Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Aggarwal Report On Gillette-PG Merger

Caricato da

Manh Cuong Nguyen TuDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Aggarwal Report On Gillette-PG Merger

Caricato da

Manh Cuong Nguyen TuCopyright:

Formati disponibili

Report to the Commonwealth of Massachusetts, Securities Division on Fairness Opinions and Value of Gillette-P&G Merger

Prepared by Rajesh K. Aggarwal University of Virginia

March 14, 2005

You have asked me to review the Gillette fairness opinions in the P&G-Gillette merger provided by Goldman, Sachs and UBS. I have reviewed the financial projections provided by Gillette. I assume that these are the projections used by Goldman, Sachs and UBS to generate their valuation analyses of the transaction. I have also reviewed the presentation to the Board of Directors on January 27, 2005. I assume that this is the transaction analysis provided by Goldman, Sachs and UBS to the Board of Directors. Having reviewed these materials, the fairness opinions by Goldman, Sachs and UBS seem reasonable and valid in that they rely on internal Gillette and Procter & Gamble projections. However, there appear to be substantial discrepancies in the estimates of how valuable the merger is between what was publicly reported and the internal reports provided by Gillette and Procter & Gamble. The public statements of officers of Gillette and P&G seem to understate the value of the merger. In addition, there seem to be errors in the way the value of the merger synergies was calculated. These errors underestimate the value of the merger. These issues would benefit P&G shareholders at the expense of Gillette shareholders. To begin, there are discrepancies between the public statements made by Gillette and P&G officers about the value of the merger and their internal company projections. Specifically, the Press Release accompanying the announcement of merger (see Exhibit 99.1 attached to Form 8-K filed by Gillette on January 27, 2005) states P&G expects to achieve revenue and cost synergies at a present value of about $14 to $16 billion. Similar statements can be found in several of the Forms 425 (SEC file no. 1-00922) filed by Gillette on January 28, 2005 (see either the Fact Sheet or the slides accompanying the Procter & Gamble and Gillette webcast). A detailed statement about these synergies can be found in the discussion by Mr. Clayton Daley, Chief Financial Officer, Procter and Gamble, in the Form 425 filing of February 2, 2005. In the internal company documents, the estimates of the revenue and cost synergies are higher. On page GIL00453 of the documents provided, Gillette (codenamed Bonefish) estimates the total value of the synergies at $22.09 billion in the second column on the left and $28.08 billion in the column on the right. The $22.1 billion figure (rounded) is repeated on page GIL 00454. These figures are significantly higher than those provided in public statements. In the discussion materials dated November 17, 2004, pages GIL00455-464, a detailed breakdown is given of cost savings totaling $1.160 billion per year, which appear to be pre-tax cost savings. There do not appear to be data here on revenue synergies. In the board of directors meeting on January 27, 2005, after-tax synergies are estimated to be $1.05 billion per year (see page GIL00483). These are presumably total synergies both cost and revenue. Working through the data provided, the after-tax synergies of $1.05 billion seem to come from taking the annual synergies of $1.501 billion from page GIL00454 (column on the right) and applying a 30% tax rate to them: $1.05 billion = (100%-30%) X $1.501 billion. I estimated a range of values for the synergies using the assumptions provided on page GIL00483 about the phase-in of the synergies (30%, 75%, 100% over three years) and the cash cost to achieve the synergies ($0.9 billion over two years). I also incorporated the assumptions on page GIL00485 about the discount rate and the FCF (free cash flow) perpetuity growth rate. These calculations are reported in

the bottom part of Table 1. As can be seen, the range of values is between $14.89 billion and $22.67 billion. Since there are approximately one billion Gillette shares outstanding, this amounts to synergies of between $14.89 and $22.67 per share of Gillette. Of this amount, Gillette shareholders receive around $9.00 (the difference between the preannouncement Gillette stock price of $45.00 and the implied value of Gillette shares based on the 0.975 exchange ratio of P&G for Gillette). Going a step further, errors in how the synergies were calculated seem to understate how large the synergies are. For example, the $1.501 billion in pre-tax synergies from page GIL00454 includes a reduction in the synergies of $375 million due to amortization step-up. This should not have been included in the calculation of the synergies. For confirmation of this point, see page GIL00453 where it says in the comments associated with Amortization Step Up that Bonefish has errantly included this non-cash item . . . In the rebuttal comments, it says point accepted. Table 2 shows what the overall value of the synergies would look like if this reduction in synergies had not been included. Here the range of values is between $18.82 billion and $28.55 billion. Again, since there are about one billion Gillette shares outstanding, the synergies per share are between $18.82 and $28.55. On the basis of the data provided by Gillette, it appears that the public announcements understated the value of the synergies. Further, the internal calculations from Gillette seem to have erroneously underestimated the value of the synergies. Underestimating the value of the synergies would benefit the P&G shareholders at the expense of the Gillette shareholders. For example, using the synergies range of $18.82 billion to $28.55 billion, Gillette shareholders receive about $9 billion of the synergy value and the P&G shareholders receive about $10 billion to $19.5 billion of the synergy value. In public statements, Gillette and P&G officers claimed that the value of the synergies to P&G shareholders was between $5.5 billion and $7.5 billion (see, for example, Mr. Clayton Daley, Chief Financial Officer, Procter and Gamble in the Form 425 filing of February 2, 2005). Given that Mr. James Kilts, CEO of The Gillette Company, has a large number of options on Gillette stock, it may seem unlikely that he would negotiate a merger transaction that was unfavorable to Gillette shareholders. Yet, in my earlier report, I noted that Mr. Kilts was receiving from Procter & Gamble an unusual additional payment of $11.316 million in addition to his contractually agreed aggregate change in control payment of approximately $32.387 million from Gillette. These are sums Mr. Kilts would not have received in the absence of a merger agreement. In conclusion, there are discrepancies between the public statements made by Gillette and P&G officers about the value of the merger and their internal company projections. The public statements seem to understate the value of the merger. In addition, there seem to be errors in the way the value of the merger synergies was calculated. These errors underestimate the value of the merger. Both of these issues would benefit P&G shareholders at the expense of Gillette shareholders.

Table 1 Synergies based on Presentation to Board, January 27, 2005

(in billions) After tax synergies Cost of synergies Net Gain

Year 1 0.315 -0.45 -0.135

Year 2 0.7875 -0.45 0.3375

Year 3 1.05 1.05

Synergies grow at growth rate in subsequent years

Terminal value of synergies (in billions) FCF Perpetuity Growth Rate 3% 3.50% 4% $21.00 $19.09 $17.50 $23.33 $21.00 $19.09 $26.25 $23.33 $21.00

Discount Rate 8% 8.50% 9.00%

Overall value of synergies (in billions) FCF Perpetuity Growth Rate 3% 3.50% 4% $18.17 $16.38 $14.89 $20.17 $18.00 $16.23 $22.67 $19.98 $17.84

Discount Rate 8% 8.50% 9.00%

Table 2 Corrected Synergies

Pre-tax synergies After-tax synergies (30%)

1.876 billion 1.313 billion

(removes amortization step up)

(in billions) After tax synergies Cost of synergies Net Gain

Year 1 0.39 -0.45 -0.06

Year 2 0.98 -0.45 0.53

Year 3 1.31 1.31

Synergies grow at growth rate in subsequent years

Terminal value of synergies (in billions) FCF Perpetuity Growth Rate 3% 3.50% 4% $26.26 $23.88 $21.89 $29.18 $26.26 $23.88 $32.83 $29.18 $26.26

Discount Rate 8% 8.50% 9.00%

Overall value of synergies (in billions) FCF Perpetuity Growth Rate 3% 3.50% 4% $22.92 $20.68 $18.82 $25.43 $22.71 $20.50 $28.55 $25.19 $22.50

Discount Rate 8% 8.50% 9.00%

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- WST Excel Shortcuts 2Documento1 paginaWST Excel Shortcuts 2Sami MohammedNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Guide To The Markets 2Q 2012 2 PDFDocumento1 paginaGuide To The Markets 2Q 2012 2 PDFManh Cuong Nguyen TuNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Vietnam Deals Review 2011: High Capital Inflows From Japanese CorporationsDocumento53 pagineVietnam Deals Review 2011: High Capital Inflows From Japanese CorporationsManh Cuong Nguyen TuNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- C2 Games1 DataDocumento1 paginaC2 Games1 DataManh Cuong Nguyen TuNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

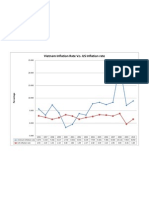

- Vietnam vs US Inflation Rates 1996-2010 GraphDocumento1 paginaVietnam vs US Inflation Rates 1996-2010 GraphManh Cuong Nguyen TuNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- ECON 201 Final ExamDocumento24 pagineECON 201 Final ExamTamseela BibiNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Basic College Mathematics With Early Integers 3Rd Edition Martin Gay Test Bank Full Chapter PDFDocumento63 pagineBasic College Mathematics With Early Integers 3Rd Edition Martin Gay Test Bank Full Chapter PDFTaylorHarveyawde100% (14)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- PEST Analysis of IOCDocumento4 paginePEST Analysis of IOCArpkin_love100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Theme Park Operations & Major PlayersDocumento10 pagineTheme Park Operations & Major Playersvitaliskc0% (1)

- A Study of Credit Assessment in Dena BankDocumento48 pagineA Study of Credit Assessment in Dena BankDeepali MahilagiriNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- XlsDocumento14 pagineXlsAldrin ZlmdNessuna valutazione finora

- Basis Technical AnalysisDocumento92 pagineBasis Technical Analysisrahulsheth_cal2159Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Ijfs 07 00018 With CoverDocumento14 pagineIjfs 07 00018 With CoverSultonmurod ZokhidovNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- BDO UITFs 2017 PDFDocumento4 pagineBDO UITFs 2017 PDFfheruNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Mittal Corp LTD 22ND November 2022Documento4 pagineMittal Corp LTD 22ND November 2022Etrans 9Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Servis Final CompliationDocumento37 pagineServis Final CompliationHamza KhanNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Exchange Traded Funds - A New Face of Investment in India - by DeepakDocumento111 pagineExchange Traded Funds - A New Face of Investment in India - by Deepakapi-19459467Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- Working Paper No. 137: Productivity Trends in Indian Manufacturing in The Pre-And Post-Reform PeriodsDocumento39 pagineWorking Paper No. 137: Productivity Trends in Indian Manufacturing in The Pre-And Post-Reform PeriodsAvaneesh JainNessuna valutazione finora

- Systems Designs - Job and Process CostingDocumento49 pagineSystems Designs - Job and Process Costingjoe6hodagameNessuna valutazione finora

- Unit 5Documento13 pagineUnit 5Sharine ReyesNessuna valutazione finora

- Chettinad Cement Corporation LTD 2008Documento10 pagineChettinad Cement Corporation LTD 2008joosuganya8542Nessuna valutazione finora

- Commercial Vehicles Market Analysis and Segment Forecasts To 2025Documento58 pagineCommercial Vehicles Market Analysis and Segment Forecasts To 2025pinku13Nessuna valutazione finora

- Schedule G Sale and Purchase Agreement (Land and Building), Contract For Sale, Housing AccommodationDocumento25 pagineSchedule G Sale and Purchase Agreement (Land and Building), Contract For Sale, Housing Accommodationirene_freezreenNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Monopolistic Competition: Number of FirmsDocumento9 pagineMonopolistic Competition: Number of FirmsshreykaranNessuna valutazione finora

- EMIS Insights - India Automotive Sector Report - OverviewDocumento33 pagineEMIS Insights - India Automotive Sector Report - OverviewTarkeshwar SinghNessuna valutazione finora

- The Bullwhip Effect in HPs Supply ChainDocumento9 pagineThe Bullwhip Effect in HPs Supply Chainsoulhudson100% (1)

- Registration: Scripting in Powerfactory With PythonDocumento2 pagineRegistration: Scripting in Powerfactory With PythonAndres Caviedes ArevaloNessuna valutazione finora

- AbcDocumento11 pagineAbcAchal SharmaNessuna valutazione finora

- Construction Economics: 1 Ce417 Construction Equipment and METHODS King Saud UniversityDocumento57 pagineConstruction Economics: 1 Ce417 Construction Equipment and METHODS King Saud UniversityhainguyenbkvhvNessuna valutazione finora

- Attachment Test 8Documento54 pagineAttachment Test 8piyushkumar151Nessuna valutazione finora

- Optimal Capital Structure AnalysisDocumento35 pagineOptimal Capital Structure AnalysismelakuNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Printing in Hong Kong & China 2021Documento15 paginePrinting in Hong Kong & China 2021Publishers WeeklyNessuna valutazione finora

- Solution of Textbook 1Documento4 pagineSolution of Textbook 1BảoNgọcNessuna valutazione finora

- 1.3 Interest Rates and Price Volatility (Oct 28) PDFDocumento58 pagine1.3 Interest Rates and Price Volatility (Oct 28) PDFRedNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)