Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cpi Us

Caricato da

Giovanni GrazianoDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cpi Us

Caricato da

Giovanni GrazianoCopyright:

Formati disponibili

WHITE PAPER

THE SHAMEFUL TRUTH ABOUT THE CPI

Euro Pacific Capital, Inc. 10 Corbin Drive Darien, Connecticut 06820 1-800-727-7922 www.europac.net

The Shameful Truth about the CPI

INFLATION EVERYWHERE

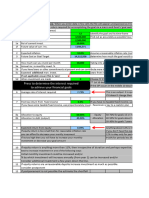

The price increases that consumers face at the supermarket are far greater than what government inflation statistics suggest. College tuitions, medical insurance, hospital beds, gas prices, airline fares and more have all risen at or close to double digit rates, yet government reported CPI figures say that inflation remains under control. In June of this year, the Bureau of Labor Statistics (BLS) reported that, for the past year, the rate of inflation as measured by the CPI was running at 2.7%. Meanwhile, some skeptical statisticians have reconstructed the CPI using the older formulasa measure they view as more reliableand have found inflation rates above 10% versus the BLSs official 2.7% number. What is wrong with this picture?

The red line indicates the governments official BLS inflation numbers. Blue line indicates Shadow Government Statistics alternative CPI measure. Notice the near 8% gap between these two lines!

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

CPI FALSE GOD?

The CPI was originally designed to help businesses and government plan for price increases under different monetary conditions. As prices of goods rose at a certain rate, so should wages, the reasoning went. The easiest way to calculate inflation was by tracking the price of a fixed basket of goods in locations across the United States, and compare monthly changes to the price of the basket. The government did not wait long to start tinkering with the formulas for calculating the CPI. They would soon have social security payments, wages, and contracts pegged to the CPI, creating a great incentive for the government to meddle with the numbers. And meddle they did.

COST OF GOODS VS. COST OF LIVING

The original method for calculating the CPI was to track how a fixed basket of goods changed over a period of time. The word fixed is critical because it ensured that the reported statistics measure a constant standard of living. The original CPI, a fixed index, is called a Cost of Goods Index. However, as the BLS has changed its methods of calculating the CPI, it has gone from a Cost of Goods Index to a Cost of Living Index. A Cost of Living Index measures the price increases in household expenditures, which is just as much a measure of consumer buying habits as it is a measure of inflation.

To illustrate what happens under these two types of indexes, let us say that a basket of goods starts out as two items, steak and gruyere cheese. In a Cost of Goods Index as

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

inflation causes prices to increase, the basket becomes more expensive. After five years, we might see a 40% increase in the cost of the basket. All the goods in the index would remain the same.

In a Cost of Living Index index, however, as the prices for these goods rise, they would be substituted for cheaper, lesser quality goods. After years of rising prices, the basket might look like hamburger and kraft singles. If this change happened in 5 years, assuming that the prices of hamburger and kraft singles rose to the point where they now cost 15% more than what steak and gruyere cheese used to cost, the government would report that the CPI increased 15%. However, the gruyere and steak are now 40% more expensive. Was inflation 15% or 40% during the 5 year period? Do you want a steak or hamburger?

This is exactly what is happening with the CPI today. Substitutions and readjustments in weights and standards have turned the index into a Cost of Living Index even though the government would like us to believe that it is still a Cost of Goods Index.

TINKERING WITH THE INDEX

In the 1990s, the BLS made some of the most egregious changes to the CPI in order to understate the actual rate of inflation. One of the most significant changes occurred in 1999, when the CPI moved away from a fixed-quantity price index to include a heavy geometric weighting. A geometric weighting is where goods rising in price are given less weight than goods decreasing in price. For example, take the basket of steak and gruyere

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

cheese. Say that the price of steak goes up by 50% and the price of cheese remains level. Under the old system of weighting, these two prices would be averaged and the inflation rate would come out to 25%.

In a geometric weighting, steak would be given a lesser weight because it increased in price. The geometric weighted inflation may only come out to be 12.5%. The result is a consistently lower published CPI number. The reasoning behind such a change is that consumers will stock up on goods that are decreasing in price and will buy less of goods that are increasing in price. While buyers may change their behavior, it does not change the underlying fact that prices are rising.

THE GOVERNMENTS INCENTIVE

By understating the true rate of inflation, the government saves an enormous amount of money because so many programs benefits escalate with the CPI. These expenditures include social security benefits for approximately 48 million people, benefits for about 4.1 million military and Federal Civil Service retirees and survivors, and payments for about 22 million food stamp recipients. In 2007, the U.S. government plans to spend $586.1 billion on Social Security benefits alone, meaning that every 1% increase in the

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

CPI costs the government approximately $5.9 billion! By more tinkering with the CPI calculation, the government can cut benefits without creating a political liability or public outcry. The average person does not understand the enormous implications of such a change.

SELLING THE NEW INDEX CALCULATIONS

How has the government managed to change the CPI with so little attention? Each major change in the CPI has been a methodical and calculated effort. Prior to the change to a geometric weighting methodology in 1999, Michael Boskin, chairman of the Council of Economic Advisors, led a congressional panel that concluded that inflation for 1996 rose 1.8% rather than the 2.9% reflected in the CPI. The 1.8% number utilized the geometric weighting that the BLS would later adopt in 1999, while the 2.9% number was using the original basket of goods that was established in 1982-84. Rather than updating the basket of goods, as the BLS had done honestly from WWII through the mid 1980s, Boskin used the opportunity to discredit the current system of calculation and suggest the ridiculous and misrepresentative geometric weighting in the CPI.

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

Release of the Boskin Commission report, Dec 4, 1996. Committee members: RJG, Dale Jorgenson, Michael Boskin, Ellen Dulberger, Zvi Griliches.

How does one go about selling such preposterous plan to the public? Take it to the press, of course. On December 16, 1996, Time magazine published Boskins findings in an article titled The Inflation Myth. As the title suggests, the article served as a propaganda piece for his viewpoint. An example of misleading journalism, it failed to even mention the problems with the panels findings and suggestions. Less than three years later, his proposal would become reality.

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

The Inflation Myth, Time Magazine. This article explained Michael Boskins findings to the public.

The introduction of the C-CPI-U was also a deliberate effort. Oddly enough, when this new index was introduced in 2002, we were in the midst of a stock market correction and deflation was a concern among many on Wall Street. During this time, Robert Prechter, a well known Wall Street forecaster, released his book, Conquer the Crash, which

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

predicted a deflationary depression. The book made the New York Times bestseller list and later went into a second printing.

THE FEDS INVOLVEMENT WOULD SOME CALL IT CONSPIRACY?

That same year, Federal Reserve chairman, Ben S. Bernanke, delivered a speech before the National Economists Club in Washington D.C. titled Deflation: Making Sure It Doesnt Happen Here. His speech addressed the publics fear of deflation. With Wall Street focused on the seemingly imminent deflation, the BLS devised and released a new method of calculating the CPI, the chained CPI-U, that would understate the rate more that the currently published numbers.

Federal Reserve Chairman Ben Bernanke.

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

10

Deflation: Making Sure It Doesnt Happen Here. Ben Bernankes Speech before the national economists club in Washington, D.C. The speech can be read in its entirety on the BLS website.

Why did the BLS want to understate inflation when so many on Wall Street were worried about deflation? The BLS knew that, contrary to public opinion, inflation, not deflation, would continue. The Federal Reserve will continue to print money and increase the money supply. Thus, deflation was a needless concern and the chained CPI-U release would go almost unnoticed. And in fact, the 2002 change was given little publicity and even less debate.

CORE RATE VS. HEADLINE (CPI-U) RATE

Adoption of the C-CPI-U in 2002 was not the first instance where the media was unable to discern and report on the manipulation of such an important statistic. Previously, the government had promulgated a new statistic it termed the core rate of inflation. The core rate is the CPI-U excluding food and energy. The reasoning behind publishing a number that excludes items critical to daily life is that food and energy prices are volatile.

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

11

Volatility is a valid argument for publishing a statistic that shows the CPI without these items. However, what is dishonest is how the core rate is often advertised as the true rate of inflation while the comprehensive CPI-U figure (sometimes called the headline rate) is often mentioned second in the media, if at all. This deception results in the public thinking that inflation is even lower that the already deceptive all-inclusive rate.

REAL RATE OF INFLATION

Since the government numbers have become so far detached from reality, it is difficult to get an accurate gauge on what the actual inflation numbers are. John Williams, a respected consulting economist and graduate from Dartmouth College, has reconstructed the CPI using previous standards, yielding results that differ greatly from the BLS inflation indices. One chart on his website at shadowstats.com suggests a current rate of inflation of over 10%!

Others make the argument that inflation is best measured against gold or a basket of commodities. This school argues that gold is a good measure of inflation since it is the only true currency in the worldthe most important property being that its production cannot be expanded quickly or greatly. Thus, if the US dollar money supply increases greatly, the large increase in dollars chasing a fixed amount of gold would push the price higher (note that gold over the past five years has achieved an annual return in excess of 20%).

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

12

Gold price chart 1998-2007. Notice the dramatic rise in the price of gold from a low of $255.80 to its current price of over $750. If the price of gold was used as a measure of inflation, such a rise would suggest an inflation rate of over 20% per year for each of the past five years.

While in theory this is a great measure of inflation, the price of gold, like any asset class, is subject to manipulation and mania where the price may go up or down, regardless of the fundamentals. In response that one commodity market can be manipulated, some suggest that inflation should be measured against a basket of precious metals. With a basket of commodities, there would be less chance of wide fluctuations in prices. Additionally, proponents argue that the price of a basket of precious metals would give an instant inflation reading, where the CPI is a lagging indicator of inflation.

The governments incentives to meddle with official CPI numbers are abundantly clear. As we have seen, the government has cleverly adjusted their calculations to dramatically understate the numbers. The most important thing that people must understand is that inflation is running far higher than the government is willing to admit. Those unfortunate

1-800-727-7922

www.europac.net

Euro Pacific Capital

The Shameful Truth about the CPI

13

investors who measure their investment returns against the governments published CPI statistics will be greatly disappointed when those investments are liquidated and they realize that their purchasing power is severely eroded.

ABOUT THE AUTHOR Incredibly, the author of this article is a senior at Goizueta Business School at Emory University in Atlanta. Cliff Gehrett is a summer intern at Euro Pacific. Cliff found us last fall requesting a summer internship because he believed in Euro Pacifics philosophy. He is a finance and accounting major, and an early convert to free market principles, Austrian economics, and distrust of big government. We were surprised at the maturity and sophistication of this talented young man. We hope he will be joining Euro Pacific after he graduates next May.

1-800-727-7922

www.europac.net

Euro Pacific Capital

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Redfin Case AnalysisDocumento11 pagineRedfin Case AnalysisherrajohnNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Macroeconomics 11th Edition Arnold Test Bank 1Documento28 pagineMacroeconomics 11th Edition Arnold Test Bank 1bertha100% (47)

- Goldman Sachs - Business Principles and Standards - Goldman Sachs Business PrinciplesDocumento3 pagineGoldman Sachs - Business Principles and Standards - Goldman Sachs Business PrinciplesGiovanni GrazianoNessuna valutazione finora

- Klarman Searches For Bargains: 1991 Barron's On SpinoffsDocumento3 pagineKlarman Searches For Bargains: 1991 Barron's On SpinoffsGiovanni GrazianoNessuna valutazione finora

- Nomad Capitalist FREE Guide PassportDocumento9 pagineNomad Capitalist FREE Guide PassportGiovanni Graziano100% (2)

- Harper Competition Policy ReviewDocumento548 pagineHarper Competition Policy ReviewGiovanni GrazianoNessuna valutazione finora

- Private Equity AsiaDocumento12 paginePrivate Equity AsiaGiovanni Graziano100% (1)

- Growth Summit 15 Brochure OnlineDocumento10 pagineGrowth Summit 15 Brochure OnlineGiovanni GrazianoNessuna valutazione finora

- Blackstone Group Annual Report No. 1Documento80 pagineBlackstone Group Annual Report No. 1Giovanni GrazianoNessuna valutazione finora

- What Should I Do With My LifeDocumento1 paginaWhat Should I Do With My LifeGiovanni GrazianoNessuna valutazione finora

- 292-Article Text-1387-1-10-20170213Documento18 pagine292-Article Text-1387-1-10-20170213Zyve AfricaNessuna valutazione finora

- Hayek and FriedmanDocumento5 pagineHayek and FriedmanRicabele MaligsaNessuna valutazione finora

- Monthly Economic Letter - November 2023 - BDC - CaDocumento3 pagineMonthly Economic Letter - November 2023 - BDC - CaJasvinder singhNessuna valutazione finora

- 2810002Documento4 pagine2810002Jay WilliamsNessuna valutazione finora

- Economics HSC Exam 2003Documento20 pagineEconomics HSC Exam 2003Billy BobNessuna valutazione finora

- McKinsey Economic Survey 2010Documento9 pagineMcKinsey Economic Survey 2010Dhruv AgarwalNessuna valutazione finora

- Econ2234 2015 Sem-2 CrawleyDocumento5 pagineEcon2234 2015 Sem-2 CrawleyDoonkieNessuna valutazione finora

- 22BEDocumento491 pagine22BESanjay AgnihotriNessuna valutazione finora

- The Great Depression Wheelock OverviewDocumento4 pagineThe Great Depression Wheelock OverviewNishant daripkarNessuna valutazione finora

- Goal Based Investing Calculator Mar 2016 2Documento6 pagineGoal Based Investing Calculator Mar 2016 2seemarani12713Nessuna valutazione finora

- Measurement of Macroeconomic VariablesDocumento35 pagineMeasurement of Macroeconomic VariablesRamadhan Der ErobererNessuna valutazione finora

- Has The Bond Market Given Up On H4L Should ItDocumento4 pagineHas The Bond Market Given Up On H4L Should Itmi.ahmadi1996Nessuna valutazione finora

- Minerals Council Facts and Figures Sep 2019 PDFDocumento47 pagineMinerals Council Facts and Figures Sep 2019 PDFNuvya BabbarNessuna valutazione finora

- GCI Analysis South Korea 17 Aug 22 2035 HrsDocumento30 pagineGCI Analysis South Korea 17 Aug 22 2035 HrsaartiNessuna valutazione finora

- Investors Behaviour in Various Investment Avenues A Study: International Journal of Technology Marketing July 2012Documento27 pagineInvestors Behaviour in Various Investment Avenues A Study: International Journal of Technology Marketing July 2012Ppurvi AgarwalNessuna valutazione finora

- Collabetition: 3 Principles For The Creative Person in All of UsDocumento146 pagineCollabetition: 3 Principles For The Creative Person in All of UsTaiNessuna valutazione finora

- Thinking Like An Economist: Learning ObjectivesDocumento19 pagineThinking Like An Economist: Learning ObjectivesandinNessuna valutazione finora

- Applied Macroeconomics - ppt1 huJ4tsClWWDocumento17 pagineApplied Macroeconomics - ppt1 huJ4tsClWWNitin JaitlyNessuna valutazione finora

- PM-ASDS Final Syllabus - 2019-2021Documento19 paginePM-ASDS Final Syllabus - 2019-2021M Masrur IkramNessuna valutazione finora

- English Pre Aarambh Checklist by Nimisha Mam 29 Sep 2023 Docx 1Documento9 pagineEnglish Pre Aarambh Checklist by Nimisha Mam 29 Sep 2023 Docx 1Ok OkNessuna valutazione finora

- Chapter 30 Money Growth and InflationDocumento53 pagineChapter 30 Money Growth and InflationluluNessuna valutazione finora

- Gleeds India Construction Cost January 2022Documento36 pagineGleeds India Construction Cost January 2022Timoty Travaagan100% (1)

- DiksyunamiksDocumento2 pagineDiksyunamiksMary Jane Ortega LlamadaNessuna valutazione finora

- Samsung PresentationDocumento21 pagineSamsung Presentationkhanzakirahmad10Nessuna valutazione finora

- MC Eco121Documento20 pagineMC Eco121Vu Truc Ngan (K17 HCM)Nessuna valutazione finora

- V1 Exam 2 AM - AnswersDocumento55 pagineV1 Exam 2 AM - AnswersHarsh KabraNessuna valutazione finora

- Application of Market Analysis For The Retail Industry in EthiopiaDocumento21 pagineApplication of Market Analysis For The Retail Industry in EthiopiafikremarkosNessuna valutazione finora

- REER Database Ver24Mar2024Documento1.543 pagineREER Database Ver24Mar2024Nguyễn Duy ĐạtNessuna valutazione finora