Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Master Bakers PVT LTD (A)

Caricato da

Swati MurarkaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Master Bakers PVT LTD (A)

Caricato da

Swati MurarkaCopyright:

Formati disponibili

Master Bakers Private Limited (A)

M.K.Balaraman, Managing Director of Master Bakers Private Limited was due to meet with his three colleagues in the team to decide whether to accept the franchise for Tommy bread in Bangalore. This decision was going to be a very significant step for him and his team in their career as entrepreneurs. As he waited for his team members to join him, he was recounting the journey they had undertaken over the last few months as entrepreneurs trying to build a portfolio of businesses. The consulting business: The beginning and its growth Master Bakers was the diversification venture of a consulting business Balaraman had founded along with another colleague, Mrs. Geetha Mukherjee in 1980. Balaraman had been a very successful corporate executive and had had an illustrious career in the pharmaceutical industry. Armed with a degree in pharmaceutical technology, Balaraman had started off in a multinational pharmaceutical company as a chemist and had transformed into a top class marketing man, ending up as the head of Indian operations for the MNC. At the peak of his career, he had given up his job to become an entrepreneur in 1977, when he was 45 years old. He had since then successfully started his own proprietary publications company and had achieved a leadership position in a niche area of technical journals for medical professionals. Given his expertise in the pharmaceutical industry, consulting engagements from medium sized and smaller start up pharmaceutical companies were always knocking at Balaramans doors. He was initially very selective in taking up these assignments, since he did not want consulting to be a distraction from his profitable but extremely demanding publications business. But when he received an offer from Mrs. Geetha Mukherjee in 1980 to join him and start a consulting practice for pharmaceutical companies, he decided to actively pursue it. Geetha Mukherjee had been a researcher and lecturer in biochemistry and had worked along with Balaraman as the medical advisor in the company which Balaraman was heading before his resignation. Having worked in various parts of the world, Mrs. Mukherjee was one of the key members of Balaramans team that pulled off an attractive foreign collaboration, a parting gift from Balaraman to his erstwhile employer. With Mrs. Mukherjee around, Balaraman felt that they were complete as a team and could effectively service their clients. Balaraman and Geetha Mukherjee together laid out the ground rules for their association. Balaraman would use his contacts and bring the assignments in, but execution responsibility will be that of Geetha Mukherjee. Balaraman will of course contribute his expertise, but his priority will remain his publishing business. Geetha could very well see the point- Balaraman was offering his publications to the medical practitioners, where accuracy and speed were very important. Moreover, Balaraman had only administrative support working for him in the publishing business and hence had to personally put together the contents and bring the publication out on time. The consulting business had a rather sedate start. Geetha took time off to have a baby in 1981 and returned to active work only towards the end of the year. Around the same time, an opportunity to scale up their consulting business came their way. In April 1982, one of their erstwhile colleagues, Anurag Sharma offered to join them. Anurag was a marketing professional, armed with an engineering degree and a MBA from one of the leading business schools in India. Anurag had been working as a General Manager of a family owned pharmaceutical company. He got caught in the internal squabbles of the promoter family and quit the company in disgust. His recent experiences had led him to believe that it was better for him to be on his own. _____________________________________________________________________________ Case draft prepared by K.Kumar for the purposes of classroom discussion only. Not to be circulated or quoted. Copyright (2004) Indian Institute of Management, Bangalore

When he learnt that his erstwhile colleagues had started a consulting firm, he offered to join them as a co promoter. Anurag also brought to the firm the services of his wife, an efficient secretary and office manager. With three-member team in place, they made all efforts to ramp up the business. One of the early issues they had to contend with was the vulnerability associated with the consulting business. Prospective clients used to draw on their time in extensive discussions on the consulting proposal itself. When pushed to sign a contract, many used to disappear, perhaps having already found the answers to some of the questions they may have had, during the discussions itself. Some clients didnt pay, even after entering into a contract, citing various reasons. On the whole, they realized that the consulting business had a lot of inherent risks and hence couldnt sustain them in the long run. Hence they decided to look for opportunities to diversify their risk. Addition to the business line: Insurance survey The first opportunity landed on their lap pretty soon. Around October 1982, Anurag was approached by his former boss to start off an insurance survey practice at Bangalore. Anurag was nominated as a director of the firm, Deva Surveyors, which was already doing business in Madras, with a specific brief to build the business in Bangalore. Though the other promoters in the team were not eligible to become surveyors (one needed a set of qualifications to be licensed as an insurance surveyor, which Anurag had and others didnt), it was decided that Anurag would run the business as the Bangalore branch of Deva Surveyors, and the revenues will be pooled and the administrative support would be shared. Anurag plunged into the insurance survey practice head on. He was able to make some quick inroads, and the quality of work he did endeared him well to the insurance managers in Bangalore. In a few months time, he had built up a significant stream of revenues, which started overshadowing the consulting revenues, both in volume and consistency. Encouraged by this trend, Anurag felt that if he was able to add at least one more person to the survey business, he could dramatically increase the revenues. The group of three debated the issue at length. Anurag explained the nature of the business to the fellow members. The role of the insurance surveyor was almost a quasi-judicial role. Whenever an insured reported a loss, the surveyor was called in to make an independent assessment of the loss. The loss assessment was a three-stage process. The first stage was to ascertain, beyond reasonable doubt, the cause of the loss. The second stage was to quantify the loss. The third stage was to make a recommendation to the insurer whether the loss was payable, and if so, the amount payable as per the terms and conditions of the policy. The team saw surveying as a business having some peculiarities. The report of a loss and the initiation of a survey can happen at any time all seven days of the week, and in some sense, all hours of the day. There were about twenty different offices of the various insurance companies, which could initiate a survey, which meant that the phone could ring any minute. Also, the insurance companies used to engage the first available surveyor in their order of preference and seldom wait for a surveyor to be available. The survey fee was in proportion to the value of the loss assessed, and there was always the possibility that one would miss out on a large survey while being out of office to attend to a small survey. Moreover, if any of the insurance company offices got a few not available messages in a row, they tended to push down the surveyor in their preference rankings. The team agreed that it was imperative to add another person to strengthen the team and not to miss out on any opportunity that came their way. However, adding another employee to the team was also not practical for two reasons. Firstly, there were a lot of moral hazards in the nature of work to be carried out, and a person with questionable integrity might irreparably damage the reputation of the Deva Surveyors and even get the company blacklisted. Secondly, the entry barriers were very low and a good employee surveyor will sooner than later move out of

employment and start his own firm. Based on these premises, the group decided that they would look for one more person to join them as a promoter, who would have a profile similar to Anurag and could possibly add value in other businesses as well. The team expands Even as these discussions were going on, the group saw another windfall coming their way. In June 1983, the consulting arm managed to win a huge contract to help a company engaged in a traditional business to diversify into pharmaceuticals. It was a comprehensive consulting service to set up a new pharmaceutical plant, and included in its scope, selection and import of plant and machinery, process design, plant layout, recruitment and project management. Only Anurag had the complete set of skills to provide such a wide range of services, and the contract was negotiated and won by him at Bombay, where the clients were located. While this was a fabulous break for the group in their consulting business, it also made their need for an additional person to support Deva Surveyors critical and immediate. Luckily, help arrived pretty soon. Anurag heard that Deva surveyors, encouraged by their success in Madras and Bangalore, wanted to set up an office in Hyderabad. Devas promoters at Madras had managed to rope in Arvind Prakash, an engineer and a MBA who had been working as a marketing executive in a leading engineering firm. Deva surveyors had already three surveyors at Madras. Arvind was to join them at Madras, get trained for a few months, and then move to Hyderabad to start off the Hyderabad operations. Anurag proposed to his counterparts at Madras that Arvind be sent to Bangalore for training. Anurag explained that since he also had a large consulting project to run, he needed help on the insurance surveys and Arvind was ideally suited to play that role. Anurag also explained that in this mode, Arvind would be involved in the surveys right from day one, and his training would become hands on and accelerated. When the proposal was mooted with Arvind, he was also very enthusiastic, particularly because of the opportunities it offered to jump into action right away and that too in his favorite city, Bangalore. Within a few days Arvind was in Bangalore to join Anurag. The next few months were hectic for all. Anurag got deeply absorbed in his consulting project and spent most of his time outside Bangalore, in Bombay, Calcutta, Delhi and Nasik. Whenever he was in Bangalore, he took Arvind around to the various insurance companies and introduced him. The insurance companies were very happy that Deva surveyors was expanding, and were pleased that Anurag had brought in a person with a very similar profile, though much younger in age, to strengthen the team. Anurag reassured them that he would continue to be involved in all surveys, either directly or through Arvind. The phones continued to ring, and Arvind got inducted into the surveys quite rapidly. Arvind soon realized that the nature of survey work eminently suited grey haired professionals on the verge of retirement. He could sense the subtle feeling amongst some of the insurance companies that their large and important customers would expect a more senior and experienced person to handle some of the larger claims. In the case of the insured, Arvind felt that many of them either wanted a more experienced surveyor or took an aggressive posture in defending their claims, given his youth and limited experience. Arvind wondered what options he had at Hyderabad if the insurance companies there also felt the way, which was very likely. Arvind decided that he had to do some thing tangibly to convince the insurance companies that he was up to the task. Arvind realized that one of the questions that was frequently asked of him by the insurance companies was about his knowledge of insurance. The Federation of Insurance Institutes of India, which was imparting training on insurance studies, also conducted qualifying examinations. The executives in the insurance companies themselves sat for those examinations, and very few of them saw real success. Arvind set for himself a goal of tackling these exams in right earnest. There were three levels of examinations. The first level exam was elementary, but the second level had many subjects and was more intense. The third level was more on management

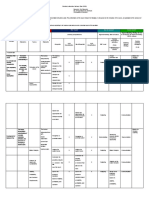

subjects and Arvind decided that he didnt have to bother with the third level. In the meanwhile, he got himself fully involved in the surveys, drawing support from Anurag and his other experienced colleagues at Madras to ensure high standards of quality in his work. The office at Bangalore was a small outfit and the team got along well together. Arvind felt that though he had started off on his own, the presence of a team to work with helped him to handle the uncertainties of business. At one level, it offered him a sounding board to discuss ideas and options to handle difficult situations. At another level, he felt that he needed a stable cash flow because of the financial responsibilities he carried. Being with a team involved in multiple activities, he reasoned, reduced his financial risks and provided improved opportunities for learning. We need something more, we need something better On its part, the team was also evaluating the progress. Balaraman pointed out that both consulting and survey businesses were service businesses and required a high degree of personal involvement of the team members. Both the businesses had some limitations to scaling up, and did not have the potential to bring huge financial rewards to the team. Balaraman also pointed out that while the two businesses were running as successfully as they could under the circumstances, they were indeed stretching the individuals quite a bit, and he foresaw a burn out sooner than later. Geetha proposed that they should diversify into a manufacturing activity and build an organisation that would give them an opportunity to become investors and managers rather than remaining self employed foot soldiers. Anurag also welcomed the idea and saw a lot of merit in pursuing that line of thinking. The team felt that a total investment in the range of Rs. 10-15 lacs was something they could manage, after taking into account the loans they could raise from the financial institutions. Balaraman set the ball rolling. In a specially scheduled team meeting in September 1983, he argued that the team was precariously balanced as of now. Balaraman had his proprietary business to take care of and after accounting for his commitment of time for the consulting business, had very little time and energy to chase new opportunities. Geetha had her hands full, with the retainerships in consulting. Anurag was the most stretched out, handling a large consulting project and the insurance business, both of which necessitated frequent travel. Even if there was merit in their desire to diversify, they felt they didnt even have the time or people to investigate new ideas. Balaraman proposed that they speak to Arvind and elicit his interest in staying back at Bangalore and becoming a part of the team. If the response was positive, then he should go ahead and propose to Deva Surveyors that they should allow Arvind to stay on in Bangalore and find another person for their Hyderabad operations. When the proposal was made to Arvind, he took a few days to think it through and finally gave his acceptance. Deva Surveyors also concurred with Arvinds decision. Search, find and discard The team immediately started exploring ideas in right earnest. Between October and December 1983, a few brainstorming sessions were held to generate ideas for a new business. It was decided that each member of the team would use their experience and contacts to generate at least a couple of ideas, which could be investigated further for feasibility. Exhibit describes a set of ides that were taken up for scrutiny. The group decided to explore two ideas further pharmaceuticals and cold forged components. Anurag was asked to investigate the pharmaceuticals idea in detail and Arvind took up the cold forging idea for further exploration. After almost two months of effort individually, the team met again in March 1984 to evaluate where they stood. Anurag reported on the pharmaceutical business. I have been traveling to places like Mysore, Hubli, Madras, Coimbatore etc for insurance surveys. I had kept aside some time to go and meet some of the distributors and loan licensees in all these locations. Most of them confirmed what we

already know. It appears that there is a market, but the economics seem to be very different from what we thought it would be. The competition has become very intense, and the distributors are looking for larger margins, almost up to 50%. Many new companies are not doing that well, and have not paid their suppliers for many months. This has made the loan licensee manufacturers very rigid about payment terms. In effect, we may have to provide for six months sales as working capital, which would mean that our investment might have to be doubled. The other issue is the large sales force we may have to maintain, which can eat significantly into the net margins and bring it down to as low as 15%. On the whole, there may be an opportunity here to sell something, but we may not see much profits. I am not able to visualize how we can grow this business two or three years down the line. Arvind, who had investigated the cold forging business, briefed the team. All the major automotive manufacturers are in the western part of India. I went to Bombay and Pune and talked to the large manufacturers of passenger cars and trucks. While they were willing to talk, they were quite cagey in sharing information. The manufacturing process is quite sophisticated and calls for investments in precision presses that are to be imported. We have to invest in the presses and the tooling will be owned and loaned to us by the customers. It appears that one of the south based automotive manufacturers is already in the process of creating capacity to manufacture these components. The companies I met seemed to be interested in getting new suppliers for these components, but all of them wanted to meet the technologist backing the venture. They wanted me to bring the technical person along so that they could discuss the requirements face to face. I presume they would also assess during those meetings our technical capability and seriousness to go through with the venture. I spoke to the importers who represent some of the leading machinery manufacturers in the world and tried to get an idea of the prices. We may need at least a couple of 100-ton presses, and a quick calculation puts the machinery cost alone at about Rs 80 lacs. I would put the ballpark total investment at about Rs 1.2 to 1.5 crores. I have no indication of the revenue stream, and none of the prospective customers would talk to me specifics without the technologist around. I have already exhausted the meager budget we had set aside for this idea. I have also accumulated a backlog of insurance work, which I need to clear. We need to decide now whether we should invest further time in investigating this venture. After some debate, the team felt that both the ideas were not looking attractive enough. Except Arvind, all the others had been in the pharmaceuticals business before and knew the industry inside out, but were still hesitant in jumping into the industry, which surprised Arvind. On further probing, he realized that their discomfort was because they knew the industry too well. The team also asked Geetha if her husband would move into the team and spearhead the cold forging business. After discussing it with her husband, Geetha informed the group that he could only provide some guidance from outside as long as such guidance did not conflict with his current job. The question of Dr.Mukherjee joining the group fulltime did not arise until the venture had been incorporated and finances fully tied up. Around the same time, the team came across an advertisement in the newspapers issued by a leading corporate house in Madras. The advertisement invited entrepreneurs, with a capability to invest up to Rs 5 lacs, to become franchisees for their leading Tommy brand of bread and other bakery products in various cities, including Bangalore. They offered the entrepreneurs know how and use of the brand name, against payment of royalty on sales. All the team members knew Tommy as a well respected and popular brand in the south. The Tommy group itself had been in business for well over hundred years and was a household name in the south. The team felt that this was an opportunity worth exploring, and sent in an application for franchise. In parallel, Arvind was asked to see if the cold forging project could be downsized to fit into the investment parameters of the group and Anurag was asked to shortlist the products and the corresponding loan licensees for the pharmaceuticals venture. Two months went by. Anurag and Arvind were too busy with their existing tasks and nothing much moved on the pharmaceuticals and cold forging front. In June 1984, Tommy group

informed the team that they were one of the five parties short listed for consideration as franchisee and invited the team for a meeting. Geetha attended the meeting and came away with an impression that the team stood a good chance of being chosen as a franchisee. A week later, Tommy group wrote a letter to the team, thanking them for the interest shown and informing them of their choice of another company in the shortlist as the franchisee. Anurag and Arvind realized that they were back to square one and had to pick up the threads from where they left off with regard to the new opportunities being investigated. Arvind felt that any further investigation of the cold forging business required Dr.Mukherjees presence in front of the customers, which was very difficult to manage. Arvind sat down for a detailed discussion with Dr.Mukherjee about the prospects of downsizing the investment. It finally emerged that the most expensive component of investment was the presses, and going in for presses of lower capacity would necessarily restrict the range of components that they could offer, which in turn would shrink the target market. Thus Arvind recommended to the team that the idea be shelved. Anurag could hardly get his preparations off the ground since he was neck deep in the consulting project and survey work. In effect, the team didnt have much to work on as far as the new venture was concerned, even after spending close to six months chasing new business ideas. Arvind got himself involved fully in insurance work and even acquired professional qualifications in insurance, that too securing first rank in the examinations.

The lucky break When the team had all but reconciled to the idea of plodding along with their existing businesses, lady luck smiled on them. In October 1984, Tommy group contacted the team and offered them the franchise, since the original awardee of the franchise could not take it up due to some personal reasons. The team was given exactly a week to communicate its acceptance of the offer, along with a preliminary plan to implement the franchise. As he waited for his colleagues to join him for making this crucial decision, Mr.Balaraman was wondering which way their decision would go. Being a creative person that he is, Mr.Balaraman had already thought of a name for the new venture Master Bakers in case they chose to ahead with the franchise. Exhibit A. Ideas discussed and short-listed Idea 1: Pharmaceuticals Concept: Develop a set of generic formulations, outsource manufacturing to loan licensees and sell through propaganda distributors. Though initially a trading activity, it can be grown into a manufacturing activi Market Potential: The industry growth rate was over 10% per annum. Industry heavily controlled by the government, and with a large rural market served by the small-scale sector. The opportunity is mainly in generic formulations and can generate up to Rs. 4 to 5 crores sales in three years time. Profitability: Gross margins of 30% are realizable Investments required: Mainly working capital. May need up to Rs 1 lac initially for setting up the loan licensees and enlisting the distributors. At least two months of sales should be provided for working capital. Assuming a first year sales of Rs 1 crore, investment could be in the range of Rs.20 lacs. Groups strength: Three of the four members are intimately familiar with the industry, carry extensive marketing and formulation expertise, and have wide contacts

Possible roadblocks: Competition, working capital financing

Idea 2: Cold forged high tensile fasteners Concept: Cold forged, high tensile fasteners for the automotive manufacturers Market potential: Market size could be of the order of Rs. 10-15 crores, growing in tandem with the automotive sector, at the rate of 8-10% per annum. There are not many manufacturers of high tensile fasteners, since the technology involved was fairly sophisticated. Profitability: Possible to realize gross margins above 40%, but net margins highly sensitive to utilization of capacity, given the high cost of capital equipment. Investments required: The heavy presses have to be imported. The total investment could be of the order of Rs.50-75 lacs. Groups strength: The group is not familiar with the technology or the market. The idea came from Mrs.Geetha Mukherjees husband, Dr.Mukherjee, a metallurgist and specialist in forging technology. Employed as a senior technologist in a leading public sector organization, Dr.Mukherjee may consider joining the venture if takes off. Possible roadblocks: Investment required may be well beyond the capability of the group.

B. Ideas discussed and rejected Idea 1: Hundred plates Concept: Serve only hundred plates of an exotic dish, at an advantageous location. Have a unique menu for each of the (7*3) 21 meals a week. Reason for rejection: The team didnt feel they could grow the business. It didnt meet the criteria of a manufacturing activity. The team didnt want to be in the restaurant business. Idea 2: Aluminium fittings for construction industry Concept: Door and window frames, cupboard frames, hinges etc made of aluminum for use in buildings Reasons for rejection: Labor intensive process; need to sell to unorganized market Idea 3: Light fittings for leading brands

Concept: Manufacturing luminaries for the leading brands in the business Reasons for rejection: All leading brands had existing tie-ups. Suffered from the inherent risks of an OEM business

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- BA (Prog.) - 2023-SEM.-II-IV-VI (CBCS) - 03-03-2023Documento17 pagineBA (Prog.) - 2023-SEM.-II-IV-VI (CBCS) - 03-03-2023BBNessuna valutazione finora

- E3 Expo Booklet - 2018Documento22 pagineE3 Expo Booklet - 2018CoachTinaFJNessuna valutazione finora

- University of Nueva CaceresDocumento11 pagineUniversity of Nueva CaceresE.D.JNessuna valutazione finora

- Sri Ramakrishna Engineering College: Information BrochureDocumento24 pagineSri Ramakrishna Engineering College: Information BrochureHarihara Gopalan SNessuna valutazione finora

- Business Feasibility Study OutlineDocumento14 pagineBusiness Feasibility Study OutlineHauwau KabirNessuna valutazione finora

- Innopreneurship Entrepreneurship + InnovationDocumento20 pagineInnopreneurship Entrepreneurship + InnovationIrene Mar T. ValdezNessuna valutazione finora

- Consultancy Project .EditedDocumento18 pagineConsultancy Project .EditedatirahzulkapliNessuna valutazione finora

- Chapter 5 ReportingDocumento30 pagineChapter 5 ReportingEmerson CruzNessuna valutazione finora

- NGHE 2 Extra MaterialDocumento32 pagineNGHE 2 Extra MaterialNguyen Thi Ly NaNessuna valutazione finora

- XXXXXX Relevant Field of Studies: XXXX EIT Digital Master SchoolDocumento3 pagineXXXXXX Relevant Field of Studies: XXXX EIT Digital Master Schoolkhan rqaib mahmudNessuna valutazione finora

- Regional Insights ReportDocumento14 pagineRegional Insights ReportToby VueNessuna valutazione finora

- Jay Abraham - Principles of Geometric Business GrowthDocumento25 pagineJay Abraham - Principles of Geometric Business GrowthTodd Warren100% (9)

- Fish Nursery Operation CGDocumento8 pagineFish Nursery Operation CGRachel Mae Calizar BagcatinNessuna valutazione finora

- SWOT AnalysisDocumento5 pagineSWOT AnalysiscamNessuna valutazione finora

- PoP WorkbookDocumento15 paginePoP WorkbookAnishaKumariGupta75% (4)

- Fei Europe Brochure 8 9Documento8 pagineFei Europe Brochure 8 9api-239091975Nessuna valutazione finora

- C6.Writing A Business PlanDocumento37 pagineC6.Writing A Business PlanmnornajamudinNessuna valutazione finora

- The Role of Business Incubators in The Economic Development of Saudi Arabia - ProQuestDocumento1 paginaThe Role of Business Incubators in The Economic Development of Saudi Arabia - ProQuestSyedkashifNessuna valutazione finora

- Open Innovation in EVs - A Case Study of Tesla MotorsDocumento32 pagineOpen Innovation in EVs - A Case Study of Tesla MotorsMarco Arturo Cueva MoralesNessuna valutazione finora

- Entrepreneurship: Chloe Xu Class 1-June 28 2022Documento66 pagineEntrepreneurship: Chloe Xu Class 1-June 28 2022Selina Sofie ArnelundNessuna valutazione finora

- Business Schools Design ThinkingDocumento78 pagineBusiness Schools Design ThinkingSunil PurohitNessuna valutazione finora

- PRETESTDocumento4 paginePRETESTRachel M. GalidoNessuna valutazione finora

- Book Published I Field of BusinessDocumento189 pagineBook Published I Field of BusinessRikeshNessuna valutazione finora

- Information and Communication Technology (ICT)Documento44 pagineInformation and Communication Technology (ICT)Economic Policy Research Center100% (1)

- The Influence of Education, Social Environment, and Motivation On Beginner Entrepreneurial Behavior With Self Efficacy As A Moderator (Albert Bandura Theory)Documento6 pagineThe Influence of Education, Social Environment, and Motivation On Beginner Entrepreneurial Behavior With Self Efficacy As A Moderator (Albert Bandura Theory)AJHSSR JournalNessuna valutazione finora

- Fotile GroupDocumento17 pagineFotile GroupMuhammad RehmanNessuna valutazione finora

- FranchisingDocumento20 pagineFranchisinggileraz90Nessuna valutazione finora

- FIDP Entrepreneurship Senior High SchoolDocumento9 pagineFIDP Entrepreneurship Senior High Schooljendelyn r. barbadillo100% (2)

- International Conference in Kavala, Greece, From 10 To 13 October 2019Documento13 pagineInternational Conference in Kavala, Greece, From 10 To 13 October 2019Boban Stojanovic100% (1)

- REC@NNECT Challenge Final Program AnnouncementDocumento10 pagineREC@NNECT Challenge Final Program AnnouncementyuritziacostaNessuna valutazione finora