Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Introduction To Retail Loans

Caricato da

Sameer ShahDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Introduction To Retail Loans

Caricato da

Sameer ShahCopyright:

Formati disponibili

Introduction to Retail Loans

India has emerges as one of the largest and fastest growing economies of the world during the last decade. The strengthening of the economy in India has been fuelled by the convergence of several key influences, like growth of the key economy sectors, liberalization policies of the government, well-educated work force and the emergence of a middle class population. India, having the second largest population in the world, is on its way to become the world's fourth largest economy in a span of 2 decades. Due to the restrictive regulatory environment and strict policies of the government of India until the early 1990's the public sector banks and other scheduled banks were the major lenders. Even with the entry of private banks, in the initial phase, there was limited competition between the public sector banks and private banks. Also, the thrust was not on developing the economy consistently through credit growth. Hence, banks did not feel the need to foray into the sectors that were under served. In the current scenario, banks have been thriving on retail lending. The focus of banks now, is to increase the probable profits while limiting possible losses. An increase in market penetration brought about a change in the business environment and in the way banks conducted their business. There was a change in terms of innovation in products as well as processes to cater to the demands of the new age customer on one hand and to protect the bank from multiple risks on the other. Retail exposure of banks includes various types of retail credit, such as residential mortgages, consumer credit cards, automobile and personal loans, loans against securities, and small business loans. Retail Loans - Characteristics

These are small size loans These loans meet the needs of a large number of customers with well diversified portfolios The target customers are generally individuals or small organizations These loans offer standard products to customers. Very rarely a customer's requirement is customized The operations of retail credit are centralized in most of the banks Bankers can make quick credit related decisions because of decentralization These loans are designed to cover varied segments of risks High volume business High number of transactions

Salient features of retail loans

Types of facilities:

Loans are the finance facility of a fixed amount extended to meet a onetime requirement of a customer, for a fixed tenure, to be repaid over a period in installments. To enable customers to meet their emergency requirements, bankers permit them an overdraft [OD]. This means that bankers allow the customer to withdraw more than the credit balance in the customer's current account or give a temporary loan in the current account itself.

Secured/Unsecured facilities: Secured loans are always secured by an underlying asset against which funding is extended. This lending is also known as asset based lending. A specific charge is created against such an asset. This gives the banker/lender the right to take possession of the asset and sell it to recover the loan in case of default. Unsecured loans do not have any underlying security and are purely extended based on the creditworthiness of the borrower. This is also known as non-asset based lending.

Interest: On a loan given at a fixed rate, interest is charged throughout the tenure of the loan at that rate which is fixed at the time of granting the loan. The customer has to pay interest at the contracted rate irrespective of whether the interest rate in the market goes up or down. In case of floating rate of interest, the rate at which the interest is charged on the loan varies from time to time according to the movement of interest rate in the market.

Tenure: The tenure for a loan depends upon the amount of the loan and repayment capacity of the customer. However, the maximum tenure permitted depends upon the period over which the asset financed could depreciate completely.

Loan to Value ratio: Loan to Value ration [LVR] refers to the maximum percentage of the value of the asset that is given as a loan. It varies according to the nature of the asset and also the rate at which the asset is expected to depreciate or reduce in value.

Potrebbero piacerti anche

- A Project Report On The Perception of The Customer About Edc Terminals at HDFCDocumento62 pagineA Project Report On The Perception of The Customer About Edc Terminals at HDFCBabasab Patil (Karrisatte)100% (1)

- Minor Project ON 'Plastic Money of HDFC Bank''Documento67 pagineMinor Project ON 'Plastic Money of HDFC Bank''ankushbabbarbcomNessuna valutazione finora

- A Study On HDFC Bank LTDDocumento17 pagineA Study On HDFC Bank LTDbahaaraujlaNessuna valutazione finora

- SBI Merger Boosts Size But Raises Stability RisksDocumento9 pagineSBI Merger Boosts Size But Raises Stability RisksPrabhujot SinghNessuna valutazione finora

- India Case Study Amalgamation BanksDocumento4 pagineIndia Case Study Amalgamation BanksMakame Mahmud DiptaNessuna valutazione finora

- Fmbo Short AnswersDocumento6 pagineFmbo Short Answersvenkatesh telangNessuna valutazione finora

- Credit Management in Indian Overseas BankDocumento60 pagineCredit Management in Indian Overseas BankAkash DixitNessuna valutazione finora

- Icici Bank Project Summer Internship Program 2020Documento45 pagineIcici Bank Project Summer Internship Program 2020Bhavna PatnaikNessuna valutazione finora

- A Study On Credit Management at District CoDocumento86 pagineA Study On Credit Management at District CoIMAM JAVOOR100% (2)

- Evaluation of Customer Satisfaction On Personal Loan (HDFC& ICICI)Documento32 pagineEvaluation of Customer Satisfaction On Personal Loan (HDFC& ICICI)Suresh Babu Reddy50% (2)

- Hinduja Leyland Finance LTDDocumento42 pagineHinduja Leyland Finance LTDparamjeet99100% (6)

- LIC (Life Insurance Corporation)Documento14 pagineLIC (Life Insurance Corporation)Abhishek KumarNessuna valutazione finora

- Financial ServicesDocumento28 pagineFinancial ServicesPrasad Sandepudi100% (1)

- Home Loans in Banking Sector ReportDocumento17 pagineHome Loans in Banking Sector ReportMohmmedKhayyumNessuna valutazione finora

- Merchant BankingDocumento17 pagineMerchant BankingRaghavendra.K.A100% (1)

- Malaysia: Finance Debt Collateralized Lien Bankruptcy LiquidationDocumento2 pagineMalaysia: Finance Debt Collateralized Lien Bankruptcy LiquidationAkhil UchilNessuna valutazione finora

- A Comparative Analysis of Risk and Return With Special Refrence Infotech and WiproDocumento48 pagineA Comparative Analysis of Risk and Return With Special Refrence Infotech and WiproRajesh RajputNessuna valutazione finora

- Bandhan Bank MbaDocumento15 pagineBandhan Bank MbaShebin JohnyNessuna valutazione finora

- Credit AppraisalDocumento89 pagineCredit AppraisalSkillpro KhammamNessuna valutazione finora

- Retail LoansDocumento3 pagineRetail LoansMonisha Bhatia0% (1)

- Competency Mapping at Ujjivan Small Finance BankDocumento8 pagineCompetency Mapping at Ujjivan Small Finance BankPRANUNessuna valutazione finora

- Retail Banking of Allahabad BankDocumento50 pagineRetail Banking of Allahabad Bankaru161112Nessuna valutazione finora

- Consumer FinanceDocumento17 pagineConsumer FinanceVaishali Trivedi OjhaNessuna valutazione finora

- Consumer Finance..yatith Poojari (Yp)Documento67 pagineConsumer Finance..yatith Poojari (Yp)Yatith PoojariNessuna valutazione finora

- MBA II Semester Short Question & Answers BA 7021 - SECURITY ANALYSIS & PORTFOLIO MANAGEMENTDocumento23 pagineMBA II Semester Short Question & Answers BA 7021 - SECURITY ANALYSIS & PORTFOLIO MANAGEMENTPalani Arunachalam100% (1)

- Credit AppraisalDocumento14 pagineCredit AppraisalRishabh Jain0% (1)

- NBFC Playbook: Understanding Non-Banking Financial CompaniesDocumento13 pagineNBFC Playbook: Understanding Non-Banking Financial CompaniesAkshay TyagiNessuna valutazione finora

- An Overview of Kyc NormsDocumento5 pagineAn Overview of Kyc NormsArsh AhmedNessuna valutazione finora

- Fringe Benefits in HRMDocumento6 pagineFringe Benefits in HRMMudit ChandanNessuna valutazione finora

- Project Presentation On "Reverse Mortgage in India": Presenter: Shaikh Azharoddin Shakeel. Roll No.03 Mms-IiDocumento17 pagineProject Presentation On "Reverse Mortgage in India": Presenter: Shaikh Azharoddin Shakeel. Roll No.03 Mms-IiAzharNessuna valutazione finora

- Income Tax ReturnDocumento96 pagineIncome Tax ReturnKapil SalujaNessuna valutazione finora

- Segmentation and Zone of ToleranceDocumento22 pagineSegmentation and Zone of Tolerancejdroxy4201108Nessuna valutazione finora

- Tax Planning for Business and IndividualsDocumento109 pagineTax Planning for Business and IndividualsrahulNessuna valutazione finora

- Project Synopsis of Insurance CompanyDocumento4 pagineProject Synopsis of Insurance CompanySamar GhorpadeNessuna valutazione finora

- Plastic MoneyDocumento48 paginePlastic Moneyvanishachhabra5008Nessuna valutazione finora

- Various Types of Companies Under Companies Act, 1956-11Documento54 pagineVarious Types of Companies Under Companies Act, 1956-11Upneet Sethi67% (3)

- Banking Fundamentals and Retail Banking DriversDocumento44 pagineBanking Fundamentals and Retail Banking DriversabhinaykasareNessuna valutazione finora

- Consumer FinanceDocumento21 pagineConsumer FinanceNeha AggarwalNessuna valutazione finora

- Ancillary Services Provided by BanksDocumento17 pagineAncillary Services Provided by BanksLogan Davis100% (2)

- Background and History of LICDocumento82 pagineBackground and History of LICVittalrao Kilikile100% (1)

- Presentation On Consumer FinanceDocumento27 paginePresentation On Consumer FinanceswatigouravNessuna valutazione finora

- Money Back PolicyDocumento58 pagineMoney Back PolicyUppal Patel83% (6)

- Icici Prudential Life InsuranceDocumento74 pagineIcici Prudential Life InsuranceJaiHanumankiNessuna valutazione finora

- SBI Home Loans Interest RatesDocumento20 pagineSBI Home Loans Interest RatesbijjubhaiNessuna valutazione finora

- Banking OmbudsmanDocumento66 pagineBanking Ombudsmanmrchavan143Nessuna valutazione finora

- Sip ProjectDocumento126 pagineSip Projectsolanki_dipen2000100% (2)

- Neelam ReportDocumento86 pagineNeelam Reportrjjain07100% (2)

- A Study On CMS in Personal LoanDocumento83 pagineA Study On CMS in Personal LoanPallavi Pallu100% (1)

- PROJECT REPORT On Housing Loans at State Bank of IndiaDocumento23 paginePROJECT REPORT On Housing Loans at State Bank of IndiaDebjyoti Rakshit100% (2)

- Consumer Behaviour Study of IDBI Federal Life Insurance CustomersDocumento9 pagineConsumer Behaviour Study of IDBI Federal Life Insurance CustomersAshu AgarwalNessuna valutazione finora

- Company Profile of HDFC LifeDocumento19 pagineCompany Profile of HDFC LifeNazir HussainNessuna valutazione finora

- Recent Trends in Financial Services Industry in IndiaDocumento3 pagineRecent Trends in Financial Services Industry in IndiaKeyur NeemaNessuna valutazione finora

- Capital Structure Analysis of ICICI Bank and SBIDocumento22 pagineCapital Structure Analysis of ICICI Bank and SBIKuldeep Ban100% (2)

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Fraud Prevention A Complete Guide - 2019 EditionDa EverandFraud Prevention A Complete Guide - 2019 EditionNessuna valutazione finora

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesDa EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNessuna valutazione finora

- Lending Institution in IndiaDocumento24 pagineLending Institution in IndiaMann SainiNessuna valutazione finora

- Banks Shape Economies Through Deposits and LendingDocumento10 pagineBanks Shape Economies Through Deposits and LendingShaifali ChauhanNessuna valutazione finora

- UNIT 2 Process and DocumentationDocumento27 pagineUNIT 2 Process and DocumentationAroop PalNessuna valutazione finora

- CH 01 SecurityDocumento34 pagineCH 01 SecurityKalolo SadathNessuna valutazione finora

- Annual Report 2020Documento107 pagineAnnual Report 2020Carolina CarolinaNessuna valutazione finora

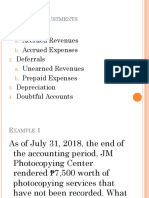

- 3 Completing The Accounting CycleDocumento6 pagine3 Completing The Accounting CycleJuan Dela CruzNessuna valutazione finora

- PFRS 12 Disclosure of Interest in Other EntitiesDocumento9 paginePFRS 12 Disclosure of Interest in Other EntitiesGino PruelNessuna valutazione finora

- P/E ratio reduction with earnings growthDocumento5 pagineP/E ratio reduction with earnings growthMrigank MauliNessuna valutazione finora

- General Ledger FAQ for Retained EarningsDocumento6 pagineGeneral Ledger FAQ for Retained Earningsnachuthan_1Nessuna valutazione finora

- Financial Statement PreparationDocumento9 pagineFinancial Statement PreparationDELFIN, LORENA D.Nessuna valutazione finora

- Efficient Capital MarketDocumento3 pagineEfficient Capital MarketTaimoorKhanNessuna valutazione finora

- AQR More Superstar Investors Woodford and Smith A4Documento16 pagineAQR More Superstar Investors Woodford and Smith A4Michael BornNessuna valutazione finora

- The Related Aggregates of National Income AreDocumento12 pagineThe Related Aggregates of National Income Aretransport bassNessuna valutazione finora

- Managerial Accounting and CostDocumento19 pagineManagerial Accounting and CostIqra MughalNessuna valutazione finora

- Cash Flow Statement FormatsDocumento7 pagineCash Flow Statement FormatsSenelwa AnayaNessuna valutazione finora

- Arthur D. Little UITP Future of Urban Mobility 2 0Documento4 pagineArthur D. Little UITP Future of Urban Mobility 2 0maxblauNessuna valutazione finora

- FUNDAMENTALS OF CASUALTY ACTUARIAL SCIENCE - CHAPTER 5 - Casualty PDFDocumento120 pagineFUNDAMENTALS OF CASUALTY ACTUARIAL SCIENCE - CHAPTER 5 - Casualty PDFRafael Xavier Botelho0% (1)

- BU111 Final December 4 /5 2018: Megan Corbett, Sam Sells, Lauren Carroll, Alex ClaytonDocumento97 pagineBU111 Final December 4 /5 2018: Megan Corbett, Sam Sells, Lauren Carroll, Alex ClaytonJugaadNessuna valutazione finora

- 2019 Survey of VC & PE FundsDocumento88 pagine2019 Survey of VC & PE FundsFazlur TSP100% (1)

- Joint VentureDocumento3 pagineJoint VenturePangestu B DarmoNessuna valutazione finora

- All Weather CritiqueDocumento3 pagineAll Weather Critiqueibs_hyder100% (2)

- Startup India Standup India: Opportunities, Challenges and National SeminarDocumento6 pagineStartup India Standup India: Opportunities, Challenges and National SeminarabhaybittuNessuna valutazione finora

- SSRN Id802724Documento48 pagineSSRN Id802724kaosdfkapsdf100% (1)

- Universal Banking in IndiaDocumento6 pagineUniversal Banking in IndiaashwanidusadhNessuna valutazione finora

- Measuring and Controlling Assets at Aloha ProductsDocumento2 pagineMeasuring and Controlling Assets at Aloha ProductsDenisse MontesNessuna valutazione finora

- 13 Accounting Cycle of A Service Business 2Documento28 pagine13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- Corporate Finance Project On Descon in PakistanDocumento43 pagineCorporate Finance Project On Descon in PakistanuzmazainabNessuna valutazione finora

- Bank FormDocumento3 pagineBank FormgeemanigNessuna valutazione finora

- HBS Classic Case StudyDocumento30 pagineHBS Classic Case Studyrtifaqs24% (21)

- Types of Opinions Provided by The AuditorDocumento20 pagineTypes of Opinions Provided by The AuditorFarrukh TahirNessuna valutazione finora

- BRITANNIADocumento3 pagineBRITANNIAsalmaNessuna valutazione finora

- Solved Suppose That A Consumer With An Income of 1 000 FindsDocumento1 paginaSolved Suppose That A Consumer With An Income of 1 000 FindsM Bilal SaleemNessuna valutazione finora

- Tax Assignment For Mar 7Documento3 pagineTax Assignment For Mar 7Marie Loise MarasiganNessuna valutazione finora