Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mobile Banking - Market Dynamics For Pakistan

Caricato da

Niaz AliDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Mobile Banking - Market Dynamics For Pakistan

Caricato da

Niaz AliCopyright:

Formati disponibili

MobileBankingMarketDynamicsforPakistan

Introduction Today there exist evolutions of mobile devices accelerating exponentially with a naturaldesireofmobility.Oneoftherationalesbehindthisevolutionistheneedfor findingeasywaytoaccessinformation,sharingthatinformation,payforshopping, accessentertainment,seekproductsandtransferfundsbytouchingbuttons.Mobile handsets are in the hand of 67% of the world population, the largest consumed electronicdeviceintheworld. The advent of value added services offerings like mcommerce over mobile networks have farreaching effects. The global mobile money industry has grown significantly in size and scope since last five years. By 2015, online shoppers worldwide will spend $119 billion on goods and services purchased via mobile phones, representing about 8% of total ecommerce sales, ABI Research predicts. AccordingtoJuniperresearch,amountofmobilepaymenttransactionisexpectedto reach 630 Billion USD by 2014, with a half a billion mobile money users globally. Mobile remittances are yet another segment of mobile commerce having a sound anticipation throughout the world. The GSMA forecasts that the 'formal' global remittance market could be grown from around US$300 billion by 2010 to over US$1trillioninfiveyearswith thehelpof mobilecommunications.Encouragingly, According to World Bank, Pakistan is among the Top 20 remittancereceiving economieswithasizeof9BillionUSD. Mobilebankingisanothergrowingphenomenon;talkingonaglobalscenarioalmost 4 billion people are unbankedwith more than twothirds of the unbanked population in the worlds low and middleincome countries. However, evidence from countries like Brazil, South Africa, India, and Kenya strongly suggests that thereisrapidpopularityofmobilebankingservices. PakistanProspective Our country has experienced an excelling growth for both mobile and banking sectorssincetheirderegulation;todaywearewitnessingmergersoftheirproducts and services. According to State bank of Pakistan, growth and turnaround in Pakistansbankingsectorhasbeenremarkableandunprecedentedinrecentyears.

Classified as Pakistans and regions best performing sector, the financial sector assets have risen to over $185 billion, its profitability is exceptional and at an all time high, nonperforming loans (NPLs) are at an alltime low, credit is fairly diversifiedandbankwidesystemrisksarewellcontained.Almost81%ofbanking assets are in private hands. Similarly mobile sector in Pakistan has observed an enormousgrowthwith asubscribersbasereaching above100million,growingat 12to15%,whichwasonly5Millionin200405. Despitethisrapidgrowth,presentlythereareonly25million bankaccountsinthe country making 14 % of the adult population with an access to formal banking services. If the opportunity relationship is mapped between the numbers of bank accounts(25million)versusthenumberofmobilesubscribers(102million),there existsacomprehensiblewindowoffacilitationfortheunbankedpopulationofthe countrymostlylivinginruralandremoteareas.Thiswindowoffacilitationcouldbe transformed into a realization through mobile banking services. An open, transparentandrobustmobilebankingregulatoryframeworkwouldnotonlyassist the population at large but would also be bridging the ability to measure undocumentedeconomyofPakistan. The high population density of mobile Pakistan is features auguring very well for success of a technology driven thrust in branchless banking. Five mobile phone companies have brought the entire country under comprehensive network coverage,withsteadygrowthinnumberofmobilephonesubscribers(alreadywell above hundred million), and also with ample information processing capacity to engage in partnerships with licensed and regulated financial service providers to devise andintroduceinnovativecosteffectivemeansofintroducingnewsegments ofbanking. We have already started witnessing availability of valuable mobile commerce servicesofferingfrommobileoperatorsandfinancialinstitutes.Theseserviceshave empowered mobile subscribers to deposit and withdraw cash, make utility bill payments, send or receive money, purchase mobile card vouchers, make postpaid mobile bill payment and much more by using diversified array of convenient channels.TelenorEasyPaisaandUBLOmniare featured examplesoflocalmobile commercesolutionintroducedinthecountry.Thesuccessofthefinancialservices availableinthecountrycanbejudgedbythefactthatbyDecember2010,Telenors EasyPaisaservicehashosted9.9milliontransactionswithatotalworthofPKR19

billion passed through the system. On the similar ground, last year MCB was nominated among the top four best mobile money services category for Global GSMAMobileAwards. RequiredEfforts However,thepresentregulatoryframeworkavailableunderElectronicTransferAct (2005) and Branchless Banking Regulations (2008) promulgated by State Bank of Pakistanisbasedon1to1relationship.Thisoffersaclosesystembetweenasingle bankandasinglemobileoperatorrequiredtodeveloptheirownpaymentsolutions withlowoutreachpossibilityintermsofsubscribersfacilitation. Subsequenttovariouspublicdialoguesarrangedonthetopicofmobilecommerce, itwasfeltthatthereisadirerequirementtodevelopaunifiedandopenregulatory frameworkforpromotionofmobilebankingservicesinthecountry. TherequirementgavebirthtoanideapresentedbymyselfthataTPS(ThirdParty Solution Provider) model may be opted for carrying out mobile commerce transactions in the country. A model gathering Mobile Operators (Providing m commerce application interface), Financial Banks (Providing Financial services), Consumer (Enduser utilizing mcommerce services) and a TPS (A third party vendorperformingintegrationofallentities).

BlockDiagramoftheTPSModel

TheprimaryapproachistoencourageManytoManyservicedeliverymechanismas opposed to OnetoOne payment system. The introduction of third party payment networks also known as MPSP (Mobile Payment Service Providers) would be of immenseadvantagesincethesethirdpartypaymenthandingagentscanworkwith many providers, rather than the closed networks. We could foresee opportunities for service providers (both from Banks and Mobile Sector) who move quickly to createnewproducts,especiallyiftheycanestablishsharednetworksofthirdparty agents.Inordertointroduceaunifiedregulatoryregimecateringtherequirements of operators, financial institutes and the consumer by providing a manytomany relationship. PTA has join hands with SBP for drafting of Mobile Banking Regulationsbasedonthirdpartserviceprovidermodel. This approach is likely to support mobile convenience to everyday banking while offering stateoftheart security to mobile users and financial institutions.

Consumersbelongingtoanybankandmobileoperatorwouldhavethefreedomof managingtheirfinanceswhenandwheretheywant.Thismeansthatallbanksand mobileoperatorswouldbeabletoconnectwitheachotherresultinginasituation where any bank customer can access their accounts, transfer funds, and interact withallotherbankcustomerusingmobileconnection.This alsoprovides anextra freedomtoallserviceproviderstostartmobilebankingofferstotheirconsumers. Under this model, all banks and all operators could join hands to offer services to virtually all bankable customers. This model offers the maximum connectivity and hencemaximumoutreachbutrequiresacentraltransactionprocessingsystemthat could be handled by a MPSP. Relying on third party service providers would also "liberate"banksfromlocationconstraints,allowingthemtocompeteforcustomers anywherebasedonproductdesign,marketing,andbranding.

Potrebbero piacerti anche

- Mobile Payments and Consumer ProtectionDocumento12 pagineMobile Payments and Consumer ProtectionMd.saydur RahmanNessuna valutazione finora

- Mobile Money:: Enabling Regulatory SolutionsDocumento40 pagineMobile Money:: Enabling Regulatory Solutionsprabin ghimireNessuna valutazione finora

- 2mobile Banking System in Bangladesh A Closer StudyDocumento8 pagine2mobile Banking System in Bangladesh A Closer StudyRawnak AdnanNessuna valutazione finora

- "Mobile Based Financial Services Its Impact and Growth in India As Well As Mobile Payments" Mobile Phones - The Key To Our Financial FutureDocumento8 pagine"Mobile Based Financial Services Its Impact and Growth in India As Well As Mobile Payments" Mobile Phones - The Key To Our Financial FutureRavindra KumarNessuna valutazione finora

- Project Ibm FinalDocumento83 pagineProject Ibm FinalnitishagrawalNessuna valutazione finora

- Chap TwoDocumento10 pagineChap Twoakandwanaho timothyNessuna valutazione finora

- 03 Literature ReviewDocumento15 pagine03 Literature ReviewPraveen PuliNessuna valutazione finora

- Chapter 1Documento7 pagineChapter 1ZyZy ArradazaNessuna valutazione finora

- NO. Particulars PG No. 1Documento58 pagineNO. Particulars PG No. 1Sunil ColacoNessuna valutazione finora

- Potential of Mobile Money Transfer in ZimbabweDocumento32 paginePotential of Mobile Money Transfer in ZimbabweGodknows MudzingwaNessuna valutazione finora

- M-Pesa Kenya vs. IndiaDocumento4 pagineM-Pesa Kenya vs. IndiaSyed fayas thanveer SNessuna valutazione finora

- Mobile Banking by Irfan ArifDocumento20 pagineMobile Banking by Irfan ArifMuhammad Talha KhanNessuna valutazione finora

- Sustainability 11 03639 v3Documento33 pagineSustainability 11 03639 v3Lydenel Altez CaisipNessuna valutazione finora

- An Overview and Future Scope of Mobile BankingDocumento5 pagineAn Overview and Future Scope of Mobile BankinganandagarwalNessuna valutazione finora

- Mobile Banking in BangladeshDocumento31 pagineMobile Banking in BangladeshCoral AhmedNessuna valutazione finora

- Shared Service Business PlanDocumento10 pagineShared Service Business PlanBerkti GetuNessuna valutazione finora

- Mobile Banking: A Study On Adoption by Indian UsersDocumento6 pagineMobile Banking: A Study On Adoption by Indian UsersshanmukhaNessuna valutazione finora

- Trends and Prospects of Mobile Payment Industry in China 2012-2015Documento0 pagineTrends and Prospects of Mobile Payment Industry in China 2012-2015zvonimir1511Nessuna valutazione finora

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsDa EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNessuna valutazione finora

- Executive Summary: Mobile BankingDocumento48 pagineExecutive Summary: Mobile Bankingzillurr_11Nessuna valutazione finora

- Analysis of FII Data 2013 & 2018 - MA EconomicsDocumento27 pagineAnalysis of FII Data 2013 & 2018 - MA EconomicsSaloni SomNessuna valutazione finora

- Mobile Commerce in BankingDocumento29 pagineMobile Commerce in BankingRuchy SinghNessuna valutazione finora

- Mobile Banking: A Boon For unbanked-IIDocumento3 pagineMobile Banking: A Boon For unbanked-IIsrujalshahNessuna valutazione finora

- The Current State and Future of Mobile Banking in EuropeDocumento16 pagineThe Current State and Future of Mobile Banking in EuropepaulojooliveiraNessuna valutazione finora

- Mobile Banking: A Tool of Financial InclusionDocumento19 pagineMobile Banking: A Tool of Financial InclusionMartinaNessuna valutazione finora

- Impact of Mobile BankingDocumento6 pagineImpact of Mobile BankingSridhar ChanNessuna valutazione finora

- The Mobile Money Revolution - Financial Inclusion EnablerDocumento30 pagineThe Mobile Money Revolution - Financial Inclusion EnablerITU-T Technology Watch100% (2)

- Mobile Phone Banking Usage Experiences in Kenya byDocumento16 pagineMobile Phone Banking Usage Experiences in Kenya byAury KashkashNessuna valutazione finora

- MGT427Documento34 pagineMGT427Asif MahmoodNessuna valutazione finora

- Dissertation On Mobile Banking in IndiaDocumento4 pagineDissertation On Mobile Banking in IndiaHelpInWritingPaperUK100% (1)

- Impact of Mobile Money Services On Thegrowth of Smes in BotswanaDocumento17 pagineImpact of Mobile Money Services On Thegrowth of Smes in BotswanaDonna MulasiNessuna valutazione finora

- Financial Inclusion For Sustainable Development: Role of IT and IntermediariesDocumento7 pagineFinancial Inclusion For Sustainable Development: Role of IT and IntermediariesBasavaraj MtNessuna valutazione finora

- Assignment Digital MarketingDocumento8 pagineAssignment Digital MarketingJustice DzamaNessuna valutazione finora

- The Rise of Mobile Banking: Annals of The University of Petroşani, Economics, 15 (2), 2015, 29-36 29Documento8 pagineThe Rise of Mobile Banking: Annals of The University of Petroşani, Economics, 15 (2), 2015, 29-36 29Ramona TabuscaNessuna valutazione finora

- From E-Government To M-Government: ICTD ProjectDocumento4 pagineFrom E-Government To M-Government: ICTD Projectdharavath999Nessuna valutazione finora

- Mobile Banking Penetration in Suburban Maharashtra: An Analytical Study With Reference To BaramatiDocumento15 pagineMobile Banking Penetration in Suburban Maharashtra: An Analytical Study With Reference To BaramatiChayan GargNessuna valutazione finora

- Mobile Money As A Driver of Digital Financial InclusionDocumento14 pagineMobile Money As A Driver of Digital Financial InclusionSabrine BelgaiedNessuna valutazione finora

- The Use of M-Payment Services in South Africa A Value Based Perceptions ApproachDocumento21 pagineThe Use of M-Payment Services in South Africa A Value Based Perceptions ApproachAyu DamanikNessuna valutazione finora

- Mobile Velocity: A Model For Selecting Global Markets - By: Razal Minhas, Sudip Mazumder, Dan Israel, Joshua DyeDocumento10 pagineMobile Velocity: A Model For Selecting Global Markets - By: Razal Minhas, Sudip Mazumder, Dan Israel, Joshua DyeSapientNitroNessuna valutazione finora

- Sriram Khanna - Final Workshop PresentationDocumento22 pagineSriram Khanna - Final Workshop PresentationNidhi_11111987Nessuna valutazione finora

- Its Money On Your Mobile Go Mobile With Your MoneyDocumento15 pagineIts Money On Your Mobile Go Mobile With Your Moneyjagat4uNessuna valutazione finora

- Project Report Mobile BankingDocumento49 pagineProject Report Mobile Bankingtanugutpta100% (7)

- MFS Conference Remarks 2Documento5 pagineMFS Conference Remarks 2Hugo DaleyNessuna valutazione finora

- Paytm Marketing StrategyDocumento4 paginePaytm Marketing StrategyPayal GedamNessuna valutazione finora

- An Analysis On The Mobile Payment Industry in China and Its Implications To MalaysiaDocumento19 pagineAn Analysis On The Mobile Payment Industry in China and Its Implications To MalaysiaGlobal Research and Development ServicesNessuna valutazione finora

- Digital Payments Transformation Roadmap ReportDocumento44 pagineDigital Payments Transformation Roadmap ReportChris aribasNessuna valutazione finora

- Thesis Mobile PaymentDocumento4 pagineThesis Mobile Paymentanneryssanchezpaterson100% (1)

- AP Research Paper FinalDocumento19 pagineAP Research Paper FinalRyNNessuna valutazione finora

- Current Situation of Mobile Financial ServicesDocumento7 pagineCurrent Situation of Mobile Financial ServicesRafsan KhondokerNessuna valutazione finora

- Study On Mobile PaymentsDocumento20 pagineStudy On Mobile Paymentsgautam_hariharanNessuna valutazione finora

- Mobile Banking and Economic Development Linking Adoption Impact and UseDocumento16 pagineMobile Banking and Economic Development Linking Adoption Impact and UseImran HosenNessuna valutazione finora

- Analysing Slow Growth of Mobile Money Market in India Using A Market Separation PerspectiveDocumento26 pagineAnalysing Slow Growth of Mobile Money Market in India Using A Market Separation PerspectiveAakanksha SharmaNessuna valutazione finora

- Human Rights ClubDocumento6 pagineHuman Rights Clubpradeep26guptaNessuna valutazione finora

- SSRN Id3170571Documento40 pagineSSRN Id3170571MuhammadAsaduzzamanNessuna valutazione finora

- Digital Financial Services (DFS) Challenge Facility Digital Financial Services (DFS) - Innovation Challenge Facility InnovationDocumento10 pagineDigital Financial Services (DFS) Challenge Facility Digital Financial Services (DFS) - Innovation Challenge Facility InnovationSyed Abbas Haider ZaidiNessuna valutazione finora

- Mobile Finance Services in BangladeshDocumento4 pagineMobile Finance Services in Bangladeshsn nNessuna valutazione finora

- Financial Inclusion Through M-Banking Services: Scope and Problems in IndiaDocumento10 pagineFinancial Inclusion Through M-Banking Services: Scope and Problems in IndiaShalini JaiswalNessuna valutazione finora

- Sales and Marketing Executive, DelhiDocumento4 pagineSales and Marketing Executive, Delhishivam shubhamNessuna valutazione finora

- Fintech and Islamic Finance: Digitalization, Development and DisruptionDa EverandFintech and Islamic Finance: Digitalization, Development and DisruptionNessuna valutazione finora

- 2014 CEoI Partner Declaration Template - RAHA Annex 6Documento2 pagine2014 CEoI Partner Declaration Template - RAHA Annex 6Niaz AliNessuna valutazione finora

- The State of U.S. Corporate Governance: What's Right and What's Wrong?Documento39 pagineThe State of U.S. Corporate Governance: What's Right and What's Wrong?Niaz AliNessuna valutazione finora

- Lahore UCs ProfilesDocumento144 pagineLahore UCs ProfilesNiaz Ali0% (1)

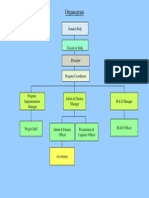

- Organo GramDocumento1 paginaOrgano GramNiaz AliNessuna valutazione finora

- Why Should Engineers Study Economics?: Macroeconomics Microeconomics Microeconomics MacroeconomicsDocumento5 pagineWhy Should Engineers Study Economics?: Macroeconomics Microeconomics Microeconomics MacroeconomicsSachin SadawarteNessuna valutazione finora

- Book of FormsDocumento212 pagineBook of Formsrajeeshmp150% (2)

- Treasury DutiesDocumento28 pagineTreasury DutiesShasha DansoNessuna valutazione finora

- MFRS 5Documento22 pagineMFRS 5mzsanjay8131Nessuna valutazione finora

- Indoor Management RuleDocumento17 pagineIndoor Management RuleJamal BorhanNessuna valutazione finora

- Contracts (Vincent) 94-95 ChisickDocumento56 pagineContracts (Vincent) 94-95 ChisickjordannobleNessuna valutazione finora

- Collector v. GoodrichDocumento5 pagineCollector v. GoodrichSocrates Jerome De GuzmanNessuna valutazione finora

- Subidha Chhatrabas 070-071Documento5 pagineSubidha Chhatrabas 070-071Junu MainaliNessuna valutazione finora

- 0 Asset Protection BasicsDocumento43 pagine0 Asset Protection Basicspwilkers36100% (1)

- Group Coursework - MBA IDocumento11 pagineGroup Coursework - MBA IBuatienoNessuna valutazione finora

- Cash Accrual Practice SetDocumento2 pagineCash Accrual Practice SetMa. Trixcy De VeraNessuna valutazione finora

- Proposed Business Strategy For British AirwaysDocumento21 pagineProposed Business Strategy For British AirwaysLucas Salam0% (1)

- Form NDH-3Documento4 pagineForm NDH-3Shobanbabu BashkaranNessuna valutazione finora

- Open University Undergraduate Prospectus 2014-2015Documento54 pagineOpen University Undergraduate Prospectus 2014-2015Darryl ArmstrongNessuna valutazione finora

- Asian Cathay Case - Unconscionable InterestDocumento9 pagineAsian Cathay Case - Unconscionable InterestMarvin Paynor GarciaNessuna valutazione finora

- Javellana V Lim Case DigestDocumento2 pagineJavellana V Lim Case DigestYodh Jamin OngNessuna valutazione finora

- IHWO Activity Pack - Level C1: MailboxDocumento9 pagineIHWO Activity Pack - Level C1: MailboxNikocaNessuna valutazione finora

- Manual On The Financial Management of BarangaysDocumento150 pagineManual On The Financial Management of BarangaysMarcellanne Valles100% (4)

- International Business Hill An Asian Perpective Chapter 9Documento29 pagineInternational Business Hill An Asian Perpective Chapter 9HafeezAbdullahNessuna valutazione finora

- Summary Report of The Exposure Visit of North East TeamDocumento5 pagineSummary Report of The Exposure Visit of North East TeamShalini KumariNessuna valutazione finora

- Chapter 11 Bankruptcy IssuesDocumento107 pagineChapter 11 Bankruptcy IssuesRayNessuna valutazione finora

- Dao Heng Bank, Inc., Now Banco de Oro Universal Bank vs. Sps. Lilia and Reynaldo LaigoDocumento5 pagineDao Heng Bank, Inc., Now Banco de Oro Universal Bank vs. Sps. Lilia and Reynaldo LaigoAdrianNessuna valutazione finora

- Port Mann/Highway 1 Improvement Project: Project Report: Achieving Value For MoneyDocumento23 paginePort Mann/Highway 1 Improvement Project: Project Report: Achieving Value For MoneyRussell A-CHNessuna valutazione finora

- Creative Real Estate InvestingDocumento6 pagineCreative Real Estate InvestingAchille Piotti100% (2)

- Credit Management: MBA Banking & Finance 3rd TermDocumento17 pagineCredit Management: MBA Banking & Finance 3rd Term✬ SHANZA MALIK ✬Nessuna valutazione finora

- Working Capital Management GlaxoDocumento11 pagineWorking Capital Management GlaxoJyotirmoy's VoiceNessuna valutazione finora

- Chapter 1Documento20 pagineChapter 1Adam MilakaraNessuna valutazione finora

- Wiley - Practice Exam 3 With SolutionsDocumento15 pagineWiley - Practice Exam 3 With SolutionsIvan BliminseNessuna valutazione finora

- Session 2: Capital Investment Appraisal (An Introduction)Documento41 pagineSession 2: Capital Investment Appraisal (An Introduction)ttzaxsanNessuna valutazione finora

- Greece, Derivates, and FX? What Went Wrong?Documento4 pagineGreece, Derivates, and FX? What Went Wrong?Zerina BalićNessuna valutazione finora