Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Taxes Ex Tern Ali Ties

Caricato da

Minaketan BeheraDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Taxes Ex Tern Ali Ties

Caricato da

Minaketan BeheraCopyright:

Formati disponibili

Econ 98-Chiu Name & SID:

Taxes & Externalities Worksheet Date:

Spring 2005

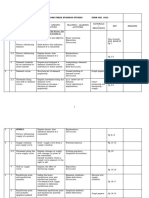

PART A: Taxes and perfectly competitive markets

We have ignored the governments role in the economy for a vast majority of the course. Now we will relax this assumption, and allow the government to intervene in the market. The rule of thumb is that, IF the demand and supply curves incorporate all the benefits and costs within a market, THEN government intervention almost always causes a DEADWEIGHT LOSS. The questions in PART A deal with perfectly competitive markets with no externalities. Please keep in mind the assumptions that we are making while you are doing the questions. Ask yourself, how will my answers change if supply was perfectly inelastic? If supply was perfectly elastic? If demand was perfectly inelastic? If demand was perfectly elastic? 1. The following market for beer is initially in equilibrium. The government wants to raise tax revenue to compensate for the states large budget deficit. The government places a $1 perunit tax on the market for beer. Assume the tax is on producers. Show graphically the effects of this excise tax. Label the price consumers pay after the tax as P1, the price the producers receive after the tax as P2, and the quantity of beer purchased after the tax as Q. P 10 S

12

D 20

Page 1 of 8

Econ 98-Chiu Name & SID:

Taxes & Externalities Worksheet Date:

Spring 2005

2. Calculate numerical values for P1, P2, and Q.

3. Calculate before-tax consumer surplus.

4. Calculate after-tax consumer surplus.

5. Calculate loss or gain in consumer surplus after the tax.

6. Calculate before-tax producer surplus.

7. Calculate after-tax producer surplus.

8. Calculate loss or gain in producer surplus after the tax.

9. How much tax revenue is collected?

Page 2 of 8

Econ 98-Chiu Name & SID:

Taxes & Externalities Worksheet Date:

Spring 2005

10. Calculate dead-weight loss before the tax.

11. Calculate dead-weight loss after the tax.

12. Calculate the consumer tax burden.

13. Calculate the producer tax burden.

14. Who has the largest tax burden?

Page 3 of 8

Econ 98-Chiu Name & SID:

Taxes & Externalities Worksheet Date:

Spring 2005

HELP SHEET for PART A

CS before taxes = A + B + C + F PS before taxes = D + E + G + H Deadweight loss = None

S'

Pa S A P1 B P* P2 H C D E F G CS after taxes = A PS after taxes = H Tax Revenue = B + C + D + E DWL = F + G Notice that taxes cause a deadweight loss to society.

Pb D

Q Practical Definitions:

Q*

Q

Formulas: Tax Size = Pc - Ps Tax Revenue = (Pc - Ps)(Q1) Keep in mind that the government cannot tax something that is not sold or purchased. Therefore the government cannot tax up to Q*. CS = area above price paid by consumers, below demand curve, and up to quantity purchased. PS = area below price received by producers, above supply curve, and up to quantity sold.

Pa is the reservation price for consumers in the market. Pa is also the highest price consumers are willing and able to buy. Pb is the lowest price for producers in the market. Pb is also the lowest prices producers are willing and able to sell. P* is the initial market price equilibrium before taxes. Q* is the initial market quantity equilibrium before taxes. P1 is the price that consumers pay after taxes. P2 is the price that producers receive after taxes. Q is quantity purchased and sold after taxes.

Page 4 of 8

Econ 98-Chiu Name & SID:

Taxes & Externalities Worksheet Date:

Spring 2005

PART B: Taxes and negative externalities

We assumed in PART A that the demand and supply curves incorporate all the benefits and costs within a market. However this is not always true. PART B deals with the same beer market but with a negative externality (i.e. traffic accidents). Here are some rules of thumbs, MSC = MPC private cost MSC = P MPC = P + MEC (Marginal social cost is sum of the marginal and marginal external cost) tells me P* and Q* (Social optimum) tells me Pc and Qc (Market optimum)

The market creates dead-weight loss when left unregulated. The government can intervene and shrink the dead-weight loss. PART B shows the necessity of government in markets with externalities. Please keep in mind the assumptions that we are making while you are doing the questions. Ask yourself, how will my answers change if the government overtaxes? If the market had only one firm (i.e. monopoly)? If marginal external cost was increasing at every level of output? If marginal social cost and marginal private cost had different slopes? 1. The marginal external cost (MEC) of beer is $1 at every level of output (Q). In other words, MEC is constant at every level of Q. Sketch and label the marginal social cost curve (MSC). Label the marginal private cost curve (MPC). Label the socially optimal price (P*) and quantity (Q*). Label the market equilibrium price (Pc) and quantity (Qc).

P 10 S

12

D 20

Page 5 of 8

Econ 98-Chiu Name & SID:

Taxes & Externalities Worksheet Date:

Spring 2005

2. Calculate numerical values for P*, Q*, Pc, Qc.

3. Calculate socially optimal consumer surplus.

4. Calculate market equilibrium consumer surplus.

5. Calculate socially optimal producer surplus.

6. Calculate market equilibrium producer surplus.

7. Calculate total external cost at social optimum.

8. Calculate total external cost at market equilibrium.

Page 6 of 8

Econ 98-Chiu Name & SID:

Taxes & Externalities Worksheet Date:

Spring 2005

9. Calculate dead-weight loss in market equilibrium.

10. Propose a per-unit tax that will completely eliminate the dead-weight loss. Be specific.

11. Calculate tax revenue.

12. Calculate the dead-weight loss after the per-unit tax.

13. Are there still traffic accidents after the government intervenes in the market?

Page 7 of 8

Econ 98-Chiu Name & SID:

Taxes & Externalities Worksheet Date:

Spring 2005

HELP SHEET for PART B

MSC

S=MPC A P* B Pc Ps H C D E F G Z Practical Definitions: P* is the socially optimal price. Q* is the socially optimal quantity. Pc is the market price. Qc is the market quantity. D

Q*

Qc

CS PS Total External Cost Tax Revenue ES DWL

Social Optimum A B+C+D+E+H H+E+C None A+B+D None

Market Equilibrium A+B+C+F D+E+G+H H+E+C+G+F+Z None A+B+C-Z Z

Government Tax A H H+E+C B+C+D+E A+B+D None

Page 8 of 8

Potrebbero piacerti anche

- IKS Livelihood KnowledgeDocumento19 pagineIKS Livelihood KnowledgeMinaketan BeheraNessuna valutazione finora

- Seminar - Delhi 27-28 Jun 2018 PDFDocumento35 pagineSeminar - Delhi 27-28 Jun 2018 PDFMinaketan BeheraNessuna valutazione finora

- Two-Day National Workshop On "Tribal Health: Status, Challenges and Possibilities"Documento1 paginaTwo-Day National Workshop On "Tribal Health: Status, Challenges and Possibilities"Minaketan BeheraNessuna valutazione finora

- NaregaDocumento1 paginaNaregaMinaketan BeheraNessuna valutazione finora

- TRDI National Workshop PDFDocumento1 paginaTRDI National Workshop PDFMinaketan BeheraNessuna valutazione finora

- OECD and Foreign Direct InvestmentDocumento9 pagineOECD and Foreign Direct InvestmentNiveen27Nessuna valutazione finora

- Worksheet 1Documento1 paginaWorksheet 1Minaketan BeheraNessuna valutazione finora

- 23174801Documento22 pagine23174801Minaketan BeheraNessuna valutazione finora

- Status of Dalit Education (PRIA - Final Report)Documento51 pagineStatus of Dalit Education (PRIA - Final Report)Minaketan BeheraNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Lect17 Mon CompDocumento40 pagineLect17 Mon CompRahm TumbagaNessuna valutazione finora

- Micro Real Final S2022 Solns PDFDocumento9 pagineMicro Real Final S2022 Solns PDFjay WuNessuna valutazione finora

- ECON1054 Chapter 3 Analytical ProblemsDocumento6 pagineECON1054 Chapter 3 Analytical ProblemslamxNessuna valutazione finora

- Bernheim 1986Documento21 pagineBernheim 1986Shabrina MahardhikaNessuna valutazione finora

- Chapter 2 The Basics of Supply and Demand Part1Summer2021Documento8 pagineChapter 2 The Basics of Supply and Demand Part1Summer2021sarahNessuna valutazione finora

- Demand and Supply WorksheetDocumento8 pagineDemand and Supply WorksheetMala100% (1)

- Musgrave Peacock 1958 Classics in The Theory of Public FinanceDocumento132 pagineMusgrave Peacock 1958 Classics in The Theory of Public FinanceCarlos Andres Casas PeñaNessuna valutazione finora

- Demand TheoryDocumento10 pagineDemand TheoryVinod KumarNessuna valutazione finora

- Economics Extended Essay: Title: Effectiveness of PMJAY-CMCHIS in Improving Standard of Living ofDocumento68 pagineEconomics Extended Essay: Title: Effectiveness of PMJAY-CMCHIS in Improving Standard of Living ofexam. netNessuna valutazione finora

- 2019 H2 Y5 CT 1 - Examiner - S Report (Final)Documento20 pagine2019 H2 Y5 CT 1 - Examiner - S Report (Final)19Y5C12 ZHANG YIXIANGNessuna valutazione finora

- Econ 221 Chapter 5. Concept of MicroeconomicsDocumento19 pagineEcon 221 Chapter 5. Concept of MicroeconomicsGrace CumamaoNessuna valutazione finora

- International Trade Topics and Test QuestionsDocumento12 pagineInternational Trade Topics and Test QuestionsGhada SabryNessuna valutazione finora

- International Economics 3Rd Edition Feenstra Test Bank Full Chapter PDFDocumento35 pagineInternational Economics 3Rd Edition Feenstra Test Bank Full Chapter PDFRebeccaBartlettqfam100% (8)

- A General Equilibrium Model of InsurrectionsDocumento11 pagineA General Equilibrium Model of InsurrectionsAdrian MacoveiNessuna valutazione finora

- Edgar E. Peters - Chaos and Order in The Capital Markets - A New View of Cycles, Prices, and Market VolatilityDocumento126 pagineEdgar E. Peters - Chaos and Order in The Capital Markets - A New View of Cycles, Prices, and Market VolatilityRobertoNessuna valutazione finora

- GGSIPU BBA Scheme and Syllabus 2021-22Documento41 pagineGGSIPU BBA Scheme and Syllabus 2021-22Ansh ChauhanNessuna valutazione finora

- Student Handouts For BananaDocumento8 pagineStudent Handouts For Bananaapi-271596792Nessuna valutazione finora

- 1016 F Exp 1 WorksheetDocumento5 pagine1016 F Exp 1 WorksheetSaurav Tuladhar0% (2)

- Business Studies Form 3 Schemes of WorkDocumento14 pagineBusiness Studies Form 3 Schemes of WorkDavi Kapchanga KenyaNessuna valutazione finora

- Homework 3Documento6 pagineHomework 3Teagan BurkeNessuna valutazione finora

- Principles OF Microeconomics: Lecturer: Kinwah LoDocumento17 paginePrinciples OF Microeconomics: Lecturer: Kinwah Longọc phạmNessuna valutazione finora

- Business Economics PDFDocumento395 pagineBusiness Economics PDFsuhail khanNessuna valutazione finora

- Chapter 1: Fundamental Concepts of Economics: ScarcityDocumento60 pagineChapter 1: Fundamental Concepts of Economics: Scarcityfarrukh zafarNessuna valutazione finora

- Syllabuses For BBA Program Level-1, Semester-IDocumento6 pagineSyllabuses For BBA Program Level-1, Semester-IAshik Ishtiaque EmonNessuna valutazione finora

- 2 Demand and Supply AnalysisDocumento47 pagine2 Demand and Supply AnalysisNishantNessuna valutazione finora

- Foundation Paper 1Documento416 pagineFoundation Paper 1pramodduttaNessuna valutazione finora

- Lecture Note 12 Game Theory III and Review QuestionsDocumento23 pagineLecture Note 12 Game Theory III and Review QuestionsOng Yong Xin, SeanneNessuna valutazione finora

- (Macro) Bank Soal Uas - TutorkuDocumento40 pagine(Macro) Bank Soal Uas - TutorkuDella BianchiNessuna valutazione finora

- Assignment 3Documento1 paginaAssignment 3Syed Jodat Askari ZaydiNessuna valutazione finora

- C) IS LM ModelDocumento19 pagineC) IS LM ModelJeny ChatterjeeNessuna valutazione finora