Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

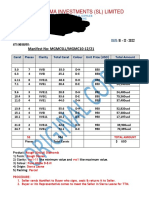

ICM-14635454-v1-Final List - 14 03 12

Caricato da

aristos_arestosDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ICM-14635454-v1-Final List - 14 03 12

Caricato da

aristos_arestosCopyright:

Formati disponibili

The Hellenic Republic (Final List)

Bonds No. ISIN No. Description Maturity Dates Denomination FIRM VOTES Bank of America/ Merrill Lynch Yes Barclays BNP Paribas Credit Suisse Yes Deutsche Bank Yes Goldman Sachs Yes JPMorgan Morgan Stanley Yes Socit Gnrale Yes UBS Blue Mountain Capital Yes Citadel D.E. Shaw Elliott Management Corporation Yes Pacific Investment Management Yes

1 GR0128010676 *

2 GR0128011682 *

3 GR0128012698 *

4 GR0128013704 *

5 GR0128014710 *

6 GR0133006198 *

7 GR0133007204 *

8 GR0133008210 *

9 GR0133009226 *

10 GR0133010232 *

11 GR0138005716 *

12 GR0138006722 *

13 GR0138007738 *

14 GR0138008744 *

15 GR0138009759 *

16 GR0138010765 *

17 GR0138011771 *

18 GR0138012787 *

19 GR0138013793 *

20 GR0138014809 *

21 GR0026111188

New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 New Bonds issued pursuant to Information Memorandum dated 24 February 2012 EUR 12,714,000 4.80% Treasury Bills due 9 March 2012 EUR 1,455,000,000 4.80% Treasury Bills due 9 March 2012 2.125% Bonds 2005-2013 of CHF 650,000,000 Repubblica Ellenica TF 5% 1999/2019 Bond of EUR 200,000,000

24 February 2023 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2024 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2025 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2026 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2027 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2028 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2029 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2030 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2031 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2032 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2033 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2034 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2035 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2036 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2037 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2038 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2039 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2040 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2041 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

24 February 2042 EUR 1

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

09 March 2012 EUR 1,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

22 GR0002087501

09 March 2012 EUR 1,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

23 CH0021839524 24 IT0006527532

05 July 2013 CHF 5,000 11 March 2019 EUR 1,000

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

0096820-0000032 ICM:14635454.1

14/03/2012

25 JP530000BS19 ** The Hellenic Republic 12th JPY 01 February 2016 30,000,000,000 5.25% Bonds due 1 February 2016 26 JP530000CR76 ** The Hellenic Republic 9th JPY 14 February 2015 20,000,000,000 Bonds due 14 July 2015 27 JP530000CS83 ** The Hellenic Republic 15th JPY 22 August 2016 40,000,000,000 5.00% Bonds due 22 August 2016 28 XS0097010440 JPY 25,000,000,000 Euro 30 April 2019 Medium Term Note issued pursuant to the USD 20,000,000,000 Euro Medium Term Note Programme 29 XS0110307930 EUR 200,000,000 6.14 per cent. 14 April 2028 Notes due 14 April 2028 30 XS0147393861 (a) EUR 300,000,000 Floating Interest Payment Date Rate Notes due 2012 falling in May 2012 (b) EUR 150,000,000 Floating Rate Notes due 2012 (to be consolidated and form a single issue with the EUR 300,000,000 Floating Rate Notes due 15 May 2012 issued by the Republic on 15 May 2002) 31 XS0165956672 EUR 400,000,000 4.59 per cent. Notes due 8 April 2016 EUR 1,000,000,000 5.20 per cent. Bonds due 17 July 2034 EUR 1,000,000,000 Floating Rate Notes due 10 May 2034

JPY 100,000, JPY 1,000,000 JPY 100,000, JPY 1,000,000 JPY 100,000, JPY 1,000,000 JPY 10,000,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

EUR 100,000 EUR 1,000

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

Yes Yes

32 XS0191352847

33 XS0192416617

08 April 2016 EUR 1,000 EUR 10,000 EUR 100,000 17 July 2034 EUR 1,000 EUR 10,000 EUR 100,000 Interest Payment Date EUR 1,000 falling in May 2034

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

34 XS0223064139

EUR 400,000,000 Fixed to CMS Interest Payment Date EUR 1,000 Spread Linked Notes due 2025 falling on 6 July 2025 EUR 250,000,000 Fixed to Floating Rate Capped Government Bonds due 2024 EUR 250,000,000 CMS - Linked Notes with Global Floor due 2020 EUR 250,000,000 CMS - Linked Notes with Coupon Floor due 2021 EUR 100,000,000 Fixed to Floating Rate Capped Government Bonds due 2021 EUR 150,000,000 Fixed to CMS Spread Linked Notes due 2021 EUR 2,100,000,000 Floating Rate Notes due 2018 Interest Payment Date EUR 1,000 falling on 7 July 2024 Interest Payment Date EUR 1,000 falling on 13 July 2020 Interest Payment Date EUR 1,000 falling on 19 April 2021 Interest Payment Date EUR 1,000 falling on 31 May 2021 Interest Payment Date EUR 1,000 falling on 9 June 2021 Interest Payment Date EUR 1,000 falling on 5 July 2018

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

35 XS0223870907

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

36 XS0224227313

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

37 XS0251384904

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

38 XS0255739350

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

39 XS0256563429

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

40 XS0260024277

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

41 XS0260349492

EUR 130,000,000 Fixed to CMS Interest Payment Date EUR 1,000 Spread Linked Notes due 2026 falling on 10 July 2026 (a) EUR 3,550,000,000 Floating Interest Payment Date EUR 1,000 Rate Notes due 11 April 2016 falling on 11 April 2016 (b) EUR 550,000,000 Floating Rate Notes due 11 April 2016 (c) EUR 500,000,000 Floating Rate Notes due 11 April 2016 (d) EUR 1,000,000,000 Floating Rate Notes due 11 April 2016 USD 1,500,000,000 4.625 per cent. Bonds due 25 June 2013. EUR 255,000,000 4.218 per cent. Guaranteed Notes due 2019 EUR 430,000,000 4.495 per cent. Guaranteed Notes due 2013 EUR 165,000,000 5.014 per cent. Guaranteed Notes due 2017 Interest Payment Date EUR 1,000 falling on 25 June 2013 20 December 2019 EUR 50,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

42 XS0357333029

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

43 XS0372384064

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

44 XS0280601658

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

45 XS0165688648

02 April 2013 EUR 1,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

46 XS0160208772

27 December 2017 EUR 1,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

0096820-0000032 ICM:14635454.1

14/03/2012

47 FR0000489676

48 XS0142390904

EUR 200,000,000 4.915 per cent. Guaranteed Notes due 2012 EUR 197,000,000 5.46 per cent. Guaranteed Notes due 2014

13 September 2012 EUR 1,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

30 January 2014 EUR 1,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

49 XS0078057725

50 XS0079012166

51 XS0097596463

52 XS0097598329

53 XS0286916027

JPY 30,000,000,000 4.5% Notes 03 July 2017 issued pursuant to the USD 5,000,000,000 EMTN Programme JPY 50,000,000,000 3.80 per 08 August 2017 cent. Notes due 2017 issued pursuant to the USD 10,000,000,000 Euro Medium Term Note Programme EUR 70,000,000 15 Year Euro 21 May 2014 CMS Indexed Notes with Embedded Floor issued pursuant to USD 20,000,000,000 Euro Medium Term Note Programme EUR 110,000,000 20 Year Euro 03 June 2019 CMS Indexed Notes with Embedded Floor issued pursuant to USD 20,000,000,000 Euro Medium Term Note Programme EUR 280,000,000 Fixed to CMS Interest Payment Date Spread Linked Notes due 2019 on 22 February 2019 EUR 320,000,000 4.851 per cent. Notes due 19 September 2016 EUR 160,000,000 4.301 per cent. Fixed Rate Guaranteed Notes due 2014 EUR 250,000,000 Floating Rate Guaranteed Notes due 2016 EUR 200,000,000 4.68 per cent. Guaranteed Notes due 2015

JPY 10,000,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

JPY 1,000,000 JPY 10,000,000 JPY 100,000,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

EUR 100,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

EUR 100,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

EUR 100,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

54 GR1150001666

19 September 2016 EUR 1,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

55 XS0198741687

12 August 2014 EUR 100,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

56 XS0193324380

24 May 2016 EUR 100,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

57 FR0010027557

29 October 2015 EUR 1,000

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

58 XS0169599361

EUR 105,000,000 Floating Rate Notes due 2013 59 JP530005AR32 ** JPY 10,000,000,000 7.35% Bonds due March 2015 60 JP530005ASC0 ** JPY 8,700,000,000 4.5% Bonds due December 2016 61 XS0308854149 EUR 200,940,000 5.008% Guaranteed Notes due 2017

03 June 2013 EUR 10,000 03 March 2015 JPY 100,000, JPY 1,000,000 06 December 2016 JPY 100,000, JPY 1,000,000 18 July 2017 EUR 60,000

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

Yes Yes Yes Yes

NOTES * For the avoidance of doubt, the GDP-linked Securities which are issued with the New Bonds can be detached from the New Bonds and accordingly do not need to be transferred with the New Bonds in settlement of RAST trades. ** We assume that coupons have not been stripped from the principal portion of these Bonds.

GENERAL NOTE The EMEA Determinations Committee has determined that any obligations of the bondholders of the New Bonds (numbers 1-20 (inclusive) in the above Final List) arising in respect of the Co-Financing Agreement, as such obligations are described in the three information memorandum dated 24 February 2012 (the "Invitation Memorandum"), are not obligations which require an indemnity to be given pursuant to Section 9.2(b) of the 2003 ISDA Credit Derivatives Definitions.

0096820-0000032 ICM:14635454.1

14/03/2012

0096820-0000032 ICM:14635454.1

14/03/2012

0096820-0000032 ICM:14635454.1

14/03/2012

Potrebbero piacerti anche

- Brief Relief From Spanish Bailout: Morning ReportDocumento3 pagineBrief Relief From Spanish Bailout: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Sovereign Risk and The Euro: Lorenzo Bini Smaghi Member of The Executive Board European Central BankDocumento66 pagineSovereign Risk and The Euro: Lorenzo Bini Smaghi Member of The Executive Board European Central BankVivian Vy LêNessuna valutazione finora

- Fateful Day For Greece: Morning ReportDocumento3 pagineFateful Day For Greece: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Spanish Debt Costs Further Up: Morning ReportDocumento3 pagineSpanish Debt Costs Further Up: Morning Reportnaudaslietas_lvNessuna valutazione finora

- "Yes, We Have A Deal": Morning ReportDocumento3 pagine"Yes, We Have A Deal": Morning Reportnaudaslietas_lvNessuna valutazione finora

- New Debt Solution in Place For Greece: Morning ReportDocumento3 pagineNew Debt Solution in Place For Greece: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Economic Fact Book: Spain: Key FactsDocumento8 pagineEconomic Fact Book: Spain: Key FactssovacapNessuna valutazione finora

- MP - Money Supply - Cyprus - Iliescu Mihai, Bustiuc Vlad & Aurelio CiroDocumento27 pagineMP - Money Supply - Cyprus - Iliescu Mihai, Bustiuc Vlad & Aurelio CiroMihaiIliescu100% (1)

- MRE121016Documento3 pagineMRE121016naudaslietas_lvNessuna valutazione finora

- CREDIT SUISSE - European - Economics - Greece's Funding Gap - Oct2012Documento20 pagineCREDIT SUISSE - European - Economics - Greece's Funding Gap - Oct2012Dimitris YannopoulosNessuna valutazione finora

- MRE120313Documento3 pagineMRE120313naudaslietas_lvNessuna valutazione finora

- Spanish Yields Climbs On Market Fear: Morning ReportDocumento3 pagineSpanish Yields Climbs On Market Fear: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Why Doesn't Spain Ask For Help?: Morning ReportDocumento3 pagineWhy Doesn't Spain Ask For Help?: Morning Reportnaudaslietas_lvNessuna valutazione finora

- MRE120514Documento3 pagineMRE120514naudaslietas_lvNessuna valutazione finora

- MRE120803Documento3 pagineMRE120803naudaslietas_lvNessuna valutazione finora

- Expect Rate Cut From Riksbanken: Morning ReportDocumento3 pagineExpect Rate Cut From Riksbanken: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Fiscal Sustainability Report: European Economy 8 - 2012Documento212 pagineFiscal Sustainability Report: European Economy 8 - 2012AdolfoSehnertNessuna valutazione finora

- US Budget Committee Fails: Morning ReportDocumento3 pagineUS Budget Committee Fails: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Efsf EsmDocumento48 pagineEfsf Esmshobu_iujNessuna valutazione finora

- Unchanged From Boe and Ecb: Morning ReportDocumento3 pagineUnchanged From Boe and Ecb: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Bini Smaghi Talks For More Action: Morning ReportDocumento3 pagineBini Smaghi Talks For More Action: Morning Reportnaudaslietas_lvNessuna valutazione finora

- International Accounting Standard 21Documento5 pagineInternational Accounting Standard 21معن الفاعوريNessuna valutazione finora

- Estonia 2021 Debt Report - 0Documento4 pagineEstonia 2021 Debt Report - 0raresNessuna valutazione finora

- No Interest Rate Cut From The ECB: Morning ReportDocumento3 pagineNo Interest Rate Cut From The ECB: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Vol 2 No. 43 January 09, 2012Documento1 paginaVol 2 No. 43 January 09, 2012Amit GuptaNessuna valutazione finora

- Greek Default Drawing Closer: Morning ReportDocumento3 pagineGreek Default Drawing Closer: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Spain Seeks Bailout: Morning ReportDocumento3 pagineSpain Seeks Bailout: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Is Fiscal Union The Answer To The Euro's Problems?: Morning ReportDocumento3 pagineIs Fiscal Union The Answer To The Euro's Problems?: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Euro-Zone Crisis RevisedDocumento46 pagineEuro-Zone Crisis RevisedSandeep L DeshbhratarNessuna valutazione finora

- Mre121213 PDFDocumento3 pagineMre121213 PDFnaudaslietas_lvNessuna valutazione finora

- Politics and Law Will Move Markets Today: Morning ReportDocumento3 paginePolitics and Law Will Move Markets Today: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Slightly Tighter Norwegian Credit Standards: Morning ReportDocumento3 pagineSlightly Tighter Norwegian Credit Standards: Morning Reportnaudaslietas_lvNessuna valutazione finora

- En Presentation Merrill Lynch Oct2011 Presentation Banco SabadellDocumento35 pagineEn Presentation Merrill Lynch Oct2011 Presentation Banco SabadellseyviarNessuna valutazione finora

- Growth in The US Picks Up: Morning ReportDocumento3 pagineGrowth in The US Picks Up: Morning Reportnaudaslietas_lvNessuna valutazione finora

- BELFCSODCXDCDocumento2 pagineBELFCSODCXDCThiyas Artha SariNessuna valutazione finora

- Corporate Financing in UKDocumento28 pagineCorporate Financing in UKSaurav MehtaNessuna valutazione finora

- 2 Trilioane Euro Cheltuite PTR Impiedicare Prabusire Zona Euro Pina in Iunie2012Documento4 pagine2 Trilioane Euro Cheltuite PTR Impiedicare Prabusire Zona Euro Pina in Iunie2012abelardbonaventuraNessuna valutazione finora

- Final Project TaxationDocumento34 pagineFinal Project TaxationAfia AzadNessuna valutazione finora

- European Union: Aaa / Aaa / AaaDocumento13 pagineEuropean Union: Aaa / Aaa / Aaaie101Nessuna valutazione finora

- Greek Bail-Out Approved: Morning ReportDocumento3 pagineGreek Bail-Out Approved: Morning Reportnaudaslietas_lvNessuna valutazione finora

- From Exchange Rate Stabilization To Inflation Targeting: The Case of TurkeyDocumento27 pagineFrom Exchange Rate Stabilization To Inflation Targeting: The Case of TurkeyAdam SmithNessuna valutazione finora

- HNX Fact Book 2012Documento152 pagineHNX Fact Book 2012Thuy VuNessuna valutazione finora

- Market Outlook 9th December 2011Documento5 pagineMarket Outlook 9th December 2011Angel BrokingNessuna valutazione finora

- Economic Fact Book Greece: Key FactsDocumento8 pagineEconomic Fact Book Greece: Key Factslevel3assetsNessuna valutazione finora

- Highlights: Economy and Strategy GroupDocumento33 pagineHighlights: Economy and Strategy GroupvladvNessuna valutazione finora

- Kwartaalupdate Kwetsbaarheidsindicator Publieke Financiën (SVI)Documento9 pagineKwartaalupdate Kwetsbaarheidsindicator Publieke Financiën (SVI)KBC EconomicsNessuna valutazione finora

- A Casual Observers Guide To The Greek EconomyDocumento24 pagineA Casual Observers Guide To The Greek EconomyChatzianagnostou GeorgeNessuna valutazione finora

- Markets Improved Yesterday: Morning ReportDocumento3 pagineMarkets Improved Yesterday: Morning ReportAija KlfNessuna valutazione finora

- Disagreement About Ecbs Role: Morning ReportDocumento3 pagineDisagreement About Ecbs Role: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Stock Prices and Interest Rates Fell: Morning ReportDocumento3 pagineStock Prices and Interest Rates Fell: Morning Reportnaudaslietas_lvNessuna valutazione finora

- The Global Debt ProblemDocumento3 pagineThe Global Debt Problemrichardck61Nessuna valutazione finora

- Budget 2012-2013Documento43 pagineBudget 2012-2013Cruz Crasborn FernandoNessuna valutazione finora

- OeKB Group Annual Report 2012Documento102 pagineOeKB Group Annual Report 2012ugyanmarNessuna valutazione finora

- Introduction To European Sovereign Debt CrisisDocumento8 pagineIntroduction To European Sovereign Debt CrisisVinay ArtwaniNessuna valutazione finora

- Topic 4: Macroeconomic Objectives: EconomicsDocumento17 pagineTopic 4: Macroeconomic Objectives: EconomicsAlvin Chai Win LockNessuna valutazione finora

- 2010 April Market Collapse Updated VersionDocumento14 pagine2010 April Market Collapse Updated VersionpragyarahuljaiswalNessuna valutazione finora

- Banks Loans Record Amount From ECB: Morning ReportDocumento3 pagineBanks Loans Record Amount From ECB: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Chapter 1Documento15 pagineChapter 1Manjunath BVNessuna valutazione finora

- Deterioration of Financial Conditions: Morning ReportDocumento3 pagineDeterioration of Financial Conditions: Morning Reportnaudaslietas_lvNessuna valutazione finora

- The Incomplete Currency: The Future of the Euro and Solutions for the EurozoneDa EverandThe Incomplete Currency: The Future of the Euro and Solutions for the EurozoneNessuna valutazione finora

- Hai The Arab World - PsDocumento17 pagineHai The Arab World - Psaristos_arestosNessuna valutazione finora

- IMF Mea CulpaDocumento51 pagineIMF Mea CulpaZerohedgeNessuna valutazione finora

- Euro GroupDocumento35 pagineEuro Grouparistos_arestosNessuna valutazione finora

- Germany Vs ItalyDocumento54 pagineGermany Vs ItalyMirriam EbreoNessuna valutazione finora

- Greece ProjectsDocumento23 pagineGreece Projectsaristos_arestosNessuna valutazione finora

- EN EN: European CommissionDocumento14 pagineEN EN: European Commissionaristos_arestosNessuna valutazione finora

- Contract I Reading ListDocumento11 pagineContract I Reading ListBUYONGA RONALDNessuna valutazione finora

- Welfare Economics of Amartya SenDocumento12 pagineWelfare Economics of Amartya SenromypaulNessuna valutazione finora

- Sthira Solns PVT LTD, BangaloreDocumento25 pagineSthira Solns PVT LTD, Bangaloreshanmathieswaran07Nessuna valutazione finora

- Andy Bushak InterviewDocumento7 pagineAndy Bushak InterviewLucky ChopraNessuna valutazione finora

- Internal Auditors Are Business PartnerDocumento2 pagineInternal Auditors Are Business PartnerValuers NagpurNessuna valutazione finora

- Managerial Remuneration Checklist FinalDocumento4 pagineManagerial Remuneration Checklist FinaldhuvadpratikNessuna valutazione finora

- Price LisDocumento9 paginePrice LisDssp StmpNessuna valutazione finora

- Production Possibility Frontiers, OC, MarginalismDocumento4 pagineProduction Possibility Frontiers, OC, Marginalismyai giniNessuna valutazione finora

- 3 Underwriting of Shares PDFDocumento8 pagine3 Underwriting of Shares PDFSangam NeupaneNessuna valutazione finora

- Bing SummaryDocumento3 pagineBing SummarySanta PermatasariNessuna valutazione finora

- The Language of Report WritingDocumento22 pagineThe Language of Report WritingAgnes_A100% (1)

- Solution Homework 5Documento5 pagineSolution Homework 5AtiaTahira100% (1)

- SN Character List of Animal Farm by George OrwellDocumento3 pagineSN Character List of Animal Farm by George Orwell10nov1964Nessuna valutazione finora

- Agro IndustrializationDocumento24 pagineAgro IndustrializationDrasko PeracNessuna valutazione finora

- Econ0002 Summer 2023 Research PaperDocumento17 pagineEcon0002 Summer 2023 Research Paperfizzyizzy628Nessuna valutazione finora

- Evolution of Asian RegionalismDocumento1 paginaEvolution of Asian Regionalismaimee0dayaganonNessuna valutazione finora

- Natural Ice CreamDocumento12 pagineNatural Ice CreamAkash Malik0% (1)

- Benjamin R. Barber - Strong Democracy - Participatory Politics For A New Age - University of California Press (2003) PDFDocumento357 pagineBenjamin R. Barber - Strong Democracy - Participatory Politics For A New Age - University of California Press (2003) PDFIngridCorrêa100% (1)

- Chronological Order of EconomistsDocumento6 pagineChronological Order of EconomistsPrince PotterNessuna valutazione finora

- Quant Checklist 476 by Aashish Arora For Bank Exams 2024Documento118 pagineQuant Checklist 476 by Aashish Arora For Bank Exams 2024palanimesh420Nessuna valutazione finora

- chính trị học so sánhDocumento18 paginechính trị học so sánhTrần Bích Ngọc 5Q-20ACNNessuna valutazione finora

- India Map in Tamil HDDocumento5 pagineIndia Map in Tamil HDGopinathan M0% (1)

- NAFTA Verification and Audit ManualDocumento316 pagineNAFTA Verification and Audit Manualbiharris22Nessuna valutazione finora

- 1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFDocumento168 pagine1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFPranav PuriNessuna valutazione finora

- Final OutputDocumento44 pagineFinal OutputJopie ArandaNessuna valutazione finora

- Manifest 232Documento2 pagineManifest 232Elev8ted MindNessuna valutazione finora

- MP Ekramul Karim ChowdhuryDocumento5 pagineMP Ekramul Karim ChowdhurySaifSaemIslamNessuna valutazione finora

- Sony India Post GST Price SheetDocumento4 pagineSony India Post GST Price Sheetgans OliveNessuna valutazione finora

- Weber - S Least Cost TheoryDocumento12 pagineWeber - S Least Cost TheoryadityaNessuna valutazione finora

- Essay On PostmanDocumento5 pagineEssay On Postmanxlfbsuwhd100% (2)