Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Go35 300309

Caricato da

Surya KumariTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Go35 300309

Caricato da

Surya KumariCopyright:

Formati disponibili

ABSTRACT RULES Tamil Nadu Value Added Tax Rules, 2007 Amendment to Rules Notification Issued.

ued. __________________________________________________________________ COMMERCIAL TAXES AND REGISTRATION (B1) DEPARTMENT G.O. Ms. No.35 Dated : 30.03.2009 gF 17, UtSt ML 2040. Read : From the Principal Secretary / Commissioner of Commercial Taxes Letter No.Drafting Cell-I/51462/2008 dated: 24.12.2008. -oOoORDER : The Notification annexed to this order will be published in the Extraordinary issue of the Tamil Nadu Government Gazette, dated the 30th March 2009. (BY ORDER OF THE GOVERNOR)

RAJEEV RANJAN, SECRETARY TO GOVERNMENT. To The Works Manager, Government Central Press, Chennai 79. (with a request to publish the Notification in the Extra-ordinary issue of the Tamil Nadu Government Gazette dated 30th March 2009 and send 50 copies to the Government and 500 copies to the Principal Commissioner / Commissioner of Commercial Taxes, Chennai -5) The Principal Secretary / Commissioner of Commercial Taxes, Chepauk, Chennai-5. All Joint Commissioners / All Deputy Commissioners of Commercial Taxes Department (Through the Principal Secretary / Commissioner of Commercial Taxes, Chennai-5.)

Copy to: The Senior PA to Minister (Commercial Taxes), Chennai-9 The Law Department, Chennai-9. The Accountant General (Accounts and Entitlements), Chennai 18. (By name) The Accountant General (Audit)-I/(Audit)-II, Tamil Nadu, Lekha Pariksha Bhavan, 361 Anna Salai, Chennai 600 018. The Commercial Taxes and Registration (B2) Department, Chennai -9. (for paper placing). Stock File / Spare Copies.

// Forwarded / By order // SECTION OFFICER.

ANNEXURE.

NOTIFICATION.

In exercise of the powers conferred by sub-section (1) of section 80 of the Tamil Nadu Value Added Tax Act, 2006 (Tamil Nadu Act 32 of 2006), the Governor of Tamil Nadu hereby makes the following amendments to the Tamil Nadu Value Added Tax Rules, 2007:-

AMENDMENTS.

In the said Rules,(1) namely:in rule 7, after sub-rule (7), the following sub-rule shall be added

"(8) In case of dealers making electronic payment of the tax, the dealers whose taxable turnover in the previous year is two hundred crores of rupees and above, shall file the returns on or before 14th of the succeeding month along with proof of payment of tax and the others shall file the above returns on or before 22nd of the succeeding month along with proof of payment of tax."; (2) in rule 23,(i) after clause (d), the following clause shall be inserted, namely:"(dd) by means of electronic payment through the website of the Commercial Taxes Department."; and (ii) after the proviso, the following proviso shall be added, namely:-

"Provided further that the category of dealers as may be directed by the Commissioner of Commercial Taxes shall make electronic payment of tax through the website of the Commercial Taxes Department.". RAJEEV RANJAN SECRETARY TO GOVERNMENT / True Copy / SECTION OFFICER.

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Statement of Account - ApartmentDocumento4 pagineStatement of Account - ApartmentBryan Jayson BarcenaNessuna valutazione finora

- History of The Republic of The United States of America VOL 6 - John C Hamilton 1857Documento648 pagineHistory of The Republic of The United States of America VOL 6 - John C Hamilton 1857WaterwindNessuna valutazione finora

- 1 Walmart and Macy S Case StudyDocumento3 pagine1 Walmart and Macy S Case StudyMihir JainNessuna valutazione finora

- Pinturas Unidas FINALDocumento60 paginePinturas Unidas FINALAlejandro MoyaNessuna valutazione finora

- The History of The Money Changers by Andrew HitchcockDocumento10 pagineThe History of The Money Changers by Andrew HitchcockMuhammad AndalusiNessuna valutazione finora

- Elw at PDFDocumento131 pagineElw at PDFserdar100% (1)

- APB Live Banks PDFDocumento14 pagineAPB Live Banks PDFHarish KotharuNessuna valutazione finora

- MeaningDocumento2 pagineMeaningHappy BawaNessuna valutazione finora

- JAIB Examination Form PDFDocumento2 pagineJAIB Examination Form PDFManisha ShahaniNessuna valutazione finora

- The Sales ProcessDocumento19 pagineThe Sales ProcessHarold Dela FuenteNessuna valutazione finora

- Drag Me To HellDocumento4 pagineDrag Me To HellEms SekaiNessuna valutazione finora

- CH 04Documento4 pagineCH 04Nusirwan Mz50% (2)

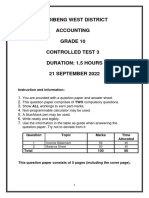

- 2022 Grade 10 Controlled Test 3 QP EngDocumento5 pagine2022 Grade 10 Controlled Test 3 QP EngkellzylesediNessuna valutazione finora

- FII+ +Form+of+Initial+Board+ConsentDocumento7 pagineFII+ +Form+of+Initial+Board+ConsentRick SwordsNessuna valutazione finora

- Principle MaterialDocumento35 paginePrinciple MaterialHay JirenyaaNessuna valutazione finora

- Czech Business and Trade 2/2010Documento60 pagineCzech Business and Trade 2/2010zamorskaNessuna valutazione finora

- WKT MFGDocumento4 pagineWKT MFGGODNessuna valutazione finora

- Lakshmi Agencies: Tax Invoice (Cash)Documento2 pagineLakshmi Agencies: Tax Invoice (Cash)srinivas kandregulaNessuna valutazione finora

- Audit Proforma 2019Documento12 pagineAudit Proforma 2019Spandana pdicdsNessuna valutazione finora

- Home Depot Strategic Audit SampleDocumento18 pagineHome Depot Strategic Audit SamplekhtphotographyNessuna valutazione finora

- Account Statement PDF 1620001413032 12 April 2019Documento57 pagineAccount Statement PDF 1620001413032 12 April 2019elisgretyNessuna valutazione finora

- Dividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsDocumento17 pagineDividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsRitesh ChatterjeeNessuna valutazione finora

- Construction 2020Documento34 pagineConstruction 2020Anonymous 2X8yWQTNessuna valutazione finora

- Hype Cycle For Supply Chain Management, 2009Documento65 pagineHype Cycle For Supply Chain Management, 2009ramapvkNessuna valutazione finora

- Finance Full Moves SopDocumento155 pagineFinance Full Moves Sopharoldpsb100% (3)

- Lampiran C - Raw Judgement - 29 - Kejuruteraan Bintai Kindenko SDN BHDDocumento21 pagineLampiran C - Raw Judgement - 29 - Kejuruteraan Bintai Kindenko SDN BHDFen ChanNessuna valutazione finora

- Case 25-27Documento4 pagineCase 25-27Alyk Tumayan CalionNessuna valutazione finora

- Audit of LiabilitiesDocumento33 pagineAudit of Liabilitiesxxxxxxxxx96% (28)

- FIN-1149-Finance For Non-Finance Managers-Module HANDBOOK - 2022-23 - UpdatedDocumento26 pagineFIN-1149-Finance For Non-Finance Managers-Module HANDBOOK - 2022-23 - UpdatedTyka TrầnNessuna valutazione finora

- v62 Form Honda CivicDocumento2 paginev62 Form Honda Civicdawudaaa9Nessuna valutazione finora