Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

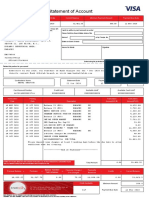

New Balance: Minimum Payment Due: Payment Due Date:: Account Activity Account Member Make Checks Payable To

Caricato da

Scott HeatwoleDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

New Balance: Minimum Payment Due: Payment Due Date:: Account Activity Account Member Make Checks Payable To

Caricato da

Scott HeatwoleCopyright:

Formati disponibili

How to Reach Us 1-866-775-0556 Customer Service BOX 6062 SIOUX FALLS, SD 57117 www.citicards.

com Account Activity 03/12/2012 Account Member SCOTT E HEATWOLE Account Number **** **** **** 3082 Member Since 2004

Make checks payable to: CITI CARDS P.O. BOX 182564 COLUMBUS, OH 43218-2564

New Balance:

Minimum Payment Due:

Payment Due Date:

$3,780.10

$56.00

04/07/2012

Make a payment now! www.payonline.citicards.com

Your next AutoPay payment of $3780.10 will be deducted from your bank account on 04/07/2012.

Summary of Account Activity Previous Balance Payments Other Credits Purchases Cash Advances Fees Charged Interest Charged New Balance Past Due Amount Amt. Over Rev. Cr. Lt. Revolving Credit Limit Avail. Revolving Credit Cash Advance Limit $1,799.32 -$1,799.32 -$0.00 +$3,780.10 +$0.00 +$0.00 +$0.00 $3,780.10 $0.00 $0.00

Late Payment Warning: If we do not receive your minimum payment by the date listed above, you may have to pay a late fee of up to $35 and your APRs may be increased up to the variable Penalty APR of 29.99%.

For information about credit counseling services, call 1-877-337-8187.

$8,500 $4,719 $1,200

Available Cash Limit Statement Closing Date Days in Billing Cycle

$1,200 03/12/2012 32

Dividend Dollars

Total Dividend Dollars Available:

147.58

Full details can be found in the Dividend Dollars Summary section of this statement.

Payments, Credits and Adjustments Sale Post Description 03/07 AUTOPAY 999990000014703RAUTOPAY AUTO-PMT Standard Purchases Sale Post 02/08 02/10 02/09 02/10 02/11 02/11 02/13 02/13 02/16 02/17 02/17 02/17 02/17 02/18 02/19 02/10 02/10 02/11 02/11 02/13 02/13 02/16 02/17 02/17 02/17 02/17 02/18 02/19

Amount -1,799.32

Description SHORE STOP 207 GIANT FOOD INC #351 LOWES #00424* GIANT FOOD INC #351 GIANT FOOD INC #351 TARGET SAMSCLUB #6383 PETSMART INC 456 WAL-MART #1890 CHICK-FIL-A #01079 GIANT FOOD INC #351 KITTY WIRELESS

SALISBURY SALISBURY SALISBURY SALISBURY SALISBURY SALISBURY SALISBURY SALISBURY SALISBURY SALISBURY SEARSPORT

MD MD MD MD MD MD MD MD MD MD MD MD ME

Amount 41.54 53.92 52.18 2.07 15.05 6.67 64.48 550.00 41.33 42.26 17.82 46.90 34.87 29.95

00012336 SALISBURY

CHRISTIAN AID MISSION 434-9775650 VA

SHELL OIL 575263943QPS SALISBURY

How to Reach Us 1-866-775-0556 Customer Service BOX 6062 SIOUX FALLS, SD 57117 www.citicards.com Account Number **** **** **** 3082

Standard Purchases (cont'd) Sale Post 02/23 02/23 02/23 02/25 02/25 02/25 02/25 02/25 02/25 02/25 02/25 02/28 02/28 02/29 02/29 03/01 03/01 03/01 03/03 03/03 03/03 03/04 03/05 03/05 03/07 03/08 03/08 03/09 03/09 03/09 03/10 03/10 03/10 Fees Sale 02/23 02/25 02/25 02/25 02/25 02/25 02/25 02/25 02/25 02/28 02/28 02/29 02/29 03/01 03/01 03/01 03/03 03/03 03/03 03/04 03/05 03/05 03/07 03/08 03/08 03/09 03/09 03/09 03/10 03/10 03/10

Description THE FOX AND OLIVE GIANT FOOD INC #351 THE HOME DEPOT 2561 LOWES #00424* THE HOME DEPOT 2561 PANERA BREAD #3593 WILLIAMS BREWING GIANT FOOD INC #351 GEICO E-ZPASS MD REBILL

SALISBURY SALISBURY SALISBURY SALISBURY SALISBURY 5108952739 SALISBURY SALISBURY SALISBURY

MD MD MD MD MD MD CA MD MD

Amount 36.40 12.80 6.46 7.59 9.98 11.12 17.40 19.02 58.98 650.80 25.00 MD 49.74 20.84 44.78 1.00 26.00 1,170.40 13.74 DE 18.00 51.71 44.45 1.95 86.39 7.99 62.22 46.35 82.97 45.03 47.55 7.29 37.75 59.36 MD

TRACTOR SUPPLY #763

08008413000 DC 888-3216824 MD

SHELL OIL 575263943QPS SALISBURY GIANT FOOD INC #351 SALISBURY MD

J&P*PARK SEED COMPANY 800-845-3369 SC J&P*PARK SEED COMPANY 800-845-3369 SC DELMAR PIZZA PASTA RES DELMAR GATEWAY SUBARU LOWES #00424* SAMSCLUB #6383 DELMAR SALISBURY SALISBURY MD MD MD MD DE

EVOLUTION CRAFT BREWIN DELMAR SHELL OIL 575263937QPS EDEN

J&P*PARK SEED COMPANY 800-845-3369 SC RED HOT & BLUE-ANNAPOL ANNAPOLIS NETFLIX.COM 8005858131 CA MD MD GIANT FOOD INC #351 SALISBURY

ROYAL FARMS 005 Q79 SALISBURY AUTOZONE #1885 GIANT FOOD INC #351 GIANT FOOD INC #351 HOW SWEET IT IS SALISBURY SALISBURY SALISBURY EDEN MD

COMCAST OF SALISBURY 800-COMCAST DE MD MD MD MD TRACTOR SUPPLY #763 SALISBURY

Post

Description TOTAL FEES FOR THIS PERIOD

Amount 0.00

Interest Charged Post Description TOTAL INTEREST FOR THIS PERIOD 2012 Totals Year-to-Date Total Fees charged in 2012 Total Interest charged in 2012 $0.00 $0.00 Amount 0.00

How to Reach Us 1-866-775-0556 Customer Service BOX 6062 SIOUX FALLS, SD 57117 www.citicards.com Account Number **** **** **** 3082

Interest Charge Calculation

Your Annual Percentage Rate (APR) is the annual interest rate on your account.

Type of Balance

Annual Percentage Rate (APR)

Balance Subject to Interest Rate

Interest Charge

PURCHASES Standard Purch ADVANCES Standard Adv Dividend Dollars Summary

Previous Statement Dividend Dollars Total Base Dividend Dollars Earned Special Category Merchant Bonus Card Member Bonus Dividend Dollars Earned Dividend Dollars Earned Dividend Dollars Earned

19.990% 25.240% (V)

$0.00 (D) $0.00 (D)

$0.00 $0.00

109.78

Total Dividend Dollars Earned this period

37.80

Total Dividend Dollars Adjusted

0.00

Total Dividend Dollars Purchased

0.00

Total Dividend Dollars Redeemed

0.00

Total Dividend Dollars Expired Total Dividend Dollars Available

37.80

0.00

0.00

0.00

0.00

147.58

Bonus Cash Back may take one to two billing cycles to appear on your statement. Please refer to the specific terms and conditions pertaining to the promotion for further details.

Transfer high-rate balances and save!

Interest and Fee Information APR for Check Transactions Use by Date 0.000% (Promotional APR on transferred balances until 03/01/2013.) After 03/01/2013, you will be charged the standard APR for purchases, currently 19.990%. In order to qualify for this offer, your check(s) must be received by us and posted to your account by 05/10/2012. If you use the check after that date, we may still honor the check but you will not receive the promotional APR. Instead, the standard APR for purchases will apply. Either $10 or 5.00% of the amount of each balance transfer, whichever is greater. We will begin charging interest on the transaction date. (The interest charge will be $0 while the promotional APR is 0%.)

Fee Paying Interest

Use of the attached check will constitute a charge against your credit account. Your next Autopay automated payment of $3,780.10 will be deducted from your designated bank account on 04/07/2012. Remember, you MUST PAY IN FULL any charges over your revolving credit limit by your statement's Payment Due Date. You may pay all or part of your account balance at any time. However, you must pay, by the payment due date, at least the minimum payment due. Our records show home phone 443-880-3294 and business phone 000-000-0000. If incorrect, please update your account online at www.citicards.com or call us at 1-866-775-0556 to let us know. Thank you for helping save another tree. Because you have not made a payment by mail during the last three months, we may have removed the remit envelope from your statement. To receive your statement online only, enroll today using the URL located on your statement. Your statement has been updated. Your statement has been updated to only show the last four digits of your account number. When contacting customer service please have your credit card available to provide us your full account number.

Make check payable to:

Citi Cards

New Balance: $3,780.10 Minimum Payment Due: $56.00 Payment Due Date: 04/07/2012

**** **** **** 3082

Amount Enclosed:

Payment must be received by 5:00 PM local time on the payment due date.

SCOTT E HEATWOLE 1402 BECKFORD CT SALISBURY MD 21804-2060

CITI CARDS P.O. BOX 182564 COLUMBUS, OH 43218-2564

Information About Your Account.

How to Avoid Paying Interest on Purchases. Your due date is at least 23 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your New Balance by the due date each month. This is called a grace period on purchases. If you do not pay the New Balance in full by the due date, you will not get a grace period on purchases until you pay the New Balance in full for two billing periods in a row. Certain balance transfer offers may take away the grace period on purchases. If that is the case, the balance transfer offer will describe what happens. We will begin charging interest on cash advances and balance transfers on the transaction date. How We Calculate Your Balance Subject to Interest Rate. We calculate it separately for each balance shown in the Interest Charge Calculation table. We use the daily balance method (including current transactions) if the Balance Subject to Interest Rate is followed by (D). We figure the interest charge by multiplying the daily balance by its daily periodic rate each day in the billing period. To get a daily balance, we take the balance at the end of the previous day, add the interest on the previous days balance and new charges, subtract new credits or payments, and make adjustments. The Balance Subject to Interest Rate is the average of the daily balances. We use the average daily balance method (including current transactions) if the Balance Subject to Interest Rate is followed by (A). To get an average daily balance, we take the balance at the end of the previous day, add new charges, subtract new credits or payments, and make adjustments. We add all the daily balances and divide by the number of days in the billing period. We figure the interest charge by multiplying the average daily balance by the monthly periodic rate, or by the daily periodic rate and by the number of days in the billing period, as applicable. Balance Transfers. Balance Transfer amounts are included in the Purchases line in the Summary of Account Activity. Variable APRs. APRs followed by (V) may vary. Minimum Interest Charge. If you are charged interest, the charge will be no less than 50 cents. Membership Fee. To avoid paying this fee, notify us that you are closing your account within 30 days of the mailing or delivery date of the statement on which the fee is billed. Credit Reporting Disputes. If you think we reported inaccurate information to a credit bureau, write us at the Customer Service address shown on the front. Report a Lost or Stolen Card Immediately. Call the Customer Service number shown on the front. What To Do if You Think You Find a Mistake on Your Statement If you think there is an error on your statement, write to us at the Customer Service address shown on the front. If you use the form below, please call Customer Service for assistance. In your letter, give us the following information: Account information: Your name and account number. Dollar amount: The dollar amount of the suspected error. Description of Problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake. You must contact us within 60 days after the error appeared on your statement. You must notify us of any potential errors in writing. You may call us, but if you do we are not required to investigate any potential errors and you may have to pay the amount in question. While we investigate whether or not there has been an error, the following are true: We cannot try to collect the amount in question, or report you as delinquent on that amount. The charge in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a mistake, you will not have to pay the amount in question or any interest or other fees related to that amount. While you do not have to pay the amount in question, you are responsible for the remainder of your balance. We can apply any unpaid amount against your credit limit. Your Rights if You Are Dissatisfied With Your Credit Card Purchases If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due on the purchase. To use this right, all of the following must be true: 1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price must have been more than $50. (Note: Neither of these are necessary if your purchase was based on an advertisement we mailed to you, or if we own the company that sold you the goods or services.) 2. You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that accesses your credit card account do not qualify. 3. You must not yet have fully paid for the purchase. If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing at the Customer Service address shown on the front. While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our decision. At that point, if we think you owe an amount and you do not pay we may report you as delinquent.

Notification of Disputed Item

Please call Customer Service before completing this form.

Please sign and return this form (or a copy) to the Customer Service address on this statement. If you use this form, record the information on the reverse for your records. Dont mail the form with your payment. You authorize us to send information you provide regarding this dispute to the merchant. Please print in blue or black ink.

Important Payment Instructions.

Crediting Payments. If we receive your payment in proper form at our processing facility by 5 p.m. local time there, it will be credited as of that day. A payment received there in proper form after that time will be credited as of the next day. Allow 5 to 7 days for payments by regular mail to reach us. There may be a delay of up to 5 days in crediting a payment we receive that is not in proper form or not sent to the correct address. The correct address for regular mail is the address on the front of the statement. The correct address for courier or express mail is the Express Payments Address shown below. Proper Form. For a payment sent by mail or courier to be in proper form, you must: Enclose a valid check or money order. No cash or foreign currency please. Include your name and account number on the front of your check or money order. If you send an eligible check, you authorize us to complete your payment by electronic debit. If we do, the checking account will be debited in the amount on the check. We may do this as soon as the day we receive the check. Also, the check will be destroyed. Copy Fee. We charge $3 for each copy of a billing statement that dates back 3 months or more. We waive the fee if your request for the copy relates to a billing error or disputed purchase. Payment Options Other Than Regular Mail. Online Bill Payment Service. If you enroll in this service, you can make payments online. Sign on to Account Online every month and pay your bill electronically using your checking or savings account. If we receive your request to make an Online Bill Payment by 5 p.m. Eastern time, we will credit your payment as of that day. If we receive your request to make an Online Bill Payment after that time, we will credit your payment as of the next day. For security reasons, you may be unable to pay your entire New Balance with your first Online Bill Payment. AutoPay Service. If you enroll in this service, your payment amount will be deducted automatically from the account you pick. Your card account will be credited on the due date with that amount. To enroll in AutoPay, visit Account Online today. Pay by Phone Service. You may use this service any time to make a payment by phone. You will be charged $14.95 if a representative of ours helps expedite your payment. Call by 5 p.m. Eastern time to have your payment credited as of that day. If you call after that time, your payment will be credited as of the next day. We may process your payment electronically after we verify your identity. Express Payments. You can send payment by courier or express mail to the Express Payments Address. This address is: Citi Cards, Attention: Payments Department, 1500 Boltonfield Street, Columbus, OH 43228. Payment must be received in proper form at the proper address by 5 p.m. Eastern time to be credited as of that day. All payments received in proper form at the proper address after that time will be credited as of the next day.

CASE ID:

Name (Please Print) Signature/Date Account # Reference # Merchant

I examined the charges on my account and dispute a charge for the following reason:

Amount of Dispute $

J 1. Neither I nor anyone authorized by me made the charge listed above or received the goods

and services represented by this charge. (If you dont recognize a sale, choose this option and call Customer Service immediately).

J 2. I participated in a transaction with the merchant, but was billed for _______ transaction(s)

totaling $___________ that I didnt engage in, nor did anyone else authorized by me. I have all my cards in my possession. Enclose copy of the Authorized sales slip. J 3. I havent received the merchandise. Expected delivery date was ___/___/_____. I contacted the merchant on ___/___/____. The response was ________________________ _________________________________________________________________________________. (You must contact the merchant.)

J 4. I returned/canceled(circle one) merchandise on___/___/_____ because ____________________

_________________________________________________________________________________. Enclose copy of return receipt, postal receipt or proof of refund.

J 5. The attached credit slip was listed as a charge. J 6. I was issued a credit slip for $______________ on ___/___/_____. It was not shown on my

statement. Enclose copy of credit slip.

J 7. Merchandise shipped to me arrived damaged and/or defective on ___/___/_____.

I returned it on ___/___/_____. Merchant response was ______________________________ _________________________________________________________________________________. Enclose copy of postal receipt and/or credit slip.

J 8. My account was charged $____________, but I should have been billed $____________.

Enclose copy of the sales receipt and/or other documents showing correct amount.

J 9. OtherAttach letter describing dispute.

Potrebbero piacerti anche

- Minimum Payment Due: $25.00 New Balance: $412.44 Payment Due Date: 03/20/15Documento4 pagineMinimum Payment Due: $25.00 New Balance: $412.44 Payment Due Date: 03/20/15MaathiaasElopoldiel100% (1)

- Your Consolidated Statement: Contact UsDocumento4 pagineYour Consolidated Statement: Contact UsBraeylnn bookerNessuna valutazione finora

- 01-15-2016 PDFDocumento6 pagine01-15-2016 PDFAnonymous CuFbT1NswYNessuna valutazione finora

- New Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredDocumento6 pagineNew Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredKevin Diaz100% (1)

- Card Statement 2013 7Documento2 pagineCard Statement 2013 72005monicaNessuna valutazione finora

- Texas Bank April30Documento4 pagineTexas Bank April3076xzv4kk5vNessuna valutazione finora

- StatementDocumento4 pagineStatementjoan manuel100% (1)

- Account Details - Navy Federal Credit Union 10.16 To 11.10Documento2 pagineAccount Details - Navy Federal Credit Union 10.16 To 11.10mondol miaNessuna valutazione finora

- Account StatementDocumento3 pagineAccount StatementJamesNessuna valutazione finora

- Avery Houston Patterson 2118 10TH PL'W BIRMINGHAM AL 35204-1309 20107016615Documento2 pagineAvery Houston Patterson 2118 10TH PL'W BIRMINGHAM AL 35204-1309 20107016615Tesatee0% (1)

- A Summary of Your Relationship/s With Us:: Dilli Kumar CDocumento10 pagineA Summary of Your Relationship/s With Us:: Dilli Kumar Cquannbui95Nessuna valutazione finora

- Trader TemplateDocumento4 pagineTrader TemplateAndre ParnellNessuna valutazione finora

- Norman Martin: Moneylion IncDocumento2 pagineNorman Martin: Moneylion Inckeogh takakoNessuna valutazione finora

- Personal Bank Statement TemplateDocumento4 paginePersonal Bank Statement TemplateMimi DiepNessuna valutazione finora

- Cap One StateDocumento6 pagineCap One StatealiNessuna valutazione finora

- Dario JunioDocumento6 pagineDario JunioManuela Granda VallejoNessuna valutazione finora

- Simply Jordan TD Bank Statement Andrew Oct 2021Documento2 pagineSimply Jordan TD Bank Statement Andrew Oct 2021MD MasumNessuna valutazione finora

- Equity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Documento5 pagineEquity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Test000001Nessuna valutazione finora

- ReneeDocumento2 pagineReneeAseadNessuna valutazione finora

- Debit 2021 2 StatementDocumento1 paginaDebit 2021 2 StatementJames DunbarNessuna valutazione finora

- Earnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Documento1 paginaEarnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Muhammad AdeelNessuna valutazione finora

- Bank STDocumento1 paginaBank STnurulamin00023Nessuna valutazione finora

- BOA Statement 2 PDFDocumento7 pagineBOA Statement 2 PDFmdyafi8084Nessuna valutazione finora

- Statement of Account - 171017 To 151117Documento2 pagineStatement of Account - 171017 To 151117Anonymous 44AH37TUNessuna valutazione finora

- Wells Fargo Everyday CheckingDocumento9 pagineWells Fargo Everyday Checkingesthercanalesmanzanares15Nessuna valutazione finora

- Statement Jazzy1 EstatementDocumento2 pagineStatement Jazzy1 EstatementJoshua HansonNessuna valutazione finora

- Marshall Brisco 3176 N 55TH ST MILWAUKEE, WI 53216-3114: Mortgage StatementDocumento2 pagineMarshall Brisco 3176 N 55TH ST MILWAUKEE, WI 53216-3114: Mortgage StatementMarshall BriscoNessuna valutazione finora

- Statement Closing Date 08/12/2020: Payment InformationDocumento4 pagineStatement Closing Date 08/12/2020: Payment Informationadrian mayo100% (1)

- StatementDocumento2 pagineStatementKaitlin CromNessuna valutazione finora

- CreditCardStatement2801868 - 2085 - 27-Oct-20Documento1 paginaCreditCardStatement2801868 - 2085 - 27-Oct-20Abdul AleemNessuna valutazione finora

- MCU News & Promotions: Consolidate Your Bills and Pay Off High Interest Rate Debt Today!Documento7 pagineMCU News & Promotions: Consolidate Your Bills and Pay Off High Interest Rate Debt Today!Annabel MarineNessuna valutazione finora

- Bank Statement Template 27Documento2 pagineBank Statement Template 27mohamed elmakhzni100% (1)

- Billing Summary Your Electric Usage Profile: Bill Acct. No. Due Date Amount DueDocumento2 pagineBilling Summary Your Electric Usage Profile: Bill Acct. No. Due Date Amount DueKeyla ZuletaNessuna valutazione finora

- Credit Card BOA DuyDocumento4 pagineCredit Card BOA Duynghia leNessuna valutazione finora

- Checking Account StatementDocumento2 pagineChecking Account StatementDevin GaulNessuna valutazione finora

- Unknown PDFDocumento2 pagineUnknown PDFMadalina MadaNessuna valutazione finora

- HUDSON VALLEY Satement USADocumento5 pagineHUDSON VALLEY Satement USAЮлия ПNessuna valutazione finora

- Green Dot StatementDocumento2 pagineGreen Dot StatementTerry WinegarNessuna valutazione finora

- BB&T Bank StatementDocumento7 pagineBB&T Bank StatementBraeylnn bookerNessuna valutazione finora

- Belize Bank StatementDocumento2 pagineBelize Bank StatementJecky SrabonNessuna valutazione finora

- Estmt - 2023 12 05Documento6 pagineEstmt - 2023 12 05alejandro860510Nessuna valutazione finora

- Viaions of The EndDocumento5 pagineViaions of The EndDon PayneNessuna valutazione finora

- Account Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021Documento2 pagineAccount Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021franklin reid rosarioNessuna valutazione finora

- Main Account: Vaska's Account Monthly FeeDocumento4 pagineMain Account: Vaska's Account Monthly FeeAkingbade VictorNessuna valutazione finora

- Account 505-275-7745 220: Billing Date Jul 22, 2023Documento40 pagineAccount 505-275-7745 220: Billing Date Jul 22, 2023kathyta03Nessuna valutazione finora

- Dan Bank StatementDocumento3 pagineDan Bank StatementJessica FullerNessuna valutazione finora

- STMT 20210131Documento2 pagineSTMT 20210131manonmani somasundaramNessuna valutazione finora

- Detailed Statement: Citibank Rewards Platinum CardDocumento4 pagineDetailed Statement: Citibank Rewards Platinum CardSudhir BarwalNessuna valutazione finora

- Your RBC Personal Banking Account StatementDocumento7 pagineYour RBC Personal Banking Account Statementmansoj777Nessuna valutazione finora

- Monthly StatementDocumento2 pagineMonthly StatementYuniioor UrbaezNessuna valutazione finora

- May StatementDocumento30 pagineMay Statementkleveland100% (1)

- 001nov262019 PDFDocumento2 pagine001nov262019 PDFsarahNessuna valutazione finora

- Late Payment WarningDocumento2 pagineLate Payment WarningAlanNessuna valutazione finora

- Statement September 2019Documento6 pagineStatement September 2019Mike Schmoronoff100% (1)

- Account Summary: 1-800-427-2200 EnglishDocumento2 pagineAccount Summary: 1-800-427-2200 Englishytprem aguNessuna valutazione finora

- John Wilson Randolph 1189 Nelson Hollow RD Somerville Al 35670Documento5 pagineJohn Wilson Randolph 1189 Nelson Hollow RD Somerville Al 35670Paul Anderson100% (1)

- Statement 2022 01 21Documento4 pagineStatement 2022 01 21Ali HassanNessuna valutazione finora

- Statement PDFDocumento6 pagineStatement PDFNelson Lanyuy67% (3)

- 01-14-2016Documento6 pagine01-14-2016SusanaNessuna valutazione finora

- Jan 28-Feb 24, 2010: Account ActivityDocumento3 pagineJan 28-Feb 24, 2010: Account ActivityAna OdenNessuna valutazione finora

- Stow v. Grimaldi, 1st Cir. (1993)Documento10 pagineStow v. Grimaldi, 1st Cir. (1993)Scribd Government DocsNessuna valutazione finora

- CPC - SummonsDocumento31 pagineCPC - SummonsNitin Sherwal83% (6)

- Lexmark 4096-00x Color Jet Printer 1000, 1100 Service ManualDocumento56 pagineLexmark 4096-00x Color Jet Printer 1000, 1100 Service ManualJose AlbanNessuna valutazione finora

- Price ListDocumento18 paginePrice ListDhiraj AgrawalNessuna valutazione finora

- 10 Big Business Breakthroughs Action GuideDocumento27 pagine10 Big Business Breakthroughs Action GuideAnthony Gay100% (3)

- Vso Fundraising Guide Ngo PDFDocumento30 pagineVso Fundraising Guide Ngo PDFChougule KiranNessuna valutazione finora

- Part B-RFP-Muzizi OE FinalDocumento161 paginePart B-RFP-Muzizi OE FinalNoli CorralNessuna valutazione finora

- Promissory NoteDocumento2 paginePromissory NoteMalcolm Walker91% (22)

- Correspondence With Memory ReadingDocumento12 pagineCorrespondence With Memory ReadingNadia CentenoNessuna valutazione finora

- Editorial Board - 2004 - Clinical Psychology ReviewDocumento1 paginaEditorial Board - 2004 - Clinical Psychology Reviewfredrussell8989Nessuna valutazione finora

- Phlpost Docs 20141031 787013f96fDocumento2 paginePhlpost Docs 20141031 787013f96fDenzel Edward CariagaNessuna valutazione finora

- Distribution Restriction Statement: Cehm-B Engineer Pamphlet 37-1-3 U.S. Army Corps of Engineers EP 37-1-3 1 May 1998Documento53 pagineDistribution Restriction Statement: Cehm-B Engineer Pamphlet 37-1-3 U.S. Army Corps of Engineers EP 37-1-3 1 May 1998Ahmad Ramin AbasyNessuna valutazione finora

- Postal and Telecommunications Regulatory Authority of Zimbabwe (Potraz)Documento24 paginePostal and Telecommunications Regulatory Authority of Zimbabwe (Potraz)Jacob PossibilityNessuna valutazione finora

- Notice123 PDFDocumento68 pagineNotice123 PDFhey_hopNessuna valutazione finora

- The Dallas Post 05-06-2012Documento18 pagineThe Dallas Post 05-06-2012The Times LeaderNessuna valutazione finora

- Postal Communications in Ancient and Medieval IndiaDocumento9 paginePostal Communications in Ancient and Medieval IndiaJ DaschaudhuriNessuna valutazione finora

- 34 Chap - Module 5 - Direct MarketingDocumento7 pagine34 Chap - Module 5 - Direct MarketingraisehellNessuna valutazione finora

- Emergency Motion To Preserve EvidenceDocumento18 pagineEmergency Motion To Preserve EvidenceJay WayneNessuna valutazione finora

- Invoice PDFDocumento1 paginaInvoice PDFSHASHANKNessuna valutazione finora

- Rotaract Club Public Relations TutorialDocumento8 pagineRotaract Club Public Relations TutorialNaelElMenshawyNessuna valutazione finora

- RTO Work For KarnatakaDocumento5 pagineRTO Work For Karnatakamachnik1486624Nessuna valutazione finora

- 2016-08-01 Watercolor ArtistDocumento76 pagine2016-08-01 Watercolor ArtistJuanRodriguez100% (4)

- Schools - HSMS 20111123 Central RegisterDocumento79 pagineSchools - HSMS 20111123 Central RegisterWilliam F. ZachmannNessuna valutazione finora

- Sellos de PARAGUAYDocumento28 pagineSellos de PARAGUAYRene Luis RodriguezNessuna valutazione finora

- Ce A ApplicationformDocumento2 pagineCe A ApplicationformChris SheltonNessuna valutazione finora

- Bhartiya Post September 09Documento14 pagineBhartiya Post September 09K V Sridharan General Secretary P3 NFPENessuna valutazione finora

- 1st Online National Moot Court Competition Brochure 2021Documento20 pagine1st Online National Moot Court Competition Brochure 2021Konark RajNessuna valutazione finora

- Vintage Airplane - Jun 1993Documento36 pagineVintage Airplane - Jun 1993Aviation/Space History Library100% (2)

- Adult SIMPLIFIED RENEWAL Passport Application: Who May Use This Form? Applying in PersonDocumento6 pagineAdult SIMPLIFIED RENEWAL Passport Application: Who May Use This Form? Applying in PersonMary CycleNessuna valutazione finora

- Popular Mechanics - August 2023 USADocumento84 paginePopular Mechanics - August 2023 USARob JongenNessuna valutazione finora

- Summary of Noah Kagan's Million Dollar WeekendDa EverandSummary of Noah Kagan's Million Dollar WeekendValutazione: 5 su 5 stelle5/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeDa EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeValutazione: 4.5 su 5 stelle4.5/5 (90)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffDa Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffValutazione: 5 su 5 stelle5/5 (19)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoDa Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoValutazione: 5 su 5 stelle5/5 (25)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverDa EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverValutazione: 4.5 su 5 stelle4.5/5 (186)

- Portfolio management strategies for technical analystsDa EverandPortfolio management strategies for technical analystsNessuna valutazione finora

- The Leader Habit: Master the Skills You Need to Lead--in Just Minutes a DayDa EverandThe Leader Habit: Master the Skills You Need to Lead--in Just Minutes a DayValutazione: 4 su 5 stelle4/5 (5)

- High Road Leadership: Bringing People Together in a World That DividesDa EverandHigh Road Leadership: Bringing People Together in a World That DividesNessuna valutazione finora

- Summary of Thinking, Fast and Slow: by Daniel KahnemanDa EverandSummary of Thinking, Fast and Slow: by Daniel KahnemanValutazione: 4 su 5 stelle4/5 (117)

- Radical Confidence: 11 Lessons on How to Get the Relationship, Career, and Life You WantDa EverandRadical Confidence: 11 Lessons on How to Get the Relationship, Career, and Life You WantValutazione: 5 su 5 stelle5/5 (52)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterDa EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterValutazione: 5 su 5 stelle5/5 (3)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureDa EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureValutazione: 4.5 su 5 stelle4.5/5 (100)

- The First Minute: How to start conversations that get resultsDa EverandThe First Minute: How to start conversations that get resultsValutazione: 4.5 su 5 stelle4.5/5 (57)