Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Membership Entry Pathways Assessment Form

Caricato da

Sieu Nhan AscouticDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Membership Entry Pathways Assessment Form

Caricato da

Sieu Nhan AscouticCopyright:

Formati disponibili

Membership Entry Pathway Assessment Application

Introduction

Please read these instructions carefully

You can enter your details directly into the application form on your computer and then send us a printed and signed copy. We recommend that you keep a copy for your own records.

What is this application for?

This assessment will help to determine your starting point in the CPA Program and your eligibility for membership.

If you were a previous member and wish to renew your membership

Please contact your local office directly. You will find a list of our offices on the CPA Australia website at cpaaustralia.com.au/contact

If you wish to apply for reciprocal membership

CPA Australia has Mutual Recognition Agreements (MRA) with a number of leading accounting bodies around the world. In most cases, members of these bodies can apply for a reciprocal membership or CPA Program exemptions. You will need to send us an application form that is specific to one of our MRAs. Information is available on the CPA Australia website at cpaaustralia.com.au/mra

If you need help or more information

You will find more information about the CPA Program at cpaaustralia.com.au/cpaprogram Please contact your local office directly. You will find a list of our offices on the CPA Australia website at cpaaustralia.com.au/contact

Send us your application There is an application fee for your assessment

There is a non-refundable fee to assess your application. We will contact you about membership if you are eligible to proceed.

We accept applications throughout the year

You can: mail your application to one of the addresses on page 12, or bring your application into your local office. You will find a list of our offices on the CPA Australia website at cpaaustralia.com.au/contact Incomplete applications cannot be processed and this will delay your assessment and possible enrolment into the CPA Program. Please turn the page to begin your application At the end of the form we will remind you what to send us and where to send your documents.

CPA Australia Membership Assessment Application (2011)

Membership Entry Pathway Assessment Application

Application Form

Office use only reference number:

(A) About you

Your personal details Title Mr Given names Mrs Ms Miss Other

Preferred name

This will be used as your first name in our correspondence.

Family name

Date of birth

D D

/

M M

/

Y Y Y Y

Do we already know you? Were you a CPA Passport student? No Yes My CPA Passport number was You will find this reference number on our qualifications assessment result letter. If available, please provide us with a copy of this letter. CPA Passport students are not members of CPA Australia.

Have you previously had a CPA Australia Qualifications Assessment for membership or migration? No Yes My reference number was

Have you changed your name?

If your name is different on any of your transcripts or identity documents, we will need a certified true copy of a proof of name change document. You can prove your name has changed by such documents as a marriage certificate or government-issued change of name document. Please ensure that these are certified true copies of the original documents. Page 10 of this form provides information about certifying your documents.

CPA Australia Membership Assessment Application (2011)

Your home contact details Home address

Suburb or City State or Province or Region Postcode or Zip Country Home phone

e.g. +61 3 1234 5678

Please include the country code and area code. Please include the country code and area code.

Mobile/Cell Phone

e.g. +61 3 1234 5678

Your employment contact details

If you are not currently employed, please ignore this section.

Employer name

Position title

Employer address

Suburb or City State or Province or Region Postcode or Zip Country Business phone

e.g. +61 3 1234 5678

Please include the country code and area code. Please include the country code and area code.

Business fax

e.g. +61 3 1234 5678

Your communication preferences We need your email address to send your assessment result and other important updates including login details so that you can track the progress of your application. Your email address (mandatory) Please ensure that your email address is written clearly and is correct. Please choose one only.

Which is your preferred postal address? At work At home

CPA Australia Membership Assessment Application (2011)

Your eligibility for membership All of these questions must be answered for your assessment. Are you currently providing public accounting services in Australia? Public accounting services include accounting, bookkeeping, auditing and assurance services, taxation, insolvency and corporate reconstruction, financial planning and financial reporting. No Yes In the past 10 years, have you ever been convicted of a criminal offence, notifiable offence or are there any pending charges against you? No Yes Are you or have you ever been a debtor in any Sequestration Order, Deed of Assignment, Composition or Deed of Arrangement, under the provisions of the Bankruptcy Act? No Yes Are you or have you ever been a Director of a company to which a Receiver, a Provisional Liquidator, a Liquidator, a Scheme Manager or an Official Manager has been appointed: while you were a Director, or within six months after you ceased to be a Director? No Yes Have you ever been refused membership or had to forfeit your membership of a statutory, professional or other body? No Yes Have you ever been subject to disciplinary proceedings by a statutory, professional, academic institution or other body that may have bearing on your professional capacity? No Yes Public Practitioners: are subject to regulation have additional training needs and responsibilities

If you answered Yes to any of these questions

Please provide more information about the nature of your situation on a separate sheet and any related official documentation to support your application. If you answered "Yes" to providing public accounting services, please provide details of your role and ownership of the business, outline services offered to the public and classification of the accounting services your business provides. Attach supporting documents to this application and mail to: General Manager, Membership CPA Australia Ltd GPO Box 2820 Melbourne VIC 3001 AUSTRALIA Your application will be considered individually on its merits and may take longer to process.

CPA Australia Membership Assessment Application (2011)

(B) Confirm your identity

We need you to confirm your identity by sending us certified true copies of your identity documents. Use the list below to score a minimum of 100 points of identity confirmation. The identification should not be expired. Proof of your identity

Type of identification Birth certificate Earns you 70 points

Your score

Citizenship certificate

Earns you 70 points

Passport National Identity Card

Issued in Hong Kong, Malaysia, Singapore and PRC etc.

Earns you 70 points

Earns you 70 points

A written reference

From a full member of a recognised professional body This reference must: be signed and dated by the referee show that you have known the referee for at least 12 months References must not be dated more than three months prior to the application being received by us

Earns you 50 points

Licence or permit issued under law (with your name on it)

This must also show your signature or photo (e.g. a drivers licence)

Earns you 40 points

Public Service ID card (with your name on it)

This must also show your signature or photo

Earns you 40 points

Social Security ID card (with your name on it)

This must also show your signature or photo

Earns you 40 points

Tertiary student ID card (with your name on it)

This must also show your signature or photo

Earns you 40 points

Medicare card

This is not a private health care card

Earns you 25 points

Credit or other bank cards

You can use more than one card (each for 25 points) but each card must be from a different bank

Earns you 25 points Your total score

Must be at least 100 points

You need to send us certified copies of these identity documents

Each identification document must be a certified true copy of the original as described on page 11. If your name is different on any of your identity documents, you will also need to send a copy of your proof of name change document.

CPA Australia Membership Assessment Application (2011)

Provide profile information

3 Tick one box only for each of the following

1. Current employment sector

Academia/Education Public Practice (not public sector) Parenting (Go to Point 6) Small to medium enterprise (<200 employees or <$50m turnover) Corporate (>200 employees or >$50m turnover) Government Commonwealth/National Government State/Territory Government Local Government Business Enterprise Not-For-Profit Not employed (Go to Point 6) Retired Manufacturing Association/Membership Organisation Construction Film/TV/Radio Libraries, Museums and the Arts Sport/Entertainment/Recreation Education Electricity/Gas/Water

4. Job responsibility

CEO/Managing Director Partner in Non-Accounting Business Self Employed Team Leader/Supervisor Academic/Teacher Chief Financial Officer or equivalent Financial Controller General Manager Manager Employee Public Practice Sole Practitioner Public Practice Partner/Director

3. Primary job function

Accounting Administration Information Management/Technology Insolvency and Reconstruction Law Management Accounting Marketing/Sales Financial Planning Superannuation Taxation Auditor External Treasury International Trade Auditor Internal Human Resources/Training General Management Procurement E-Business/E-Commerce Business Development Financial Management Risk Management Business Advisory Services/ Management Consulting Company Secretarial Corporate Governance External Reporting Financial Control

5. Employer size

1 5 6 10 11 20 21 50 51 100 101 200 201 300 301 500 501 1000 1000+

2. Industry

Hospitality Finance and Banking Insurance Financial Services Government Admin/Defence Health/Community Services Printing/Publishing/Recording Oil/Petroleum Agriculture/Forestry/Fishing Mining/Extractive Property Services Business Services Transport/Storage Communications Wholesale/Retail Trade E-Business/E-Commerce Recruitment Travel and Tourism Advertising/Marketing Tick all relevant boxes in the following

6. Your communication preference ongoing

Email Mail

7. Notice of AGM

Email Mail

8. Membership renewal

Email Mail

9. CPA Australia Annual report

Full Annual Report Concise Version No Annual Report

13. Licences/certificates

Auditor of Superannuation Funds Australian Financial Services Licence Licensed Insurance Agent (Singapore) Licensed Investment Advisor Registered Company Liquidator Legal Practitioner ICAA Practice Certificate Licensed Securities Dealer Registered Company Auditor Registered Tax Agent Trustee in Bankruptcy

National Institute of Accountants Financial Services of Australasia

Outside Australia

American Institute of Certified Public Accountants Association of International Accountants Chinese Institute of Certified Public Accountants Institute of Certified Public Accountants of Singapore Association of Chartered Certified Accountants Chartered Institute of Management Accountants Hong Kong Institute of Certified Public Accountants Malaysian Institute of Accountants Zealand Institute of Chartered New Accountants

14. Other memberships you hold Australia

Australian Computer Society Australian Institute of Management Financial Planning Association Institute of Internal Auditors Australia National Tax and Accountants Association Australian Institute of Company Directors Chartered Secretaries Australia Institute of Chartered Accountants Australia

15. Professional interests

Information Management/Technology Insolvency and Reconstruction Law Management Accounting

Marketing/Sales Financial Planning Small Business Superannuation Taxation Auditing External Treasury General Management E-Business/E-Commerce Human Resources/Training/Industrial Relations Securities/Funds Management Public Sector Issues Risk Management Banking Auditing Internal Financial Markets Insurance TBL/Sustainability Advisory Service/Management Consulting Company Secretarial Corporate Governance Ethics External Reporting Financial Control

6

CPA Australia Membership Assessment Application (2011)

(C) Provide us with your education history

This section asks you about any studying you have done to help us decide the components of CPA Program that you would need to complete to qualify for full CPA status. Do you have any relevant qualifications?

Have you had your qualifications previously assessed by CPA Australia?

Do you have more than two relevant qualifications?

If you had a CPA Australia Qualifications Assessment for membership or migration before, please provide your reference number on page 2 of this form. Qualification A Name of qualification University or Institute Campus (if applicable) Country Full-time study Part-time study Have you completed this qualification? Yes I completed it in

M M

Please add a separate sheet that provides the details for each additional qualification.

Please provide a certified true copy of official academic transcripts showing the grades or results from the institution where you completed the original study. If you have received any exemptions, credits or advanced standing in this qualification, please include a certified true copy of the official academic transcripts showing the grades or results from the institution where the prior study took place. /

Y Y Y Y

No I will complete it in

M M

/

Y Y Y Y

If you have completed your qualification, please provide a certified true copy of the official academic award or letter of completion.

Qualification B Name of qualification University or Institute Campus (if applicable) Country Full-time study Part-time study Have you completed this qualification? Yes I completed it in

M M

Please provide a certified true copy of official academic transcripts showing the grades or results from the institution where you completed the original study. If you have received any exemptions, credits or advanced standing in this qualification, please include a certified true copy of the official academic transcripts showing the grades or results from the institution where the prior study took place. /

Y Y Y Y

No I will complete it in

M M

/

Y Y Y Y

If you have completed your qualification, please provide a certified true copy of the official academic award or letter of completion.

Do you have a relevant professional membership? Are you or have you ever been a member of a professional accounting body? No Yes Name of the professional accounting body Level of membership Send us a certified true copy of your membership certificate or letter of good standing (if applicable). You should also send a certified true copy of your official results for all professional papers or examinations you completed with this body.

CPA Australia Membership Assessment Application (2011)

(D) How to pay

How much is the application fee? There is a non-refundable fee to assess your application. it is charged in Australian dollars you can pay this fee by credit card, cheque or bank draft it is based on your preferred mailing address, as follows If your preferred mailing address is in Australia New Zealand Hong Kong, Malaysia or Singapore This charge is AUD$138 (GST inclusive) AUD$144 (NZ GST inclusive) AUD$125 You can pay by cheque, credit card or in person at your local CPA Australia office in your local currency, using a set monthly exchange rate. see the current application fee rate at cpaaustralia.com.au/memberfees contact your local office listed on cpaaustralia.com.au/contact Any other location If you are paying by credit card Select which credit card would you like to use. AMEX Card number Please ensure these numbers are entered clearly and correctly. Expiry date /

M M Y Y

AUD$125

Visa

Diners Club

MasterCard

Cardholders name Total amount Please print and sign. We do not accept digital signatures.

Cardholders signature If you are paying by cheque Your cheque should be made payable to CPA Australia Ltd.

Personal cheques will only be accepted if drawn on an Australian bank account unless paying directly to our offices in Hong Kong, Malaysia or Singapore. You will be liable for any fees incurred from a dishonoured cheque. If you are paying from outside of Australia, the bank draft must nominate a corresponding Australian bank through which we can process the payment. Tick this box if are paying by cheque and staple your cheque to this page.

CPA Australia Membership Assessment Application (2011)

(E) Terms and conditions for membership applications

Privacy Statement As part of your application, you will need to read and agree to this Privacy Statement. CPA Australia Ltd (CPA Australia) is committed to protecting the privacy and security of your personal information. The personal information you provide may be used by CPA Australia to: process your application for membership with CPA Australia record your membership details and profile information manage your membership of CPA Australia ensure you comply as a member with CPA Australias Constitution and By-Laws conduct market research in order to identify and analyse the ongoing needs of CPA Australia members provide you with access to and information about a range of current and future membership benefits including Member Benefits+ enrol you in the CPA Program administer the CPA Program administer your enrolments administer your exams customise future service offerings, such as exams for the CPA Program compile an employer-requested list for your employer of those persons in their employment undertaking the CPA Program and their member status notify you about CPA Australia events arrange study group contact if required aggregate and use for internal review to analyse trends and statistics Failure to complete the application form correctly may delay or render us unable to process your application. CPA Australia may disclose the personal information you provide to: CPA Program providers Member Benefits+ partners so that they may contact you about their products and services. For a full list of Member Benefits+ partners, see the CPA Australia website cpaaustralia.com.au external service providers to whom we have contracted out functions such as printers, mailing houses, IT companies and marketing and communications agencies universities and other education providers, professional and regulatory bodies, governmental departments such as the Department of Immigration and Citizenship, Australian Education International - National Office of Overseas Skills Recognition and Department of Education, Employment and Workplace Relations The personal information you provide will be treated by us in the following ways: your personal information may be transferred or stored outside the country where the information was collected for the purposes stated above you have the right to access personal or correct any personal information which CPA Australia holds about you, (subject to any applicable legal exceptions) and can do this via the 'Update my profile' service on the website at cpaaustralia.com.au. You can use this service to opt out of receiving further communications from CPA Australia. For more information on CPA Australia's Privacy Policy, visit the CPA Australia website CPA Australia processes assessment payments using EFTPOS and online technologies. All transactions processed by CPA Australia meet industry security standards to ensure member details and payments are protected. For more information about our security procedures and payment processes contact +61 3 9606 9606. Your acceptance I wish to apply for an assessment by CPA Australia. I have read and agree to the Privacy Statement. Your signature /

D D M M

Date

/

Y Y Y Y

Please print and sign. We do not accept digital signatures.

If you do not want to receive information about our Member Benefits+ partners and their products and services, please tick this box. Please turn the page to find out what to send us and where.

CPA Australia Membership Assessment Application (2011)

Membership Entry Pathway Assessment Application

What to send us

What to send

Please send us your: application form (pages 2 to 9) payment details or application fee supporting documents (see below) Attach your supporting documents You will need to send us certified true copies of some of the following documents. We suggest that you tick each row in the checklist below when you have collected the documents to send to us.

If You wish us to process your application. Your name is different on any of your transcripts or identity documents You have previously had a CPA Australia Qualifications Assessment for membership or migration You have completed or are completing a relevant qualification

Please send us certified true copies of Your identity documents (see page 5). Your proof of change of name documentation such as: a marriage certificate or government-issued change of name documents Your assessment letter, if you have this. Your official academic transcripts or exam results. If you have received any exemptions, credits or advanced standing in this qualification, please include a certified true copy of the official academic transcripts showing the grades or results from the institution where the prior study took place. If you have completed your qualification, please provide a certified true copy of the official academic award or letter of completion. Your membership certificate or letter of good standing (if applicable). You should also send the official results for all professional papers or examinations you completed with this body.

You are a qualified member of a recognised International Federation of Accountants (IFAC) professional body

Please note

Please do not staple this form or any documents together. However, you can: use a paper clip to hold your pages together staple any cheques or money orders for the application fee to page 8 Please do not attach any sticky notes to your application. You need to send us certified copies of your supporting documents When you send us copies of your documents, they must be certified true copies of the originals and in English. You will need to have non-English documents officially translated. Send us a certified true copy of the original language document and a certified true copy of the translation. Do not send original documents. They will not be returned. What is a certified true copy" of an original? A certified copy is a copy of an original document that is verified as being a true copy. An authorised person must certify the copy after seeing the original document. A list of authorised people who can certify documents is below. What needs to be certified? copies of all identity documents documents relating to your education (e.g. academic transcripts, academic award or letter of completion) documents relating to professional memberships non-English documents, as listed above, and the corresponding English version that have been translated by a professional translator

CPA Australia Membership Assessment Application (2011)

10

How do I get my documents certified? 1. photocopy your original documents 2. take your original documents and photocopies to a person who is authorised to certify documents 3. have the authorised person certifying write on each copy I certify this is a true copy of the original document sighted by me sign and print their name state their profession or occupation group (as below) member number (if applicable) the date certified (within the last 12 months)

Statement by person authorised to certify Statement of profession Signed name Printed name Member number

Date the original document was sighted and the copy was certified

We do not accept photocopies or faxes of certified documents certifications where the identity of the person certifying cannot be read certification made by a person not authorised to certify documents certification made by yourself, on your own documents, even if you are a person authorised to certify documents Who can certify my documents? The following people are authorised to certify documents: staff at your local CPA Australia office listed on the CPA Australia website cpaaustralia.com.au/contact CPA or FCPA (Fellow) but this person cannot be an Associate member of CPA Australia full member of a recognised International Federation of Accountants (IFAC) professional body as listed on www.ifac.org/about/member-bodies commissioner for oaths Justice of the Peace solicitor or lawyer migrant agent registered with Migration Agents Registration Authority (MARA) dentist, medical practitioner, pharmacist or veterinary surgeon bank manager, school principal or registered migration agent police officer, sheriff or sheriffs officer notary officer Australian consular or diplomatic officer any other official, who in your home country, is authorised to endorse documents and legal declarations or to witness sworn affidavits

CPA Australia Membership Assessment Application (2011)

11

Where to send your application

Your application and documents can be: mailed to one of the addresses below, or brought to your local CPA Australia office listed on the CPA Australia website at cpaaustralia.com.au/contact They cannot be faxed or emailed. Your location Australia & all other locations Mail your application to CPA Australia Member Advisory and Information Services GPO Box 2820 Melbourne VIC 3001 AUSTRALIA Telephone: 1300 73 73 73 (in Australia) or + 61 3 9606 9677 (outside Australia) Greater China CPA Australia 20/F Tai Yau Building 181 Johnston Road Wanchai HONG KONG Telephone: +852 2891 3312 Malaysia CPA Australia Suite 10.01, Level 10 The Gardens South Tower Mid Valley City Lingkaran Syed Putra 59200 Kuala Lumpur MALAYSIA Telephone: +603 2267 3388 Singapore CPA Australia 31 01 One Raffles Place 1 Raffles Place SINGAPORE 048616 Telephone: +65 6671 6500

What happens next?

1. We will send you an acknowledgement email Our email will let you know: we have received your application how to track the progress of your application or contact us with any questions 2. We will let you know if your application cannot be processed This may occur if: your form is incomplete or unsigned certified true copies of relevant documents have not been provided 3. We will let you know the outcome of your application This assessment will help to determine your starting point in CPA Program and your eligibility for membership. In general, you should receive our response by email within 10 working days. You can find our current response times at cpaaustralia.com.au/apply. Please check that you have provided the correct clearly written email address to contact you.

CPA Australia Membership Assessment Application (2011)

12

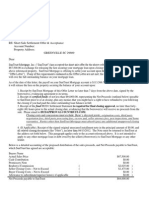

Enrolment dates for the 2012 CPA Program professional level Semester 1 Enrolments open Early bird enrolment fee closing date (Professional level only) Enrolments close (Professional level only) Semester begins Friday 9 December 2011 6.00pm AEDST Monday 16 January 2012 Monday 30 January 2012 Monday 13 February 2012 Semester 2 Friday 15 June 2012 6.00pm AEST Monday 9 July 2012 Monday 23 July 2012 Monday 6 August 2012

Enrolments for the CPA Program are not accepted if received after the enrolment closing date. Important information you have six years (12 semesters) to complete the CPA Program professional level if you have not completed a recognised Taxation and a recognised Auditing unit at university, you must enrol in Advanced Taxation and Advanced Audit and Assurance in the CPA Program professional level for your two electives

If you need help or more information

You will find more information about the CPA Program at cpaaustralia.com.au/cpaprogram Please contact your local office directly. You will find a list of our offices on the CPA Australia website at cpaaustralia.com.au/contact

CPA202247 10/2011

CPA Australia Membership Assessment Application (2011)

13

Potrebbero piacerti anche

- TimePayment Vendor ApplicationDocumento2 pagineTimePayment Vendor Applicationapi-17419604Nessuna valutazione finora

- Vietnam Family Travel Agent ContractDocumento6 pagineVietnam Family Travel Agent ContractIrish SalvadorNessuna valutazione finora

- Employee Standard DiscountDocumento2 pagineEmployee Standard DiscountJohn Matthew ZachariasNessuna valutazione finora

- CMAP - Cease & Desist LetterDocumento5 pagineCMAP - Cease & Desist LetterWFAE 90.7 FMNessuna valutazione finora

- Wca Travel and TourDocumento11 pagineWca Travel and TourBaylon M. Julicar100% (1)

- Member Discount List: Choose State: CaliforniaDocumento26 pagineMember Discount List: Choose State: CaliforniaJohn TuringNessuna valutazione finora

- 078 Federal Income TaxDocumento67 pagine078 Federal Income Taxcitygirl518Nessuna valutazione finora

- 2015 Joint Small Business Credit SurveyDocumento13 pagine2015 Joint Small Business Credit SurveyRapha JohnNessuna valutazione finora

- Savvy Business Report 1Documento8 pagineSavvy Business Report 1domphoenixNessuna valutazione finora

- Loan Modification Client Service AgreementDocumento17 pagineLoan Modification Client Service AgreementDelicia33Nessuna valutazione finora

- Hotel CodesDocumento14 pagineHotel CodesAngel BambaNessuna valutazione finora

- Business Plan TemplateDocumento5 pagineBusiness Plan TemplateRola OnrNessuna valutazione finora

- USD Tax Clinics: Dan Kimmons Reference Librarian USD Legal Research Center 619.260.6846 Dkimmons@sandiego - EduDocumento36 pagineUSD Tax Clinics: Dan Kimmons Reference Librarian USD Legal Research Center 619.260.6846 Dkimmons@sandiego - EducglaskoNessuna valutazione finora

- United States Bankruptcy Court Voluntary Petition: Central District of CaliforniaDocumento65 pagineUnited States Bankruptcy Court Voluntary Petition: Central District of California11CV00233Nessuna valutazione finora

- Finance For Everyone Assignment Roahan 1099Documento10 pagineFinance For Everyone Assignment Roahan 1099Natho100% (1)

- Income Statement of Mercantile Bank Limited and NRB Commercial BankDocumento4 pagineIncome Statement of Mercantile Bank Limited and NRB Commercial BankmahadiparvezNessuna valutazione finora

- VendorsDocumento266 pagineVendorsmrcalvintineNessuna valutazione finora

- What the Profit and Loss Statement Reveals About a Company's FinancesDocumento5 pagineWhat the Profit and Loss Statement Reveals About a Company's Financesnenaddejanovic100% (1)

- CPN I ExplanationDocumento2 pagineCPN I ExplanationFederal Communications Commission (FCC)Nessuna valutazione finora

- Chase Credit Card ApplicationDocumento4 pagineChase Credit Card ApplicationJames McguireNessuna valutazione finora

- Groupon A63EFA1D2BDocumento1 paginaGroupon A63EFA1D2BSalif NdiayeNessuna valutazione finora

- Jessica LaplaceDocumento2 pagineJessica Laplacejtm3323Nessuna valutazione finora

- 5 Steps Cheatsheet 2022Documento9 pagine5 Steps Cheatsheet 2022Dana OwensNessuna valutazione finora

- Payroll Voucher GuideDocumento32 paginePayroll Voucher GuideVerry NoviandiNessuna valutazione finora

- Locating and Applying For Governmental and Private Grant FundingDocumento29 pagineLocating and Applying For Governmental and Private Grant Fundinglrrcenter100% (1)

- Oasis Bank Account Details.Documento1 paginaOasis Bank Account Details.NandhaNessuna valutazione finora

- Fully Baked - Business Plan PresentationDocumento40 pagineFully Baked - Business Plan PresentationcdourmashkinNessuna valutazione finora

- Credit Policy: An Opportunity For The OrganizationDocumento14 pagineCredit Policy: An Opportunity For The OrganizationurmanjusajjanNessuna valutazione finora

- Team Member Code of EthicsDocumento24 pagineTeam Member Code of EthicsranusofiNessuna valutazione finora

- TLD Auto Car Financing Barre VTDocumento3 pagineTLD Auto Car Financing Barre VTBarre ATLNessuna valutazione finora

- SunTrust Short Sale Approval (Fannie Mae)Documento3 pagineSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- Public Service Driving School Program HandbookDocumento33 paginePublic Service Driving School Program HandbookYuvaraj ChandrasekaranNessuna valutazione finora

- Keep your hotel smiling with integrated property managementDocumento8 pagineKeep your hotel smiling with integrated property managementseenubhaiNessuna valutazione finora

- EDC Profit and LossDocumento7 pagineEDC Profit and LossCody WommackNessuna valutazione finora

- COMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24Documento350 pagineCOMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24http://secwatch.comNessuna valutazione finora

- Medicare Letters DraftDocumento32 pagineMedicare Letters DraftAmiel Clark100% (1)

- ISO8583 Summary: Author: Andrew MarshallDocumento12 pagineISO8583 Summary: Author: Andrew MarshallAnas SoryNessuna valutazione finora

- TaxWorks Manual 2012Documento256 pagineTaxWorks Manual 2012chintankumar_patelNessuna valutazione finora

- Vendor Application Form: (Please Click For A Sample Format)Documento3 pagineVendor Application Form: (Please Click For A Sample Format)MITRANZO PAYANessuna valutazione finora

- AASBC Sample ManualDocumento21 pagineAASBC Sample ManualViceRoy1228100% (1)

- Sample Engagement Letter - PartnershipsDocumento12 pagineSample Engagement Letter - PartnershipsSRIVASTAV17Nessuna valutazione finora

- Notary Public & I9 Form Authorize Rep - Call For An AppointmentDocumento22 pagineNotary Public & I9 Form Authorize Rep - Call For An AppointmentNotaryPubliccaNessuna valutazione finora

- Direct Deposit Form 2019Documento1 paginaDirect Deposit Form 2019Rudolph RushinNessuna valutazione finora

- TYPES OF LetterDocumento15 pagineTYPES OF Letter7SxBlazeNessuna valutazione finora

- NEMT Texas Handbook16 4Documento35 pagineNEMT Texas Handbook16 4guani360100% (1)

- Bcbs - HCSC IllinoisDocumento2 pagineBcbs - HCSC IllinoisShirley Pigott MDNessuna valutazione finora

- Application For American Bully Breed Single Registration: Step 1 Dog InformationDocumento2 pagineApplication For American Bully Breed Single Registration: Step 1 Dog Informationjohn kingNessuna valutazione finora

- Welcome IrsDocumento22 pagineWelcome IrsJohn Bates BlanksonNessuna valutazione finora

- (2004) Rapid Refund Rip-OffDocumento15 pagine(2004) Rapid Refund Rip-OffJordan AshNessuna valutazione finora

- Palace Entertainment EE Handbook - 2011Documento54 paginePalace Entertainment EE Handbook - 2011Jake C. SchneiderNessuna valutazione finora

- Chapter 8 - Refundable Tax Credits, Benefits and T1 AdjustmentsDocumento62 pagineChapter 8 - Refundable Tax Credits, Benefits and T1 AdjustmentsRyan YangNessuna valutazione finora

- Convergent Outsourcing Collection Letter FDCPADocumento1 paginaConvergent Outsourcing Collection Letter FDCPAghostgripNessuna valutazione finora

- Tax Credits for Child Care and Education ExpensesDocumento17 pagineTax Credits for Child Care and Education ExpensesKeti AnevskiNessuna valutazione finora

- Hours and ProceduresDocumento4 pagineHours and ProceduresttawniaNessuna valutazione finora

- AGB SALES LTD - Odr IssueDocumento4 pagineAGB SALES LTD - Odr IssueArooj AkhterNessuna valutazione finora

- Self Employment HandbookDocumento60 pagineSelf Employment HandbookAankh BenuNessuna valutazione finora

- Four Things - Travel VouchersDocumento2 pagineFour Things - Travel Vouchershh021686Nessuna valutazione finora

- BOOK - Model - Clean Credit ActDocumento21 pagineBOOK - Model - Clean Credit Act123pratusNessuna valutazione finora

- 2009 - Matlin - Political Party Machines of The 1920s and 30s AmericaDocumento293 pagine2009 - Matlin - Political Party Machines of The 1920s and 30s AmericaAnonymous Hj7vA6Nessuna valutazione finora

- MES - Project Orientation For Night Study - V4Documento41 pagineMES - Project Orientation For Night Study - V4Andi YusmarNessuna valutazione finora

- Harmonizing A MelodyDocumento6 pagineHarmonizing A MelodyJane100% (1)

- Electric Vehicles PresentationDocumento10 pagineElectric Vehicles PresentationKhagesh JoshNessuna valutazione finora

- Hand Infection Guide: Felons to Flexor TenosynovitisDocumento68 pagineHand Infection Guide: Felons to Flexor TenosynovitisSuren VishvanathNessuna valutazione finora

- Ax 397Documento2 pagineAx 397Yingyot JitjackNessuna valutazione finora

- Kristine Karen DavilaDocumento3 pagineKristine Karen DavilaMark anthony GironellaNessuna valutazione finora

- Entrepreneurship and Small Business ManagementDocumento29 pagineEntrepreneurship and Small Business Managementji min100% (1)

- UA-Series EN F2005E-3.0 0302Documento25 pagineUA-Series EN F2005E-3.0 0302PrimanedyNessuna valutazione finora

- Final DSL Under Wire - FinalDocumento44 pagineFinal DSL Under Wire - Finalelect trsNessuna valutazione finora

- Derivatives 17 Session1to4Documento209 pagineDerivatives 17 Session1to4anon_297958811Nessuna valutazione finora

- HVDC PowerDocumento70 pagineHVDC PowerHibba HareemNessuna valutazione finora

- Syllabus Sibos CLTDocumento5 pagineSyllabus Sibos CLTgopimicroNessuna valutazione finora

- 100 Bedded Hospital at Jadcherla: Load CalculationsDocumento3 pagine100 Bedded Hospital at Jadcherla: Load Calculationskiran raghukiranNessuna valutazione finora

- Dr. Xavier - MIDocumento6 pagineDr. Xavier - MIKannamundayil BakesNessuna valutazione finora

- Grade 1 English For KidsDocumento4 pagineGrade 1 English For Kidsvivian 119190156Nessuna valutazione finora

- CARET Programme1 Bennett-1Documento10 pagineCARET Programme1 Bennett-1TerraVault100% (3)

- Simply Learn Hebrew! How To Lea - Gary Thaller PDFDocumento472 pagineSimply Learn Hebrew! How To Lea - Gary Thaller PDFsuper_gir95% (22)

- Factors Affecting Job Satisfaction of EngineersDocumento35 pagineFactors Affecting Job Satisfaction of Engineerslingg8850% (2)

- Reduce Home Energy Use and Recycling TipsDocumento4 pagineReduce Home Energy Use and Recycling Tipsmin95Nessuna valutazione finora

- Career Guidance Program Modules MonitoringDocumento7 pagineCareer Guidance Program Modules MonitoringJevin GonzalesNessuna valutazione finora

- Unit 9 What Does APES Say?Documento17 pagineUnit 9 What Does APES Say?johnosborneNessuna valutazione finora

- Aftab Automobiles LTD - Surveillance Report 2015Documento13 pagineAftab Automobiles LTD - Surveillance Report 2015Mehedi Hasan RimonNessuna valutazione finora

- CV Finance GraduateDocumento3 pagineCV Finance GraduateKhalid SalimNessuna valutazione finora

- Platform Tests Forj Udging Quality of MilkDocumento10 paginePlatform Tests Forj Udging Quality of MilkAbubaker IbrahimNessuna valutazione finora

- Bhikkhuni Patimokkha Fourth Edition - Pali and English - UTBSI Ordination Bodhgaya Nov 2022 (E-Book Version)Documento154 pagineBhikkhuni Patimokkha Fourth Edition - Pali and English - UTBSI Ordination Bodhgaya Nov 2022 (E-Book Version)Ven. Tathālokā TherīNessuna valutazione finora

- Karnataka PUC Board (KSEEB) Chemistry Class 12 Question Paper 2017Documento14 pagineKarnataka PUC Board (KSEEB) Chemistry Class 12 Question Paper 2017lohith. sNessuna valutazione finora

- Human Resource Development's Evaluation in Public ManagementDocumento9 pagineHuman Resource Development's Evaluation in Public ManagementKelas KP LAN 2018Nessuna valutazione finora

- Present Tense Simple (Exercises) : Do They Phone Their Friends?Documento6 paginePresent Tense Simple (Exercises) : Do They Phone Their Friends?Daniela DandeaNessuna valutazione finora

- MEE2041 Vehicle Body EngineeringDocumento2 pagineMEE2041 Vehicle Body Engineeringdude_udit321771Nessuna valutazione finora

- Elliptic FunctionsDocumento66 pagineElliptic FunctionsNshuti Rene FabriceNessuna valutazione finora