Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 7 Assn Questions.n

Caricato da

elmsavingsDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 7 Assn Questions.n

Caricato da

elmsavingsCopyright:

Formati disponibili

Chapter 7 4.Why is it important to distinguish between explicit and implicit costs?

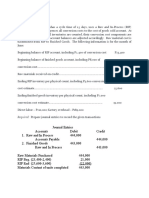

It is important to distinguish between implicit and explicit cost because opportunity cost includes both explicit costs and implicit costs. Business economic profits are determined using opportunity costs. Accounting profits are calculated using only explicit costs. It will give a clearcut idea as to how much a business economic profits are. Also its important to tell the costs apart because it will affect the decisions that are made within the business. It determines the accounting profit, which is determined using only explicit costs. 6. Jane quit her job at IBM where she earned $50,000 a year. She cashed in $50,000 in corporate bonds that earned 10% interest annually to buy a mini-bus. Jane has decided to buy the mini-bus and set up a commuter service between Lincoln and Omaha. There are 1000 people who will pay $400 a year each for the commuter service; $280 from each person goes for gas, maintenance, insurance, depreciation, etc. (a) Complete the following questions: (1) What are Janes total revenues? (2) What are Janes explicit costs? (3) What is her accounting profit? (b) List two important implicit costs that Jane has not included. (c) What is Janes pure economic profit (loss)? A.(1) Janes total revenue is $400,000.00 (2) Janes explicit cost is $330,000.00 ($280.00 x 1,000 people) for gas, maintenance, etc. and $50,000.00 in corporate bonds she cashed in. (3) Janes accounting profit is the difference between her total sales revenue and her explicit costs which is $70,000.00. (b) Two of Janes important implicit cost is $55,000.00 - 1) the salary/wages of $50,000.00 she will not receive from IBM and 2) the 10% interest she will not earn on the $50,000.00 in corporate bonds, which is $5,000.00. (c) Janes pure economic profit loss is $15,000.00

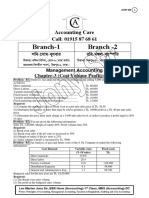

8. Indicate whether the inputs below are variable (V) or fixed (F) in the short run. Input Variable Meat Fire Fixed insurance Variable Tires Output

in hamburgers. dry in cleaning. in automobiles. textile Fixed Property tax in production. trucking Variable Gasoline in services.

Fixed

aircraft Depreciation in production.

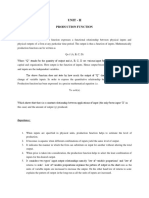

9. What is the difference between the short run and the long run? The difference between short run and long run is basically the flexibility the long run has over the short run. The short run is defined as a period in which producers are able to change the quantities of some but not all of the resources, meaning some resources are fixed and some variable. The long run is defined as a period of time long enough to enable producers of a product to change the quantities of all the resources they employ. Many decisions are fixed in the short run but variable in the long run. For instance, over a period of three months, Mercedes auto manufacturer cant change the size of its car factories. In order to produce more autos is to hire more factory workers at the factories it has. The cost of these factories is a fixed cost in the short run. Over a period of several years, the auto manufacturer can expand the size of its factories by building new ones and closing down old ones. The cost of its factories is a variable cost in the long run. 12. Interpret this statement: If diminishing returns did not occur, the world could be fed out of a flower pot. If each unit of input (adding seeds, fertilizer & water to a flower pot) would add more to output (food produced from the seeds) than the last unit of input. The food produce would be overly abundant, therefore, we would never be without food. If diminishing returns did not occur, obviously increasing returns would, because we would receive more and more each time. However, because diminishing returns is true and constant we will never be able to feed the world from a flower pot because we would eventually produce less and less as time goes by. 19. What is the relationship between marginal cost and marginal product? Marginal cost is the increase in total cost that comes from producing one more unit. Marginal product is the increase in output from an extra unit of input, such as hiring one more worker. Marginal cost and marginal product is inversely related. Marginal product and marginal costs are mirror images of each other. When marginal product is rising, marginal cost falls. When marginal product falls, marginal cost is rises. When marginal product reaches a maximum, marginal cost is at its minimum.

Potrebbero piacerti anche

- RP 267Documento10 pagineRP 267Shadab Ahmed MohammedNessuna valutazione finora

- Application of SCADA in PSDocumento5 pagineApplication of SCADA in PSupparahalNessuna valutazione finora

- Study of Maximum Power Point Tracking (MPPT) in PV SystemsDocumento10 pagineStudy of Maximum Power Point Tracking (MPPT) in PV SystemsabdalbarNessuna valutazione finora

- DC DC ConveretersDocumento18 pagineDC DC ConveretersHukmran Hussain100% (1)

- Design and Simulation of DC DC Boost ConverterDocumento11 pagineDesign and Simulation of DC DC Boost ConverterHãrshã SmîlęýNessuna valutazione finora

- Fall of MalaccaDocumento11 pagineFall of MalaccaChoo Siew MeeNessuna valutazione finora

- A Web-Based Hotel Reservation SystemDocumento26 pagineA Web-Based Hotel Reservation SystemLeus FelipeNessuna valutazione finora

- Wipro R & DDocumento17 pagineWipro R & DDhanyaNessuna valutazione finora

- MPPT Proposal 248 PDFDocumento31 pagineMPPT Proposal 248 PDFajmaltkNessuna valutazione finora

- Free Rider ProblemDocumento2 pagineFree Rider ProblemManoj KNessuna valutazione finora

- Feminist Interpretations AristotleDocumento7 pagineFeminist Interpretations Aristotlesayonee73Nessuna valutazione finora

- Free RiderDocumento12 pagineFree Ridercesar_te_4802Nessuna valutazione finora

- Maximum Power Point TrackerDocumento6 pagineMaximum Power Point Trackervharish23100% (1)

- Life Cycle CostingDocumento8 pagineLife Cycle CostingAmit GuptaNessuna valutazione finora

- LCC and OEEDocumento4 pagineLCC and OEESAURAV KUMARNessuna valutazione finora

- Impact of Electric Vehicles On The Grid WML W VideoDocumento13 pagineImpact of Electric Vehicles On The Grid WML W VideoAndres RichNessuna valutazione finora

- IEEE Distribution Automation Working Group White Paper v3Documento13 pagineIEEE Distribution Automation Working Group White Paper v3evss_raghavendraNessuna valutazione finora

- MPPT AlgorithmsDocumento9 pagineMPPT AlgorithmssimmulationNessuna valutazione finora

- Drivers and Barriers of LCCDocumento9 pagineDrivers and Barriers of LCCFarhan JunizalNessuna valutazione finora

- AS Economics - 11 - The Price System and The Micro Economy (Consumer & Producer Surplus)Documento181 pagineAS Economics - 11 - The Price System and The Micro Economy (Consumer & Producer Surplus)Damion BrusselNessuna valutazione finora

- IDB: Trinidad and Tobago, Sustainable Energy Program - Loan Proposal, 11-2011Documento27 pagineIDB: Trinidad and Tobago, Sustainable Energy Program - Loan Proposal, 11-2011Detlef LoyNessuna valutazione finora

- 66851Documento30 pagine668519600257003Nessuna valutazione finora

- The Costs of Production CLASS EXERCISEDocumento2 pagineThe Costs of Production CLASS EXERCISEJoNessuna valutazione finora

- Principles of Economics I: Microeconomics Final (1/16/2009) : Part I. Multiple Choice (15 Questions, 30%)Documento8 paginePrinciples of Economics I: Microeconomics Final (1/16/2009) : Part I. Multiple Choice (15 Questions, 30%)Trần Triệu VyNessuna valutazione finora

- Econ RevisionDocumento6 pagineEcon Revisionelserry.comNessuna valutazione finora

- Macro Homework AnswersDocumento81 pagineMacro Homework Answersqwerty43240% (1)

- Tutorial 11, Week 11QDocumento4 pagineTutorial 11, Week 11QKasmira K.Bathu GanesanNessuna valutazione finora

- Economics For BusinessDocumento14 pagineEconomics For BusinessgodwinNessuna valutazione finora

- Econ Macro Canadian 1St Edition Mceachern Solutions Manual Full Chapter PDFDocumento26 pagineEcon Macro Canadian 1St Edition Mceachern Solutions Manual Full Chapter PDFeric.herrara805100% (12)

- ECON Macro Canadian 1st Edition McEachern Solutions Manual 1Documento36 pagineECON Macro Canadian 1st Edition McEachern Solutions Manual 1shawnmccartyjxqsknofywNessuna valutazione finora

- International Financial Management V1Documento13 pagineInternational Financial Management V1solvedcareNessuna valutazione finora

- DemandDocumento3 pagineDemandHafizah Ab RahmanNessuna valutazione finora

- Class 12th QuestionBank EconomicsDocumento114 pagineClass 12th QuestionBank Economicsgamacode132Nessuna valutazione finora

- Exam 21082011Documento8 pagineExam 21082011Rabah ElmasriNessuna valutazione finora

- Finman-Activity, Dawami, Richard J.Documento7 pagineFinman-Activity, Dawami, Richard J.rich dawNessuna valutazione finora

- BB 107 (Spring) Tutorial 6(s)Documento4 pagineBB 107 (Spring) Tutorial 6(s)高雯蕙Nessuna valutazione finora

- Iefinmt Reviewer For Quiz (#2) : I. IdentificationDocumento9 pagineIefinmt Reviewer For Quiz (#2) : I. IdentificationpppppNessuna valutazione finora

- Chapter 9 The Quest For Profit and The Invisible Hand: Answers To Review QuestionsDocumento4 pagineChapter 9 The Quest For Profit and The Invisible Hand: Answers To Review QuestionsmaustroNessuna valutazione finora

- Respostas e Aplicações em InglêsDocumento193 pagineRespostas e Aplicações em InglêsRPDPNessuna valutazione finora

- To Organize TeamsDocumento2 pagineTo Organize TeamsShrey MangalNessuna valutazione finora

- Form 4 Economics Final Exam 2015-2016Documento13 pagineForm 4 Economics Final Exam 2015-2016yoyoNessuna valutazione finora

- ECON 352 Problem Set 1 (With Key)Documento22 pagineECON 352 Problem Set 1 (With Key)Ceylin SenerNessuna valutazione finora

- Assignment 6 PDFDocumento2 pagineAssignment 6 PDFBilal BilalNessuna valutazione finora

- Kumpulan An Michael BayeDocumento14 pagineKumpulan An Michael BayeJermia MT ParhusipNessuna valutazione finora

- Weeks 1-7 Examples Answers and Key Concepts Discussion ProblemsDocumento57 pagineWeeks 1-7 Examples Answers and Key Concepts Discussion ProblemsAshish BhallaNessuna valutazione finora

- Introduction To Economics I Dr. Ka-Fu WONG: ECON 1001 ABDocumento29 pagineIntroduction To Economics I Dr. Ka-Fu WONG: ECON 1001 ABSurya PanwarNessuna valutazione finora

- Sample Questions Part 1-Feb08webDocumento9 pagineSample Questions Part 1-Feb08webDidacus Triphone PereraNessuna valutazione finora

- Remedial Take-Home Exam For Introduction To EconomicsDocumento2 pagineRemedial Take-Home Exam For Introduction To EconomicsAgZawNessuna valutazione finora

- Econ 101 Sample Quiz Ques 4Documento8 pagineEcon 101 Sample Quiz Ques 4choppersureNessuna valutazione finora

- Tài Chính Công Ty Nâng CaoDocumento8 pagineTài Chính Công Ty Nâng CaoTrái Chanh Ngọt Lịm Thích Ăn ChuaNessuna valutazione finora

- Test 1 (PM)Documento5 pagineTest 1 (PM)Nabil NizamNessuna valutazione finora

- Quiz Week 3 QnsDocumento6 pagineQuiz Week 3 QnsRiri FahraniNessuna valutazione finora

- FinalDocumento5 pagineFinalmehdiNessuna valutazione finora

- Cfa Level 1 - Testbank: (64 Questions With Detailed Solutions)Documento33 pagineCfa Level 1 - Testbank: (64 Questions With Detailed Solutions)ranjuncajunNessuna valutazione finora

- Seminar, Week Commencing 11 January 2021: Key Concepts This WeekDocumento4 pagineSeminar, Week Commencing 11 January 2021: Key Concepts This WeekYago GrandesNessuna valutazione finora

- 04 Comm 308 Final Exam (Winter 2009) SolutionDocumento18 pagine04 Comm 308 Final Exam (Winter 2009) SolutionAfafe ElNessuna valutazione finora

- Tutorial 5 QuestionsDocumento13 pagineTutorial 5 QuestionsJudah SaliniNessuna valutazione finora

- HW1 - MC Answer KeyDocumento2 pagineHW1 - MC Answer Keytszkei.tang.christyNessuna valutazione finora

- ACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemDocumento2 pagineACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemRiri FahraniNessuna valutazione finora

- Fma2 Mock 1Documento15 pagineFma2 Mock 1smartlearning1977Nessuna valutazione finora

- Notes On Elements of Cost and Cost SheetDocumento14 pagineNotes On Elements of Cost and Cost SheetPOOJA WALZADENessuna valutazione finora

- Bab 2 - Perilaku BiayaDocumento40 pagineBab 2 - Perilaku BiayaAndy ReynaldyyNessuna valutazione finora

- Theory of Production and Cost Analysis Theory of Production The Production FunctionDocumento12 pagineTheory of Production and Cost Analysis Theory of Production The Production FunctionDeevi PerumalluNessuna valutazione finora

- Midterm Examination Iii Intermediate MicroeconomicsDocumento5 pagineMidterm Examination Iii Intermediate MicroeconomicsAhmed LakhaniNessuna valutazione finora

- The Costs of Production: DR Ayesha Afzal Assistant ProfessorDocumento19 pagineThe Costs of Production: DR Ayesha Afzal Assistant ProfessorFady RahoonNessuna valutazione finora

- Anatomy of A Constant Elasticity of Substitution Type Production/Utility Function in Three Dimensions (A Visual Guide For Econ Majors)Documento7 pagineAnatomy of A Constant Elasticity of Substitution Type Production/Utility Function in Three Dimensions (A Visual Guide For Econ Majors)Cepade ProjectosNessuna valutazione finora

- Module 2Documento32 pagineModule 2Finmonkey. InNessuna valutazione finora

- Exercise 2 Job Order Costing Final ProblemsDocumento5 pagineExercise 2 Job Order Costing Final ProblemsClene DoconteNessuna valutazione finora

- Problem 2 JitDocumento2 pagineProblem 2 JitChristian J. AbbatuanNessuna valutazione finora

- Material Requirements PlanningDocumento28 pagineMaterial Requirements Planningentertainment lastsNessuna valutazione finora

- CVP (4th) - SheetDocumento11 pagineCVP (4th) - SheetMahabubur RahmanNessuna valutazione finora

- FinancialAnalysis - EQUIPOS DEL NORTEDocumento6 pagineFinancialAnalysis - EQUIPOS DEL NORTEOscar TrujilloNessuna valutazione finora

- Unit - 2 EEFMDocumento19 pagineUnit - 2 EEFMAppasani ManishankarNessuna valutazione finora

- PL Nov OktDocumento2 paginePL Nov OktKahfiNessuna valutazione finora

- Macroeconomics 9th Edition Abel Solutions Manual 1Documento36 pagineMacroeconomics 9th Edition Abel Solutions Manual 1todddoughertygswzfbjaon100% (27)

- I. Elasticity: Q Q Q Q P P P PDocumento6 pagineI. Elasticity: Q Q Q Q P P P PAIREEN DEIPARINENessuna valutazione finora

- Eric Stevanus - 2201756600 - LA28: 1. The Cost FunctionDocumento2 pagineEric Stevanus - 2201756600 - LA28: 1. The Cost Functioneric stevanusNessuna valutazione finora

- Short-Run and Long-Run Analysis of ProductionDocumento12 pagineShort-Run and Long-Run Analysis of ProductionDirgha ShertukdeNessuna valutazione finora

- 2 Opportunity Cost Incremental PrincipleDocumento13 pagine2 Opportunity Cost Incremental Principlelali62Nessuna valutazione finora

- Week 09 - Inventory EstimationsDocumento3 pagineWeek 09 - Inventory EstimationsPj ManezNessuna valutazione finora

- Managerial Economics 8th Edition Samuelson Solutions Manual DownloadDocumento18 pagineManagerial Economics 8th Edition Samuelson Solutions Manual DownloadJulie Tauscher100% (23)

- EOQ Problem SolvingDocumento4 pagineEOQ Problem Solvingmishal zikria100% (1)

- Week 11 - English Muhammad Rizky RamadhanDocumento44 pagineWeek 11 - English Muhammad Rizky RamadhanMuhammad Rizky RamadhanNessuna valutazione finora

- PS 1 Process Costing Answer KeyDocumento56 paginePS 1 Process Costing Answer KeyKelvin CulajaráNessuna valutazione finora

- Answer Key Bacostmx-3tay2021-Finals Quiz 2Documento8 pagineAnswer Key Bacostmx-3tay2021-Finals Quiz 2Marjorie Nepomuceno100% (1)

- Schedule 1 Allison Manufacturing Sales Budget For The Quarter I Ended March 31 First QuarterDocumento16 pagineSchedule 1 Allison Manufacturing Sales Budget For The Quarter I Ended March 31 First QuarterSultanz Farkhan SukmanaNessuna valutazione finora

- ME Cost Problem SetDocumento3 pagineME Cost Problem SetPrithiraj MahantaNessuna valutazione finora

- Variable Costing and Segment Reporting: Tools For ManagementDocumento17 pagineVariable Costing and Segment Reporting: Tools For ManagementĐàm Quang Thanh TúNessuna valutazione finora

- ME Mod 3Documento35 pagineME Mod 3Madan KumarNessuna valutazione finora

- Managerial Economics Analysis Problems Cases 8Th Edition Truett Test Bank Full Chapter PDFDocumento54 pagineManagerial Economics Analysis Problems Cases 8Th Edition Truett Test Bank Full Chapter PDFMrJosephCruzMDfojy100% (12)