Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sies - Excise Procedure & Cenvat - Jan 2012

Caricato da

Suja PillaiDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Sies - Excise Procedure & Cenvat - Jan 2012

Caricato da

Suja PillaiCopyright:

Formati disponibili

1 REGISTRATION For the administration of the Central Excise Act, 1944 and the Central Excise Rules, 2002,

manufacturers of excisable goods or any person who deals with excisable goods with some exceptions, are required to get the premises registered with the Central Excise Department before commencing business. Legal Provisions : As per SECTION 6 of the Central Excise Act, 1944 any prescribed person who is engaged in (a) The production or manufacture or any process of production or manufacture of any specified goods included in the (the First Schedule and the Second Schedule) to the Central Excise Tariff Act, 1985 (5 of 1986) or (b) The wholesale purchase or sale (whether on his own account or as a broker or commission agent) or the storage of any specified goods included in (the First Schedule and the Second Schedule) to the shall Central Excise Tariff Act, 1985 (5of 1986), Shall get himself registered with the proper officer in such manner as may be prescribed. For all practical purposes, the legal provisions contained in rule 9 of the Central Excise Rules, 2002 govern the scheme of registration which provides that: (1) Every person, who produces, manufactures, carries on trade, holds private store-room or warehouse or otherwise uses excisable goods, shall get registered. (2) The Board may by notification and subject to such conditions or limitations as may be specified in such notification, specify person or class of persons who may not require such registration.

2 (3) The registration under sub-rule (1) shall be subject to such conditions, safeguards and procedure as may be specified by notification by the Board. Persons Requiring Registration : In accordance with Rule 9 of the said Rules the following category of persons are required to register with jurisdictional Central Excise Officer in the Divisional Office having jurisdiction over his place of business/factory : (i) Every manufacturer of excisable goods (including Central / State Government undertakings or undertakings owned or controlled by autonomous corporation) on which excise duty is leviable. First and second stage dealers (including manufactures depots and importers) desiring to issue Cenvatable invoices. Persons holding warehouses for storing non-duty paid goods. Persons who obtain excisable goods for availing end use based exemption. Exporter-manufactures under rebate/bond procedure; and Export Oriented Units, which have interaction with the domestic economy (through DTA sales or procurement of duty free inputs). Persons who get yarns, fabrics, readymade garments etc. manufactured on job work under Rule 12B. (not required now)

(ii) (iii) (iv) (v)

(vi)

Separate registration is required in respect of separate premises except in cases where two or more premises are actually part of the same factory (where process are interlinked), but are segregated by public road, canal or railway-line. The fact that the two premises are part of the same factory will be decided by the Commissioner of Central Excise based on factors, such as: Separate Registration is required for each depot, godown etc. However, in the case of liquid and gaseous products, availability of godown before grant of registration should not be insisted upon. Exemption from Registration : The Central Board of Excise and Customs (CBEC), by Notification No. 36/2001-C.E. (N.T.), dated 26-6-2001 as amended has exempted specified

3 categories of persons / premises from obtaining registration. The exemption applies to the following : (i) Persons who manufacture the excisable goods, which are chargeable to nil rate of excise duty or are fully exempt from duty by a notification. (ii) SSI manufactures having annual turn over below the specified exemption limit. However, such units will be required to give a declaration in Annexure-4 (see Part-7) once the value of their clearances reaches the specified limit which is *Rs. 40 Lakhs presently. (iii) In respect of ready-made garments, the job-worker need not get registered if the principal manufacturer undertakes to discharge the duty liability. (iv) Persons manufacturing excisable goods by following the warehousing procedure under the Customs Act, 1962 subject to certain conditions. (v) The person who carries on wholesale trade or deals in excisable goods (except first and second stage dealer, as defined in Cenvat Credit Rules, 2002 (Now Cenvat Credit Rules,2004) and the depots of a registered manufacturer); (vi) A Hundred per cent Export Oriented Undertaking, licensed or appointed, as the case may be, under the provisions of the Customs Act, 1962 other than having dealings with DTA. (vii) Persons who use excisable goods for any purpose other than for processing or manufacture of goods availing benefit of concessional duty exemption notification. Verification There shall be a post-registration verification of the premises for which Registration is sought, by the Range Officer within 5 working days of the receipt of Duplicate Copy of Application for Registration along with a copy of Registration Certificate. The Range Officer along with the Sector Officer shall verify the declared address and premises. If any deviations or variations are noticed during the Verification, the same should be got corrected. Any major discrepancy, such as fake address, non-existence of any Factory etc. shall be reported in writing to the Divisional Officer within 3 working days and action shall be initiated

4 by the Divisional Officer to revoke the Registration after providing reasonable opportunity to the Registrant to explain his case. PROCEDURE FOR REGISTRATION UNDER CENTRAL EXCISE Every manufacturer before commencing the manufacturing activities of excisable goods should apply to the jurisdictional Deputy Commissioner in the application form (Form A-1) giving the necessary details. Same Form A-1 to be used for registration of dealer category. Ground Plan of the manufacturing/business premises, in case of manufacturers, with specific reference to Store Room for finished goods should be submitted. A Xerox copy of PAN Number allotment letter duly self-attested for the Company as well as the authorized signatory to the application should be submitted. The Registration Certificate will be issued on the spot or within 7 days with post facto verification. Verification shall be done by Range Officer within 5 days. The Registration Certificate (RC) granted is valid for the specified premises and is a permanent one unless otherwise revoked or surrendered. There is no need for renewal every year. Details of excisable goods to be declared only once at the time of registration and thereafter if any new items are to be manufactured or to be dealt with need not be declared every time. The RC shall be exhibited in a conspicuous part of the premises. Where a registered person transfers his business to another person, the transferee shall get himself registered afresh. Where a registered person is a firm or a company or association of persons, any change in the constitution of firm, company or association, shall be intimated to the jurisdictional Central Excise Officer within thirty days of such change. Every registered person, who ceases to carry on the operation for which he is registered, shall de-register himself by making a declaration in the form specified and depositing his registration certificate with the Superintendent of Central Excise, after complying with statutory obligations under excise law, particularly payment of all dues to the govt. including duty on finished products lying in the factory.

5 MANUFACTURE of final products Manufacturing must be properly recorded for which a Production Memo/ Daily Production report shall be maintained and filed. This is the document through which production is recorded and forms basis for accounting in the Daily Stock Account. This shows the variety of goods manufactured, quantity and other relevant details and prepared as and when the goods are fully packed and ready for dispatch.

STORING of goods As we all are aware, excise is a duty on manufacture and duty liability starts as soon as the goods are manufactured but the same is postponed till clearance of the same from the factory for administrative convenience of collection of duty. Therefore, there is a time gap between manufacturing and clearance of goods and the goods shall be stored in an Approved Store Room for finished product (ASR) without payment of duty till removal from the factory. This has to be specifically shown in the ground plan and got approved by the Proper Officer. The goods should be properly stored and should be made available for verification by excise officials. The stock in the ASR and the stock shown in DSA should tally at any given point of time. ACCOUNTING of excisable goods Accounting of excisable goods is an important factor and has to be done Daily of all goods manufactured and cleared. A register known as Daily Stock Account (DSA) has to be maintained to keep record of the finished products stored in the ASR as per the Daily Production Report for manufactured quantity and as per the chits for clearance of goods. This register (DSA) should show Op. Balance, Qtty. Manufactured, Quantity cleared for Home Consumption, export or Captive Consumption, Value of goods cleared, Rate of duty, Amount of duty and Qtty. held in balance. This has to be maintained daily and mandatory on all assesses.

DSA should be serially numbered, separate folio kept for each variety of goods, self-pre-authenticated before being put into use, preserved for five years. CLEARANCE of final products The removal of excisable goods from the factory can be under one or more of the following categories: Clearance for Home Consumption i.e. for sale within India Clearance for Export Clearance for Captive Consumption i.e. inside the same factory

INVOICE SYSTEM An invoice is the document under cover of which the excisable goods are to be cleared by the manufacturer. This is also the document which indicates the assessment of the goods to duty. The invoice is the manufacturers own document. Removal only on invoice Rule 11 of the Central Excise Rules, 2002, provides that no excisable goods shall be removed from a factory or a warehouse except under an invoice signed by the owner of the factory or his authorized agent. In respect of cigarettes, each invoice shall also be countersigned by the Inspector of Central Excise or the Superintendent of Central Excise before the cigarettes are removed from the factory. If the factory is in operation for all 24 hours, the officers are rotated / posted for 24 hours.

Serially numbering of invoice The invoice shall be serially numbered and shall contain the registration number, name of consignee, mode of transport and vehicle number (if any)

7 description, classification, time and date of removal, mode of transport, vehicle number, if any, rate of duty, quantity and value of goods and the duty payable thereon. The serial number shall commence from 1st April every year [beginning of a financial year]. Number invoice copies The invoice shall be prepared in triplicate in the following manner, namely :(i) The original copy being marked as ORIGINAL FOR BUYER; (ii) The duplicate copy being marked as DUPLICATE FOR TRANSPOTER; (iii) The triplicate copy being marked as TRIPLICATE FOR ASSESSEE. Number of Invoice book The sub-rule (4) of rule 11 of the said Rules provides that only one invoice book shall be in use at a time, unless otherwise allowed by the Deputy / Assistant Commissioner of Central Excise in the special facts and circumstances of each case. The Board has decided that where assessee requires two different invoice books for the purposes of removals for home-consumption, and removals for export, they may do so by intimating the jurisdictional Deputy / Assistant Commissioner of Central Excise. Intimation of serial numbers Sub rule (6) of rule 11 of the said Rule provides that before making use of the invoice book, the serial numbers of the same shall be intimated to the Superintendent of Central Excise having jurisdiction over the factory of the assessee. This can be done in writing by post / e-mail / fax / hand delivery or any other similar means. MANNER OF PAYMENT OF DUTY AND ACCOUNT CURRENT Rule 8 of the said Rules provides that duty relating to removals during a month can be discharged within FIVE days of the following month. In case of a manufacturer (SSI) availing an exemption based on value of clearances

8 during a financial year, the duty for a QUARTER may be discharged by FIFTH of the succeeding month of a quarter. For the month of March, the duty has to be discharged by 31st March in both the circumstances. In the case of duty payment through Internet banking, the due date is 6th of the following month except March. If the assessee fails to pay the amount of duty by the due date, he shall be liable to pay the outstanding amount along with an interest @ 18% p.a. for the period starting with the first day after due date till the date of actual payment of the outstanding amount. Where such duty and interest are not paid within a period of one month from the due date, the consequences and the penalties as provided in Rule 8 shall follow viz. Non-utilization of Cevat Credit and payment of duty consignment-wise till such time the pending liability is fulfilled. The duty can be discharged by debiting an account current (also referred to as Personal Ledger Account [PLA] ) and debiting the CENVAT Credit Account maintained by the assessee under the provisions of CENVAT Credit Rules, 2004. Account current (PLA) and procedures relating thereto The manufacturers shall maintain an account current (Personal Ledger Account) in the Form specified. Each credit and debit entry should be made on separate lines and assigned a running serial number for the financial year. The account current must be prepared in triplicate by writing with indelible pencil and using double-sided carbon. Original and duplicate copies of the account current should be detached by the manufacturers and sent to the Central Excise Officer in charge along with the monthly/quarterly periodical return in form E.R.-1/E.R.2/E.R.-3.

9 Credit and debit in account current The assessee may make credit in the account current by making cash payment into the Authorised Bank. Deposit into the authorized bank should be made in a Challan in form GAR-7 under the correct Head of Account. The Assessees Registration number should also be indicated in the challans. A copy of each Challan bearing Bank seal and the signature of the authorized officer of the Bank which is received back from the Bank should be sent by the assessee to the Central Excise Officer along with the monthly/periodical return. Once the assessee has deposited a cheque in the bank designated by the Central Board of Excise and Customs, the date of presentation of the cheque shall be deemed to be the date on which the duty has been paid subject to realization of the cheque. Mutilations or erasures of entries once made in the PLA are not allowed. If any correction becomes necessary, the original entry should be neatly scored out and attested by the assessee or his authorized agent.

SUBMISSION of Monthly/Quarterly Return (ER-1/ER-3) As per Rule 12 of The Central Excise Rules, 2002, the assessee shall file a periodical return, which relates to his tax liability and other transactions during the month or quarter. Every assessee shall submit to the Superintendent of Central Excise a monthly return in proper form (ER-1) of production, removal of goods, value and duty paid, PLA extract, Cenvat Credit Account and other relevant particulars, within TEN days after the close of the month to which the return relates. However, where an assessee (SSI) is availing of the exemption under a notification based on the value of clearances in a financial year, he shall file a quarterly return in proper form (E.R.-3).

10 SCRUTINY OF ASSESSMENT As per Rules 6, assessee shall himself assess (self-assessment) the duty payable on the excisable goods. The Central Excise Officers having jurisdiction over the factory/premises of the assessee is responsible for the scrutiny of returns. For this purpose, the said officer may require the relevant documents such as the invoices issued by the assessee, Daily Stock Account, Cenvat Account, cash ledgers, Ledger of all receipts and payments and the source documents etc. RECORDS Records are to be necessarily maintained in the course of any business activity to determine the tax liability of the assessee. No statutory records prescribed under Central Excise Rules, 1944 and it was decided to rely on private records as a measure of simplification w.e.f 2000. Every assessee shall maintain private records and is free to devise his record-keeping, depending upon his accounting requirements but shall ensure that the requirements of particular rules are met. All such records shall be preserved for a period of five years immediately after the financial year to which such records pertain. Every assessee / dealer is statutorily required to furnish to the Range Officer, a list in duplicate, of all the records prepared or maintained by him for accounting of transactions in regard to receipt, purchase, manufacture, storage, sales or delivery of the goods including inputs and capital goods and receipt, procurement or payment of input services. The assessee shall also on demand, provide all financial records including trial balance or its equivalent. The private records relevant for Central Excise including the Daily Stock Account maintained in compliance with the provisions of the said Rules shall necessarily be kept in the factory to which they pertain.

11

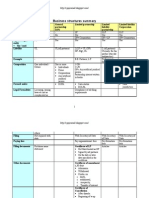

EXCISE FORMALITIES AT A GLANCE

COMMENCEMENT OF MANUFACTURING ACTIVITIES

REGISTRATION FORMALITIES A-1/GROUND PLAN/ PAN CARD

DECIDING CLASSIFICATION OF PRODUCTS

ENTRIES IN THE DAILY STOCK ACCOUNT (DSA) [After moving the goods to store room]

DAILY PRODUCTION REPORT TO RECORD PRODN IN DSA

DECIDING PRICE TO BE APPLIED

OPENING PLA ACCOUNT AND CENVAT ACCOUNT VEHICLE LEAVING FACTORY PREMISES WITH DUPLICATE INVOICE COPY POSTINGS OF CLEARANCES IN THE DSA AS PER INVOICE

DEPOSIT THRU GAR-7 CHALLAN IN THE BANK IF NEEDED

CREDIT ENTRY IN PLA OR CENVAT ACCOUNT

LOADING OF GOODS IN THE VEHICLE AS PER INVOICE

PREPARATION OF EXCISE INVOICE

MONTHLY DEBIT ENTRY IN PLA OR CENVAT A/C

SUBMISSION OF MONTHLY ER 1 RETURN

CENVAT CREDIT SCHEME

12

BASIC CONCEPT

The cenvat scheme is designed to reduce the cascading effect of incidence of tax on final products or output services. In other words, double taxation i.e. duty on duty or tax on tax has been avoided. The scheme allows instant cenvat credit to be taken of duties such as Cenvat duty, SED, ADE and CVD and Edu. Cess, SHE Cess paid on inputs and capital goods and Service Tax paid on input services received in a factory for the manufacture of any dutiable final products except Matches or providing any taxable output service. The credit taken is allowed to be utilized to discharge the excise duty liability on the final products or the service tax liability on the output service. This effectively reduces the duty liability on the final products or the service tax liability on the output service to the extent of credit taken of the duty paid on input/capital goods or input services used therein.

Basic Conditions 1. The final products or output services must be dutiable/taxable. 2. Inputs and capital goods and the input services should suffer duty/service tax 3. Inputs and capital goods must be received in the factory physically under cover of valid duty paying documents as prescribed. 4. Used in or in relation to the manufacture of final products. Salient Features Wider Applicability

All manufacturers of excisable goods and all service providers who are providing taxable services are eligible for CENVAT Credit of Excise duty paid on inputs as well as Service Tax paid on Input services, under CENVAT Credit Rules, 2004 w.e.f. 10.09.2004. Thus the dream concept of Inter Sectoral Credit has been successfully implemented, a step towards GST Act. There is no need for the manufacturer or service provider to file any declaration to avail cenvat credit.

13

No one to one co-relation As long as the inputs or input service are used in or in relation to manufacture and clearance of any final product on payment of duty or are used for providing any taxable output service, such credit can be used for payment of excise duty on any final product or used for payment of service tax on any output service. 50% credit on capital goods The manufacturer and service provider procuring capital goods notified under Rule 2 of CENVAT Credit Rules, 2004 can take only 50% of the credit of Excise duty paid during the year of purchase and the balance 50% can be taken only in subsequent financial year provided the said capital goods are in possession and in use except for spares and components. No credit on capital goods, if depreciation claimed This is a condition applicable to both manufactures and service providers that the credit of excise duty paid on capital goods is not permissible, if duty amount is claimed as depreciation under Section 32 of Income Tax Act, 1961 No credit on exempted goods/services Cenvat credit cannot be taken if the input/capital goods and input services are exclusively used for manufacture of exempted final product or exempted output service.

Definitions U/Rule 2 of Cenvat Credit Rules, 2004

Rule 2 (a) - Capital goods means:(A) the following goods, namely:(i) all goods falling under Chapter 82, Chapter 84, Chapter 85, Chapter 90, heading No. 68.02 and sub-heading No. 6801.10 of the First Schedule to the Excise Tariff Act; (ii) pollution control equipment; (iii) components, spares and accessories of the goods specified at (i) and (ii);

14 (iv) moulds and dies, jigs and fixtures; (v) refractories and refractory materials; (vi) tubes and pipes and fittings thereof; and (vii) storage tank, used(1) in the factory of the manufacturer of the final products, but does not include any equipment or appliance used in an office; or (2) For providing output service; (B) motor vehicle registered in the name of provider of output service for providing taxable service as specified in sub-clauses (f), (n), (o), (zr), (zzp), (zzt) and (zzw) of clause (105) of section 65 of the Finance Act; Rule 2(k) - "input" means(i) all goods, except light diesel oil, high speed diesel oil and motor spirit, commonly known as petrol, used in or in relation to the manufacture of final products whether directly or indirectly and whether contained in the final product or not and includes lubricating oils, greases, cutting oils, coolants, accessories of the final products cleared along with the final product, goods used as paint, or as packing material, or as fuel, or for generation of electricity or steam used in or in relation to manufacture of final products or for any other purpose, within the factory of production; (ii) all goods, except light diesel oil, high speed diesel oil, motor spirit, commonly known as petrol and motor vehicles, used for providing any output service; Explanation 1.- The light diesel oil, high speed diesel oil or motor spirit, commonly known as petrol, shall not be treated as an input for any purpose whatsoever. Explanation 2.- Input include goods used in the manufacture of capital goods which are further used in the factory of the manufacturer; Rule 2(l) - "Input Service" means any service,(i) used by a provider of taxable service for providing an output service; or

15

(ii) used by the manufacturer, whether directly or indirectly, in or in relation to the manufacture of final products and clearance of final products from the place of removal, and includes services used in relation to setting up, modernization, renovation or repairs of a factory, premises of provider of output service or an office relating to such factory or premises, advertisement or sales promotion, market research, storage upto the place of removal, procurement of inputs, activities relating to business, such as accounting, auditing, financing, recruitment and quality control, coaching and training, computer networking, credit rating, share registry, and security, inward transportation of inputs or capital goods and outward transportation upto the place of removal; Prescribed duty paying document In order to ensure that both manufacturers and service providers avail the CENVAT Credit facility in the intended manner, the following documents are specified under Rule 9(1): For inputs and capital goods Invoice issued by the manufacturers or depots of the manufacturers Invoice issued by the importers or depots of importers A supplementary invoice issued by a manufacturer or importer of inputs/capital goods Bill of Entry A certificate issued by an Appraiser of Customs in respect of goods imported through a foreign post office Invoice issued by First stage dealer or second stage dealer For input services Invoice, bill or Challan issued under Rules 4A by input service provider Invoice, bill or Challan issued by Input Service Distributor under Rule 4A of Service Tax Rules, 1994 A Challan evidencing payment of service tax by a person liable to pay service tax under provision of Service Tax Rules, 1994.

16

Types of duties eligible/Specified for CENVAT The following types of duties specified under Rule 3 of CENVAT Credit Rules, 2004 are permitted as credit to the manufacturers and service providers. For Manufacturers Basic excise duty paid on inputs or capital goods Special excise duty paid on inputs or capital goods Education Cess paid on inputs or capital goods Secondary & Higher Ed. Cess paid on inputs/capital goods CVD paid on the imported inputs or capital goods Education Cess paid on CVD National Calamity Contingent duty paid on inputs Additional Duty of excise paid on specified goods Additional duty of import paid on imported goods Service Tax and Ed. Cess and SHE Cess paid on the input services For Service Providers Basic excise duty paid on inputs and capital goods Special excise duty paid on inputs and capital goods Education Cess paid on inputs and capital goods National Calamity Contingent duty CVD paid on imported input/capital goods Education Cess paid on CVD Additional Duty of excise paid on specified goods Service Tax and Ed. Cess & SHE Cess paid on the input services ACCOUNTING OF CENVAT CREDIT The manufacturer of final products or the provider of output service shall maintain proper records for the receipt, disposal, consumption and inventory of the input and capital goods in which the relevant information regarding the value, duty paid, CENVAT credit taken and utilized, the person from whom the input or capital goods have been procured is recorded and the burden of proof regarding the admissibility of the

17 CENVAT credit shall lie upon the manufacturer or provider of output service taking such credit. The manufacturer of final products or the provider of output service shall maintain proper records for the receipt and consumption of the input services in which the relevant information regarding the value, tax paid, CENVAT credit taken and utilized, the person from whom the input service has been procured is recorded and the burden of proof regarding the admissibility of the CENVAT credit shall lie upon the manufacturer or provider of output service taking such credit. The manufacturer of final products shall submit within ten days from the close of each month to the Superintendent of Central Excise, a monthly return in the form specified, by notification, by the Board. Manufacturer availing exemption under a notification based on the value or quantity of clearances in a financial year shall file a quarterly return in the form specified, by notification, by the Board within twenty days after the close of the quarter to which the return relates. The provider of output service availing CENVAT credit, shall submit a half yearly return in form specified, by notification, by the Board to the Superintendent of Central Excise, by the 25th of the month following the particular half year.

UTILIZATION OF CENVAT CREDIT As per Rule 4 of CCR2004, CENVAT credit may be utilized for payment of any duty of excise on any final product manufactured; an amount equal to CENVAT credit taken on inputs if such inputs are removed as such or after being partially processed; an amount equal to the CENVAT credit taken on capital goods if such capital goods are removed as such; an amount under sub rule (2) of rule 16 of Central Excise Rules, 2002; payment of an amount on exempted goods or reversal of credit under Rule 6(3) of CCR04. Reversal of credit if assessee opts out of cenvat scheme

18 Payment of an amount under Rule 4(5)(a) of CCR04 service tax on any output service

Provided that while paying duty of excise or service tax, as the case may be, the CENVAT credit shall be utilized only to the extent such credit is available on the last day of the month or quarter, as the case may be, for payment of duty or tax relating to that month or the quarter, as the case may be:

PROCEDURE TO AVAIL CENVAT CREDIT The main procedures are Receipt of inputs and capital goods inside the factory under cover of proper duty paying documents Maintaining records of inputs and capital goods for receipt and utilization. Maintaining records of Cenvat credit of duties received and utilized. Submission of returns by manufacturer / Dealer / Service Provider / Input Service Distributor

REMOVAL OF INPUTS/CAPITAL GOODS AS SUCH (Rule 3(5) CCR04) Removal of inputs The manufacturer and output service providers are allowed to remove the inputs on which credit has been taken for any further processing, without payment/reversal of duty under a Challan but should be brought back within 180 days as otherwise the credit taken originally will have to be reversed. Removal of capital goods When inputs, on which CENVAT credit has been taken, are removed as such from the factory, or premises of the provider of output service, the manufacturer of the final products or provider of output service, as the case may be, shall pay an amount equal to the credit availed in respect of

19 such inputs and such removal shall be made under the cover of an invoice referred to in rule 9: In the case of Capital Goods cenvat credit should be reversed after adjusting 2.5% per quarter of use from the original credit taken. The amount paid under sub-rule (5) shall be eligible as CENVAT credit as if it was a duty paid by the person who removed such goods under sub-rule (5). Provided that such payment shall not be required to be made where any inputs are removed outside the premises of the provider of output service for providing the output service: MANUFACTURE OF EXEMPTED AND DUTIABLE GOODS & PROVIDNG TAXABLE & EXEMPTED SERVICES Cenvat implication (Restriction on utilization of credit) CENVAT implications under Rule 6 of CCR04 If a manufacturer avails Cenvat credit on the inputs, capital goods and input services and engages in manufacture of both dutiable and exempted goods, then he has to keep separate accounting of the inputs & input services going into the exempted goods and if not he has to pay an amount equal to 5% of the sale price of the exempted goods excluding taxes. If the output service provider avails CENVAT Credit and engage in providing both taxable output service and exempted output service, he has to maintain separate accounts of inputs and inputs services meant for use in exempted and taxable services and if not he has to pay an amount equal to 5% of the value of exempted service.

PROBABLE QUESTIONS

20 1. Discuss the contents of Excise Invoice under Central Excise rules, 2002. 2. Define Capital Goods or Inputs under Cenvat Credit Rules, 2004. 3. Explain the basic concept of Cenvat Credit Scheme . 5 marks 4. a) List out the 4 basic conditions for availing Cenvat Credit. 2 marks

b) ABC Ltd. a manufacturer of excisable goods, pays service tax on the charges paid for Testing and Certification of the goods manufactured by them to M/s. Q Labs. Can ABC Ltd. avail the credit of service tax paid by them? Justify giving Reason. c) XYZ Ltd. Is having a Unit at Thane registered under Central Excise Manufacturing excisable goods. XYZ Ltd. proposes to set up another unit in Panvel as Unit No.2. Does unit No.2 need to be registered under Central Excise or not? Why? d) State whether following are eligible as inputs for CENVAT: (i) Light Diesel Oil (LDO) used in manufacture; (ii) Moulds & Dies; (iii) Parts used to manufacture capital goods within the factory e) ABC Ltd. purchases 2 Air Conditioning units. Out of which One he uses in the Factory Managers Office and the other he uses in his production department in factory. Can he avail cenvat credit of duty paid on both the units? Why?

5. a. b. c. d. e. f. g. h.

.3 marks

Application for Central Excise Registration to be made in Form . Full form of PLA is .. Last date of submitting monthly Return is Excise duty is payable on 10th of the following month. True or false? Separate registration is required for each premise. True or false? Cenvat credit can be taken on Photo copy of Excise Invoice. Credit of duty paid on Motor Vehicle can be availed by manufacturers.. The cenvat scheme is designed to reduce the cascading effect of incidence of tax on final products or output services. i. Cenvat Credit on Capital Goods is available 100% in the year of purchase. j. Last date for making payment of excise duty is

Potrebbero piacerti anche

- Piping Drawings Basics: N.P.TodkarDocumento37 paginePiping Drawings Basics: N.P.Todkaredgar_glezav100% (2)

- Inventory ControlDocumento25 pagineInventory ControlSuja Pillai100% (1)

- Ca ProjDocumento6 pagineCa ProjSuja PillaiNessuna valutazione finora

- Introduction To HmsDocumento20 pagineIntroduction To HmsSuja Pillai100% (1)

- I TDocumento14 pagineI TSuja PillaiNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Private Foundation TemplateDocumento4 paginePrivate Foundation TemplateGee Penn100% (5)

- Manappuram General Finance & Leasing Ltd. (Gold Loan)Documento14 pagineManappuram General Finance & Leasing Ltd. (Gold Loan)Rushabh ShahNessuna valutazione finora

- Model On Small Scale Cashew ProcessingDocumento20 pagineModel On Small Scale Cashew Processingrajesh67% (3)

- 9-Death of A Salesman Test 2Documento15 pagine9-Death of A Salesman Test 2ErlGeordieNessuna valutazione finora

- Chapter 29 Macroeconomics HWDocumento6 pagineChapter 29 Macroeconomics HWMỹ Dung PhạmNessuna valutazione finora

- Loan Policy of Uco Bank For Retail SectorDocumento22 pagineLoan Policy of Uco Bank For Retail SectorAnurag BohraNessuna valutazione finora

- Research Proposal by Pragya Jaiswal - Edited VersionDocumento8 pagineResearch Proposal by Pragya Jaiswal - Edited Versionpragya jaiswalNessuna valutazione finora

- Car WC - Petronas Refinery and Petrochemical Corporation SDN BHD Unijaya Industri SDN BHDDocumento6 pagineCar WC - Petronas Refinery and Petrochemical Corporation SDN BHD Unijaya Industri SDN BHDniedanorNessuna valutazione finora

- Santos Vs CA - 120820 - August 1, 2000 - JDocumento7 pagineSantos Vs CA - 120820 - August 1, 2000 - Jlala reyesNessuna valutazione finora

- FNAN 321: (COMPANY NAME) (Company Address)Documento7 pagineFNAN 321: (COMPANY NAME) (Company Address)Shehryaar AhmedNessuna valutazione finora

- A Study of Non Performing Assets in Bank of BarodaDocumento88 pagineA Study of Non Performing Assets in Bank of BarodaShubham MayekarNessuna valutazione finora

- Assignement 3 - 24 GSIS v. Heirs of CaballeroDocumento2 pagineAssignement 3 - 24 GSIS v. Heirs of CaballeropatrickNessuna valutazione finora

- Mrunal (Economic Survey Ch7) International Trade, FTA, PTA, ASIDE, E-BRC, CEPA Vs CECA Difference Explained MrunalDocumento21 pagineMrunal (Economic Survey Ch7) International Trade, FTA, PTA, ASIDE, E-BRC, CEPA Vs CECA Difference Explained MrunalHamdard BoparaiNessuna valutazione finora

- Ethics in FinanceDocumento30 pagineEthics in FinanceSujit Dutta MazumdarNessuna valutazione finora

- Debt RestructuringDocumento2 pagineDebt RestructuringVicong PogiNessuna valutazione finora

- Withholding Tax Invoices in Oracle APDocumento8 pagineWithholding Tax Invoices in Oracle APvijaymselvamNessuna valutazione finora

- Core Banking Partner GuideDocumento19 pagineCore Banking Partner GuideClint JacobNessuna valutazione finora

- G.R. No. 97753 August 10, 1992 CALTEX (PHILIPPINES), INC., Petitioner, Court of Appeals and Security Bank and Trust Company, RespondentsDocumento17 pagineG.R. No. 97753 August 10, 1992 CALTEX (PHILIPPINES), INC., Petitioner, Court of Appeals and Security Bank and Trust Company, RespondentsJucca Noreen SalesNessuna valutazione finora

- AC EXAM PDF 2019 - LIC Assistant Main Exam (Jan-Dec14th) by AffairsCloud PDFDocumento309 pagineAC EXAM PDF 2019 - LIC Assistant Main Exam (Jan-Dec14th) by AffairsCloud PDFRajaram RNessuna valutazione finora

- Fil Assurance Vs NavaDocumento5 pagineFil Assurance Vs NavamansikiaboNessuna valutazione finora

- The Case of The Returned CollateralDocumento18 pagineThe Case of The Returned CollateralJoyce Ann Sosa60% (5)

- Employee Compensation and BenefitsDocumento46 pagineEmployee Compensation and BenefitsJuanito Cabiles JrNessuna valutazione finora

- AJ ResumeDocumento3 pagineAJ ResumeCristin StefenNessuna valutazione finora

- Components of Indian Financial SystemDocumento10 pagineComponents of Indian Financial Systemvikas1only100% (2)

- 1602Documento2 pagine1602Rhizz RamirezNessuna valutazione finora

- UK Home Office: Set (O) FormDocumento15 pagineUK Home Office: Set (O) FormUK_HomeOfficeNessuna valutazione finora

- Economics Nov 2009 Eng MemoDocumento30 pagineEconomics Nov 2009 Eng Memokubayik7402Nessuna valutazione finora

- Mid Term Exam MCQs For 5530Documento6 pagineMid Term Exam MCQs For 5530Amy WangNessuna valutazione finora

- Business Structures SummaryDocumento5 pagineBusiness Structures SummaryMrudula V.100% (2)

- Non Current Liabilities San Carlos CollegeDocumento12 pagineNon Current Liabilities San Carlos CollegeRowbby Gwyn50% (2)