Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Millennial Media Smart 2011 YIR

Caricato da

Brad FowlerDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Millennial Media Smart 2011 YIR

Caricato da

Brad FowlerCopyright:

Formati disponibili

Scorecard for Mobile Advertising Reach and Targeting (S.M.A.R.T.

YEAR IN REVIEW

Visit www.millennialmedia.com/mobile-intelligence to sign up

Mobile Vertical Spending in 2011

2011 Year in Review

Top 10 Global Advertising Verticals

2011 Ranked by Spend CHART A

Vertical Explosion

VERTICALS

Year over Year Spend Growth - 2011/2010 CHART B

RANK 1 2 3 4 5 6 7 8 9 10

CATEGORIES FINANCE RETAIL & RESTAURANTS ENTERTAINMENT TELECOMMUNICATIONS AUTOMOTIVE PORTALS & DIRECTORIES CPG/FMCG EDUCATION TRAVEL TECHNOLOGY

GROWTH

TECHNOLOGY FINANCE HEALTH: FITNESS & WELLNESS CPG/FMCG RETAIL & RESTAURANTS AUTOMOTIVE PHARMACEUTICALS ENTERTAINMENT EDUCATION

Source: Millennial Media, 2011.

698% 314% 229% 199% 193% 185% 159% 133% 122%

Source: Millennial Media, 2011.

Insights:

In 2011, nine verticals experienced triple digit growth year-over-year (Chart B). Health: Fitness & Wellness has not been on the Top 10 Global Advertising Vertical ranking to date, yet experienced growth of 229% year-over-year (Chart B). Health: Fitness & Wellness advertisers leveraged mobile to provide seasonally relevant messages to customers, heavily promoting tness products during the beginning of the year and summer months, while promoting wellness products and services during the cold and allergy seasons. Finance was the number one vertical on the Top 10 Global Advertising Vertical ranking (Chart A). Finance campaign spending grew 314% year-over-year (Chart B). In 2011, Banking advertisers utilized mobile to create awareness campaigns and drive customers into their branch locations while insurance and credit card brands heavily utilized mobile for generating leads. Entertainment experienced a 133% increase year-over-year (Chart B) and ranked in the number three spot on the Top 10 Global Advertising Vertical ranking (Chart A). In 2011, advertisers in the Entertainment vertical leveraged mobile to create awareness of new motion picture and DVD releases. They also drove downloads of branded applications, which allowed customers to watch premium television content on-the-go. CPG/FMCG ranked in the number seven spot on the Top 10 Global Advertising Vertical ranking (Charts A). Year-over-year CPG/FMCG spending increased 199% (Chart B). CPG/FMCG advertisers utilized mobile to engage customers through social media platforms. They leveraged those channels to cross-promote and drive product reuse by providing product usage tips to their target audiences.

Audience Targeting: Real World Audiences

Audience Targeting builds audiences by analyzing massive amounts of data every day, supplying algorithmically controlled enrollments into rich behavioral models. This enables verticals, like Automotive, to connect with their intended audiences at exactly the most relevant time and place. Audience Targetings capacity to reach consumers who are actively considering product purchase is powering the Automotive verticals spend growth.

AUTO INTENDER AUDIENCE

ACTIVITY

Location Actions Views Standard Attributes

TIME

Visit www.millennialmedia.com/advertise/targeting to learn more.

Visit www.millennialmedia.com/mobile-intelligence to sign up

2011 Mobile Advertising Trends & Campaign Goals

2011 Year in Review

TOP 3 GLOBAL ADVERTISER TRENDS OF 2011

LOCAL TARGETING 1 NA: In 2011, we saw a shift in

advertising dollars from traditional media, such as print and radio, to mobile campaigns. EMEA: Sophisticated targeting, including local market targeting, has been a key driver for retail spend as this maximises campaign eectiveness by targeting consumers when they are in the vicinity and drives instore footfall. SEA: Advertisers leveraged mobile to deliver locally relevant messages to their target audiences, knowing that within Southeast Asia, consumer trends can vary greatly from country to country.

2 MOBILE VIDEO year we saw NA: Throughout the

brands increase their investment in mobile video advertising to drive brand awareness for their products and services. EMEA: Entertainment advertisers led other verticals in incorporating mobile video into their campaigns, enabling their movie trailers and TV spots to engage audiences at scale. SEA: In 2011, we saw an increase in the adoption of tablets and smartphones. Advertisers responded to this trend by increasing the usage of mobile video and extending their TV creative to mobile.

REACH 3 MASS MARKETutilized mobile as a NA: Brands further

mass media solution, enabling them to reach audiences at scale. EMEA: Brands are demanding social media integration within ad units, to leverage the omnipresent nature of the channel and encourage secondary, viral content distribution. SEA: Brands recognized the continued need to create cross-platform mobile campaigns in response to the explosion of iOS and Android in the region. While Android is growing rapidly in Indonesia, BlackBerry continues to dominate and is the leading mobile platform that brands target in the Indonesian market.

Insights:

In 2011, we saw three main advertiser trends emerge, the growth of local market targeting, the adoption of mobile video, and the continued use of mobile for mass market reach. Our Top 3 Global Advertisers Trends capture how each of these global trends were seen on a local level in North America (NA), Europe, the Middle East, Africa (EMEA), and Southeast Asia (SEA). The Top Campaign Goal in 2011 was Sustained-In-Market Presence, representing 31% of the Advertisers Campaign Goal Mix (Chart A). Campaigns with the goal of Sustained-In-Market Presence drove consumers to download applications and to play branded games to promote their products and services, while increasing their brand awareness and loyalty. Lead Gen/Registrations represented 25% of the Advertisers Campaign Goal Mix (Chart A). Education was one of the top verticals which ran campaigns with a goal of Lead Gen/Registrations. Education brands focused on generating lead lists for their various regional degree programs.

Advertisers Campaign Goals

2011 CHART A

5% 31%

9% 12% 18%

SUSTAINED IN MARKET PRESENCE LEAD GEN/REGISTRATIONS PRODUCT LAUNCH/RELEASE BRAND AWARENESS INCREASED FOOT TRAFFIC SITE TRAFFIC

25%

Source: Millennial Media, 2011. Data is based on the Top 250 Campaigns monthly on Millennial Medias Platform in 2011.

Visit www.millennialmedia.com/mobile-intelligence to sign up

2011 Mobile Advertising Trends Spotlight on HTML5

2011 Year in Review

DEFINITION:

HTML5 The next-generation of HTML which is changing the mobile advertising world. HTML5 is a combination of the fth revision of the HTML markup language, CSS3, and a series of JavaScript APIs that is cross-platform, eliminating the need for 3rd party plug-ins. HTML5 enables mobile advertisers to create powerful, vibrant experiences that enhance interactivity and connectivity, which previously could only be created for desktop platforms.

BEST PRACTICES:

Make Motion HTML5 can manipulate the page beyond its dimensions, using gestures or user position to provide immersive experiences for users. Use Video HTML5 enables users to rotate, move, and resize video to maximize their experience. Create Audio Events 3rd party plug-ins are no longer needed with HTML5, making audio simple and dependable.

CAMPAIGN HIGHLIGHT: WESTIN

We've been very impressed with the ability of the in Millennial platform to extend our brand campaign

mobile with high levels of consumer engagement. We are inspired by the results from a recent media eectiveness test indicating our rich mobile units with Millennial are driving positive lifts across key brand attributes.

~ Christi Gettinger, Sr. Director Brand Management Westin Hotels & Resorts

GOAL:

Extend Westins new campaign into mobile channels with cutting edge rich media that would drive brand awareness and preference with travelers on-the-go.

STRATEGY:

The campaign featured two separate rich media creatives. The rst was a shakable unit that allowed consumers to display dierent Westin images that could be changed by physically shaking the phone. The second unit featured a screen full of balloons, which users could pop by touching. When every balloon was popped, an image was revealed of a woman lying on a bed of balloons, symbolic of how Westin has engineered a good nights sleep through the Heavenly Bed.

DOWNLOAD THE FULL CAMPAIGN SUMMARY NOW!

www.millennialmedia.com/advertise/campaign-successes

Visit www.millennialmedia.com/mobile-intelligence to sign up

2011 Mobile Advertising Trends Campaign Engagement Methods

2011 Year in Review

Campaign Destination Mix

2011 CHART A

2011 CHART B

Post-Click Campaign Action Mix

22% 53% 25%

40% 35% 30% 25% 20% 15% 10% 5% 0%

36% 32% 31% 23% 18% 15% 24%

22% 19% 13%

MOBILE SITE APPLICATION DOWNLOAD LANDING PAGE

Source: Millennial Media, 2011. Campaign destinations represent the immediate click-through from creative to site, landing page, or rich media. Data is based on the Top 250 Campaigns monthly on Millennial Medias Platform in 2011.

APPLICATION DOWNLOAD

ENROLL/ JOIN/ SUBSCRIBE

mCOMMERCE

MOBILE SOCIAL MEDIA

PLACE CALL

RETAIL PROMOTION

SITE SEARCH

STORE LOCATOR

VIEW MAP

WATCH VIDEO

Source: Millennial Media, 2011. Data is based on the Top 250 Campaigns monthly on Millennial Medias Platform in 2011.

Insights:

Application Download represented 25% of the Campaign Destination Mix and 32% of the Post-Click Campaign Action Mix in 2011 (Charts A & B). With the rapid Tablet adoption that occurred in 2011, customers increasingly had two or more mobile devices and advertisers responded to this trend by creating branded applications with the full functionality of their websites in a simple user interface. The Retail and Finance verticals led other verticals in creating high utility applications that allow customers to easily transact on-the-go. Watch Video was included in 24% of the campaigns in 2011 as a Post-Click Campaign Action (Chart B). Entertainment and Telecom advertisers heavily utilized Watch Video as a Post-Click Campaign Action in their mobile campaigns to promote the release of new motion pictures and new mobile devices. In 2011, Store Locator accounted for 23% of the Post-Click Campaign Action Mix (Chart B). Advertisers in the Retail vertical leveraged mobile to promote seasonal sales, while Auto advertisers promoted new model year releases; both verticals drove customers to brick and mortar locations (retail outlets and auto dealerships) to complete their purchases.

CAMPAIGN HIGHLIGHT: MODERN WARFARE 3

GOAL: Drive pre-orders ahead of the game release date, generate awareness and social media buzz. STRATEGY: The rich media creative included a video trailer, post-click social media actions, and a store locator that enabled consumers to nd the nearest site where they could pre-order. The campaign also leveraged mCommerce to allow consumers to pre-order the game from Amazon.com directly on their mobile devices. "Modern Warfare 3 was the most talked about entertainment release of 2011 and the multi-faceted nature of the campaign allowed us to hit all our objectives. Not only did the mobile campaign drive strong consumer awareness across a key touch point, but it helped fuel fan engagement across all major social media platforms."

~ Alex Hicks, Activation Manager at MEC

DOWNLOAD THE FULL CAMPAIGN SUMMARY NOW!

www.millennialmedia.com/advertise/campaign-successes

Visit www.millennialmedia.com/mobile-intelligence to sign up

2011 Developer Trends

2011 Year in Review

Top Mobile Application Categories

Ranked by Impressions CHART A 2011 1 2 3 4 5 6 7 8 9 10 2010 2 3 1 4 8 7 5

TOP 3 DEVELOPER TRENDS OF 2011

CATEGORIES GAMES MUSIC & ENTERTAINMENT SOCIAL NETWORKING COMMUNICATIONS NEWS SPORTS WEATHER PRODUCTIVITY & TOOLS HEALTH & FITNESS TRAVEL & LOCAL

shifting spend to mobile from other 1 With advertisersads became mainstream and app channels, video

developers beneted from these higher eCPM campaigns.

embraced the cross-platform opportunity. 2 Developersand monetized applications across every They built major platform.

3 As tablets soared in popularity with consumers, developers responded with applications for iPad,

Amazons Kindle Fire, and other popular devices.

Source: Millennial Media, 2010-2011.

Highlights of 2011 Device & Developer Trends:

Gaming applications moved into the number one spot on the Top Mobile Application Categories ranking in 2011, growing 16% year-over-year (Chart A). Popular gaming developers like Zynga and Rovio heavily contributed to the continued growth of gaming applications in 2011. Music & Entertainment applications moved to the number two position on the Top Mobile Application Categories ranking in 2011 (Chart A). With the increased sophistication of Smartphones and the larger viewing screens of tablets, Music & Entertainment applications doubled their impression share year-over-year, as consumers started using their mobile devices for entertainment. In 2011, Android led the OS Mix on our platform with 47% of the impressions, a 57% increase year-over-year (Chart B, Page 7). Android was the fastest growing OS on our platform in 2011 and overtook iOS as the leading OS at the end of 2010. In 2011, over a dozen new tablet devices entered the market, along with new versions of the two leading tablet devices, the Apple iPad and the Samsung Galaxy Tab (Chart A, Page 7). In November 2011, the Kindle Fire entered the U.S. market as the rst signicant contender to the leading tablet, the Apple iPad. Within the rst few weeks of launch, the Kindle Fire grew at an average daily rate of 19%, slightly outpacing the growth of the original Apple iPad at its launch (Chart A, Page 7).

MOBILE ADVERTISING BEST PRACTICES FOR APP DEVELOPERS

As in-app advertising becomes central to a mobile app developers monetization strategy, its important to understand how to make the most of this growing opportunity. Developers should consider the following best practices to maximize the revenue they earn through advertising: Integrate all types of ads This includes banners and rich media, but also mobile video ads that can dramatically boost eCPMs. Provide available metadata Metadata includes age, zip code, latitude/longitude, etc. This is data that users have agreed to share with your application, and have given you permission to share with us. Integrate the latest SDKs To access all of the available revenue-generating technology and capabilities desired by top brand advertisers.

Mobile application developers can visit developer.millennialmedia.com to learn more.

Visit www.millennialmedia.com/mobile-intelligence to sign up

2011 Developer Trends

2011 Year in Review

2011 U.S. Tablet Launches

CHART A

Motorola Xoom FEBRUARY 2011

Apple iPad 2 MARCH 2011

HTC Flyer MAY 2011

HP Touchpad JULY 2011

Amazon Kindle Fire NOVEMBER 2011

Dell Streak 7 FEBRUARY 2011

BlackBerry Playbook APRIL 2011

Galaxy Tab 10.2 JUNE 2011

Sony Tablet D AUGUST 2011

Source: Washington Post, CNN Money, Amazon, PC World, InfoSync, Android Community, 2011.

OS Mix including Smartphones & Other Connected Devices

Ranked by Impressions CHART B

Connected Device Mix

Ranked by Impressions CHART C

2011

2%1% 1% 16% 47% 33%

3% 2% 6% 18% 30% 41%

2010

2011

2010

15% 17%

14% 55%

68%

31%

Android iOS

RIM Windows

Symbian Other

Smartphones Feature Phones Other Connected Devices

Source: Millennial Media, 2010-2011.

Source: Millennial Media, 2010-2011. Other includes webOS, Danger, Nokia OS, Palm OS.

Visit www.millennialmedia.com/mobile-intelligence to sign up

S.M.A.R.T. Glossary of Terms

2011 Year in Review

Audience Takeover A targeting technique that allows an advertiser to achieve dominant share-of-voice with a target audience. Behavioral Audience A targeting technique that categorizes customers by their interests. Campaign Destination Used to dene where advertisers are sending consumers from their ads to view more content. Based upon thousands of campaigns, we nd that campaigns drive to three primary destinations: Trac to Site (the clients persistent mobile site), Custom Landing Page (a special mobile landing page created for the campaign), or Application Download. Connected Device A mobile device, such as a traditional mobile phone, a smartphone and a tablet, that is able to connect to the internet through a cellular, wireless or other network. Cross-Platform Pertaining to multiple devices (Smartphones, tablets, feature phones, connected devices), carriers (AT&T, Verizon, Vodafone, Telefonica, SingTel, etc.), or platforms (iOS, Android, RIM, Windows Phone 7, Symbian, etc). Millennial Media is cross-platform or platform-agnostic because we do not focus on one single OS or device type. This enables advertisers to reach as many mobile users as possible, regardless of their mobile device or carrier of choice. Deal Size The size of a clients mobile advertising contract. Developer Provider/creator of mobile applications or a publisher of mobile sites. eCPM Also Eective CPM or Eective cost per thousand impressions. Used as a performance measure to estimate earnings for every thousand impressions received. eCPM is derived by dividing total earnings over total number of impressions in thousands. Feature Phone Any web-enabled mobile phone that is not a Smartphone. Impression A count of the number of times an ad unit appears on a mobile device. Inventory The ad space available on mobile websites and applications. Local Market A targeting technique that allows advertisers to customize their message to local markets i.e. DMA to more precise levels of granularity. (Previously classied as GEO in earlier SMART reports). Mobile Targeting A strategy used by advertisers to achieve their campaign goals by delivering relevant messaging to specic target audiences. Advertisers have a variety of targeting strategies available to them including, Audience Targeting, Local Market Targeting and Tactical Targeting. Targeting strategies vary according to campaign objectives. Mobile Video A high impact HD video ad that can be layered with interactive features to deliver a uniquely mobile, actionable experience to customers. Post-Click Campaign Action The action a marketing campaign is driving the customer to take once an ad is viewed (i.e., Place Call, Download Application, View Map, etc.). SDK Software Development Kit. A tool that enables developers to seamlessly integrate mobile advertising into their applications, thus monetizing their app. Developer partners on Millennial Medias platform download and integrate our SDKs (available for a variety of operating systems iOS, Android, Windows Phone 7, etc.) to gain access to the ads run by our advertising partners. Smartphone Any web-enabled and application-enabled mobile phone that runs on an operating system and oers the user more advanced capabilities beyond just voice and mobile web access. Vertical The classication of advertisers by industry.

Visit www.millennialmedia.com/mobile-intelligence to sign up

Summary & Reporting Methodology

2011 Year in Review

About Millennial Media Millennial Media is the leading independent mobile advertising platform company. Our technology, tools and services help app developers and mobile website publishers maximize their advertising revenue, acquire users for their apps and gain insight about their users. We oer advertisers signicant audience reach, sophisticated targeting capabilities and the ability to deliver rich and engaging ad experiences to consumers on their mobile connected devices. Visit www.millennialmedia.com for more information. About S.M.A.R.T. The Scorecard for Mobile Advertising Reach and Targeting (S.M.A.R.T.) delivers monthly insights on key trends in mobile advertising based on actual campaign and platform data from Millennial Media. Visit www.millennialmedia.com/research to sign up to receive Millennial Media-related news including the Mobile Mix report, the Scorecard for Mobile Advertising Reach and Targeting (S.M.A.R.T.) report, and the Mobile Intel Series. For questions about the data in this report, or for recommendations for future reports, please contact us at research@millennialmedia.com.

2012 Millennial Media, Inc. All rights reserved. All product names and images are trademarks or registered trademarks of their respective owners.

Visit www.millennialmedia.com/mobile-intelligence to sign up

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- DG Oil SpecificationDocumento10 pagineDG Oil SpecificationafsalmohmdNessuna valutazione finora

- Bill of Quantities 16FI0009Documento1 paginaBill of Quantities 16FI0009AJothamChristianNessuna valutazione finora

- The Future of FinanceDocumento30 pagineThe Future of FinanceRenuka SharmaNessuna valutazione finora

- Affidavit of Co OwnershipDocumento2 pagineAffidavit of Co OwnershipEmer MartinNessuna valutazione finora

- Method Statement FINALDocumento61 pagineMethod Statement FINALshareyhou67% (3)

- Present Tenses ExercisesDocumento4 paginePresent Tenses Exercisesmonkeynotes100% (1)

- MillennialMedia SMART Q1 2013Documento9 pagineMillennialMedia SMART Q1 2013Brad FowlerNessuna valutazione finora

- Cross-Screen: Consumer Behavior: DecodedDocumento8 pagineCross-Screen: Consumer Behavior: DecodedBrad FowlerNessuna valutazione finora

- Millennial Media Intel Series - RetailDocumento22 pagineMillennial Media Intel Series - RetailBrad FowlerNessuna valutazione finora

- Millennialmedia Smart 2012 YearinreviewDocumento9 pagineMillennialmedia Smart 2012 YearinreviewRichard L BrownNessuna valutazione finora

- Mobile Marketing RoadmapDocumento45 pagineMobile Marketing RoadmapBrad Fowler100% (2)

- Bii - Mobile Commerce - 2013Documento20 pagineBii - Mobile Commerce - 2013Brad FowlerNessuna valutazione finora

- Millennialmedia Smart July 2012Documento5 pagineMillennialmedia Smart July 2012MobileLeadersNessuna valutazione finora

- Device & Manufacturer Data Device & OS Mix Mobile Developer Trends Global Tablet TrendsDocumento7 pagineDevice & Manufacturer Data Device & OS Mix Mobile Developer Trends Global Tablet TrendsBrad FowlerNessuna valutazione finora

- Online Holiday Sales Forecast - Emarketer Nov 2011Documento11 pagineOnline Holiday Sales Forecast - Emarketer Nov 2011Brad FowlerNessuna valutazione finora

- Mobile Phone Shopping Diaries FINAL 100512Documento41 pagineMobile Phone Shopping Diaries FINAL 100512Brad FowlerNessuna valutazione finora

- 1 19320 Mobile Marketing Three Principles For SuccessDocumento19 pagine1 19320 Mobile Marketing Three Principles For SuccessBrad FowlerNessuna valutazione finora

- How Tablets, Smartphones and Connected Devices Are Changing U.S. Digital Media Consumption HabitsDocumento33 pagineHow Tablets, Smartphones and Connected Devices Are Changing U.S. Digital Media Consumption HabitsJeff SondermanNessuna valutazione finora

- ComScore 2012 Mobile Future in FocusDocumento49 pagineComScore 2012 Mobile Future in FocusBrad FowlerNessuna valutazione finora

- Mary Meeker 2012 State of InternetDocumento112 pagineMary Meeker 2012 State of InternetBrad FowlerNessuna valutazione finora

- Emarketer US Digital Media Usage-A Snapshot of 2012Documento8 pagineEmarketer US Digital Media Usage-A Snapshot of 2012Brad Fowler100% (1)

- Emarketer US Digital Media Usage-A Snapshot of 2012Documento8 pagineEmarketer US Digital Media Usage-A Snapshot of 2012Brad Fowler100% (1)

- US Interactive Marketing Forecast, 2011 To 2016 (Forrester) - AGOS11Documento21 pagineUS Interactive Marketing Forecast, 2011 To 2016 (Forrester) - AGOS11retelurNessuna valutazione finora

- MM Smart November 2011Documento5 pagineMM Smart November 2011Brad FowlerNessuna valutazione finora

- November 2011: Device & Manufacturer Data Device OS Mix Kindle Fire SpotlightDocumento5 pagineNovember 2011: Device & Manufacturer Data Device OS Mix Kindle Fire SpotlightBrad FowlerNessuna valutazione finora

- Quarterly Report: Scorecard For Mobile Advertising Reach and Targeting (S.M.A.R.T.™)Documento11 pagineQuarterly Report: Scorecard For Mobile Advertising Reach and Targeting (S.M.A.R.T.™)Brad FowlerNessuna valutazione finora

- Mobile Payments-Moving Closer To A World Without Wallets - Emarkter September 2011Documento18 pagineMobile Payments-Moving Closer To A World Without Wallets - Emarkter September 2011Brad FowlerNessuna valutazione finora

- November 2011: Device & Manufacturer Data Device OS Mix Kindle Fire SpotlightDocumento5 pagineNovember 2011: Device & Manufacturer Data Device OS Mix Kindle Fire SpotlightBrad FowlerNessuna valutazione finora

- OCTOBER 2011: Device & Manufacturer Data Device OS Mix Mobile Developer TrendsDocumento5 pagineOCTOBER 2011: Device & Manufacturer Data Device OS Mix Mobile Developer TrendsBrad FowlerNessuna valutazione finora

- Androids RiseDocumento1 paginaAndroids RiseBrad FowlerNessuna valutazione finora

- Mobile Data On Retail IndustryDocumento20 pagineMobile Data On Retail IndustrySumit RoyNessuna valutazione finora

- MM MobileMix Q3 2011Documento6 pagineMM MobileMix Q3 2011Brad FowlerNessuna valutazione finora

- Mobile Payments-Moving Closer To A World Without Wallets - Emarkter September 2011Documento18 pagineMobile Payments-Moving Closer To A World Without Wallets - Emarkter September 2011Brad FowlerNessuna valutazione finora

- How Tablets, Smartphones and Connected Devices Are Changing U.S. Digital Media Consumption HabitsDocumento33 pagineHow Tablets, Smartphones and Connected Devices Are Changing U.S. Digital Media Consumption HabitsJeff SondermanNessuna valutazione finora

- Re-Defining The Word MobileDocumento1 paginaRe-Defining The Word MobileBrad FowlerNessuna valutazione finora

- Dynamic Study of Parabolic Cylindrical Shell A Parametric StudyDocumento4 pagineDynamic Study of Parabolic Cylindrical Shell A Parametric StudyEditor IJTSRDNessuna valutazione finora

- A Project On "Automatic Water Sprinkler Based On Wet and Dry Conditions"Documento28 pagineA Project On "Automatic Water Sprinkler Based On Wet and Dry Conditions"Srínívas SrínuNessuna valutazione finora

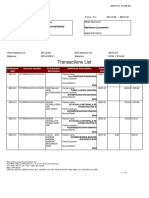

- Transactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinDocumento12 pagineTransactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinConstantin MarilenaNessuna valutazione finora

- Catalogo PukangDocumento41 pagineCatalogo PukangClarita Muller LeigueNessuna valutazione finora

- The Phases of The Moon Station Activity Worksheet Pa2Documento3 pagineThe Phases of The Moon Station Activity Worksheet Pa2api-284353863100% (1)

- Chapter1 Intro To Basic FinanceDocumento28 pagineChapter1 Intro To Basic FinanceRazel GopezNessuna valutazione finora

- Fashion DatasetDocumento2.644 pagineFashion DatasetBhawesh DeepakNessuna valutazione finora

- Cln4u Task Prisons RubricsDocumento2 pagineCln4u Task Prisons RubricsJordiBdMNessuna valutazione finora

- SPFL Monitoring ToolDocumento3 pagineSPFL Monitoring ToolAnalyn EnriquezNessuna valutazione finora

- DL Manual - Com Vs Controller Gs Driver p100 Operating ManualDocumento124 pagineDL Manual - Com Vs Controller Gs Driver p100 Operating ManualThiago Teixeira PiresNessuna valutazione finora

- Level of Organisation of Protein StructureDocumento18 pagineLevel of Organisation of Protein Structureyinghui94Nessuna valutazione finora

- Documentos de ExportaçãoDocumento17 pagineDocumentos de ExportaçãoZineNessuna valutazione finora

- Acceptable Use Policy 08 19 13 Tia HadleyDocumento2 pagineAcceptable Use Policy 08 19 13 Tia Hadleyapi-238178689Nessuna valutazione finora

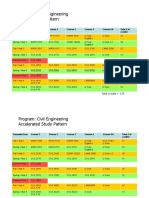

- HKUST 4Y Curriculum Diagram CIVLDocumento4 pagineHKUST 4Y Curriculum Diagram CIVLfrevNessuna valutazione finora

- Advanced Herd Health Management, Sanitation and HygieneDocumento28 pagineAdvanced Herd Health Management, Sanitation and Hygienejane entunaNessuna valutazione finora

- Tata NanoDocumento25 pagineTata Nanop01p100% (1)

- Physiol Toric Calculator: With Abulafia-Koch Regression FormulaDocumento1 paginaPhysiol Toric Calculator: With Abulafia-Koch Regression FormuladeliNessuna valutazione finora

- Our Story Needs No Filter by Nagarkar SudeepDocumento153 pagineOur Story Needs No Filter by Nagarkar SudeepKavya SunderNessuna valutazione finora

- Punches and Kicks Are Tools To Kill The Ego.Documento1 paginaPunches and Kicks Are Tools To Kill The Ego.arunpandey1686Nessuna valutazione finora

- Ships Near A Rocky Coast With Awaiting Landing PartyDocumento2 pagineShips Near A Rocky Coast With Awaiting Landing PartyFouaAj1 FouaAj1Nessuna valutazione finora

- Final SEC Judgment As To Defendant Michael Brauser 3.6.20Documento14 pagineFinal SEC Judgment As To Defendant Michael Brauser 3.6.20Teri BuhlNessuna valutazione finora

- Saudi Methanol Company (Ar-Razi) : Job Safety AnalysisDocumento7 pagineSaudi Methanol Company (Ar-Razi) : Job Safety AnalysisAnonymous voA5Tb0Nessuna valutazione finora

- 2010 Information ExchangeDocumento15 pagine2010 Information ExchangeAnastasia RotareanuNessuna valutazione finora

- Sociology A Brief Introduction Canadian Canadian 5th Edition Schaefer Test Bank DownloadDocumento44 pagineSociology A Brief Introduction Canadian Canadian 5th Edition Schaefer Test Bank DownloadJohn Blackburn100% (20)