Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Deloitte - Transfer - Pricing For Energy Sector

Caricato da

superandrosaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Deloitte - Transfer - Pricing For Energy Sector

Caricato da

superandrosaCopyright:

Formati disponibili

Transfer pricing services for the energy sector

Your challenge As oil and gas companies continue to extend their reach around the world, transfer pricing is one of most significant tax issues they face. It is one of the areas in which the corporate tax function of a multinational company can help support corporate business objectives and undertake tax planning. Cost sharing. The increasing need to deploy new energy technologies across the globe has led oil and gas companies to employ cost sharing mechanisms to allow their affiliates access to critical equipment and techniques. The IRS has intensified its scrutiny of cost sharing arrangements and issued new regulations to require buy-in payments that U.S. taxpayers receive from foreign participants to adequately reflect the arms length value of the contributed intangibles. It is a complex challenge to comply with these new regulations, while balancing business objectives. Adding to these concerns is the growing sophistication of tax authorities around the world. Many of the more than 60 countries that now have transfer pricing statutes also have transfer-pricing-specific penalty regimes. The use

From the oil field to the pump, transfer pricing offers opportunity for energy sector tax planning.

This is especially true for oil and gas companies. Pricing the sale of tangible products between related companies is generally a challenge when companies operate in numerous jurisdictions and remote locations. Recent developments in the United States and global regulatory environment have created additional transfer pricing complexity in several other areas of the oil and gas supply chain, including: Services Regulations. The scope of cross-border services provided between related oil and gas companies has grown dramatically in recent years, and extends across the whole energy supply chain. Whether it is back-office support services or specialized R&D, engineering, or marketing, your companys methodology for pricing these services, along with the documentation that supports the approach, are critical to compliance with the transfer pricing regulations. Intangible Property. As demand for oil and gas products increases globally, oil and gas companies are continuing to develop new technologies and techniques for exploration, production, and distribution. Deciding where intellectual property should reside and how licenses to that intellectual property should be priced represent a challenge for transfer pricing compliance and planning.

As used in this document, Deloitte means Deloitte Financial Advisory Services LLP, which provides financial services; and Deloitte Consulting LLP, which provides consulting services. These entities are separate subsidiaries of Deloitte LLP. Please see www.deloitte. com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. . Certain services may not be available to attest clients under the rules and regulations of public accounting.

Deloitte Center for Energy Solutions

of deemed profit regimes in many of the hydrocarbonproducing countries adds to the pressure. Accordingly, the risk of incurring double taxation between these countries and the United States is increasing. Our approach Whether it is helping you develop an approach to transfer pricing or addressing discrete and highly technical issues that can arise, Deloittes team of oil and gas transfer pricing specialists is well equipped to work with you. We are full-time transfer pricing professionals and have access to professionals in Deloitte Touche Tohmatsu (DTT) member firms located, and with recognized experience, in major markets worldwide. Among our team members are energy economists with years of experience working either in energy companies or foreign energy-producing governments. This experience is valuable, but only if it can be applied with a deep understanding of your business. This is where we excel. In addition to our recognized experience in the oil and gas industry and its individual segments, we are widely known for our collaborative and flexible approach. We listen carefully to understand the particulars of your situation, quickly zero in on issues that are important to your company, and help you explore options that can be both effective and sustainable. Our services include: Planning Support. We can help you assess the tax impact of IP holding companies, cost sharing arrangements, and commissionaire or contract manufacturing relationships. We also perform rigorous functional analyses to help you consider what functions add value and what opportunities exist for evaluating the pricing of these functions. We can also help evaluate the transfer pricing impact of assumption of risks and analyze risk transfer arrangements, contingent payment mechanisms, and R&D cost sharing, which may help you effectively align the functional, risk, and economic profile of each entity and product with your organizations transfer pricing practices Documentation. Many foreign jurisdictions have similar, yet distinct, requirements for documentation and reporting. Thus, it is critical for oil and gas companies to have a consistent multicountry approach to documentation, but one in which the nuances of each jurisdiction can be addressed quickly and cost efficiently. Our team includes economists and tax specialists who are familiar with the documentation rules and practices in specific jurisdictions. We can help you develop the analyses and documentation to support your pricing methodologies.

Tax Controversies and Competent Authority. Controversies are increasingly likely, given the growing emphasis countries around the world are placing on transfer pricing. Transfer pricing examinations are expensive and disruptive, but so we have highly experienced professionals ready to assist you with audit defense and dispute resolution, including former competent authorities from several countries who can help you navigate that critical process. Advance Pricing Agreements. In many jurisdictions, it is advantageous to consider an Advance Pricing Agreement (APA) as a mechanism for avoiding disputes and managing cash flow. We are leaders in helping to negotiate APAs with tax authorities around the world. The Deloitte difference The Deloitte Transfer Pricing team brings a breadth of experience to help oil and gas businesses deal with the complexities of cross-border activity. We are recognized as having one of the worlds leading transfer pricing services organizations, integrating both the international tax and economic aspects of transfer pricing. The ability to team cross functionally with oil and gas specialists from the Deloitte & Touche LLP audit practice, valuation specialists from Deloitte Financial Advisory Services LLP, and actuaries and technology integration specialists from Deloitte Consulting LLP has distinguished our oil and gas industryfocused services. In serving our clients, we draw upon: A global transfer pricing practice serving more than half of the Fortune 100 and Fortune Global 100. We have access to transfer pricing specialists, including economists and tax professionals, in DTT member firms and their affiliates in more than 80 countries. The DTT member firms, collectively, have been ranked Number One in Euromoneys list of Worlds Leading Transfer Pricing Advisers in 2002, 2004, 2006, and 2008. In fact, the 2008 Guide recognized the DTT member firms as having the greatest number of leading transfer pricing advisers, with 81 featured advisers. Highly experienced transfer pricing specialists including former government officials and examiners. Our professionals understand both stated documentation requirements and the types of issues that authorities are likely to focus on in their examinations. Oil and gas industry specialists in specific locations across the United States, as well as dedicated DTT member firms professionals around the world, including Germany, Japan, and the United Kingdom. Proven approaches to developing transfer pricing strategies, methodologies, and documentation. Access to the specialized and recognized resources of the Deloitte U.S. Firms, and the member firms of DTT and their affiliates.

About the Deloitte Center for Energy Solutions The Deloitte Center for Energy Solutions provides a forum for innovation, thought leadership, groundbreaking research, and industry collaboration to solve the most complex energy challenges. Through the Center, Deloittes Energy & Resources Group leads the debate on critical topics on the minds of executivesfrom legislative and regulatory policy, to operational efficiency, to sustainable and profitable growth. We provide complete solutions through a global network of specialists and thought leaders. With locations in Houston and Washington, D.C., the Deloitte Center for Energy Solutions offers interaction through seminars, roundtables and other forms of engagement, where established and growing companies can come together to learn, discuss and debate. www.deloitte.com/energysolutions This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte, its affiliates, and related entities shall not be responsible for any loss sustained by any person who relies on this publication.

Copyright 2011 Deloitte Development LLC. All rights reserved. Member of Deloitte Touche Tohmatsu Limited

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Art of Network ArchitectureDocumento3 pagineThe Art of Network ArchitectureCentaur ArcherNessuna valutazione finora

- COGS Practise Questions 2 SolutionDocumento13 pagineCOGS Practise Questions 2 SolutionBisma ShahabNessuna valutazione finora

- Div Fy2020 Aps-7200aa20aps00013 PDFDocumento24 pagineDiv Fy2020 Aps-7200aa20aps00013 PDFGoodman HereNessuna valutazione finora

- MGT489 Mavengers Rport On RocketDocumento39 pagineMGT489 Mavengers Rport On RocketAniruddha RantuNessuna valutazione finora

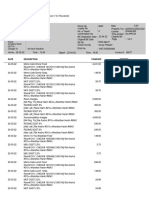

- Invoice::: Group Agent: Company Name Fssai NoDocumento2 pagineInvoice::: Group Agent: Company Name Fssai NoSuryaNessuna valutazione finora

- Quiz Lab AkmDocumento20 pagineQuiz Lab AkmAdib PramanaNessuna valutazione finora

- Needs Scheme TamilnaduDocumento6 pagineNeeds Scheme Tamilnadukannan nattuthuraiNessuna valutazione finora

- Hausser Food ProductsDocumento4 pagineHausser Food ProductsHumphrey Osaigbe100% (1)

- Financial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter QuestionsDocumento24 pagineFinancial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter Questionscostel11100% (1)

- Equity Mutual FundsDocumento49 pagineEquity Mutual FundskeneoNessuna valutazione finora

- World Class Manufacturing: Final AssignmentDocumento3 pagineWorld Class Manufacturing: Final AssignmentVikram VaidyanathanNessuna valutazione finora

- Product Pricing StrategyDocumento3 pagineProduct Pricing StrategyOsama RizwanNessuna valutazione finora

- BSG Decisions & Reports3Documento9 pagineBSG Decisions & Reports3Deyvis GabrielNessuna valutazione finora

- Hotel ManagerDocumento2 pagineHotel ManagerImee S. YuNessuna valutazione finora

- Supply Chain Management in Retail ManagementDocumento83 pagineSupply Chain Management in Retail ManagementMohammadAneesNessuna valutazione finora

- Pre-Quali TQ 2a With Answer KeyDocumento10 paginePre-Quali TQ 2a With Answer KeyJeepee John100% (2)

- 16 Open EconomyDocumento10 pagine16 Open EconomyOleg AndreevNessuna valutazione finora

- Film BudgetDocumento34 pagineFilm BudgetAmish Schulze95% (20)

- Chapter in Smelser-Baltes 2001Documento8 pagineChapter in Smelser-Baltes 2001Virendra Mahecha100% (1)

- AC2101 SemGrp4 Team4 (Updated)Documento41 pagineAC2101 SemGrp4 Team4 (Updated)Kwang Yi JuinNessuna valutazione finora

- HR Challenges For SelfRidgesDocumento5 pagineHR Challenges For SelfRidgesDinar KhanNessuna valutazione finora

- Safety and Health Representative Form3 PDFDocumento2 pagineSafety and Health Representative Form3 PDFSteve ThompsonNessuna valutazione finora

- Bautista v. SiosonDocumento1 paginaBautista v. SiosonHana Chrisna C. RugaNessuna valutazione finora

- Turmeric Contract Spec 08032011Documento4 pagineTurmeric Contract Spec 08032011Sivarajadhanavel PalanisamyNessuna valutazione finora

- MS EXCEL TutorialDocumento25 pagineMS EXCEL Tutorialphasnani100% (2)

- T1-Legal Entity of A CompanyDocumento14 pagineT1-Legal Entity of A CompanykityanNessuna valutazione finora

- This Study Resource Was: Scope and DelimitationDocumento1 paginaThis Study Resource Was: Scope and DelimitationRemar Jhon PaineNessuna valutazione finora

- Business EconomicsDocumento3 pagineBusiness EconomicsLilibeth SolisNessuna valutazione finora

- Pce Sample Questions 2016 - EngDocumento39 paginePce Sample Questions 2016 - EngImran Azman100% (1)

- Valencia Reginald G Assignment Chapter 19 ProblemsDocumento15 pagineValencia Reginald G Assignment Chapter 19 ProblemsReginald ValenciaNessuna valutazione finora