Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lord 1996

Caricato da

Sebastien MarcDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Lord 1996

Caricato da

Sebastien MarcCopyright:

Formati disponibili

Management Accounting Research , 1996, 7, 347 366

Strategic management accounting: the emperor s new clothes?

Beverley R. Lord*

The term strategic management accounting has been in the management accounting literature for more than a decade. Despite many papers on the subject, there still seems to be a paucity of examples of strategic management accounting actually being used. This paper argues that the techniques and elements of strategic management accounting may in many cases already be found in rms. However, the information may not be quantied in accounting gures, and may not be collected and used by management accountants. Rather, the techniques for gathering and using information necessary for survival in a hostile and competitive environment may be part of the operational management of rms.

1996 Academic Press Limited

Key words: management accounting; strategic cost management; value chain analysis; cost driver analysis; case study.

1. Introduction The term strategy has been borrowed from the military. It is dened as the art of so moving or disposing troops or ships or aircraft as to impose upon the enemy the place and time and conditions for ghting preferred by oneself (The Concise Oxford Dictionary ). Applying this denition to the business environment, it can be seen that business strategy is not simply long-term planning, but must also consider the plans of competitors, the main objective being to place and keep the rm in a position of competitive advantage. What role does accounting play in the strategic decision-making process? Tricker (1989) likened the relationship between business strategy and management accounting to the relationship between military strategy and military intelligence. Management accountants could assess the strategic impact of internal information and collect information about the position of competitors, synthesising the resultant information and making it available to the strategic process (p. 28). Simmonds (1981, 1982) coined the phrase strategic management accounting for the accounting information that would assist strategic decision-makers. However, although it is now more than a decade since Simmonds rst used the term, and despite the fact that there have been many papers on the subject, particularly in

* University of Canterbury, Private Bag 4800, Christchurch, New Zealand. Received 1 April 1994; accepted 25 October 1995. 1044 5005 / 96 / 030347 20 $18.00 / 0 1996 Academic Press Limited

348

B. R . Lord

professional journals, there still seems to be a paucity of examples of strategic management accounting actually being used. This paper critically evaluates the whole notion of strategic management accounting. It argues that the techniques and elements of strategic management accounting may in many cases already be found in rms. However, the information may not be quantied in accounting gures, and may not be collected and used by management accountants. Rather, the techniques for gathering and using information necessary for survival in a hostile and competitive environment may be part of the operational management of rms. Having heard about a rm that seemed to have successfully followed a strategy of differentiation in the face of a radically changing competitive environment, the author was interested in whether its management accounting system supported its strategy, and whether the management accounting system included the elements of strategic management accounting. In order to determine the relationship between the management accounting system and the rms strategy, the rm was studied over a 12-month period. Initial information about, and access to, the rm was obtained through a former director. Data were obtained from a variety of sources, including newspaper articles; company reports; interviews with former and present directors, managers, employees and customers; observation; internal management accounting and other records; and advertising material. This paper is in two major sections. The rst section examines the literature on strategic management accounting, drawing out elements that one would expect to see in a strategic management accounting system. The second section shows how the case study rm displays many of these characteristics. However, although accountants are purported to be ideal for or necessary to these strategic activities, the activities have taken place in this rm without any involvement of the management accountant.

2. Strategic management accounting: what is it? The literature on strategic management accounting has several strands. Most papers on the subject published in the U.K. journal, Management Accounting , emphasize the extension of traditional management accountings internal focus to include external information about competitors. This viewpoint is presented in the rst part of this section: What are our competitors doing? Several taxonomies of strategic positioning have been developed in the business strategy literature. The relationship between the strategic position chosen by a rm and the expected emphasis on management accounting is examined in the second part of this section: Accounting for strategic position. The third viewpoint advocates analysis of ways to decrease costs and / or enhance differentiation of a rms products, through exploiting linkages in the value chain and optimizing cost drivers. The literature on value chain and cost driver analyses is reviewed in the section: Gaining competitive advantage. The fourth viewpoint challenges the basis of the other viewpoints. It points out that they assume that managers are able to deliberately plan what strategy the rm will follow. The section, Can strategy be planned? questions the ability of

SMA: The Emperors New Clothes?

349

managers to realise planned strategies in some circumstances, also throwing doubt on the concept of strategic management accounting. The nal part of this section summarises the elements of strategic management accounting promoted in the literature presented in the rst three parts. The second half of the paper then demonstrates that many of these elements are to be found in the case study rm, but without any input by the management accountant, and without any impact on the management accounting system. What are our competitors doing ? Simmonds (1981, 1982) denition and description of strategic management accounting focused on comparison of the rm with its competitors. He advocated collection of information necessary to enable determination of market share and competitors pricing, costs and volume. A rm which monitors market share can measure the extent to which it is gaining or losing competitive position. Knowledge of a competitors costs enables a rm to detect when the competitor is trying to change relative competitive positions, for example, by manipulating prices. Knowledge of relative market share and cost structure enables decisions to be evaluated in the light of possible competitor reactions. This idea is not new. Johnson and Kaplan (1987) wrote that, in the late nineteenth century, Carnegie relied on nancial information which concerned his competitors direct production costs. Carnegies operating strategy [of pushing] his own direct costs below his competitors ... prompted him to require frequent information showing his direct costs in relation to those of his competitors (pp. 33 34). Competitor information may be obtained through public, formal sources, such as published reports and the business press, or through informal channels, such as the rms sales force, its customers and its suppliers. Simmonds (1981) suggested some changes and additions to traditional management accounting systems in order to include this information. Market share assessments could be incorporated into management accounts. Budgets could be routinely presented in a strategic format with columns for Ourselves, Competitor A, Competitor B etc. (p. 28). Changes in competitive position as a result of capital expenditure or pricing decisions could be compared with the status quo. Bromwich (1988) reiterated that the focus of the rm should be on external matters, as it is in the rms markets that prots are made and where competitors challenge the enterprise (p. 26). Bromwich said that it is necessary to go even further than Simmonds suggestions, not only comparing the rm with its competitors, but also evaluating the benets of the enterprises products both from the customers point of view and the rms perspective (p. 27). Several writers point out that, as well as not including information about external factors affecting the rm, orthodox nancial reports have the opposite orientation to that needed for evaluating and measuring strategic issues. For example, Allen (1985) stated that information for strategic decision-making must be forward lookingnot based on past costs and the concept of capital maintenance, but being concerned with values, investments and cash ows over the longer-term continuum. Wilson (1990), too, criticised traditional management accounting systems as tending to be reactive and to deal in a programmed way with one-off decisions. By contrast, a strategic approach needs to be proactive and designed to deal in an

350

B. R . Lord

unprogrammed way with each phase of strategic decision-making (p. 42). Taylor and Graham (1992) promoted the inclusion of non-nancial information crucial to strategic planning and control. Accounting for strategic position Writers on strategic management have developed various taxonomies of the strategic positions that rms may choose or may nd themselves in. Simons (1990) provides a good summary of the archetypes identied by Mintzberg, Utterback, Miles and Snow, and Porter (see Simons, 1990, Table 1, p. 130). Two of these taxonomies particularly have been taken up in the accounting literature: Miles and Snows, and Porters. Miles and Snow (1978) classied organizations by their way of responding to the environment, and according to their particular conguration of technology, structure, and process (p. 29). Defenders are prominent in a stable, narrow product-market. In order to maintain prominence in the chosen segment, defenders will aggressively pursue technological efciency. Because of the stability of their markets, defenders can concentrate on reducing costs and / or improving quality. Prospectors, on the other hand, are organizations which almost continually search for market opportunities (p. 29). For the prospector, exibility is more important than efciency and perhaps even than high protability. Analysers are a combination of defender and prospector, having a core of traditional products while pursuing new product and market opportunities. Reactors are unsuccessful in attaining competitive advantage, because they do not respond effectively to environmental change and uncertainty. Because this type of organization lacks a consistent strategy structure relationship, it seldom makes adjustment of any sort until forced to do so by environmental pressures (p. 29). In his taxonomy, Porter (1980, 1985) detailed two specic ways in which managers can position their rms so they have a strategic advantage over their competitors: rms need to either differentiate their product(s) or achieve a position of cost leadership. To differentiate its product, the rm must provide something unique that is of value to the purchaser, for example, better quality, or features that are not included in the competitors products. Competitive advantage can then be attained by being able to ask a higher price, by being able to sell more at the given price, or by achieving increased customer loyalty. However, superior performance can only be achieved if costs are kept as low as possible, especially the costs of differentiation. For cost leaders, competitive advantage is attained by having lower costs than all competitors. The accounting literature suggests that rms will place more emphasis on particular accounting techniques, depending on which strategic position they take. Using Porters taxonomy, Shank (1989) and Shank and Govindarajan (1989) analysed the relative importance of several management accounting methods depending on whether the rm was pursuing cost leadership or differentiation. They suggested that companies choosing cost leadership would put the most emphasis on the traditional cost accounting applications. They would use standard costs to assess performance, product cost as an input to pricing decisions, and exible budgeting for manufacturing cost control. They would perceive meeting budgets and analysis of competitors costs to be of great importance. On the other hand, companies differentiating their products as a way of achieving

SMA: The Emperors New Clothes?

351

competitive advantage would consider marketing cost analysis to be critical to their success. They would consider exible budgeting and meeting budgets to be of only moderate importance, and rank standard costing for performance assessment, product costing for pricing decisions, and competitor cost analysis of little importance. Bromwich (1990) used two economic theories in an effort to provide theoretical support for strategic management accounting, linking the theories with Porters taxonomy. The theory of attribute analysis supports accountants costing attributes and monitoring the performance of these attributes over time (p. 28), which in turn contributes to Porters differentiation strategy. The theory of contestable markets requires that the accountant extends cost analysis beyond the rm and report on the cost structure of rival enterprises (p. 29), which contributes to Porters cost leadership strategy. Govindarajan and Shank (1992) added another dimension to the expected management accounting emphasis, by linking the rms mission (i.e. build, hold or harvest) to its strategic position. They concluded that the accounting implications for strategic planning, budgeting and incentive compensation would be similar under both the harvest mission and cost leadership strategic position. Similarly, the accounting emphasis suggested for the differentiation strategy would also t a build mission. Simons (1987) used questionnaires and interviews to test the relationship between accounting control systems and business strategy. Using Miles and Snows taxonomy, he divided the rms studied into prospectors and defenders. He found that prospector rms place great importance on forecast data, setting tight budget goals and monitoring outputs, with reduced importance on cost control. Large prospectors emphasize frequent reporting and the use of uniform control systems. Defenders appear to use their control systems less intensively, placing their emphasis on bonus remuneration based on the achievement of budget targets (p. 370). Simons (1990) added other taxonomies (summarised in Table 1, p. 130) to his analysis and comparison of two competing rms following different strategies. His conclusions from this analysis are similar to his earlier (1987) paper. He added the suggestion that defenders need only focus on strategic uncertaintiesoften related to product or technological changes that could undermine current low cost positions (p. 141). Gaining competitive advantage Value chain analysis. Under Porters strategic positioning, reducing costs is important no matter which strategy is chosen. Firms involved in product differentiation will want to reduce costs to maximise their prots; cost leaders want to reduce costs to a level below all their competitors. Costs can be reduced by reducing activities that cause costs without increasing value. They can also be reduced by exploiting linkages in the value chain. The value chain is the linked set of value-creating activities all the way from basic raw material sources ... through to the ultimate end-use product (Shank, 1989, p. 50). Porter (1985) presented value chain analysis as one of the keys to gaining competitive advantage. The aim of value chain analysis is to nd linkages between

352

B. R . Lord

value-creating activities which result in lower costs and / or enhanced differentiation. These linkages may be within the rm or between the rm and its suppliers, channels and customers. Thus, business strategy differs from the military denition in that competitive forces are not always enemiesthere is a possibility of partnership with suppliers, competitors and customers, with benet to all. Shank and Govindarajan have promoted accounting inputs to value chain analysis under the name strategic cost management. Their papers give several examples of how value chain analysis using accounting gures would result in different decisions than using traditional management accounting techniques (see, for example, Shank and Govindarajan, 1988, 1992a , b , c ). However, it appears that none of their cases are of companies that are actually using strategic cost management. Several of their examples are obviously teaching cases, designed to show that a different decision resulted from using strategic cost management, but unable to show that the different decision was the best one for the company. Shank and Govindarajan (1992b , p. 179) themselves admitted that they could not nd a case of a rm actually using value chain analysis. Porter (1985) complained that, while accounting systems do contain useful data for cost analysis, they often get in the way of strategic cost analysis (p. 63). Hergert and Morris (1989) asserted that much accounting information is not in a suitable form to be used in analysing the value chain. They pointed out that traditional management accounting systems do not adequately quantify the costs and benets of joint optimization and coordination between parts of the rm, and between the rm and its suppliers and buyers. Currently, rms are organized into divisions or responsibility centres on the basis of products or functions, which may obscure linkages. Firms need to be organized into strategic business units according to critical activities, with the accumulation of accounting data for each activity. However, while acknowledging the problems in performing value chain analysis, Hergert and Morris (1989) considered that the process itself provided useful insights, even if it was impossible to estimate precise numerical outputs. One of the strengths of value chain analysis is that it forces managers to think about which activities create prots, to choose a generic strategy for each product and to ask of each item of expenditure how does this add value to buyers? (p. 187). Shank and Govindarajan (1992b ) also recognised that there were problems involved in calculating the value chain, but reiterated that Even the process of performing the value chain analysis, in and by itself, can be quite instructive (p. 184). Cost driver analysis. No matter which strategic position is chosen, differentiation or cost leadership, analysis of the causes of costs is important. These causes of costs are called cost drivers. Shank (1989) grouped cost drivers into two types: structural and executional. Structural cost drivers are scale, scope, experience, technology and complexity. Increasing these structural drivers does not necessarily decrease costs. For example, there are diseconomies of scale and scope as well as economies. Executional drivers include work force involvement, total quality management, capacity utilisation, plant layout efciency, product conguration effectiveness and exploitation of linkages. According to Shank, increasing executional drivers will always result in decreased costs.

SMA: The Emperors New Clothes?

353

Shank (1989) pointed out that the cost driver analysis suggested by Porter (1985) was a much broader concept than activity based costing, which focuses primarily on complexity. Although Porter (1985) advocated quantifying the analysis of cost drivers, the suggestions he gave for controlling cost drivers were really mostly operational initiatives (e.g. gaining the appropriate type of scale, learning from competitors, leveling throughput, working with suppliers and channels to exploit vertical linkages, optimising location, and enhancing bargaining leverage through purchasing policies). Nanni et al. (1992) noted that cost driver analysis needs to be dynamic continuous improvement may reduce cost drivers to such insignicant levels that they have to be replaced with new cost drivers. They recognised the need for performance measurement both as a guide to putting strategy into action and for evaluation of actions taken. However, they suggested that both nancial and non-nancial measures be used (p. 17). Can strategy be planned ? Some writers assert that the concepts of strategic planning and positioning only cover part of business strategy. Strategies may be deliberate, that is, achieved as planned. However, in many cases strategies emerge from interaction between management, employees and the environment. Accordingly, in some cases the emergent strategy may differ from the strategy originally planned by management. Mintzberg (1978) was one of the rst to point out that the strategic planning literature ignored other types of strategy formation. Some strategies do arise from strategic planning. This is achieved in purposeful organizations with highly ordered, neatly integrated processes. Planned strategies may also be achieved in entrepreneurial rms, where powerful leaders make bold, risky decisions to implement their visions. However, some organizations may consist of many decision-makers with conicting goals. As they bargain among themselves they may produce incremental, disjointed decisions. Strategies will form out of this adaptive process. Mintzberg thus made a distinction between strategy formulation and formation. He dened strategy formulation as the long-range planning by leaders of organizations. Strategy formation, on the other hand, he dened as the result of interplay between the environment, the organizational operating system and the organizations leadership. The environment is changing continuously but irregularly; the organizational operating system seeks stability; and the leadership mediates between the two, trying to achieve both organizational stability and the ability to adapt to change. Mintzberg (1978) dened the strategies that formed, the realised strategies, as a pattern in a stream of decisions. He considered a strategy to have formed when a sequence of decisions in some area exhibits a consistency over time (p. 935). Mintzberg contrasted deliberate strategies and emergent strategies. Perfectly deliberate strategies arise out of precise intentions, common to virtually all the actors in the organization, which have been realised exactly as intended. The deliberate strategy is only possible when the external environment has no inuence over the organization. A perfectly emergent strategy is a pattern over a period of time without any express or deliberate intention by the organization to form the same. An emergent strategy can result where the external environment imposes patterns of action. Although purely deliberate and purely emergent strategies are

354

B. R . Lord

unlikely to exist, the reality is that most strategies fall somewhere on a continuum between the two extremes. Strategy, then, is not formulated and implemented solely by top management. There are likely to be several interest groups within an organization, each having its own set of stakeholders with whom it acknowledges relationships and whose expectations it considers (Dermer and Lucas, 1986, p. 473). Strategy (i.e. patterns in decisions) emerge out of conict between these networks of interacting stakeholders pursuing individual interests (Dermer, 1988, p. 26; see also Dermer, 1990). Simons (1992, p. 44) raised the question, What role can accounting ... play in ... stimulating emergent strategies? He suggested that accounting plays a role in interactive control systems. Data are collected about strategic uncertainties. Dialogue and debate in response to that data trigger organizational learning which may cause new (and often unanticipated) strategies to emerge (p. 48). However, he admitted that these emergent strategies were still shaped and guided by top managers (p. 49). Several accounting writers, such as Dermer and Lucas (1986), Dermer (1988, 1990) and Dent (1990), have questioned the effectiveness of traditional management control systems in an organization which tends towards emergent strategy formation. Dermer (1990) proposed that accounting has three roles in shaping strategy: it may be used as a language of discourse (p. 74), as an authority establishing and maintaining credibility, and as a provider of an historical context for strategy. However, Dermer considered that accounting, with its economic basis, is unable to deal with the human factors in a rm, such as interest groups, and the overall mood of the organization. He pointed out that stakeholders may use accounting systems to support their own strategy. Dermer also argued that research on the relationship between accounting and strategy has been biased towards attempting to make accounting more useful to managers. He pointed out that stakeholders will assess and use the strengths and weaknesses of conventional accounting ... in ways not anticipated by accountants (p. 75). Summary of strategic management accounting characteristics Given the range of views expressed, how then can one describe what strategic management accounting is? A summary of the main themes in the literature suggests that the following elements are important. Collection of competitor information. In order to compare the rm with competitors, information about competitors pricing, costs and volume, and information to enable determination of market share would have to be collected. Exploitation of cost reduction opportunities. Instead of merely meeting standards, there would be a focus on continuous improvements. These would include nding ways of reducing costs and / or enhancing differentiation by exploiting linkages in the value chain, increasing executional cost drivers and getting structural cost drivers to the optimal level. Different, and in some cases non-nancial, performance measures may be employed to measure and monitor improvements in all these areas.

SMA: The Emperors New Clothes?

355

Matching of accounting emphasis with strategic position. Depending on the strategic position chosen, rms would place different emphasis on elements of traditional management accounting. Product differentiators would attach high importance to marketing cost analysis. Flexible budgeting for manufacturing cost control and meeting budgets would be of moderate to low importance. As products may have to change frequently to meet market demand, little or no importance would be attached to detailed standard costing for performance assessment, using product costs for pricing decisions and performing competitor cost analysis. Cost leaders, on the other hand, would attach high importance to standard costing for performance assessment, exible budgeting for manufacturing cost control, meeting budgets, using product costs for pricing decisions, and competitor cost analysis. In these rms, little or no importance would be attached to marketing cost analysis. Having provided a summary of the elements of strategic management accounting, the remainder of this paper uses a case study to show that these elements ascribed to strategic management accounting can be found in a real life situation. 3. Cyclemakers Group (NZ) Ltd. In 1981, a group of cycle retailers, in and around New Zealands South Island town of Timaru, started to consider manufacturing bicycles in competition with the two dominant manufacturers. The groups contact with customers led them to believe that the large manufacturers were not satisfying consumer need. Subsequently, the small manufacturing rm, Cyclemakers , was established, with a stated policy of exibility in order to satisfy customer need. Within 5 years, Cyclemakers commanded about 20% of the New Zealand market. During the rst years of production, Government regulations were in force which drastically restricted the importation of cycles. Only 10% of bicycles sold were allowed to be imported cycles. Imported cycles were also subject to a heavy tariff of 27.5%. The Government also required two-thirds New Zealand content in each frame manufactured. Thus Cyclemakers had to make some components that could have been imported more cheaply. However, the company was also protected from cheap imported frames and cycles. In July 1987 the Government deregulated the industry, removing the restriction on imports and reducing the tariff to 22.5% in the rst year, and by a further 2.5% per annum thereafter. The required New Zealand content in the frame was reduced from two-thirds to a quarter. The directors of Cyclemakers realised that the competitive environment was going to change from the time of deregulation onwards, as there would be a ood of cheap imported bicycles from Asian countries. They had to consider whether it would be cheaper to manufacture or import frames. Although its competitors decided to cease manufacturing, Cyclemakers decided it could remain competitive against imports in the new environment. In repositioning itself in the market, Cyclemakers decided to focus on the mid to high price, mountain and racing bike range, differentiating its product on the basis of high quality, exibility and satisfying consumer demand. The rm soon achieved a 20% market share in the New Zealand market segment on which it chose to focus.

356

B. R . Lord

In order to nance its repositioning at the time of deregulation, the original directors of the company decided the company needed a broader equity base. A consortium, comprising a public holding company, another organization and an individual, bought into the company. The public company subsequently took over the company completely, but left the day-to-day running of the company to the managing director and his team of management. Management accounting According to a former director with an accounting background, the management accounting system at the time of repositioning was completely inadequate. There was no-one in the rm with accounting training. Product costing was performed by the former managing director and the factory manager, but only for the purpose of inventory valuation for nancial reporting. Accounting information, which was collected for nancial reporting purposes only, was collected by the ofce manager, and transmitted at the end of each month to a rm of chartered accountants. Any ambiguities in classication were resolved arbitrarily by the accounting rm, without consultation with Cyclemakers ofce manager. As the nished accounts were conveyed directly to the managing director, without reference to the ofce manager, any misclassications were not isolated. As the nancial reports prepared by the accountants were the aggregated reports required for nancial reporting purposes, the information contained in them was neither timely nor sufciently detailed for management decision-making and planning. The new equity partners formed a new board of directors, and appointed a new managing director. One of the new directors visited the company regularly, helping the ofce manager to install a management accounting system, which included a standard costing system, cash ow projections and reports, sales and revenue projections and reports, and reports on debtors aging and overdue debtors. About 9 months before the commencement of this research, the public company had employed a management accountant to work full-time on the management team at Cyclemakers . This accountant had gradually changed the management accounting from a manual to a computerised system, but had otherwise made few changes. Despite the lack of change in the management accounting system, many of the elements ascribed to strategic management accounting could be found at Cyclemakers . Examples of the collection of competitor information, exploitation of cost reduction opportunities, and matching of accounting emphasis with strategic position follow. However, it will be seen that the management accountant was not involved in these initiatives. Collection of competitor information Management at Cyclemakers were diligent at collecting competitor information, as promoted by Simmonds (1981, 1982). Sales representatives regularly reported competitor information to the managing director. This information about competitors sales volumes and prices was gleaned mainly from conversations with retailers and observation of competitors products in the retailers shops. Competitors costs were estimated from Cyclemakers knowledge of its own costs and observation of components on its competitors products. Market share was

SMA: The Emperors New Clothes?

357

estimated from knowledge of how many cycles dealers had sold, customs records of the number of cycles landed, and Cyclemakers own production gures. However, although detailed competitor information was collected and continually used in make-or-buy and marketing decisions, its use differs in several ways from that suggested by Simmonds (1981, 1982). First, the information was not collected or recorded by the management accountant, even though Simmonds (1981, p. 29) noted that accountants have both the concepts and the skills to provide these gures with precision. Second, Cyclemakers did not develop comparative budgets between its own and its competitors costs. Rather, Cyclemakers used the competitor information to enable it to make decisions about the introduction of new features and / or models, and to enable it to impart to sales representatives, and through them to retailers, information about the points of differentiation chosen by Cyclemakers in contrast to its competitors. The rst element expected in a strategic management accounting system was thus to be found at Cyclemakers . However, the management accountant was not involved in either the collection or the use of the competitor information. The second element of strategic management accounting as summarised above is the exploitation of cost reduction opportunities. The following examples of this element are split into sub-sections: cost reductions from exploiting linkages in the value chain, cost reductions from increasing executional cost drivers, cost reductions from attaining optimal levels of structural cost drivers, and non-nancial performance measures. Cost reductions from exploiting linkages in the value chain Porter (1985) advocated value chain analysis, that is, nding linkages between activities, as the key to competitive advantage. Linkages may be exploited in order to lower costs and / or enhance differentiation. Cyclemakers successfully both lowered costs and enhanced its differentiation (which was based on exibility and high quality) by identifying linkages both within the rm and with external parties. Linkages with suppliers. Cyclemakers successfully exploited the advantages of selecting certain suppliers, enabling Cyclemakers to lower its own costs and to purchase components at lower costs than its competitors. The Japanese rm of Shimano are the leading manufacturers of gear and brake components in the world. As well as selling its own New Zealand manufactured cycles, Cyclemakers sought an agency in New Zealand for Peugeot cycles, importing and assembling the cycles here. The company did not need Peugeot cycles for their quality or name, as Cyclemakers considered its own cycles to be as good as or better than Peugeot . However, Peugeot has a favourable relationship with component suppliers, because of its size and position among the top four cycle manufacturers in the world. Thus the Peugeot agency enabled Cyclemakers to buy Shimano components with cost savings of up to 20%. Savings on freight were also obtained by good relationships with suppliers. For example, Cyclemakers arranged to purchase unpainted Peugeot frames and forks. This obviated the necessity for cardboard packaging to prevent paint chipping, allowing more items to be packed in one container. Cyclemakers also arranged with component suppliers to pack the maximum number of components and parts into one container, and even arranged with those suppliers to consolidate their orders so

358

B. R . Lord

that containers were full. It also determined the size of container which maximised the number of parts that could be shipped at once. The above examples illustrate the successful exploitation of linkages with suppliers in order to reduce costs. Cyclemakers were also able to exploit linkages within the rm. Linkages within the rm. Cyclemakers qualied as an Original Equipment Manufacturer (OEM) by choosing to manufacture rather than import frames. Using its OEM status, it could import parts and components at a reduced OEM rate, not after-market prices, thereby reducing raw material cost. Labour cost at Cyclemakers was a signicant proportion of total product cost, but was difcult to estimate accurately, as demand was variable and seasonal. Slack time in winter and extra demand approaching the Christmas peak (and southern summer) resulted in wasted time and overtime, respectively. To stabilise labour cost and provide employees with a steady income, management offered employees a contract whereupon they worked only a 5 hour day in winter, but were paid for an 8 hour day. The difference in pay between a 5 hour and an 8 hour day was recorded as a debt to the company. In the busy season they worked more than an 8 hour day, but only received cash wages for 8 hours. The overtime, at overtime rates, was applied to reducing their debt. Any debt not repaid by Christmas was forgiven. The scheme benetted the employees, as they had a steady income all year round. The scheme also benetted the company, as it had a stable work-force, and the smoothed pay rate simplied the estimation of direct labour costs. Upon the introduction of the Employment Contracts Act in September 1991, which allows direct bargaining between employer and employee, a new employment contract was negotiated. Under the new employment contract, all of the factory employees, apart from apprentices and supervisors, were retained as though they were outside contractors. A contract payment existed for each completed unit at each work station (e.g. each completely welded frame at welding; each completely painted frame and fork set at painting; each completely assembled wheel at wheel assembly; each assembled and packed bicycle at bicycle assembly). These contract payments were therefore the standard labour cost for each part. Because they were only paid for completed work, there was a more consistent production rate and less down-time. When there was a shortage of work available in their area of specialisation, workers moved to another work station. Also, some parts can be either bought outside or manufactured at the factoryif there was slack time, workers could choose to manufacture these parts at the same cost as the outside price. The new contract resulted in 25% higher earnings for the workers, because they chose to work longer hours in the busy times, rather than letting the company employ temporary labour. Simultaneously, labour costs for the rm decreased by 20%, as it was no longer paying overtime rates and employing temporary labour. Therefore, the new employment contract resulted in both reduced labour costs and more accurate product costing. Having started the company in response to a perceived lack of exibility to adapt to market conditions present in the large manufacturing rms, Cyclemakers placed considerable emphasis on providing the features that satised customers demands.

SMA: The Emperors New Clothes?

359

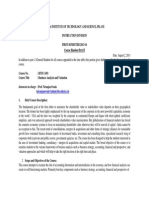

Most of these desired features could be supplied at minimal extra cost. However, changing dimensions of cycle frames was expensive, a major proportion of the cost being incurred in the design and set-up stages of manufacture of the frames. A top New Zealand cycle frame builder developed a computer program to simplify the design of custom frames. He also designed and built a jig on which the basic angles of the frame could be quickly altered according to the design. Cyclemakers purchased this program, designing and building a modied version of the jig more suited to full-scale production. In September 1991, Cyclemakers was able to start production of custom built cycles which cost only about 10% more than standard cycles. Non-value-added labour was greatly reduced by the introduction of computeraided design, which reduced the time required to complete a design from the previous more than half a day to a matter of minutes. The custom jig obviated the need to build special jigs for unusual frame dimensions, thus avoiding the need for more non-value-added labour and materials. In April 1990 a re razed the original factory to the ground. This at rst seemed to be a complete disaster, but in fact provided management with an opportunity to design a new factory with a logical ow of work. The new factory layout reduced material handling to a minimum. Figure 1 contains a plan of the factory, showing work ows. Product quality was one of the cornerstones of Cyclemakers strategy. The company aimed to provide the customer with a better value for money product than that which could be obtained from similarly priced imports. Therefore, the manager in charge of quality control concentrated on total quality management. Initially the workers expected the manager to stand at the end of the production line and say Okay or Not okay. Eventually, the quality control manager trained the workers to judge the standard of quality of their output for themselves. A reward / punishment system was instituted to detect errors as early as possible. Each team of workers checked the product of the previous work station as it came to them. If any mistake had been made, the person who found it was paid a $1

Welding Custom Cutting Washing Cycle assembly & packing

Painting

Offices

Braise-ons

Wheel assembly

OEM store

After-sales store

Figure 1. Factory layout.

360

B. R . Lord

reward, and the team that made the mistake was ned $1. In this way, the number of mistakes and the work station at which they occurred could be easily ascertained from the number of payments / nes. The item returned for rework was deleted from the tally of nished units, with the result that the team was not paid for the item until it has been reworked. Thus, the company did not pay any extra for the additional labour of reworking. The quality of manufacturing increased markedly after the introduction of this quality control system. By using peer review, the company achieved higher quality while avoiding costly recording schemes, the cost of rework, and the cost of quality inspectors. Many of the improvements at Cyclemakers were a direct result of the skill and innovation of the employees. For example, even though the idea for the custom jig came from a frame builder outside the rm, the engineers within the rm improved on the idea and built a jig suited to the larger scale production expected at Cyclemakers . Management was receptive to ideas and suggestions from employees. For example, at one time management had decided to stop manufacturing a particular item as it had become more expensive to make than to buy. Factory employees approached the managing director, and suggested that they could manufacture the item more cheaply than the external price if the company were prepared to buy an extra piece of equipment. Management calculated the perceived costs and benets of the investment, and decided to implement the employees suggestion. Thus, the staff were able to earn more by making the item, and the company made a cost saving. The receptivity of management to employee ideas and suggestions has enabled the company to exploit the innovation and skills of its staff. All the above are examples of exploiting linkages within the rm to achieve lower costs and / or enhance its points of differentiation: exibility and quality. As well as nding linkages at the beginning of the value chain (with the suppliers), and within the rm, Cyclemakers was also able to nd opportunities to exploit linkages at the end of the value chain, with customers. Linkages with customers. As a consequence of its position in a South Island town, Cyclemakers received favourable freight rates with the airlines, it being cheaper to freight goods from the South Island to the North Island than vice versa . Cyclemakers took advantage of this by moving its warehouse for after-sales parts, which was formerly in the North Island, down to its factory in the South Island. The favourable location of Cyclemakers also enabled it to minimise freight charges for delivery to retailers, by using the cheaper rate for south-to-north air freight. Passing on the cost reduction on freight to the customer increased the good-will of the rm. The exploitation of this linkage with customers beneted both the rm and the customer. As well as product quality, the companys quality strategy included quality of service, in particular speed of service. A standard cycle could be delivered to a retailer within 4 days of receiving the order. Because Cyclemakers used airfreight, it could also guarantee quick delivery, within 24 hours for bicycles and components which were in stock. The low number of late deliveries was a measure of its success in pursuing the goal of quality of service, that is, enhancing its differentiation.

SMA: The Emperors New Clothes?

361

The greater precision and exibility provided by the computer aided design and the custom jig enabled Cyclemakers to maximise its responsiveness to customer needs. The rm was also able to emphasise its quality of service by providing fast delivery and excellent after-sales service. It can be seen from the above examples that Cyclemakers was able to both reduce cost and enhance their products differentiation by exploiting linkages in the value chain. In many cases, the benets were enjoyed by suppliers or customers as well as the rm. Figure 2 summarises visually the linkages in the value chain that have been a source of cost reduction and / or product differentiation for Cyclemakers . However, nding linkages and exploiting them was not an initiative of the management accountant or the ofce manager. Linkages were found by managers and staff working close to them; for example, the purchasing agent found ways of exploiting linkages with suppliers, the quality control manager thought of linkages related to quality, and designers and welders thought of ways to build custom cycles. Also, linkages were exploited, resulting in cost savings, without a detailed cost analysis having to be performed.

Suppliers

Cyclemakers

Customers

Peugeot agency Packaging Cooperation

Raw materials OEM status Direct labour Employment contract Workforce involvement Design Computer aided design Set-up Custom jig Material handling Factory layout Quality Employee detection Reward/punishment Employee suggestions

Figure 2. Linkages in the value chain.

Cheap freight Fast delivery Custom products After-sales service

362

B. R . Lord

Cost reductions from increasing executional cost drivers At Cyclemakers , exploiting linkages in the value chain (one of Shanks (1989) executional cost drivers) in many cases involved increasing other executional cost drivers as well. The examples above demonstrate increased work force involvement, total quality management, plant layout efciency and effectiveness of product conguration. Cost reductions from attaining optimal levels of structural cost drivers Cyclemakers made decisions about scale and scope of the business both at the time of deregulation, and on rebuilding the factory. Whether these cost drivers were at an optimal level or not is a subjective judgment. The company managed to keep experience costs down by providing an employment contract that resulted in a high retention of employees. The high technical ability and innovativeness of the staff enabled Cyclemakers to improve processes and provide exibility in product choice without signicant increases in costs. Non -nancial performance measures The use of non-nancial performance measures was not in evidence at Cyclemakers . Although several non-nancial performance measures could have been easily extracted from the records, they did not appear to be used at all in assessing or improving the performance of the company. For example, the number of defects could have been determined from the records of $1 nes / rewards. However, these gures were not collected and displayed as a means of measuring improvement or highlighting areas that needed attention. Similarly, the rm could have monitored improvements in quality through comparing the number of repairs made under warranty. However, this was not done on a formal basis. With the exception of non-nancial performance measures, most of the suggested ways of exploiting cost reduction opportunities were well used at Cyclemakers . However, they were not instituted or monitored by the management accountant, nor did they inuence the accounting system. Matching of accounting emphasis with strategic position Shank (1989) suggested that some traditional management accounting techniques and measures are more appropriate for rms pursuing cost leadership while other techniques and measures are better suited to product differentiators. The management accountant at Cyclemakers had adopted some traditional management accounting functions and largely ignored others. However, the emphasis was not entirely as predicted by Shank. As Cyclemakers pursued a strategy of product differentiation, its emphasis, according to Shank, should have been on marketing costs rather than internal budgeting and competitor cost analysis. Unexpectedly, Cyclemakers used standard / product costing information primarily for comparison with competitors, and it did not perform detailed analysis of actual marketing costs. As expected, detailed budget analysis did not have high priority. The management accountant prepared a budget of expected sales, expenses and cash ows for 12 months ahead. This was updated each month, and new projections were made based on the year to date. Budget and actual were compared, but there was

SMA: The Emperors New Clothes?

363

no detailed variance analysis. As expected, product costing was not used for performance assessment. Product costs were part of pricing decisions, but not in the traditional cost-plus sense. When setting prices for outward goods, Cyclemakers used a type of target pricing. Management decided what price the market would be prepared to pay for a model with particular features and components. Having decided on a price, they deducted their desired prot margin, leaving a target cost. The manufacturing cost of every component in a cycle, with the desired features, was then itemised and summed. If the resulting cost was higher than the target cost, several actions were considered. The company might have replaced some of the components with similar but cheaper substitutes; it might have decided to decrease the desired margin so the product could still be marketed for the same price; or it might have tried to reduce the cost of components. Although Cyclemakers did place different amounts of emphasis on particular elements of its management accounting system, the emphasis was not always as predicted by the strategic management accounting literature. 4. Conclusions Dimnik and Kudar (1989) warned managers not to use accounting numbers to drive decisions, as this fosters concerns about accuracy of the numbers used. Instead, accounting numbers should be used to guide decisions, with care being taken that attitudes and behaviours congruent with organizational goals are promoted. Comparing Western and Japanese management accounting systems, Hariman (1990) considered integration of corporate competitive strategies and management accounting to be the secret of the success of Japanese management accounting. However, Japanese management accounting does not seem to involve detailed quanticationHiromoto (1988) commented that:

Japanese companies seem to use accounting systems more to motivate employees to act in accordance with long-term manufacturing strategies than to provide senior management with precise data on costs, variances, and prots. Accounting plays more of an inuencing role than an informing role (p. 22).

Proponents of strategic management accounting, by comparison, consider that detailed nancial quantication is essential. For example, Simmonds (1981) advocated not only collecting competitor information, but also displaying it in account format, and Shank and Govindarajan (1988, 1989, 1992a , b , c ) gave detailed examples of how value chain analysis could be quantied. Simmonds (1981) suggestion of preparing multiple accounts, comparing the rm with its competitors, has some weaknesses. First, data about competitors will have been collected by a variety of methods, both formal and informal. Printing them in hard gures gives the impression that these are true gures, rather than estimates and speculations. Second, given the wide range of error inherent in gures based in many cases on informal guesses, one could question any comparability between the rms gures and those for the competitors. Third, even with the ease of data manipulation and display available with computers, the costs of collecting and collating detailed competitor information may exceed any benets.

364

B. R . Lord

Shank and Govindarajans strategic cost management also does not appear to be necessary. As the Cyclemakers case shows, rms may be exploiting linkages in the value chain without having to perform detailed nancial analysis. It is the contention of this paper that what has been proposed as the results of strategic management accounting are in fact the natural outcomes of effective operational management processes. That is, if rms are focussing on satisfaction of external and internal customers, and on supplier relationships, they will automatically gain the benets from exploiting linkages internally and externally, without the formal value chain analysis as promoted by Shank and Govindarajan. It may be argued that because Cyclemakers is such a small rm, manufacturing basically one product, it is easier for managers to detect linkages and cost saving opportunities. However, the thesis of this paper is that in many cases these opportunities may be found by those at the operational level, not by managers or accountants, nor as a result of formal analysis. If this is the case, the size and extent of diversication of the rm are irrelevantthose at the operational level will have intimate knowledge and experience of the rms processes and products. Simmonds (1981) not only suggested that management accountants are the ideal people to collect and analyse external data that is relevant for strategic managementhe also implied that only people with highly developed management accounting skills could do it properly. The Cyclemakers case shows that Simmonds assertion is not truethe rm has successfully collected and used competitor information without any input from the management accountant. There has been some recent disagreement with Simmonds view. After describing Simmonds, Porters, and Shank and Govindarajans approaches to strategic management accounting, Roslender (1995) questioned the feasibility of implementing their suggestions. He also observed that most UK accountants are presently wholly ill-suited to such exercises as a consequence of their experience of an essentially quantitative, number-crunching approach to accounting education and training (p. 52). He stated that many accountants are nding it difcult to come to terms with simple and soft accounting numbers (p. 54), and predicted a resistance to their use. He also noted problems with the necessary cooperation between disciplinesaccountants working with engineers and sales and marketing colleagues. Although he expressed a hope that a revitalized form of management accounting would be developed, with more emphasis on the qualitative aspects of organization and management ... a genuinely managerial form of accounting (p. 55, emphasis in original), he had doubts about its acceptance at present. So what is strategic management accountinga prerequisite for survival in a global economy, another job to pad out the diminishing role of the accountant, or the emperors new clothes? This case study suggests that the characteristics that have been ascribed to strategic management accounting are likely to be already operating in many rms. However, it appears that the management accountant does not need to be involved in their operation, nor do they need to be quantied in accounting gures. Perhaps the widely touted strategic management accounting is but a gment of academic imagination. Are tomorrows management accountants going to nd themselves naked, without yesterdays old clothes and with no substance to their new clothes?

Acknowledgements: The author acknowledges the useful criticisms and comments from

SMA: The Emperors New Clothes?

365

Richard Laughlin, Jane Broadbent, two anonymous reviewers, the Editor, Alan Robb, Yvonne Shanahan, Peter Brownell, Ken Lord, and participants at the Management Accounting Research Conference, University of New South Wales, Sydney, October 1992.

References

Allen, D., 1985. Strategic management accounting, Management Accounting (CIMA), March, 25 27. Bromwich, M., 1988. Managerial accounting denition and scopefrom a managerial view, Management Accounting (CIMA), 66(8), 26 27. Bromwich, M., 1990. The case for strategic management accounting: The role of accounting information for strategy in competitive markets, Accounting , Organizations and Society , 15(1 / 2), 27 46. Dent, J. F., 1990. Strategy, organization and control: Some possibilities for accounting research, Accounting , Organizations and Society , 15(1 / 2), 3 25. Dermer, J., 1988. Control and organizational order, Accounting , Organizations and Society , 13(1), 25 36. Dermer, J., 1990. The strategic agenda: Accounting for issues and support, Accounting , Organizations and Society , 15(1 / 2), 67 76. Dermer, J. and Lucas, R., 1986. The illusion of managerial control, Accounting , Organizations and Society , 11(6), 471 482. Dimnik, T. and Kudar, R., 1989. Dont throw out the baby with the bathwater!, CMA Magazine (Canada), 63(6), July / August, 12 16. Govindarajan, V. and Shank, J. K., 1992. Strategic cost management: Tailoring controls to strategies, Journal of Cost Management , Fall, 14 24. Hariman, J., 1990. Inuencing rather than informing: Japanese management accounting, Management Accounting (CIMA), 68(3), March, 44 46. Hergert, M. and Morris, D., 1989. Accounting data for value chain analysis, Strategic Management Journal , 10(2), March April, 175 188. Hiromoto, T., 1988. Another hidden edgeJapanese management accounting, Harvard Business Review , July August, 22 26. Johnson, H. T. and Kaplan, R. S., 1987. Relevance Lost : The Rise and Fall of Management Accounting , Boston, Mass., Harvard Business School Press. Miles, R. E. and Snow, C. G., 1978. Organizational Strategy , Structure , and Process , New York, McGraw-Hill. Mintzberg, H., 1978. Patterns in strategy formulation, Management Science , 24(9), May, 934 948. Nanni, A. J., Dixon, J. R. and Vollmann, T. E., 1992. Integrated performance measurement: Management accounting to support the new manufacturing realities, Journal of Management Accounting Research , 4, 1 19. Porter, M. E., 1980. Competitive Strategy : Techniques for Analyzing Industries and Competitors , New York, The Free Press. Porter, M. E., 1985. Competitive Advantage : Creating and Sustaining Superior Performance , New York, The Free Press. Roslender, R., 1995. Accounting for strategic positioning: Responding to the crisis in management accounting, British Journal of Management , 6, 45 57. Shank, J. K., 1989. Strategic cost management: New wine, or just new bottles?, Journal of Management Accounting Research , 1, 47 65. Shank, J. K. and Govindarajan, V., 1988. Making strategy explicit in cost analysis: A case study, Sloan Management Review , Spring, 19 29. Shank, J. K. and Govindarajan, V., 1989. Strategic Cost Analysis : The Evolution from Managerial to Strategic Accounting , Homewood, IL, Irwin. Shank, J. K. and Govindarajan, V., 1992a . Strategic cost analysis of technological investments, Sloan Management Review , Fall, 39 51. Shank, J. K. and Govindarajan, V., 1992b . Strategic cost management: The value chain perspective, Journal of Management Accounting Research , 4, 179 197.

366

B. R . Lord

Shank, J. K. and Govindarajan, V., 1992c . Strategic cost management and the value chain, Journal of Cost Management , Winter, 5 21. Simmonds, K., 1981. Strategic management accounting, Management Accounting (CIMA), April, 26 29. Simmonds, K., 1982. Strategic management accounting for pricing: A case example, Accounting and Business Research , Summer, 206 214. Simons, R., 1987. Accounting control systems and business strategy: An empirical analysis, Accounting , Organizations and Society , 12(4), 357 374. Simons, R., 1990. The role of management control systems in creating competitive advantage: New perspectives, Accounting , Organizations and Society , 15(1 / 2), 127 143. Simons, R. L., 1992. The Strategy of Control, CA Magazine , March, 44 50. Taylor, B. and Graham, C., 1992. Information for strategic management, Management Accounting (CIMA), January, 52 54. The Concise Oxford Dictionary , 1983. Oxford, Oxford University Press. Tricker, R. I., 1989. The management accountant as strategist, Management Accounting (CIMA), December, 26 28. Wilson, R., 1990. Strategic cost analysis, Management Accounting (CIMA), 68(9), October, 42 43.

Potrebbero piacerti anche

- The Balanced Scorecard: Turn your data into a roadmap to successDa EverandThe Balanced Scorecard: Turn your data into a roadmap to successValutazione: 3.5 su 5 stelle3.5/5 (4)

- Strategic Management AccountingDocumento6 pagineStrategic Management AccountingQuratz31Nessuna valutazione finora

- Experiencing Change in German Controlling: Management Accounting in a Globalizing WorldDa EverandExperiencing Change in German Controlling: Management Accounting in a Globalizing WorldNessuna valutazione finora

- Chapter Two Literature ReviewDocumento10 pagineChapter Two Literature ReviewPatriqKaruriKimboNessuna valutazione finora

- Financial Statement Analysis: Business Strategy & Competitive AdvantageDa EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageValutazione: 5 su 5 stelle5/5 (1)

- Lord 1 94Documento24 pagineLord 1 94Mani GandanNessuna valutazione finora

- Engineering Economics & Accountancy :Managerial EconomicsDa EverandEngineering Economics & Accountancy :Managerial EconomicsNessuna valutazione finora

- Management Accounting: Concepts and Applications by Kingsley AmahDocumento44 pagineManagement Accounting: Concepts and Applications by Kingsley AmahMolusca DesignNessuna valutazione finora

- Controllership: The Work of the Managerial AccountantDa EverandControllership: The Work of the Managerial AccountantNessuna valutazione finora

- Chapter - 1 - Introduction To Strategic Management AccountingDocumento11 pagineChapter - 1 - Introduction To Strategic Management AccountingNusrat Islam100% (1)

- Exploring The Potential of Customer AccoDocumento47 pagineExploring The Potential of Customer AccoQuoc Viet TrinhNessuna valutazione finora

- PRESENTATION Criticisms Strategic Management AccountingDocumento38 paginePRESENTATION Criticisms Strategic Management AccountingAzri Mohamed YusofNessuna valutazione finora

- Strategic Management AccountingDocumento14 pagineStrategic Management Accountingshimuooshili laviniaNessuna valutazione finora

- Strategic Management Accounting - What Is The Current State of The Concept?Documento9 pagineStrategic Management Accounting - What Is The Current State of The Concept?Mutia Rizki KusumawardaniNessuna valutazione finora

- Strategic Management Accounting PDFDocumento3 pagineStrategic Management Accounting PDFMohamed IrshaNessuna valutazione finora

- Accounting: Management Accounting or Managerial Accounting Is Concerned With The Provisions and UseDocumento6 pagineAccounting: Management Accounting or Managerial Accounting Is Concerned With The Provisions and Useomair133Nessuna valutazione finora

- Strategic Management Accounting and Sense Making in A German Multinational CompanyDocumento56 pagineStrategic Management Accounting and Sense Making in A German Multinational CompanyasaNessuna valutazione finora

- 02 MavisDocumento41 pagine02 MavisSantosh TalariNessuna valutazione finora

- DocxDocumento7 pagineDocxRavinesh PrasadNessuna valutazione finora

- Reading Summary: Bhimani A Et Al (2012)Documento1 paginaReading Summary: Bhimani A Et Al (2012)ZaynahNessuna valutazione finora

- Al., 1996 Mitchell, 2002 Abdel-Kader and Luther, 2008)Documento41 pagineAl., 1996 Mitchell, 2002 Abdel-Kader and Luther, 2008)Junior NimehNessuna valutazione finora

- C30HY - S2 - 2021 - Suggested SolutionsDocumento3 pagineC30HY - S2 - 2021 - Suggested SolutionssharetopreetNessuna valutazione finora

- SStrategic Management Accounting PDFDocumento27 pagineSStrategic Management Accounting PDFLucksen SumbaNessuna valutazione finora

- INTRODUCTIONDocumento91 pagineINTRODUCTIONFaheem KwtNessuna valutazione finora

- Management AccountingDocumento13 pagineManagement AccountingEr Amit MathurNessuna valutazione finora

- Five Aspects of Accounting Departments WorkDocumento22 pagineFive Aspects of Accounting Departments WorkSahir HayatNessuna valutazione finora

- Effects of Modern Strategic Management Accounting Techniques On Performance of Commercial Banks in Palestine: An Empirical StudyDocumento14 pagineEffects of Modern Strategic Management Accounting Techniques On Performance of Commercial Banks in Palestine: An Empirical StudyNica VizcondeNessuna valutazione finora

- Strategic-PerformanceMeasurement2016 - Competitor CostingDocumento10 pagineStrategic-PerformanceMeasurement2016 - Competitor CostingMd. Nafiz ShahrierNessuna valutazione finora

- Tugas Kewirausahaan Review JurnalDocumento6 pagineTugas Kewirausahaan Review JurnalIntan Nurul AiniNessuna valutazione finora

- Strategic Human Resource ManagementDocumento31 pagineStrategic Human Resource ManagementNeha Sharma0% (1)

- Abc 8 PDFDocumento17 pagineAbc 8 PDFNathan LeNessuna valutazione finora

- Strategic Business Analysis TopicsDocumento3 pagineStrategic Business Analysis TopicsLyca MaeNessuna valutazione finora

- Accounts: Critically Evaluate The Evolution in The Role of Management Accounting in Assisting Decision Makers in OrganisationsDocumento7 pagineAccounts: Critically Evaluate The Evolution in The Role of Management Accounting in Assisting Decision Makers in OrganisationsPrabina PoudelNessuna valutazione finora

- Cae07 All Chapter PDFDocumento108 pagineCae07 All Chapter PDFJocelyn Sta AnaNessuna valutazione finora

- Chapter 10 - Financial Performance and Investment AppraisalDocumento10 pagineChapter 10 - Financial Performance and Investment AppraisalSteffany RoqueNessuna valutazione finora

- Lecture 3Documento11 pagineLecture 3neri biNessuna valutazione finora

- Chapter Two: Modern Management Control Systems and Strategic Management AccountingDocumento29 pagineChapter Two: Modern Management Control Systems and Strategic Management AccountingyebegashetNessuna valutazione finora

- Contingent Factors of Strategic Management AccountingDocumento9 pagineContingent Factors of Strategic Management AccountingsaifuddinNessuna valutazione finora

- Learning Plan IntrodocxDocumento16 pagineLearning Plan IntrodocxSittie Ainna A. UnteNessuna valutazione finora

- Management Approaches, Techniques, and Management ProcessesDocumento13 pagineManagement Approaches, Techniques, and Management Processesapi-3709659Nessuna valutazione finora

- What Are Sso Good Theis TopiDocumento11 pagineWhat Are Sso Good Theis TopiAireeseNessuna valutazione finora

- ArticleDocumento26 pagineArticleMitiku ShewaNessuna valutazione finora

- Data Analysis Ch-8Documento68 pagineData Analysis Ch-8Yasir KhanNessuna valutazione finora

- Abdel Razza Khoirie-185020307141016-Assignment 1Documento5 pagineAbdel Razza Khoirie-185020307141016-Assignment 1Abdel RazzaNessuna valutazione finora

- Strategic Management Accounting PracticeDocumento8 pagineStrategic Management Accounting Practiceahmad.kafabi.agb21Nessuna valutazione finora

- Strategic Management Accounting Literature ReviewDocumento10 pagineStrategic Management Accounting Literature Reviewea0xbk19Nessuna valutazione finora

- Chapter 1Documento3 pagineChapter 1Andrea QuetzalNessuna valutazione finora

- Characteristics of The Strategic Planning Process and The Relevance of Management Accounting: Evidence From German DAX30 CompaniesDocumento34 pagineCharacteristics of The Strategic Planning Process and The Relevance of Management Accounting: Evidence From German DAX30 CompaniesMuhammad DazmiNessuna valutazione finora

- Strategic Management Accounting ThesisDocumento4 pagineStrategic Management Accounting Thesisfjda52j0100% (2)

- Business Matrics Research ArticleDocumento13 pagineBusiness Matrics Research ArticleSufyan AneesNessuna valutazione finora

- STRATEGIC MANAGEMENT ACCOUNTING: DEFINITIONS AND DIMENSIONS RuiDocumento18 pagineSTRATEGIC MANAGEMENT ACCOUNTING: DEFINITIONS AND DIMENSIONS RuiRikaz RahmanNessuna valutazione finora

- Instructor-In-Charge: Prof. Niranjan Swain: Niranjanswain@pilani - Bits-Pilani.c.inDocumento13 pagineInstructor-In-Charge: Prof. Niranjan Swain: Niranjanswain@pilani - Bits-Pilani.c.inSiddharth MehtaNessuna valutazione finora

- Greenwood 1990Documento32 pagineGreenwood 1990FandiNessuna valutazione finora

- Session 1 SMA - An Overview - Rev1Documento28 pagineSession 1 SMA - An Overview - Rev1Ahmed MunawarNessuna valutazione finora

- Empirical Research On Accounting ChoiceDocumento49 pagineEmpirical Research On Accounting ChoiceTiiWiiNessuna valutazione finora

- Beaman 2007 TI Et MGMT Acc RoleDocumento11 pagineBeaman 2007 TI Et MGMT Acc RolePat NNessuna valutazione finora

- Give 4 Examples of Firms You Think Would Be Significant Users of Cost Management Information and Explain Why?Documento2 pagineGive 4 Examples of Firms You Think Would Be Significant Users of Cost Management Information and Explain Why?Vernn92% (13)

- Content ServerDocumento9 pagineContent ServerDANIELANessuna valutazione finora

- Management Accounting: Navigation SearchDocumento5 pagineManagement Accounting: Navigation SearchDaniel AtemaNessuna valutazione finora

- Dwnload Full Horngrens Cost Accounting A Managerial Emphasis 16th Edition Datar Solutions Manual PDFDocumento36 pagineDwnload Full Horngrens Cost Accounting A Managerial Emphasis 16th Edition Datar Solutions Manual PDFaffluencevillanzn0qkr100% (10)

- Ma Si 8 Ms UAIf CDSFBDocumento15 pagineMa Si 8 Ms UAIf CDSFBFiroj Md ShahNessuna valutazione finora

- Can Capitalism Bring Inclusive Growth?: - Suneel SheoranDocumento4 pagineCan Capitalism Bring Inclusive Growth?: - Suneel SheoranSandeepkumar SgNessuna valutazione finora

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDocumento29 pagineSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100Nessuna valutazione finora

- International Marketing Solved MCQs (Set-1)Documento6 pagineInternational Marketing Solved MCQs (Set-1)Priyanka MahajanNessuna valutazione finora

- Cbleecpu 12Documento8 pagineCbleecpu 12Pubg GokrNessuna valutazione finora

- Brand Management: Group 13 Procter & Gamble CompanyDocumento11 pagineBrand Management: Group 13 Procter & Gamble CompanyAbhishekKumarNessuna valutazione finora

- SalvoDocumento8 pagineSalvoAlamgir HossainNessuna valutazione finora

- QuestionDocumento5 pagineQuestionJulian Rio PatiNessuna valutazione finora

- Labourindindustrial 1 1Documento148 pagineLabourindindustrial 1 1Brian ChegeNessuna valutazione finora

- 2023 HSC Business StudiesDocumento22 pagine2023 HSC Business StudiesSreemoye ChakrabortyNessuna valutazione finora

- 4 - Hierarchy of Effects ModelDocumento13 pagine4 - Hierarchy of Effects ModelRobertRaisbeckNessuna valutazione finora

- FX Risk ManagementDocumento32 pagineFX Risk Managementapi-3755971100% (1)

- 01 R3 PI Aqua Care 040317Documento2 pagine01 R3 PI Aqua Care 040317abhijitNessuna valutazione finora

- NCR NegoSale Batch 15134 090522Documento35 pagineNCR NegoSale Batch 15134 090522April Jay BederioNessuna valutazione finora

- Chapter8 TaxationonindividualsDocumento12 pagineChapter8 TaxationonindividualsChristine Joy Rapi MarsoNessuna valutazione finora

- Identifying Causes of Construction Waste - Case of Central Region of Peninsula MalaysiaDocumento7 pagineIdentifying Causes of Construction Waste - Case of Central Region of Peninsula MalaysiaTewodros TadesseNessuna valutazione finora

- Answer Key Audit of SHE LIAB and REDocumento8 pagineAnswer Key Audit of SHE LIAB and REReginald ValenciaNessuna valutazione finora

- ATP 108 Commercial Transactions Course Outline 2023 - 2024Documento5 pagineATP 108 Commercial Transactions Course Outline 2023 - 2024Topz TrendzNessuna valutazione finora

- KMI 30 IndexDocumento27 pagineKMI 30 IndexSyed NomaanNessuna valutazione finora

- Trade Finance Presentation - 24-01-2024Documento22 pagineTrade Finance Presentation - 24-01-2024Anup KhanalNessuna valutazione finora

- Case Study On The Rational of Multi-Channel Platform As A Management Information System in The Banking SectorDocumento11 pagineCase Study On The Rational of Multi-Channel Platform As A Management Information System in The Banking SectorHurul AinNessuna valutazione finora

- Human Resource ManagementDocumento66 pagineHuman Resource ManagementMwanza MaliiNessuna valutazione finora

- The Textile and Apparel Industry in India PDFDocumento11 pagineThe Textile and Apparel Industry in India PDFhoshmaNessuna valutazione finora

- HR - Manpower PlanningDocumento128 pagineHR - Manpower PlanningPrashant Chaubey100% (1)

- Revenue Cycle Self-TestDocumento10 pagineRevenue Cycle Self-TestPeachyNessuna valutazione finora

- MIGA Presentation For KCCIDocumento20 pagineMIGA Presentation For KCCIahmed mohammedNessuna valutazione finora

- OLIP Immigration StrategyDocumento124 pagineOLIP Immigration StrategyAmfieNessuna valutazione finora

- CV - Denny Pratama PDFDocumento2 pagineCV - Denny Pratama PDFRobin SetiawanNessuna valutazione finora

- Sudha Milk DairyDocumento62 pagineSudha Milk Dairyimamitanand83% (6)

- Finance & StrategyDocumento36 pagineFinance & StrategySirsanath Banerjee100% (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDa EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyValutazione: 5 su 5 stelle5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyDa EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyValutazione: 4.5 su 5 stelle4.5/5 (37)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora