Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

AVAG Micro Finance Profile 2011

Caricato da

Auroville Village Action GroupDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

AVAG Micro Finance Profile 2011

Caricato da

Auroville Village Action GroupCopyright:

Formati disponibili

Micro Finance Profile 2011 Auroville Village Action Group

INDEX

Central aim of micro-finance programme....................................................3 Micro-finance activity..................................................................................3 What is special in AVAG micro-funding programme?..................................4 Types of loans by source and purpose.........................................................5 Group formation and day to day work.........................................................5 Decision making of the Federations of Self Help Groups............................6 Micro finance and the UWC (Udhayam Womens Center)...........................6 Loans and savings charts.............................................................................7

www.villageaction.in villageactiongroup@gmail.com avagoffice@auroville.org

/2

The Micro-finance programme:

In 1995 was formed the first SHG, since then slowly but firmly we have been creating an extensive network of SHGs. In 2000 and in 2007, federations for women SHGs and men SHGs were formed for collective decision-making and they continue to give AVAG feedback and suggestions pertaining to the planning and implementation of the programs of AVAG. The federations and AVAG have developed a symbiotic relationship with guidance and advice freely exchanged in both directions. Despite the partnership, AVAG maintains formal oversight over the federations.

The central aim of the micro finance programme is:

to free the poor from the clutches of the money lenders to inculcate the habit of savings among the villagers to teach them the concept of self help to give a sense of cooperation and mutual help among the women and men to help the members of the SHG to get recognition from the family and the society at large to enlarge livelihood possibilities of the SHG members to build solidarity and a sense of we feeling among the participants.

4000 3500 3000 2500 2000 1500 1000 500 0 1997-1998 2001-2002 2005-2006 2009-2010 1995-1996 1999-2000 2003-2004 2007-2008

Year Members 1995-1996 68 1996-1997 188 1997-1998 327 1998-1999 435 1999-2000 614 2000-2001 1101 2001-2002 1600 2002-2003 1741 2003-2004 1800 2004-2005 1950 2005-2006 2000 2006-2007 2334 2007-2008 3245 2008-2009 3466 2009-2010 3478 2010-2011 3726

Micro Finance Activity (As of 1st April 2011):

AVAG works with 3,726 women organised in 197 SHGs, and 701 men organised in 42 SHGs. Rs. 20,830,771 of savings has been collected by SHGs. /3

www.villageaction.in villageactiongroup@gmail.com avagoffice@auroville.org

Rs. 55,552,350 circulating among the groups as loans. To date all SHGs have repaid loans on schedule through fixed installments. Loans are offered for business development , agriculture, education, housing, consumption, family functions, and health, atan annual interest rate of 18 %. far lower than the average market rate in rural areas. So far finance has been facilitated from the following sources for lending: savings generated by SHGs, corpus fundsof AVAG/the Federation, Government Funds and Indian and Pallavan Grameen Bank through SHG linkage. The ratio between SHGs to AVAG field staff is 35/1, which allows effective management. AVAG collects the copies of all receipts and invoices and monitors each transaction. Loan repayment rate is virtually 100 %: During the implementation of micro finance programmes over the past 15 years, only two people have defaulted. Micro-funding programme is the backbone of the activities of integral rural development of AVAG. Capacity building is of prime importance, so constant training is always provided to the groups. The Federations of SHG have a core position in the decision making process of AVAG, not only in the microfinance programme, also in the other activities of the organization, creating an strong bounding relation materialized, among other results, in the strong vocation of continuity of the SHG formed by AVAG. To avoid individuals monopolizing the SHGs and to make sure that every one talks upthe responsibility, AVAG encourages the change of leaders on a regular basis. Empowering lending policies as mentioned below: Loan amounts are awarded gradually, growing in relation to the proven capability of individual members for repayment. Loans are offered for a wide variety of needs. By its experience AVAG learnt that purpose depending loans drives people to cheat and would weaken the trust and relationship between the SHGs and AVAG, and hence it encourages people to be open and truthful with the purpose. As long as the SHG supports and it is confident of the repayment capacity, a member can get loan easily, Group members are encouraged to give priority to each members financing needs, rather than dividing the borrowed amount into equal shares. Re-lending is not dependent on the completion of a previous loan, but rather is encouraged only when there is a genuine need. This system ensures group members will not compulsively re-apply for a loan immediately after the previous loan has ended. To make sure that there is no misuse of funds, AVAG keeps track of all the financial transactions of the SHGs, which is a uniqueness of the organization. AVAG has also successfully mediated with the bankers on behalf of the SHGs to be flexible with the rules for its members. Since the banks recognize the

What is special in AVAG micro-funding programme?

www.villageaction.in villageactiongroup@gmail.com avagoffice@auroville.org

/4

important role played by AVAG, they listen to these fair demands. The Groups have a double aim, the micro-funding activities and the debate and action about human rights, community development and other issues.

Types of loans by source and purpose:

Internal Lending: Individual members can take up loans from savings of the group. Federation Loan: An initial grant of 6 lakhs was given by AVAG to the Federation in 2003, which along with the SHGs contribution of Rs.20000 each has grown to Rs. 13,86,500 in 2008-2009. Federation members are responsible for loan approval, which depends upon repayment history and cohesiveness of the applying SHG. AVAG Loan: AVAG issues loans when the Federation has reached loan capacity and lacks the sufficient funds to continue SHG lending. An SHG submits its application through AVAG, which is later processed by Federation members. AVAG sanctions the loan only after getting the approval of the Federation members. Government Lending: AVAG evaluate and recommend SHGs to access to Governmental squemes like the Revolving Fund1 Economic Assistance (E.A), Toilet Scheme. Housing Scheme etc.)2 Direct Lending: SHGs are linked directly to the banks for loans. Groups can get up to Rs. 5,00,000. Amount of loans, M & W Federations of SHGs

Purpose of loans M&W SHGs

Loan Repayment Housing Function Agriculture Education Business Medical Others

Group formation and day to day work.

Each group can have 12-20 members. The group has to choose its own leaders i.e. an animator and two representatives. The position must be renew every 2 years, in order to give the opportunity to grow in capacities everybody.

Under this scheme, each group can sign up for an amount of Rs. 60,000 out of which Rs. 10,000 is subsidy and Rs. 50,000 is loan to be repaid in monthly installments. This scheme has a subsidy component of Rs. 1,25,000 sanctioned by the government to commence agricultural or business activities.

www.villageaction.in villageactiongroup@gmail.com avagoffice@auroville.org

/5

The group meets at least two times a month. The first meeting of the month is to deposit the savings, to pay back the loans and to decide upon the new loans. The second meeting is allotted to discuss about the issues, projects, participation in the seminars and meetings, report about the trainings and meetings etc Once in a year every group participate in the Cluster meeting, with other groups of the same panchayat (local government), in this meetings are exchanged the community development activities made during the last year (fixing the road, distribution of food in health centers...), the past discussions of community problems inside every SHG are shared with the rest of the groups, and is tried to arrive to a collective action to solve them. When a group t affiliated to AVAG, it is asked to join the federation by way of paying the annual subscription which is Rs.50 per member (Rs.25 for men). The group receives from the federation a set of registers3 to maintain the groups accounts. Each SHG decides on a monthly savings amount (usually between Rs. 50-100 /month/member) which is deposited in the name of the club in the bank With the introduction of AVAG, each SHG opens a bank account to deposit the monthly savings. be aged from 18 to 55 years be a resident of that village not to be a member of any other SHG of any organisation.

To be member of a SHG, a person should:

Decision making of the Federations of Self Help Groups.

At present there are 25 Womens Federation members and 15 Mens Federation members, each elected to represent an average of 8 WSHGs and 3 MSHGs for a period of two years, in order to develop the leadership skills of every person. In addition to regular Federation meetings, AVAG regularly conducts seminars and trainings for members in order to build capacity and skills. Positions rotate (through elections) every two years in order to increase representation, build leadership skills for multiple individuals, and avoid concentration of power. The formation of the Womens and Mens Federations marks a crucial step in handing over responsibility and decision making to the local beneficiaries of AVAGs programs while codifying political power in their hands. Since decisions are taken collectively, they take every single step to make it a success.

Micro finance and the UWC (Udhayam Womens Center):

A major function of the Federations is to transfer micro finance loan administration from AVAG to locals. By investing authority and decision making responsibility in their hands, beneficiaries are engaged as active participants employed in the successful outcome of the micro finance program. This accountability has significant implications both for technical loan management and personal empowerment. At the moment the Mens Federation doesnt have any corpus fund, and the MSHGs work mainly with the internal lendings of every group plus the links provided by AVAG with the commercial banks and the Governmental credit schemes.

3

set of registers : books and registers maintained by the club

www.villageaction.in villageactiongroup@gmail.com avagoffice@auroville.org

/6

The Womens Federation is responsible for reviewing applications for two separate corpuses, Udhayams own and AVAGs. As stated above, it is the Federation members who are responsible for loan application review. While most of AVAGs staff live in the organizations target area and have extensive knowledge of conditions on the ground, the Federations have an even better check on the pulse of village life. By employing beneficiaries in the micro finance process, AVAG can be confident that financing is being used for pertinent village needs. AVAGs role is more advisory than controlling, although the organization does hold veto power over any decisions to avoid incidents of abuse and prevent corruption lities.

www.villageaction.in villageactiongroup@gmail.com avagoffice@auroville.org

/7

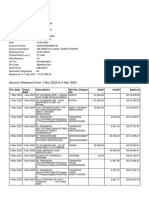

Loans and savings charts:

For both women and men federations:

Total Savings 2010-2011 UWSHGs & MSHGs- AVAG, Irumbai

Total savings UWSHGs MSHGs Total Amount (in Rs.) Members 18,255,221 3,726 2,575,550 701

20,830,771

4,427

in %

48.70% 24.59% 17.20% 6.85% 2.67%

Loan sources

Internal Lending Direct Lending (Bank) RF (Bank) AVAG Loan Udhayam Loan

Amount (in Rs.)

27,054,650 13,659,500 9,554,200 3,803,000 1,481,000

Total

55,552,350

100.00%

Amount and purpose of loans UWSHGs & MSHGs- AVAG

Grand Total

Rs.10001-15000 Rs.15001-20000 Rs.5001-10000 Rs.Upto 5000 Above 20000 4,992,000 4,285,000 3,717,500 1,628,000 1,831,300 1,663,000 486,500 47,500 18,650,800

Type

Total

Function Education Medical Housing Loan Repayment Agriculture Business Others Total

12,294,000 12,273,000 10,191,300 6,357,500 5,615,000 5,201,000 2,768,500 852,050 55,552,350

22.13 398,000 22 509,100 18.35 369,500 11.44 192,500 10.11 449,200 9.36 217,500 4.98 192,500 1.53 204,650 100 2,532,950

1,479,500 2,050,200 1,537,300 1,172,000 1,146,000 1,093,500 880,000 203,700 9,562,200

1,620,500 1,540,000 1,326,000 914,000 843,000 704,000 516,000 141,400 7,604,900

3,804,000 3,888,700 3,241,000 2,451,000 1,345,500 1,523,000 693,500 254,800 17,201,500

www.villageaction.in villageactiongroup@gmail.com avagoffice@auroville.org

/8

Women Federation:

AMOUNT AND PURPOSE OF LOAN OF WSHGs 2010-2011

Grand Total

Rs.15001-20000 Rs.10001-15000 Rs.5001-10000 Rs.Upto 5000 Above 20000 4,285,000 4,839,000 3,717,500 1,432,000 1,806,300 1,498,000 306,500 47,500 17,931,800 Above 20000 0 25,000 0 0

Type

Total

Loan Repayment Housing Function Agriculture Education Business Medical Others Total

11,679,500 11,489,000 10,066,300 5,411,500 5,311,300 3,458,500 1,654,500 729,050 49,799,650

23.45 410,600 23.07 296,000 20.21 350,500 10.87 146,500 10.67 422,500 6.94 113,500 3.32 103,500 1.46 138,650 100 1,981,750

1,751,200 1,271,500 1,491,300 818,000 1,096,000 416,000 475,500 181,700 7,501,200

1,420,000 3,812,700 1,534,500 3,548,000 1,326,000 3,181,000 758,000 2,257,000 798,000 1,188,500 405,000 1,026,000 331,000 438,000 126,400 234,800 6,698,900 15,686,000

Men Federation:

AMOUNT AND PURPOSE OF LOAN OF MSHGs 2010-2011

Grand Total

Rs.10001-15000 Rs.15001-20000 76,000 157,000 60,000 20,000 0 15,000 Rs.5001-10000 677,500 404,500 354,000 208,000 299,000 50,000 46,000 22,000 2,061,000 Rs.Upto 5000 104,000 89,000 46,000 102,000 98,500 26,700 19,000 66,000 551,200

Type

Total

Agriculture Business Housing Function Education Loan Repayment Medical Others Total

1,742,500 30.29 1,114,000 19.36 946,000 16.44 805,000 13.99 593,500 10.32 303,700 125,000 123,000 5,752,700 5.28 2.17 2.14 100

299,000 185,000 156,000 86,000 120,000 45,000

497,000 165,000 255,500 180,000 194,000 196,000 256,000 153,000

906,000 1,515,500 719,000

www.villageaction.in villageactiongroup@gmail.com avagoffice@auroville.org

/9

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- AVAG 2011-2012 Annual ReportDocumento25 pagineAVAG 2011-2012 Annual ReportAuroville Village Action GroupNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Ecolife Price ListDocumento3 pagineEcolife Price ListAuroville Village Action GroupNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- AVAG Menstrual Survey ReportDocumento23 pagineAVAG Menstrual Survey ReportAuroville Village Action Group100% (1)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- EcoLife CatalogDocumento18 pagineEcoLife CatalogAuroville Village Action GroupNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Villageaction BriefDocumento2 pagineVillageaction BriefAuroville Village Action GroupNessuna valutazione finora

- VillageAction Micro Finance ProfileDocumento11 pagineVillageAction Micro Finance ProfileAuroville Village Action GroupNessuna valutazione finora

- VillageAction Womens Empowerment ReportDocumento32 pagineVillageAction Womens Empowerment ReportAuroville Village Action GroupNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Punjab & Sind Bank: Jump To Navigationjump To SearchDocumento5 paginePunjab & Sind Bank: Jump To Navigationjump To SearchSakshi BakliwalNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Bus 5111: Financial Management: Written Assignment Unit 1 Ratios CalculationDocumento5 pagineBus 5111: Financial Management: Written Assignment Unit 1 Ratios CalculationCharles IrikefeNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Direct Deposit FormDocumento2 pagineDirect Deposit FormLaz Equality Estrada100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Rural Finance and Micro FinanceDocumento32 pagineRural Finance and Micro FinanceThe Cultural CommitteeNessuna valutazione finora

- EconomicsDocumento10 pagineEconomicsCalvinNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Case Studies - Various Sources of Frauds in ADCsDocumento15 pagineCase Studies - Various Sources of Frauds in ADCsJayant RanaNessuna valutazione finora

- ICICI Prudential Multi-Asset Fund Tactical Note-1Documento7 pagineICICI Prudential Multi-Asset Fund Tactical Note-1sdaobtrinNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Substation Tender DocumentDocumento97 pagineSubstation Tender DocumentthibinNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Theodore E. Raiford - Mathematics of FinanceDocumento500 pagineTheodore E. Raiford - Mathematics of FinanceHeru HermawanNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- ALM Presentation 02-12-2013Documento27 pagineALM Presentation 02-12-2013Cvijet IslamaNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- 4 AdjustmentDocumento19 pagine4 AdjustmentMina AmirNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Nigerian Financial System at A Glance - Monetary Policy DepartmentDocumento356 pagineThe Nigerian Financial System at A Glance - Monetary Policy DepartmentAgbons EbohonNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- 143 Quiz4Documento3 pagine143 Quiz4Leigh PilapilNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Thesis - Progress Report. For Advisor OnlyDocumento3 pagineThesis - Progress Report. For Advisor OnlyamogneNessuna valutazione finora

- M14 Krugman 46657 09 IE C14 FDocumento50 pagineM14 Krugman 46657 09 IE C14 FlucipigNessuna valutazione finora

- MNC Valuation MefDocumento9 pagineMNC Valuation MefKabulNessuna valutazione finora

- Demonetisation: A Project OnDocumento52 pagineDemonetisation: A Project OnSwarnajeet GaekwadNessuna valutazione finora

- From Inception of Operations To December 31 2008 Blaise PascalDocumento1 paginaFrom Inception of Operations To December 31 2008 Blaise PascalM Bilal SaleemNessuna valutazione finora

- Accountancy 12th SPSDocumento4 pagineAccountancy 12th SPSMahesh TandonNessuna valutazione finora

- AIG Offer To Buy Maiden Lane II SecuritiesDocumento43 pagineAIG Offer To Buy Maiden Lane II Securities83jjmackNessuna valutazione finora

- Business InfographicDocumento1 paginaBusiness InfographicLuck BananaNessuna valutazione finora

- Intermediate Accounting - Investment Property (Pas 40)Documento2 pagineIntermediate Accounting - Investment Property (Pas 40)22100629Nessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- BDO Pay Ultimate GuideDocumento8 pagineBDO Pay Ultimate Guidejulius004Nessuna valutazione finora

- Foreign Exchange ManagementDocumento21 pagineForeign Exchange ManagementSreekanth GhilliNessuna valutazione finora

- ThesisDocumento193 pagineThesisDebarchitaMahapatraNessuna valutazione finora

- SHARES - EXERCISES - KopiaDocumento6 pagineSHARES - EXERCISES - KopiaOla KrupaNessuna valutazione finora

- Transfer - RemittanceDocumento3 pagineTransfer - RemittanceEman MostafaNessuna valutazione finora

- Account Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento2 pagineAccount Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesameer bawejaNessuna valutazione finora

- Jawaban P11-4Documento3 pagineJawaban P11-4nurlaeliyahrahayuNessuna valutazione finora

- Aviva India LTD.: Background Factors For SuccessDocumento4 pagineAviva India LTD.: Background Factors For SuccessAtul KatochNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)