Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Wealth Maximizer-Multiplier Fund

Caricato da

Vijay KumarDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Wealth Maximizer-Multiplier Fund

Caricato da

Vijay KumarCopyright:

Formati disponibili

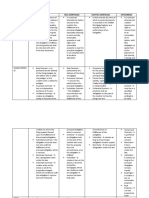

BOND OPPORTUNITIES FUND as on 31st December 2011

Fund Objective : To provide reasonable returns through investments in high credit quality debt instruments while maintaining an optimal level of interest rate risk.

SFIN CODE

Date of Inception :

ULIF03004/08/08BondOprtFd101

AssetAllocation

04 Aug 2008

Fund V/s Benchmark Performance

Period

Inception (04-Aug-08)

5 Years

3 Years

2 Years

1 Years

3 Mths

Returns (%)

07.22

N/A

02.52

04.66

05.24

01.75

Government

Securities

58.36%

Benchmark

Returns (%)#

07.26

N/A

05.11

05.93

06.90

02.28

# CRISIL Composite Bond Fund Index

Dep,MMI&

Others13.83%

Debentures/

Bonds27.81%

DebtMaturityProfile

50.00%

40.00%

PORTFOLIO

30.00%

Debentures / Bonds

10.40%ReliancePortsandTerminalLtdNCDmat18Jul2021

9.75%RuralElectrificationCorpLtdNCDmat11Nov2021

7.75%RuralElecCorpLtdNCDMat17/11/2012

7.90%RuralElecCorpLtdNCDMat06/10/2012

9.32%NABARDmat16August2014

8.10%ShreeCementLtd.Mat23/11/2012

6.90%NationalHousingBankNCDMat01/09/2012

11.50%RuralElecCorpLtdNCDMat26/11/2013

Others

Total

Government Securities

% to Fund

4.03%

2.67%

2.57%

2.35%

2.13%

1.64%

1.63%

1.47%

9.31%

Total

58.36%

13.83%

100.00%

Debt Parameters

PortfolioYield(%)

AvgMaturity(InMonths)

ModifiedDuration(InYears)

0.00%

1 3Yrs

3 10Yrs

Above10Yrs

DebtRatingProfile

AA+4.09%

% to Fund

12.01%

7.57%

7.51%

5.65%

4.89%

4.83%

3.66%

3.37%

2.39%

2.30%

1.13%

1.07%

1.98%

Grand total

10.00%

27.81%

9.15%GOImat14112024

7.17%GOIMD14June2015

7.02%GOIMAT17/08/2016

8.30%GOI2040MAT02.07.2040

6.07%GOIMAT15/05/2014

7.61%OilBondsMat07/03/2015

7.37%GSmat16/04/14

8.20%GOI15/02/2022

8.28%GOImat21Sep2027

7.59%GOI2016

4.81%GOI10/09/2013(Floater).

10.71%GOI19/04/2016

Others

Deposits, Money Mkt Securities and other Assets.

20.00%

8.96%

77.42

3.21

AAA29.43%

Sovereign

66.49%

Large Cap Niche Life Fund as on 31st December 2011

Fund Objective : To generate long term capital appreciation from a diversified portfolio of pre-dominantly in large cap equity and equity related securities.

SFIN CODE

Date of Inception :

ULIF03204/08/08Large-CapF101

AssetAllocation

04 Aug 2008

Dep,MMI&

Others4.35%

Fund V/s Benchmark Performance

Period

Inception (04-Aug-08)

5 Years

3 Years

2 Years

1 Years

3 Mths

Returns (%)

03.45

N/A

17.89

-05.49

-25.71

-09.39

Benchmark

Returns (%)#

01.50

N/A

16.04

-05.71

-24.62

-07.80

Equity95.65%

AllocationBySector Equity

Finance

23.04%

Oil&Gas

13.95%

InformationTechnology

13.61%

# NIFTY

PORTFOLIO

Equity

INFOSYSLTD

RelianceIndustriesLtd.

ICICIBankLtd.

ITCLtd

Larsen&ToubroLimited.

HDFCBankLtd.

TataConsultancyServicesLtd

JindalSteel&PowerLimited

CoalIndiaLimited.

StateBankofIndia

SterliteIndustriesLimited

BankofBaroda

KotakMahindraBankLimited

Oil&NaturalGasCorporationLtd

ZeeEntertainmentEnterprisesLtd

BharatHeavyElectricalsLtd

NationalThermalPowerCorporationLtd

BajajAutoLtd.

NestleIndiaLimited

Mahindra&MahindraLtd

BHARTIAIRTELLTD

PunjabNationalBank

CiplaLimited

PowerGridCorporationofIndiaLtd.

CumminsIndiaLtd.

SunPharmaceuticalsIndustriesLtd

LupinLimited.

GasAuthorityofIndiaLtd

CromptonGreavesLtd.

CAIRNINDIALIMITED.

HCLTechnologiesLimited.

HindustanZincLtd.

Others

% to Fund

7.85%

7.50%

6.36%

5.58%

4.83%

4.30%

4.14%

3.18%

2.91%

2.61%

2.42%

2.34%

2.29%

2.10%

2.01%

1.91%

1.89%

1.88%

1.87%

1.83%

1.75%

1.70%

1.62%

1.54%

1.52%

1.46%

1.45%

1.40%

1.39%

1.06%

1.03%

1.02%

8.90%

Total

95.65%

Deposits, Money Mkt Securities and other Assets.

4.35%

Grand total

100.00%

Metal,MetalProducts&Mining

9.98%

CapitalGoods

8.49%

FastMovingConsumerGoods

7.79%

Healthcare

5.77%

TransportEquipments

5.47%

Power

3.58%

HousingRelated

2.46%

Media&Publishing

2.10%

TransportServices

1.93%

Telecom

1.83%

DebtMaturityProfile

120.00%

100.00%

80.00%

60.00%

40.00%

20.00%

0.00%

1 3Yrs

Mid Cap Niche Life Fund as on 31st December 2011

Fund Objective : To generate long term capital appreciation from a diversified portfolio of pre-dominantly inmid cap equity and equity related securities.

SFIN CODE

Date of Inception :

ULIF03104/08/08Mid-capFnd101

AssetAllocation

04 Aug 2008

Dep,MMI&

Others2.97%

Fund V/s Benchmark Performance

Period

Inception (04-Aug-08)

5 Years

3 Years

2 Years

1 Years

3 Mths

Returns (%)

10.87

N/A

26.82

-01.51

-28.48

-15.01

Benchmark

Returns (%)#

-03.23

N/A

16.65

-12.57

-34.19

-16.71

Equity97.03%

AllocationBySector Equity

Finance

18.53%

Agriculture

13.30%

FastMovingConsumerGoods

12.05%

# BSE MID CAP INDEX

PORTFOLIO

Equity

MindTreeLimited

ShreeCementLimitesd

CoromandelInternationalLtd.

GlaxoSmithklineCons

EIDParryIndiaLtd

UnitedPhosphorousLimited

BajajElectricalsLimited

GujaratStatePetronetLtd.

ApolloTyresLtd

TATAGLOBALBEVERAGESLTD

WyethLimited

UnitedBankofIndiaLtd

GujaratMineralDevelopmnetCorporationLtd.

IPCALaboratoriesLtd.

DenaBank

IndianOverseasBank.

AndhraBank

SyndicateBank.

OptoCircuits(India)Ltd

BajajHoldings&InvestmentLimited

BlueStarLimited

AMTEKAUTOLTD.

PowerTradingCorporationofIndiaLtd.

TataChemicalsLtd

GujaratGasCompanyLimited

BRITANNIAINDUSTRIESLTD

P&GHygine&HealthCareLtd

SobhaDevelopersLtd

SintexIndustriesLtd

IndraprasthaGasLtd.

ThermaxLtd

CorporationBankLtd

Others

Healthcare

9.71%

HousingRelated

8.56%

% to Fund

Oil&Gas

7.77%

5.07%

4.93%

4.75%

4.53%

3.91%

3.83%

3.78%

3.62%

3.42%

3.22%

3.16%

3.13%

3.02%

2.90%

2.88%

2.80%

2.73%

2.55%

2.45%

2.37%

2.36%

2.32%

2.22%

1.96%

1.79%

1.77%

1.71%

1.43%

1.40%

1.32%

1.32%

1.09%

7.29%

ConsumerDurables

6.32%

TransportEquipments

5.91%

InformationTechnology

5.55%

Metal,MetalProducts&Mining

3.11%

Power

2.89%

CapitalGoods

2.63%

Diversified

2.50%

Others

1.18%

Total

97.03%

Deposits, Money Mkt Securities and other Assets.

2.97%

Grand total

100.00%

DebtMaturityProfile

120.00%

100.00%

80.00%

60.00%

40.00%

20.00%

0.00%

1 3Yrs

MONEY PLUS FUND as on 31st December 2011

Fund Objective : To generate optimal returns from investments biased to the highest credit quality at the short end of the yield curve, such that interest rate risks and credit risks are low.

SFIN CODE

Date of Inception :

ULIF02904/08/08MoneyPlusF101

AssetAllocation

04 Aug 2008

Debentures/

Bonds0.70%

Fund V/s Benchmark Performance

Period

Returns (%)

Inception (04-Aug-08)

5 Years

3 Years

2 Years

1 Years

3 Mths

06.37

N/A

04.67

04.51

05.46

01.81

Benchmark

Returns (%)#

06.50

N/A

06.03

06.62

08.15

02.09

# CRISIL Liquid Fund Index

Dep,MMI&

Others5.69%

Government

Securities

93.61%

DebtMaturityProfile

120.00%

100.00%

PORTFOLIO

80.00%

60.00%

Debentures / Bonds

% to Fund

7.60%LICHousingFinanceLtdMat23Apr2012.

0.70%

Total

0.70%

Government Securities

% to Fund

7.37%GSmat16/04/14

93.61%

Total

93.61%

Deposits, Money Mkt Securities and other Assets.

5.69%

Grand total

20.00%

0.00%

1 3Yrs

DebtRatingProfile

AAA0.74%

100.00%

Sovereign

99.26%

Debt Parameters

PortfolioYield(%)

AvgMaturity(InMonths)

ModifiedDuration(InYears)

40.00%

8.12%

27.28

2.02

Managers Fund as on 31st December 2011

Fund Objective : This is a fund of funds which will invest in Money Plus Niche Life Fund, Bond Opportunities Niche Life Fund, Large Cap Niche Life Fund and Mid Cap Niche Life

Fund. The allocation to each fund will depend on the fund manager's market view and will be within the limits

SFIN CODE

Date of Inception :

ULIF03304/08/08ManagerFnd101

AssetAllocation

04 Aug 2008

Dep,MMI&

Others3.26%

Fund V/s Benchmark Performance

Debentures/

Bonds10.49%

Equity53.99%

Period

Inception (04-Aug-08)

5 Years

3 Years

2 Years

1 Years

3 Mths

Returns (%)

08.31

N/A

14.77

00.34

-13.37

-06.64

Benchmark

Returns (%)#

N/A

N/A

N/A

N/A

N/A

N/A

Government

Securities

32.26%

AllocationBySector Equity

# NA

% to Fund

INFOSYSLTD

RelianceIndustriesLtd.

ICICIBankLtd.

ITCLtd

MindTreeLimited

ShreeCementLimitesd

HDFCBankLtd.

CoromandelInternationalLtd.

TataConsultancyServicesLtd

GlaxoSmithklineCons

Larsen&ToubroLimited.

EIDParryIndiaLtd

UnitedPhosphorousLimited

p

BajajElectricalsLimited

Others

2.35%

2.25%

1.91%

1.67%

1.35%

1.31%

1.29%

1.27%

1.24%

1.21%

1.19%

1.04%

1.02%

1.01%

33.88%

Total

53.99%

Debentures / Bonds

10.40%ReliancePortsandTerminalLtdNCDmat18Jul2021

7.75%RuralElecCorpLtdNCDMat17/11/2012

9.75%RuralElectrificationCorpLtdNCDmat11Nov2021

9.32%NABARDmat16August2014

8.10%ShreeCementLtd.Mat23/11/2012

Others

Total

Government Securities

9.15%GOImat14112024

8.79%GOImat08Nov2021

8.97%GOImat05Dec2030

7.17%GOIMD14June2015

7.02%GOIMAT17/08/2016

7.37%GSmat16/04/14

6.07%GOIMAT15/05/2014

7.61%OilBondsMat07/03/2015

8.20%GOI15/02/2022

Others

% to Fund

1.09%

1.03%

0.83%

0.83%

0.69%

6.03%

% to Fund

4.97%

4.97%

4.15%

3.13%

3.10%

2.95%

2.02%

2.00%

1.40%

3.57%

32.26%

Deposits, Money Mkt Securities and other Assets.

3.26%

100.00%

Debt Parameters

PortfolioYield(%)

AvgMaturity(InMonths)

ModifiedDuration(InYears)

10.68%

InformationTechnology

9.88%

Healthcare

7.71%

Metal,MetalProducts& 6.79%

Agriculture

6.37%

TransportEquipments

5.73%

HousingRelated

5.40%

CapitalGoods

5.29%

Power

3.29%

ConsumerDurables

3.03%

Diversified

1.20%

Media&Publishing

1.11%

Others

2.04%

DebtMaturityProfile

80.00%

70.00%

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

1 3Yrs

3 10Yrs

Above10Yrs

10.49%

Total

Grand total

21.56%

FastMovingConsumer 9.91%

PORTFOLIO

Equity

Finance

Oil&Gas

8.78%

81.85

4.38

DebtRatingProfile

AA+4.54%

AAA21.18%

Sovereign

74.28%

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Lesson 12. Internal - Rate - of - Return - MethodDocumento3 pagineLesson 12. Internal - Rate - of - Return - MethodOwene Miles AguinaldoNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- TAX-CREBA VS Executive Secretary RomuloDocumento2 pagineTAX-CREBA VS Executive Secretary RomuloJoesil Dianne100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Long-Term Construction Contracts & FranchiseDocumento6 pagineLong-Term Construction Contracts & FranchiseBryan ReyesNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- P DZupavm Hy TCBJG 4Documento6 pagineP DZupavm Hy TCBJG 4sandeepNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Documento2 pagineChapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Ma Teresa B. CerezoNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Business 2257 Tutorial #1Documento12 pagineBusiness 2257 Tutorial #1westernbebeNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- General JournalDocumento2 pagineGeneral JournalJacob SnyderNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- DueDiligence Group7Documento104 pagineDueDiligence Group7chhavibNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Wall Street Courier Services, Inc. PayslipDocumento1 paginaWall Street Courier Services, Inc. PayslipAimee TorresNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Digital Assets GuideDocumento22 pagineDigital Assets GuideProject Erch64Nessuna valutazione finora

- Pledge Real Mortgage Chattel Mortgage AntichresisDocumento12 paginePledge Real Mortgage Chattel Mortgage AntichresisKATHERINEMARIE DIMAUNAHANNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Balance Sheet or Statement of Financial PositionDocumento52 pagineBalance Sheet or Statement of Financial PositionkarishmaNessuna valutazione finora

- 50 Questions To Ask A FranchisorDocumento3 pagine50 Questions To Ask A FranchisorRegie Sacil EspiñaNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetDocumento14 pagineMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer Sheetmimi supasNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Sanjay Bakshi: Dear StudentsDocumento2 pagineSanjay Bakshi: Dear StudentsBharat SahniNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Partnership Accounting Practical Accounting 2Documento13 paginePartnership Accounting Practical Accounting 2random17341Nessuna valutazione finora

- E-Way Bill - 7Documento2 pagineE-Way Bill - 7AshishTrivediNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- CGISA and Board Prescribed Textbooks 2023Documento5 pagineCGISA and Board Prescribed Textbooks 2023MichaelNessuna valutazione finora

- ASJ #1 September 2011Documento72 pagineASJ #1 September 2011Alex SellNessuna valutazione finora

- Shrawan Bhadra Aswin Kartik: Problem 1Documento17 pagineShrawan Bhadra Aswin Kartik: Problem 1notes.mcpu100% (1)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Chapter 4 The Internal AssessmentDocumento26 pagineChapter 4 The Internal AssessmentKrisKettyNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- ACCT 10001: Accounting Reports & Analysis Lecture 2 Illustration: ARA Galleries Pty LTDDocumento5 pagineACCT 10001: Accounting Reports & Analysis Lecture 2 Illustration: ARA Galleries Pty LTDBáchHợpNessuna valutazione finora

- Tax Card Moldova EN 2023Documento20 pagineTax Card Moldova EN 2023VNessuna valutazione finora

- International Corporate Finance 11 Edition: by Jeff MaduraDocumento34 pagineInternational Corporate Finance 11 Edition: by Jeff MaduraMahmoud SamyNessuna valutazione finora

- Sample Questionnaire On Financial InstrumentsDocumento4 pagineSample Questionnaire On Financial InstrumentsHarish KumarNessuna valutazione finora

- Bài 12 - Bài tập thực hànhDocumento2 pagineBài 12 - Bài tập thực hànhDuyên BùiNessuna valutazione finora

- Asda Asd Dasad Sda Asda Das Da Asde Policy 2017Documento18 pagineAsda Asd Dasad Sda Asda Das Da Asde Policy 2017hahaha555plusNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Thompson IndictmentDocumento10 pagineThompson IndictmentCrainsChicagoBusinessNessuna valutazione finora

- AnnexureDocumento7 pagineAnnexureshaantnuNessuna valutazione finora

- Packers Amp Movers ProjectDocumento57 paginePackers Amp Movers Projectabdullah100% (2)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)