Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Research Project Report Niet

Caricato da

Kishan RajDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Research Project Report Niet

Caricato da

Kishan RajCopyright:

Formati disponibili

RESEARCH PROJECT REPORT

On

Retail Banking

At

Delhi

Submitted for the partial fulfillment towards the award of the degree in Master of Business Administration of Mahamaya Technical University Submitted by: KULDEEP SINGH ROLL NO. 1013370024 (BATCH:2010-2012) UNDER THE SUPERVISION OF: MRS. VANCHAN TRIPATHI

Department of MBA NOIDA INSTITUTE OF ENGINEERING & TECHNOLOGY (NIET) 19, Knowledge Park -2, Industrial Area, GREATER NOIDA Gautam Budh Nagar(UP), (INDIA)-201306

1) INTRODUCTION Retail banking in India has fast emerged as one of the major drivers of the overall banking industry and has witnessed enormous growth in the recent past. The Retail Banking Report encompasses extensive study & analysis of this rapidly growing sector. It primarily covers analysis of the present status, current trends, major issues & challenges in the growth of the retail banking sector. Retail banking is banking in which banking institutions execute transactions directly with consumers, rather than corporations or other banks. Services offered include: savings and transactional accounts, mortgages, personal loans, debit cards, credit cards, and so forth. Retail banking aims to be the one-stop shop for as many financial services as possible on behalf of retail clients. Some retail banks have even made a push into investment services such as wealth management, brokerage accounts, private banking and retirement planning. While some of these ancillary services are outsourced to third parties (often for regulatory reasons), they often intertwine with core retail banking accounts like checking and savings to allow for easier transfers and maintenance. Often retail banking is referred to as "non commercial banking" this would be your common checking accounts and consumer loans. Where as "core banking" is often the very solid business accounts and commercial loans. It is referred to, as 'core' because it is a core or central to the banks business. Few banks survive from just retail banking services, they need those core business accounts that are perhaps more stable than retail business. The exact term usage may also be based on the part of the country you live in as is often the case with our language. All around the world retail lending has been an established market; however its rise in emerging economies like India has been of recent origin. If recent statistics on consumer finance are any indication, the last few years have been trend setting. The traditional debt-averse, middle-class Indians who lived within their thrifty means, never to venture beyond their means, seem to have given way to a new middle-class that is free from all inhibitions regarding conspicuous consumption. Unlike its predecessors, the middle-class of today has donned a new attitude; it attaches no social-stigma in taking loans for spending.

Indian retail banking is up and kicking. During 2004-05 retail contributed 42% of overall credit growth. Growing at the CAGR of 35% over last 5 years the retail asset touched Rs1,89,000 crore. Major product segments of retail credit include housing finance, auto finance, personal loans, consumer durable loan and credit cards to name a few. Housing constitutes the biggest segment of 48% of the entire retail credit; followed by the auto loans segment which constitutes almost 27.8%. While the balance retail credit is used by consumer durables at 7.2%, educational and other personal loans take the remaining 16%. Banks are increasing their dominance in housing finance and capturing the market share of the housing finance companies. During 2004-05, the market share of banks stood at 62%, against the 33% by Housing finance companies; Rs2-5 lakh margins constitutes almost a third of the loan size. All the players in this market are adopting an aggressive attitude and the housing loan availability is playing into the players hands. Despite this phenomenal growth in India, the housing loan as a percentage of GDP at 4.91% indicates low penetration when compared to other countries like Malaysia (17%) and Thailand (9%). But again this coupled with the population growth indicates good future prospects. Following the housing loans, it is the auto loan which is also giving the growth of retail credit the necessary boost. In Asia Pacific, India has emerged as the third largest market for cars and MUVs i.e. only after Japan and China. Low interest rates, easy finance, up-gradation of rider from two- wheeler to 4wheelers and opening up of second hand car finance are growth drivers of this segment. The consumer durable loan follows the auto loan market in the third position, constituting approximately 7% of total credit. Metro centres continue to dominate the market with 29% of total retail credit, closely followed by the rural market at 27% of total retail market. Urban and Semi Urban centres contribute around 22% each. The rural market uprising is a recent phenomenon, which has immense growth potential. While private sector banks have dominance in metropolitan areas, nationalized banks have their hold in the urban and semi-urban areas. The rural areas are dominated by RRBs. The last few years have witnessed a high increase in students aspiring for management and professional courses, leading to a spurt in educational loans. Banks are now having a direct tie-up with the educational institutions to cash in on the opportunity. Public sector banks (PSBs) are more focussed on the educational loans segment. In the educational loan segment, disbursement of domestic banks has surged by 13% to Rs2249 crore in 2004-05; up from Rs1983 crore in 2003-04. The number of students availing education loans has increased to 1,40,000 from 1,08,000 during this period.

The other personal loans market is characterized by intense competition and the players vie with one another to get business. These loans are driven by urgent and short-term needs and banks have to act swiftly to cash in on that need. Metropolitan and urban areas together constitute two third of total loans under this category. Private sector banks lead in metropolitan areas, whereas in the rural areas the nationalized banks dominate. 8

Potrebbero piacerti anche

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesDa EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesNessuna valutazione finora

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Da EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Nessuna valutazione finora

- A Study On Customer Perception Towards The Services Offered in Retail Banking by South Indian Bank, Vennikulam Branch (Kerala)Documento71 pagineA Study On Customer Perception Towards The Services Offered in Retail Banking by South Indian Bank, Vennikulam Branch (Kerala)Lini Susan John100% (4)

- Project On Retail Assets of BOB OkDocumento76 pagineProject On Retail Assets of BOB OkKanchan100% (1)

- Synopsis 1Documento16 pagineSynopsis 1Vipul GuptaNessuna valutazione finora

- A Study On Contemporary Challenges and Opportunities of Retail Banking in IndiaDocumento12 pagineA Study On Contemporary Challenges and Opportunities of Retail Banking in IndiakokoNessuna valutazione finora

- Retail Banking - A Real Growing Concept in The Present Scenario Dr.A.SelvarajDocumento8 pagineRetail Banking - A Real Growing Concept in The Present Scenario Dr.A.Selvarajrajeshraj0112Nessuna valutazione finora

- Impact of Retail Banking in Indian Economy: Research Article Parmanand Barodiya and Anita Singh ChauhanDocumento5 pagineImpact of Retail Banking in Indian Economy: Research Article Parmanand Barodiya and Anita Singh ChauhanthNessuna valutazione finora

- Akshu Full ProjectDocumento73 pagineAkshu Full ProjectAshwini VenugopalNessuna valutazione finora

- Solution 1Documento6 pagineSolution 1searock25decNessuna valutazione finora

- Dissertation Project IqbalDocumento85 pagineDissertation Project Iqbalsunnychauhan89Nessuna valutazione finora

- Project Report On::: Retail Banking StrategyDocumento24 pagineProject Report On::: Retail Banking StrategyMadhuri KanadeNessuna valutazione finora

- Page 11-37Documento28 paginePage 11-37Preeti MishraNessuna valutazione finora

- Kotak FinalDocumento46 pagineKotak FinalRahul FaliyaNessuna valutazione finora

- Study On Retail BankingDocumento47 pagineStudy On Retail Bankingzaru1121Nessuna valutazione finora

- Banking ProjectDocumento35 pagineBanking Projectvarun_varunsharmaNessuna valutazione finora

- Finance (ANALYSIS OF HDFC CAR LOAN'S FINANCE)Documento40 pagineFinance (ANALYSIS OF HDFC CAR LOAN'S FINANCE)AneesAnsariNessuna valutazione finora

- Service Sector BankingDocumento63 pagineService Sector BankingsayliNessuna valutazione finora

- UTI BankDocumento69 pagineUTI BankSnehal RunwalNessuna valutazione finora

- Indian Retail Banking Industry: Drivers & Dooms - An Empirical StudyDocumento16 pagineIndian Retail Banking Industry: Drivers & Dooms - An Empirical StudyApoorva PandeyNessuna valutazione finora

- Retail BankingDocumento15 pagineRetail BankingjazzrulzNessuna valutazione finora

- Banking Retail ProductsDocumento7 pagineBanking Retail ProductsaadisssNessuna valutazione finora

- Retail BankingDocumento10 pagineRetail BankingAtul MadNessuna valutazione finora

- Retail Banking An Introduction Research Methodology: Title of Project Statement of The Problem Objective of The StudyDocumento9 pagineRetail Banking An Introduction Research Methodology: Title of Project Statement of The Problem Objective of The StudySandeep KumarNessuna valutazione finora

- Shyamala Gopinath: Retail Banking - Opportunities and ChallengesDocumento5 pagineShyamala Gopinath: Retail Banking - Opportunities and ChallengesAmol ShindeNessuna valutazione finora

- Banking & InsuranceDocumento35 pagineBanking & InsuranceBhaveen JoshiNessuna valutazione finora

- Service Sector: BankingDocumento62 pagineService Sector: Bankingsteffszone100% (4)

- Issues and Challenges in Indian Banking SectorDocumento7 pagineIssues and Challenges in Indian Banking Sectorbhattcomputer3015Nessuna valutazione finora

- Thesis On Banking in IndiaDocumento4 pagineThesis On Banking in Indiamichellebojorqueznorwalk100% (2)

- Project Ameer Draft For PrintDocumento124 pagineProject Ameer Draft For PrintameerashnaNessuna valutazione finora

- Retail Banking Front Office Management ActivityDocumento66 pagineRetail Banking Front Office Management ActivitysargunkaurNessuna valutazione finora

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDocumento9 pagineA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationNessuna valutazione finora

- Pooja MishraDocumento7 paginePooja MishrasmsmbaNessuna valutazione finora

- 10 Nishith Devraj Paper For Jbfsir 1 PDFDocumento10 pagine10 Nishith Devraj Paper For Jbfsir 1 PDFpareek gopalNessuna valutazione finora

- Challenges To Retail Banking in IndiaDocumento2 pagineChallenges To Retail Banking in IndiapadmajammulaNessuna valutazione finora

- BANKING INDUSTRY-Fundamental AnalysisDocumento19 pagineBANKING INDUSTRY-Fundamental AnalysisGopi Krishnan.nNessuna valutazione finora

- BANKING INDUSTRY-Fundamental AnalysisDocumento19 pagineBANKING INDUSTRY-Fundamental AnalysisGopi Krishnan.nNessuna valutazione finora

- IndexDocumento15 pagineIndexJagdish BambhaniyaNessuna valutazione finora

- 3.1 Assessment of The Position of Credit Inclusion in India and Benchmarking Vis-À-Vis The Global PositionDocumento1 pagina3.1 Assessment of The Position of Credit Inclusion in India and Benchmarking Vis-À-Vis The Global PositionRajat ChawlaNessuna valutazione finora

- 2.10 Retail BankingDocumento14 pagine2.10 Retail BankingSrinivas RaoNessuna valutazione finora

- Banking Module 1Documento26 pagineBanking Module 1mansisharma8301Nessuna valutazione finora

- Retail Banking 11Documento15 pagineRetail Banking 1105550Nessuna valutazione finora

- Yes Bank Mainstreaming Development Into Indian BankingDocumento20 pagineYes Bank Mainstreaming Development Into Indian Bankinggauarv_singh13Nessuna valutazione finora

- Growth and Development of Retail Banking in India: Drivers of Retail BankingDocumento17 pagineGrowth and Development of Retail Banking in India: Drivers of Retail BankingDR.B.REVATHYNessuna valutazione finora

- Ancillary Services Provided by BankersDocumento17 pagineAncillary Services Provided by BankersLogan Davis100% (2)

- Research Paper On Indian BanksDocumento8 pagineResearch Paper On Indian Banksc9sj0n70100% (1)

- Growth and Development of Retail Banking in India: Drivers of Retail BankingDocumento17 pagineGrowth and Development of Retail Banking in India: Drivers of Retail BankingPRASANNANessuna valutazione finora

- 10 Chapter 02Documento28 pagine10 Chapter 02Shweta ShindeNessuna valutazione finora

- Retail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To StudentDocumento51 pagineRetail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To Studentganeshkhale7052Nessuna valutazione finora

- Final ProjectDocumento55 pagineFinal ProjectYash MaheshwariNessuna valutazione finora

- Synopsis On Education LoansDocumento10 pagineSynopsis On Education Loansshriya guptaNessuna valutazione finora

- Retail BakingDocumento29 pagineRetail BakingdarshpujNessuna valutazione finora

- Name: Jay Ketanbhai Changela Enrollment No.: 20fomba11508 For The Submission Of: SeeDocumento26 pagineName: Jay Ketanbhai Changela Enrollment No.: 20fomba11508 For The Submission Of: SeeMAANNessuna valutazione finora

- International Journal of Information Technology and Knowledge ManagementDocumento6 pagineInternational Journal of Information Technology and Knowledge Managementrakeshkmr1186Nessuna valutazione finora

- ChapterDocumento16 pagineChapterAjay YadavNessuna valutazione finora

- It IsinDocumento1 paginaIt IsinRajat ChawlaNessuna valutazione finora

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeDa EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNessuna valutazione finora

- Banking India: Accepting Deposits for the Purpose of LendingDa EverandBanking India: Accepting Deposits for the Purpose of LendingNessuna valutazione finora

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsDa EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNessuna valutazione finora

- 2016 Personal Schedule FeesDocumento24 pagine2016 Personal Schedule FeescampeonpcNessuna valutazione finora

- RDBMS Project - Banking SystemDocumento28 pagineRDBMS Project - Banking SystemSai Keerthan ReddyNessuna valutazione finora

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Documento5 pagineForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sourabh PunshiNessuna valutazione finora

- Banking ProductsDocumento9 pagineBanking Productsbeena antuNessuna valutazione finora

- Banking TransactionsDocumento45 pagineBanking Transactionsmukesh420Nessuna valutazione finora

- Ft2 Cash To Receivables Key FinalDocumento49 pagineFt2 Cash To Receivables Key Finalkmarissee100% (1)

- Wells Fargo Combined Statement of AccountsDocumento4 pagineWells Fargo Combined Statement of Accountskarely jackson lopezNessuna valutazione finora

- Review - Leo SusserDocumento8 pagineReview - Leo Susserapi-707987072Nessuna valutazione finora

- Act 1 Solutions - Cash and Cash EquivalentsDocumento3 pagineAct 1 Solutions - Cash and Cash Equivalents이시연100% (1)

- MAP-DRC-Diagnostic English FinalDocumento195 pagineMAP-DRC-Diagnostic English FinalBoubacar Zakari WARGONessuna valutazione finora

- USAA - Bank StatementDocumento2 pagineUSAA - Bank Statementbills67% (3)

- All About Interest Rates in IndiaDocumento27 pagineAll About Interest Rates in IndiaNitinAggarwalNessuna valutazione finora

- Best Design 1Documento10 pagineBest Design 1AmeliaNessuna valutazione finora

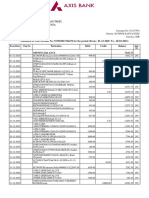

- Axis Bank Latest StatementDocumento4 pagineAxis Bank Latest StatementPrashant KumarNessuna valutazione finora

- Chase Aug V 2.9Documento9 pagineChase Aug V 2.9faxev83733100% (1)

- Sbi Maxgain Home Loan BrochureDocumento8 pagineSbi Maxgain Home Loan Brochuremazin0% (1)

- Business Studies Form Four NotesDocumento66 pagineBusiness Studies Form Four Notestimothy muyumbiNessuna valutazione finora

- Employees OrientationDocumento26 pagineEmployees OrientationRojila luitelNessuna valutazione finora

- Plaint M S Telecom#18Documento16 paginePlaint M S Telecom#18Jitendra PrajapatiNessuna valutazione finora

- Facts:: Bpi vs. Intermediate Appellate Court 164 SCRA 630 (1988)Documento9 pagineFacts:: Bpi vs. Intermediate Appellate Court 164 SCRA 630 (1988)Bluebells33Nessuna valutazione finora

- Research Proposal - Determinants of Local Islamic Bank's Profitability in Malaysia 1Documento44 pagineResearch Proposal - Determinants of Local Islamic Bank's Profitability in Malaysia 1Khairi Izuan100% (1)

- Table of Service and Maintenance FeesDocumento1 paginaTable of Service and Maintenance FeesYt PremNessuna valutazione finora

- CIBC Business Bank Account StatementDocumento24 pagineCIBC Business Bank Account StatementJames RossNessuna valutazione finora

- Diposit Mixing of Shahjalal Islamic BankDocumento22 pagineDiposit Mixing of Shahjalal Islamic BanktauhidultNessuna valutazione finora

- Introduction To Private and Public BankDocumento17 pagineIntroduction To Private and Public BankAbhishek JohariNessuna valutazione finora

- Exercises: LESSON 1: Cash and Cash Equivalents and Petty Cash FundDocumento4 pagineExercises: LESSON 1: Cash and Cash Equivalents and Petty Cash FundRiza Zaira MateoNessuna valutazione finora

- Sanima Bank - CSDDocumento32 pagineSanima Bank - CSDalan maharjanNessuna valutazione finora

- ICICI Bank NewDocumento23 pagineICICI Bank NewTushar DevNessuna valutazione finora

- SRSDocumento14 pagineSRSYaqoob KhanNessuna valutazione finora

- Mode of OperationsDocumento5 pagineMode of OperationsArchana SinhaNessuna valutazione finora