Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Market Wrap 020312 (MG)

Caricato da

Ainaaz ZolkifliDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Market Wrap 020312 (MG)

Caricato da

Ainaaz ZolkifliCopyright:

Formati disponibili

MARKET WRAP: WEEK ENDED 3 FEBRUARY12

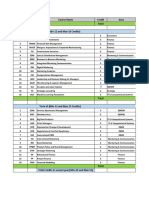

Bursa Securities vs Public Mutuals performance*

FBM KLCI FBMS Shariah MSCI FEXJ# MSCI World# Local Fund PSF PGF PIX PIF PAGF PRSF PBF P SmallCap PEF PFSF PDSF PSSF PSA30F POGF PBBF PBGF PBGSQF Local Islamic Funds P Ittikal PIEF PIOF PIMXAF PIDF PISSF PISTF PIOGF PISEF PIA40GF PISVF PITGF PITSEQ PBIEF Foreign Funds PFES PRSEC PGSF PFEDF PFEBF PTAF PCSF PFEPRF PSEASF PFECTF PCTF PFETIF PNREF PAUEF PFA30F PINDOSF PBAEF PBADF PBEPEF PBCPEF PBCAEF PBCAUEF PBSGA30EF PBAPENTF PBAREIF PBADBF PBINDOBF PSGEF PBAEGF Foreign Islamic Funds PAIF PIADF PIATAF PCIF PIALEF PBIAEF PBIASSF 3 Feb'12 1,538.77 10,676.20 487.36 325.12 0.5623 0.4798 0.6811 0.5201 0.6571 0.6529 0.6816 0.7188 0.2700 0.2612 0.2901 0.2888 0.3077 0.2910 0.7781 0.7726 0.2536 0.8612 0.3442 0.3194 0.2811 0.3642 0.2925 0.3124 0.2810 0.3768 0.2679 0.2521 0.2739 0.2593 0.2416 0.2199 0.1915 0.1799 0.2094 0.2021 0.1971 0.1571 0.2428 0.2513 0.2474 0.2058 0.2859 0.2254 0.2492 0.2131 0.2684 0.2028 0.2705 0.1655 0.1453 0.2255 0.1831 0.2421 0.2143 0.2498 0.2823 0.2629 0.2411 0.2681 0.2533 0.2413 0.2195 0.1707 0.2375 0.2112 0.1738 27 Jan'12 1,520.90 10,515.01 478.13 317.68 0.5553 0.4779 0.6737^^ 0.5141 0.6528 0.6496 0.6780 0.7135 0.2686 0.2575 0.2865 0.2871 0.3043 0.2883 0.7718 0.7610 0.2522 0.8521 0.3405 0.3139 0.2800 0.3609 0.2905 0.3081 0.2781^^ 0.3712 0.2638 0.2507 0.2698 0.2572 0.2378 0.2175 0.1901 0.1782 0.2051 0.2012 0.1964 0.1506^ 0.2402 0.2496 0.2479 0.2012^ 0.2835 0.2249 0.2511 0.2104 0.2702 0.2009 0.2684 0.1641 0.1413^ 0.2239 0.1824 0.2428 0.2130 0.2480 0.2838 0.2640 0.2418 0.2648 0.2519 0.2385 0.2185 0.1682^ 0.2367 0.2100 0.1735 % chng +1.2 +1.5 +1.9 +2.3 +1.3 +0.4 +1.1 +1.2 +0.7 +0.5 +0.5 +0.7 +0.5 +1.4 +1.3 +0.6 +1.1 +0.9 +0.8 +1.5 +0.6 +1.1 +1.1 +1.8 +0.4 +0.9 +0.7 +1.4 +1.0 +1.5 +1.6 +0.6 +1.5 +0.8 +1.6 +1.1 +0.7 +1.0 +2.1 +0.4 +0.4 +4.3 +1.1 +0.7 -0.2 +2.3 +0.8 +0.2 -0.8 +1.3 -0.7 +0.9 +0.8 +0.9 +2.8 +0.7 +0.4 -0.3 +0.6 +0.7 -0.5 -0.4 -0.3 +1.2 +0.6 +1.2 +0.5 +1.5 +0.3 +0.6 +0.2

WEEKLY HIGHLIGHTS The FBM KLCI climbed to a 6-month intraday high of 1,541.3 points on Friday before closing at 1,538.8 points to register a gain of 1.2% for the week. Regional markets closed higher on expectations that U.S. and regional economic activities will continue to be sustained. Looking ahead, the local market is anticipated to move in tandem with overseas markets as investors continue to monitor the outlook for global economic activities. STOCKMARKET COMMENTARY After a weak start to the week, the local market moved higher to touch a 6-month intraday high of 1,541.3 points on Friday in tandem with the resilient tone in offshore markets. The FBM KLCI closed at 1,538.8 points to register a gain of 1.2% for the week. Average daily trading volume increased to 2.4bil from 2.0bil in the preceding week while daily turnover in value terms fell to RM2.3bil from RM2.6bil over the same period. On Wall Street, the Dow moved in a trading range as investors awaited the release of January non-farm jobs data on Thursday. Share prices subsequently rose on Friday upon the release of robust jobs data for January. The Dow closed at 12,862 points to register a weekly gain of 1.6% while the broader-based S&P 500 Index rose by 2.2% to close at 1,345 points. The Nasdaq was up by a wider margin of 3.2% to a 11-year high of 2,906 points over the same period.

# *Buying Price in USD ^NAV as at 18 Jan12. Non Business day from 19 to 27 Jan12 ^^Adjusted for distribution

In the U.S., macroeconomic data released over the week were upbeat with new nonfarm jobs surging to a 9-month high of 243,000 jobs in January 2012 from 203,000 jobs in December 2011 as hiring across all the sectors increased. Private sector jobs continued to gain pace for the third consecutive month. The unemployment rate eased to a 3-year low of 8.3% in January 2012 from 8.5% in December 2011. Meanwhile, the Institute for Supply Managements (ISM) Manufacturing Index rose to a 7-month high of 54.1 in January 2012 from 53.1 in December 2011 on the back of higher new orders and input prices. However, consumer confidence as measured by the Conference Board eased to 61.1 in January 2012 from 64.8 in December 2011 due to lower consumers assessment of current business and labour market conditions. Crude oil prices eased to US$97.84/brl to register a weekly loss of 1.7% following an increase in U.S. oil stockpiles. On the local front, Malaysias loans growth rose to a 3-month high of 13.6% in December from 12.8% in November due to higher growth of corporate loans. Meanwhile, money supply (M3) growth rose to 14.4% in December from 12.4% over the same period on higher deposits. On a weekly basis, the Ringgit strengthened by 0.9% to close at RM3.011 against the US$ while on a year-to-date basis, the Ringgit appreciated by 4.9% against the greenback.

Looking ahead, the local market is anticipated to move in tandem with overseas markets as investors continue to monitor the outlook for global economic activities. As at 3rd February 2012, the local stock market is valued at a P/E of about 15.3x on 2012 earnings, which is lower than its 10-year average P/E ratio of 16.7x but higher than the regional 2012 P/E of 11.3x. However, the local market is supported by a gross dividend yield of 3.6%, which is in line with the 10-year average of 3.7% and the 12-month fixed deposit rate of 3.15%.

Other Markets Performance 3 Feb'12 27 Jan'12 Dow Jones 12,862 12,661 Nasdaq 2,906 2,817 TOPIX 760.7 761.1 SH Comp 2,330 2,319^ China*, H share 11,606 11,447 MSCI China 6,112 6,025 Hong Kong 20,757 20,502 Taiwan 7,675 7,234^^ South Korea 1,972 1,965 Singapore 2,918 2,916 Thailand 1,099 1,076 Indonesia 4,016 3,986

* Hang Seng China Enterprises Index ^ Index as at 20 Jan12 ^^ Index as at 18 Jan12

% chng +1.6 +3.2 -0.1 +0.5 +1.4 +1.4 +1.2 +6.1 +0.4 +0.1 +2.1 +0.7

Bursa Securities Market Valuations^ 3 Feb'12 27 Jan'12 FBM KLCI 1,538.77 1,520.90 PER'12 (x) 15.11 15.31 Price/NTA(x) 5.22 5.43 3mth InterBk 3.22% 3.22% 12mth Fix Dep, % 3.15% 3.15%

*2002-2011 average ^PMB In-House Statistics

10 yr ave* 16.67 2.79 3.12% -

Malaysias Economic Snapshot 2010 2011F GDP growth, % 7.2 5.0 Inflation, % 1.7 3.2

F=forecast

2012F 4.5 2.7

Bursa Securities 10 year P/E Ratio

30 25 20 15 Average: 16.7x 10

01 02 03 04 05 06 07 08 09 10 11 12

3 Feb'12 P/E on 2012 earnings: 15.3x

P/E Ratio (x)

REGIONAL MARKET WRAP: WEEK ENDED 3 FEBRUARY12

Regional Markets Performance 3 Feb'12 27 Jan'12 FBM KLCI 1,539 1,521 MSCI FEXJ# 487 478 China*, H share 11,606 11,447 SH Comp 2,330 2,319^ MSCI China 6,112 6,025 Hong Kong 20,757 20,502 Taiwan 7,675 7,234^^ TOPIX 760.7 761.1 South Korea 1,972 1,965 Singapore 2,918 2,916 Thailand 1,099 1,076 Indonesia 4,016 3,986 Philippines 4,759 4,680 Australia 4,251 4,288

in USD

FORTNIGHTLY REGIONAL MARKETS COMMENTARY WEEKLY HIGHLIGHTS Regional markets closed higher on expectations that U.S. and regional economic activities will continue to be sustained. Manufacturing activities in China showed signs of resilience while inflationary pressures in the region continued to moderate in January. Regional markets are anticipated to continue moving in tandem with global markets as investors monitor the outlook for global economic activities and developments in the Eurozone. STOCKMARKET COMMENTARY In North Asian, the Taiwan market topped the gainers with a weekly gain of 6.1% to a 5-month high of 7,675 points on expectations that Taiwans tech stocks will benefit from the upturn in economic activities in the U.S. Buying was also driven by the end of the long lunar holidays. The China H shares and Hong Kong markets rose by 1.4% and 1.2% respectively for the week. South-East Asian markets remained firm with the Thailand and Philippine markets rising by 2.1% and 1.7% respectively on the back of higher offshore markets. Down under, the Australian market moved in a trading range before ending the week on a loss of 0.9%.

% chng +1.2 +1.9 +1.4 +0.5 +1.4 +1.2 +6.1 -0.1 +0.4 +0.1 +2.1 +0.7 +1.7 -0.9

* Hang Seng China Enterprises Index

^ Index as at 20 Jan12

^^ Index as at 18 Jan12

Regional Economies Snapshot GDP Growth (%) 2010 2011f China 10.4 9.2 Indonesia 6.1 6.3 Singapore 14.5 5.0 Thailand 7.8 2.5 Philippines 7.6 5.0 Taiwan 10.9 4.8 Hong Kong 7.0 5.0 South Korea 6.1 3.8 Japan 4.4 -0.6 Australia 2.7 1.2

2012f 8.0 6.5 4.0 4.0 4.5 3.5 3.8 3.6 2.0 1.5

Source: International Monetary Fund, f=consensus forecast

Regional Markets Valuations Estimated Prospective Dividend P/E Yield (%) (x) Australia 12.08 5.03 Taiwan 13.93 4.80 Thailand 11.59 3.84 Hong Kong 10.51 3.78 China H Shares 8.60 3.61 Singapore 13.57 3.32 Shanghai Comp 9.60 2.92 Philippines 14.43 2.74 Indonesia 13.63 2.43 Japan 17.82 2.42 South Korea 9.65 1.43

Source: Bloomberg, 3 Feb12

PER 26 23 20 17 14 11 8 5 1987 1991

MSCI AC Far-East Ex-Japan- P/E RATIO

Average: 15.57

3 February'12 = 11.25x

1995 1999 2003 2007 2011

Chinas manufacturing activities as measured by the China Federation of Logistics and Purchasings Purchasing Managers Index for Manufacturing rose to a 4-month high of 50.5 in January 2012 from 50.3 in December 2011 due to higher production and new orders. Indonesias inflation rate moderated to 3.7% in January 2012 from 3.8% in December 2011 on lower food prices. In South Korea, the inflation rate eased to a 12-month low of 3.4% in January 2012 from 4.2% in December 2011 on lower food and transportation costs. Thailands inflation rate moderated to 3.4% in January 2012 from 3.5% in December 2011 on lower food prices. As at 3rd February 2012, the valuations of regional markets, as proxied by the MSCI Far East ex-Japan Index, is at a P/E of 11.3x on 2012 earnings, which is 28% lower than its 22year average P/E ratio of 15.6x. Despite the recent rebound in regional markets, selected markets are currently trading at P/E valuations of 10x and below.

You are advised to read and understand the contents of the Master Prospectus of Public Series of Funds dated 30th April 2011 and expires on 29th April 2012, Master Prospectus of Public Series of Shariah-Based Funds dated 30th April 2011 and expires on 29th April 2012, Master Prospectus of PB Series of Funds dated 30th April 2011 and expires on 29th April 2012, Information Memorandum of PB Cash Plus Fund and PB Islamic Cash Plus Fund dated 1st March 2010, Information Memorandum of PBB MTN Fund 1 dated 10th November 2009 and expires on 24th December 2009, Prospectus of Public Singapore Equity Fund dated 7th June 2011 and expires on 29th April 2012, Prospectus of Public Islamic Treasures Growth Fund and Public Sukuk Fund dated 19th July 2011 and expires on 29th April 2012, Prospectus of PB Asia Emerging Growth Fund, PB Bond Fund & PB Sukuk Fund dated 6th September 2011 and expires on 29th April 2012, Prospectus of Public Ittikal Sequel Fund dated 11th October 2011 and expires on 29th April 2012, Prospectus of PB Growth Sequel Fund dated 15th November 2011 and expires on 29th April 2012, Prospectus of Public Islamic Savings Fund dated 15th December 2011 and expires on 29th April 2012, Supplemental Prospectus of Public Tactical Allocation Fund dated 12th December 2011 and expires on 29th April 2012 and Supplemental Prospectus of Public Islamic Mixed Asset Fund and Public Islamic Asia Tactical Allocation Fund dated 12th December 2011 and expires on 29th April 2012. These prospectus have been registered with the Securities Commission who takes no responsibility for their contents, and neither should their registration be interpreted to mean that the Commission recommends the investment. You should note that there are fees and charges involved; and that the prices of units and distribution payable, if any, may go down as well as up. Applications to purchase must come in the form of a duly completed application form referred to in and accompanying the prospectus. A copy of the prospectus can be obtained from your attending agent, corporate representative or nearest Public Mutual Office. Past performance should not be taken as an indication of future performance.

4 Block B, Sri Damansara Business Park, Persiaran Industri, Bandar Sri Damansara, 52200 Kuala Lumpur, Malaysia. P.O. Box 10045, 50700 Kuala Lumpur Tel: 03-62796800 Fax: 603-62779800 Website:http://www.publicmutual.com.my

Public Mutual Berhad (23419-A)

Potrebbero piacerti anche

- Final Project On Stock MarketDocumento329 pagineFinal Project On Stock MarketAllan07563% (27)

- HR Staffing ProposalDocumento11 pagineHR Staffing ProposalPavan KumarNessuna valutazione finora

- JPM Emerging MarketsDocumento26 pagineJPM Emerging Marketsbc500Nessuna valutazione finora

- Tesco 14 FullDocumento4 pagineTesco 14 FullBilal SolangiNessuna valutazione finora

- Market Wrap 010612 (MG)Documento4 pagineMarket Wrap 010612 (MG)Jason KhooNessuna valutazione finora

- Weekly Highlights: Bursa Securities Vs Public Mutual's PerformanceDocumento4 pagineWeekly Highlights: Bursa Securities Vs Public Mutual's PerformancePenyu CuteNessuna valutazione finora

- Market Wrap: Week Ended 2 September 11 Weekly Highlights: Bursa Securities Vs Public Mutual's PerformanceDocumento4 pagineMarket Wrap: Week Ended 2 September 11 Weekly Highlights: Bursa Securities Vs Public Mutual's PerformanceRohana IshakNessuna valutazione finora

- Market Wrap 07 15 11 (MG)Documento4 pagineMarket Wrap 07 15 11 (MG)Khairul AzmanNessuna valutazione finora

- Market Wrap: Week Ended 9 September'11 Weekly Highlights: Bursa Securities Vs Public Mutual's PerformanceDocumento4 pagineMarket Wrap: Week Ended 9 September'11 Weekly Highlights: Bursa Securities Vs Public Mutual's PerformanceakartunjangNessuna valutazione finora

- Market Wrap 110813 (MG)Documento4 pagineMarket Wrap 110813 (MG)hanweeNessuna valutazione finora

- DNH Sri Lanka Weekly 07-11 Jan 2013Documento9 pagineDNH Sri Lanka Weekly 07-11 Jan 2013ran2013Nessuna valutazione finora

- DNH Sri Lanka Weekly 10-14 Dec 2012Documento9 pagineDNH Sri Lanka Weekly 10-14 Dec 2012Randora LkNessuna valutazione finora

- Eekly Conomic Pdate: High Gas Prices Don'T Dent Personal SpendingDocumento2 pagineEekly Conomic Pdate: High Gas Prices Don'T Dent Personal Spendingapi-118535366Nessuna valutazione finora

- Monthly Economic Report: October 2006Documento11 pagineMonthly Economic Report: October 2006Risti ArdhiLaNessuna valutazione finora

- Asia Cyclical Dashboard 130214Documento5 pagineAsia Cyclical Dashboard 130214Yew Toh TatNessuna valutazione finora

- SEB Report: Asian Recovery - Please Hold The LineDocumento9 pagineSEB Report: Asian Recovery - Please Hold The LineSEB GroupNessuna valutazione finora

- Weekly Market Update June 17thDocumento2 pagineWeekly Market Update June 17thmike1473Nessuna valutazione finora

- Gold Market Update April - GSDocumento16 pagineGold Market Update April - GSVictor KerezovNessuna valutazione finora

- Performance Watch May 2015 - 1432730962Documento17 paginePerformance Watch May 2015 - 1432730962gohiljsNessuna valutazione finora

- Eekly Conomic Pdate: Doug Potash PresentsDocumento3 pagineEekly Conomic Pdate: Doug Potash PresentsDoug PotashNessuna valutazione finora

- More Oil in The Chinese Machinery: Morning ReportDocumento3 pagineMore Oil in The Chinese Machinery: Morning Reportnaudaslietas_lvNessuna valutazione finora

- 17 Aug 11 - The Ministry of CNY - 16 - 08 - 11 - 22 - 02Documento8 pagine17 Aug 11 - The Ministry of CNY - 16 - 08 - 11 - 22 - 02tallanzhouwenqiNessuna valutazione finora

- The World Economy - 13/04/2010Documento3 pagineThe World Economy - 13/04/2010Rhb InvestNessuna valutazione finora

- Icn April 2006Documento94 pagineIcn April 2006Fitriyah Hazimah MuhammadNessuna valutazione finora

- Morning Pack: Regional EquitiesDocumento59 pagineMorning Pack: Regional Equitiesmega_richNessuna valutazione finora

- Weekly Commentary 4-2-12Documento2 pagineWeekly Commentary 4-2-12Stephen GierlNessuna valutazione finora

- Asian Weekly Debt HighlightsDocumento12 pagineAsian Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Weekly Market Update Week Ending 2015 February 1Documento4 pagineWeekly Market Update Week Ending 2015 February 1Australian Property ForumNessuna valutazione finora

- SLAMC Weekly (Oct 24, 2011)Documento3 pagineSLAMC Weekly (Oct 24, 2011)Engkiong GoNessuna valutazione finora

- Monthly Report: JANUARY 2013 Daily Pse Index and Value TurnoverDocumento2 pagineMonthly Report: JANUARY 2013 Daily Pse Index and Value TurnoversrichardequipNessuna valutazione finora

- Stumbling Blocks: HighlightsDocumento3 pagineStumbling Blocks: Highlightsjoemar625Nessuna valutazione finora

- Eekly Conomic Pdate: Doug Potash PresentsDocumento2 pagineEekly Conomic Pdate: Doug Potash PresentsDoug PotashNessuna valutazione finora

- Bond Market in AsiaDocumento21 pagineBond Market in Asia00812700Nessuna valutazione finora

- What Beckons: Malaysia EquityDocumento56 pagineWhat Beckons: Malaysia EquityPhoon Kar LiangNessuna valutazione finora

- Fundamentals Dec 2014Documento40 pagineFundamentals Dec 2014Yew Toh TatNessuna valutazione finora

- Internation Al Financial Managemen T: Forex AnalysisDocumento10 pagineInternation Al Financial Managemen T: Forex AnalysisMurali Balaji M CNessuna valutazione finora

- Thai Baht - ForexDocumento10 pagineThai Baht - ForexMurali Balaji M CNessuna valutazione finora

- ASEAN Economics: What Does A Cross-Current of DM Recovery, Rising Real Rates & China Slowdown Mean For ASEAN?Documento20 pagineASEAN Economics: What Does A Cross-Current of DM Recovery, Rising Real Rates & China Slowdown Mean For ASEAN?bodai100% (1)

- Weekly Mutual Fund and Debt Report: Retail ResearchDocumento15 pagineWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanNessuna valutazione finora

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocumento3 pagineRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470Nessuna valutazione finora

- SEB Asia Corporate Bulletin: MayDocumento7 pagineSEB Asia Corporate Bulletin: MaySEB GroupNessuna valutazione finora

- JP Morgan Global Markets Outlook and StrategyDocumento32 pagineJP Morgan Global Markets Outlook and StrategyEquity PrivateNessuna valutazione finora

- Ratings On Thailand Affirmed at 'BBB+/A-2' and 'A-/A-2' Outlook StableDocumento7 pagineRatings On Thailand Affirmed at 'BBB+/A-2' and 'A-/A-2' Outlook Stableapi-239405494Nessuna valutazione finora

- Invesment Strategy 2012Documento16 pagineInvesment Strategy 2012Chai Hong WenNessuna valutazione finora

- Nestle IndiaDocumento38 pagineNestle Indiarranjan27Nessuna valutazione finora

- JPM Weekly MKT Recap 8-13-12Documento2 pagineJPM Weekly MKT Recap 8-13-12Flat Fee PortfoliosNessuna valutazione finora

- Asia Pacific DailyDocumento35 pagineAsia Pacific DailyAnkit SinghalNessuna valutazione finora

- China GDP Growth Eases: Morning ReportDocumento3 pagineChina GDP Growth Eases: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Monthly Report: September 2012Documento44 pagineMonthly Report: September 2012GauriGanNessuna valutazione finora

- India Infoline Weekly WrapDocumento8 pagineIndia Infoline Weekly WrappasamvNessuna valutazione finora

- Westpac - Melbourne Institute Consumer Sentiment Index March 2013Documento8 pagineWestpac - Melbourne Institute Consumer Sentiment Index March 2013peter_martin9335Nessuna valutazione finora

- JSTREET Volume 325Documento10 pagineJSTREET Volume 325JhaveritradeNessuna valutazione finora

- Daily Bulletin (English Version) - 21 Mei 2014Documento22 pagineDaily Bulletin (English Version) - 21 Mei 2014jojo ajahNessuna valutazione finora

- Asia Economic Monitor - December 2003Documento99 pagineAsia Economic Monitor - December 2003Asian Development BankNessuna valutazione finora

- Eekly Conomic Pdate: Doug Potash PresentsDocumento2 pagineEekly Conomic Pdate: Doug Potash PresentsDoug PotashNessuna valutazione finora

- Asia - Weekly Debt HighlightsDocumento13 pagineAsia - Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Markets For You - January 15 2015Documento2 pagineMarkets For You - January 15 2015rps92Nessuna valutazione finora

- Pakistan Short Introduction of The Financial System of A CountryDocumento5 paginePakistan Short Introduction of The Financial System of A CountryAbdul Basit MithaniNessuna valutazione finora

- JPM Weekly MKT Recap 3-05-12Documento2 pagineJPM Weekly MKT Recap 3-05-12Flat Fee PortfoliosNessuna valutazione finora

- Cassidy Turley - U.S. EMPLOYMENT TRACKER February 2014Documento3 pagineCassidy Turley - U.S. EMPLOYMENT TRACKER February 2014Cassidy TurleyNessuna valutazione finora

- Monthly Report: JANUARY 2012 Daily Pse Index and Value TurnoverDocumento2 pagineMonthly Report: JANUARY 2012 Daily Pse Index and Value TurnoversrichardequipNessuna valutazione finora

- Daily Report 20141106Documento3 pagineDaily Report 20141106Joseph DavidsonNessuna valutazione finora

- Chapter 12: Big Data, Datawarehouse, and Business Intelligence SystemsDocumento16 pagineChapter 12: Big Data, Datawarehouse, and Business Intelligence SystemsnjndjansdNessuna valutazione finora

- CAMEL NCP Tuesday FinalDocumento83 pagineCAMEL NCP Tuesday FinalJoel LampteyNessuna valutazione finora

- Comparison of Consumer BehaviorDocumento15 pagineComparison of Consumer BehaviorSubhayu MajumdarNessuna valutazione finora

- Preferential Taxation For Senior CitizensDocumento53 paginePreferential Taxation For Senior CitizensNddejNessuna valutazione finora

- Tan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Documento2 pagineTan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Barrymore Llegado Antonis IINessuna valutazione finora

- CIO 100 2011 - Google Apps For Business-Keval Shah-SumariaDocumento9 pagineCIO 100 2011 - Google Apps For Business-Keval Shah-SumariaCIOEastAfricaNessuna valutazione finora

- Operations and Supply Chain Management B PDFDocumento15 pagineOperations and Supply Chain Management B PDFAnonymous sMqylHNessuna valutazione finora

- Venga Tu ReinoDocumento2 pagineVenga Tu ReinoOmar camacho HernandezNessuna valutazione finora

- CH 12Documento81 pagineCH 12Chiran AdhikariNessuna valutazione finora

- Asian Development Bank: Project Completion ReportDocumento34 pagineAsian Development Bank: Project Completion ReportsanthoshkumarkrNessuna valutazione finora

- Unit I For Bba CBDocumento36 pagineUnit I For Bba CBPoonam YadavNessuna valutazione finora

- Raw Fury ContractDocumento14 pagineRaw Fury ContractMichael Futter100% (1)

- @magzrock Dalal Street Invest Jour - June - 2017Documento69 pagine@magzrock Dalal Street Invest Jour - June - 2017Srinivasulu MachavaramNessuna valutazione finora

- Cost Accounting (Chapter 1-3)Documento5 pagineCost Accounting (Chapter 1-3)eunice0% (1)

- Working Capital Ultra Tech CementDocumento91 pagineWorking Capital Ultra Tech CementGnaneswari GvlNessuna valutazione finora

- Mobilink FinalDocumento28 pagineMobilink FinalMuhammad Imran Burhanullah0% (1)

- CH 10Documento9 pagineCH 10Saleh RaoufNessuna valutazione finora

- Coa M2015-007Documento12 pagineCoa M2015-007Abraham Junio80% (5)

- Incoterms Latest PDFDocumento1 paginaIncoterms Latest PDFAnand VermaNessuna valutazione finora

- Mini Project ON "Amazon - In": Future Institute of Management & Technology Bareilly - Lucknow Road Faridpur, BareillyDocumento44 pagineMini Project ON "Amazon - In": Future Institute of Management & Technology Bareilly - Lucknow Road Faridpur, BareillyImran AnsariNessuna valutazione finora

- Motorola - Strategic OverviewDocumento18 pagineMotorola - Strategic OverviewjklsdjkfNessuna valutazione finora

- HS ComProDocumento7 pagineHS ComProgabrielNessuna valutazione finora

- Section 2 Theories Chapter 20Documento53 pagineSection 2 Theories Chapter 20Sadile May KayeNessuna valutazione finora

- Electives Term 5&6Documento28 pagineElectives Term 5&6GaneshRathodNessuna valutazione finora

- Chapter 5 - External AuditDocumento11 pagineChapter 5 - External AuditJesus ObligaNessuna valutazione finora

- Chapter 13 Principles of Deductions 4Documento6 pagineChapter 13 Principles of Deductions 4Avox EverdeenNessuna valutazione finora

- Stock Update - HCL Tech - HSL - 061221Documento12 pagineStock Update - HCL Tech - HSL - 061221GaganNessuna valutazione finora