant turnarounds and lower deep-sea shipments. The shipments included cargoes from the United States, Europe, South Korea, Japan, Taiwan and Thailand. Meanwhile, spot acetone supplies were getting tighter in most parts of Asia because of several turnarounds, traders said.

i.

Thai PTT Phenol said it would skip spot acetone exports in March because it is retaining supplies to feed its new 150,000 ton/year bisphenol A (BPA) plant at Map Ta Phut in Rayong province South Koreas Kumho P & B Chemicals is not offering spot acetone cargoes following a brief plant outage late last month that translated to a production loss of above 1,000 tons of acetone.

ii.

9 2.5 TARGET CONSTUMER

Since phenol plant will be on Malaysia base, phenol production should be able to fulfill the demand of the current demand that focused on the Asia region. So, phenol will be export to Thailand, Singapore, India, Indonesia, Philippines and Vietnam. According to Figure 2.4, the target customers are buyers from Thailand, Singapore, India, Indonesia, Philippines and Vietnam. These countries are targeted as potential customer because of two factors: location and demand from these countries. In marketing view, location of the supplier is the important factor to the successful of the business because it can cause best price offer and the transport facilities. Second is the demand from all of these countries is high. This situation can be proved by referring to phenol export data by Japan and Taiwan (Table 2.2, Table 2.3) where both of these countries are major player in phenol market. These data was taken from Malaysia External Trade Development Corporation (MATRADE). Phenols customers from different country for each application were attached in Appendix A.

Figure 2.4: Maps of Asia Region Source: maps-asia

10 Table 2.2: Quantity Phenol Import from Taiwan YEAR COUNTRY CHINA INDIA JAPAN SAUDI ARABIA SOUTH KOREA THAILAND UNITED STATES VIETNAM 137 461.28 0 846.26 1474.76 0 29.986 0 2009 2010 TONNE 93.73 322.28 0 0 881.12 0 4 0 301.26 2813.22 60 342.26 443.66 237 77.672 1.384 2010

Source: Malaysia External Trade Development Corporation (MATRADE).

Table 2.3: Quantity Phenol Import from Japan YEAR COUNTRY CHINA INDIA INDONESIA MALAYSIA PHILIPPINES SINGAPORE SOUTH KOREA TAIWAN THAILAND VIETNAM 2867.955 882.18 48.759 137.1 0 13.86 2798.665 2320.845 2015.785 0.844 2009 2010 TONNE 2268.431 623.9 111.38 6.14 5 2.28 1312.22 3350.633 2289.107 45.136 1028.906 260.8 62.358 22.5 0 6584.53 903.482 1503.655 1222.525 4.568 2011

Source: Malaysia External Trade Development Corporation (MATRADE).

11 2.6 PHENOL PRODUCTION RATE

Generally, production rate is determined by doing a few analyses on the current phenol plant and future phenol plant production rate. According to the Table 2.1, the largest current phenol production is 1.87 million tons per year produce by INEOS Phenol while 180,000 tons per year is the lowest production produce by NOVAPEX. The entire phenol producer in Table 2.1 is the major producers in the world that already have the big marks in the phenol industry. Recently, all of these big players are planning new project for phenol plant venture development. The new project for phenol production is listed as below: 1. According to the ICIS news on 7 July 2011, Rabigh Refining and Petrochemical (Petro Rabigh) is expected to complete its 275,000 tonne/year phenol project in Rabigh, Saudi Arabia, in 2014. Petro Rabigh, a joint venture between state-owned Saudi Aramco and Japans Sumitomo Chemical, is expected to expand its 1.3 million tonne/year Stone and Webster-technology cracker by 300,000tonnes/year. Petro Rabigh is likely to bring its Phase II expansion project on stream by 2015, Ziad Al-Labban, the companys President and CEO, said earlier. The Phase II project wills double our existing capacity, Al-Labban said at the recent second GPCA (Gulf Petrochemicals and Chemicals Association) Plastics-Summit. 2. According to The Business Times written by Ronnie Lim on 14 July 2010, another project that Mitsui Chemicals has on the cards is for phenols. Mitsui indicated in August 2008, just before the global economic downturn hit, that it was planning to build a second, new-generation phenol plant here of about 250,000 to 350,000 tons per annum. This would be bigger than its existing 250,000 tons per annum Singapore phenol plant, which cost more than $300 million. Mr. Tanaka said yesterday that Mitsui Chemicals the worlds No. 2 phenol producer has since gone ahead with a phenol investment with Sinopec in China to cater to strong market growth there. But we want to be No. 1 and will consider Singapore, and also China, for our next round of phenol expansion, he said. Asked about Singapores advantages vis-a-vis China, Mr. Tanaka outlined several including the Republics transparency which is very important.

12 Another local advantage is the availability of competitive raw materials from petrochemical crackers here, he said: Things can also be done speedily here, and there is good logistics to China and other Asian markets. We have also been here for 40 years and there are thrust in the Economic Development Board and other agencies here. 3. Mitsui Chemicals, Inc. with its Head Office in Tokyo, Japan Toshikazu Tanaka and China Petroleum & Chemical Corp. with its head office in Beijing, China Wang Tianpu, President reached a partnership agreement for a joint venture in phenol, the raw material for production of bisphenol A (BPA) which is currently being produced and sold by the two companies equal investment joint-venture, Shanghai Sinopec Mitsui Chemicals (SSMC) Co., Ltd. The project detail is as in Table 2.4. Table 2.4: Project detail of MITSUI phenol plant Location Investment Production Capacity : Shanghai Petrochemical Area, China : 50:50 (same investment ratio as SSMC) : New Plant: Phenol 250,000 tons/year Acetone 150,000 tons/year. Note: In addition, Sinopecs Shanghai Gaoqiao Company plant (phenol 125,000 tons/year,

acetone 75,000 tons/year) will be conjoined with SSMC. SSMCs total annual phenol production capacity will be 375,000 tons, acetone 225,000 tons, and BPA 120,000 tons. New Plant Process : Mitsui Chemicals technology (Phenol Process) Commercial Operation 4. On 28th January 2011, INEOS Phenol and Sinopec Yangzi Petrochemical Co. have reached a framework agreement on the design and future operation of a 400,000-tonnes/year phenol/acetone joint venture at the Nanjing Chemical Industrial Park in Jiangsu Province, Chinathe largest plant of its kind in China. Phenol and acetone are key chemical forerunners to polycarbonate, phenolic resins, solvents, and synthetic fibers, including nylon. : Second Quarter of 2013

13 This latest step follows the original letter of intent signed in December 2009 and a subsequent evaluation of the investment, with the project forecast to be completed by the end of 2013. In addition to 400,000 tons per year of phenol capacity, the site will have 250,000 tons per year of acetone production available, as well as 550,000 tons per year of cumene capacity. According to the four new phenol plant project listed above, phenol player are planning to build phenol plant in China, Saudi Arabia and Singapore, and they plan to produce phenol in the range of 250,000 400,000 tons per year. In Malaysia, there is no phenol plant even though Malaysia is one of the petrochemical producers in Asia region. As how Mitsui Chemicals take advantage on the availability of raw materials from petrochemical crackers in local area, this new project will take place in Malaysia and the production rate is 100,000 metric tons per year. In this new phenol project, a plant will be built with a capacity of 100,000 metric tons phenol per year. As compared to other new project listed above, this production rate is considered low but it is compatible with the raw material availability in Malaysia. Furthermore, as a new player in phenol industry, the expectation should be not too high since the competition in phenol industry is too tight. As a new player in phenol industry, market positioning in current market is need to well develop. Thus, in order to ensure this phenol project run smoothly, the project will be implemented in phases. Phase 1 focuses on phenol capacity of 100,000 metric tons per year, while Phase 2 will double the existing capacity and so on, based on the supply and demand research.

14 2.7 PRICE OF PHENOL

In phenol production, the major product and by product of the production both are sell to collect the profit from the overall production. Thus, the segmentation of the customer will base on the type of the product. In order to determine product price, price analysis should be performed first. According to Table 2.1, the major phenol production was located at China. Thus, it is possible to export phenol to the Chinas nearest country. Then, by assuming the plant in Malaysia, phenol export activities to these countries should not be problem because the prices that offer was lower which is RM 7,500 per tonnes and the most important is the transportation of the product should not be problem because Malaysia was located in between all of these countries or it is called as 3 point country. The price basis is taken from Taiwans phenol price analysis and in addition the price offer is in range of current market price as can refer in ICIS PRICING. Phenol price analysis was done by analyze phenol price export by Thailand, Malaysia, Taiwan and Vietnam. Below is the summary of the phenol price analysis by country. 2.7.1 Thailand

Refer to Table 2.5, Thailand offer phenol trading to six (6) countries which are Germany, Malaysia, Singapore, China, Philippines and Japan. All of these countries are located within Asia region except Germany. From the table, the market demand from Thailand is just started around year 2010. By looking at the current year, 2011, the price offer by Thailand is very expensive and most of the price is not suitable to analyze and become the reference because most of the Thailands trading is two way trading business. It is more obvious when the price offer was not in range and the difference price offer is too much depends on the country.

15 Table 2.5: Phenol Price Offer by Thailand (RM per tonne) YEAR COUNTRY GERMANY MALAYSIA SINGAPORE CHINA PHILIPPINES JAPAN 2009 RM/Tonne 30,892.80 2010 RM/Tonne 31,400.00 2,354.75 39,528.16 39,306.40 2011 RM/Tonne 41,241.62 104,741.58 7,814.22 43,325.10 897.14

Source: Malaysia External Trade Development Corporation (MATRADE). 2.7.2 Malaysia

Malaysia is a very small country and the contribution of the phenol production in the world is not too significant. Thus, customer for phenol production in Malaysia is only Thailand and Singapore. According to the Table 2.6, the quantity of phenol that imported by Thailand and Singapore both is too less and the maximum imported recorded is 30.11 tonnes which is by Singapore. Currently, the quantity import is become less due to the demand is increasing in Taiwan and China. As the quantity is not too much, the price offer by Malaysia is very expensive since it is limited production in Malaysia. Even though the price is expensive; Thailand and Singapore still import Phenol from Malaysia in order fulfill the phenol consumption in their country. Now, the price offer to Singapore and Thailand is RM 25,441.10 and RM 19,718.67 respectively. Table 2.6: Phenol Price Offer by Malaysia (RM per tonne) YEAR COUNTRY THAILAND SINGAPORE 2009 RM/TONNE 20,000.00 19,206.15 2010 RM/TONNE 220,925.50 7,465.31 2011 RM/TONNE 19,718.67 25,441.10

Source: Malaysia External Trade Development Corporation (MATRADE).

16 2.7.3 Taiwan

As reported in ICIS PRICING, China monopoly the phenol market currently. Even it is, there is a few problems arise as the phenol market now is going to transfer to Taiwan. This phenomenon is shown in Table 2.7 as the quantity phenol import by country from Taiwan is increasing year by year except in year 2009. Taiwan is most nearest country to the China and the price offer by Taiwan to the phenols buyer is quite similar to Chinas offer. As Taiwan concern to the problem arise in China, Taiwan now is attract the buyers with the amazing price with good quality as the buyers can get from China. In other words, Taiwan currently is replacing China role as a major supplier of Phenol in Asia. Table 2.7 shows the price offer and the country that imported phenol from Taiwan. Table 2.7: Phenol Price Offer by Taiwan (RM per tonne) YEAR COUNTRY INDIA SOUTH KOREA SAUDI ARABIA CHINA THAILAND UNITED STATES JAPAN VIETNAM 2009 RM/TONNE 4,182.59 5,232.25 5,051.23 6,586.46 0.00 79,155.71 0.00 0.00 2010 RM/TONNE 5,892.95 5,989.58 0.00 7,258.76 0.00 27,721.37 0.00 0.00 2011 RM/TONNE 7,735.37 7,171.75 7,709.30 7,360.36 7,927.54 9,029.00 7,897.70 9,921.91

Source: Malaysia External Trade Development Corporation (MATRADE)

17 2.7.4 Japan

Previously, Japan was major player in Phenol industry as Mitsui Chemicals is the third largest phenol producer in the world. Base on article Japans Mitsui Chem shuts Chiba phenol/acetone unit due to quake written by Heng Hui, after Japan was attacked by disaster tsunami, the production of Phenol is slowing down. According to Table 2.8, the price offer before 2011 is cheaper compared to price offer in 2011. This increasing price was affected by present Japans situation and phenol plant that located in Japan is still not stable. This situation was effect to the fluctuation of the phenol price offer by Japan. Now, the quantity phenol import by major customer which Taiwan, Thailand, Malaysia, India, South Korea and China was become less as shown in Table 2.8. Table 2.8: Phenol Price Offer by Japan (RM per ton) YEAR COUNTRY SINGAPORE TAIWAN CHINA THAILAND SOUTH KOREA INDIA INDONESIA MALAYSIA VIETNAM PHILIPPINES 2009 RM/TONNE 27,353.63 4,909.84 7,885.00 5,403.27 5,333.81 4,825.03 12,059.40 6,948.22 34,967.88 0.00 2010 RM/TONNE 76,723.19 7,828.11 13,169.01 6,669.98 6,689.56 6,696.67 16,829.14 40,200.19 15,676.05 7,378.06 2011 RM/TONNE 4,960.11 9,024.23 11,960.13 9,076.12 9,949.18 7,349.53 22,471.15 23,820.52 28,952.45 0.00

Source: Malaysia External Trade Development Corporation (MATRADE).

18 2.8 BY-PRODUCT MARKET ANALYSIS

Second product from phenol production is acetone. In one ton phenol production, 0.62 tons of acetone will produce as by-product. Acetone application is differ from the phenol. Then, it should be helping the organization to increase the profit from the acetones sales. 2.8.1 Acetone Price Analysis

Phenol demand recovery has been slower than expected and this combined with persistently high inventory levels is beginning to put downward pressure on phenol/acetone operating rates. The weighted average acetone price in East China was RMB50 per ton higher during the second half of the month; however it fell back to RMB8400 per ton towards the end of the month. Inventory level continued to disappoint while import talks for April arrival cargoes were rarely heard due to extremely low availability on sell side. Recently, China is the largest Acetone consumer in the world (Chemical Market Associates, Inc., Acetone Market Report, 2011). For the import markets, prices are notionally around RM 3,312.75 per ton CFR China. In Shanghai, Sinopec Gaoqiao PC maintained its ex-factory price at RMB8500 (RM 4,232.23). Tight cash conditions have hindered speculative buying which was spurred by expectations of an inventory drop in April. Meanwhile,

demand from BPA has been slightly weaker due epoxy resin demand easing (Chemical Market Associates, Inc., Acetone Market Report, 2011). 2.8.2 Asia Price Forecast

According to article in ICIC News by Felicia Loo and Yeow Pei Lin, acetone prices in Asia are expected to edge higher in the coming weeks amid rising feedstock costs and several plant turnarounds that will tighten spot supply availability, market players said on Friday. However, bloated inventories in China will signal limited spot buying from the regions top acetone importer and put a lid on overall price gains, sources said. Spot acetone prices were assessed at $990-1,085/ton (RM 3,556.183,895.57/ton) CFR (cost & freight) China Main Port (CMP), according to ICIS data. The price range on a zero anti-dumping duty (ADD) basis, while subject to 5.5% import duty, was assessed at $1,030-1,050 (RM 3,249.65- 3,312.75) CFR CMP. There are two domestic productions and marketing enterprises an acetone:

19 1. Bluestar Harbin factory price of 8060 yuan (RM 4,013.15) acetone / ton, the product has been the supply of local production users, shipping in general. At present 12 million tons / year of phenol ketone unit to keep running at full capacity. 2. Jilin Petrochemical acetone offer in 7920 yuan (RM 3,943.44) / ton, the current and methyl methacrylatemma (MMA), methyl isobutyl ketone (MIBK) basic for downstream production, acetone-free export available, some foreign mining. Chemical Market Associates, Inc. (CMAI) expects that acetone prices will continue to increase in April over those in March due to upward propylene prices, fewer imports and regional turnarounds. At this time the increases look to be on the order of $190 (RM 599.45) per ton. The acetone price for 2011 is expected to average $1171 (RM 3,694.50) per metric ton and may draw imports from the U.S. and West Europe as supply improves. In one ton phenol production, 0.62 tons of acetone will produce as by-product. Acetone application is differ from the phenol. Thus, target customer also is different except for the Singapore and Thailand. From the price analysis, the price offer for Acetone is RM 3,400 per ton.

2.9

RAW MATERIAL SUPPLY

Phenol production is very famous market currently each of the major players in this industry was provides different process production in order to distinguish the product quality from other player. But, most of the phenol production was need benzene and propylene as their raw material. In this section, the raw material price and supply raw material sources was discussed in order to minimized the cost of production and at the same time to increase the production profit.

20 2.9.1 Benzene

Figure 2.5: Asia Benzene Market Price Offer From the data taken from the MATRADE, Malaysia was recorded imported benzene from 11 countries which is India, Japan, Germany, United States, China, Indonesia, Iran, South Korea, Singapore, Taiwan and Thailand. But, from all of these benzene suppliers in the world, the benzene supplier that will discussed in this section was focused on the major supplier in Asia region. Thus, Figure 2.5 was representing the benzene supply analysis. Figure 2.5 showed that the increment of the Benzene market price in India and Japan. While, in this year Malaysia not more import benzene from Taiwan because Malaysia more focused on trading activities with India. The lowest latest market price was offer by India with offer of RM 3534.14 per tonnes. This price quite lower but by referring to the phenol demand currently it is possible that benzene price will be increase due to the increasing phenol demand. From export data taken from MATRADE (Table 2.9), Japan is supply benzene only to two countries which is South Korea and China because Japan is major benzene importer in world. So, from this data, it can be showed that Japan is not qualified as Benzene supplier for this phenol production. Next is Thailand as benzene supplier is can be considered as Thailand has a strategic location but the price offer is very expensive compared to other countries. Thailand price offer is listed in Table 2.10.

21 Table 2.9: Japan Benzene Price Offer YEAR COUNTRY SOUTH KOREA CHINA 2009 RM/Tonne 2,133.01 2,554.88 2010 RM/Tonne 9,103.59 0.00 2011 RM/Tonne 3,624.57 0.00

Source: Malaysia External Trade Development Corporation (MATRADE). Table 2.10: Thailand Benzene Price Offer YEAR COUNTRY JAPAN MALAYSIA UNITED KINGDOM UNITED STATES INDIA 2009 RM/Tonne 216,942.22 18,542.84 48,185.25 0.00 0.00 2010 RM/Tonne 95,738.71 23,753.97 41,368.80 0.00 7,599.95 2011 RM/Tonne 19,820.43 21,044.80 42,935.80 0.00 0.00

Source: Malaysia External Trade Development Corporation (MATRADE).

Even it is there was alternative way in order to have benzene supplier. Alternative way to get the benzene supply with lowest price is get local supplier within Malaysia. In Malaysia itself, there are a lot of petrochemical plants that produce petrochemical products including benzene. Company that is able to supply benzene for phenol production is Titan Petchem (M) Sdn Bhd. This company is located in Johor. The average benzene price that is offer is in range of RM3250RM3500 per tonnes. Titan Petchem (M) Sdn Bhd is qualified as a benzene supplier as this company fulfills two most important factors to be good supplier. First is the price offer is lower compare to other supplier and the second is the location of this company is same base area of the plant and the transportation and tax issues should not be arised. In order to run good business, any possible problem that will arise in the future must be forecast and the protection should be providing earlier. In production plant, the most important thing is raw material. As mention above, local supplier is available but if in case there will any problem arise, the next potential benzene supplier should be from Singapore. In Singapore, total production capacity of benzene is 420,000 ton per year. So, it is possible to import benzene from Singapore as well.

22 2.9.2 Propylene

Figure 2.6: Asia Propylene Market Price Offer Propylene is the second raw material in phenol production. Propylene is needed to react with the benzene before it is produce cumene and then go through the next stage of the process. Propylene supplier in Asia is too many but most of these suppliers also act as a propylene supplier for China such as Japan, Taiwan and Vietnam. Figure 2.6 showed that the market price offer was fluctuated and it is not impossible was influence by phenol demand. Even the market price was fluctuated; the market price was in range of RM3500-RM4500 per tonnes. The lowest propylene price offer was by Singapore with price of RM 3587.10 per tonns and the total production capacity of propylene in Singapore is 1.055 million tons per year. According to Table 2.11, Japan is offering propylene to South Korea and Taiwan. Current price offer is RM 4516.99 per tonne and that price is considered as low price for propylene. Analysis on one country is not enough to decide the best propylene supplier for this project.

23 Table 2.11: Japan Propylene Price Offer YEAR COUNTRY SINGAPORE UK US INDONESIA JAPAN MALAYSIA 2009 RM/TONNE 0.00 0.00 0.00 0.00 0.00 2,664.85 2010 RM/TONNE 3,179.45 25,649.32 637,246.67 4,095.24 22,243.76 0.00 2011 RM/TONNE 706,090.00 37,747.33 0.00 0.00 0.00 0.00

Source: Malaysia External Trade Development Corporation (MATRADE). Next, by referring to Table 2.12, Thailand export Propylene to most of the countries that located around Thailand. Indonesia, Singapore and Malaysia are the nearest to Thailand and the prices offer also are low compared to others. Thus, besides considered local supplier as a permanent supplier, Thailand would be selected as the second supplier because the price offer is lowest which is in range of RM 2500 RM 4000 per tonnes. In addition, the Thailand is located next to Malaysia and the transportation of the raw material should not be problem. Besides Thailand, Singapore can be the best competitor candidate to propylene local supplier because its only situated next to Malaysia. The only factor that can challenge Singapore is propylene supplier is Titan Petchem (M) Sdn Bhd. Titan Petchem (M) Sdn Bhd is located in Pasir Gudang, Johor. It is good to have both local supplier compared to outside because the raw material supply contact should be more simple and the two way communication between the supplier and buyers should be good. In addition, transportation issue would not arise in future. The most important is, the price offer by Titan Petchem (M) Sdn Bhd was in range of RM3000/ton which is lowest compared to Singapore. Table 2.12: Thailand Propylene Price Offer YEAR COUNTRY SOUTH KOREA TAIWAN 2009 RM/TONNE 2,922.12 2,948.55 2010 RM/TONNE 3,679.21 3,966.15 2011 RM/TONNE 4,516.99 0.00

Source: Malaysia External Trade Development Corporation (MATRADE)

24 2.9.3 Catalyst

Instead raw material in phenol production, catalyst also involved directly to the process. In phenol production, there are three types of catalyst that will involve directly which are beta zeolites, diethylene triamine penta-acetic acid (DTPA) and copper oxide. Details of the suppliers that offer the lowest price at high quality of catalyst is listed in Table 2.13. Table 2.13: Price of catalyst Supplier Zibo Xinhong Chemical Trade Co., Ltd, China Sulfonic Resins AVA Chemicals Pvt. Ltd, India Copper Oxide Coogee Asia Sdn. Bhd, Pasir Gudang, Johor RM 20,650.63/ton RM 18,210.00/ton

Catalyst Beta Zeolite

Price Offer RM 71,176.00/ton

25 2.10 BREAK EVEN POINT (BEP) ANALYSIS

In economics & business, specifically cost accounting, the break-even point (BEP) is the point at which cost or expenses and revenue are equal which means there is no net loss or gain, and one has broken even. In other words, a profit or a loss has not been made, although opportunity costs have been paid, and capital has received the risk-adjusted, expected return. The break-even point is one of the simplest yet least used analytical tools in management. It helps to provide a dynamic view of the relationships between sales, costs and profits. According to the BEP definition, the calculation on expected cost and profit need to perform in order to define breakeven point for the project. Break-even point will result in terms of units or in term of value (RM). 2.10.1 Type of Expenses

In costing, expenses that would be include is

i. -

Equipment cost In equipment cost, all the equipment cost that are listed in Process Flow

Diagram (PFD). In this expected costing, all the equipment sizing and design is based on medium size equipment because the plant is medium capacity plant. ii. Capital Investment Funds invested in a firm or enterprise for the purposes of furthering its business objectives. Capital investment may also refer to a firms acquisition of capital assets or fixed assets such as manufacturing plants and machinery that is expected to be productive over many years. Sources of capital investment are manifold, and can include equity investors, banks, financial institutions, and venture capital and angel investors.

iii. -

Total Manufacturing Expenses Total costs of direct materials, direct labor, and manufacturing overhead

incurred and charged to production during an accounting period. Manufacturing overhead includes such things as the electricity used to operate the factory equipment, depreciation on the factory equipment and building, factory supplies and factory personnel (other than direct labor)

26 2.10.1.1 Equipment Cost According Table 2.14, it shows the type equipment used in production of 100,000 tons per year of phenol, as well as the quantity of the equipment. From the quantity of the equipment, it will give total bare module cost for equipment that will get from multiplying the base bare module cost with the quantity of equipment required in the plant. Base bare module cost is the price of equipment in the market. From the total bare module cost, auxiliary facilities, contingency and fee can be calculated.

Table 2.14: Total Bare Module Cost for Equipment EQUIPMENT BASE BARE MODULE COST (RM) QUANTITY (UNIT) TOTAL BARE MODULE COST (RM) 1 2 4 5 6 7 8 9 10 11 12 15 16 17 18 Furnace Recycle drum Distillation column Compressor Valve Storage tank Reactor Pump Bubble Column Separator Rotating Pump Condenser Heat Exchanger Cooler Turbine 2,245,364.63 101,128.50 2,139,021.07 211,278.00 58,831.48 13,166.60 328,514.41 4,286.80 208,692.46 32,457.20 13,779 63,567.12 159,836.40 110,232.00 246,692.26 TOTAL Bare Module Cost, TBM (Source: http://matche.com and Perry, 1999) Contingency and Fee (18%): Total Bare Module x 0.18 = RM 3,618,499.54 Total Module Cost, TMC TMC = Total Bare Module Cost + Contingency and fee = RM 23,721,274.75 1 1 6 3 20 6 4 27 1 1 3 1 1 1 4 2,245,364.63 101,128.50 12,834,126.42 633,834.00 1,176,629.60 78,999.6 1,314,057.64 115,743.6 208,692.46 32,457.20 41,337.00 63,567.12 159,836.40 110,232.00 986,769.04 20,102,775.21

27 Auxiliary Facilities (30%): Total module Cost 0.30 Grass-roots capital (GRC) GRC = RM 7,116,382.42 = Total Module Cost + Auxiliary Facilities = RM 30,837,657.17

2.10.1.2 Fixed Capital Investment (FCI) Fixed capital investment is assets or capital investments that are needed to start up and conduct business, even at a minimal stage. These assets are considered fixed in that they are not used up in the actual production of a good or service, but have a reusable value and it is consists of direct and indirect cost. Direct cost is cost needed to install all the plant equipments and also for the surrounding of the plant but for the indirect cost, it consists of all the legal activities and fees for contractors. Direct costs items and indirect costs items that are considered in fixed capital investment for 100 000 metric ton per year phenol plant is shown Table 2.15. Table 2.15: Fixed Capital Investment Specification DIRECT COST Onsite Purchased Equipment Installation Piping (installed) Instrumentation and Control (installed) Electrical and Material (installed) 30% GRC 9,251,297.15 12,335,062.87 Cost (RM) Total (RM)

40% GRC 15% GRC

4,625,648.58

8% GRC Offsite

2,467,012.57

Building Yard Improvements Land Service Facilities

10% GRC 1% GRC 2% GRC 1% GRC

3,083,765.72 308,376.57 616,753.14 1,541,882.86 34,229,799.46

28 INDIRECT COST Contingency Construction Expenses Engineering and supervision Contractors Fee 10% GRC 8% GRC 5% GRC 1.5% GRC 3,083,765.72 2,467,012.57 1,541,882.86 462,564.86 7,555,226.01 TOTAL COST = TOTAL DIRECT COST + TOTAL INDIRECT COST = RM 41,785,025.47 Fix Capital Investment (FCI) Working Capital Start Up Cost Total cost + GRC 12% FCI 8% FCI Total Capital Investment, (TCI) 72,622,682.64 8,714,721.92 5,809,814.61 92,364,950.76

2.10.1.3 Total Manufacturing Expenses (AME) Prices (RM) Revenue from sales Phenol Acetone 7,500 3,400 100,000 62,000 750,000,000 210,800,000 960,800,000.00 Direct Production Cost Raw Material Natural Gas Benzene Propylene Hydrogen Price (RM) RM 0.5/m

3

Production/ton

Cost (RM)

Total

Usage 200,000.00 m

3

Cost (RM) 100,000 312,439,820 158,575,080 569,568

Total Cost (RM)

RM3500/ton RM3000/ton RM10.00/kg

89268.52 ton 52858.36 ton 56,956.80 kg

471,684,468 Cooling Water Chilled Water RM2.96/m3 RM2.96/m

3

267218 m3 88524.2 m

3

790,965.20 262,031.54

29 Steam Catalyst Electricity Maintenance and repairs Operating supplies Operating Labor Direct Supervision & Clerical Labor Laboratory charges 15% Operating Labor 540,000.00 10,302,327.24 Send waste to Kualiti Alam Water Waste treatment Solvent Waste treatment 5,327,337.60 487,314,132.84 Indirect Production Cost Plant Overhead Insurance Local authority taxes 1% FCI 726,226.83 1,089,340.24 Total Manufacturing Expenses, AME 488,403,473.08 50% Operating Labor 0.5% FCI 1,800,000.00 363,113.41 RM3,150/ton 704.68 ton 2,219,724.00 RM1,890/ton 1644.24 ton 3,107,613.60 15% Operating Labor 540,000.00 RM71,176/Ton RM 0. 46/kWh 10.72763 Ton 871,257 kWh 271,208.78 763,549.60 400,778.23 2,178,680.48

3% FCI

0.5% FCI

363,113.41

RM 3,000 per person/month

3,600,000.00

30 2.10.1.4 Rate of Return General Expenses Distribution & Selling Expenses Administration Cost Research Development & 8% FCI 10% Overhead 5% FCI 5,809,814.61 180,000.00

3,631,134.13 9,620,948.74

Total General Expenses,AGE Total Production Cost, APC Depreciation, AD AME + AGE 10% FCI 498,024,421.83 7,262,268.26 Total Expenses, ATE Annual Profit,ANP Income Taxes Revenue sales ATE 30% ANP 136,653,992.97 Net Annual Profit, ANNP Rate of Return (ANNP + AD) / TCI 100% from 455,513,309.91

505,286,690.09

182,205,323.96

217.41%

31 2.10.2 Cash Flow Data without Discount Rate

Table 2.16: Summaries of total plant expenses for 15 years plant life Plant life 15 years (for chemical and allied products manufacturing) Working Capital Annual Total Production Cost, TPC Annual Depreciation value Total Capital Investment, TCI Land (4 hectare) RM 8,714,721.92 RM 488,403,473.08 RM 7,262,268.26 RM 92,364,950.76 RM 19,375,038.90

Table 2.15 shows the summary of the expenses through 15 years of plant life. Refer to table 2.16, the table shows annual capital investment, sales incomes, depreciation, total expenses, cash income, net profit, federal income taxes and accumulation of ANNP for 15 year of phenol plant life.

Noted: Calculation Information 1. Sales income for the first year is considered as 80% from the annual sales income for the next year.

32 Table 2.17: Total revenues and expenses over 15 years plant life

Year

Annual Capital Investment A(I)

Sales Income A(S)

Depreciation A(BD)

Total Expenses A(TE)

Cash Income A(CI)=A(S)(TE)+A(BD)

Net Profit ANP A(CI)-A(BD)

Federal Income Taxes (30%) A(IT)

Accumulation of ANNP

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

19,375,038.90 91,997,721.54 100,712,443.46 600,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 750,000,000.00 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 7,262,268.26 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 505,286,890.09 101,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 251,975,578.17 94,713,309.91 244,713,309.91 228,131,596.79 228,131,596.79 228,131,596.79 228,131,596.79 228,131,596.79 228,131,596.79 228,131,596.79 228,131,596.79 228,131,596.79 228,131,596.79 228,131,596.79 28,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97 73,413,992.97

-19,375,038.90 -111,372,760.44 -212,085,203.90 -145,785,886.96 25,513,429.98 196,812,746.91 368,112,063.85 539,411,380.79 710,710,697.72 882,010,014.66 1,053,309,331.60 1,224,608,648.54 1,395,907,965.47 1,567,207,282.41 1,738,506,599.35 1,909,805,916.28

33 Table 2.18: Net income cash and accumulation of ANNP for 15 years plant life Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Net Cash Income, A(NCI) -7,265,639.70 -86,210,041.70 -94,104,481.70 66,299,316.94 171,299,316.94 171,299,316.93 171,299,316.94 171,299,316.94 171,299,316.93 171,299,316.94 171,299,316.94 171,299,316.94 171,299,316.93 171,299,316.94 171,299,316.94 171,299,316.93 Accumulation of ANNP -19,375,038.90 -111,372,760.44 -212,085,203.90 -145,785,886.96 25,513,429.98 196,812,746.91 368,112,063.85 539,411,380.79 710,710,697.72 882,010,014.66 1,053,309,331.60 1,224,608,648.54 1,395,907,965.47 1,567,207,282.41 1,738,506,599.35 1,909,805,916.28

Figure 2.7: Cumulative Net Cash Income vs. Years of Plant Life

34 2.10.3 Payback Period

PBR = 3 + (145,785,886.96/ 171,299,316.94) PBR = 3.85 years 4 years

2.10.4 Break Even Point (BEP)

According to the above calculation on cost spending for the production and also expected profit that would gain from the production, break-even point is 185,926.82 tonnes and this can be achieve within four (4) years. So, company need to sell more than 185,926.82 tonnes of phenol in order to get profit. According to the payback period calculation, company is expected to get profit after four years. The main thing for investor to consider the profitability for new project is the payback period and break-even point both. So, four years payback period is very good for investors to consider either to invest or not because investors no need to wait for a long time to gain profit compared to other plants. In addition, from the previous phenol plant built, this expected payback period is follows the actual in industry. Below are listed two types of phenol plant that built with their expected payback period:

1.

The Cumene/Phenol project has a capacity of 270,000 tonnes and 200,000 tonnes respectively. This project is a joint venture with Petroleum Authority of Thailand (PTT) 40%, National Petrochemical (NPC) 20%, Thai Olefins (TOC) 20% and Thai Aromatics (ATC) 20%. The project has an investment

35 cost of $200mn with an investment return ratio of 15.6% and payback period of 7 years and the plant will come on line in 2007 (Kitichan Sirisukarcha, 2004). 2. Phenolic Anti-Oxidants plant: Table 2.19: Description of phenolic anti-oxidants plant Capacity Total Investment Return of Investment Payback Period Total Revenues Source: Saudi Basic Industries Corporation (SABIC) According to the market analysis, it can be concluded that the phenol industry is become more expand in Asia region and this give an opportunity to build a new phenol plant production in Malaysia. Phenols market trend is going to increase in next future years after passed the recession year due to Greece financial crisis. Presently, the global production of phenol reaches 10 million tonnes per year. The phenol market is forecast to remain tight for the coming 2 years. Worldwide demand for Phenol as of 2008 was 9 million ton per year with a projected 3.5% annual growth rate through to 2015. Consumption of phenol for bisphenol A will be driven by majorly growth in Asia. World consumption of phenol for bisphenol A is expected to grow at an average annual rate of about 3% until 2015. According to the break-even analysis, break-even point is 185,926.82 tonnes and this can be achieved within 4 years with rate of return 217.41%. By comparing to other phenol projects, this expected breakeven analysis is reasonable due to the current phenol industry scenario. Malaysias government is recommended to give attention to the phenol industry since there is no phenol plant in Malaysia. There should be someone appointed by the government to run depth studies on how phenol industry can help Malaysia increase Malaysias income as well as increase gross domestic product (GDP). 3250 tons/year SR 136 million 33.5 5 years SR 90 million

36 APPENDIX A Phenols Buyers by Country for each Application in Text Section 2.5

Application 1: Bisphenol A (BPA) BUYERS (COMPANY) Marklon Industries Sdn. Bhd. Carboron Sdn Bhd Acrylic Synergy Sdn Bhd AKN Technology Bhd HTP Soles Manufacturer Sdn. Bhd Thai Polycarbonate Co., Ltd Taiyo Yuden Co., Ltd LTEC Ltd Eastern Polypack Co.,Ltd. Micron Storage Media Co., Ltd. Sumitomo Electric Automotive Products Pte Ltd Denso International Singapore Pte Ltd HLN Technologies Pte Ltd BPA International Pvt. Ltd. ASTRO Trade Pvt Ltd. Shah Polymers Pt.Rejeki Adigraha Impack Pratama Industri Pt Cv.Amoz Bottle Pt.Dutamulti Intioptic Pratama Wd & J Builders Apex Intec Philippines Co Ltd Inc. Green Light Led Energy Solutions, Inc Optima Display Systems Co. Guoxinghengye Technology Development Co.,Ltd Royce Universal Co.,Ltd Ntr Technology Co.Ltd Truong Phat Construction Ad Trading Jsc Cheng Lih Industrial Co.,Ltd VIETNAM PHILIPPINES INDONESIA INDIA SINGAPORE THAILAND MALAYSIA COUNTRY

37 Application 2: Phenolic Resin BUYERS (COMPANY) Mentari Alam (M) Sdn Bhd Inter-Chemicals Sdn.Bhd. Hitachi Chemical Sdhn.Bhd Kenso Corporation (M) Sdn Bhd Aditya Birla Chemicals Thailand Ltd Luxchem Trading Sdn Bhd. Wholesome Pte. Ltd. Jushi Singapore Pte Ltd Galaxy Bearings Ltd. CK Birla Group KG Bearing Pvt. Ltd. PT. Tanjung Jaya Diangraha Engineering CV. Andalan Makmur Sejahtera Mcgraw Engineering Veril Transformer Asian Provider Traders Co. Ltd. Nndo Industrial Equipment Co., Ltd Vietboard Jsc Sovimex Co., Ltd Vietnam Philippines Indonesia India Thailand Malaysia COUNTRY

Singapore

38 Application 3: Nylon BUYERS (COMPANY) Nanmu Yarns & Threads Manufacturing Sdn.Bhd Textrend Industry & Trading Pannu Elastic Industries Sdn Bhd Asia Fishery Industry Co. Ltd KL & SONS GROUP GT Trading Co. Ltd Springwell International Enterprise Infoline Solutions & Marketing PTE LTD World Plastics Recovery Pte Ltd Panther Uniforms Petals Concept SHARIE International Infinite Asia PT Pelangi Elasindo Ltd Pt. Wiratama Prima International Synthetic Ind., Inc Carlsan Bag Enterprises DERHAO Textile (Vietnam) Co. Ltd Hualon Corporation Viet Nam Blue Ocean Cordages Company Limited Van Phat Garment Trading Co., Ltd Vietnam Philippines Indonesia India Singapore Thailand Malaysia COUNTRY

39 REFERENCES

Robroad.com, 2005. 2009 Global phenol production capacity of 10 million tons Chao. [Online] Available at:<http://www.robroad.com/light-industry/global /200702/13528.html> [Accessed 9 October 2011]. Julia Meehan, 2011. World phenol demand could lead to acetone overcapacity Mitsu. [Online] Available at:<http://www.icis.com/Articles/2010/06/16/

9368198/world-phenol-demand-could-lead-to-acetone-overcapacitymitsui.html> [Accessed 9 October 2011].

The Saudi Network, 2007. Investment Opportunities in Chemical Industries. [Online] Available at:<http://www.the-saudi.net/business-center/jvchem.htm#

Phenolic Anti-Oxidants> [Accessed 12 December 2011].

Manfred Weber, M. W. (2010). Phenolic Resins: A Century of Progress (1st ed.): Springer.

Elvira O. Camara Greiner and Chiyo Funada, 2011. Phenol. [Image Online] Available at:<http://chemical.ihs.com/CEH/Public/Reports/686.5000/>

[Accessed 9 October 2011].

IHS, Inc., 2011. Phenol. [Image Online] Available at:<http://chemical.ihs.com/WP/ Public/Reports/phenol/> [Accessed 9 October 2011].

Josh Peterson, 2011. Map of Southeast Asia Region. [Image Online] Available at:<http://maps-asia.blogspot.com/> [Accessed 2 December 2011].

Sumitomo Chemical, 1999. Sumitomo Chemical | Company Information from ICIS. [Online] Available at:<http://www.icis.com/v2/companies/9146266

/sumitomo-chemical.html> [Accessed 9 October 2011]. PlasticsToday Staff, 2011. INEOS Phenol and Sinopec to build Chinas largest phenol/acetone plant. [Online] Available at:<http://www.plasticstoday.com/ articles/ineos-and-sinopec-build-china%E2%80%99s-largestphenolacetone-plant> [Accessed 9 October 2011].

40 Mitsui Chemicals, Inc., 2009. Mitsui Chemicals and Sinopec Reach Fundamental Agreement to Form a Joint Venture in Phenol. [Online] Available at:<http://www.mitsuichem.com/release/2009/091102_02.htm> [Accessed 9 October 2011].

Ronnie Lim, 2010. Mitsui Chemicals opens 2nd elastomers plant here. [Online] Available at:<http://www.sgmaritime.com/Singlenews.aspx?DirID=99&

rec_code=619958> [Accessed 9 October 2011]. Heng Hui, 2011. Japans Mitsui Chem shuts Chiba phenol/acetone unit due to quake. [Online] Available at:<http://www.icis.com/Articles/2011/03/14/

9443291/japans-mitsui-chem-shuts-chiba-phenolacetone-unit-due-to.html> [Accessed 9 October 2011].

Chemical Market Associates, I. C. (2011). ACETONE MARKET REPORT (Vol. 174).

Peh Soo Hwee, Junie Lin and Liu Xin, 2011. Asia acetone prices to rise on feedstock costs, tight supply. [Online] Available at:<http:// 9

news.chemnet.com/Chemical-News/detail-1513707.html> October 2011].

[Accessed

Malaysia External Trade Development Corporation (MATRADE), 2011.

Guidelines for Hazard Identification, Risk Assessment and Risk Control (HIRARC). (2008). Malaysia.

Cheremisimoff, N. P. (2000). Handbook of Hazardous Chemical Properties. USA: Butterworth-Heinemann.

Woodard, F. (2001). Industrial Waste Treatment Handbook. USA: ButterworthHeinemann.

Department of Environment, Malaysia, 2010. List of Scheduled Waste. [Online] Available at:< http://www.doe.gov.my/portal/> [Accessed 11 November 2011].

41 Department of Occupational Safety and Health Malaysia, 2011. Acts and Legislation. [Online] Available at:<http://www.dosh.gov.my> [Accessed 11 November 2011].

Health and Safety Environment, UK, 2011. Risk Management. [Online] Available at:< http://www.hse.gov.uk/risk/index.htm> [Accessed 11 November 2011].

Centers

for

Disease

Control

and

Prevention,

2011. Hazards

to

Outdoor

Workers. [Online] Available at:< http://www.cdc.gov/niosh/topics/outdoor/> [Accessed 11 November 2011].

Fire Fighter Close Calls, 2003. 6 FF 1 COP INJURED IN MA PHENOL SPILL. [Online] Available at:<http://www.firefighterclosecalls.com/

news/fullstory/newsid/144797> [Accessed 10 October 2011].

American Chemical Society, 2011. Friday chemical safety round-up. [Online] Available at:<http://cenblog.org/the-safety-zone?s=incident+phenol>

[Accessed 10 November 2011].

Forensic Services (M) Sdn Bhd, 2011. Furnace Failures. [Online] Available at:< http://www.forensic.cc/newsletter/furnace-failures> [Accessed 10 November 2011]. Metallurgical Consultants, 1999. Pipeline Failure Analysis. [Online] Available at:< http://www.materialsengineer.com/CA-pipeline-failure.htm> [Accessed 10 November 2011].

Canadian

Centre

for

Occupational Available

Health at:<

&

Safety,

1997. Hearing

Protectors. [Online]

http://www.ccohs.ca/oshanswers/

prevention/ppe/ear_prot.html> [Accessed 12 December 2011].

University of Toronto Hearing Protection Devices Standard, 1998. Hearing Protection Standard. [Online] Available at:<http://www.civ.toronto.edu/dept/ safety/Legislation_etc/uoft_hearing_protection_policy.html> [Accessed 12 December 2011].

42 SeoulBuffoon, 2007. Interview: Ms. Arlida Ariff, President & CEO, Iskandar Investment Berhad. [Online] Available at:<http://seoulbuffoon.blogspot.com /2010/09/interview-ms-arlida-ariff-president-ceo.html> [Accessed 9 October 2011].

Trading

Economics,

2011. Malaysia

GDP. [Online]

Available

at:<http://

www.tradingeconomics.com/malaysia/gdp> [Accessed 9 October 2011].

Scribd Inc., 2011. Thailand Industrial Estate Market Report. [Online] Available at:<http://www.scribd.com/doc/52226027/Thailand-Industrial-Estate-MarketReport-H2-2010> [Accessed 9 October 2011].

HubPages Inc, 2011. Malaysia Political and Economic Outlook for 2011 and Beyond. [Online] Available at:<http://ecoggins.hubpages.com/hub/ [Accessed 9

Malaysia-Political-and-Economic-for-2011-and-Beyond> October 2011].

U.S. Department of State, 2011. Background Note: Thailand. [Online] Available at:< http://www.state.gov/r/pa/ei/bgn/2814.htm#political> [Accessed 9 October 2011].

Trading

Economics,

2011. Thailand

GDP. [Online]

Available

at:<http://www.

tradingeconomics.com/thailand/gdp> [Accessed 9 October 2011].

Port

Klang

Free

Zone,

2008. About

PKFZ. [Online]

Available 9

at:<

http://www.pkfz.com/content/profile/profile.html> 2011].

[Accessed

October

Pelabuhan Tanjung Pelepas Sdn Bhd., 2008. PTP Location. [Online] Available at:< http://www.ptp.com.my/location.html> [Accessed 9 October 2011].

UEM Environment Sdn. Bhd., 2011. Hazardous Waste Management. [Online] Available at:<http://www.kualitialam.com.my/index.php?page_id=48>

[Accessed 9 October 2011] Malaysian Investment Development Available Authority (MIDA), 2008. Electricity

Rates. [Online]

at:<http://www.mida.gov.my/env3/index.php?

page=electricity-rates> [Accessed 9 October 2011].

43 Map Ta Phut Industrial Estate, 2004.Utilities and Facilities System. [Online] Available at:<http://www.mtpie.com/utlts/mn_utlts.htm> [Accessed 9

October 2011].

Iskandar Regional Development Authority, 2007. Flagship C: Western Gate Development. [Online] Available at:<http://www.iskandarmalaysia.com.my/ flagship-c-western-gate-development> [Accessed 9 October 2011].

Engineers Guide, 2005. Types Of Phenol Manufacturing Process. [Online] Available at:<http://www.inclusive-science-engineering.com/2010/07/phenolmanufacturing-process.html> [Accessed 9 October 2011].

Manfred Weber, M. W. (2010). Phenolic Resins: A Century of Progress (1st ed.): Springer.

Potrebbero piacerti anche

- Management and EconomicsDocumento2 pagineManagement and EconomicsAvandhiNessuna valutazione finora

- Distillation and Hydrotreating ComplexDocumento1 paginaDistillation and Hydrotreating ComplexKatharina AjengNessuna valutazione finora

- Thu Isome HoaDocumento71 pagineThu Isome HoaHoai Thuong NguyenNessuna valutazione finora

- Saturated Steam Properties in a TableDocumento68 pagineSaturated Steam Properties in a TableEirojram MarjorieNessuna valutazione finora

- A 350 Tonne Per Day Phthalic Anhydride Plant: Presentation On Plant Design ForDocumento29 pagineA 350 Tonne Per Day Phthalic Anhydride Plant: Presentation On Plant Design Forbaniya is hereNessuna valutazione finora

- Material BalanceDocumento7 pagineMaterial Balanceramsrivatsan0% (1)

- Chemical Design Team PPT ReviewDocumento25 pagineChemical Design Team PPT ReviewMaryam AlqasimyNessuna valutazione finora

- N-Butanol Plant Design BriefDocumento5 pagineN-Butanol Plant Design BriefTom Hart100% (1)

- Hidratação Direta PropenoDocumento53 pagineHidratação Direta Propenossargo100% (2)

- AfdhalDocumento11 pagineAfdhalRiky Mario YuluciNessuna valutazione finora

- Convergence Hints (Aspen)Documento13 pagineConvergence Hints (Aspen)Saurabh GuptaNessuna valutazione finora

- Lab 4 CompiledDocumento29 pagineLab 4 CompiledFakhrulShahrilEzanieNessuna valutazione finora

- 0203 2 TocDocumento7 pagine0203 2 Tocعمر الاسمريNessuna valutazione finora

- Stearic Acid MsdsDocumento5 pagineStearic Acid MsdsAnnisaNessuna valutazione finora

- N16S-GT Package 23x23mm Technical SpecificationsDocumento49 pagineN16S-GT Package 23x23mm Technical Specificationsvi aNessuna valutazione finora

- Nitric AcidDocumento14 pagineNitric Acidmalini2201Nessuna valutazione finora

- Techno-Economic Modelling and Cost Functions of CO Capture ProcessesDocumento11 pagineTechno-Economic Modelling and Cost Functions of CO Capture ProcessesAlex MarkNessuna valutazione finora

- Batch Manufacture of Propylene GlycolDocumento6 pagineBatch Manufacture of Propylene Glycolprassna_kamat1573Nessuna valutazione finora

- New agitated reactor and heat exchanger installation cost estimateDocumento2 pagineNew agitated reactor and heat exchanger installation cost estimateDiego MoralesNessuna valutazione finora

- Chemical Engineering Projects Can Be Divided Into Three TypesDocumento25 pagineChemical Engineering Projects Can Be Divided Into Three Typestrungson1100% (1)

- 1,3 ButadieneDocumento7 pagine1,3 ButadieneAbdalmoedAlaiashyNessuna valutazione finora

- Wo 2014185872 A 1Documento11 pagineWo 2014185872 A 1Shahid AliNessuna valutazione finora

- Synthesis and Evaluation of Mechanical Properties For Coconut FiberDocumento6 pagineSynthesis and Evaluation of Mechanical Properties For Coconut FiberYudanis TaqwinNessuna valutazione finora

- Coal Tar MSDS (Composicion Alquitran de Hulla)Documento7 pagineCoal Tar MSDS (Composicion Alquitran de Hulla)Ricardo Alejandro Ruiz NavasNessuna valutazione finora

- Lampiran PerhitunganDocumento15 pagineLampiran PerhitunganAchmadJa'farShodiqShahabNessuna valutazione finora

- File1 - Laporan 5Documento48 pagineFile1 - Laporan 5Bhaskoro AbdillahNessuna valutazione finora

- Diagram Alir Pra Rancangan Pabrik Asetaldehid 50 TonDocumento1 paginaDiagram Alir Pra Rancangan Pabrik Asetaldehid 50 TonFajar AgumNessuna valutazione finora

- Yulianti Sampora, Yenni Apriliany Devy, Dewi Sondari, Dan Athanasia Amanda Septevani. 2020. Simultaneous Pretreatment ProceDocumento9 pagineYulianti Sampora, Yenni Apriliany Devy, Dewi Sondari, Dan Athanasia Amanda Septevani. 2020. Simultaneous Pretreatment ProceAdhan AkbarNessuna valutazione finora

- 64788Documento35 pagine64788ghatak2100% (1)

- Packed Columns 110-126Documento24 paginePacked Columns 110-126tanveerpuNessuna valutazione finora

- Manufacture of Monobasic Potassium PhosphateDocumento190 pagineManufacture of Monobasic Potassium PhosphateIndra Setio PujiNessuna valutazione finora

- Reaction Kinetics of Ammonia & Nitric AcidDocumento116 pagineReaction Kinetics of Ammonia & Nitric AcidMonica Garcia100% (1)

- Tabel Antoine 1Documento3 pagineTabel Antoine 1atikaindrnNessuna valutazione finora

- Intro To Methyl Chloride Plant 1Documento57 pagineIntro To Methyl Chloride Plant 1Kimberly ConleyNessuna valutazione finora

- Che 456 Spring 2011 Major 2 Styrene Production BackgroundDocumento6 pagineChe 456 Spring 2011 Major 2 Styrene Production Backgroundyamel huaira taipeNessuna valutazione finora

- Vapor/Liquid Equilibrium: Vle by Modified Raoult'S LawDocumento16 pagineVapor/Liquid Equilibrium: Vle by Modified Raoult'S LawAby JatNessuna valutazione finora

- Asian Paints Limited Penta Division CuddaloreDocumento63 pagineAsian Paints Limited Penta Division CuddaloreChaudhryNaveedAnwar100% (1)

- Tatoraytechsheet PDFDocumento2 pagineTatoraytechsheet PDFAnubhavAgarwalNessuna valutazione finora

- Synthesis of N Butyl Acetate Via Reactive Distillation Column Using Candida Antarctica Lipase As CatalystDocumento12 pagineSynthesis of N Butyl Acetate Via Reactive Distillation Column Using Candida Antarctica Lipase As CatalystjavasoloNessuna valutazione finora

- CHE F422 - Midsem Test - PRT PDFDocumento2 pagineCHE F422 - Midsem Test - PRT PDFTarun MandalamNessuna valutazione finora

- FullDocumento33 pagineFullEja RotiKeju100% (2)

- Minyak Kacang TanahDocumento3 pagineMinyak Kacang TanahauliyahokeNessuna valutazione finora

- Research ProjectDocumento30 pagineResearch ProjectYasser AshourNessuna valutazione finora

- Lecture 18: Isopropanol and Acetone From Propylene: Module 3: PetrochemicalsDocumento2 pagineLecture 18: Isopropanol and Acetone From Propylene: Module 3: Petrochemicalsshamsullah hamdardNessuna valutazione finora

- Equipments Specification For Power House: Economic Evaluation & ProfitabilityDocumento12 pagineEquipments Specification For Power House: Economic Evaluation & Profitabilitysaur1Nessuna valutazione finora

- Hargreaves ProcessDocumento7 pagineHargreaves ProcessMuhammad BilalNessuna valutazione finora

- Nhóm (Đ.Anh+ Hiếu + Ý) Syngas to MethanolDocumento40 pagineNhóm (Đ.Anh+ Hiếu + Ý) Syngas to MethanolStrong NguyenNessuna valutazione finora

- Handout p3k 1 HGNDocumento33 pagineHandout p3k 1 HGNRio SanjayaNessuna valutazione finora

- Proposal KP HolcimDocumento27 pagineProposal KP HolcimPutu Trisnayadhi DharmawanNessuna valutazione finora

- Pengolahan Limbah Cair Industri Karet deDocumento9 paginePengolahan Limbah Cair Industri Karet deludira luckyNessuna valutazione finora

- Daftar PustakaDocumento2 pagineDaftar PustakaHammany Nur ZulkyNessuna valutazione finora

- LRS 10Documento1 paginaLRS 10anshuman432Nessuna valutazione finora

- Turton Analysis Synthesis and Design of Chemical Processes PDFDocumento1 paginaTurton Analysis Synthesis and Design of Chemical Processes PDFCarlos ABNessuna valutazione finora

- Chlorine: International Thermodynamic Tables of the Fluid StateDa EverandChlorine: International Thermodynamic Tables of the Fluid StateNessuna valutazione finora

- 2 4Documento11 pagine2 4Berry1010% (1)

- PDocumento15 paginePBerry101Nessuna valutazione finora

- Chapter 2Documento10 pagineChapter 2Berry101Nessuna valutazione finora

- UntitledDocumento15 pagineUntitledapi-305947303Nessuna valutazione finora

- Time Value of Money: Brooks, (2013) Chapters 3, 4Documento49 pagineTime Value of Money: Brooks, (2013) Chapters 3, 4DiannaNessuna valutazione finora

- CTS SummaryDocumento3 pagineCTS SummaryEngr Muhammad Javid NawazNessuna valutazione finora

- Class Guide - Sales Funnel Fundamentals PDFDocumento15 pagineClass Guide - Sales Funnel Fundamentals PDFJayson Tabuen ChanchicoNessuna valutazione finora

- PDF Chapter 2 CompressDocumento33 paginePDF Chapter 2 CompressRonel GaviolaNessuna valutazione finora

- StockDocumento4 pagineStockNiño Rey LopezNessuna valutazione finora

- Absorption Costing For Decision Making - Zimmerman ApproachDocumento6 pagineAbsorption Costing For Decision Making - Zimmerman ApproachKEETARUTH OUMATEENessuna valutazione finora

- Bba 1Documento9 pagineBba 1Vinod Kumar NaikNessuna valutazione finora

- Exercise 2 - CVP Analysis Part 1Documento5 pagineExercise 2 - CVP Analysis Part 1Vincent PanisalesNessuna valutazione finora

- Riyaz Ahmad OriginalDocumento1 paginaRiyaz Ahmad OriginalHamid SaifNessuna valutazione finora

- 1 Om PPT M-1Documento89 pagine1 Om PPT M-1K P RUTHWIKNessuna valutazione finora

- Chapter 2Documento14 pagineChapter 2Ncim PoNessuna valutazione finora

- Basics of Retail MerchandisingDocumento38 pagineBasics of Retail MerchandisingRishabh SharmaNessuna valutazione finora

- Demand Analysis Question BankDocumento3 pagineDemand Analysis Question BanknisajamesNessuna valutazione finora

- Clarkson Lumber SolutionDocumento9 pagineClarkson Lumber SolutionDiego F. Guty JadueNessuna valutazione finora

- Private Equity in AustraliaDocumento5 paginePrivate Equity in AustraliaWinnifred AntoinetteNessuna valutazione finora

- Intermediate Accounting III Homework Chapter 18Documento15 pagineIntermediate Accounting III Homework Chapter 18Abdul Qayoum Awan100% (1)

- Case Analysis Questions and RubricDocumento11 pagineCase Analysis Questions and RubricAbinaya SathyaNessuna valutazione finora

- Director Marketing in San Francisco Bay CA Resume Jeff BuchoffDocumento2 pagineDirector Marketing in San Francisco Bay CA Resume Jeff BuchoffJeffBuchoffNessuna valutazione finora

- Inventory Modelindg Management SystemDocumento19 pagineInventory Modelindg Management Systemtsegab bekeleNessuna valutazione finora

- Gaurav Kumar Jaiswal - National Winner, MTV-LinkedIn Get a Job 2020Documento1 paginaGaurav Kumar Jaiswal - National Winner, MTV-LinkedIn Get a Job 2020The Cultural CommitteeNessuna valutazione finora

- 2010-10-22 003512 Yan 8Documento19 pagine2010-10-22 003512 Yan 8Natsu DragneelNessuna valutazione finora

- Montego Bay Community College Variance Analysis WorksheetDocumento8 pagineMontego Bay Community College Variance Analysis WorksheetLeigh018Nessuna valutazione finora

- Marketing Management: Sixteenth EditionDocumento24 pagineMarketing Management: Sixteenth EditionFarid BakhtazmaNessuna valutazione finora

- Principles of Marketing Worksheet 2Documento3 paginePrinciples of Marketing Worksheet 2Ash SatoshiNessuna valutazione finora

- Exam Practice Case Study: Flipkart: 1 Explain What Is Meant by Corporate Strategy'. (4 Marks)Documento3 pagineExam Practice Case Study: Flipkart: 1 Explain What Is Meant by Corporate Strategy'. (4 Marks)Gazi Kashfi JahanNessuna valutazione finora

- Diploma in Accountancy Qa March 2022Documento217 pagineDiploma in Accountancy Qa March 2022Chanda LufunguloNessuna valutazione finora

- Chevalier AER 1995Documento22 pagineChevalier AER 1995Prasad HegdeNessuna valutazione finora

- Accounting Practices and Challenges of MSMEs in Quezon ProvinceDocumento13 pagineAccounting Practices and Challenges of MSMEs in Quezon Provincely chnNessuna valutazione finora

- Absorption CostingDocumento3 pagineAbsorption CostingThirayuth BeeNessuna valutazione finora

- Customer Loyalty and Patronage of Quick Service Restaurant in NigeriaDocumento23 pagineCustomer Loyalty and Patronage of Quick Service Restaurant in NigeriaMhiz AdesewaNessuna valutazione finora