Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

An Explanatory Model For The Decision To Enter Emerging Markets - A Shareholder Perspective

Caricato da

Stefan SchmidtDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

An Explanatory Model For The Decision To Enter Emerging Markets - A Shareholder Perspective

Caricato da

Stefan SchmidtCopyright:

Formati disponibili

320

International Journal of Management

Vol. 27 No. 2

August 2010

An Explanatory Model for the Decision to Enter Emerging Markets: A Shareholder Perspective

Anthony J. Kos Youngstown State University This paper proposes an alternative framework for making the decision the to enter emerging markets. The approach takes the view of the shareholders of a multinational enterprise to analyze the entry decisions: whether or not enter an emerging market and how to enter the market. Emerging markets provide opportunities for multinational enterprises, and also pose great risks if a multinational enterprise enters. It is theorized that if excessive returns are less than the associated risk firms will choose not to enter. If potential returns are greater than the risk associated with entry into emerging markets, firm risk tolerance is a determinant of entry mode choice. Firms with low risk tolerance are predicted to enter through joint ventures or strategic alliances while those with a higher tolerance for risk are likely to enter through wholly owned enterprises.

1. Introduction

An emerging market (domestic market) provides growth opportunities for a multinational enterprise, which may find its existing business in a mature and saturated market. Multinational enterprises first need to make the decision whether to enter a particular emerging market or not. Then they need to choose the best entry mode to enter the market, that is, to form a wholly owned enterprise or find a partner to form a joint venture. Finally, they need to decide the percentage ownership if they choose to have a joint venture. Those decisions follow a chronological sequence and entry mode is selected after the decision to enter the market is made. However, in the existing literature, the entry mode decisions are isolated from the sequence of decisions. Entry mode decisions analyzed in the context of transaction cost theory (Sarkar and Cavusgil, 1996; Rindfleisch and Heide, 1997; Meyer, 2001; Nakos and Brouthers, 2002; Herrmann and Datta, 2002; Meyer, 2004 and Zhao and Decker, 2006) suggest that multinational enterprises select entry mode through the minimization of the transaction costs associated with each form of entry. North notes that firms try to minimize total cost, not just transaction costs (North 1987, 1990, North and Wallis, 1994) in the choice of entry modes. While Ie believe that cost minimization is critical in entry mode selection, it does not fully explain entry mode choice. Risk management and the creation of shareholder wealth are critical factors in guiding foreign investment . Gordon, Hayt and Marton (1998) reported that 83% of firms with market values greater than $1.2 billion engage in risk management. The scope of risk management has increased. In the past risk management was limited to addressing the sufficiency of insurance for casualties and liabilities. Markowitz ( 2005) notes that political and operational risks account for about one-half of the total risk Recent studies of corporate governance (e.g. Gompers, Ishii, and Metrick, 2003) draw strong correlation between the type of corporate governance and the financial performance of the firm. Klapper and Love (2003) have found similar results in emerging markets. This study is

International Journal of Management

Vol. 27 No. 2

August 2010

321

organized as follows. Section 2 explains the key factors considered in the entry decision into emerging markets. Section 3 describes the proposed approach to the entry decisions into emerging markets. Section 4 provides a discussion and concludes the paper

2. Key Factors in Entry Decision

Maximizing risk adjusted reward is the key aspect of investing in an emerging market (Ollson, 2002). Specifically, multinational enterprises estimate the potential financial reward if they enter an emerging market. At the same time, the multinational enterprises analyze the potential risks they will face if they enter. In other words, multinational enterprises estimate the risk-adjusted financial return of their investments in the emerging market. Thus, a multinational enterprise invests in the emerging market only if the risk associated with the emerging market can be properly compensated by the reward of the investment. Putting the entry decision question under the tradeoff between reward and risk, I link how management makes the entry mode decisions to the maximization of the shareholder value of the multinational enterprise. This view is able to answer why a multinational enterprise invests in some emerging markets but not others, why different firms choose different entry modes into the same market, why a multinational enterprise chooses a certain ownership percentage, and how firm characteristics affect the firms entry mode decisions. Entry Decision: Rewards and Risk Entry mode selection cannot be divorced from the process used in making the decision to enter an emerging market. The factors that are used to decide if a particular market is worthwhile to enter will also play a key role with transaction costs in entry mode selection. The decision process concerning the possible entry into a new market is complex. . Potential rewards for entering the market are weighed against the risks of entering or not entering. A foreign estimates the return to its investment under a normal circumstance and also estimates the potential losses under worse scenarios. Multinational enterprises cannot skip the later step because of high risk in emerging market investments. The return on investment is dependent upon the resources makeup the firm, the skill that firm possesses in deploying those resources, the size of the investment and the risk that tempers the incoming stream of payments. Reward: The Resource Based View (RBV) posits that firms are comprised of unique bundle of resources (Penrose, 1959; Wernerfelt, 1984; and Barney, 1991). According to RBV these resources can consist of valuable physical assets, intangible assets, human assets, organizational assets, competitive capabilities, etc. that are idiosyncratic to each. To the extent to which these assets are valuable, rare, inimitable and exploitable by the organization determines ability of firm to generate competitive advantage, parity or disadvantage in a market. Madhok (1998) found that the organizational capability was a key determinant of firm boundaries of multinational enterprises entering emerging markets. It is precisely this uniqueness and the multinational enterprises ability to effectively and efficiently utilize those resources that differentiates the potential return on investments among multinational enterprises pondering market entrance given equal investments.

322

International Journal of Management

Vol. 27 No. 2

August 2010

Risk: Risks associated with market entrance can either be general or firm specific. General risks are connected to a particular industry or geographic region. These could include economic, financial, political, regulatory, cultural, currency exchange and others. However, these general risks can either be reduced or magnified by the factors that a make a firm unique. A proprietary technology that automates a manufacturing process could alleviate some of the cultural risk connected to a labor-intensive process. Likewise too much debt could increase the financial risk to a firm who has uncertain future cash inflows. Firm risk tolerance: As discussed in the above, different multinational enterprises have different risk characteristics. Each firm needs to define its risk tolerance, which is the basis factor for the firm to make entry mode decisions. One of the approach to determine the firms risk tolerance is Value at Risk approach (VaR). In words, VaR defines how much money a firm can afford to lose in a worst case scenario. Depending on the firms unique capital structure and financial situation, a firms risk tolerance is characterized by the total value loss allowance, eg what are the losses the firm can afford without throwing the firm into bankruptcy or financial ruin and what is the likelihood that the losses would happen. The risk tolerance constraints the size of the investment in an emerging market and it determines the percentage of ownership in a joint venture. We present our approach in the following section.

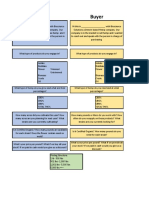

3. Entry and Entry Mode Decisions

Figure 1 shows a firms entry and entry mode decisions and the key factors affecting the decisions. First, a multinational enterprise analyzes the potential return on investments in an emerging market and the potential risk if it enters the market. As discussed previously, the risk the firm will face depends on the entry mode it chooses. At this stage, the risk is analyzed based on an assumed entry mode, for example, a wholly owned enterprise. If the return on investments after adjusting for risk to the emerging market is higher than the normal return of the industry, then the firm should choose to enter the market. The foreign analyzes the potential losses and controls the losses by choosing the best entry mode. Using VaR approach, the multinational enterprise determines its risk tolerance, or how much money it can afford to lose in a worst case scenario. If the multinational enterprise can take large losses under unfavorable conditions, the wholly owned enterprise may be the choice. However, if it cannot take large losses, it should consider finding a partner in the emerging market to share the risks. It should be noted that the risk taken by the firm is different if it chooses a wholly owned enterprise rather than a joint venture. Thus, the risk-adjusted return can be higher for a joint venture than a wholly owned enterprise. The multinational enterprise has to tradeoff between a bigger investment (wholly owned venture) with a lower return and a smaller investment (joint venture). Finally, the multinational enterprise determines the percentage ownership in the joint venture if it chooses to have a partner. In this case, the larger the losses the firm can take, the higher percentage of ownership the firm should have in the joint venture. Under the constraint of risk tolerance, the size of the investment in a new venture or the percentage of ownership in a joint venture is determined.

International Journal of Management

Vol. 27 No. 2

August 2010

323

The decision processes may need iterations. The risk a multinational enterprise faces if it enters an emerging market depends on the entry mode. In the first step, an assumption on the entry mode is made in order to estimate the risk and start the analysis. However, the entry mode assumed may not be the entry mode determined at the final step. Then, the processes can be repeated using the final entry mode decision as the assumed entry mode in the first step to check if the same results will be reached. Table 1 summarizes the main predictions. For the emerging markets having high risk that cannot be compensated by their potential return, multinational enterprises will not enter (for example, Iraq). For the emerging markets having low risk that can be compensated by their potential return, multinational enterprises will enter the markets. For the firms with low risk tolerance, the firms will choose joint venture as the best entry mode. For the firms with high risk tolerance, the firms will choose wholly-owned enterprise as the best entry mode.

Figure 1. Flow chart of entry and entry mode decisions

Table 1. Entry and entry mode decisions

EXCESSIVE RETURN < RISK LOW RISK TOLERANCE HIGH RISK TOLERANCE NO ENTRY NO ENTRY EXCESSIVE RETURN > RISK JOINT VENTURE WHOLLY OWNED ENTERPRISE

324

International Journal of Management

Vol. 27 No. 2

August 2010

4. Discussion and Conclusions

This paper attempts to move beyond transaction cost analysis in determining choice of entry mode in entering emerging markets. An alternative framework utilizing risk management is proposed. The proposed approach determines the entry decisions and the optimal entry mode choice by tradeoff between potential return and risk of an emerging market under the constraint of the multinational enterprises risk tolerance. In brief, given both the characteristics of an emerging market and a multinational enterprise, the entry and entry mode choice is mainly determined by return and risk of an emerging market and the firms risk tolerance. In the proposed approach, given the characteristics of a foreign and a potential foreign partner, the multinational enterprises demand for control is higher if one of following is true while all else being equal: (1) the emerging market has a higher potential growth rate; (2) the emerging market has a lower risk; (3) the multinational enterprise can tolerate higher losses. The paper theorizes that, by incorporating risk management and shareholder value, the alternative approach can explain entry mode choice by multinational enterprises investing abroad. By incorporating risk management the model is specifically relevant to investing in emerging markets due to their risk characteristics. Furthermore, the new approach answers some questions the transaction cost model has not been able to answer, particularly, why multinational enterprises enter some emerging markets but not others. Empirical testing would be the next step.

References

Barney, J.B. Firm Resources and Sustained Competitive Advantage Journal of Management, 32, 1991, 99-120. Copeland, T., Koller, T., and Murrin, J., Valuation: Measuring and managing the Value of Companies, New York: John Wiley & Sons. Inc. 2001. Gompers, P., Ishii, L, and Metrick, A., Corporate governance and equity prices, Quarterly Journal of Economics, 118, 2003, 107-155. Gordon, G.S. Hayt, G.S., and R.C. Marston, R.C., 1998 Wharton survey of financial risk management by U.S. non-financial firms, Financial Management, Winter 1998, 70-91. Herrmann, Pol and Deepak K. Datta, D.K., CEO Successor Characteristics and the Choice of Emerging market Entry Mode: An Empirical Study, Journal of International Business Studies, 33 (3), 2002, 551 -569. Klapper, L.F. and Love, I., Corporate governance, investor protection, and performance in emerging markets, Journal of Corporate Finance 195, 2003, 1-26. Madhok, A., The Nature of Foreign Firm Boundaries: Transaction Costs, Firm Capabilities and Foreign Entry Mode. International Business Review, (7) 1998, 259-290

International Journal of Management

Vol. 27 No. 2

August 2010

325

Markowitz, H., New Frontier of Risk, Thought Leadership Series, Bank of New York, 2005. Meyer, K. E., Institutions, Transaction Costs, and Entry Mode Choice in Eastern Europe, Journal of International Business Studies, 2001 VOL 32; part 2, 2001, 357-368. Meyer, Klaus E., Perspectives on Foreign Enterprises on Emerging Economies, Journal of International Business Studies, 35, 2004, 259-276 Nakos, G. and Brouthers, K.D., Entry Mode Choice of SMEs in Central and Eastern Europe, Entrepreneurship Theory and Practice 27 (1), 2002, 47 -64. North, D. C., Institutions, transaction costs and economic growth, Economic Inquiry, 25(3), 1987, 419-428. North, D. C., Institutions, institutional change and economic performance, edited by J. Alt and D.C. North, The Political Economy of Institutions and Decisions Series, Cambridge: Cambridge University Press, 1990. Penrose, E.T. , The Theory of the Growth of the Firm. Blackwell: Oxford 1959 North, D. C. and Wallis, J.J., Integrating institutional change and technical change in economic history: a transaction cost approach, Journal of Institutional and Theoretical Economics, 150(4), 1994, 609-624. Olsson, C., Risk Management in Emerging Markets, Prentice Hall, 2002. Rindfleisch, A. and Heide, J. B., Transaction cost analysis: Past, present, and future applications, Journal of Marketing, 61(October), 1997, 30-54. Sarkar, M. and Cavusgil, S. T., Trends in international business thought and literature: A review of international market entry mode research: Integration and synthesis, The International Executive, 38(6), 1996, 825-847. Wernerfelt, B., A Resource-Based Theory of the Firm Strategic Management Journal, 5(2) 1984, 171-180 Zhao, X. and R. Decker, Choice of Emerging market Entry Mode: Cognitions from Empirical and Theoretical Studies, working paper, University of Bielefeld, 2006. Contact email address: ajkos@ysu.edu

Copyright of International Journal of Management is the property of International Journal of Management and its content may not be copied or emailed to multiple sites or posted to a listserv without the copyright holder's express written permission. However, users may print, download, or email articles for individual use.

Potrebbero piacerti anche

- The Management of Foreign Exchange RiskDocumento98 pagineThe Management of Foreign Exchange RisknandiniNessuna valutazione finora

- Foreign Exchange RiskDocumento9 pagineForeign Exchange Riskwendosen seifeNessuna valutazione finora

- The Management of Foreign Exchange RiskDocumento97 pagineThe Management of Foreign Exchange RiskVajira Weerasena100% (1)

- Strategic RiskDocumento18 pagineStrategic RiskJonisha JonesNessuna valutazione finora

- Derivatives and Corporate Risk Management: Participation and Volume Decisions in The Insurance IndustryDocumento41 pagineDerivatives and Corporate Risk Management: Participation and Volume Decisions in The Insurance IndustryTubagus Donny SyafardanNessuna valutazione finora

- DER - Using Derivatives - What Senior Managers Must KnowDocumento22 pagineDER - Using Derivatives - What Senior Managers Must KnowYUBISA GARCÍANessuna valutazione finora

- Investment Risk APADocumento10 pagineInvestment Risk APAMuhammad Ramiz AminNessuna valutazione finora

- Rich Text Editor FileDocumento4 pagineRich Text Editor FileKamini Satish SinghNessuna valutazione finora

- Risks in Derivatives Markets: Financial Institutions CenterDocumento29 pagineRisks in Derivatives Markets: Financial Institutions CenterNisha AhirwarNessuna valutazione finora

- Foreign Exchange Risk Management AnalysisDocumento12 pagineForeign Exchange Risk Management AnalysisPrashant AgarkarNessuna valutazione finora

- Discussion Paper v33 FinalDocumento38 pagineDiscussion Paper v33 FinalPrince KumarNessuna valutazione finora

- SMEsinternationalizationDocumento22 pagineSMEsinternationalizationRaihan RakibNessuna valutazione finora

- T1-FRM-2-Ch2-503-20.4-v3 - Practice QuestionsDocumento10 pagineT1-FRM-2-Ch2-503-20.4-v3 - Practice QuestionscristianoNessuna valutazione finora

- Country Risk AnalysisDocumento20 pagineCountry Risk AnalysisMaria RamiezNessuna valutazione finora

- Understanding and Evaluating Sovereign RiskDocumento8 pagineUnderstanding and Evaluating Sovereign RiskjeffreyblNessuna valutazione finora

- Module 7Documento21 pagineModule 7Trayle HeartNessuna valutazione finora

- Treasury RisksDocumento24 pagineTreasury RisksAngelie Dela CruzNessuna valutazione finora

- Introduction To Risk ManagementDocumento21 pagineIntroduction To Risk ManagementRaghavendra.K.ANessuna valutazione finora

- Risk Classification System Actuarial ProfessionDocumento42 pagineRisk Classification System Actuarial ProfessionWubneh AlemuNessuna valutazione finora

- 10 CisarDocumento15 pagine10 CisarTú NguyễnNessuna valutazione finora

- Risk Management: Alternative Risk Transfer: StructureDocumento21 pagineRisk Management: Alternative Risk Transfer: StructureRADHIKAFULPAGARNessuna valutazione finora

- Financial Risk ManagementDocumento18 pagineFinancial Risk Managementdwimukh360Nessuna valutazione finora

- Ibee (1) - IntroDocumento14 pagineIbee (1) - IntroDare ShobajoNessuna valutazione finora

- Affect of Leverage On Risk and Stock Return .. International Research Jornal of Finance and Economincs1-With-Cover-Page-V2Documento19 pagineAffect of Leverage On Risk and Stock Return .. International Research Jornal of Finance and Economincs1-With-Cover-Page-V2(FPTU HCM) Phạm Anh Thiện TùngNessuna valutazione finora

- Risk ManagementDocumento4 pagineRisk ManagementHemant AgrawalNessuna valutazione finora

- Apec AssignmentDocumento17 pagineApec AssignmentHOPE MAKAUNessuna valutazione finora

- What Is Financial Engineering?Documento4 pagineWhat Is Financial Engineering?Chandini AllaNessuna valutazione finora

- Volume 30, Issue 1: Industry Concentration and Cash Flow at RiskDocumento9 pagineVolume 30, Issue 1: Industry Concentration and Cash Flow at RiskzagatovNessuna valutazione finora

- SM Chapter 3 NotesDocumento8 pagineSM Chapter 3 NotesAnns AhmadNessuna valutazione finora

- Jurnal 7Documento49 pagineJurnal 7Ricky SatriaNessuna valutazione finora

- Risks of Derivative Markets in BDDocumento3 pagineRisks of Derivative Markets in BDAsadul AlamNessuna valutazione finora

- Exchange Risk MNGTDocumento28 pagineExchange Risk MNGTHassaniNessuna valutazione finora

- A Study On Risk and Return Analysis of Pharma Companies in IndiaDocumento47 pagineA Study On Risk and Return Analysis of Pharma Companies in Indiakarthikkarthi6301Nessuna valutazione finora

- Derivatives & Structured Products - SBR 1: Case: Rethinking Saizeriya's Currency Hedging StrategyDocumento6 pagineDerivatives & Structured Products - SBR 1: Case: Rethinking Saizeriya's Currency Hedging StrategyPooja JainNessuna valutazione finora

- Fin Risk MGTDocumento11 pagineFin Risk MGTmahipal2009Nessuna valutazione finora

- Methods of Entry in The International MarketDocumento7 pagineMethods of Entry in The International MarketCelso Garcia100% (1)

- Classification of RisksDocumento7 pagineClassification of RisksAnurag GargNessuna valutazione finora

- Topic 5 Types of RisksDocumento11 pagineTopic 5 Types of Riskskenedy simwingaNessuna valutazione finora

- Individual Research - Personal Development ReportDocumento5 pagineIndividual Research - Personal Development Reportbenlim1992Nessuna valutazione finora

- IHM Lecture 3Documento3 pagineIHM Lecture 3Mariam AdelNessuna valutazione finora

- Impact of Currency Fluctation On The Indian IT SectorDocumento12 pagineImpact of Currency Fluctation On The Indian IT Sectorashish20705Nessuna valutazione finora

- Seminar Report ON Corporate Hedging Process & Techniques Submitted To: Sir. Yasin Zia Submitted By: Zahid Hussain 2009-Ag-65 MBA (R) FinanceDocumento12 pagineSeminar Report ON Corporate Hedging Process & Techniques Submitted To: Sir. Yasin Zia Submitted By: Zahid Hussain 2009-Ag-65 MBA (R) FinanceZahid HussainNessuna valutazione finora

- P1.T1. Foundations of Risk Chapter 2. How Do Firms Manage Financial Risk? Bionic Turtle FRM Study NotesDocumento10 pagineP1.T1. Foundations of Risk Chapter 2. How Do Firms Manage Financial Risk? Bionic Turtle FRM Study NotescristianoNessuna valutazione finora

- Nocco Enterprise Risk Management Theory and PracticeDocumento33 pagineNocco Enterprise Risk Management Theory and PracticeMichael RitterNessuna valutazione finora

- Quarterly Brief: Valuation of Early-Stage CompaniesDocumento17 pagineQuarterly Brief: Valuation of Early-Stage CompaniesViktorNessuna valutazione finora

- Risk Management by Multinational Corporations: A New Test of The Underinvestment HypothesisDocumento22 pagineRisk Management by Multinational Corporations: A New Test of The Underinvestment HypothesisDinesh KumarNessuna valutazione finora

- Risk and Return Analysis of Automobile and Oil &gas Sectors - A StudyDocumento30 pagineRisk and Return Analysis of Automobile and Oil &gas Sectors - A StudysaravmbaNessuna valutazione finora

- Enterprise-Wide Risk Is Now A Widely Used Term in The Financial Services and Energy IndustriesDocumento4 pagineEnterprise-Wide Risk Is Now A Widely Used Term in The Financial Services and Energy IndustriesRagav SathyamoorthyNessuna valutazione finora

- Marketing Concepts 1Documento5 pagineMarketing Concepts 1kenoNessuna valutazione finora

- 6learning Outcome 6Documento19 pagine6learning Outcome 6Indu MathyNessuna valutazione finora

- MS 44Documento12 pagineMS 44Rajni KumariNessuna valutazione finora

- 4.6.1 A Closer Look at Information Asymmetry Adverse SelectionDocumento5 pagine4.6.1 A Closer Look at Information Asymmetry Adverse SelectionYanee ReeNessuna valutazione finora

- CherifDocumento26 pagineCherifNuwan Tharanga LiyanageNessuna valutazione finora

- Module - 1Documento67 pagineModule - 1Shubham BaralNessuna valutazione finora

- Risk Management 2Documento45 pagineRisk Management 2virajNessuna valutazione finora

- HRG Risk ManagementDocumento9 pagineHRG Risk ManagementkautiNessuna valutazione finora

- Foreign Exchange Risk Management - International Financial Environment, International Business - EduRev NotesDocumento8 pagineForeign Exchange Risk Management - International Financial Environment, International Business - EduRev Notesswatisin93Nessuna valutazione finora

- PPM en 2006 03 NoordinDocumento9 paginePPM en 2006 03 NoordinAnay RajNessuna valutazione finora

- EIB Working Papers 2018/08 - Debt overhang and investment efficiencyDa EverandEIB Working Papers 2018/08 - Debt overhang and investment efficiencyNessuna valutazione finora

- Tender Documents PKG 4 Shaheed Benazir Bhutto BridgeDocumento133 pagineTender Documents PKG 4 Shaheed Benazir Bhutto BridgeAbn e MaqsoodNessuna valutazione finora

- BV2018 - MFRS 4Documento41 pagineBV2018 - MFRS 4Tok DalangNessuna valutazione finora

- CH 12Documento30 pagineCH 12ReneeNessuna valutazione finora

- Phil Mosley and Rolando Shannon Financial RatiosDocumento12 paginePhil Mosley and Rolando Shannon Financial Ratiosapi-282888108Nessuna valutazione finora

- The Valuation of Long-Term SecuritiesDocumento83 pagineThe Valuation of Long-Term SecuritiesThida WinNessuna valutazione finora

- RV3 PDFDocumento1 paginaRV3 PDFTam SimeonNessuna valutazione finora

- PPE - Initial Measurement - Assignment - No AnswersDocumento2 paginePPE - Initial Measurement - Assignment - No Answersemman neriNessuna valutazione finora

- ValuationDocumento20 pagineValuationNirmal ShresthaNessuna valutazione finora

- Dayrit v. CA DigestDocumento3 pagineDayrit v. CA DigestJosh BersaminaNessuna valutazione finora

- 4 L GST Certificate New PDFDocumento3 pagine4 L GST Certificate New PDFSuhas SuviNessuna valutazione finora

- Acca f3 BPP Question Amp Answer BankDocumento45 pagineAcca f3 BPP Question Amp Answer BankHải LongNessuna valutazione finora

- Cost Accounting Jobs: The Role of A Cost AccountantDocumento2 pagineCost Accounting Jobs: The Role of A Cost AccountantchokieNessuna valutazione finora

- P.O Box 1770, Rahim Pur Khichian Said Pur Road Sialkot-Pakistanphone:-+92-52 - 4268188,4260850-1 Fax: - +92-52-4262852Documento56 pagineP.O Box 1770, Rahim Pur Khichian Said Pur Road Sialkot-Pakistanphone:-+92-52 - 4268188,4260850-1 Fax: - +92-52-4262852adeelbajwaNessuna valutazione finora

- Resume - CA Anuja RedkarDocumento2 pagineResume - CA Anuja RedkarPACreatives ShortFilmsNessuna valutazione finora

- Hedge Fund Structures PDFDocumento9 pagineHedge Fund Structures PDFStanley MunodawafaNessuna valutazione finora

- Supply Side PoliciesDocumento5 pagineSupply Side PoliciesVanessa KuaNessuna valutazione finora

- Release Waiver and Quitclaim - No Ee-Er RelnshipDocumento2 pagineRelease Waiver and Quitclaim - No Ee-Er RelnshipmisyeldvNessuna valutazione finora

- Accounting Assignment Bilal 18798Documento4 pagineAccounting Assignment Bilal 18798Muhammad Shahid KhanNessuna valutazione finora

- Investment Triangle TriangleDocumento2 pagineInvestment Triangle TriangleramakrishnanNessuna valutazione finora

- BT Australian Shares Index W: Growth of $10,000Documento3 pagineBT Australian Shares Index W: Growth of $10,000Ty ForsythNessuna valutazione finora

- Customer Authorization Form - EnglishDocumento1 paginaCustomer Authorization Form - EnglishsamNessuna valutazione finora

- Pradhan Mantri Kaushal Vikas YojanaDocumento32 paginePradhan Mantri Kaushal Vikas YojanaPreet SasanNessuna valutazione finora

- Isae 3400Documento9 pagineIsae 3400baabasaamNessuna valutazione finora

- Deloitte Vietnam - Tax Newsletter - May 2019Documento27 pagineDeloitte Vietnam - Tax Newsletter - May 2019Nguyen Hoang ThoNessuna valutazione finora

- Conceptual Framework in AccountingDocumento4 pagineConceptual Framework in AccountingKrizchan Deyb De LeonNessuna valutazione finora

- Gradient Series and AsDocumento8 pagineGradient Series and AsJayrMenes100% (1)

- Muh. SyukurDocumento6 pagineMuh. SyukurDrawing For LifeNessuna valutazione finora

- CH 09Documento94 pagineCH 09ayu utamiNessuna valutazione finora

- Partnership Formation QuizDocumento1 paginaPartnership Formation QuizMaria Carmela MoraudaNessuna valutazione finora

- Microfinance As A Poverty Reduction PolicyDocumento12 pagineMicrofinance As A Poverty Reduction PolicyCarlos105Nessuna valutazione finora