Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sales Contract

Caricato da

shapnokoliDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Sales Contract

Caricato da

shapnokoliCopyright:

Formati disponibili

MD. ABU ZAFAR SHAMSUDDIN, SAVP & MANAGER (CR & FX) Trust Bank Ltd.

, Gulshan Corporate Branch

Sales/Purchase Contract and Related Documents :

Every foreign trade transaction is the result of a sale contract between the seller and the buyer. In a sale contract, the seller agrees to sell and the buyer agrees to buy a specified quantity of goods on terms mutually agreed upon. However, the exact form of the sale contract varies from transaction to transaction. A sale contract need not necessarily be a formal and legally executed document as is often believed. It can even be an exchange of correspondences between the seller and the buyer. In some trades legally drafted contracts may be used. The following are most common clauses in a contract: a) b) c) d) e) f) g) h) i) j) k) l) m) Which conditions to apply. Definition of the terms. Conclusion of the contract. Assignment (Transfer of the right and obligations to a third party) Trade terms. Quality and Quantity. Pre-shipment inspection. Price and payment. Patent rights and indemnity. Delivery. Warranty/Guarantee. Liquidated damages (Penalty for late delivery) Force Majeure (In the situations like natural disaster, war, revolutions, the performance of a contract becomes impossible, then how to sort out the rights and obligations of each party). n) Packing and Marking. o) Shipping documents p) Dispute settlement.

MD. ABU ZAFAR SHAMSUDDIN, SAVP & MANAGER (CR & FX) Trust Bank Ltd., Gulshan Corporate Branch

The following documents are usually used in contract as per URC 522, Articles 2b 1) Financial Documents Bill of Exchange 2) Commercial Documents Commercial Invoice Transport Documents Insurance Documents Others Documents

1) Financial Documents:

These documents are used in payment by the buyer to the seller of goods in the international trade transactions. Bills of Exchange, Promissory Notes are very commonly used such documents.

Bill of Exchange: As per interpretation of Uniform Rules for Collection, the Bills of

Exchange (B/E) is treated as a financial document through which majority of international payments, arising out of international trade. A bill of exchange is a negotiable instrument and is payable to the bearer or to the person in whose favor it is endorsed. There are six parties involved in a bill of exchange. They are: (i) the drawer (ii) the drawee (iii) the payee (iv) the endorser (v) the endorsee, and (vi) the acceptor

2) Commercial Documents:

As per URC 522, Articles 2b, Commercial documents means invoices, transport documents, documents, of title or other similar documents, or any other documents whatsoever, not being financial documents.

MD. ABU ZAFAR SHAMSUDDIN, SAVP & MANAGER (CR & FX) Trust Bank Ltd., Gulshan Corporate Branch

Commercial Invoice:

A Commercial Invoice is the sellers bill for the merchandise. The document describes the goods which are subject of contract of sale between the buyer and seller. A commercial Invoice: i. must appear to have been issued by the beneficiary ii. must be made out in the name of the applicant. iii. must be made out in the same currency as the credit; and

Transport Documents:

These are the documents which evidence that the goods have been delivered to the named shippers, airlines or transporters for the carriage to a named port, airport or place of delivery. Following transport documents are being used at present in the international trade: i) ii) iii) iv) v) vi) Bill of Lading Airway Bill/Air Consignment Note Railway consignment note/ Railway Receipt Road Bill Post Parcel Documents Mates Receipt

Bill of Lading : The bill of lading is one of the most important documents is

international trade operation. It is a document signed by the master of the ship or shipping company or its agents acknowledging receipt of specified goods on board the vessel for carriage which are deliverable to the consignee named in the bill, or to his order or his assignees in the same condition as they were received at an agreed destination on payment of freight. The bill of leading serves three main purposes. Viz: a) as a document of title to the goods b) as a receipt from the shipping company c) as a contract for transportation of the goods Insurance Documents: The banks are largely responsible for financing the overseas trade in the world. There are risks of damage, loss or destruction of goods during the time of transit. Insurance company

MD. ABU ZAFAR SHAMSUDDIN, SAVP & MANAGER (CR & FX) Trust Bank Ltd., Gulshan Corporate Branch

takes the responsibility to fulfill any damage or risks arise from any part through their policy or cover note.

Others Documents:

Other documents are issued as per terms of contract.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Indigo Flight Sample PDFDocumento2 pagineIndigo Flight Sample PDFRupam Dutta75% (4)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Dutch Lady Milk Industries Berhad-2Documento16 pagineDutch Lady Milk Industries Berhad-2Navinya Gopala Krishnan100% (2)

- The Ashok Leyland WayDocumento15 pagineThe Ashok Leyland WayShreyas HNNessuna valutazione finora

- Construction Risk Register: This Template Was Provided byDocumento2 pagineConstruction Risk Register: This Template Was Provided byZameer AhmedNessuna valutazione finora

- Ucp 600Documento56 pagineUcp 600shapnokoli82% (11)

- NI ActDocumento20 pagineNI ActshapnokoliNessuna valutazione finora

- Opening at Operation of LCDocumento7 pagineOpening at Operation of LCshapnokoliNessuna valutazione finora

- International Trade Payment MethodsDocumento2 pagineInternational Trade Payment MethodsSCRIBD1868100% (1)

- Lodgement of Import BillDocumento4 pagineLodgement of Import Billshapnokoli100% (4)

- CRG - ManualDocumento24 pagineCRG - ManualshapnokoliNessuna valutazione finora

- Corporation: Basic Concepts in Establishing OneDocumento26 pagineCorporation: Basic Concepts in Establishing OnearctikmarkNessuna valutazione finora

- Kasus ANTAM Chapter 6 MBA 78EDocumento9 pagineKasus ANTAM Chapter 6 MBA 78EIndra AdiNessuna valutazione finora

- What Is A Job Safety AnalysisDocumento2 pagineWhat Is A Job Safety AnalysisAnonymous LFgO4WbIDNessuna valutazione finora

- Resume Formats: Choose The Best... !!Documento10 pagineResume Formats: Choose The Best... !!Anonymous LMJCoKqNessuna valutazione finora

- CatalogueDocumento132 pagineCataloguesamsungmkNessuna valutazione finora

- Sap SD BillingDocumento236 pagineSap SD Billinggl_sudhir765386% (7)

- Procedure and Jurisdiction Philippine Labor LawDocumento14 pagineProcedure and Jurisdiction Philippine Labor LawJohn DoeNessuna valutazione finora

- Biznet Technovillage BrochureDocumento5 pagineBiznet Technovillage BrochuregabriellaNessuna valutazione finora

- TestDocumento3 pagineTestMehak AliNessuna valutazione finora

- A Project Report On "Study of Marketing Strategies" and "Consumer Buying Behaviour" ofDocumento88 pagineA Project Report On "Study of Marketing Strategies" and "Consumer Buying Behaviour" ofAkash SinghNessuna valutazione finora

- Islamic Economic SystemDocumento5 pagineIslamic Economic Systemhelperforeu100% (1)

- Understanding Service FailureDocumento20 pagineUnderstanding Service FailureAnonymous H0SJWZE8Nessuna valutazione finora

- Rate Schedules Under The Profession Tax Act, 1975Documento5 pagineRate Schedules Under The Profession Tax Act, 1975Aditya PatilNessuna valutazione finora

- Section - 2 Case-2.4Documento8 pagineSection - 2 Case-2.4syafiraNessuna valutazione finora

- Jason Spero: With Johanna WertherDocumento41 pagineJason Spero: With Johanna WertherVasco MarquesNessuna valutazione finora

- A Brief History of The MBADocumento16 pagineA Brief History of The MBAasimaneelNessuna valutazione finora

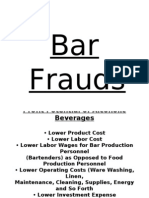

- Bar Frauds & FormsDocumento41 pagineBar Frauds & FormsOm Singh100% (6)

- "Role of Performance ManagementDocumento104 pagine"Role of Performance ManagementSanjay NgarNessuna valutazione finora

- Marriott Promo Codes 2014Documento4 pagineMarriott Promo Codes 2014Dave Ortiz100% (1)

- Short Term and Long Term: by - Chaksh SharmaDocumento17 pagineShort Term and Long Term: by - Chaksh SharmaSushAnt SenNessuna valutazione finora

- Menu EngineeringDocumento9 pagineMenu Engineeringfirstman31Nessuna valutazione finora

- Designing Good Fiscal System FinalDocumento54 pagineDesigning Good Fiscal System Finalbillal_m_aslamNessuna valutazione finora

- Search Engine MarketingDocumento6 pagineSearch Engine MarketingSachinShingoteNessuna valutazione finora

- A Study On Consumer Behaviour About Remanufactured Electronic Gadgets in Indian MarketDocumento10 pagineA Study On Consumer Behaviour About Remanufactured Electronic Gadgets in Indian MarketarcherselevatorsNessuna valutazione finora

- Corporate Finance: Class Notes 10Documento39 pagineCorporate Finance: Class Notes 10Sakshi VermaNessuna valutazione finora

- BSV11102 CW1 D1 22-23 (Project Appraisal & Finance)Documento8 pagineBSV11102 CW1 D1 22-23 (Project Appraisal & Finance)Muhammad AhmadNessuna valutazione finora