Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Brian R. Leach: Citigroup Inc. Chief Risk Officer 399 Park Avenue New York, NY 10022

Caricato da

MarketsWikiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Brian R. Leach: Citigroup Inc. Chief Risk Officer 399 Park Avenue New York, NY 10022

Caricato da

MarketsWikiCopyright:

Formati disponibili

Brian R.

Leach Chief Risk Officer

Citigroup Inc. 399 Park Avenue New York, NY 10022

February 13, 2012 Board of Governors of the Federal Reserve System 20th Street and Constitution Avenue, NW Washington, DC 20551 Office of the Comptroller of the Currency 250 E Street, SW Washington, DC 20219 Commodity Futures Trading Commission 1155 21st Street, NW Washington, DC 20551 Federal Deposit Insurance Corporation 550 17th Street, NW Washington, DC 20429 Securities and Exchange Commission 100 F Street, NE Washington, DC 20549

Re:

Joint Notice of Proposed Rulemaking Implementing the Volcker Rule: Federal Reserve Docket No. R-1432 and RIN 7100 AD 82 OCC Docket ID OCC-2011-14 FDIC RIN 3064-AD85 SEC File No. S7-41-11 CFTC RIN 3038-AC[ ]

Ladies and Gentlemen: Citigroup Inc. appreciates the opportunity to comment on the joint notice of proposed rulemaking implementing Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly known as the Volcker Rule. In an effort to provide constructive feedback to the regulators on the proposal, Citi has engaged with the Agencies, submitted its own comment letters and has actively participated in the drafting of comment letters by certain industry trade associations. Citis breadth of business lines and global footprint provide a unique perspective on the Volcker Rule and its implementation. We provide products and services to a global client base, and we are deeply involved in markets worldwide. Across this footprint, we pursue a client oriented business model including in our trading businesses which we believe is consistent

with the core principles of the Volcker Rule. It is from this vantage point that we submit this comment letter. Executive Summary We stand firmly behind the Volcker Rules core principles of re-focusing trading businesses on the needs of customers and markets, while reducing potential risk to financial institutions and our financial system. We have been steadfast in this support since the Rules legislative passage; however, we believe the proposal should be recalibrated to make it simpler, less burdensome to implement, and most importantly, consistent with preserving the functioning of global trading markets. The final version of the rule must give full effect to the statutory mandate of Section 619 of the Dodd Frank Act, which permits market-making and related activities, including underwriting, hedging and trading on behalf of customers. These activities require a commitment of capital to markets and customers, but the current proposal overly limits banking entities ability to commit such capital. In addition, the proposed rule is complex, with overlapping and imprecise compliance requirements, and does not provide sufficient clarity as to what type and level of activity is permissible, which itself may impair capital markets. This complexity will also make the proposal highly challenging to enforce or administer in a consistent manner. Beyond the need for clarity, we think there is also a need to maintain focus on the key goal of reducing risk in financial institutions. The complexity of the compliance infrastructure required by the proposed rule undermines that focus by effectively making the compliance program the primary implementation goal and the focus of regulatory examination and potential enforcement. These likely effects of the proposal are all the more concerning given the potential disparate application of the Volcker Rule to banking entities and markets across jurisdictions, potentially reducing liquidity and impairing segments of global and local trading markets. Therefore, we propose a recalibrated approach, one that is simpler and clearer while still achieving the Volcker Rules fundamental goals. We believe the final rule should be revised to require each institution to establish a risk architecture that prescribes a customer-focused business model for market-making and related activities. This risk architecture should include a comprehensive set of risk limits, selected and sized appropriately to a banking entitys client model, products and financial capacity. Use of risk limits and capital as benchmarks will assist horizontal comparisons across the industry and harmonize Volcker Rule compliance with the broader capital and regulatory risk management construct being developed internationally. This approach will focus market-making on servicing customers and ensuring safety and soundness. This risk architecture would be built during the conformance period provided by the statute (until at least July 2014). During this time, financial institutions and their regulators would engage in extensive dialogue regarding the overall compliance program, would structure requirements to avoid market dislocations and competitive disadvantages, and would refine any final requirements based on observations during this process.

Below we expand on this suggested approach as well as the reasons why a new approach is necessary. Preserving Critical Liquidity in Global Markets Section 619 of the Dodd-Frank Act explicitly permits underwriting, market-makingrelated trading and other activities, recognizing the importance of these activities to U.S. and global financial markets. We believe that implementation of the proposals narrow approach to capital commitment, combined with its extensive controls, multiple metrics and onerous compliance requirements, would unintentionally reduce liquidity in markets and impair the availability of credit. To avoid regulatory scrutiny related to accumulated inventory, market-makers are likely to reduce trades to a size and tenor that can be quickly sold or hedged. Market-makers are also likely to widen bid-ask spreads in an effort to improve their ability to exit positions quickly. We believe the proposal would not adequately preserve the very activities that Congress stated were critical and fundamental functions of financial institutions. This reduction in market liquidity and associated expansion of spreads is likely to have real and direct implications to our economy. Over the longer term, increases in spreads will translate to higher costs to borrowers, including small and middle market companies that critically need to tap the capital markets. Securities issuances backed by mortgages, credit card receivables and auto loans will also have to offer higher returns, invariably leading to consumers being charged higher rates on these forms of consumer credit at a time when the economy remains fragile. At the same time, the value of securities, including those held by consumers and their 401(k) plans, are likely to decrease in value, having a material impact on overall wealth and consequently macroeconomic activity. While these impacts will be felt acutely in the U.S., they will also affect international markets, particularly those in their early stages of development. From our experience in international markets, the single most important driver for the effective development of trading markets is the commitment of capital to products and customers. Without such active participation by financial institutions, taking positions as principals in connection with marketmaking-related and underwriting activities, markets will lack depth and will be more vulnerable to market disruptions and imbalances. Local markets and asset classes in their most fragile, early stages of development could experience the proposals impact most acutely. The impact on the role and effectiveness of financial intermediaries has also been raised by other market observers, including international regulators. They believe market-makingrelated activity will be impaired, with significant adverse consequences to the liquidity and vitality of local markets, well beyond the proposals impact on nonU.S. sovereign securities. They too have therefore urged that the proposal be modified to preserve liquidity and capital commitment provided by market-making functions. Complexity Further Impairs the Effectiveness of the Proposal The proposed rule also layers on significant complexity and imposes broad control processes and costs. We are concerned that the complexity of the compliance regime will, 3

despite its intention, actually undermine compliance efforts. The proposed rules set of overlapping and imprecise compliance requirements does not provide sufficient clarity to traders or financial institutions as to what types or levels of activities will be seen as permissible trading, which itself may impair capital markets. In addition, this complexity will make it challenging to enforce or administer compliance with any consistency across banking entities and jurisdictions. Beyond the need for clarity, we think there is also a need to maintain focus on the key goal of reducing risk in financial institutions. The complexity of the compliance and reporting infrastructure required by the proposed rule undermines that focus by effectively making the compliance program the primary implementation goal and the focus of regulatory examination and potential enforcement. We propose a recalibrated approach, one that is simpler and clearer while still achieving the Volcker Rules fundamental goals. Principles of a More Effective Approach We believe the final rules should build directly on the original core principles of the Volcker Rule by permitting financial institutions to purchase and maintain positions in marketmaking-related trades, while limiting and managing the risk of such positions. The ownership of principal positions, and potential price appreciation of those positions, is very much within the business model of a customer-focused market-maker. The primary difference between proprietary trading and market-making is that the success of a market-maker depends upon managing its portfolio around what customers want to buy and sell, whereas a proprietary trader trades solely for its own account. But, market-makers must, of course, engage in several forms of principal position-taking to successfully handle customer demand. Similar to other consumer franchises, market-makers must keep inventory in stock to effectively service their clients. These market-making related activities not only involve buying and selling financial instruments with customers, but also obtaining positions in anticipation of customer flow, and trading in the market in order to understand liquidity, volatility, pricing and other market trends, so customer needs can be served quickly and efficiently. The success of a market-making business is based on both the level of client satisfaction with the services provided, as well as the ability to service clients at a profit. In all but the most liquid portions of the equity, rate and foreign exchange markets, profitability from bona fide market-making-related activity is significantly derived from price appreciation of inventory positions. Most markets, and even the most liquid markets, require a commitment of capital, the taking of inventory, and the potential for price appreciation or depreciation beyond a bid-ask spread for market makers to be sustainable. Market sectors such as the debt capital markets, especially in growth sectors of the economy, require commitment of capital to inventory because they are primarily characterized by trading in less liquid and less fungible instruments. Any requirement that revenue must be generated primarily from a bid-ask spread will especially inhibit these markets. Indeed, in most markets, it is almost impossible to objectively identify a bid-ask spread or to capture profit and loss solely from a bid-ask spread. While it is uncommon for the failure of a regulated financial institution to stem from principal risks taken in connection with market-making-related trading activity, we nonetheless believe these risks should be limited. The risk architecture we propose would not permit outsized open risk positions, and would focus on allowing only the amount of risk necessary to 4

carry on market-making-related activity in various asset classes. We recommend that the regulations, and the regulators, focus not on an institutions ownership of principal positions and the potential for price appreciation in market-making-related transactions, but instead on whether the risks of price volatility are being limited and managed appropriately for the permitted activity. Comprehensive risk limits, sized appropriately to a banks client model and financial capacity, are the key to focusing market making on servicing customers and ensuring safety and soundness. An Enhanced Risk Architecture Focused on Customer Needs and Risk Limits We recommend that, in place of the complex rules in the proposal, each institution impacted by the Volcker Rule should be required to create a robust risk architecture that is designed for underwriting and market-making-related activity, but that maintains a strict focus on facilitating customer activity. Our alternative builds on the risk management infrastructure already present in institutions, thus leading to less complex and more efficient implementation, while at the same time requiring construction of an architecture that enhances existing procedures and addresses the purposes of the Volcker Rule. We strongly believe that building on existing risk limits and risk management systems will reduce the costs and complexity of the current proposal while enabling a robust compliance mechanism for the Volcker Rule. We would be happy to discuss and expand upon any aspects of our proposal in meetings with the Agencies, or in any other manner that the Agencies find efficient. Risk Measurement and Management. Our proposal starts with managing risk. The original and most basic intent behind the Volcker Rule is to reduce excessive risk taking in entities related to depository institutions, and an appropriate risk framework would accomplish the goals of the Volcker Rule without the complexity, cost and unintended consequences we describe above. We support appropriately calibrated risk-based metrics (in particular, value-atrisk, risk factor sensitivities, and risk and position limits, as highlighted in Appendix A of the proposed rule). We respectfully but strongly believe that the other proposed metrics have a greater capacity to obscure rather than elucidate what is permitted activity. Risk-based metrics are the most important measure of compliance, and should be prioritized for study during any conformance period that follows the issuance of a final rule. A more limited set of metrics than in the proposed rule is required to reduce compliance complexity, inefficiencies, cost-ineffectiveness and irrelevant noise that may arise from the pursuit of too many multi-directional calculations. The multiple metrics proposed will make horizontal review, compliance transparency and enforcement difficult. By calibrating risk-based metrics to benchmark against the capital of an organization, as we discuss further below, there can be greater consistency of application across the industry and transparency into compliance. Sizing of Risk Limits. Appropriate calibration of this risk architecture requires consideration of a number of factors in order to size the limits for trading that provides liquidity to customers, while avoiding trading and hedging that do not further customer-focused marketmaking-related activity. Our proposal would require institutions to create an architecture that is consistent with what is needed for market-making-related activity. For example, many asset classes, such as fixed income securities, need wider risk limits to provide sufficient time to

manage the various risks of market-making-related transactions. Smaller limits may be appropriate for other asset classes. Sizing must also take into account appropriate inventory to be held in anticipation of customer demand. Calibration should also look to historical and modeled risk limits for similar assets, and specific market conditions and characteristics. More specifically, trading units would estimate expected levels of client trading, based on historical results, target product and customer lists, and target market share. Trading units would also estimate an appropriate amount of required inventory to support the level of client trading. Risk limits would then be set based on the estimated inventory and level of client trading. Limits would require that the amount of stress loss that could result from using the limit would be well within the amount of capital allocated to the trading unit and would still maintain profitability of the unit. An institution and its examiners would review these risk limits, as well as expected levels of market share, client trading and inventory, and compare them to actual results on a periodic basis. An open dialogue will enable regulators to ensure compliance with not only the letter but also the spirit of the law. Benchmarking of Risk Limits to Avoid Significant Losses to Capital. In addition to calibrating for customer-focused market-making-related activity, risk-based metrics should measure risk as a function of the capital of the organization. The only way to appropriately size risk limits or risk metric thresholds is to understand that losses should not have a significant impact on capital. By calculating acceptable risk tolerance in comparison to capital, our proposal would link Volcker Rule compliance to the broader regulatory architecture that is being implemented globally to address systemic risks. Not only is this important in developing a coherent and cohesive regulatory structure, it will drive consistency of application across institutions. Improvements in risk management and limiting of risk are a common theme throughout many of the new regulatory initiatives globally, including enhanced capital and liquidity requirements, stress testing, counterparty credit limits, swaps clearing, swaps transparency through public reporting and swap data repositories, increased required margin and capital for swaps, and related measures. Our proposal would complement these initiatives without resulting in the creation of a separate, un-integrated compliance framework. We also note that these new initiatives, and in particular new capital and liquidity requirements, would also create economic disincentives for engaging in proprietary trading. Customer Orientation. Each trading unit would establish high-level principles to focus the trading units activities and compensation on providing customers with the service, products and liquidity that they need. Management of the trading unit would define a units target customer base, which could include other dealers and market participants appropriate for the particular market. Management and control functions would also define permitted products for the trading unit. Traders would participate in training programs and certify on a periodic basis their understanding of the customer-facilitation principles. Management would evaluate the performance of traders based on return on capital and key customer-facilitation criteria, including focus on target customers, expertise in facilitating customer trades, customer satisfaction, ability to increase target customers and customer volume, ability to increase market 6

share, adherence to the permitted product list, and satisfaction of internal and external compliance requirements. Flexibility would be incorporated into these policies and procedures to take into account the need to inventory positions in anticipation of customer demand and to trade in the inter-dealer market to hedge and develop efficient customer pricing parameters. Simplicity and Transparency. A simpler Volcker Rule compliance framework harmonized with the broader systemic capital/risk management construct will increase transparency and reduce overall regulatory complexity, compliance confusion and costs. Information relevant to the compliance infrastructure, including customer orientation policies and procedures, target customer and product lists, trade histories, and risk limit calibration methodology and analyses, would all be made available to examiners. Benchmarking calculations of capital requirements to common baseline portfolios, which Citi has recently proposed, coupled with a risk-limits-based compliance regime, will increase transparency and comparability among institutions for regulators and the public. Enhanced transparency will also enable regulators to ensure compliance with not only the letter but also the spirit of the law. Effective Use of the Conformance Periods for Implementation We believe that it would be appropriate to provide a two-year conformance period after the effective date of a final rule. During this period, the Agencies should facilitate dialogue and education between the industry and regulators. We are confident that an open dialogue with our examiners about our proposed approach, and an iterative process for testing the calibration of risk metrics, will arrive at a compliance and risk limit framework consistent with preserving the health and liquidity of the capital markets, while adhering to the Volcker Rules original purpose of eliminating prohibited proprietary trading. We also suggest that compliance be phased in, preferably by asset class, and additional time should be provided for overseas operations to adjust to the new rules in a way that does not create immediate competitive disadvantages. In sum, re-instating the explicit statutory mandate to preserve market-making-related trading, underwriting and customer facilitating activities, and focusing banking entities on risk management of market-making-related transactions, will ensure that U.S. and global markets can evolve and unintended consequences to customers are avoided. Additional Issues for Consideration We also believe that the following topics require additional consideration. Foreign Branches of U.S. Institutions Should Be Deemed to be Non-U.S. Persons. Although foreign institutions that have U.S. banking operations are also covered by the Volcker Rules restrictions, a statutory exemption is available for the activities they conduct solely outside the United States. However, the proposal would invoke the full brunt of restrictions on a foreign institution if its business transacts with U.S. persons. The proposed rule would treat our foreign branches as U.S. persons, even if the transaction occurs wholly outside the U.S. Given the choice between looking to other market participants and trading with a branch of a U.S. institution, foreign banks will be strongly incentivized to avoid dealings with us. Although this relates to provisions of the proposed rule regulating foreign banking organizations, the negative impact will be incurred primarily by U.S. institutions. This anomaly 7

will shut our branches out of critical market flow that is necessary to make markets and assist our customers. The ability of our branches to manage their own risk will also be significantly curtailed as the number of potential counterparties is diminished. The impact will not be solely borne by trading functions, but will be felt by other areas of our operations, including liquidity and asset-liability management, credit risk management and FX/rate management. The proposal deviates from the definition in Regulation S, even though Regulation S also focuses on keeping certain securities activities offshore. The statute does not require such a determination with regard to our foreign branches, and this was not the intended policy behind the Volcker Rule. Indeed, operations of our non-U.S. branches would remain fully subject to the Volcker Rule. Trading in Foreign Sovereign Debt Should Be Exempt From the Application of the Volcker Rule. At a global institution such as Citi, we depend upon the continued robust liquidity of sovereign securities for numerous reasons not solely related to trading. For example, sovereign securities, as is the case in the U.S., are often the choice of local institutions and counterparties for the posting of collateral. Also, Citi often manages international rate and FX risk with transactions in sovereign bonds, particularly in our local operations. Local sovereign securities are also used for liquidity and asset-liability management in our operations in different countries. Therefore, we are concerned that an adverse impact on the liquidity of foreign sovereign securities will impair our ability to deal with customers and to manage our own risks. Foreign governments have weighed in with their concerns about liquidity of their markets. Notably, the Japan Financial Services Agency and Bank of Japan were not only concerned about the ability of Japan organizations to trade Japan Government Bonds, but also about the liquidity to their market provided by U.S. banking organizations. Global institutions facilitate the movement of global liquidity for instruments such as these. To the extent that traders of both U.S. and foreign banking organizations pull back from taking positions in sovereign securities for fear of regulatory scrutiny or to avoid accumulating inventory, the critical liquidity needed to support many credit risk management, and liquidity and asset-liability management functions will be significantly constrained. Further, in some markets, local regulations or market practice may require branches or subsidiaries located in that jurisdiction to hold, trade or support the government issuances of local sovereign securities. For these reasons, the Volcker Rule should contain an exemption for activities related to foreign sovereign debt securities. The Agencies have ample basis in the statute to provide exceptions that would promote the safety and soundness of institutions and the markets. Concerns regarding the quality of any particular issue of sovereign debt securities can be addressed through safety and soundness measures and the appropriate calibration of risk limits in consultation with examiners, as we propose above. Foreign Exchange Swap and Forward Transactions Should Be Exempt From the Application of the Volcker Rule. The Dodd-Frank Act signals an intent by Congress not to impede the functioning and liquidity of the foreign exchange markets. For example, Title VII of the Act explicitly permits the Treasury Secretary to exclude foreign exchange swaps and forwards for most Title VII purposes. The Treasury Secretary issued a proposal in April 2011 to grant this exclusion. In addition, the Agencies have rightly determined that the Volcker Rule is not applicable to spot foreign exchange transactions. 8

Subjecting foreign exchange swaps and forwards to the Volcker Rule, however, will negatively affect the spot market. Foreign exchange forwards in particular are simply delayed spot transactions. Although foreign exchange is currently a highly liquid market, we are concerned that global banking organizations will be reluctant to take on the timing issues that occur as markets open and close around the globe for fear of regulatory scrutiny under the proposed rule. Any negative effects on liquidity and foreign exchange management will directly impair an activity that has been a core banking function for centuries dealing in the exchange of currencies for customers. We request that the Agencies exempt foreign exchange swaps and forwards from the Volcker Rule. * * *

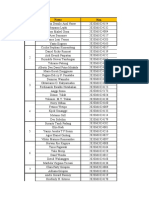

In addition to this comment letter, Citi has actively participated in the drafting of comment letters by certain industry trade associations that address more specific issues. Citi has also submitted, or is a named signatory, to the following comment letters: Citi letter, dated January 27, 2012, on municipal agency/authority securities and tender option bonds; and Letter, dated February 13, 2012, from multiple banking entities on the applicability of the market-making-related permitted activities to fund interests.

so.

We would be happy to discuss any of these issues in greater depth should you wish to do

Very truly yours, / s / Brian Leach Brian Leach Chief Risk Officer cc: Department of the Treasury 1500 Pennsylvania Avenue, NW Washington, DC 20520

10

Potrebbero piacerti anche

- Summary of Stefan Loesch's A Guide to Financial Regulation for Fintech EntrepreneursDa EverandSummary of Stefan Loesch's A Guide to Financial Regulation for Fintech EntrepreneursNessuna valutazione finora

- Unlocking Capital: The Power of Bonds in Project FinanceDa EverandUnlocking Capital: The Power of Bonds in Project FinanceNessuna valutazione finora

- Black RockDocumento16 pagineBlack RockMarketsWikiNessuna valutazione finora

- Timothy J. Sloan Wells Fargo & CompanyDocumento39 pagineTimothy J. Sloan Wells Fargo & CompanyMarketsWikiNessuna valutazione finora

- Capital: Re: Credit RiskDocumento9 pagineCapital: Re: Credit RiskMarketsWikiNessuna valutazione finora

- Bank of AmericaDocumento113 pagineBank of AmericaMarketsWikiNessuna valutazione finora

- International Swaps and Derivatives Association, IncDocumento24 pagineInternational Swaps and Derivatives Association, IncMarketsWikiNessuna valutazione finora

- InvescoDocumento6 pagineInvescoMarketsWikiNessuna valutazione finora

- MBA Letter On Credit Risk Retention Proposed RuleDocumento39 pagineMBA Letter On Credit Risk Retention Proposed RuleThe Partnership for a Secure Financial FutureNessuna valutazione finora

- Alch 59cookDocumento3 pagineAlch 59cookVanessa AbhishekNessuna valutazione finora

- BlackRock Equity Market Structure Letter Sec 091214Documento7 pagineBlackRock Equity Market Structure Letter Sec 091214tabbforumNessuna valutazione finora

- Michael BoppDocumento6 pagineMichael BoppMarketsWikiNessuna valutazione finora

- RIN 1557-AD43 Docket ID OCC-2011-0008 RIN 2590-AA43: Financing America's EconomyDocumento14 pagineRIN 1557-AD43 Docket ID OCC-2011-0008 RIN 2590-AA43: Financing America's EconomyMarketsWikiNessuna valutazione finora

- Re: Consultative Document, Basel III:: The Net Stable Funding RatioDocumento10 pagineRe: Consultative Document, Basel III:: The Net Stable Funding Ratioapi-249785899Nessuna valutazione finora

- Re: Prompt Corrective Action, Risk Based Capital. 12 CFR Parts 700, 701, 702, 703, 713, 723 and 747, RIN 3133-AD77Documento8 pagineRe: Prompt Corrective Action, Risk Based Capital. 12 CFR Parts 700, 701, 702, 703, 713, 723 and 747, RIN 3133-AD77api-249785899Nessuna valutazione finora

- Re: Blackrock Comments On Proposed Margin Requirements For Uncleared SwapsDocumento5 pagineRe: Blackrock Comments On Proposed Margin Requirements For Uncleared SwapsMarketsWikiNessuna valutazione finora

- Re: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45Documento42 pagineRe: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45MarketsWikiNessuna valutazione finora

- Via Electronic SubmissionDocumento15 pagineVia Electronic SubmissionMarketsWikiNessuna valutazione finora

- Volker RuleDocumento3 pagineVolker RuleUmair ChishtiNessuna valutazione finora

- OTCDocumento20 pagineOTCLameuneNessuna valutazione finora

- Unit 5Documento9 pagineUnit 5EYOB AHMEDNessuna valutazione finora

- The Capital Markets IndustryDocumento36 pagineThe Capital Markets Industryrf_1238Nessuna valutazione finora

- The Volcker Rule and Evolving Financial Markets - Charles WhiteheadDocumento37 pagineThe Volcker Rule and Evolving Financial Markets - Charles WhiteheadLuis Miguel Garrido MarroquinNessuna valutazione finora

- OTC Derivatives ClearingDocumento18 pagineOTC Derivatives ClearingStephen HurstNessuna valutazione finora

- Chapter Five The Regulation of Financial Markets and Institutions 5.1. The Nature of Financial System RegulationDocumento7 pagineChapter Five The Regulation of Financial Markets and Institutions 5.1. The Nature of Financial System RegulationWondimu TadesseNessuna valutazione finora

- Chapter 5Documento7 pagineChapter 5Tasebe GetachewNessuna valutazione finora

- Alchemist July 2010Documento20 pagineAlchemist July 2010rsaittreyaNessuna valutazione finora

- Global Financial Crisis and SecuritizationDocumento6 pagineGlobal Financial Crisis and SecuritizationSumit KumramNessuna valutazione finora

- Dodd-Frank Act Honor ResearchDocumento7 pagineDodd-Frank Act Honor ResearchLinh KinNessuna valutazione finora

- I. Executive SummaryDocumento15 pagineI. Executive SummaryMarketsWikiNessuna valutazione finora

- Surat KuasaDocumento33 pagineSurat Kuasapuputrarindra99Nessuna valutazione finora

- SP CMBS Legal and Structured Finance CriteriaDocumento248 pagineSP CMBS Legal and Structured Finance CriteriaVijay GogiaNessuna valutazione finora

- Goldman Sachs Presentation To The Sanford Bernstein Strategic Decisions Conference Comments by Gary Cohn, President & COODocumento7 pagineGoldman Sachs Presentation To The Sanford Bernstein Strategic Decisions Conference Comments by Gary Cohn, President & COOapi-102917753Nessuna valutazione finora

- Chapter 6 FIMDocumento5 pagineChapter 6 FIMZerihun ReguNessuna valutazione finora

- Barclays' Strategic Position Regarding New Financial Market RegulationsDocumento21 pagineBarclays' Strategic Position Regarding New Financial Market Regulationskatarzena4228Nessuna valutazione finora

- The Regulation of Financial Markets and InstitutionDocumento6 pagineThe Regulation of Financial Markets and InstitutionMany GirmaNessuna valutazione finora

- Ibc AbhiDocumento15 pagineIbc AbhiAbhijit BansalNessuna valutazione finora

- Examining The Extensive Regulation of Financial TechnologiesDocumento39 pagineExamining The Extensive Regulation of Financial TechnologiesCrowdfundInsiderNessuna valutazione finora

- Singh NewRegulationsCollateralRequirements2Documento22 pagineSingh NewRegulationsCollateralRequirements2hector perez saizNessuna valutazione finora

- A Capital Markets View of Mortgage Servicing RightsDocumento31 pagineA Capital Markets View of Mortgage Servicing RightsekcnhoNessuna valutazione finora

- Financial Regulation - Still Unsettled A Decade After The CrisisDocumento21 pagineFinancial Regulation - Still Unsettled A Decade After The CrisisVicente MirandaNessuna valutazione finora

- Co, A S: I UturDocumento5 pagineCo, A S: I UturMarketsWikiNessuna valutazione finora

- 2010 09 RGE Steps We Must Take After Dodd FrankDocumento2 pagine2010 09 RGE Steps We Must Take After Dodd FrankgsnithinNessuna valutazione finora

- Better M Rkets: Transparency Acco NtabilityDocumento15 pagineBetter M Rkets: Transparency Acco NtabilityMarketsWikiNessuna valutazione finora

- By Electronic SubmissionDocumento38 pagineBy Electronic SubmissionMarketsWikiNessuna valutazione finora

- Via Agency WebsiteDocumento13 pagineVia Agency WebsiteMarketsWikiNessuna valutazione finora

- CH4 - CH 6 Edited - 2013Documento6 pagineCH4 - CH 6 Edited - 2013kirosNessuna valutazione finora

- Via Agency WebsiteDocumento9 pagineVia Agency WebsiteMarketsWikiNessuna valutazione finora

- Chapter Five Regulation of Financial InstitutionDocumento10 pagineChapter Five Regulation of Financial InstitutionKalkayeNessuna valutazione finora

- Strategic Role Econ CapDocumento9 pagineStrategic Role Econ Capnadekaramit9122Nessuna valutazione finora

- Docket ID OCC-2011-0008 Docket No. R-1415 RIN 7100 AD74 RIN 3064-AD79Documento6 pagineDocket ID OCC-2011-0008 Docket No. R-1415 RIN 7100 AD74 RIN 3064-AD79MarketsWikiNessuna valutazione finora

- Working Paper 0802Documento52 pagineWorking Paper 0802rohanmanxNessuna valutazione finora

- Assignment 4 - Tee Chin Min BenjaminDocumento1 paginaAssignment 4 - Tee Chin Min BenjaminBenjamin TeeNessuna valutazione finora

- Global Corporate and Investment Banking An Agenda For ChangeDocumento96 pagineGlobal Corporate and Investment Banking An Agenda For ChangeSherman WaltonNessuna valutazione finora

- K0384 Financial ReformDocumento3 pagineK0384 Financial ReformShane MerrittNessuna valutazione finora

- Chapter Five Regulation of Financial Markets and Institutions and Financial InnovationDocumento22 pagineChapter Five Regulation of Financial Markets and Institutions and Financial InnovationMikias DegwaleNessuna valutazione finora

- Transforming Syndicated Loan MarketDocumento14 pagineTransforming Syndicated Loan Marketsseggujja HenryNessuna valutazione finora

- International Swaps and Derivatives Association, IncDocumento73 pagineInternational Swaps and Derivatives Association, IncMarketsWikiNessuna valutazione finora

- NicholsBrose Article FINAL Mar-1-2009Documento14 pagineNicholsBrose Article FINAL Mar-1-2009Bill NicholsNessuna valutazione finora

- Market Consistency: Model Calibration in Imperfect MarketsDa EverandMarket Consistency: Model Calibration in Imperfect MarketsNessuna valutazione finora

- Federal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsDocumento6 pagineFederal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsMarketsWikiNessuna valutazione finora

- Federal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesDocumento13 pagineFederal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesMarketsWikiNessuna valutazione finora

- CFTC Final RuleDocumento52 pagineCFTC Final RuleMarketsWikiNessuna valutazione finora

- Minute Entry 336Documento1 paginaMinute Entry 336MarketsWikiNessuna valutazione finora

- 34 77617 PDFDocumento783 pagine34 77617 PDFMarketsWikiNessuna valutazione finora

- Via Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400Documento7 pagineVia Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400MarketsWikiNessuna valutazione finora

- Eemac022516 EemacreportDocumento14 pagineEemac022516 EemacreportMarketsWikiNessuna valutazione finora

- Commodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015Documento26 pagineCommodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015MarketsWikiNessuna valutazione finora

- Douglas C I FuDocumento4 pagineDouglas C I FuMarketsWikiNessuna valutazione finora

- Commodity Futures Trading Commission: Office of Public AffairsDocumento3 pagineCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNessuna valutazione finora

- Commodity Futures Trading Commission: Office of Public AffairsDocumento5 pagineCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNessuna valutazione finora

- 2015-10-22 Notice Dis A FR Final-RuleDocumento281 pagine2015-10-22 Notice Dis A FR Final-RuleMarketsWikiNessuna valutazione finora

- Commodity Futures Trading Commission: Office of Public AffairsDocumento2 pagineCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNessuna valutazione finora

- Commodity Futures Trading Commission: Office of Public AffairsDocumento2 pagineCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNessuna valutazione finora

- Daniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostDocumento97 pagineDaniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostMarketsWikiNessuna valutazione finora

- 34 76474 PDFDocumento584 pagine34 76474 PDFMarketsWikiNessuna valutazione finora

- Odrgreportg20 1115Documento10 pagineOdrgreportg20 1115MarketsWikiNessuna valutazione finora

- Aggregate Demand and Aggregate Supply PDFDocumento18 pagineAggregate Demand and Aggregate Supply PDFAsif WarsiNessuna valutazione finora

- 2019 Apr 20 Dms Aiu MasterDocumento25 pagine2019 Apr 20 Dms Aiu MasterIrsyad ArifiantoNessuna valutazione finora

- CookBook 08 Determination of Conformance - 09-2018Documento4 pagineCookBook 08 Determination of Conformance - 09-2018Carlos LópezNessuna valutazione finora

- HM ExpansionDocumento21 pagineHM Expansionafatonys0% (1)

- AP Macro 2008 Audit VersionDocumento24 pagineAP Macro 2008 Audit Versionvi ViNessuna valutazione finora

- Ethiopia Profile Enhanced Final 7th October 2021Documento6 pagineEthiopia Profile Enhanced Final 7th October 2021sarra TPINessuna valutazione finora

- Cost Accounting de Leon Chapter 3 SolutionsDocumento9 pagineCost Accounting de Leon Chapter 3 SolutionsRommel Cabalhin0% (1)

- 80D Medical InsuranceDocumento3 pagine80D Medical InsuranceRafique ShaikhNessuna valutazione finora

- Microeconomics ProjectDocumento5 pagineMicroeconomics ProjectRakesh ChoudharyNessuna valutazione finora

- Dmu Bal Options Accounting&BusinessManagementDocumento2 pagineDmu Bal Options Accounting&BusinessManagementMonalisa TayobNessuna valutazione finora

- Structural Change Model PDFDocumento10 pagineStructural Change Model PDFRaymundo EirahNessuna valutazione finora

- Abre Viation SDocumento62 pagineAbre Viation SAlinaNessuna valutazione finora

- Agutayan IslandDocumento38 pagineAgutayan IslandJunar PlagaNessuna valutazione finora

- 2019 Marking Scheme Account PDFDocumento287 pagine2019 Marking Scheme Account PDFsaba alamNessuna valutazione finora

- Registration of PropertyDocumento13 pagineRegistration of PropertyambonulanNessuna valutazione finora

- Ioriatti Resume PDFDocumento1 paginaIoriatti Resume PDFnioriatti8924Nessuna valutazione finora

- Neelam ReportDocumento86 pagineNeelam Reportrjjain07100% (2)

- File Magang 2020Documento6 pagineFile Magang 2020keny dcNessuna valutazione finora

- Project 4 Sem 3 Danda Yoga KrishnaDocumento70 pagineProject 4 Sem 3 Danda Yoga Krishnadanda yoga krishnaNessuna valutazione finora

- A Study On Customer Satisfaction Towards Idbi Fortis Life Insurance Company Ltd.Documento98 pagineA Study On Customer Satisfaction Towards Idbi Fortis Life Insurance Company Ltd.Md MubashirNessuna valutazione finora

- KONTRAK KERJA 2 BahasaDocumento12 pagineKONTRAK KERJA 2 BahasaStanley RusliNessuna valutazione finora

- Sercu SolutionsDocumento155 pagineSercu SolutionsVassil StfnvNessuna valutazione finora

- Vertical and Horizontal IntegrationDocumento11 pagineVertical and Horizontal IntegrationDone and DustedNessuna valutazione finora

- Artifact5 Position PaperDocumento2 pagineArtifact5 Position Paperapi-377169218Nessuna valutazione finora

- Double Taxation Relief: Tax SupplementDocumento5 pagineDouble Taxation Relief: Tax SupplementlalitbhatiNessuna valutazione finora

- 2017 Hu Spence Why Globalization Stalled and How To Restart ItDocumento11 pagine2017 Hu Spence Why Globalization Stalled and How To Restart Itmilan_ig81Nessuna valutazione finora

- "Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselDocumento101 pagine"Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselRasel89% (9)

- List of Top 100 Construction Companies in UaeDocumento4 pagineList of Top 100 Construction Companies in Uaeazeem100% (1)

- Poverty Alleviation Programmes in IndiaDocumento4 paginePoverty Alleviation Programmes in IndiaDEEPAK GROVERNessuna valutazione finora

- External Query LetterDocumento2 pagineExternal Query LetterRohan RedkarNessuna valutazione finora